Highly Recommended: Protection for your trip

#1

Original Poster

Join Date: Dec 2018

Location: Seattle

Programs: Alaska airlines 100k

Posts: 963

Highly Recommended: Protection for your trip

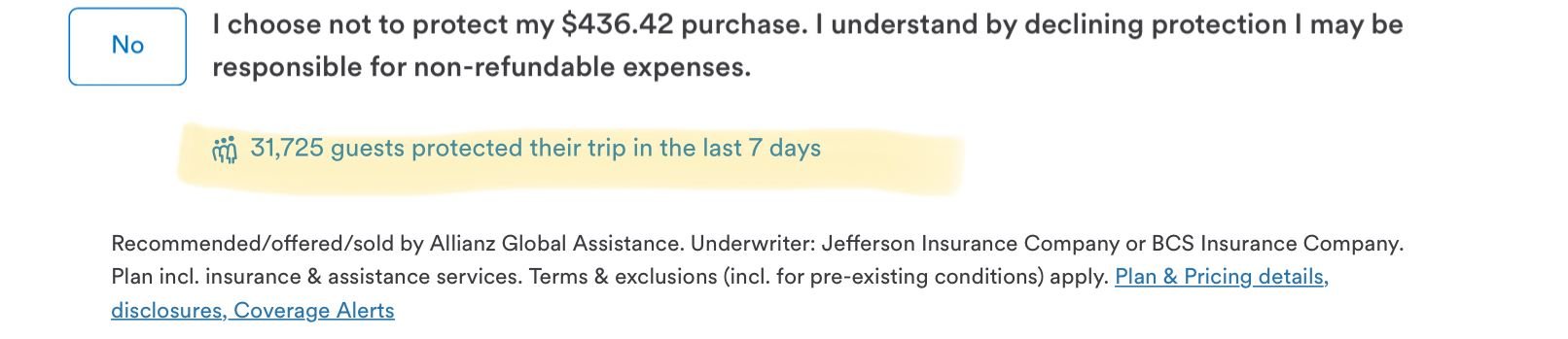

Has anybody selected YES and paid for the “Highly Recommended: Protection for your trip” AND actually was able to use the benefit with ease ?

Would it actually be useful for my business trips to and from the midwest (Chicago and Milwaukee) during winter months) and if i cancel a flight could this fee also be put into my wallet for future use?

What does “100% reimbursement for trip cancellation or interruption” mean. I would already get 100% of my ticket price back for either circumstance if the flight doesn’t occur

Would it actually be useful for my business trips to and from the midwest (Chicago and Milwaukee) during winter months) and if i cancel a flight could this fee also be put into my wallet for future use?

What does “100% reimbursement for trip cancellation or interruption” mean. I would already get 100% of my ticket price back for either circumstance if the flight doesn’t occur

#2

Join Date: Jan 2012

Location: ANC

Programs: AS MVP, Club 49, Global Entry, National Emerald Club, Hilton Silver

Posts: 1,445

Clicked once, but couldn’t use it. I’ll never click it again. The only reason was because Covid was an emerging threat. I booked an ANC-KEF-TXL award in March 2020 for May 2020 because at the time it was “two weeks to flatten the curve”.

anyways, I obviously had to cancel. Everything was refunded by AS, including partner booking fee. FI also refunded the seat selection fee, but that took several months. I could not get the trip protection fee back though.

anyways, I obviously had to cancel. Everything was refunded by AS, including partner booking fee. FI also refunded the seat selection fee, but that took several months. I could not get the trip protection fee back though.

#3

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 57,279

It is an entirely separate product from the ticket and is not refundable. Your money goes to the insurer, not Alaska, which just receives a commission on the sale.

#4

Original Poster

Join Date: Dec 2018

Location: Seattle

Programs: Alaska airlines 100k

Posts: 963

I can't imagine why anyone would purchase airline coverage rather than use a credit card that provides equivalent coverage. Especially if traveling on business, where presumably any IRROPS-related costs will be reimbursable.

It is an entirely separate product from the ticket and is not refundable. Your money goes to the insurer, not Alaska, which just receives a commission on the sale.

It is an entirely separate product from the ticket and is not refundable. Your money goes to the insurer, not Alaska, which just receives a commission on the sale.

