Barclays relaunches VISA Black Card (October 2013)

#31

Join Date: May 2010

Posts: 583

The Ink Lounge Club membership includes only two visits, $27 per person per visit thereafter:

https://www.chase.com/online/busines...s/ink-bold.htm

https://www.chase.com/online/busines...s/ink-bold.htm

Priority Pass membership is also available for purchase now at $212 / year for 10 visits or $339 / year for unlimited visits.

#32

It's such a shame that this card offers so little. With Amex plat dropping benefits, and all the chaos going on with mergers and devaluations, this card could have become a formidable competitor against other travel cards had it offered a little more.

#33

Join Date: Dec 2013

Posts: 15

There is no limit on the number of visits with the Priority Pass provided with American Express Platinum. Guests are $27 per person per visit. The Priority Pass lounge network is much larger than the Lounge Club network. (Lounge Club is a subset of Priority Pass, same company.)

I am definitely aware that Lounge Club is a subset of the PP and there are definitely a list of beautiful lounges that the Lounge Club does not grant access to (as opposed to PP).

#34

Join Date: Dec 2013

Posts: 15

Stainless Steel Card vs "Carbon" Card

I just received the Stainless Steel version of the card today. It's quite beautiful. I'm not sure whether this is important to a forum that isn't necessarily dedicated to the physical qualities and appearance of the cards themselves, but I felt compelled to share.

The raised ISO/IEC 7812 account numbers and other text from the previous generation are gone, now replaced by numbers and text that are directly etched through the topcoat into the steel material. The VISA logo is also etched in but gets special treatment as it appears to have some color fill.

The lack of raised/debossed numbers means that this card is likely incompatible with the older model manual imprint machines. The thickness of the card appears to remain unchanged, but the card does not have a substantial weight to it. It is very solid and feels almost unbendable. Comparing this with the Chase Sapphire card which feels like it can fold in half and fall apart. In fact, when I get home today, If I have some time, I will weigh them to compare. The rear is supposed to use the same "Carbon" material that was applied to the front of the old card. It feels much more like matte plastic. It also has a very faint carbon-fiber pattern printed on to it - it looks a little bit cheesy.

I've attached a photo I took the other day of the previous generation card with the accompanying Lounge Club card.

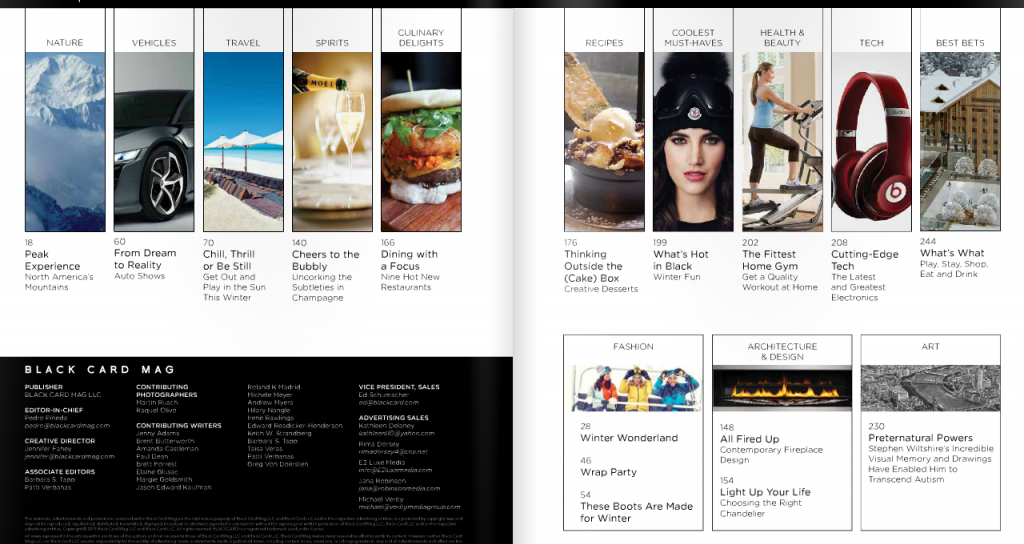

Black Card Mag - I've attached a screenshot of the TOC to give the forum an idea of the contents of the magazine. I wouldn't say anything in here is all that exclusive, but the production value of the publication seems to be okay.

