Which card(s) next? [Consolidated]

#16

Original Poster

Join Date: Feb 2012

Location: Ohio

Programs: Marriott Gold, Hilton Gold, UA Silver; 800K+ points 2012

Posts: 115

Ok, here's my results... very positive :-)

Cards for me:

Cards for wife:

By my math, this should add up to a total of 410,000 miles if I play all my cards right. I confirmed with Citi that I did indeed hit both the 50k & 40k Hilton offers (the 50k one was blind). Total required spend should be $7000, which is not going to be too much of a problem, especially since we have 3 months before most of it is due.

That's quite a successful afternoon if you ask me!!

Cards for me:

- Chase Marriott (70k after 1st purchase, $85 fee 1yr waive)- approved, instant

- Citi Hilton #1 (2 browser trick; 50k after $1500/6mo, no fee)- approved, call-in

- Citi Hilton #2 (2 browser trick; 40k after $1000/4mo, no fee)- approved, call-in

- Amex Hilton (60k after $750/3mo, no fee)- approved, instant

- Barclays US Airways (40k after 1st purchase, $89 fee 1yr waive)- approved, instant

Cards for wife:

- Chase Sapphire Premier (50k after $3000/3mo, $95 fee 1yr waive)- approved, instant

- Citi Aadvantage Amex (2 browser trick; 50k after $3000/4mo, $85 fee 1yr waive)- decided against applying due to spending requirement

- Citi Aadvantage Visa (2 browser trick; 40k after $3000/4mo, $85 fee 1yr waive)- decided against applying due to spending requirement

- Amex Hilton (60k after $750/3mo, no fee)- approved, instant

- Barclays US Airways (40k after 1st purchase, $89 fee 1yr waive)- approved, instant

By my math, this should add up to a total of 410,000 miles if I play all my cards right. I confirmed with Citi that I did indeed hit both the 50k & 40k Hilton offers (the 50k one was blind). Total required spend should be $7000, which is not going to be too much of a problem, especially since we have 3 months before most of it is due.

That's quite a successful afternoon if you ask me!!

#17

Join Date: Jan 2012

Location: DTW

Programs: Delta Platinum, Marriott Platinum, Hilton Diamond, IHG Platinum, Avis First

Posts: 106

I should note that its been almost a year since we got the AA Visa, and I'm aware of the 18 month rule, but wasn't sure if you could apply for both at different times and still get them.

And as for agencies, I really am not sure. I don't do this too often (about every 6 months) and I've look at my report here and there, but really am out of the loop on that one.

And as for agencies, I really am not sure. I don't do this too often (about every 6 months) and I've look at my report here and there, but really am out of the loop on that one.

Also if you plan to use your Hilton points soon, I would consider getting the Hilton Amex so you are eligible for the AXON award savings which can be considerable.

Best of luck!

#19

Join Date: Apr 2011

Location: Philadelphia

Posts: 297

Looking at a round of apps for the wife and I and I'm looking at keeping the min spends down. I'll say what I'm interested in and what I would like.

What I could use from all of you is help with the questions and any other advice you might have.

we are looking at banking some Hotel points mainly in this cycle with the exception of the Chase SWA Personal plus card or AA AMEX.

1)BofH & BofA Hawaii cards. i understand these both transfer to hilton at a 1:2 rate for a possible total of 280,000 points.

2)Either the Hilton Amex (60,000 points) card or the AA Amex card (50,000 miles)

3)SWA Personal Plus card 50,000 points +$69 fee or the PC 80,000 sign up bonus ( But i like the SWA card a little better for using for gift cards)

My questions are these.

~With me spreading these out between the diff companies do you think there is a chance we would get approved for all? (credit score is great)

~If we currently have the AA Visa and got approved for the AMEX version, would we get the 50,000 miles

~And if we both have the SWA personal Premium card ($99 fee) if approved for the Plus card, would we still get the 50,000 point bonus?

Thanks for your time.

What I could use from all of you is help with the questions and any other advice you might have.

we are looking at banking some Hotel points mainly in this cycle with the exception of the Chase SWA Personal plus card or AA AMEX.

1)BofH & BofA Hawaii cards. i understand these both transfer to hilton at a 1:2 rate for a possible total of 280,000 points.

2)Either the Hilton Amex (60,000 points) card or the AA Amex card (50,000 miles)

3)SWA Personal Plus card 50,000 points +$69 fee or the PC 80,000 sign up bonus ( But i like the SWA card a little better for using for gift cards)

My questions are these.

