Last edit by: storewanderer

Older (archived) threads: 2014-16

- - - - - -

- What is EMV contactless?

EMV contactless is a form of contactless/NFC that uses the same security and encryption that is used when inserting a chip card into an EMV-enabled terminal. Other than not having to sign/enter a PIN for smaller transactions, the security is effectively the same as chip and PIN/chip and signature.

In contrast, MSD contactless is an older version that is designed just and only for the United States. This effectively uses much the same flow as a swiped card transaction with the same rules.

- What is CDCVM?

CDCVM stands for Consumer Device Cardholder Verification Method. It's a method of telling the terminal that the customer verified their identity using their mobile device. Terminals that support it will waive the signature/PIN requirement typically in place for larger transactions, potentially saving time at checkout.

More info: https://support.apple.com/en-us/HT202527

- Does EMV contactless need to be supported to support CDCVM?

Typically, yes. (However, there are some exceptions below.)

- Why can't I tap my foreign-issued contactless card at most places in the US?

This is likely because the store does not support EMV contactless. Foreign issued contactless cards typically do not support MSD contactless since other markets have had EMV for quite some time. In contrast, most stores in the US have yet to get the necessary certifications/software for EMV contactless so they are typically MSD-only--if contactless is enabled at all. (See below for a list of stores where your card will likely work.)

- I paid for a purchase with Apple/Android/Samsung Pay and still had to sign for it.

Most likely, the store in question does not have EMV contactless enabled (see above question). However, there are instances where CDCVM does not work even with EMV contactless enabled. Restaurants that allow tip adjust, for example--where the tip amount is written on a paper receipt and entered by the staff later--cannot support CDCVM. It may simply be a matter of the merchant's processor or the POS software in use not supporting it too.

Another common reason is if you used a US-issued AmEx card with a mobile wallet. AmEx currently does not allow EMV contactless support in mobile wallets for these cards, so they always run as MSD contactless. Because of this, CDCVM is not supported (with very few exceptions, as noted below).

Note: if you used Samsung Pay, you may have paid with MST instead of NFC. Since MST emulates the magnetic pulses that the terminal receives when swiping a regular card, the normal magstripe rules apply.

- How can I tell whether EMV contactless was used?

An easy way to tell if you have Apple Pay is to pay with a Visa or MC while in airplane mode. Wallet will then show a transaction amount next to "Payment" for the card that was used. Alternatively, EMV-related information will typically print on the receipt (AID, etc.) if EMV contactless was used.

(Non-exhaustive) list of EMV contactless supporting merchants in the US:

- 7-Eleven

- 99 Ranch

- Albertsons (Safeway, Vons, Pak N Save, Jewel, Acme, Shaws, Star, Carrs, Randalls, Tom Thumb, Haggen, Eagle, Lucky UT/SoCal)

- Apple Store*†

- Athleta

- Auntie Anne’s Pretzels

- Banana Republic

- Costco Wholesale

- CVS

- DuaneReade*

- El Pollo Loco

- EG Group US (Quik Stop, Kwik Shop, Tom Thumb, Turkey Hill) Note: cashier must press "Electronic Payment" to activate NFC

- Five Below*

- Five Guys

- GAP

- Grocery Outlet*

- Harmon's Grocery

- H&M*

- Jolibee

- Kohl's*

- Lush Cosmetics*

- Maverik

- McDonald's*

- Meijer

- Old Navy

- Panera Bread

- PetSmart

- Ray's Food Place

- Round Table Pizza

- Royal Farms

- Red Ribbon Bakeshop

- Sheetz

- Sherm's Thunderbird Discount Markets Inc.*

- Sprouts

- Staples*

- Starbucks*

- Subway

- Walgreens*

- Weis Markets

- All businesses that use Square and support contactless*

- All businesses that use Clover and support EMV†**

- All businesses that use First Data standalone terminals (e.g. FD100+FD35, FD130) with EMV enabled**

* CDCVM support confirmed

** CDCVM support depends on store/restaurant

† CDCVM supported in MSD mode

USA contactless credit/debit/transit (2017 - 2021)

#8986

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

It kind of feels like CDCVM Is kind of dieing in North America. Even here in Canada, most terminals have been updated to have no contactless limit and banks will just decline transactions above $250 when a card is used to tap. Outside of the Apple Store and Bed Bath & Beyond, I've never seen CDCVM in Canada. This setup does the have the unfortunate side effect of seemingly allowing some international cards to be tapped for an unlimited amount with no verification (I managed to tap for a transaction over $500 on a European card).

