Last edit by: yugi

US Bank Altitude Reserve card

Mobile wallet category is defined as follows: the method of paying for a transaction by use of a mobile device (in-store, in-app or online) and includes ApplePayģ, Samsung Pay,Android Google Payô, Microsoft Wallet, LG Payģ

Card provides primary CDW coverage in the US for cars up to $75k in value up to 15 days. In other countries coverage is up to 31 days. Excluded countries: Israel, Jamaica, Ireland and Northern Ireland.

Card provides 8 Priority Pass lounge visits per PP membership year.

Direct link to application:

http://mycard.usbank.com/credit/team...e_reserve.html

Point Redemptions

Reconsideration Line: 1-800-947-1444

- 50,000 bonus points after $4,500 spend within first 90 days

- Up to $325 annually (cardmember year NOT calendar year) in statement credits for eligible travel and dining/takeout purchases

- $400 annual fee

- Free authorized users

- 3x on travel and mobile wallet purchases

- 5x on hotel and car rental purchases made via US Bank portal

Mobile wallet category is defined as follows: the method of paying for a transaction by use of a mobile device (in-store, in-app or online) and includes ApplePayģ, Samsung Pay,

Card provides primary CDW coverage in the US for cars up to $75k in value up to 15 days. In other countries coverage is up to 31 days. Excluded countries: Israel, Jamaica, Ireland and Northern Ireland.

Card provides 8 Priority Pass lounge visits per PP membership year.

Direct link to application:

http://mycard.usbank.com/credit/team...e_reserve.html

Point Redemptions

- Redeem at 1.5c per point value for travel purchases made directly at the US Bank travel site

- Redeem at 1.5c per point for travel purchases made at other sites when using the Realtime Rewards feature. Must enroll first.

- Otherwise redeem at 1c per point.

- With Realtime Rewards it's possible to redeem for fees such as Delta award charges for example.

- To redeem for lodging the minimum purchase must be

$500$150 and you must have enough points to cover the whole purchase. For car rentals, the minimum is$250$150. $10 minimum for the rest of the categories. - Some non-US travel charges work with Realtime Rewards even though they shouldn't.

Reconsideration Line: 1-800-947-1444

US Bank Altitude Reserve Card (2017 - 2023)

#1083

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

Unless this is new I donít believe this is the case. Iíve used RTR to use practically my entire balance of points. I donít redeem for anything that isnít $0.015/pt.

#1084

Join Date: Jun 2008

Location: BAY AREA

Posts: 1,125

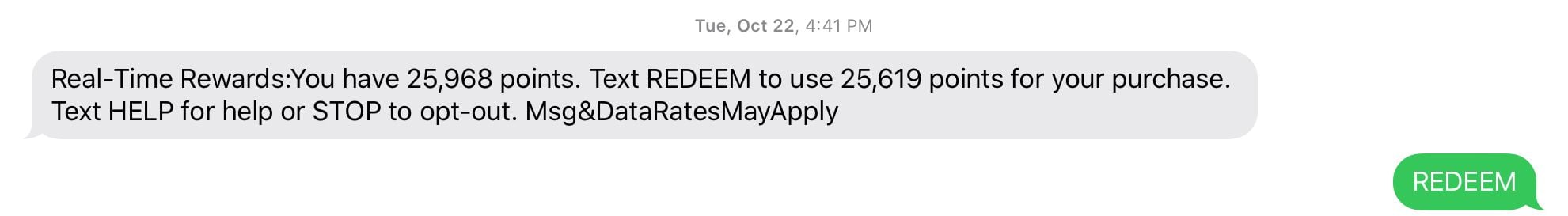

That's what others in here wrote. I personally haven't redeemed yet since I just got card. So you're saying if you charge $500 for hotel, you'll get a text to redeem if you only have 34k points?

#1085

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

In October 2019 I had 25,968 points and redeemed 25,619 against a $384.29 flight via RTR.

Last edited by jags86; Jan 16, 2020 at 10:29 am

#1086

Join Date: Jul 2014

Location: Western US

Programs: Costco Executive Member, Amazon Optimus Prime

Posts: 1,251

I think the best value is to redeem for hotels since you can use/get portals/loyalty points/elite perks, but the problem is that you have to have a $500 minimum charge for lodging AND you need to have enough points in the account to cover the whole stay. I'm not sure whether that is counted at .01 or .015 value per AR point. But it creates a tricky set of conditions to meet. Our normal lodging bills are either big expensive week long stays, or weekend/overnights, neither of which meet those conditions.

