Last edit by: rasheed

Some key factors of credit surcharging as it applies to the US market only.

-Disclosure and itemization is key. You can still report such issues if there is indeed lack of proper disclosure AND itemization. Itemization is going to be very unlikely unless the terminal is specifically setup to create that line item. Those merchants who just tell you and "add it to the card total" are not compliant. They may not care even with complaints made to Visa/MC/Discover/AmEx.

-Visa's complaint form: https://usa.visa.com/Forms/visa-rules.html Visa does review all complaints and asks the merchant/processor for a response, but you might never hear back from them on the outcome. Sometimes, you will see a minor change at the store. Visa also does covert operations to visit such merchants in certain situations.

-Mastercard's complaint email: [email protected]

-Discover and AmEx as "closed loop" systems require any complaints be done directly as a cardholder under their current merchant dispute options.

-The current surcharge limit in the US is 4%

-Visa's website on the topic: https://usa.visa.com/support/small-b...ions-fees.html

-Visa's diagram on the topic: https://usa.visa.com/dam/VCOM/global...rements-r5.pdf

-Mastercard's website on this topic: https://www.mastercard.us/en-us/merc...rge-rules.html

-Mastercard's document on this topic: https://www.mastercard.us/content/da...arge_Rules.pdf

-Elavon's guidance for merchants to get surcharge allowance: https://website.elavon.com/cbsettlement.html

-Visa and Mastercard allow product-level surcharges (such as only Signature or World/World Elite), but that seems really hard to communicate and implement, so brand-level (all Visa/Mastercard/etc.) is the only kind I have seen so far.

-AmEx does not require fee itemization.

California NO LONGER feels it can go against merchants who add surcharges (even beyond the initial "industries" that were allowed in the court ruling):

Same also applies in Florida and Texas.

WorldPay presentation: https://nacm.org/pdfs/webinars/Credi...Fees-82218.pdf

Surging credit surcharges in the US (2019 - 2023)?

#46

Join Date: Aug 2006

Location: ATL, BHM, DUB, County Wexford

Programs: DL DM, AA ExPlt, Diamond HH, HY, BW, & Titanium Elite Marriott

Posts: 4,864

#47

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

(Really, merchants could just stop accepting Visa and MC too, but that might be more problematic. At least with AmEx, most people also have at least one Visa or MC, even if it's just a debit card.)

#48

Join Date: Jul 2011

Posts: 1,136

Haven't run into many surcharges but I did run into a store that had a $20 minimum for credit cards, which is higher than allowed by law (unless NY has a law that overrides). As much as I would normally report that, it is a very nice local shop, so I refrained from doing so.

#49

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

The vending machines at my workplace recently changed how they display prices, possibly to satisfy card network rules. Instead of listing only cash prices and having a placard saying such (and mentioning a 10c fee for card), it now lists out cash and credit prices for each item. As far as I can tell, the card price is still 10c more than the cash price (though IMO it's still above the 4% maximum).

#50

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

FWIW, it looks like Square's upcoming change to their fee structure is causing at least one business to adopt minimums when they haven't had any before: https://wtkr.com/2019/10/28/local-bu...ansaction-fee/

#51

Original Poster

Join Date: Oct 2007

Programs: AA, WN, UA, Bonvoy, Hertz

Posts: 2,491

https://www.marketwatch.com/story/cr...ind-2019-11-01

Keeping the content fresh on this thread, but it does appear the QR systems are doing just fine in China. payTM is the thing to use in India.

Starbucks has 1.6 billion in SGC (much of it may never be redeemed). The article is pointing to how stores avoid per transaction card charges.

PayPal, Chase Pay, Amazon Pay, etc. had opportunities to really offer a competitive option. Chase seems out as it has called it quits on its own QR option using Visa instead with no incremental costs to increase its profit, but really no benefits to merchants or consumers.

PayPal has played both sides by offering merchants options to take Venmo and PayPal as payment, but also have connected most of their systems to a MC option. Again, no benefit for merchants with fees similar to taking cards.