VIP Booklet - someone was asking about the "VIP Treatment at over 3,000 Properties" claim. I've attached a screenshot of one of the pages in the VIP booklet. At the bottom you will see what these VIP treatment claims are, IMO the same treatment you would get as a regular paying customer. Not sure if "Free WiFi" can be considered VIP treatment.

I hope I can continue shedding light on this, sometimes elusive credit card. Throughout the year I've used it like any of the dozen credit cards I own, but after paying nearly $1k in membership fees, I'd really like to evaluate to see if this card can live up to the marketing claims.

As vain as I am, so far the sleek stainless steel material is one of the high points.

I just received the Stainless Steel version of the card today. It's quite beautiful. I'm not sure whether this is important to a forum that isn't necessarily dedicated to the physical qualities and appearance of the cards themselves, but I felt compelled to share.

The raised ISO/IEC 7812 account numbers and other text from the previous generation are gone, now replaced by numbers and text that are directly etched through the topcoat into the steel material. The VISA logo is also etched in but gets special treatment as it appears to have some color fill.

The lack of raised/debossed numbers means that this card is likely incompatible with the older model manual imprint machines. The thickness of the card appears to remain unchanged, but the card does not have a substantial weight to it. It is very solid and feels almost unbendable. Comparing this with the Chase Sapphire card which feels like it can fold in half and fall apart. In fact, when I get home today, If I have some time, I will weigh them to compare. The rear is supposed to use the same "Carbon" material that was applied to the front of the old card. It feels much more like matte plastic. It also has a very faint carbon-fiber pattern printed on to it - it looks a little bit cheesy.

I've attached a photo I took the other day of the previous generation card with the accompanying Lounge Club card.

Black Card Mag - I've attached a screenshot of the TOC to give the forum an idea of the contents of the magazine. I wouldn't say anything in here is all that exclusive, but the production value of the publication seems to be okay.

VIP Booklet - someone was asking about the "VIP Treatment at over 3,000 Properties" claim. I've attached a screenshot of one of the pages in the VIP booklet. At the bottom you will see what these VIP treatment claims are, IMO the same treatment you would get as a regular paying customer. Not sure if "Free WiFi" can be considered VIP treatment.

I hope I can continue shedding light on this, sometimes elusive credit card. Throughout the year I've used it like any of the dozen credit cards I own, but after paying nearly $1k in membership fees, I'd really like to evaluate to see if this card can live up to the marketing claims.

As vain as I am, so far the sleek stainless steel material is one of the high points.

#35

Join Date: Feb 2013

Location: NYC

Programs: UA 1K, AA EP, Hyatt Diamond, SPG Platinum, M life Noir

Posts: 1,279

Thanks for the insight chino1127, but this information only reinforces my belief that this card is a joke.

I stayed at the Andaz West Hollywood just a week ago (using points before Hyatt bumped it from a category 4 to 5). The "Black Card VIP" benefits of "non-alcoholic mini-bar refreshments, free wireless internet & local phone calls" are benefits that all guests at this property receive.

I'll keep my J.P. Morgan Palladium card for when I need an ego boost. Speaking of which, the J.P. Morgan concierge was able to get me bumped from a standard room to a suite on the penthouse level at the Andaz West Hollywood. I'll take that over a free breakfast. ^

I stayed at the Andaz West Hollywood just a week ago (using points before Hyatt bumped it from a category 4 to 5). The "Black Card VIP" benefits of "non-alcoholic mini-bar refreshments, free wireless internet & local phone calls" are benefits that all guests at this property receive.

