European Airlines May Need Additional Government Support

the space above the earth that you can see when you look up, where clouds and the sun, moon and stars appear,view from airplane window with blue sky and white clouds (Photo: iStock)

As the European Council continues to recommend governments slowly re-open borders in fear of COVID-19, air carriers from the respective states are experiencing losses like never before. One analyst says carriers from European states may look for more support this fall, after the busy summer travel season was grounded by COVID-19.

Because the traditionally-busy summer travel season never happened in Europe, air carriers from the region may be looking for additional state support. The analysis comes from the latest CAPA Centre for Aviation report, suggesting that air carriers are struggling more than anticipated because of the lack of passengers from COVID-19.

European Airlines Propped Up by State Aid or Cash Reserves

With governments closing borders and travelers encouraged to stay at home, European airlines are reporting their worst years in memorable history. Among the eight major European airline companies, including Lufthansa Group and IAG, available seat-kilometers have catastrophically dropped by 94.5 percent year over year, causing revenue to drop by nearly 90 percent.

As a result, airlines have been forced to get creative in their funding, or outright ask for state help. Lufthansa Group had a very public battle over their bailout package from the German government, while IAG sold paintings from British Airways’ art collection and retired their entire fleet of Boeing 747 aircraft.

Other airlines are holding out because of a combination of cash reserves and lines of credit. In particular, CAPA Centre for Aviation notes low-cost carriers EasyJet, Ryanair and Wizzair are able to survive because of their reserves.

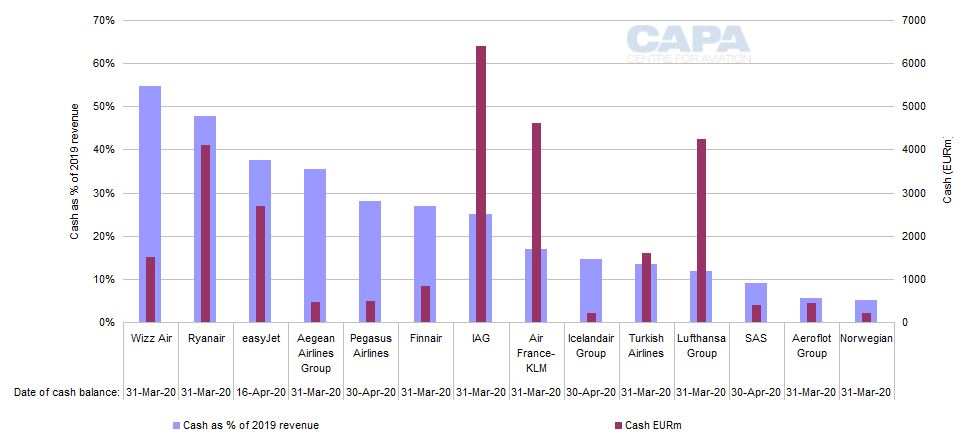

A graph shows how much cash on hand European airlines have on hand in the first quarter of 2020, compared to the percentage of their 2019 revenue. Source: Source: CAPA – Centre for Aviation, airline press releases and results announcements.

However, the reserves won’t last forever. And although borders are slowly starting to open, the analysts warn that the airlines may need more liquidity to survive beyond 2020.

“Liquidity fell over the quarter and cash burn may grow as capacity returns,” the group warns in their latest report. “Expect more European airlines to seek fresh equity capital.”

Where could the liquidity come from? In a previous report, CAPA Centre for Aviation noted that the two primary sources were credit facilities and state aid packages. If the COVID-19 pandemic continues, airlines could be turning to banks or their elected officials looking for more money.

Airlines and Airport Work Together to Find COVID-19 Solutions

Although the liquidity problem isn’t going away, airlines and airports are working together to try and figure out how to open aviation to travelers safely. In July 2020, a group of four airlines asked both the United States and European Commission to work out a plan to re-open skies between the two, while ACI World is asking governments to look at alternatives to COVID-19 testing instead of quarantine.