Last edit by: derek2010

Churning and Welcome Offers: Credit Card Asiamiles Churning and Welcome Offers discussion (HK) - continuously upda

For time required to transfer miles from banks, please see here.

On-going offers

Beginner's recommendation (rates quoted before other short term promotions):

(Just one for now) BEA Flyer World Master - 1 mile per $5 for local and overseas purchases; 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee)

Credit Cards that are by Invitation Only / Applied in lieu with an Account / Needs possessing certain membership for Application:

1. WLB Luxe Visa Infinite - 1 mile per $2.4 for overseas airline / travel / hotel / dining; $4/mile on local airline / travel / hotel / dining ($50/5,000 miles min $50 max $500) (Need to be Wing Lung Private Banking customers)

2. BoC Wealth Management Visa Infinite - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $5 for overseas spending / local dining, 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. HSBC Premier World Master for 6X (select one category only below, 1 mile per $4.16. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2019] (Need to be HSBC Premier customer)

4. BoC Enrich World MC - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $3 for dining/dept store if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Enrich (智盈理財) customer)

5. HSBC Advance Platinum Visa for 6X (select one category only below, 1 mile per $4.16. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2019] (Need to be HSBC Advance customer)

6. Citibank Ultima card - 1 mile per $4 for local / overseas / octopus (no redemption fee, $23,800 non-waivable annual fee) (Need to be Citigold Private Client customer AND by Invitation only)

7. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] $7.5 per mile for local spending ($15 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $5 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2, [from 28 Feb 2020] $12.5 per mile for local spending ($25 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $8.33 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2

8. BEA Supreme Gold World Master - 1 mile per $5 for local / overseas, 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee) (Need to be BEA Supreme Gold (顯卓理財) customer) Note 3

9. Shacom World Master - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be Shacom SMART Banking (慧通理財) customer)

10. CCB HK Visa Infinite - 1 mile per $8 spent for Local Spending / Overseas Spending / Octopus / Bill payment ($50 per 5,000 miles AM min $100) (Need to be CCB Premier Banking (貴賓理財) / Premier Select (貴賓晉裕) customer)

11. BEA Hong Kong Racehorse Owners Association (HKROA) World Master - 1 mile per $5 for local / overseas, 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee) (Need to be member of Hong Kong Racehorse Owners Association (香港馬主協會)) Note 3

12. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent for local / online / octopus spendings, 1 mile per $4 for overseas spendings (no fee, $19,800 non-waivable annual fee with 120000 miles awarded annually) (Need to be OCBC Wing Hang Premier Banking (宏富理財) customer)

13. Shacom Shanghai Fraternity Association (上海總會) UnionPay Dual Currency Diamond - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be member of Shanghai Fraternity Association (上海總會))

Full list:

I. Overseas

1. BOC Travel Rewards Visa Signature Card - 8% rebate for each transaction >$500 overseas spending (max $500 per month) (requirement: 1. overseas transaction for that month (any amount per transaction) > $6,000; 2. three times local spending (any amount)) plus 1 mile per $15

2. BoC Wealth Management Visa Infinite - 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. [to 31 Dec 2019] HSBC (excluding amounts billed in HK and PRC) - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent (select Overseas Spending category ONLY) / $6.25 (HSBC Visa Signature) spent (NOT select Overseas Spending category) ($300 fee for a year's worth of redemptions)** ++

4. (if ONLINE / PAYWAVE) CCB HK eye Card - 1 mile / $2.14 (inclusive of 5X online bonus, cap at $50,000 per calender year and (2X extra overseas bonus, cap at $75000 per membership year ) ($50 per 5,000 miles min $100)

5. Citibank Premiermiles (>=$20K per billing cycle) (excluding RMB and MOP) - 1 mile per $3 spent (no redemption fee)** ++ ^

6. [to 31 Dec 2018] DBS Eminent (excluding MOP) - 1 mile per $3.6 spent ($50 fee per 5,000 miles)

7. [to 28 Feb 2019] Fubon Platinum / Titanium - 1 mile per $3.75 spent ($50/5,000AM min $250 max $500) (plus 133 Sure win miles if txn amt >$600)

Note: 1 mile per $0.75 for TWD spendings in Taiwan (max $5,000/month and $10,000/year), and 1 mile per $1.875 for KRW and JPY spendings in Korea and Japan (Seperate registration needed, max $20,000/month, two months per calendar year max)^

8. AMEX Platinum Charge - 1 mile per $3.75 spent (first $160,000 spending, $5/mile thereafter, $200 flat redemption fee, $7,800 non-waiveable annual fee)

9. Citibank Prestige / PremierMiles (<$20K) (excluding RMB and MOP) - 1 mile per $4 spent (no redemption fee, $3,800 non-waivable annual fee for the Prestige)** ++ ^

10. DBS Black World Master (excluding MOP) - 1 mile per $4 spent overseas (no fee)^

11. SCB Asia Miles World Master - 1 mile per $4 spent (automatic conversion)

12. AMEX CX Elite - 1 mile per $4 spent (automatic conversion)

13. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 (no fee)^

14. AMEX Platinum Credit - 1 mile per $5 spent (to $160,000, 1 mile per $15 thereafter), $200 flat redemption fee, $2,200 non-waiveable annual fee for AMEX Platinum Credit if one does not possess AMEX Platinum Charge in lieu) ** ++

15. CCB HK Platinum Visa / Platinum Master - 1 mile per $5 ($50 per 5,000 miles min $100)

16. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $8.33 spent ($300 flat redemption fee)

17. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

18. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $4 for overseas spendings (no fee)