~With me spreading these out between the diff companies do you think there is a chance we would get approved for all? (credit score is great)

~If we currently have the AA Visa and got approved for the AMEX version, would we get the 50,000 miles

~And if we both have the SWA personal Premium card ($99 fee) if approved for the Plus card, would we still get the 50,000 point bonus?

Thanks for your time.

2. It is doubtful that you'll get the AA Amex. You would be eligible for the business card, if you want to go that route, but you mentioned you might not want to.

3. Most people say they are different cards and have had success getting both. Again you could get a business card of the Southwest one and pretty much gaurantee you'll get it.

I did a very extensive blog post about my upcoming app-o-rama and why I was considered certain cards. All the cards you list are evaluated, so you might want to check it out:

http://www.extrapackofpeanuts.com/my...he-candidates/

#20

Join Date: Apr 2011

Location: Philadelphia

Posts: 297

Wow, great job! The only advice I would have given would be to look into the Virgin Airways card. It gives you 50k Virgin miles which can transfer to Hilton points at 2:1, meaning you get 100k Hilton points. Major downside is that the $99 annual fee isn't waived, but you might want to stow that away as a possibility for next time.

#21

Original Poster

Join Date: Feb 2012

Location: Ohio

Programs: Marriott Gold, Hilton Gold, UA Silver; 800K+ points 2012

Posts: 115

#22

Original Poster

Join Date: Feb 2012

Location: Ohio

Programs: Marriott Gold, Hilton Gold, UA Silver; 800K+ points 2012

Posts: 115

I did a very extensive blog post about my upcoming app-o-rama and why I was considered certain cards. All the cards you list are evaluated, so you might want to check it out:

http://www.extrapackofpeanuts.com/my...he-candidates/

http://www.extrapackofpeanuts.com/my...he-candidates/

- John

#23

Join Date: Jan 2012

Location: DTW

Programs: Delta Platinum, Marriott Platinum, Hilton Diamond, IHG Platinum, Avis First

Posts: 106

Umm you don't need a business license. You can apply using for SSN. Also the spend on the VA card is same as the Hawaiin cards but offers a higher bonus...

#24

Join Date: Dec 2011

Location: SEA

Programs: BA Gold, Hyatt Glob, MR Plat, HH Diamond, IHG Amb

Posts: 443

Chase Freedom, One Pass, or United Explorer?

It's been more than 2 months since my last Chase card app, so I'm considering getting either Freedom (5x points on bonus categories + nice combo with the checking account), Continental One Pass (before it goes away), or United Mileage Explorer (50K miles). Since I can only get one at a time, what do you think is a better card to get? I already have ~170K UA miles, and I don't think I can double up on CO/UA cards..

#26

Join Date: Apr 2011

Location: Philadelphia

Posts: 297

If you combine the two B of H cards you are looking at $2,000 spend in 4 months and $160 fee for 140,000 Hilton points whereas the VA card is $2,500 in 3 and a $99 fee for 100,000 Hilton points. Guess it depends if you value the 40k extra points at $60 and an extra pull.

#27

Join Date: Jan 2012

Programs: Delta Gold/US Air Gold/GHA Black

Posts: 35

CC Advice

Background:

Airline Preference: Delta (currently Platinum, >400,000 banked miles)

Hotel Preference: Four Seasons. Most travel is to Asia and Caribbean. Next two big trips likely to Kenya and Fiji.

Current Credit Cards: Delta Reserve (15,000 MQM for 30,000 spend, access to Delta Lounges, free checked bags, $495 fee), JP Morgan Palladium (great concierge, great hotel benefits, Priority Pass Select for access to lounges when not flying Delta, $495 fee), Chase Sapphire Preferred (Recently added, 50,000 bonus, almost met minimum spend), Chase Freedom (oldest CC, low credit limit)

What would the FT community reccomend for the next CC churn (CCC?)? I don't put much valve in the Hilton, Hyatt, SPG hotel benefits as most of my travel is leisure and I prefer to stay at properties that these cards might not help much with. I know you can transfer with the SPG amex but a 25,000 transfer doesn't seem worthwhile for an application/credit check even with the transfer bonus -- bumping up value to ~ 30,000?

Thoughts:

Amex Gold Preferred Rewards: Not sure when I would use this as opposed to the Sapphire Preferred and the yearly fee is higher. What has the highest signup bonus been for this card (or put another ways, what should I hold out for)?

