Rapid Rewards Points Inheritable?

#1

Original Poster

Join Date: Jun 2018

Location: Nevada Ohio Florida

Programs: WN A+, CP, HH Diamond, National EE

Posts: 44

Rapid Rewards Points Inheritable?

I have a casual friend who shared with me that when her husband died, Chase immediately cancelled their Southwest credit card. He was the cardholder, and she was an authorized user. She said that, in addition, Southwest zeroed out the Rapid Rewards account, so whatever points were in the account are gone.

I'm not sure she is exactly stating this correctly. That is, due to the credit card being cancelled, she may be assuming that the RR account is also cancelled, but doesn't know how to check. Does anyone have experience like this? Is there a strategy for managing your RR account/points so they can transfer to your spouse/partner if you die? Are the points inheritable?

Any comments will be appreciated. Thanks!

I'm not sure she is exactly stating this correctly. That is, due to the credit card being cancelled, she may be assuming that the RR account is also cancelled, but doesn't know how to check. Does anyone have experience like this? Is there a strategy for managing your RR account/points so they can transfer to your spouse/partner if you die? Are the points inheritable?

Any comments will be appreciated. Thanks!

#2

Join Date: Nov 2005

Location: SEA

Programs: HH Silver

Posts: 2,400

I am betting you are correct with this. When my sister died, my BIL just used her points for his own flights. Much easier and cheaper than trying to figure out if they are inheritable, transferable, etc. I have all my FF accounts with passwords listed on a separate sheet of paper in my will binder. My partner knows what to do with them, lol.

#3

Join Date: Nov 2015

Location: St. Louis, MO

Programs: Southwest Companion Pass

Posts: 790

If you have access to his account, I'd just use the points to book flights for myself or whoever. One important thing to remember is not to let his account expire due to lack of point earning inactivity. You have to have some point earning activity at least once every two years. This can easily be checked by looking at the homepage. It will show you at the top of the page when the last Point earning activity was made. It's pretty easy to keep the account active though. Maybe once a year you could make a small purchase through Rapid Rewards Shopping. Just make sure you're logged on through his account.

#4

Join Date: Aug 2012

Location: LAS

Posts: 1,525

Perhaps the RR points in question became "inactive" due to lack of earning.

This is copied directly from the SWA website, Rapid Rewards Program Terms and Conditions:

Points may not be transferred to a Member's estate or as part of a settlement, inheritance, or will. In the event of a Member’s death, his/her account will become inactive after 24 months from the last earning date (unless the account is requested to be closed) and points will be unavailable for use.

This is copied directly from the SWA website, Rapid Rewards Program Terms and Conditions:

Points may not be transferred to a Member's estate or as part of a settlement, inheritance, or will. In the event of a Member’s death, his/her account will become inactive after 24 months from the last earning date (unless the account is requested to be closed) and points will be unavailable for use.

#5

Join Date: Feb 2009

Posts: 6,606

My dad doesn't fly. I get CC's in his name and he collects the bonus. I then use his points to book flights for me. I have used well over 1 million miles that were in my dads name to boook flights and hotels for my wife and I . As long as you have access to his SW account you can book flights for yourself ( or anyone else) using his points

#6

FlyerTalk Evangelist

Join Date: Nov 2000

Location: Nashville -Past DL Plat, FO, WN-CP, various hotel programs

Programs: DL-MM, AA, SW w/companion,HiltonDiamond, Hyatt PLat, IHF Plat, Miles and Points Seeker

Posts: 11,072

I think you are dealing with less than ALL the facts here.

#7

Join Date: Oct 2014

Location: LAS

Posts: 211

Fully anecdotal but when my grandfather passed a few years ago my mother wanted to use his remaining points to buy flights for my grandmother - my mother did call and the WN agent couldn't transfer the points, but did some sort of point adjustment magic to buy my grandmother's tickets with the points she had in her acct - this was definitely on the old system so may not be possible anymore, and sounds very much like a case by case basis - I also don't think it was a ton of pts in my grandfathers acct, so more of a courtesy adjustment I think.

#8

Join Date: Feb 2009

Posts: 6,606

Fully anecdotal but when my grandfather passed a few years ago my mother wanted to use his remaining points to buy flights for my grandmother - my mother did call and the WN agent couldn't transfer the points, but did some sort of point adjustment magic to buy my grandmother's tickets with the points she had in her acct - this was definitely on the old system so may not be possible anymore, and sounds very much like a case by case basis - I also don't think it was a ton of pts in my grandfathers acct, so more of a courtesy adjustment I think.

All your mother had to do was log into your grandfathers Southwest acct and book the flights using points for whoever she wanted.

The only airline I know of that makes it a bit more difficult is American where you have to use a credit card to pay the award fees that is in the frequent fliers account holders name.

#9

Moderator: Southwest Airlines, Capital One

Join Date: Sep 1999

Location: California

Programs: WN Companion Pass, A-list preferred, Hyatt Globalist; United Club Lietime (sic) Member

Posts: 21,624

Just between you and me and forum readers, in my experience the bank doesn't care what name you use for an online purchase if the address and card numbers are correct.

#10

Join Date: Jul 2013

Posts: 5,813

My MIL used cards and accounts with her deceased husbands name on them for many years. She never bothered to update the accounts. As long as the bills got paid the banks didn't care.

#11

FlyerTalk Evangelist

Join Date: Aug 2009

Location: ZOA, SFO, HKG

Programs: UA 1K 0.9MM, Marriott Gold, HHonors Gold, Hertz PC, SBux Gold, TSA Pre✓

Posts: 13,811

While it sounds anti-intuitive, a primary cardholder can in fact open an additional card in the name of the deceased to resolve this.

#12

Join Date: Mar 2011

Posts: 6,286

Having dealt with this kind of thing multiple times, I can tell you that no banks know of the death until you report it to one of them. If the surviving spouse or partner is assuming the debt, there's really no reason to let the bank know immediately.

#13

Join Date: Feb 2009

Posts: 6,606

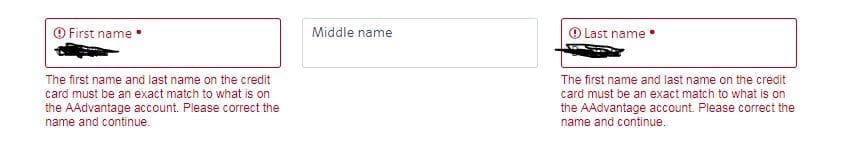

For American Airlines award tickets the credit card used to pay the fees has to be in the American Airlines frequent fliers name. This not a bank issue but it seems to be a AA rule as I have run into this several times as I book flights for me using my dads miles.

No big deal for me as I have credit cards in my dads name at my house and he is also a AU on one of my cards.

I'm not sure if I would open a card in a dead persons name but I already have my dad as an AU one one of my accounts in case he passes as I would still want to use his 1 million or so AA miles.

Last edited by flyer4512; Oct 15, 2018 at 3:05 pm

#14

Join Date: Feb 2009

Posts: 6,606

I tried putting my dads name for billing (my CC number and address ) and the bank rejected the transaction.

Last edited by flyer4512; Oct 15, 2018 at 4:05 pm

#15

Join Date: Jul 2013

Posts: 5,813

If so how about husband and wife who both have cards on the same account.