Credit Card bill before US Congress killing FF programs?

#16

Join Date: Mar 2024

Posts: 7

Payment Card Pricing and Merchant Cost Pass-through in the United States and Canada," published by the Federal Reserve Bank of Kansas.)

The system should be changed so that credit card users pay the cost of using their cards, rather than causing inflated prices by using them. Merchants should have to pay only for the hardware and software they use, and costs (if any) associated with their banking.

#17

Join Date: Mar 2024

Posts: 7

The airlines will just have to adjust their business models. It is simply a question of whether the airfare is paid directly by the traveler, or whether it is paid by a subsidy imposed on the general public through the higher prices caused by the use of credit cards and the "rewards" involved.

#18

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

As much as I love miles/points, it seems too grossly self-serving to write my Congressman to say "keep this duopoly intact to keep my prices higher so that I can get points/miles on the back end." I get the banks' logic and the airlines' logic, but I totally realize that the 99% of the people in this world who aren't points/miles nerds should *not* want this.

The EU in general has much better consumer protections than the US does. While the US arguably should improve those, I don't see that happening any time soon regardless of whether this bill passes.

#19

Join Date: Mar 2024

Posts: 7

The card companies likely could still offer such benefits through their ability (from their large scale), to do them as group policies for their card holders. It may add a bit to the cost to card holders of each card use (or a particular card use), but nonetheless the insurance could be low-cost.

#20

Join Date: Apr 2005

Location: ATL

Posts: 802

Welcome to Flyertalk.

Where is the analysis to support this claim? Merchants benefit from accepting payment by card, and they should pay for the service. I do understand that merchants would prefer to pay less, but to suggest that they should pay nothing needs further explanation.

Where is the analysis to support this claim? Merchants benefit from accepting payment by card, and they should pay for the service. I do understand that merchants would prefer to pay less, but to suggest that they should pay nothing needs further explanation.

1- Cash $11

2- Check $14

3-Discover $17

4- Master Card $23

5- Visa $26

6- AMEX $31

#21

Join Date: Mar 2024

Posts: 7

Thanks, BigBuy. I have tried replying twice to Mia's reply to me, but those replies haven't been posted to the board. My replies were on the up-and-up, so I have no idea why. She asked for info to back up what I said, and I was trying to provide it.

#22

Community Director Emerita

Join Date: Oct 2000

Location: Anywhere warm

Posts: 33,756

The posts are now approved. When a new member begins to participate - which we appreciate; it's the only way for the board to be sustained - the posts have to be approved. The forum mod has to be online, read the post and approve it. Everyone is a volunteer and there can be a delay in that happening. Thank you very much for your contribution.

#24

Join Date: Apr 2005

Location: ATL

Posts: 802

I'm pretty sure that mia refers to Miami international airport and that the poster is a guy but I may be wrong.

#25

Moderator: Lufthansa Miles & More, India based airlines, India, External Miles & Points Resources

Join Date: Dec 2002

Location: MUC

Programs: LH SEN

Posts: 48,198

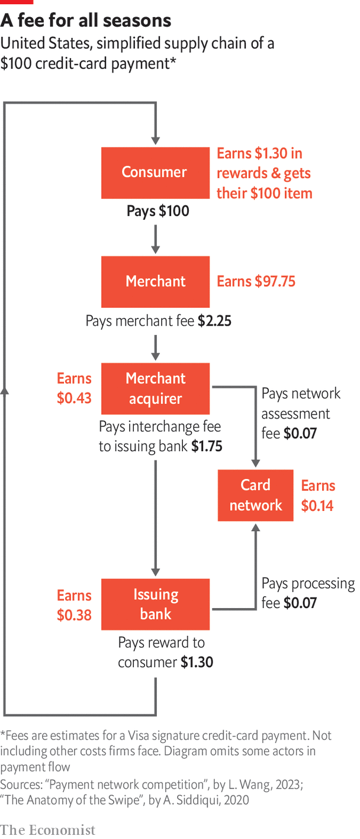

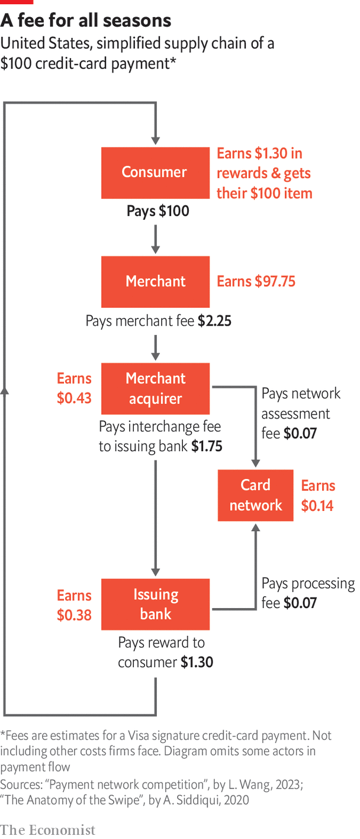

The economist had a nice article on the topic:

https://www.economist.com/special-re...the-rich-world

https://www.economist.com/special-re...the-rich-world

#27

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,508

(BTW, disabling JavaScript lets you read the article without the registration prompt if you don't have an Economist subscription.)

#28

Join Date: Mar 2013

Posts: 10

But if the above are showing the inflated price because of credit card processing fee, then you make a lot more in profit ??

#29

Join Date: Mar 2013

Posts: 10

I bet if they lowered the fee and most credit card users dropped the card, merchants would end up refusing to accept credit cards altogether.

I remember 20+ years ago, most merchants did not accept credit cards as either new technology or flatly refused to accept a "delayed" payment and the associated fee with a credit card.

Imagine bringing cash when you travel across the border and the hassle that comes with it.

I remember 20+ years ago, most merchants did not accept credit cards as either new technology or flatly refused to accept a "delayed" payment and the associated fee with a credit card.

Imagine bringing cash when you travel across the border and the hassle that comes with it.

#30

Moderator: Lufthansa Miles & More, India based airlines, India, External Miles & Points Resources

Join Date: Dec 2002

Location: MUC

Programs: LH SEN

Posts: 48,198

Dropping the interchange to 0.2-0-3% was a major success factor for merchants in Europe to accept cards during the pandemic. CC acceptance was terrible in comparison to the US.