AS is already strong on the West Coast and many believe that they can organically grow in all the markets VX has a presence for a fraction of the price of this merger and without all the complexities.

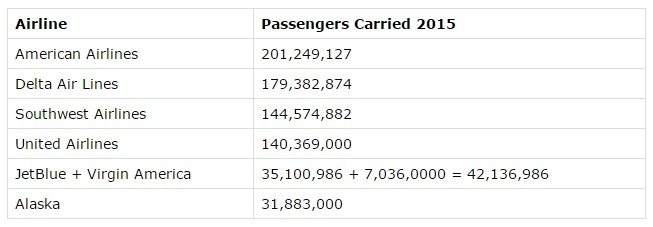

B6 and VX may have more synergies when combined than AS with VX. This deal, however, may be about keeping B6 out of the West Coast and AS territory than it is about VX. After the merger AS will be able to surpass B6 in traffic:

They will also be able to strengthen their market share in the West Coast while adding 2 hubs in SFO and LAX:

As for the VX aircraft, they are mostly leases, which I think they can either terminate at a cost or allow to expire. I think in the long run, they will probably continue to use aircraft from only one provider to minimize operational costs like WN does.

The DAL slots may be sold as they are likely unprofitable. B6 has been operating them at a loss in order to compete in price with AA which is one of AS main partners. AS may not want to antagonize AA or go in direct competition with them in DFW/DAL. Besides, it would be hard to compete with AA at one of their main hubs.

I actually read an article recently stating that AA stands to benefit a lot from this deal without incurring any risk as they will be able to access AS network in the West Coast and AK where they are weak:

An Alaska-Virgin America Deal Is A Big Win For American Airlines

Together AA and AS will control a combined market share greater than #2 DL. That is bad for DL and B6.