#5

FlyerTalk Evangelist

Join Date: Nov 2009

Location: SEA — the REAL Washington; occasionally (but a lot less often than before) in the other Washington (DCA area)

Programs: DL PM 1.57MM; AS MVPG 100K (closing in on 0.5MM)

Posts: 21,636

#6

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA ExPlat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 17,399

(not sure if that number isn‘t just hardcoded for marketing purposes)

Many people don’t know/understand what benefits their credit card offers them. And the card of choice of many Alaska Airlines customers (the BofA Visa) doesn’t offer any travel protection, as far as I recall, which is one more reason I don’t generally use it for AS ticket purchases if I can avoid it.

But all that said, I have never actually made a claim against my Amex or CSR travel insurance - my travel seems to generally be pretty uneventful. So I can’t imagine shelling out cash for this insurance offer on my ticket purchases.

I wish there was a traveler profile option to disable this offer for good. A browser script probably could handle this, but most of my bookings are made on the couch on an iPad these days.

#7

FlyerTalk Evangelist

Join Date: Oct 2014

Posts: 10,904

I can't imagine why anyone would purchase airline coverage rather than use a credit card that provides equivalent coverage. Especially if traveling on business, where presumably any IRROPS-related costs will be reimbursable.

It is an entirely separate product from the ticket and is not refundable. Your money goes to the insurer, not Alaska, which just receives a commission on the sale.

It is an entirely separate product from the ticket and is not refundable. Your money goes to the insurer, not Alaska, which just receives a commission on the sale.

Also a lot of people simply don't have the credit score to qualify for a good credit card. I'm sure that a lot of people are using debit cards, or credit cards with limited benefits, to buy tickets, because that's all that they can get.

#8

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 57,279

Moreover, even if you don't have such a card, the coverage the airlines offer at ticket purchase is not worth the premium. That's why the airlines push the product so heavily - there are large profit margins built in.

#9

FlyerTalk Evangelist

Join Date: Jul 1999

Location: ORD/MDW

Programs: BA/AA/AS/B6/WN/ UA/HH/MR and more like 'em but most felicitously & importantly MUCCI

Posts: 19,727

I have never actually made a claim against my Amex or CSR travel insurance - my travel seems to generally be pretty uneventful. So I can’t imagine shelling out cash for this insurance offer on my ticket purchases.

I wish there was a traveler profile option to disable this offer for good.

I wish there was a traveler profile option to disable this offer for good.

#10

Join Date: Apr 2009

Location: YYF/YLW

Programs: AA, DL, AS, VA, WS Silver

Posts: 5,986

Credit cards that provide good travel insurance tend to have high annual fees. For people who only travel once every year or two, I could see this being a reasonable purchase. It's not worth getting a travel credit card, and if you have to cancel you may not be able to use a travel credit before it expires.

Also a lot of people simply don't have the credit score to qualify for a good credit card. I'm sure that a lot of people are using debit cards, or credit cards with limited benefits, to buy tickets, because that's all that they can get.

Also a lot of people simply don't have the credit score to qualify for a good credit card. I'm sure that a lot of people are using debit cards, or credit cards with limited benefits, to buy tickets, because that's all that they can get.

Self-insuring is absolutely a win for me based on the number of claims I've made against my CSR insurance (zero, although there's one claim I probably could have made but didn't because I expect to ultimately be reimbursed by the airline once a Canadian Transportation Agency appeal is completed in 1-2 years, but even if I make that claim I would come out ahead compared to paying ≈$20 per trip for insurance — the CSR insurance is no-extra-cost to me because I have the card for other reasons). There's a reason travel insurance companies push those so much and pay commissions to airlines: they come out ahead.

#11

Join Date: May 2009

Location: EUG

Programs: AS MVP, AA MM, HH Diamond, MR Gold

Posts: 8,281

I always just click NO so never really thought about this.

Does the Alaska Airlines Visa have travel protection? I know the Amex I use for MOST of my trips on AS does. However, with the stipulation that if you are using a Companion Fare means you MUST use your AS Visa to purchase the tickets, I wonder if that would change things?

I have enough status on my hotel choices that even if I'm past the XL deadline, they let me cancel. And as long as I cancel my AS flight before take-off it goes back into my wallet. I'd say even with a companion fare I'd say no.

This reminds me when I first started traveling in the early 70's (yes, I'm that old). We would ALWAYS buy those insurance policies from the vending machines in the airports. They were mostly for death (IIRC) but we were so superstitious that we "knew" they were keeping our plane from crashing.

Does the Alaska Airlines Visa have travel protection? I know the Amex I use for MOST of my trips on AS does. However, with the stipulation that if you are using a Companion Fare means you MUST use your AS Visa to purchase the tickets, I wonder if that would change things?

I have enough status on my hotel choices that even if I'm past the XL deadline, they let me cancel. And as long as I cancel my AS flight before take-off it goes back into my wallet. I'd say even with a companion fare I'd say no.