I'll keep my J.P. Morgan Palladium card for when I need an ego boost. Speaking of which, the J.P. Morgan concierge was able to get me bumped from a standard room to a suite on the penthouse level at the Andaz West Hollywood. I'll take that over a free breakfast. ^

#36

Join Date: Dec 2013

Posts: 15

Thanks for the insight chino1127, but this information only reinforces my belief that this card is a joke.

I stayed at the Andaz West Hollywood just a week ago (using points before Hyatt bumped it from a category 4 to 5). The "Black Card VIP" benefits of "non-alcoholic mini-bar refreshments, free wireless internet & local phone calls" are benefits that all guests at this property receive.

I'll keep my J.P. Morgan Palladium card for when I need an ego boost. Speaking of which, the J.P. Morgan concierge was able to get me bumped from a standard room to a suite on the penthouse level at the Andaz West Hollywood. I'll take that over a free breakfast. ^

I stayed at the Andaz West Hollywood just a week ago (using points before Hyatt bumped it from a category 4 to 5). The "Black Card VIP" benefits of "non-alcoholic mini-bar refreshments, free wireless internet & local phone calls" are benefits that all guests at this property receive.

I'll keep my J.P. Morgan Palladium card for when I need an ego boost. Speaking of which, the J.P. Morgan concierge was able to get me bumped from a standard room to a suite on the penthouse level at the Andaz West Hollywood. I'll take that over a free breakfast. ^

I just recently booked the St. Regis Bal Harbour for 2-nights during the Valentines Day weekend. I booked through Black Card Concierge and was able to redeem the VIP Benefits stated which was for a $100 Spa Credit. I'm wondering if this is a perk of the BC, or also included in any full fare booking with the hotel.

Below is the Rate Description in my Starwood account summary: Ensemble Travel One 100usd Spa Credit Ps, Upgrade If Avl, Daily Full Breakfast For Two Guests (maximum Value Of $40 Per Guest, Per Day), Late Checkout If Available.

Lately, I've been really trying to leverage the concierge service. They've helped me in the booking process and I was able to redeem flights and a rental car through the concierge service. I am aware that many cards have this feature, so I'm trying to find out if there's really a distinction between the one provided by BC and say a comparable one by Visa Signature.

I'm still diggin' the stainless steel. It seems like a small thing, but it has some real weight and I can't tell you how many inquisitive looks, comments and compliments I get on it. I would say that service has improved since flashing this baby around.

Note: I've just been approved with AMEX Platinum - I'll give that a thorough run during the year and compare the two cards.

Last edited by chino1127; Jan 20, 2014 at 7:58 pm Reason: Note

#37

Join Date: Dec 2013

Posts: 15

I'll probably do a full writeup to compare the two cards (AMEX Platinum vs Visa Black Card), but here's a quick comparison of the airline booking engines.

