Investor Day Highlights

#1

Original Poster

Join Date: Apr 2017

Programs: AS 100k, DL PM, New Sagaya

Posts: 1,292

Investor Day Highlights

Not sure the Investor Day materials were shared. This pre-dates the Q4 Earnings call transcript I shared earlier. Here is a link to the presentation:

http://investor.alaskaair.com/static...a-452723220c5b

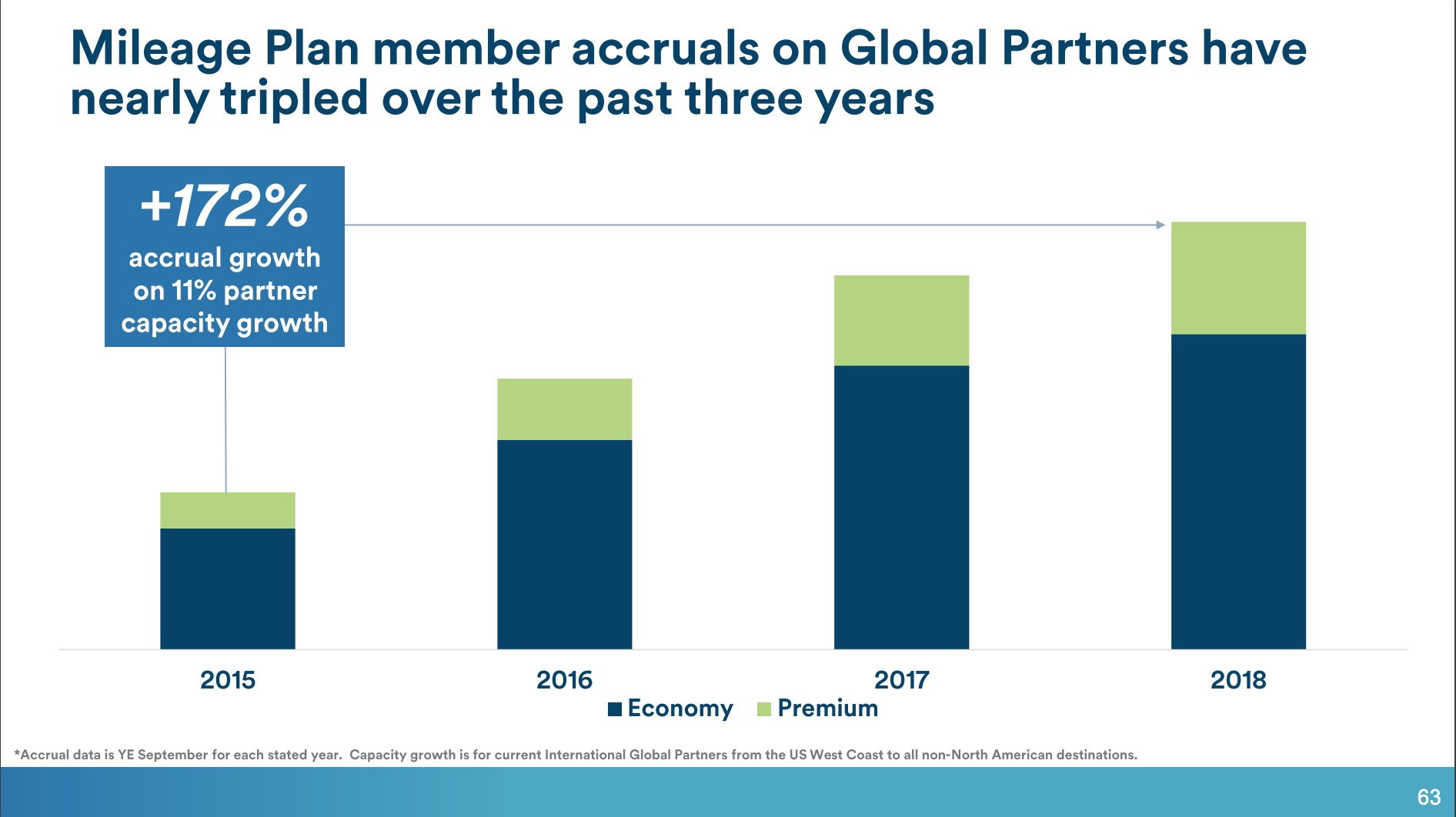

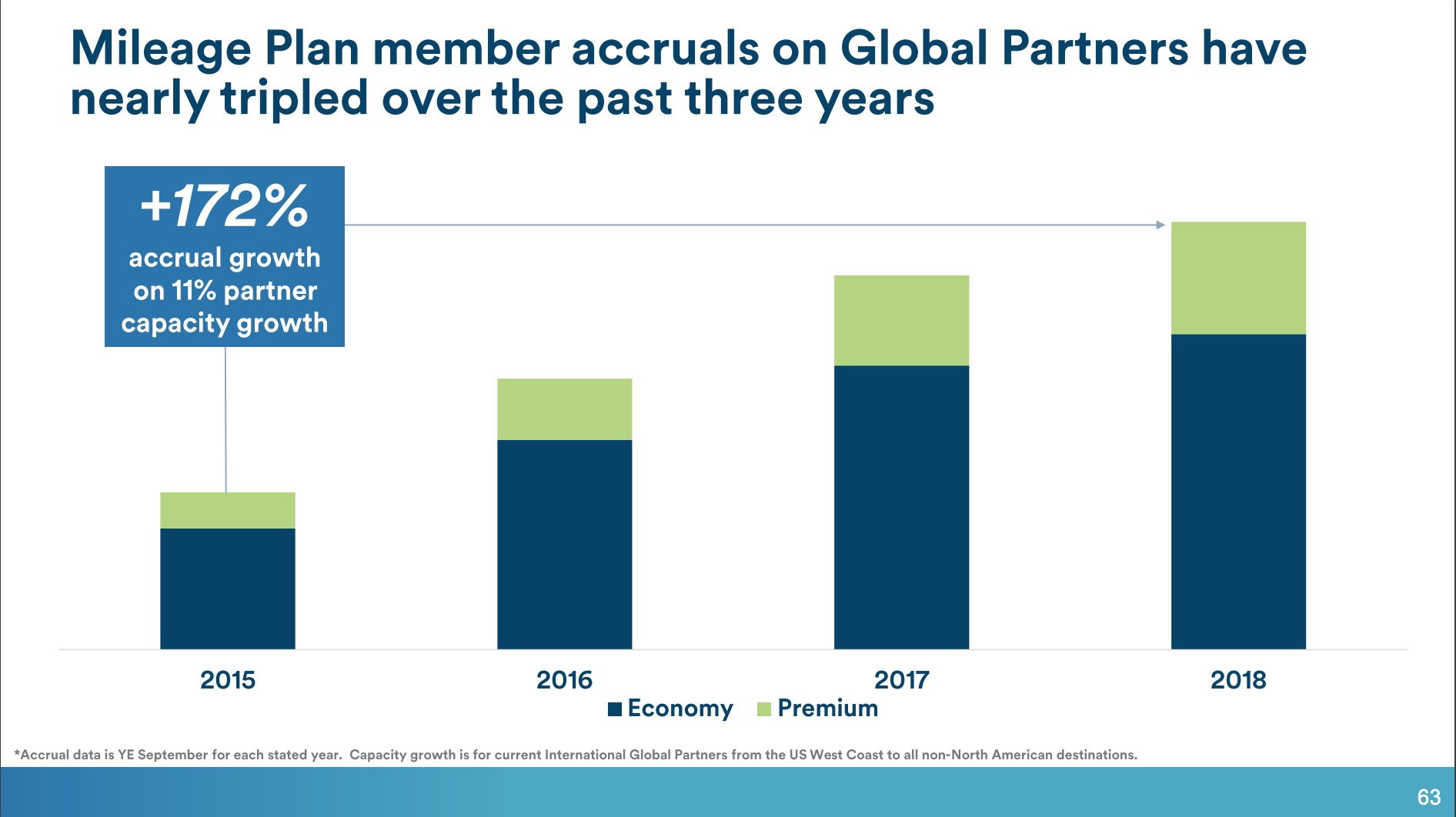

Here are some snapshots from the presentation I think FT'ers would appreciate. Some discussion of the revenue side, staffing, the VISA card, and partner accruals.

http://investor.alaskaair.com/static...a-452723220c5b

Here are some snapshots from the presentation I think FT'ers would appreciate. Some discussion of the revenue side, staffing, the VISA card, and partner accruals.

#5

Join Date: Dec 2007

Location: USA

Programs: AS MVPG75k

Posts: 330

#6

Join Date: Oct 2010

Location: SEA/ORD/ADB

Programs: TK ELPL (*G), AS 100K (OWE), BA Gold (OWE), Hyatt Globalist, Hilton Diamond, Marriott Plat, IHG Plat

Posts: 7,764

Indeed. Which is why "average F fare" is a rather meaningless metric - it's a much better indicator of average stage length of revenue F tickets compared to premium cabin yields.

#8

Original Poster

Join Date: Apr 2017

Programs: AS 100k, DL PM, New Sagaya

Posts: 1,292

@AndyPatterson: If you want to dive deep, here is the transcript of the presentation and Q&A from the Investor Day:

http://investor.alaskaair.com/static...2-deaac374899a

Re: PRASM - the presentation was a little cagey about this. And it shows in the transcript above where analysts ask about RASM. The presentation suggests RASM for 4Q at 3-5%. But the analysts pushed back a bit suggesting that 2% load capacity growth should show more growth. They definitely do not breakout by segment - its aggregated across all the revenue streams to get to a system level number.