^: DO NOT Award points for DCC Transactions

II. Supermarket, Department store, Telecommunications bills on autopay:

1A . [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Home Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1B. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Lifestyle Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1C. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Entertainment Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

2. [till 14 Jan 2021] Citibank Rewards - 1 mile / $3 spent ($50 fee per 5,000 mile redeemed) (on first $12,500 spending per statement month) Note 2 ** ++

3. (if ONLINE / PAYWAVE) CCB HK Eye Card - 1 mile / $3 (inclusive of 5X online bonus, cap at $75000 per calender year ($50 per 5,000 miles AM min $100)

4. HSBC Red World Master - 1 mile / $5 spent ($300 fee for a year's worth of redemptions)** ++

5. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

III. Dining

1. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Dining Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1b. [to 31 Dec 2019] HSBC (non-Visa Signature, INCLUDING HSBC Premier World Master) (select Dining category) - 1 mile / $4.16 ($300 fee for a year's worth of redemptions)** ++

1c. [to 31 Dec 2019] HSBC Visa Signature (did not select Dining category) - 1 mile / $6.25 ($300 fee for a year's worth of redemptions) ** ++

2. SCB Asia Miles World Master - 1 mile / $4 (automatic conversion)

3. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile / $5 (no fee) Note 3

4. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

5. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

Note: Restaurants in hotels sometimes are regarded as "Hotel" under V/M classification and thus ineligible for any dining promotions, using CUP can usually (but not always) get around this problem

IV. Travel agents:

** ++1. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select LifeStyle Spending category ONLY)/ $6.25 (HSBC Visa Signature NOT selecting LifeStyle Spending category)($300 fee for a year's worth of redemptions)

2. CCB HK EYE (if online) - 1 mile per $2.14 spent (First $50,000 only) ($50 per 5,000 miles AM min $100)

3. AMEX Platinum Charge - 1 mile per $3.75 spent (first $160,000 spending, $5/mile thereafter, $200 flat redemption fee, $7,800 non-waiveable annual fee)

V. Other retail spending

1. [to 14 Mar 19] (if online or Apple Pay) CCB HK Premier Banking Visa Infinite - 1 mile per $2.67 spent ($50 per 5,000 miles AM min $100) (first $12.5K spending ONLINE per month only, else $8 per mile)

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (PAYWAVE Spending ONLY, else $15 per mile)

3. SCB Asia Miles World Master - 1 mile per $6 spent (automatic conversion)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 spent (no fee) Note 3

** ++ 5. AMEX Platinum Credit - 1 mile per $5 spent (to $160,000, 1 mile per $15 thereafter), $200 flat redemption fee, $2,200 non-waiveable annual fee for AMEX Platinum Credit if one does not possess AMEX Platinum Charge in lieu)

** 6. SCB WorldMiles AE - 1 mile per $6 spent ($300 flat redemption fee)

** ++ 7. Citi Prestige - 1 mile per $6 spent (no redemption fee, $3,800 non-waiveable annual fee)

8. AMEX CX Elite - 1 mile per $6 spent (automatic conversion)

** ++ 9. DBS Black World Master - 1 mile per $6 spent (no fee)

10. [to 31 Dec 2018] DBS Eminent - 1 mile per $7.2 spent ($50 fee per 5,000 miles)

11. [to 28 Feb 2019] Fubon Platinum / Titanium - 1 mile per $7.5 spent spending >=$300 on Saturdays and Sundays ($50/5,000AM min $250 max $500) (plus 133 Sure win miles if txn amt >$600 (if NOT ONLINE))

** 12. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $7.5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $12.5 spent ($300 flat redemption fee)

** ++ 13. AMEX (Gold grade and higher, except Platinum Credit) - 1 mile per $7.5 spent (to $160,000), $200 flat redemption fee). (1 mile per $3 spent for 5x shops and 1 mile per $1.5 spent for 10x shops, $7,800 non-waiveable annual fee for AMEX Platinum Charge)

** ++ 14. Citi Premiermiles - 1 mile per $8 spent (no fee)

15. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

16. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

17. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

VI. Bill payments (Excluding Tax or any payment to IRD)

VI A. General Bill Payments

1. CCB HK Visa Infinite / CCB HK Diamond Prestige - 1 mile per $8 spent ($50 per 5,000 miles AM min $100 max $300)

2. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

3. BoC Wealth Management Visa Infinite / BOC Travel Rewards Visa Signature Card / BoC Platinum Visa & Master (including co-branded cards like Sogo) / BoC Platinum Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

4. HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Red World Master - 1 mile per $25 spent (cap at $10,000 per Month)

VI B. Specific bill payment merchants who accept autopay for higher earn rates (by merchant)

1. Towngas autopay - Citi Prestige $6/mile

2. CLP autopay - Citi Prestige $6/mile, BEA $5/AM

3. HKE - AlipayHK (rever to IX.iii earn rates), DBS Black $6/AM

Note 1: Other issuers in Hong Kong DO NOT award bonus points for bill payment

VII. Octopus Automatic Add-Value

** ++ 1. Citibank Prestige - 1 mile per $6 spent (no redemption fee, $3,800 non-waiveable annual fee)

2. SCB Asia Miles World Master - 1 mile per $6 spent (automatic conversion)

** 3. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $7.5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $12.5 spent ($300 flat redemption fee)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $8 spent (no fee) Note 3

5. CCB HK Visa Infinite / CCB HK Diamond Prestige - 1 mile per $8 spent ($50 per 5,000 miles AM min $100 max $300)

** ++ 6. Citibank Premiermiles - 1 mile per $8 spent (no fee)

7. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

8. Bankcomm Diamond Dual Currency Card - 1 mile per HK$12 spent ($50 per 5,000 AM min $100 max $300)

9. HSBC (all HKD cards) - 1 mile per $25 spent

10. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

VIII. China Unionpay RMB spending

** ++1. [to 31 Dec 2019] HSBC Dual Currency Unionpay card - 1 mile per RMB4.16 spent (select China Spending category ONLY) ($300 fee for a year's worth of redemptions)