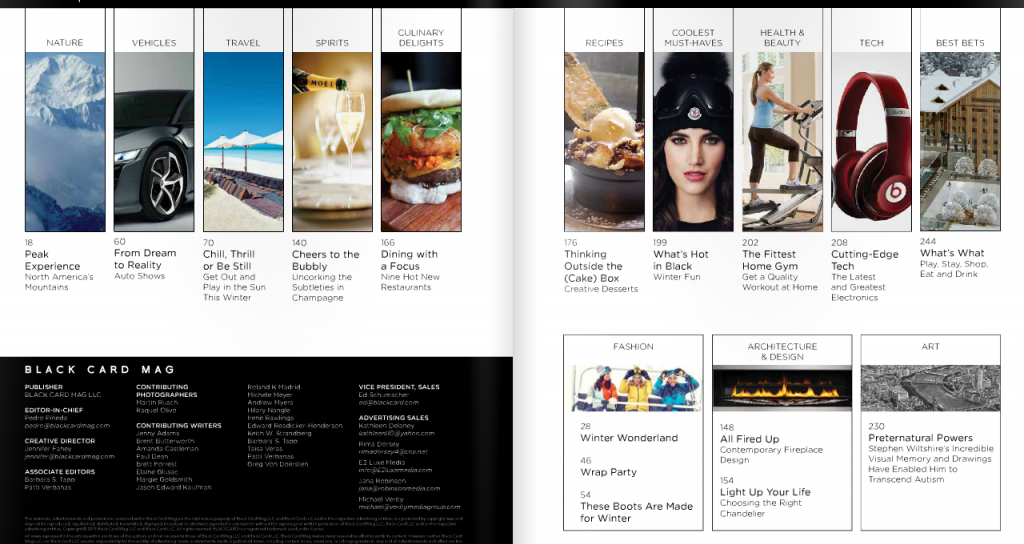

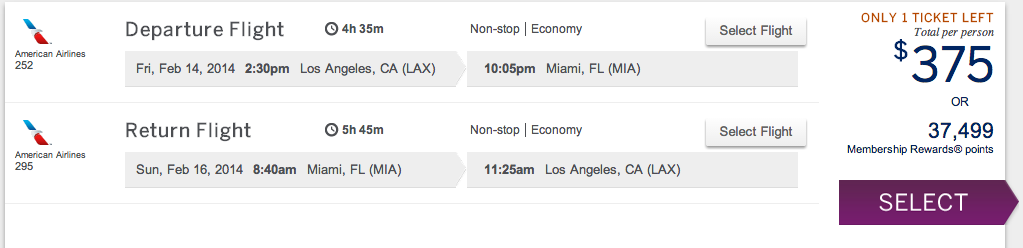

Below are the results of a trip I entered using AMEX's booking engine.

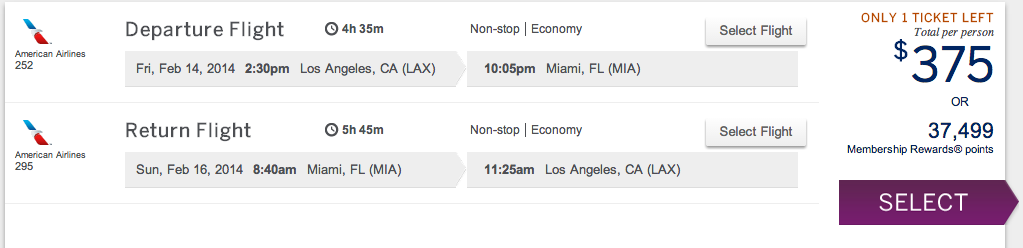

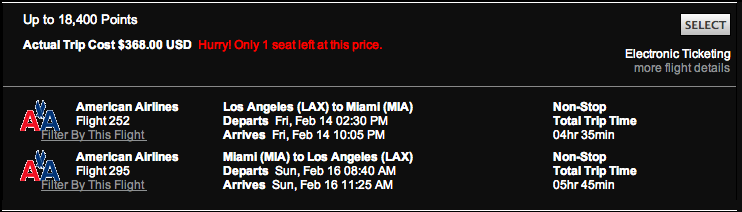

Below is a snapshot of the results of a trip I entered into the system using the Black Card booking engine. You'll notice that everything is in black (go figure) and that the interface and design are not quite a pretty as AMEX.

The flights are identical and were requested within minutes of each other (I entered the request into AMEX's system about a minute before doing it in BC's system). Both appear to be final pricing including all taxes and fees.

So it seems the prices are fairly similar, w/Black Card taking the win by a small margin, but what is more important is that Black Card requires half of the point redemption.

To understand exactly what this means, we have to know that BC only provides 1 pt per $1.00 spent. I have not seen any promos or spending methods that could earn more than that.

AMEX Platinum allows you to earn 2pts per $1.00 on certain qualified purchases and 1pt per $1.00 on everything else. This means if you performed all your purchases within these qualified boundaries, then you can effectively match the benefit as the Black Card, however, if you are like most people and your expenses vary, with only a portion earning double the reward points, booking through AMEX will actually cost you more than through Black Card when redeeming airfare w/points.