There are other ways to extract 1.5c in value out of your points too, but I think those run the slim risk of getting a shut down if it was a noticeable pattern and practice of an account. It's a great card from a nice issuer who has left their benefit package alone thus I'm content to play by the stated rules.

There are other ways to extract 1.5c in value out of your points too, but I think those run the slim risk of getting a shut down if it was a noticeable pattern and practice of an account. It's a great card from a nice issuer who has left their benefit package alone thus I'm content to play by the stated rules.

#1087

Join Date: Jun 2008

Location: BAY AREA

Posts: 1,125

I think the best value is to redeem for hotels since you can use/get portals/loyalty points/elite perks, but the problem is that you have to have a $500 minimum charge for lodging AND you need to have enough points in the account to cover the whole stay. I'm not sure whether that is counted at .01 or .015 value per AR point. But it creates a tricky set of conditions to meet. Our normal lodging bills are either big expensive week long stays, or weekend/overnights, neither of which meet those conditions.

There are other ways to extract 1.5c in value out of your points too, but I think those run the slim risk of getting a shut down if it was a noticeable pattern and practice of an account. It's a great card from a nice issuer who has left their benefit package alone thus I'm content to play by the stated rules.

There are other ways to extract 1.5c in value out of your points too, but I think those run the slim risk of getting a shut down if it was a noticeable pattern and practice of an account. It's a great card from a nice issuer who has left their benefit package alone thus I'm content to play by the stated rules.

#1088

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

I think the best value is to redeem for hotels since you can use/get portals/loyalty points/elite perks, but the problem is that you have to have a $500 minimum charge for lodging AND you need to have enough points in the account to cover the whole stay. I'm not sure whether that is counted at .01 or .015 value per AR point. But it creates a tricky set of conditions to meet. Our normal lodging bills are either big expensive week long stays, or weekend/overnights, neither of which meet those conditions.

There are other ways to extract 1.5c in value out of your points too, but I think those run the slim risk of getting a shut down if it was a noticeable pattern and practice of an account. It's a great card from a nice issuer who has left their benefit package alone thus I'm content to play by the stated rules.

There are other ways to extract 1.5c in value out of your points too, but I think those run the slim risk of getting a shut down if it was a noticeable pattern and practice of an account. It's a great card from a nice issuer who has left their benefit package alone thus I'm content to play by the stated rules.

#1089

Join Date: Jun 2008

Location: BAY AREA

Posts: 1,125

Does us Bank get spooked if you pay off your balance before your first statement? I heard they are very picky for other things but not sure about this.

#1090

Join Date: Jul 2014

Location: Western US

Programs: Costco Executive Member, Amazon Optimus Prime

Posts: 1,251

But hotels booked direct do have a real benefit of being paid for via USB AR RTR vs my other methods (loyalty programs, bank points, travel agencies etc.). I just wish that the threshold wasn't $500, and it was something more reasonable like $250 like what they have with rental cars. Clearly they don't want to encourage redemptions on hotels since its probably not a juicy MCC interchange category, compared to others.

#1091

Join Date: Dec 2018

Posts: 200

I did it on mine as I had quite a few big purchases that would have exceeded my credit limit. Everything seems to be fine. If you are doing it to restore credit limit, it took about 5 days before I could use that line of credit after paying off though.

#1092

Join Date: Jun 2008

Location: BAY AREA

Posts: 1,125

I got plenty of limit. I just don't like keeping a large balance before statement

#1093

Join Date: Jun 2008

Location: BAY AREA

Posts: 1,125

Just made my first payment from iOS app. The pending payment not even showing in app. 🤷🏻.♂️

#1094

Join Date: Dec 2007

Location: Virginia City Highlands

Programs: Nothing anymore after 20 years

Posts: 6,900

I really donít care - no plans to apply for a new card and the balance will be paid off automatically from savings account at US bank. Credit score did recover but it took couple of months.

#1095

Join Date: Jan 2014

Posts: 133

Almost anything else (except rental cars) in the AR's travel categories seems better to me, since they don't have that silly minimum spending restriction (which is, really, an implicit devaluation of your points). That makes it easier to consume small quantities of points once you've burned through the signup bonus.