2. Bankcomm Diamond Dual Currency Card - 1 mile per RMB6 spent for restaurants or hotels spending >= RMB300, 1 per RMB12 spent other categories ($50 per 5,000 AM min $100 max $300)

3. CCB HK Diamond Prestige - 1 mile per RMB8 spent ($50 per 5,000 miles AM min $100 max $300)

4. Shacom Diamond UnionPay - 1 mile per RMB8 spent ($10 per 1,000AM min $100 max $500)

5. BoC Dual Currency Unionpay Card - 1 mile per RMB15 spent ($50/5,000 miles min $100)

IX. Electronic wallets (in descending chronological order):

i. Payme

https://www.mrmiles.hk/payme/

http://flyformiles.hk/8847

ii. Wechat

http://flyformiles.hk/8847

https://www.mrmiles.hk/wechat-pay/

iii. Alipay P2P

http://flyformiles.hk/8847

https://www.mrmiles.hk/alipay/

iv. O!epay (Oepay): see VII. Octopus Automatic Add-Value above

X. Online spending in HKD

1. HSBC Red World Master - 1 mile / $2.5 spent ($300 fee for a year's worth of redemptions)** ++

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (ONLINE Spending ONLY, else $15 per mile)

3. SCB Asia Miles World Master - 1 mile per $4 spent (automatic conversion) (ONLINE spending ONLY, else $6 per mile)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 spent (no fee) (EXCLUDING PayMe transactions) Note 3

Note 2:

** can opt for Krisflyer miles in lieu (conversion of Krisflyer for SCB Non-AM cards will end at 27 Feb 2020)

++ can opt for BAEC AVIOS in lieu

For HSBC, ONLY Premier World Master holders are able to opt for BAEC Avios and KrisFlyer Miles

Note 3:

BEA Supreme Gold World Master / BEA HKROA World Master cardholders need to register in advance for the "BEA Mileage Reward" scheme during application (Supreme Gold account opening / co-branded card application), or else pay $1800 penalty to register thereafter.

HK miles/hotel points earning ability

Refer to here

For time required to transfer miles from banks, please see here.

On-going offers

Beginner's recommendation (rates quoted before other short term promotions):

(Just one for now) BEA Flyer World Master - 1 mile per $5 for local and overseas purchases; 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee)

Credit Cards that are by Invitation Only / Applied in lieu with an Account / Needs possessing certain membership for Application:

1. WLB Luxe Visa Infinite - 1 mile per $2.4 for overseas airline / travel / hotel / dining; $4/mile on local airline / travel / hotel / dining ($50/5,000 miles min $50 max $500) (Need to be Wing Lung Private Banking customers)

2. BoC Wealth Management Visa Infinite - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $5 for overseas spending / local dining, 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. HSBC Premier World Master for 6X (select one category only below, 1 mile per $4.16. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2019] (Need to be HSBC Premier customer)

4. BoC Enrich World MC - 1 mile per $15 for local / overseas / octopus AAVS / bill payment, 1 mile per $3 for dining/dept store if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Enrich (智盈理財) customer)

5. HSBC Advance Platinum Visa for 6X (select one category only below, 1 mile per $4.16. Under this promotion, cap at $100,000), and all other seasonal promotions. ($300 fee for a year's worth of redemption) [to 31 Dec 2019] (Need to be HSBC Advance customer)

6. Citibank Ultima card - 1 mile per $4 for local / overseas / octopus (no redemption fee, $23,800 non-waivable annual fee) (Need to be Citigold Private Client customer AND by Invitation only)

7. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] $7.5 per mile for local spending ($15 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $5 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2, [from 28 Feb 2020] $12.5 per mile for local spending ($25 per mile for Insurance Spending (NOT BILL PAYMENT)) and Octopus, $8.33 per mile overseas spending ($300 flat redemption fee) (Need to be SCB Priority Banking customer) Note 2

8. BEA Supreme Gold World Master - 1 mile per $5 for local / overseas, 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee) (Need to be BEA Supreme Gold (顯卓理財) customer) Note 3

9. Shacom World Master - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be Shacom SMART Banking (慧通理財) customer)

10. CCB HK Visa Infinite - 1 mile per $8 spent for Local Spending / Overseas Spending / Octopus / Bill payment ($50 per 5,000 miles AM min $100) (Need to be CCB Premier Banking (貴賓理財) / Premier Select (貴賓晉裕) customer)

11. BEA Hong Kong Racehorse Owners Association (HKROA) World Master - 1 mile per $5 for local / overseas, 1 mile per $8 for Octopus / Electronic Wallet (Payme ONLY) (no fee) (Need to be member of Hong Kong Racehorse Owners Association (香港馬主協會)) Note 3

12. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent for local / online / octopus spendings, 1 mile per $4 for overseas spendings (no fee, $19,800 non-waivable annual fee with 120000 miles awarded annually) (Need to be OCBC Wing Hang Premier Banking (宏富理財) customer)

13. Shacom Shanghai Fraternity Association (上海總會) UnionPay Dual Currency Diamond - 1 mile per $8 local purchases / overseas / octopus ($10 per 1,000AM min $100 max $500) (Need to be member of Shanghai Fraternity Association (上海總會))

Full list:

I. Overseas

1. BOC Travel Rewards Visa Signature Card - 8% rebate for each transaction >$500 overseas spending (max $500 per month) (requirement: 1. overseas transaction for that month (any amount per transaction) > $6,000; 2. three times local spending (any amount)) plus 1 mile per $15

2. BoC Wealth Management Visa Infinite - 1 mile per $2.5 for overseas spending / local dining if that month's accumulated spending is over $15000 ($50/5,000 miles min $100 max $300) (Need to be BoC Wealth Management (中銀理財) customer)

3. [to 31 Dec 2019] HSBC (excluding amounts billed in HK and PRC) - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent (select Overseas Spending category ONLY) / $6.25 (HSBC Visa Signature) spent (NOT select Overseas Spending category) ($300 fee for a year's worth of redemptions)** ++

4. (if ONLINE / PAYWAVE) CCB HK eye Card - 1 mile / $2.14 (inclusive of 5X online bonus, cap at $50,000 per calender year and (2X extra overseas bonus, cap at $75000 per membership year ) ($50 per 5,000 miles min $100)

5. Citibank Premiermiles (>=$20K per billing cycle) (excluding RMB and MOP) - 1 mile per $3 spent (no redemption fee)** ++ ^

6. [to 31 Dec 2018] DBS Eminent (excluding MOP) - 1 mile per $3.6 spent ($50 fee per 5,000 miles)

7. [to 28 Feb 2019] Fubon Platinum / Titanium - 1 mile per $3.75 spent ($50/5,000AM min $250 max $500) (plus 133 Sure win miles if txn amt >$600)

Note: 1 mile per $0.75 for TWD spendings in Taiwan (max $5,000/month and $10,000/year), and 1 mile per $1.875 for KRW and JPY spendings in Korea and Japan (Seperate registration needed, max $20,000/month, two months per calendar year max)^

8. AMEX Platinum Charge - 1 mile per $3.75 spent (first $160,000 spending, $5/mile thereafter, $200 flat redemption fee, $7,800 non-waiveable annual fee)

9. Citibank Prestige / PremierMiles (<$20K) (excluding RMB and MOP) - 1 mile per $4 spent (no redemption fee, $3,800 non-waivable annual fee for the Prestige)** ++ ^

10. DBS Black World Master (excluding MOP) - 1 mile per $4 spent overseas (no fee)^

11. SCB Asia Miles World Master - 1 mile per $4 spent (automatic conversion)

12. AMEX CX Elite - 1 mile per $4 spent (automatic conversion)

13. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 (no fee)^

14. AMEX Platinum Credit - 1 mile per $5 spent (to $160,000, 1 mile per $15 thereafter), $200 flat redemption fee, $2,200 non-waiveable annual fee for AMEX Platinum Credit if one does not possess AMEX Platinum Charge in lieu) ** ++

15. CCB HK Platinum Visa / Platinum Master - 1 mile per $5 ($50 per 5,000 miles min $100)

16. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $8.33 spent ($300 flat redemption fee)

17. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

18. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $4 for overseas spendings (no fee)

^: DO NOT Award points for DCC Transactions

II. Supermarket, Department store, Telecommunications bills on autopay:

1A . [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Home Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1B. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Lifestyle Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1C. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature)/$4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Entertainment Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

2. [till 14 Jan 2021] Citibank Rewards - 1 mile / $3 spent ($50 fee per 5,000 mile redeemed) (on first $12,500 spending per statement month) Note 2 ** ++

3. (if ONLINE / PAYWAVE) CCB HK Eye Card - 1 mile / $3 (inclusive of 5X online bonus, cap at $75000 per calender year ($50 per 5,000 miles AM min $100)

4. HSBC Red World Master - 1 mile / $5 spent ($300 fee for a year's worth of redemptions)** ++

5. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

III. Dining

1. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select Dining Spending category ONLY) ($300 fee for a year's worth of redemptions)** ++

1b. [to 31 Dec 2019] HSBC (non-Visa Signature, INCLUDING HSBC Premier World Master) (select Dining category) - 1 mile / $4.16 ($300 fee for a year's worth of redemptions)** ++

1c. [to 31 Dec 2019] HSBC Visa Signature (did not select Dining category) - 1 mile / $6.25 ($300 fee for a year's worth of redemptions) ** ++

2. SCB Asia Miles World Master - 1 mile / $4 (automatic conversion)

3. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile / $5 (no fee) Note 3

4. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

5. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

Note: Restaurants in hotels sometimes are regarded as "Hotel" under V/M classification and thus ineligible for any dining promotions, using CUP can usually (but not always) get around this problem

IV. Travel agents:

** ++1. [to 31 Dec 2019] HSBC - 1 mile / $2.78 (HSBC Visa Signature) / $4.16 (other HSBC Credit Cards INCLUDING HSBC Premier World Master) spent# (select LifeStyle Spending category ONLY)/ $6.25 (HSBC Visa Signature NOT selecting LifeStyle Spending category)($300 fee for a year's worth of redemptions)

2. CCB HK EYE (if online) - 1 mile per $2.14 spent (First $50,000 only) ($50 per 5,000 miles AM min $100)

3. AMEX Platinum Charge - 1 mile per $3.75 spent (first $160,000 spending, $5/mile thereafter, $200 flat redemption fee, $7,800 non-waiveable annual fee)

V. Other retail spending

1. [to 14 Mar 19] (if online or Apple Pay) CCB HK Premier Banking Visa Infinite - 1 mile per $2.67 spent ($50 per 5,000 miles AM min $100) (first $12.5K spending ONLINE per month only, else $8 per mile)

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (PAYWAVE Spending ONLY, else $15 per mile)

3. SCB Asia Miles World Master - 1 mile per $6 spent (automatic conversion)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 spent (no fee) Note 3