For those willing to take advantage of airfare, this could be a big deal. There are a lot of airline rewards cards out there that may offer similar benefits, but there are few that have the combination of benefits that these two cards have.

Right now both cards offer 25,000 pts when signing up and reaching the spending minimums over a set period of time. AMEX Platinum requires $2,000 in 3 months and Black Card requires $1,500 in 90 days. These points will be worth $250 in airfare with AMEX and $500 in airfare with Black Card.

I do not work for Black Card (or AMEX). I only wanted to shed some more light on this subject, particular in reaction to the many posts about Black Card being a "joke" or a "scam" from people who have never owned the card or whom cancelled their membership without utilizing all aspects of the card.

Keep in my the Black Card has added to their membership benefits since it's introduction several years ago. It is still a rather new card but it is making some progress.

Below are the results of a trip I entered using AMEX's booking engine.

Below is a snapshot of the results of a trip I entered into the system using the Black Card booking engine. You'll notice that everything is in black (go figure) and that the interface and design are not quite a pretty as AMEX.

The flights are identical and were requested within minutes of each other (I entered the request into AMEX's system about a minute before doing it in BC's system). Both appear to be final pricing including all taxes and fees.

So it seems the prices are fairly similar, w/Black Card taking the win by a small margin, but what is more important is that Black Card requires half of the point redemption.

To understand exactly what this means, we have to know that BC only provides 1 pt per $1.00 spent. I have not seen any promos or spending methods that could earn more than that.

AMEX Platinum allows you to earn 2pts per $1.00 on certain qualified purchases and 1pt per $1.00 on everything else. This means if you performed all your purchases within these qualified boundaries, then you can effectively match the benefit as the Black Card, however, if you are like most people and your expenses vary, with only a portion earning double the reward points, booking through AMEX will actually cost you more than through Black Card when redeeming airfare w/points.

For those willing to take advantage of airfare, this could be a big deal. There are a lot of airline rewards cards out there that may offer similar benefits, but there are few that have the combination of benefits that these two cards have.

Right now both cards offer 25,000 pts when signing up and reaching the spending minimums over a set period of time. AMEX Platinum requires $2,000 in 3 months and Black Card requires $1,500 in 90 days. These points will be worth $250 in airfare with AMEX and $500 in airfare with Black Card.

I do not work for Black Card (or AMEX). I only wanted to shed some more light on this subject, particular in reaction to the many posts about Black Card being a "joke" or a "scam" from people who have never owned the card or whom cancelled their membership without utilizing all aspects of the card.

Keep in my the Black Card has added to their membership benefits since it's introduction several years ago. It is still a rather new card but it is making some progress.

#38

Join Date: Jun 2011

Posts: 3,528

To an extent, this seems to be veering into "high end credit card comparison" thread, which would actually be quite an interesting thread, I would think.

FWIW, if you're looking for a similar high-end credit card and want to redeem awards towards domestic airfare, the Citi Prestige can actually beat both of these cards.

FWIW, if you're looking for a similar high-end credit card and want to redeem awards towards domestic airfare, the Citi Prestige can actually beat both of these cards.

#39

Join Date: Feb 2013

Location: NYC

Programs: UA 1K, AA EP, Hyatt Diamond, SPG Platinum, M life Noir

Posts: 1,279

I booked the Hyatt stay with my points. Subsequently, I called the JPM concierge to arrange some dining reservations and, after mentioning my Hyatt stay, coyly asked if they had the ability to get me an upgrade there. They said they'd do their best and called me back 10 minutes later to confirm I was now booked for a top-floor suite. I know JPMC has a relationship with Hyatt, so that may been part of it.