Revenue discussion starts at slide 75 of the presentation: http://investor.alaskaair.com/static...a-452723220c5b

Another element they are clearly still figuring out is the cost side of things, and cross-fleeting is a large part of this. The flight attendants can be cross-fleeted, but not pilots. So they productivity drags from the merger are still there and probably won't get back to pre-merger based on the costs of pilot productivity.

http://investor.alaskaair.com/static...2-deaac374899a

Re: PRASM - the presentation was a little cagey about this. And it shows in the transcript above where analysts ask about RASM. The presentation suggests RASM for 4Q at 3-5%. But the analysts pushed back a bit suggesting that 2% load capacity growth should show more growth. They definitely do not breakout by segment - its aggregated across all the revenue streams to get to a system level number.

Revenue discussion starts at slide 75 of the presentation: http://investor.alaskaair.com/static...a-452723220c5b

Another element they are clearly still figuring out is the cost side of things, and cross-fleeting is a large part of this. The flight attendants can be cross-fleeted, but not pilots. So they productivity drags from the merger are still there and probably won't get back to pre-merger based on the costs of pilot productivity.

#9

Join Date: Apr 2003

Programs: B6 Mosaic, Bonvoy LT Titanium (x SPG LT), IHG Spire, UA Silver

Posts: 5,851

It is not even an indicator or average state length as they don't define how they are calculating the average. Is a $50 fee to upgrade at the gate counted in the average? Would the coach portion of the fare be added to the $50 to make it look higher? If 15 people are getting free upgrades and 1 person pays $179 for F, the average is actually only $11.19 in extra revenue per F seat that the F cabin on that flight generated. There are numerous ways to make it look better or worse to get whatever result you like. AS is also not selling $10,000 one way international flights like the legacies do so if AS had the same average as competitors, their stock price would be much higher that it has ever been.

#10

Original Poster

Join Date: Apr 2017

Programs: AS 100k, DL PM, New Sagaya

Posts: 1,292

On a product with a pretty big spread in value ($200 F on numerous short runs vs $1600 F on a smaller set of longer runs) a mean is a crummy measure. (Ideally median or some other statistic to represent the distribution...) But it is for comparison purposes here - which could be more meaningful IF we can assume similar routes and price distributions. So, yeah take a block of salt with that number....

#11

Join Date: Jan 2008

Location: Seattle, WA

Programs: AS MVPG, 1MM

Posts: 377

@AndyPatterson: If you want to dive deep, here is the transcript of the presentation and Q&A from the Investor Day:

http://investor.alaskaair.com/static...2-deaac374899a

Re: PRASM - the presentation was a little cagey about this. And it shows in the transcript above where analysts ask about RASM. The presentation suggests RASM for 4Q at 3-5%. But the analysts pushed back a bit suggesting that 2% load capacity growth should show more growth. They definitely do not breakout by segment - its aggregated across all the revenue streams to get to a system level number.

Revenue discussion starts at slide 75 of the presentation: http://investor.alaskaair.com/static...a-452723220c5b

Another element they are clearly still figuring out is the cost side of things, and cross-fleeting is a large part of this. The flight attendants can be cross-fleeted, but not pilots. So they productivity drags from the merger are still there and probably won't get back to pre-merger based on the costs of pilot productivity.

http://investor.alaskaair.com/static...2-deaac374899a

Re: PRASM - the presentation was a little cagey about this. And it shows in the transcript above where analysts ask about RASM. The presentation suggests RASM for 4Q at 3-5%. But the analysts pushed back a bit suggesting that 2% load capacity growth should show more growth. They definitely do not breakout by segment - its aggregated across all the revenue streams to get to a system level number.

Revenue discussion starts at slide 75 of the presentation: http://investor.alaskaair.com/static...a-452723220c5b

Another element they are clearly still figuring out is the cost side of things, and cross-fleeting is a large part of this. The flight attendants can be cross-fleeted, but not pilots. So they productivity drags from the merger are still there and probably won't get back to pre-merger based on the costs of pilot productivity.

#12

A FlyerTalk Posting Legend, Moderator, Information Desk, Ambassador, Alaska Airlines

Join Date: Dec 2006

Location: FAI

Programs: AS MVP Gold100K, AS 1MM, Maika`i Card, AGR, HH Gold, Hertz PC, Marriott Titanium LTG, CO, 7H, BA, 8E

Posts: 42,957

Yes I think AS would like to get back to a single fleet type. But this will take time, as additional frames need to be acquired, plus more pilot training. We'll see how the 737-MAX performs for AS once it's on property.

#13

Join Date: May 2003

Location: SFO, mostly

Posts: 2,204

I�d expect they will get rid of A319s and A320s as their leases expire, but that will take some years. The A321NEOs are an attractive plane for transcons, so it wouldn�t surprise me to see those stay in the fleet, unless it doesn�t perform up to expectations.