** ++ 5. AMEX Platinum Credit - 1 mile per $5 spent (to $160,000, 1 mile per $15 thereafter), $200 flat redemption fee, $2,200 non-waiveable annual fee for AMEX Platinum Credit if one does not possess AMEX Platinum Charge in lieu)

** 6. SCB WorldMiles AE - 1 mile per $6 spent ($300 flat redemption fee)

** ++ 7. Citi Prestige - 1 mile per $6 spent (no redemption fee, $3,800 non-waiveable annual fee)

8. AMEX CX Elite - 1 mile per $6 spent (automatic conversion)

** ++ 9. DBS Black World Master - 1 mile per $6 spent (no fee)

10. [to 31 Dec 2018] DBS Eminent - 1 mile per $7.2 spent ($50 fee per 5,000 miles)

11. [to 28 Feb 2019] Fubon Platinum / Titanium - 1 mile per $7.5 spent spending >=$300 on Saturdays and Sundays ($50/5,000AM min $250 max $500) (plus 133 Sure win miles if txn amt >$600 (if NOT ONLINE))

** 12. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $7.5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $12.5 spent ($300 flat redemption fee)

** ++ 13. AMEX (Gold grade and higher, except Platinum Credit) - 1 mile per $7.5 spent (to $160,000), $200 flat redemption fee). (1 mile per $3 spent for 5x shops and 1 mile per $1.5 spent for 10x shops, $7,800 non-waiveable annual fee for AMEX Platinum Charge)

** ++ 14. Citi Premiermiles - 1 mile per $8 spent (no fee)

15. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

16. HSBC Red World Master - 1 mile / $10 spent ($300 fee for a year's worth of redemptions)** ++

17. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

VI. Bill payments (Excluding Tax or any payment to IRD)

VI A. General Bill Payments

1. CCB HK Visa Infinite / CCB HK Diamond Prestige - 1 mile per $8 spent ($50 per 5,000 miles AM min $100 max $300)

2. CCB HK Platinum Visa / CCB HK Platinum Master / CCB HK Platinum Dual Currency UnionPay - 1 mile per $15 spent (Each Card Membership Year cap at 12 times of credit limit)

3. BoC Wealth Management Visa Infinite / BOC Travel Rewards Visa Signature Card / BoC Platinum Visa & Master (including co-branded cards like Sogo) / BoC Platinum Dual Currency Unionpay - 1 mile per $15 spent (Each Card cap at $10,000 per Month) ($50/5,000 miles min $100)

4. HSBC Platinum Visa / Advance Platinum Visa / Premier World Master / Visa Signature / Red World Master - 1 mile per $25 spent (cap at $10,000 per Month)

VI B. Specific bill payment merchants who accept autopay for higher earn rates (by merchant)

1. Towngas autopay - Citi Prestige $6/mile

2. CLP autopay - Citi Prestige $6/mile, BEA $5/AM

3. HKE - AlipayHK (rever to IX.iii earn rates), DBS Black $6/AM

Note 1: Other issuers in Hong Kong DO NOT award bonus points for bill payment

VII. Octopus Automatic Add-Value

** ++ 1. Citibank Prestige - 1 mile per $6 spent (no redemption fee, $3,800 non-waiveable annual fee)

2. SCB Asia Miles World Master - 1 mile per $6 spent (automatic conversion)

** 3. SCB Priority Banking Visa Infinite - [till 27 Feb 2020] 1 mile per $7.5 spent ($300 flat redemption fee), [from 28 Feb 2020] 1 mile per $12.5 spent ($300 flat redemption fee)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $8 spent (no fee) Note 3

5. CCB HK Visa Infinite / CCB HK Diamond Prestige - 1 mile per $8 spent ($50 per 5,000 miles AM min $100 max $300)

** ++ 6. Citibank Premiermiles - 1 mile per $8 spent (no fee)

7. Shacom World Master / Platinum / Titanium / Diamond UnionPay - 1 mile per $8 spent ($10 per 1,000AM min $100 max $500)

8. Bankcomm Diamond Dual Currency Card - 1 mile per HK$12 spent ($50 per 5,000 AM min $100 max $300)

9. HSBC (all HKD cards) - 1 mile per $25 spent

10. OCBC Wing Hang VOYAGE World Elite Master - 1 mile per $6 spent (no fee)

VIII. China Unionpay RMB spending

** ++1. [to 31 Dec 2019] HSBC Dual Currency Unionpay card - 1 mile per RMB4.16 spent (select China Spending category ONLY) ($300 fee for a year's worth of redemptions)

2. Bankcomm Diamond Dual Currency Card - 1 mile per RMB6 spent for restaurants or hotels spending >= RMB300, 1 per RMB12 spent other categories ($50 per 5,000 AM min $100 max $300)

3. CCB HK Diamond Prestige - 1 mile per RMB8 spent ($50 per 5,000 miles AM min $100 max $300)

4. Shacom Diamond UnionPay - 1 mile per RMB8 spent ($10 per 1,000AM min $100 max $500)

5. BoC Dual Currency Unionpay Card - 1 mile per RMB15 spent ($50/5,000 miles min $100)

IX. Electronic wallets (in descending chronological order):

i. Payme

https://www.mrmiles.hk/payme/

http://flyformiles.hk/8847

ii. Wechat

http://flyformiles.hk/8847

https://www.mrmiles.hk/wechat-pay/

iii. Alipay P2P

http://flyformiles.hk/8847

https://www.mrmiles.hk/alipay/

iv. O!epay (Oepay): see VII. Octopus Automatic Add-Value above

X. Online spending in HKD

1. HSBC Red World Master - 1 mile / $2.5 spent ($300 fee for a year's worth of redemptions)** ++

2. CCB HK eye Card - 1 mile per $3 ($50 per 5,000 miles AM min $100) (ONLINE Spending ONLY, else $15 per mile)

3. SCB Asia Miles World Master - 1 mile per $4 spent (automatic conversion) (ONLINE spending ONLY, else $6 per mile)

4. BEA Flyer World Master / BEA Supreme Gold World Master / BEA HKROA World Master - 1 mile per $5 spent (no fee) (EXCLUDING PayMe transactions) Note 3