It's not a problem with Interac debit cards though as the limit is enforced by the card chip/device and not by the terminal.

It's not a problem with Interac debit cards though as the limit is enforced by the card chip/device and not by the terminal.

EDIT: BTW, speaking of CDCVM, I suspect Chase ATMs are blocking all non-CDCVM transactions on Visa (and simply not supporting any other networks at all); tapping my physical Schwab card at a Chase ATM last night just caused the ATM to beep a couple of times. Which would be weird since Chase has had contactless debit cards for a while.

#8987

Join Date: Jul 2003

Location: Boston

Posts: 249

I'm not sure it's dying in the US per se as Google Pay at least is still mandating authentication before every tap (and most terminals complain with a specific "check phone" message if you don't). However, terminals/software that's being certified now might be more likely not to print out anything on the receipt indicating such and/or ignore the CDCVM indicator once the phone allows payment.

EDIT: BTW, speaking of CDCVM, I suspect Chase ATMs are blocking all non-CDCVM transactions on Visa (and simply not supporting any other networks at all); tapping my physical Schwab card at a Chase ATM last night just caused the ATM to beep a couple of times. Which would be weird since Chase has had contactless debit cards for a while.

EDIT: BTW, speaking of CDCVM, I suspect Chase ATMs are blocking all non-CDCVM transactions on Visa (and simply not supporting any other networks at all); tapping my physical Schwab card at a Chase ATM last night just caused the ATM to beep a couple of times. Which would be weird since Chase has had contactless debit cards for a while.

BTW, is Samsung Pay dying too?

#8988

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

Oh, Google Pay is dying? I mainly use Apple Pay, but have Google Pay set up. I received an email from Google telling me that I have to switch to their new Google Pay in January 2021 and this new app requires I register a phone number whereas the old one didn't. Perhaps Google's plan for saving Google Pay is to associate all Google Pay purchases to a phone number and then sell that data in order to save Google Pay?

BTW, is Samsung Pay dying too?

BTW, is Samsung Pay dying too?

As for Samsung Pay, they're basically killing what little remains of their rewards system, but that's also different than outright ending the service.

#8989

Join Date: Jul 2006

Location: SAN

Posts: 1,171

As long as the US doesn’t have a contactless limit, there’s no effective difference to a terminal to do CDCVM vs No CVM. In other countries where there is a limit on card-based contactless transactions, recognizing CDCVM and accepting it allows the terminal to accept a transaction above the limit for a mobile device payment.

#8990

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

As long as the US doesn’t have a contactless limit, there’s no effective difference to a terminal to do CDCVM vs No CVM. In other countries where there is a limit on card-based contactless transactions, recognizing CDCVM and accepting it allows the terminal to accept a transaction above the limit for a mobile device payment.

Of course, this again brings up the question of why mobile wallets insist on CVM for US cards in the first place when Google Pay at least allows low-value transactions without one for non-US cards (not to mention the de facto "official" CVM in the US being effectively "none").