Last edited by bribro; Jan 21, 2014 at 5:48 pm

#40

Join Date: Feb 2013

Location: NYC

Programs: UA 1K, AA EP, Hyatt Diamond, SPG Platinum, M life Noir

Posts: 1,279

The Visa Black Card is essentially a 2% cash back card (but only when points are redeemed specifically for airfare using their online tool). AFAIK, they have zero travel partners that you can transfer to, so 2% is the most you'll ever get with this card. If you wanted a 2% cash back card, you can look elsewhere in Barclays' credit card portfolio and find the Arrival card that gets 2.2% cash back (when redeemed against the broader category of travel). Bottom line, you're paying $400+ extra every year in AFs to get a card that earns less in rewards in order to get lounge access, a concierge, and a card made of metal. Considering all the extra benefits and travel partners you get with the Palladium and Platinum cards for similar AFs, that's why this card is largely considered a joke.

Right now both cards offer 25,000 pts when signing up and reaching the spending minimums over a set period of time. AMEX Platinum requires $2,000 in 3 months and Black Card requires $1,500 in 90 days. These points will be worth $250 in airfare with AMEX and $500 in airfare with Black Card.

Last edited by bribro; Jan 22, 2014 at 10:37 am

#43

Join Date: Dec 2013

Posts: 15

The Visa Black Card is essentially a 2% cash back card (but only when points are redeemed specifically for airfare using their online tool). AFAIK, they have zero travel partners that you can transfer to, so 2% is the most you'll ever get with this card. If you wanted a 2% cash back card, you can look elsewhere in Barclays' credit card portfolio and find the Arrival card that gets 2.2% cash back (when redeemed against the broader category of travel). Bottom line, you're paying $400+ extra every year in AFs to get a card that earns less in rewards in order to get lounge access, a concierge, and a card made of metal. Considering all the extra benefits and travel partners you get with the Palladium and Platinum cards for similar AFs, that's why this card is largely considered a joke.

Yes the annual fee is one of the highest in the industry ($495 for Black Card, $195 per additional card vs $450 for AMEX Platinum and $170 for multiple cards) but rather inconsequential for high spenders. I will also mention that I got the annual fee at Black Card waived with just a phone call - if you demonstrate a decent spend and are polite they will not hang the fee over your head.

Also, keep in mind AMEX is a charge card and BC is a credit card. AMEX will let you carry a balance with a rather high interest charge for 30 additional days, but will not allow you to carry a revolving line of credit like the BC. Also it is important to note that AMEX is not accepted at many retailers (especially overseas), where Visa is accepted almost everywhere. This obviously helps in point accumulation as well as utility.

I can't comment on the Palladium card you referenced, having no experience with it, but the benefits at a glance when perusing the web does seem to beat what's offered by BC or AMEX Plat. The annual fee is a bit higher at $595, but again, inconsequential if you're already a client with JPM's Private Banking Group. That being said, it would be unfair to say any card is a "joke" in comparison with a card like this - this is not a mass market card, and the benefits are designed for a higher tier client and paid for by the clients AUM.

I booked the Hyatt stay with my points. Subsequently, I called the JPM concierge to arrange some dining reservations and, after mentioning my Hyatt stay, coyly asked if they had the ability to get me an upgrade there. They said they'd do their best and called me back 10 minutes later to confirm I was now booked for a top-floor suite. I know JPMC has a relationship with Hyatt, so that may been part of it.

To an extent, this seems to be veering into "high end credit card comparison" thread, which would actually be quite an interesting thread, I would think.

FWIW, if you're looking for a similar high-end credit card and want to redeem awards towards domestic airfare, the Citi Prestige can actually beat both of these cards.

FWIW, if you're looking for a similar high-end credit card and want to redeem awards towards domestic airfare, the Citi Prestige can actually beat both of these cards.

Last edited by chino1127; Jan 22, 2014 at 6:48 pm

#44

FlyerTalk Evangelist

Join Date: Sep 1999

Location: New York, NY, USA

Posts: 12,482

Or was the fee waiver for subsequent years only?

Or was the fee waiver for subsequent years only?

#45

Join Date: Jul 2011

Location: Asia Pac

Programs: AA UA DL AS CXDM JL NH Hilton Hyatt Marriott SPG IHG

Posts: 545