If seven or more years has passed, can get an initial spend bonus again?

#16

Join Date: Dec 2009

Location: DEN

Posts: 502

I suspect most other Amex cards still have a 7 year look-back period.

#17

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,934

And now 5-6 years per this DoC post:

What Does American Express Consider A Lifetime? (5-6 Years)

But I'm thinking that the best approach is to ask in a chat to see the whole list of Amex cards you've "ever' had. People report being able to get such a list in an Amex chat.If the card you want to apply for is on that list, then it's too early to apply unless you see an application with no lifetime language.

But if the card you want to apply for is not on that list (but more recent cards are), then presumably it has dropped off of the list that Amex will use, and it's most likely safe to apply even with an application that spells out "once in a lifetime".

Anyway, whether it can very from one week to the next, or from one person to the next, it seems to me either of those possibilities make checking your own list, if that works, probably the best solution.

#18

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,299

Regardless of 4 or 5-6 or 7 years, is it from account opening date, SUB date, account closure date, dogís birthdate, pop-up jail starting date, LL (Lifetime language) starting date, median account open date, or some other date? Thank you. (Yes, sorry, ďsome other dateĒ is possibly inane, dogís birthdate being completely sensible  , but with credit card issuers, AmEx in particular, one never knows.

, but with credit card issuers, AmEx in particular, one never knows.  )

)

BREAK

Slightly off topic but AmEx Hilton Aspire card is an excellent example of a substantial annual fee potentially sock drawered card. AF is $450 (youch), low hanging fruit easily attainable without flying* or staying* (at a Hilton) credits of $500 (airline fee $250, resort $250) plus free weekend night (~$350 IME) every year. I see this card as paying me a few hundred dollars per year regardless of usage. Hilton extended the expiration dates and made them usable any day of the week (COVID) the last couple yearís free night certs, Iíve got 2 that are burning a hole in my sock drawer with expected use later this summer for significantly more than ~$350 value. Itís the first card (of just 2 or 3) Iíve kept open for more than a year or 2 in the credit card modern era (subsequent to anti-churning policies).

(* UA TB for airline fee credit, book and cancel Hilton reservation for resort credit = $500 without flying or staying which can occur in the future.)

, but with credit card issuers, AmEx in particular, one never knows.

, but with credit card issuers, AmEx in particular, one never knows.  )

)BREAK

(* UA TB for airline fee credit, book and cancel Hilton reservation for resort credit = $500 without flying or staying which can occur in the future.)

#19

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

#20

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,299

Thank you. I guess that makes a card like Aspire a keeper forever being that it would be 4 or 5-6 or 7 years without (that card) until possibly churning the SUB.

To be certain, is it completely different than Chase’s policy which allows for closing an account and then being approved for the exact same account (other things being acceptable) a week or a month later?

It’s not been mentioned on this thread but if the goal is repetitive SUBs there are many datapoints on other AmEx threads of individuals with many (targeted NLL) Biz Plats and/or Biz Golds and thus many (substantial) SUBs.

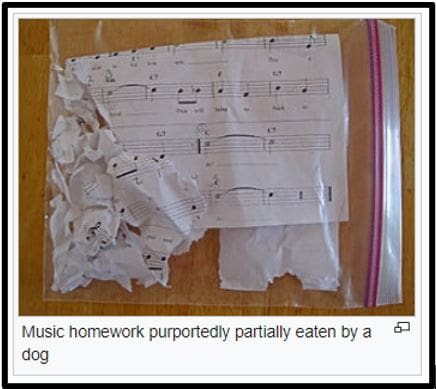

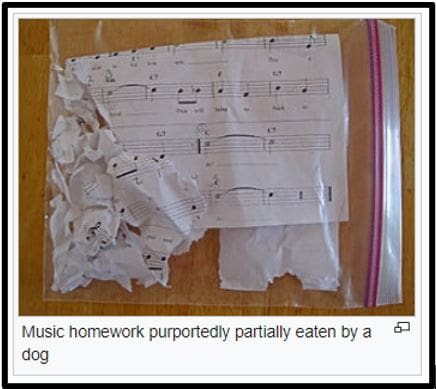

(BTW mia, no comment about “dog’s birthday ? Gotta admit, it was slightly amusing

? Gotta admit, it was slightly amusing  . Just now thought of a new reason for churning; my dog ate my

. Just now thought of a new reason for churning; my dog ate my homework card, not sure a recon rep would buy it  .)

.)

The dog ate my homework

To be certain, is it completely different than Chase’s policy which allows for closing an account and then being approved for the exact same account (other things being acceptable) a week or a month later?

(BTW mia, no comment about “dog’s birthday

? Gotta admit, it was slightly amusing

? Gotta admit, it was slightly amusing  . Just now thought of a new reason for churning; my dog ate my

. Just now thought of a new reason for churning; my dog ate my  .)

.)The dog ate my homework

Last edited by Dr Jabadski; Jun 26, 2022 at 12:04 pm Reason: avoid consecutive posts

#21

Join Date: Apr 2003

Location: Scottsdale AZ

Posts: 728

Mentioned upwards in the thread, I did get the AMEX SPG personal (before product change to Bonvoy) six years after I applied for it (closed it after a year or two). I also got the AMEX biz hilton this January withOUT a NLL offer despite getting in in June 2018 and holding it for a year or two. Not even four years after applying, not to mention cancelling. But I’m in pop up jail for the bonvoy brilliant (tried to get this when offer was like 150,000 points). So YMMV. As I’ve mentioned in other threads, I spend a TON organically on Amex cards and have also referred a bunch of business owner friends, perhaps I’m hoping my account is flagged as a VIP?

#22

Join Date: Mar 2016

Posts: 17

SoÖ I had the Platinum card roughly 4-5 years ago. I have had the Gold card for 9 years. I logged in to my account and see an offer to upgrade my Gold card to Platinum for 100,000 points after $6k spend in 6 months. I need to book some international flights soon, so figured why not. I messaged the agents to confirm my eligibility and they told me Iíd have to call to check. The agent I called reviewed my account, checked with her supervisor and said nothing was there. I told her the offer I saw. She checked again and said they can give me 25,000 points on the same terms. I declined. I still see the 100,000 offer when I log into my account and it shows my name right next to it. Should I go ahead online and hope it works or do you think my chances are shot? The terms donít mention lifetime, but says Amex can revoke points for any reason if they think Iím gaming the system.

#23

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,958

#24

Join Date: Mar 2015

Posts: 485

It was very easy to get the listing from them, just by asking. I did this earlier this year using the chat function and the rep responded very quickly with what cards I have had in the past. I'm nearing the seven year mark on two cards, but they haven't fell off the list that AMEX has yet.

#25

Join Date: Apr 2018

Posts: 262

I have a few cards closed and I kept them visible on the website (no reason other than to make sure the account balance still show zero). I wonder if keeping these cards like this will affect the 5-6-7 year database record. Anyone know?