#8991

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

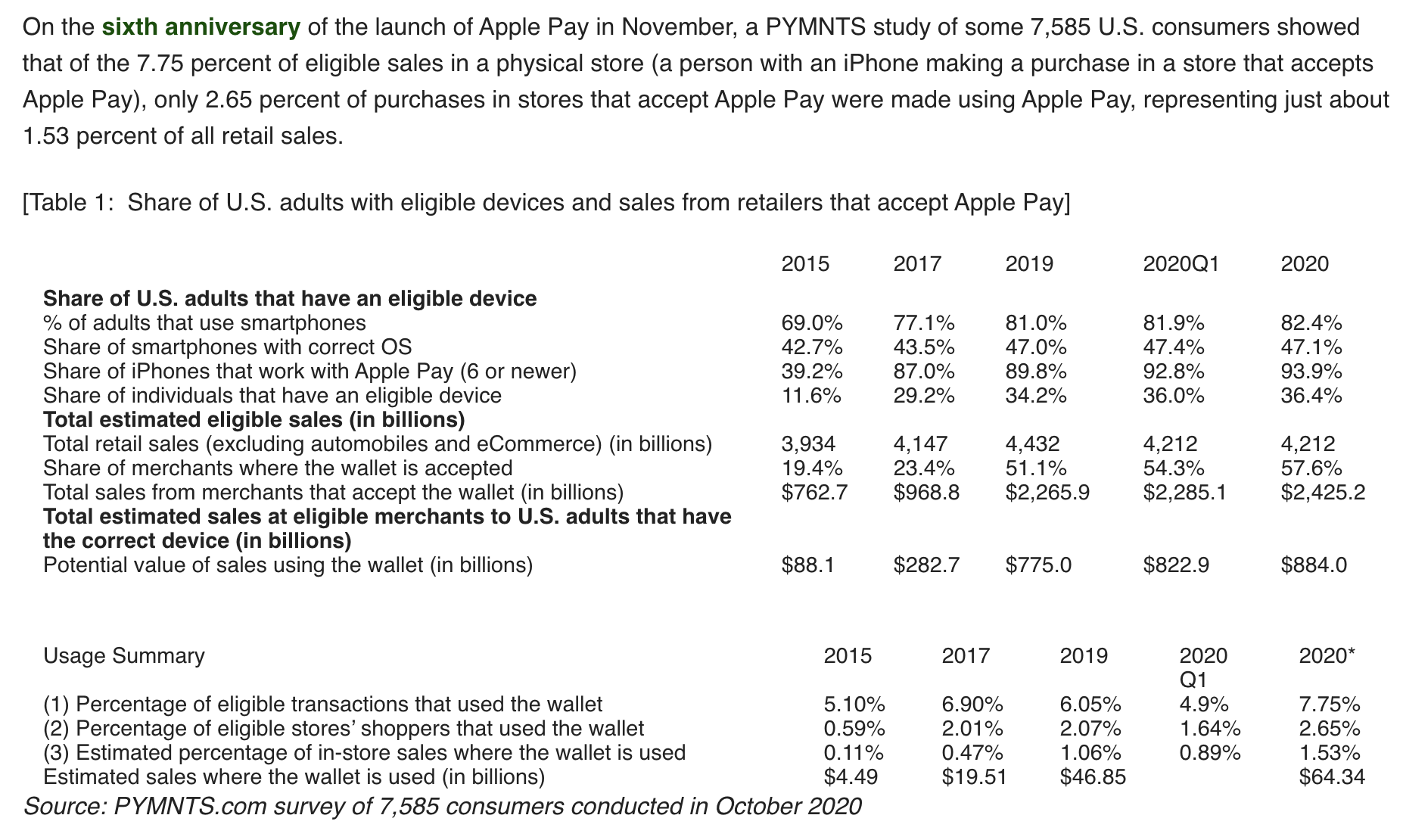

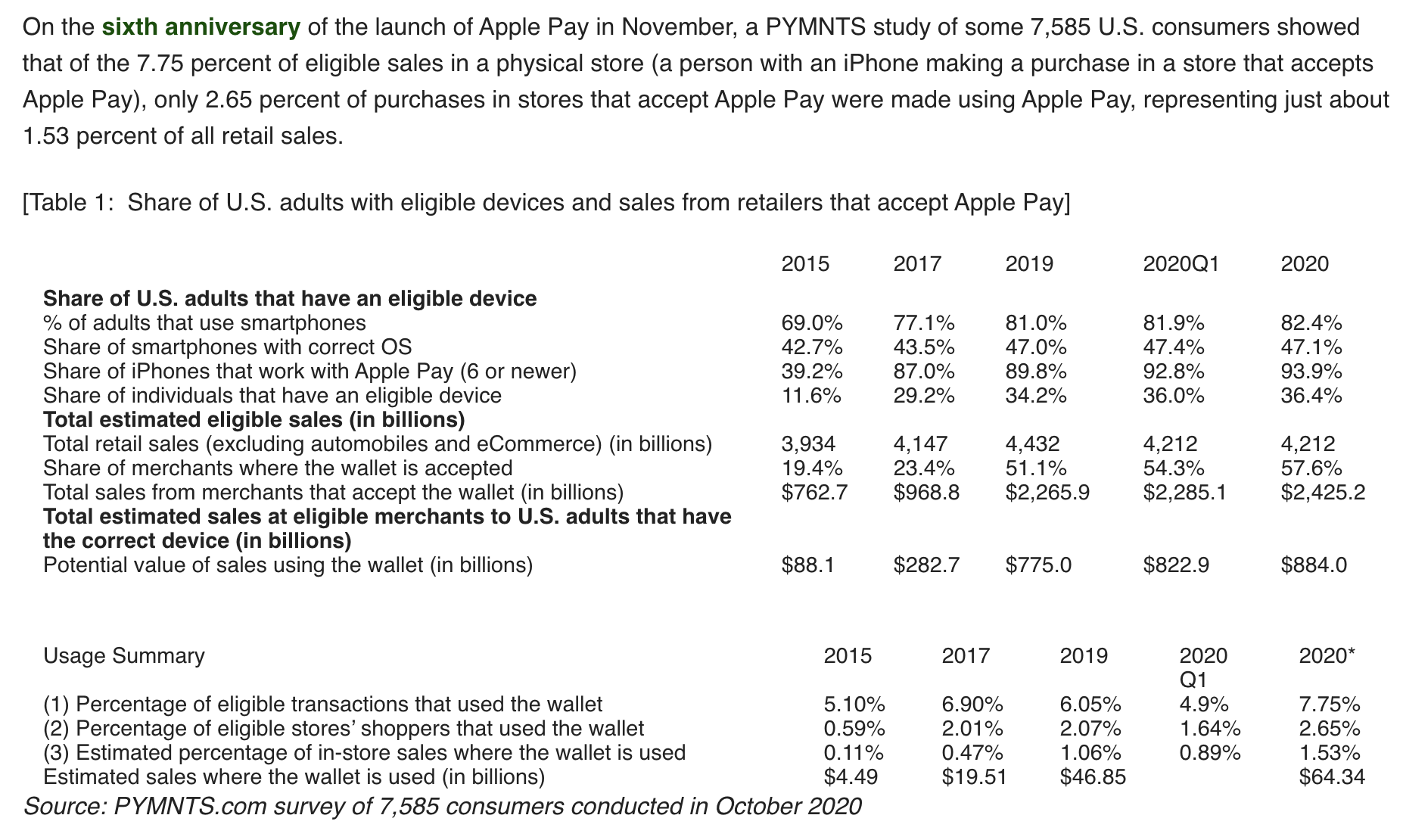

PYMNTS is still pushing the "Apple Pay isn't popular" meme, this time through an article about how Apple maybe should let third parties use the NFC chip on iPhones:

Last I checked, 2.65% is a 28% increase over 2019 figures--and that's using incomplete data as 2020 isn't done yet. I will concede that it's likely we'll eventually end up with the majority of transactions being done online, though, but that was a trend happening prior to COVID-19 (and isn't related to NFC adoption except by virtue of reducing card present transactions in general).

BTW, speaking of online, the article also claimed that 4x more people prefer to use PayPal over Apple Pay for online purchases. PayPal has been around a lot longer than Apple Pay, so I'm not sure that's a good comparison.

Last I checked, 2.65% is a 28% increase over 2019 figures--and that's using incomplete data as 2020 isn't done yet. I will concede that it's likely we'll eventually end up with the majority of transactions being done online, though, but that was a trend happening prior to COVID-19 (and isn't related to NFC adoption except by virtue of reducing card present transactions in general).