Note 2:

** can opt for Krisflyer miles in lieu (conversion of Krisflyer for SCB Non-AM cards will end at 27 Feb 2020)

++ can opt for BAEC AVIOS in lieu

For HSBC, ONLY Premier World Master holders are able to opt for BAEC Avios and KrisFlyer Miles

Note 3:

BEA Supreme Gold World Master / BEA HKROA World Master cardholders need to register in advance for the "BEA Mileage Reward" scheme during application (Supreme Gold account opening / co-branded card application), or else pay $1800 penalty to register thereafter.

HK miles/hotel points earning ability

Refer to here

Credit card Asia Miles earning opportunities (HK) 2020

#271

Join Date: Sep 2019

Posts: 19

Hi,

Has anyone been crediting on one of below promotions?

- ASIA MILES promotion:

https://www.flyertalk.com/forum/32462716-post237.html

- HSBC promotion:

https://www.flyertalk.com/forum/32498338-post242.html

- and also the 2.4% RC bonus (quarterly limit)

https://www.redhotoffers.hsbc.com.hk...SE-L03-001-all

I am quite new and struggle a bit to follow up for which promotion I have received the reward.

Thank you!

Has anyone been crediting on one of below promotions?

- ASIA MILES promotion:

https://www.flyertalk.com/forum/32462716-post237.html

- HSBC promotion:

https://www.flyertalk.com/forum/32498338-post242.html

- and also the 2.4% RC bonus (quarterly limit)

https://www.redhotoffers.hsbc.com.hk...SE-L03-001-all

I am quite new and struggle a bit to follow up for which promotion I have received the reward.

Thank you!

#272

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,801

You need to start getting used to reading the T&Cs.

It is commonplace in Hong Kong for bank/program to credit bonuses months in arrears. You have to keep in good standing, and they can decide to not rebate any spending that may be borderline/MS.

e.g. the first one:

7. Bonus Miles will be credited to the successfully registered member’s account latest by 5 October 2020.

My wife has a tracker. I just wait for someone on hongkongcard to report "promo received in full"

It is commonplace in Hong Kong for bank/program to credit bonuses months in arrears. You have to keep in good standing, and they can decide to not rebate any spending that may be borderline/MS.

e.g. the first one:

7. Bonus Miles will be credited to the successfully registered member’s account latest by 5 October 2020.

My wife has a tracker. I just wait for someone on hongkongcard to report "promo received in full"

#273

Join Date: Sep 2019

Posts: 19

Thank you so much!

I saw this mention in the T&C, which makes the follow up even more difficult.

I was also thinking that they crédit usually faster than the date announced (e.g. credit card opening bonus for HSBC).

I will keep using my excel tracker to have a quick follow up.

From your experience, did it happen that you have not been credited and contacted the bank/AM to get the bonus?

otherwise there is no real point to follow up.

thanks !!

I saw this mention in the T&C, which makes the follow up even more difficult.

I was also thinking that they crédit usually faster than the date announced (e.g. credit card opening bonus for HSBC).

I will keep using my excel tracker to have a quick follow up.

From your experience, did it happen that you have not been credited and contacted the bank/AM to get the bonus?

otherwise there is no real point to follow up.

thanks !!