Amazon Pay is experimenting in India. Currently supporting movie tickets and flight tickets, but that doesn't seem to approach the issue of small ticket purchases and items.

It is not new that existing corporations will do whatever it takes to avoid innovation in this area. It does seem the entry point for challengers is getting harder and harder.

Keeping the content fresh on this thread, but it does appear the QR systems are doing just fine in China. payTM is the thing to use in India.

Starbucks has 1.6 billion in SGC (much of it may never be redeemed). The article is pointing to how stores avoid per transaction card charges.

PayPal, Chase Pay, Amazon Pay, etc. had opportunities to really offer a competitive option. Chase seems out as it has called it quits on its own QR option using Visa instead with no incremental costs to increase its profit, but really no benefits to merchants or consumers.

PayPal has played both sides by offering merchants options to take Venmo and PayPal as payment, but also have connected most of their systems to a MC option. Again, no benefit for merchants with fees similar to taking cards.

Amazon Pay is experimenting in India. Currently supporting movie tickets and flight tickets, but that doesn't seem to approach the issue of small ticket purchases and items.

It is not new that existing corporations will do whatever it takes to avoid innovation in this area. It does seem the entry point for challengers is getting harder and harder.

#52

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

https://www.marketwatch.com/story/cr...ind-2019-11-01

Keeping the content fresh on this thread, but it does appear the QR systems are doing just fine in China. payTM is the thing to use in India.

Starbucks has 1.6 billion in SGC (much of it may never be redeemed). The article is pointing to how stores avoid per transaction card charges.

PayPal, Chase Pay, Amazon Pay, etc. had opportunities to really offer a competitive option. Chase seems out as it has called it quits on its own QR option using Visa instead with no incremental costs to increase its profit, but really no benefits to merchants or consumers.

PayPal has played both sides by offering merchants options to take Venmo and PayPal as payment, but also have connected most of their systems to a MC option. Again, no benefit for merchants with fees similar to taking cards.

Amazon Pay is experimenting in India. Currently supporting movie tickets and flight tickets, but that doesn't seem to approach the issue of small ticket purchases and items.

It is not new that existing corporations will do whatever it takes to avoid innovation in this area. It does seem the entry point for challengers is getting harder and harder.

Keeping the content fresh on this thread, but it does appear the QR systems are doing just fine in China. payTM is the thing to use in India.

Starbucks has 1.6 billion in SGC (much of it may never be redeemed). The article is pointing to how stores avoid per transaction card charges.

PayPal, Chase Pay, Amazon Pay, etc. had opportunities to really offer a competitive option. Chase seems out as it has called it quits on its own QR option using Visa instead with no incremental costs to increase its profit, but really no benefits to merchants or consumers.

PayPal has played both sides by offering merchants options to take Venmo and PayPal as payment, but also have connected most of their systems to a MC option. Again, no benefit for merchants with fees similar to taking cards.

Amazon Pay is experimenting in India. Currently supporting movie tickets and flight tickets, but that doesn't seem to approach the issue of small ticket purchases and items.

It is not new that existing corporations will do whatever it takes to avoid innovation in this area. It does seem the entry point for challengers is getting harder and harder.

That all said, I think the best time for competitors to try to push QR in the US was back in 2014-15. NFC was still uncommon enough that one could credibly make the "doesn't need anything new" argument to merchants in order to add support (and if you had a large enough user base like, say, Venmo, it could very well have been enough).

