FAQ : Marriott Bonvoy point value / valuation : How much is a point worth ?

#61

FlyerTalk Evangelist

Join Date: Aug 2011

Location: Barcelona, London, on a plane

Programs: BA Silver, TK E+, AA PP, Hyatt Globalist, Marriott LT Plat, Hilton Diamond

Posts: 13,048

I also wonder if the big points blogs (TPG) are considering opportunity cost on point redemptions when valuing various point currencies. Given that redemption calculation articles do not mention opportunity cost at all, I’m inclined to believe that most people are over-valuing their points.

It's also worth noting that it is really quite difficult to explain opportunity cost - not to mention Kacee 's excellent point - to anybody other than business / economics graduates and other numerically-minded people. For everybody else their eyes glaze over and they don't read your blog again...

#62

Join Date: Apr 2021

Location: Manhattan, Palm Beach Island, San Francisco, Boston, & Hong Kong

Programs: Lifetime United Global Services, Delta Plat, Hyatt Globalist, Marriott Ambassador, & Hilton Diamond

Posts: 3,165

It's actually even a bit more complex than that, because it's not really appropriate to value accruals of a devaluing currency based on a current redemption. This is exacerbated if one refrains from redemptions because the perceived value is too low, since it leads to hoarding of a devaluing currency. Further, for a truly accurate analysis, you'd have to impute an interest accrual on the cash expenditure through the date the earned points are actually redeemed.

We can make this as complicated as you like, but as a rough yardstick for determining whether a particular redemption makes sense, I'll stick with .7 cpp. As a corollary, it is IMO not ideal to be sitting on more than half a million or so Marriott points, unless you have a very specific redemption goal.

We can make this as complicated as you like, but as a rough yardstick for determining whether a particular redemption makes sense, I'll stick with .7 cpp. As a corollary, it is IMO not ideal to be sitting on more than half a million or so Marriott points, unless you have a very specific redemption goal.

Also, I really respect what you said about not hoarding points for the sake of hoarding them. I agree completely that all unused point balances should be discounted until an actual redemption is made (which is why I focused everything on redemptions). I started this hobby to chase after that 400,000 point Christmas Maldives trip. On paper, itís 108% return on spend but subjectively it is probably less.

Edit: just to add onto this, the opportunity cost we are paying with redemptions is quite concrete.

Example using the STR point redemption from my video-

Letís say my points balance is an even 400,000. The point difference between redeeming that vacation and paying for that vacation is in excess of 800,000 and not merely 400,000. If we are going to say the 400,000 points being spent have value then the 400,000 points we are giving up the opportunity to earn absolutely have value as well. In my opinion, this is much more impactful than any marginal value difference from time value inflation especially in the context of real redemptions (not idle point balances).

Last edited by WasKnown; Apr 26, 2021 at 11:08 am

#63

Join Date: Apr 2021

Location: Manhattan, Palm Beach Island, San Francisco, Boston, & Hong Kong

Programs: Lifetime United Global Services, Delta Plat, Hyatt Globalist, Marriott Ambassador, & Hilton Diamond

Posts: 3,165

With other bloggers, one can discuss how much of a bona fide effort was made to value points currencies appropriately. With TPG you can be 100% sure that the objectiive is to attract more credit card signups and to keep their customers (i.e. banks and travel companies) happy.

It's also worth noting that it is really quite difficult to explain opportunity cost - not to mention Kacee 's excellent point - to anybody other than business / economics graduates and other numerically-minded people. For everybody else their eyes glaze over and they don't read your blog again...

It's also worth noting that it is really quite difficult to explain opportunity cost - not to mention Kacee 's excellent point - to anybody other than business / economics graduates and other numerically-minded people. For everybody else their eyes glaze over and they don't read your blog again...

#64

FlyerTalk Evangelist

Join Date: May 2002

Location: Pittsburgh

Programs: MR/SPG LT Titanium, AA LT PLT, UA SLV, Avis PreferredPlus

Posts: 31,008

"Points value" often depends on how hard you work at finding good deals, how far in advance you plan, what type of properties are involved, etc. I've redeemed at well over one cent and as low as 1/2 cent since I have a boatload of points that will only depreciate over time.