#274

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,801

#275

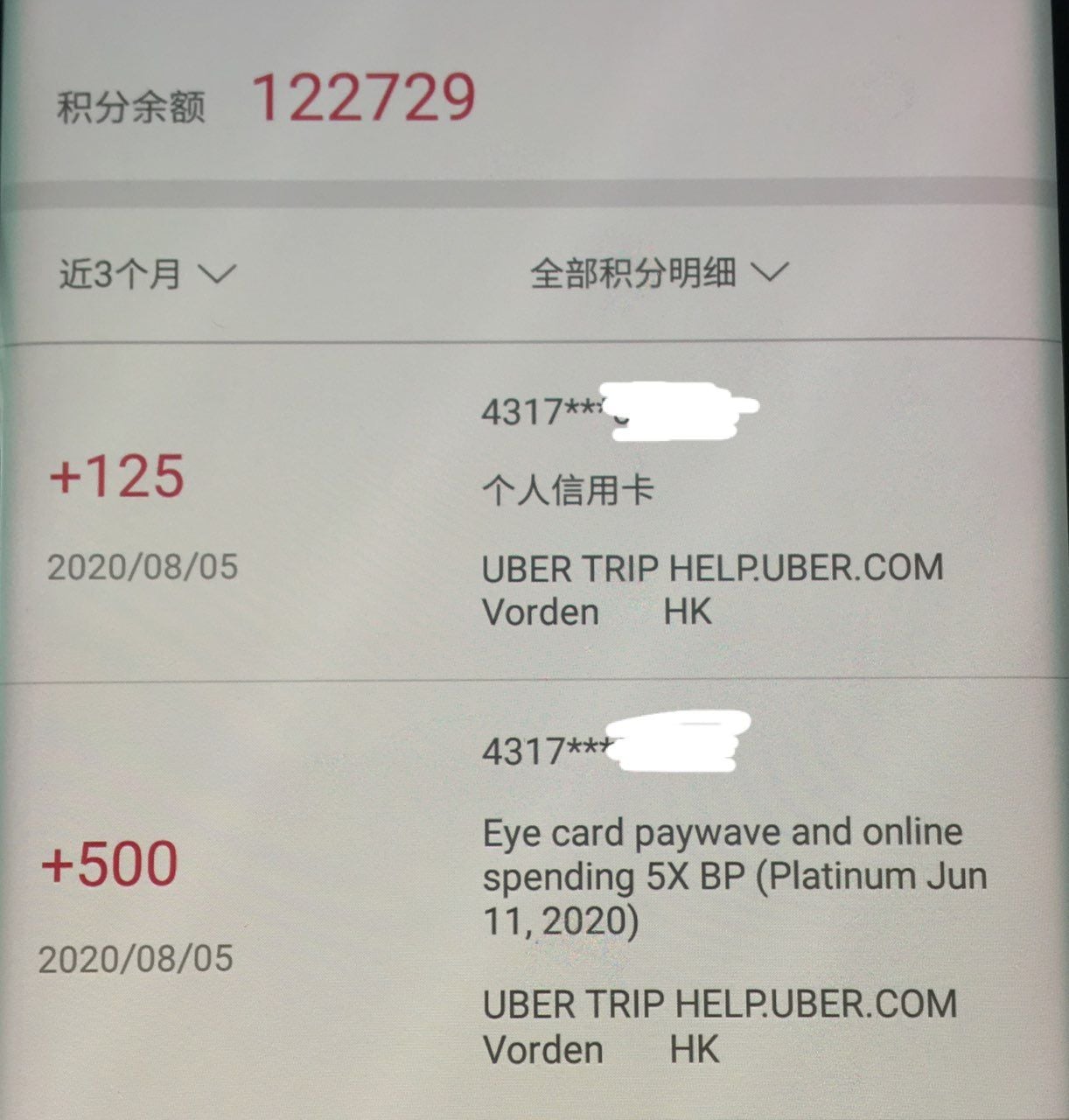

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,801

Uber HSBC Red see https://docs.google.com/spreadsheets...7Qc/edit#gid=0

#276

Join Date: Jan 2011

Posts: 2,345

I wish HSBC would break it down so that each transaction you know how many RC you earned. Would save us a lot of trouble.

#277

Join Date: Apr 2009

Posts: 60

Talking about transportation, I am wondering if drivers using the cross harbour tunnel/government tunnels have any problems using credit cards.

It is obviously easy to use Octopus but think the earn rate is only $6=1AM.

I think the best method is to pay via either BEA which would give you $5=1AM or BOC giving you 10x for mobile transaction. But nowadays I have trouble getting the credit card payment processed. There are no issues using these cards for Paywave for other merchants though. When I called up the bank customer services, they always said there shouldn't be any specific issue using the cards for the tunnel fee.

It is obviously easy to use Octopus but think the earn rate is only $6=1AM.

I think the best method is to pay via either BEA which would give you $5=1AM or BOC giving you 10x for mobile transaction. But nowadays I have trouble getting the credit card payment processed. There are no issues using these cards for Paywave for other merchants though. When I called up the bank customer services, they always said there shouldn't be any specific issue using the cards for the tunnel fee.

#278

Join Date: Feb 2005

Location: Hong Kong

Posts: 2,068

Slightly OT, has anyone considered HKTVMall's Citi Credit Card. Seems to suggest you get 15% on Thursdays if you are a VIP shopper (which isn't too hard to get). It's broken down as follows:

- Use promo code and you get 10% off and then you also get 5% in Mall Dollars to be used at another time

- You also get what seems to work out at 2% discount on Monday's for non HKTVMall online shopping.

https://cloud.marketing.hktvmall.com...mallcardpre_en

- Use promo code and you get 10% off and then you also get 5% in Mall Dollars to be used at another time

- You also get what seems to work out at 2% discount on Monday's for non HKTVMall online shopping.

https://cloud.marketing.hktvmall.com...mallcardpre_en

#279

Join Date: Jan 2011

Posts: 2,345

Slightly OT, has anyone considered HKTVMall's Citi Credit Card. Seems to suggest you get 15% on Thursdays if you are a VIP shopper (which isn't too hard to get). It's broken down as follows:

- Use promo code and you get 10% off and then you also get 5% in Mall Dollars to be used at another time

- You also get what seems to work out at 2% discount on Monday's for non HKTVMall online shopping.

https://cloud.marketing.hktvmall.com...mallcardpre_en

- Use promo code and you get 10% off and then you also get 5% in Mall Dollars to be used at another time

- You also get what seems to work out at 2% discount on Monday's for non HKTVMall online shopping.

https://cloud.marketing.hktvmall.com...mallcardpre_en

#281

Join Date: May 2012

Location: Hong Kong

Posts: 28

Citi Prestige & utility of Asia Miles

I am grappling with this as well. On renewal you do get 240k points, which I guess is worth HKD2400 in cashback at the cheapest end but this is probably boosted through relationship years and also boosted redemption offers. This means the card in effect becomes "free". However its benefits are now no longer as great as they once were. You do get the extended 1 year warranty which could come in use. But at the moment the travel benefits are a bit crap.

I guess the issue is that you have been grandfathered to the cheaper annual fee. If you cut it and want back in, then you have to pay the higher annual fee.

I guess the issue is that you have been grandfathered to the cheaper annual fee. If you cut it and want back in, then you have to pay the higher annual fee.

(1) As above, I'm wondering whether to cut the Citi Prestige. I'm on the old annual fee (I've had this card since 2013). For me, it comes down to whether I cut the Prestige or the BEA World Flyer MC.