#53

Original Poster

Join Date: Oct 2007

Programs: AA, WN, UA, Bonvoy, Hertz

Posts: 2,491

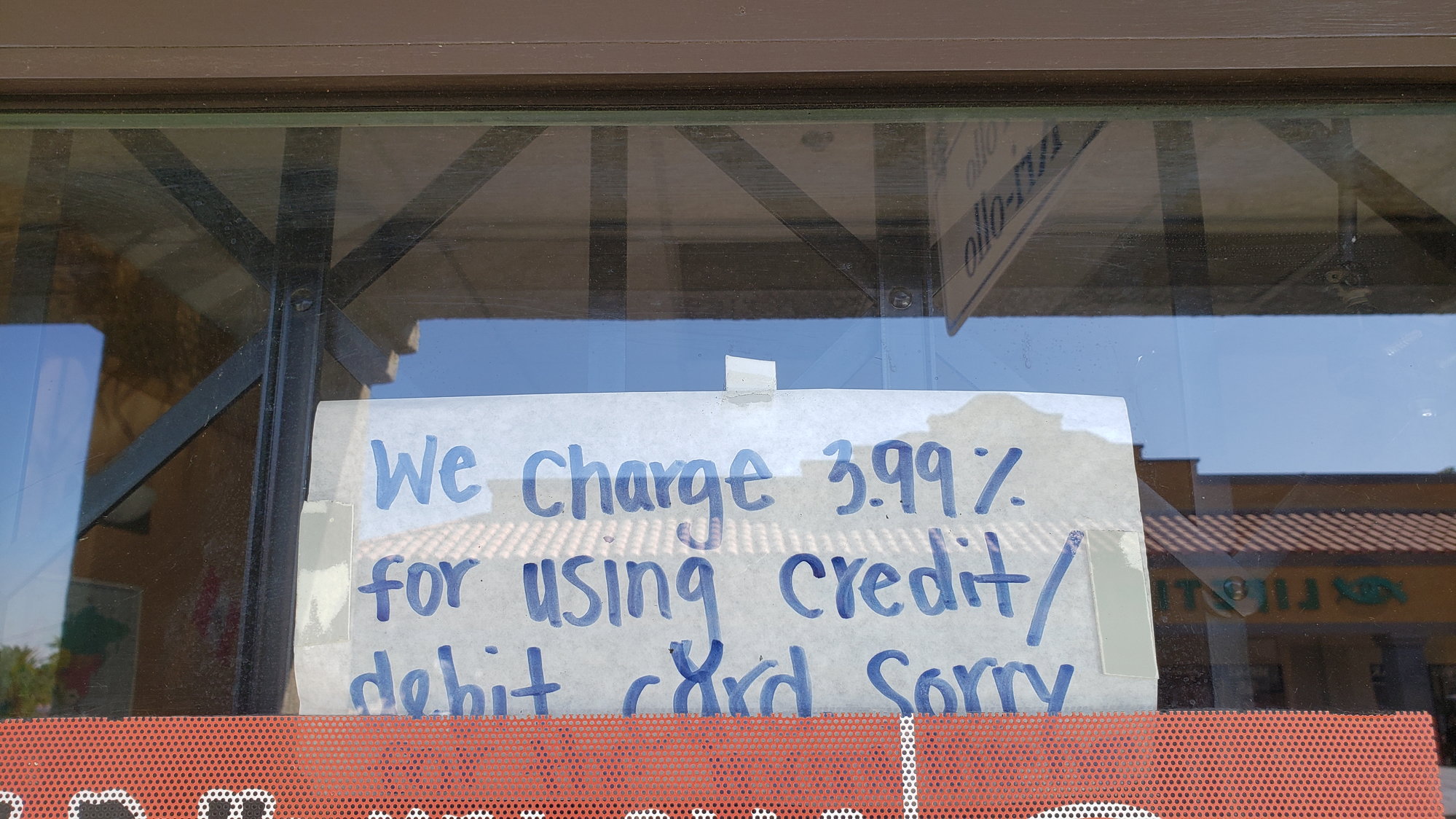

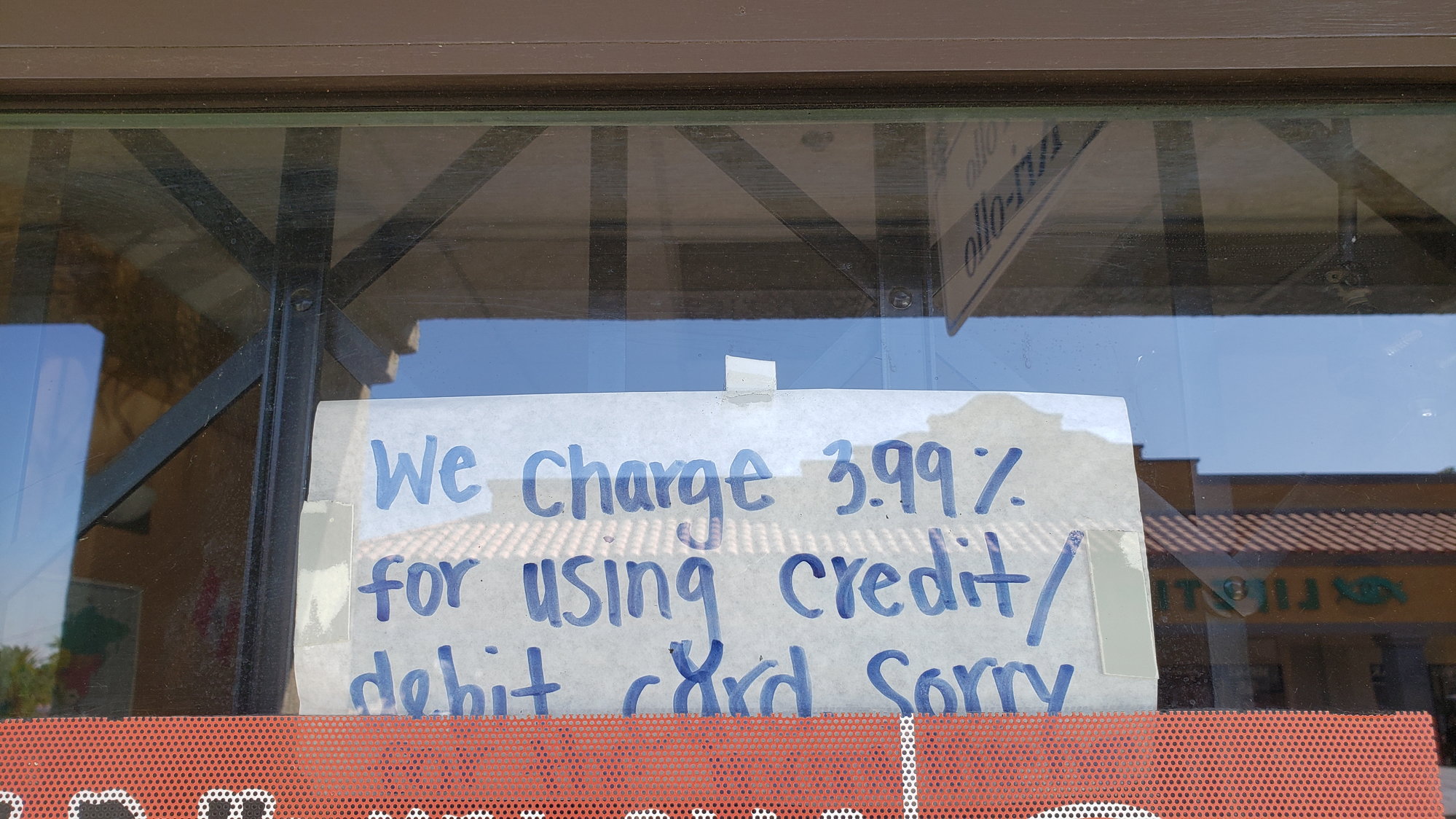

Seen at a Peruvian restaurant. The surcharge applies to both credit and debit, which is troublesome of course.

#54

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

Note: for small enough purchases, merchants could very well pay more than ~3% simply due to the fixed fee component. I'm not sure how common that is, however.