Chase Ink Bold: Good bonus (50,000) but I already have 3 Chase accounts so I'm not sure if the application would be approved. Is this just a business card? Is there a personal version as well?

US Airways Business and Personal: Can get up to 65,000 miles with both but not sure how to further build on Star Alliance benefits. Seems like a dead end.

Delta Platinum and/or Gold?

Amex Marriott? Can these point be used for Ritz properties?

Thank you.

Airline Preference: Delta (currently Platinum, >400,000 banked miles)

Hotel Preference: Four Seasons. Most travel is to Asia and Caribbean. Next two big trips likely to Kenya and Fiji.

Current Credit Cards: Delta Reserve (15,000 MQM for 30,000 spend, access to Delta Lounges, free checked bags, $495 fee), JP Morgan Palladium (great concierge, great hotel benefits, Priority Pass Select for access to lounges when not flying Delta, $495 fee), Chase Sapphire Preferred (Recently added, 50,000 bonus, almost met minimum spend), Chase Freedom (oldest CC, low credit limit)

What would the FT community reccomend for the next CC churn (CCC?)? I don't put much valve in the Hilton, Hyatt, SPG hotel benefits as most of my travel is leisure and I prefer to stay at properties that these cards might not help much with. I know you can transfer with the SPG amex but a 25,000 transfer doesn't seem worthwhile for an application/credit check even with the transfer bonus -- bumping up value to ~ 30,000?

Thoughts:

Amex Gold Preferred Rewards: Not sure when I would use this as opposed to the Sapphire Preferred and the yearly fee is higher. What has the highest signup bonus been for this card (or put another ways, what should I hold out for)?

Chase Ink Bold: Good bonus (50,000) but I already have 3 Chase accounts so I'm not sure if the application would be approved. Is this just a business card? Is there a personal version as well?

US Airways Business and Personal: Can get up to 65,000 miles with both but not sure how to further build on Star Alliance benefits. Seems like a dead end.

Delta Platinum and/or Gold?

Amex Marriott? Can these point be used for Ritz properties?

Thank you.

#28

Join Date: Jan 2012

Location: DTW

Programs: Delta Platinum, Marriott Platinum, Hilton Diamond, IHG Platinum, Avis First

Posts: 106

It's been more than 2 months since my last Chase card app, so I'm considering getting either Freedom (5x points on bonus categories + nice combo with the checking account), Continental One Pass (before it goes away), or United Mileage Explorer (50K miles). Since I can only get one at a time, what do you think is a better card to get? I already have ~170K UA miles, and I don't think I can double up on CO/UA cards..

#29

Join Date: May 2008

Location: PHL (kinda, no airport is really close)

Programs: AA Exp, but not sure for how long. Enterprise Platinum woo-hoo!

Posts: 4,550

Amex's signup bonuses have not been so great lately. I don't think you will get more than 25K for PRG. Compared to Sapphire, it has the 15K bonus after spending 30K, but other than that, you get 2X on gas and groceries and 3X on airfare, compared to 2X for dining and travel on Sapphire.

If you are already paying $495 for JP Morgan, you might consider dumping that and getting Amex Plat. They have a concierge, Priority Pass Select, some hotel benefits, it's only $450, and 50K signup bonus with $3K spend. Also, Amex Plat gives you $200 in airline fee benefits per year. If you are Plat on Delta, things like free drinks and free bag check won't help you much, but you MIGHT get award ticket fees rebated. (Spotty luck there, last year I did for one, but didn't for the other.) Amex Plat also gives you access to US lounges even if not flying on US.

If you are already paying $495 for JP Morgan, you might consider dumping that and getting Amex Plat. They have a concierge, Priority Pass Select, some hotel benefits, it's only $450, and 50K signup bonus with $3K spend. Also, Amex Plat gives you $200 in airline fee benefits per year. If you are Plat on Delta, things like free drinks and free bag check won't help you much, but you MIGHT get award ticket fees rebated. (Spotty luck there, last year I did for one, but didn't for the other.) Amex Plat also gives you access to US lounges even if not flying on US.

#30

Original Poster

Join Date: Feb 2012

Location: Ohio

Programs: Marriott Gold, Hilton Gold, UA Silver; 800K+ points 2012

Posts: 115

From the first thread:

Holders of the US-based Hilton American Express cards (both the regular and Surpass versions) enjoy extra benefits. In addition to receiving automatic elite status -- Gold for the Surpass card; Silver for the regular Amex -- and the corresponding VIP reward discount described above, cardholders also qualify for a separate class of discounted rewards (AXON).