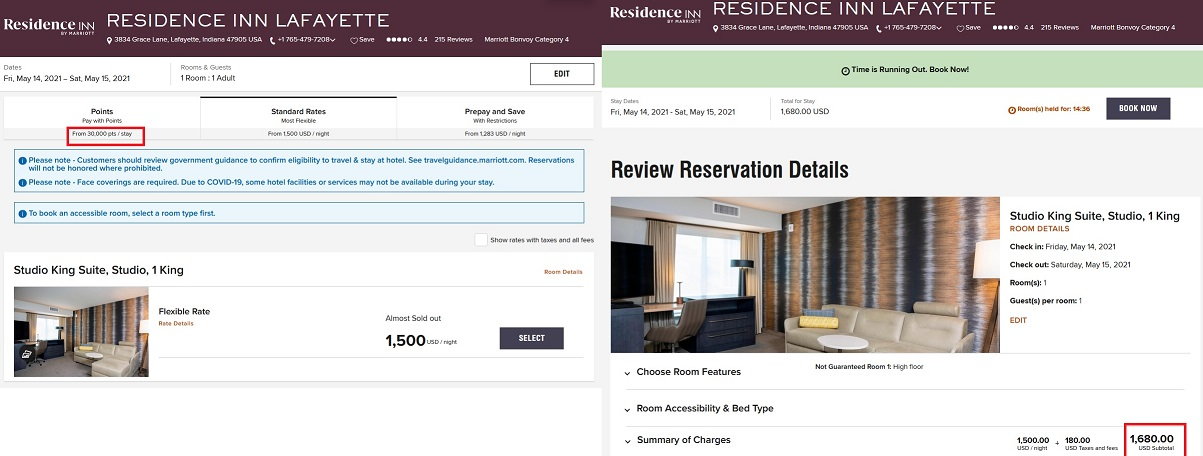

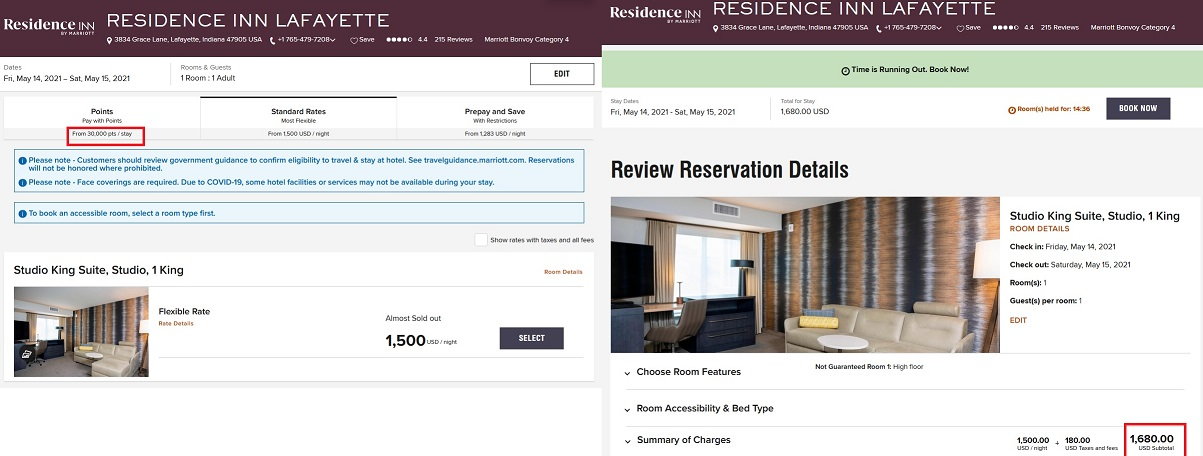

In the spirit of FT's "airline miles are worth xxx based on a peak, last-minute F flight to Tokyo", I present "Marriott points are worth 5.6 cents."

In the spirit of FT's "airline miles are worth xxx based on a peak, last-minute F flight to Tokyo", I present "Marriott points are worth 5.6 cents."

#65

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,455

Example using the STR point redemption from my video-

Letís say my points balance is an even 400,000. The point difference between redeeming that vacation and paying for that vacation is in excess of 800,000 and not merely 400,000. If we are going to say the 400,000 points being spent have value then the 400,000 points we are giving up the opportunity to earn absolutely have value as well. In my opinion, this is much more impactful than any marginal value difference from time value inflation especially in the context of real redemptions (not idle point balances).