#55

Join Date: May 2013

Location: New York

Programs: UA Silver, Marriott LTPP, Hertz Five Star

Posts: 1,079

Surcharging is going to increase and there's not much that can be done about it. The largest brands won't do it out of fears of outcry, generally having better card processing agreements with the networks anyways, etc. but smaller merchants will likely approach it as a way to reduce their cost of card processing. The smaller merchants still resist friction/people refusing to patronize them, but a lot of people put up with inconveniences to support local businesses.

The rules from Visa/MC permit surcharging up to the average merchant discount rate across all transactions, which includes the network & acquirer percentage fees and per transaction fees. For example, with this acquirer, a Mastercard World Restaurant purchase with the network + acquirer fees combined would be 2% + 19 cents. If the restaurant averaged at $25 transactions, that would be 2.76% effective. However, if they averaged at $10 transactions, that would instead be 3.9%. In which case, a 3.5% surcharge would be technically allowable.

That's just another way of applying the cash discount rules, and it's the way many gas stations in the US Northeast work; e.g. regular unleaded cash $3.19, regular unleaded credit $3.26. That's considered legal as a cash discount because the credit price is disclosed plainly and the cash price is lower.

A lot of local coffee places near me have had minimums for a while if they weren't on Square. Now with the rule changes I'm not surprised coffee shops are considering minimums or surcharging (between the two I think most people would rather pay 10 cents more for a coffee and a pastry then have to buy more in order to use a card).

Surcharging debit whether signature or PIN straight up isn't allowed, merchant is asking to get in trouble if someone reports it.

Hard to say. The rules of the networks require merchants to tell their acquirers (and in turn, acquirers tell the networks) of intent to surcharge in advance. The guidance that Visa and Mastercard provide is generally that if brand surcharging that it's based off the average merchant discount rate on the brand, including both percentages and flat per transaction fees charged both the network and acquirer. On a smaller transaction depending on the acquirer and network, as you said it may easily exceed 4% if the average transaction amount is low enough.

Muddying the waters further is the provision that the surcharge rule not disfavor any brand - if the average merchant discount rate on one accepted brand is lower than the other brands a merchant accepts, they can only apply the lowest surcharge rate allowed under the rules of all brands, and they must apply that to all brands.

Given that Visa's interchange for restaurants only goes up to 2.4% at most (2.2% for MC), that claim is either wildly exaggerated or they have a particularly bad processing agreement. I'm not even sure AmEx's worst rates are over 3.5%, either, but the owner could just stop accepting it if that's the issue.

(Really, merchants could just stop accepting Visa and MC too, but that might be more problematic. At least with AmEx, most people also have at least one Visa or MC, even if it's just a debit card.)

(Really, merchants could just stop accepting Visa and MC too, but that might be more problematic. At least with AmEx, most people also have at least one Visa or MC, even if it's just a debit card.)

The vending machines at my workplace recently changed how they display prices, possibly to satisfy card network rules. Instead of listing only cash prices and having a placard saying such (and mentioning a 10c fee for card), it now lists out cash and credit prices for each item. As far as I can tell, the card price is still 10c more than the cash price (though IMO it's still above the 4% maximum).

FWIW, it looks like Square's upcoming change to their fee structure is causing at least one business to adopt minimums when they haven't had any before: https://wtkr.com/2019/10/28/local-bu...ansaction-fee/

The question is, does it really consistently cost them 3.99% to run cards, or are they just using that number because 4% is the current maximum in the card network rules (and there's no way for customers to prove that said merchant isn't charging more than they're supposed to)?

Note: for small enough purchases, merchants could very well pay more than ~3% simply due to the fixed fee component. I'm not sure how common that is, however.

Note: for small enough purchases, merchants could very well pay more than ~3% simply due to the fixed fee component. I'm not sure how common that is, however.

Muddying the waters further is the provision that the surcharge rule not disfavor any brand - if the average merchant discount rate on one accepted brand is lower than the other brands a merchant accepts, they can only apply the lowest surcharge rate allowed under the rules of all brands, and they must apply that to all brands.