Any thoughts appreciated - I am thinking of keeping the Prestige, given I do get an annual amount of points on renewal and the benefits are generally better than the BEA card otherwise, and with the better AM redemption rate being a bit useless at the moment with no travel (see Q3 below)). I'm also Citigold and have been with Citibank since 2012, so the loyalty years are a small bonus.

(2) I will keep my CCB Eye just for online spending/PayWave, and use Prestige for everything else (if I cut BEA). Right move? I've been pretty disappointed with CCB Eye's online interface and customer service, but I guess that's all banks...

(3) What is the utility of Asia Miles these days given travel restrictions? If I cut BEA, I've got a lot of points that I need to redeem beforehand - and doesn't seem like they have anything exciting to offer me other than Asia Miles (to be fair, that's why I got it in the first place, before COVID-19). What else can I use Asia Miles for? I would rather exchange the BEA points (And other CC points, for that matter) for AM rather than supermarket vouchers, but if we don't get to fly again for a very long time...

Appreciate any thoughts, thanks!

#282

Join Date: Sep 2015

Posts: 139

Hi guys, I wanted to tag on to this comment, and had a couple of questions. I want to slim down to one/two credit cards max.

(1) As above, I'm wondering whether to cut the Citi Prestige. I'm on the old annual fee (I've had this card since 2013). For me, it comes down to whether I cut the Prestige or the BEA World Flyer MC.

Any thoughts appreciated - I am thinking of keeping the Prestige, given I do get an annual amount of points on renewal and the benefits are generally better than the BEA card otherwise, and with the better AM redemption rate being a bit useless at the moment with no travel (see Q3 below)). I'm also Citigold and have been with Citibank since 2012, so the loyalty years are a small bonus.

(2) I will keep my CCB Eye just for online spending/PayWave, and use Prestige for everything else (if I cut BEA). Right move? I've been pretty disappointed with CCB Eye's online interface and customer service, but I guess that's all banks...

(3) What is the utility of Asia Miles these days given travel restrictions? If I cut BEA, I've got a lot of points that I need to redeem beforehand - and doesn't seem like they have anything exciting to offer me other than Asia Miles (to be fair, that's why I got it in the first place, before COVID-19). What else can I use Asia Miles for? I would rather exchange the BEA points (And other CC points, for that matter) for AM rather than supermarket vouchers, but if we don't get to fly again for a very long time...

Appreciate any thoughts, thanks!

(1) As above, I'm wondering whether to cut the Citi Prestige. I'm on the old annual fee (I've had this card since 2013). For me, it comes down to whether I cut the Prestige or the BEA World Flyer MC.

Any thoughts appreciated - I am thinking of keeping the Prestige, given I do get an annual amount of points on renewal and the benefits are generally better than the BEA card otherwise, and with the better AM redemption rate being a bit useless at the moment with no travel (see Q3 below)). I'm also Citigold and have been with Citibank since 2012, so the loyalty years are a small bonus.

(2) I will keep my CCB Eye just for online spending/PayWave, and use Prestige for everything else (if I cut BEA). Right move? I've been pretty disappointed with CCB Eye's online interface and customer service, but I guess that's all banks...

(3) What is the utility of Asia Miles these days given travel restrictions? If I cut BEA, I've got a lot of points that I need to redeem beforehand - and doesn't seem like they have anything exciting to offer me other than Asia Miles (to be fair, that's why I got it in the first place, before COVID-19). What else can I use Asia Miles for? I would rather exchange the BEA points (And other CC points, for that matter) for AM rather than supermarket vouchers, but if we don't get to fly again for a very long time...

Appreciate any thoughts, thanks!

If I were you, I would use the HSBC red card for all local online transactions which earn me 4% RC. You could either use the RC simply as cash rebate or converting them into miles.

For contactless(paypass) spending, you might want to take a look of the BOC iCard both physical and virtual card. They can give you 4% rebate or HK$1.5/mile (HK$1111 max each card)

I would keep earning miles for a moderate amount over time, especially due to the new expiry policy of Asia miles, but I would not exchange all my CC points into miles.

#283

Join Date: May 2012

Location: Hong Kong

Posts: 28

Thanks davidtai

To your last point, I would only exchange all the CC points for cards that I'm cutting (e.g. I'm cutting my AMEX, so I'd have to redeem all my points on it before I cut it). I'm also trying to cut down the # of cards I have for now (and not apply for new cards!), so the choice is between WorldFlyer MC and the Citi Prestige for everyday spending. I thought about keeping them both but on lower credit limits, but I think I'll just cut one and not think about it going forward.

To your last point, I would only exchange all the CC points for cards that I'm cutting (e.g. I'm cutting my AMEX, so I'd have to redeem all my points on it before I cut it). I'm also trying to cut down the # of cards I have for now (and not apply for new cards!), so the choice is between WorldFlyer MC and the Citi Prestige for everyday spending. I thought about keeping them both but on lower credit limits, but I think I'll just cut one and not think about it going forward.

#284

Join Date: Sep 2015

Posts: 139

Unless you really stretched your credit among all of the credit cards, I don't seen any reason to cut down the number of cards in my opinion.

Unlike the cc in the US or other countries, the annual fees of the cc issued in HK are almost non-existent except a small number of them e.g. Amex platinum, Citi prestige, etc. The point is how to spend in a smart way

Unlike the cc in the US or other countries, the annual fees of the cc issued in HK are almost non-existent except a small number of them e.g. Amex platinum, Citi prestige, etc. The point is how to spend in a smart way

#285

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,801

Well if you aren't into buying miles, cut the Citi next fee anniversary.