Letís say my points balance is an even 400,000. The point difference between redeeming that vacation and paying for that vacation is in excess of 800,000 and not merely 400,000. If we are going to say the 400,000 points being spent have value then the 400,000 points we are giving up the opportunity to earn absolutely have value as well. In my opinion, this is much more impactful than any marginal value difference from time value inflation especially in the context of real redemptions (not idle point balances).

I agree though that if you're considering redeeming in lieu of shelling out that kind of cash, it makes sense to consider opportunity cost. Particularly if redeeming during a 2x (or similar) promo.

#66

Join Date: Nov 2014

Location: New York

Programs: MB-LTT , HH-Diam., HGP-Expl.

Posts: 778

Also, Marriott occasionally sells gift cards at a discount. Last year, I bought gift cards for 80% of face value. For a Titanium member who could earn 17.5 points per dollar paying with gift cards, the actual value of points may be much lower than some might expect.

#67

Join Date: Apr 2021

Location: Manhattan, Palm Beach Island, San Francisco, Boston, & Hong Kong

Programs: Lifetime United Global Services, Delta Plat, Hyatt Globalist, Marriott Ambassador, & Hilton Diamond

Posts: 3,165

One of the issues that we'll bump into is that many here who would redeem at StR Maldives would not ever pay those rates in cash. So in that scenario, the opportunity cost analysis rests on an incorrect assumption, i.e., that the value foregone is accrual of points on a $2k+ per night hotel room. Example: This weekend I'm redeeming 60,000 at Santa Monica Proper, for a room that retails for $499. There's no way I'd actually spend that to stay there, the alternative is not paying the cash rate, but rather redeeming at a different property or in a different program.

I agree though that if you're considering redeeming in lieu of shelling out that kind of cash, it makes sense to consider opportunity cost. Particularly if redeeming during a 2x (or similar) promo.

I agree though that if you're considering redeeming in lieu of shelling out that kind of cash, it makes sense to consider opportunity cost. Particularly if redeeming during a 2x (or similar) promo.

The original model had a section to put in my own cost for the calculation while still using the market price to calculate the points opportunity cost. I removed it when sharing the file around because it messed up with some of the hidden columns that do not impact ARV but can still be helpful for others.

I agree with the idea that people should ultimately just redeem points for the trips they care about. The reason why I care about point valuations is because I want to optimize the return on my relatively high spend. The point valuations impact my strategy a lot so I am trying to be careful.

#68

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,455

And that is exactly the scenario where a thorough economic analysis makes best sense.

#69

Join Date: Feb 2005

Location: PHL

Programs: AA EXP MM, HHonors Lifetime Diamond, Marriott Lifetime Ti, UA Silver

Posts: 5,037

I currently have 2 points reservations booked and 9 cash reservations booked.

The first points reservation is 274,000 points for a 5 night stay with a current all-in cash price of about $3350, for a gross value of about 1.22 cents per point. Yes, I know that there's an opportunity cost in not earning points on the $3350 spend, but the valuation comparisons from program to program typically don't consider this.

The second points reservation is 100,000 points for a 2 night stay with a current all-in cash price of about $1495. Granted the points stay carries fees and taxes of $85, but even factoring that gives a gross value of over 1.3 cents per point.

Both of those properties are "aspirational" places where I'd be very unlikely to pay cash out of pocket, but am happy to pay points for an elevated experience. The other nine cash reservations are all at properties where the points redemption value is nowhere near 1.0 cents per point. They also are not nearly as high-end as the other two.

So yes, there are very good values to be found using points, and they can definitely return better than 1.0 cpp value. However, these are increasingly hard to find, and there are plenty of properties where these kinds of values are simply unheard of. Are points gradually devaluing over time? Absolutely. Am I going to continue to use points judiciously where the value is well above average? Absolutely.

The first points reservation is 274,000 points for a 5 night stay with a current all-in cash price of about $3350, for a gross value of about 1.22 cents per point. Yes, I know that there's an opportunity cost in not earning points on the $3350 spend, but the valuation comparisons from program to program typically don't consider this.

The second points reservation is 100,000 points for a 2 night stay with a current all-in cash price of about $1495. Granted the points stay carries fees and taxes of $85, but even factoring that gives a gross value of over 1.3 cents per point.

Both of those properties are "aspirational" places where I'd be very unlikely to pay cash out of pocket, but am happy to pay points for an elevated experience. The other nine cash reservations are all at properties where the points redemption value is nowhere near 1.0 cents per point. They also are not nearly as high-end as the other two.