This reminds me when I first started traveling in the early 70's (yes, I'm that old). We would ALWAYS buy those insurance policies from the vending machines in the airports. They were mostly for death (IIRC) but we were so superstitious that we "knew" they were keeping our plane from crashing.

#13

Join Date: Oct 2006

Location: BLI or CLT

Programs: The usual suspects

Posts: 1,925

The key is in the specific language "up to 100%" reimbursement for a "covered trip cancellation or interruption."

The insurer is free to find some fine-print reason that you are not entitled to 100% but probably only a small fraction of that amount. The policy also likely has abundant fine-print exclusions on what is actually "covered." That's why these policies are so profitable for the insurer.

The insurer is free to find some fine-print reason that you are not entitled to 100% but probably only a small fraction of that amount. The policy also likely has abundant fine-print exclusions on what is actually "covered." That's why these policies are so profitable for the insurer.

#14

FlyerTalk Evangelist

Join Date: Oct 2014

Posts: 10,904

I always just click NO so never really thought about this.

Does the Alaska Airlines Visa have travel protection? I know the Amex I use for MOST of my trips on AS does. However, with the stipulation that if you are using a Companion Fare means you MUST use your AS Visa to purchase the tickets, I wonder if that would change things?

I have enough status on my hotel choices that even if I'm past the XL deadline, they let me cancel. And as long as I cancel my AS flight before take-off it goes back into my wallet. I'd say even with a companion fare I'd say no.

This reminds me when I first started traveling in the early 70's (yes, I'm that old). We would ALWAYS buy those insurance policies from the vending machines in the airports. They were mostly for death (IIRC) but we were so superstitious that we "knew" they were keeping our plane from crashing.

Does the Alaska Airlines Visa have travel protection? I know the Amex I use for MOST of my trips on AS does. However, with the stipulation that if you are using a Companion Fare means you MUST use your AS Visa to purchase the tickets, I wonder if that would change things?

I have enough status on my hotel choices that even if I'm past the XL deadline, they let me cancel. And as long as I cancel my AS flight before take-off it goes back into my wallet. I'd say even with a companion fare I'd say no.

This reminds me when I first started traveling in the early 70's (yes, I'm that old). We would ALWAYS buy those insurance policies from the vending machines in the airports. They were mostly for death (IIRC) but we were so superstitious that we "knew" they were keeping our plane from crashing.

This is also one of the problems with those gift cards that everyone loves buying from Costco (the other problem is, no travel category bonus miles, which essentially negates the 10% discount)

If you have a good travel credit card (Amex Plat, CSR) these are much better choices IMO.

In the past, with AS, they have treated me very well when things have gone badly, so I haven't actually needed to use my travel insurance. But that was pre-covid and I'm not sure how strict they are now.

Surprisingly, AS is the only carrier where I've ever had significant disruptions (delayed several hours or overnight). It's never come up for when when flying internationally, or on AA or UA (which is total luck, I'm sure)

#15

Join Date: Aug 2012

Location: LAX/SFO

Programs: AS 100k, BA GGL, UA 1k, DL DM, AC SE, B6 Mosaic4, Hyatt/Hilton/Wyndham/IHG Diamond, Marriot Ti

Posts: 1,356

No travel insurance on the AS card AFAIK. Same with all the other ~$100 cobranded cards for various US carriers.

This is also one of the problems with those gift cards that everyone loves buying from Costco (the other problem is, no travel category bonus miles, which essentially negates the 10% discount)

If you have a good travel credit card (Amex Plat, CSR) these are much better choices IMO.

In the past, with AS, they have treated me very well when things have gone badly, so I haven't actually needed to use my travel insurance. But that was pre-covid and I'm not sure how strict they are now.

Surprisingly, AS is the only carrier where I've ever had significant disruptions (delayed several hours or overnight). It's never come up for when when flying internationally, or on AA or UA (which is total luck, I'm sure)

This is also one of the problems with those gift cards that everyone loves buying from Costco (the other problem is, no travel category bonus miles, which essentially negates the 10% discount)

If you have a good travel credit card (Amex Plat, CSR) these are much better choices IMO.

In the past, with AS, they have treated me very well when things have gone badly, so I haven't actually needed to use my travel insurance. But that was pre-covid and I'm not sure how strict they are now.

Surprisingly, AS is the only carrier where I've ever had significant disruptions (delayed several hours or overnight). It's never come up for when when flying internationally, or on AA or UA (which is total luck, I'm sure)