BTW, speaking of online, the article also claimed that 4x more people prefer to use PayPal over Apple Pay for online purchases. PayPal has been around a lot longer than Apple Pay, so I'm not sure that's a good comparison.

#8992

Join Date: Oct 2014

Programs: Skymiles

Posts: 3,251

Google Pay isn't dying. The previous post was about CDCVM, a form of authentication for contactless transactions. The GPay app is a separate deal and it involves their move into consumer banking (think something like Revolut).

As for Samsung Pay, they're basically killing what little remains of their rewards system, but that's also different than outright ending the service.

As for Samsung Pay, they're basically killing what little remains of their rewards system, but that's also different than outright ending the service.

#8993

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

Speaking of which, I can confirm offline PIN does work at Costco pumps, though outside of non-US cards and the slowly shrinking pool of US Visa credit cards (what little that existed, anyway), I'm not sure it matters much. The pump I used also didn't have the "optical scan not working" sticker on the barcode scanner, so hopefully this means that they're about to enable digital membership at the pump for all locations.

#8994

Suspended

Join Date: Feb 2009

Programs: DL, UA, AA, VS

Posts: 5,226

How would you even use PayPal at retail?

Do they have some QR code app?

If that's what they're relying on, no I doubt that's more popular.

Do they have some QR code app?

If that's what they're relying on, no I doubt that's more popular.

#8995

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

They do have a QR code thing for in person shopping that came out during the pandemic but the article was referring to their normal "log in with a username and password" thing for online purchases.

#8996

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,061

The problem with the new Google Pay is that one can only have a single registered device per phone number. It's unhelpful for those of us who carry multiple devices and want to register everything under a single phone number or account.

#8997

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

Seems like a weird restriction to have. IIRC not even Revolut does this, and I'm fairly sure Venmo and CashApp don't either.

#8998

Join Date: Jun 2012

Location: New England

Programs: American Gold, Marriott Gold, Hilton Silver

Posts: 5,640

I would argue (against those Apple Pay statistics) that with current generation Apple phones not having Touch ID (fingerprint sensor) and requiring either Face ID or a passcode to use Apple Pay, that if I'm pulling something out of my pocket to pay, it might as well be my wallet. I would simply pull out the card that I want, and tap that, instead of pulling my phone out, double tapping the side button, selecting a credit card, letting the Face ID fail twice (because I'm wearing a mask) before it shows me the "Pay with Passcode" button that I have to tap and then enter my passcode, and then hold the phone to the pin pad, which takes longer than simply taking card out, tapping it, and putting it away. If we all didn't have to wear masks in public, then yes, Face ID is faster, but during these times, I've found that pulling a card out of my wallet is faster.

#8999

Join Date: Oct 2019

Posts: 137

Last edited by PrendellHiggins; Dec 23, 2020 at 6:10 pm

#9000

Join Date: Apr 2019

Posts: 201

I would argue (against those Apple Pay statistics) that with current generation Apple phones not having Touch ID (fingerprint sensor) and requiring either Face ID or a passcode to use Apple Pay, that if I'm pulling something out of my pocket to pay, it might as well be my wallet. I would simply pull out the card that I want, and tap that, instead of pulling my phone out, double tapping the side button, selecting a credit card, letting the Face ID fail twice (because I'm wearing a mask) before it shows me the "Pay with Passcode" button that I have to tap and then enter my passcode, and then hold the phone to the pin pad, which takes longer than simply taking card out, tapping it, and putting it away. If we all didn't have to wear masks in public, then yes, Face ID is faster, but during these times, I've found that pulling a card out of my wallet is faster.

I suspect the statistics for Apple Pay also account for in-app/web site-based uses, which I'm typically doing without a mask on (in the car to order something for pickup, buying things while at home, etc.) Still, ultimately, my Apple Watch has gotten more in-person use since it's always "authenticated" and has my cards and wallet passes for places. It does become a two-step process if I'm buying groceries (loyalty pass barcode, then the payment card, typically Square's Cash Card, not the default).