So yes, there are very good values to be found using points, and they can definitely return better than 1.0 cpp value. However, these are increasingly hard to find, and there are plenty of properties where these kinds of values are simply unheard of. Are points gradually devaluing over time? Absolutely. Am I going to continue to use points judiciously where the value is well above average? Absolutely.

#70

Join Date: Oct 2009

Location: BNA

Programs: Hyatt Explorist, Bonvoy Plat, HHonors Diamond, DL Gold

Posts: 383

That makes perfect sense. Frankly, I do not fault TPG for their approach and respect the fact that they need to make money like any other business. I will simply choose not to use their valuations. I just wish more content online would consider this because these valuations do impact optimization for max return on spend strategies.

#71

Join Date: Apr 2011

Location: madrid

Posts: 66

AGREE

.6 is probably a good overall valuation. I have used millions of them and

hard to go over that value except perhaps in Level 1 and 2

hard to go over that value except perhaps in Level 1 and 2

I've found Marriott points to be worth 0.5-0.6 cents. I never have enough to do the stay fifth night free (nor do I typically want to be in a place that long) and that is based on the properties I like to stay at. You may just want to try to figure out what properties you like and come up with your own valuation. If the valuation is better use points, if not use cash.

#72

Join Date: Feb 2005

Location: New York City

Programs: AA,BNV,HIL

Posts: 879

For those of us who don't have unlimited amounts of money - Will the use of points get you a stay you might not otherwise be able to pay for or save you money you would use on real life? Also, will not using the points mean they sit and collect dust which effectively means you're getting $0.00 per point, in perpetuity waiting for the highest value?

Just sayin....

Just sayin....

#73

A FlyerTalk Posting Legend

Join Date: Jul 2002

Location: MCI

Programs: AA Gold 1MM, AS MVP, UA Silver, WN A-List, Marriott LT Titanium, HH Diamond

Posts: 52,574

My two main uses for points are 5-night stays, usually at pretty aspirational places, and 1-night stays in low categories. Sometimes I'll redeem the larger stays with Alaska miles (Travel Package), other times not.

I still look for about a penny a point on redemptions. All programs have leaked value in recent years, but Marriott is still a decent play. For now... I don't worry too much about the exact cents-per-point on every redemption (it often looks artificially high on very expensive and sometimes overpriced hotels), but even on mundane airport hotel stays that might have otherwise set you back a couple hundred dollars/euros/pounds, you can get solid value.

The OP referenced one of the worst places on the planet to spend travel rewards - Orlando. There, all of the hotels will be two categories too high because they know that's where novice users spend points. We used to have family in Orlando and visit twice a year...we'd just aim for the most off-peak times and pay cash. We actually hit upon sweet deals for the MVCI properties a few times.

I still look for about a penny a point on redemptions. All programs have leaked value in recent years, but Marriott is still a decent play. For now... I don't worry too much about the exact cents-per-point on every redemption (it often looks artificially high on very expensive and sometimes overpriced hotels), but even on mundane airport hotel stays that might have otherwise set you back a couple hundred dollars/euros/pounds, you can get solid value.

The OP referenced one of the worst places on the planet to spend travel rewards - Orlando. There, all of the hotels will be two categories too high because they know that's where novice users spend points. We used to have family in Orlando and visit twice a year...we'd just aim for the most off-peak times and pay cash. We actually hit upon sweet deals for the MVCI properties a few times.

#74

Join Date: Mar 2003

Location: Pittsburgh, PA, USA

Programs: MR LT Titanium, IHG Plat.,UA Premier Silver, & PA/OH Turnpike Million Miler

Posts: 2,320

For those of us who don't have unlimited amounts of money - Will the use of points get you a stay you might not otherwise be able to pay for or save you money you would use on real life? Also, will not using the points mean they sit and collect dust which effectively means you're getting $0.00 per point, in perpetuity waiting for the highest value?

Just sayin....

Just sayin....

--Jon

#75

Join Date: Mar 2011

Posts: 1

For those of us who don't have unlimited amounts of money - Will the use of points get you a stay you might not otherwise be able to pay for or save you money you would use on real life? Also, will not using the points mean they sit and collect dust which effectively means you're getting $0.00 per point, in perpetuity waiting for the highest value?

Just sayin....

Just sayin....