#56

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

Surcharging is going to increase and there's not much that can be done about it. The largest brands won't do it out of fears of outcry, generally having better card processing agreements with the networks anyways, etc. but smaller merchants will likely approach it as a way to reduce their cost of card processing. The smaller merchants still resist friction/people refusing to patronize them, but a lot of people put up with inconveniences to support local businesses.

As for whether surcharging will continue to increase, I'm not so sure. For instance, Walmart and Kroger have had issues with Visa and MC for years (with the latter temporarily ending Visa acceptance), so you'd think at least one of them would have started surcharging by now--even if it was by a token amount. They're also retailers that see much more debit card transactions than credit cards, so any surcharges they'd have imposed wouldn't have impacted most customers anyway.

That all said, what might make surcharging a standard practice is if a few major retailers did it and ended up with little blowback and/or significant public concessions on the part of the networks. If there are really that many businesses unhappy with the card networks, seeing positive (or at least no negative) effects from a large company doing it could tip them over the edge.

A lot of local coffee places near me have had minimums for a while if they weren't on Square. Now with the rule changes I'm not surprised coffee shops are considering minimums or surcharging (between the two I think most people would rather pay 10 cents more for a coffee and a pastry then have to buy more in order to use a card).

Really, one of the requirements to surcharge should have been a mandatory prompt on the terminal allowing customers to confirm they're okay with it. (Of course, I can see cashiers subsequently being trained to just push Yes for customers--potentially without verbal confirmation--given how many terminals are not easily accessible to the latter in the US.)

#57

Join Date: Apr 2008

Location: MSP

Programs: Delta SkyMiles GM/United Mileage Plus/Hilton Honors

Posts: 166

If I go to a restaurant and get hit with some surcharge BS, the difference will come right of the tip and I will let the server know. If they are going to force me to pay a cost of doing business, they can pay their employees a proper wage. Maybe if the waitstaff gets enough complaints they can pressure the management? I know it is a dick move but so are surcharges.

#58

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

Interestingly, a group of medium to large merchants responsible for 25% of interchange volume have opted out of the proposed interchange settlement: https://www.digitaltransactions.net/...ge-court-case/

We'll see if that causes the settlement to go away again.

We'll see if that causes the settlement to go away again.

#59

Join Date: May 2013

Location: New York

Programs: UA Silver, Marriott LTPP, Hertz Five Star

Posts: 1,079

Well, customers could start pushing Congress to impose EU style interchange caps, but good luck with that actually being passed any time soon. Not to mention that such caps might not affect the processor's markup all that much, which could very well mean that many that are surcharging now will continue to do so.

As for whether surcharging will continue to increase, I'm not so sure. For instance, Walmart and Kroger have had issues with Visa and MC for years (with the latter temporarily ending Visa acceptance), so you'd think at least one of them would have started surcharging by now--even if it was by a token amount. They're also retailers that see much more debit card transactions than credit cards, so any surcharges they'd have imposed wouldn't have impacted most customers anyway.

That all said, what might make surcharging a standard practice is if a few major retailers did it and ended up with little blowback and/or significant public concessions on the part of the networks. If there are really that many businesses unhappy with the card networks, seeing positive (or at least no negative) effects from a large company doing it could tip them over the edge.

Why not just roll it into your prices at that point? It's one thing if a coffee shop needs 50c+ increases across the board to cover CC processing, but an extra 5c or so on the most commonly purchased items might be enough to cover the increase. Of course, this all depends on the specific shop.

#60

Join Date: Jul 2012

Location: RDU

Programs: DL(PM), UA(Silver), AA(EXP) Marriott(Ti), HH(Gold), Hertz(PC)

Posts: 2,669

If I go to a restaurant and get hit with some surcharge BS, the difference will come right of the tip and I will let the server know. If they are going to force me to pay a cost of doing business, they can pay their employees a proper wage. Maybe if the waitstaff gets enough complaints they can pressure the management? I know it is a dick move but so are surcharges.