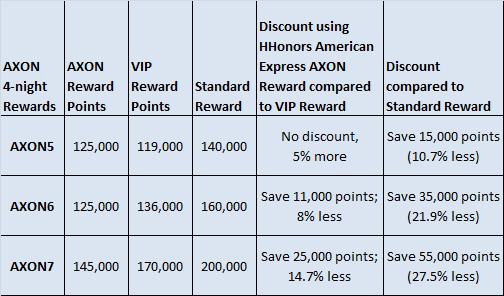

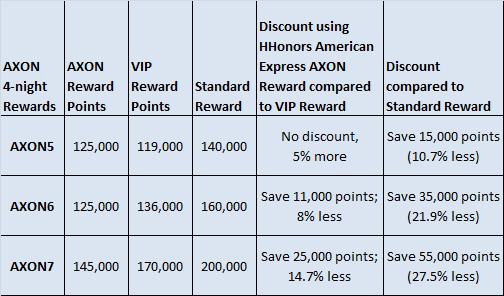

AXON rewards are available for 4-night stays at hotels in categories 5 through 7, as follows:

As with standard and VIP rewards, AXON rewards apply only to standard rooms, and not to higher room categories. See the discussion at the end of post #1 concerning capacity controls.

Inexplicably, the AXON rate for category 5 hotels is higher than the VIP reward rate: 125K vs. 119K for a VIP reward. (Inexplicably, because anyone who qualifies for AXON is by definition a Hilton elite eligible for the VIP reward, meaning that no-one should ever need or want to use the AXON5 reward rate.) However, AXON awards provide substantial discounts at category 6 and 7 hotels, as illustrated by the following chart taken from Ric Garrido's blog post:

For a comprehensive comparison of AXON to VIP/GLON and standard awards, see the post below.

AXON awards cannot be booked online, and must instead be made by calling 1-800-920-5649, per the Hilton Amex terms and conditions. Note that this is the Diamond Desk, and the CSR will automatically ask for your Diamond number. Don't be thrown off; if you are not Diamond Elite, simply explain that you are calling to redeem an AXON reward stay.

Some members report that confirmation emails and/or online reservation records for AXON awards sometimes show the higher VIP rate instead of, or in addition to, the correct AXON point charge, although the proper amounts are deducted from their accounts. Also, as noted in the September 2011 thread http://www.flyertalk.com/forum/hilto...ging-axon.html, some American Express websites list outdated AXON point costs (i.e., showing 6 as the top HHonors category).

For general discussion concerning AXON awards, see the FT thread http://www.flyertalk.com/forum/hilto...ve-thread.html.

AXON rewards are available for 4-night stays at hotels in categories 5 through 7, as follows:

- Category 5: 125,000 points

- Category 6: 125,000 points

- Category 7: 145,000 points

As with standard and VIP rewards, AXON rewards apply only to standard rooms, and not to higher room categories. See the discussion at the end of post #1 concerning capacity controls.

Inexplicably, the AXON rate for category 5 hotels is higher than the VIP reward rate: 125K vs. 119K for a VIP reward. (Inexplicably, because anyone who qualifies for AXON is by definition a Hilton elite eligible for the VIP reward, meaning that no-one should ever need or want to use the AXON5 reward rate.) However, AXON awards provide substantial discounts at category 6 and 7 hotels, as illustrated by the following chart taken from Ric Garrido's blog post:

For a comprehensive comparison of AXON to VIP/GLON and standard awards, see the post below.

AXON awards cannot be booked online, and must instead be made by calling 1-800-920-5649, per the Hilton Amex terms and conditions. Note that this is the Diamond Desk, and the CSR will automatically ask for your Diamond number. Don't be thrown off; if you are not Diamond Elite, simply explain that you are calling to redeem an AXON reward stay.

Some members report that confirmation emails and/or online reservation records for AXON awards sometimes show the higher VIP rate instead of, or in addition to, the correct AXON point charge, although the proper amounts are deducted from their accounts. Also, as noted in the September 2011 thread http://www.flyertalk.com/forum/hilto...ging-axon.html, some American Express websites list outdated AXON point costs (i.e., showing 6 as the top HHonors category).

For general discussion concerning AXON awards, see the FT thread http://www.flyertalk.com/forum/hilto...ve-thread.html.