Charged twice for same flight? Is this common?

#16

Join Date: Jan 2008

Location: EAU

Programs: UA 1K, CO Plat, NW Plat, Marriott Premiere Plat, SPG Plat, Priority Gold, Hilton Gold

Posts: 4,712

I've had debit cards stolen and all it took was a phone call to my bank to get the money back. Obviously YMMV depending on your bank and card, but debit cards aren't NECESSARILY as bad as they used to be.

(I still wouldn't use one if you have access to a credit card.)

As others said, any authorization uses up credit on your card until it clears. With a credit card, that's not usually a big deal as you're just reducing the amount of credit you have available on the card. With a debit card, because your 'credit' is the amount of money in your account, an authorization ties up your cash until it clears.

#18

Join Date: Jul 2007

Location: San Francisco/Sydney

Programs: UA 1K/MM, Hilton Diamond, Marriott Something, IHG Gold, Hertz PC, Avis PC

Posts: 8,156

However what debit cards generally don't have are the protections beyond that point. 'Often1' specifically mentioned an airline going insolvent, not a card being stolen - and I'm sure that was deliberate as for something like that the protections are completely different. With a credit card, you're covered (based on the merchant not providing the services), and your credit card company will provide a full refund. With a debit card, you're generally not covered.

#19

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,450

Sorry, I wasn't clear. I was not referring to fraudulent debit card charges, I was referring to the underlying account being compromised. The protection against that is much more limited (though it's not as bad as I remembered . . . there is some protection).

#20

Suspended

Join Date: Aug 2017

Programs: Rapid Rewards, AAdvantage, SkyMiles

Posts: 2,931

#21

Join Date: Feb 2005

Location: CLE, DCA, and 30k feet

Programs: Honors LT Diamond; United 1K; Hertz PC

Posts: 4,162

To reply to the original question I see this frequently when I buy UA tickets on my Bank of America Visa (credit) card, and it seems to be especially common when there are two travelers on the PNR.

What happens is the original auth is taken for the full purchase amount but the auth isn't converted into a charge and posted. Instead the ticket is posted as a charge when issued (or for multiple pax like, a separate charge for each ticket is posted) and the auth (showing as a pending charge) is allowed to natrually expire (generally 72-96 hours out, though I have seen them linger longer)

What happens is the original auth is taken for the full purchase amount but the auth isn't converted into a charge and posted. Instead the ticket is posted as a charge when issued (or for multiple pax like, a separate charge for each ticket is posted) and the auth (showing as a pending charge) is allowed to natrually expire (generally 72-96 hours out, though I have seen them linger longer)

#22

Join Date: Dec 2002

Location: SFO

Posts: 3,941

I bought a flight on the 15th and that payment was posted. However thereís a duplicate charge thatís showing as processing. I contacted United via twitter and they say it should drop off in two days.

Meantime Iím showing $700 as being processed and canít use the money (Iím using my debit card). I did use Apple Pay and this is the first time itís happened to me. As a result Iím not planning on using Apple Pay on the United app ever again.

Is this a is a common occurrence. I normally use a credit card and book on the website. Either way itís an inconvenience

Meantime Iím showing $700 as being processed and canít use the money (Iím using my debit card). I did use Apple Pay and this is the first time itís happened to me. As a result Iím not planning on using Apple Pay on the United app ever again.

Is this a is a common occurrence. I normally use a credit card and book on the website. Either way itís an inconvenience

#23

Join Date: Nov 2017

Posts: 3,359

That may be true as far as federal law goes, but both Mastercard and Visa offer protection against unauthorized charges on debit cards.

I've had debit cards stolen and all it took was a phone call to my bank to get the money back. Obviously YMMV depending on your bank and card, but debit cards aren't NECESSARILY as bad as they used to be.

I've had debit cards stolen and all it took was a phone call to my bank to get the money back. Obviously YMMV depending on your bank and card, but debit cards aren't NECESSARILY as bad as they used to be.

In the past year I've had the extremely unfortunate experience of having 3 credit cards compromised. I've done everything I could to keep my cards protected including using Apple Pay but in this era of card skimmers appearing everywhere and stolen card data being sold on the black market for pennies on the dollar it's becoming increasingly difficult. In one of the cases, I didn't realize it was happening right away and just received a package from AmEx one day with a new card and a note saying the card was compromised. In the other two instances, my card's fraud notification warned me of a potential issue and I called the banks up to get everything sorted. All in all I probably spent about an hour or so on these 3 separate issues whereas if it were debit it would've been a huge headache.

-James

#25

Original Poster

Join Date: Dec 2018

Location: Houston, Texas

Posts: 7

Well, United is saying its not on them and Bank of America is saying the same thing. Therefore, I am currently out of $670 which sucks. Its like trying to pull teeth.

The United customer rep is blaming Apple Pay and wants me to call Apple haha.

I do have a credit card, I just have a debit card linked to my Apple Pay since I mostly use it for Uber and Lyft.

The United customer rep is blaming Apple Pay and wants me to call Apple haha.

I do have a credit card, I just have a debit card linked to my Apple Pay since I mostly use it for Uber and Lyft.

#27

Join Date: Jan 2020

Posts: 1

How did you fix this issue? I made the same mistake using apple pay on the united app

I bought a flight on the 15th and that payment was posted. However thereís a duplicate charge thatís showing as processing. I contacted United via twitter and they say it should drop off in two days.

Meantime Iím showing $700 as being processed and canít use the money (Iím using my debit card). I did use Apple Pay and this is the first time itís happened to me. As a result Iím not planning on using Apple Pay on the United app ever again.

Is this a is a common occurrence. I normally use a credit card and book on the website. Either way itís an inconvenience

Meantime Iím showing $700 as being processed and canít use the money (Iím using my debit card). I did use Apple Pay and this is the first time itís happened to me. As a result Iím not planning on using Apple Pay on the United app ever again.

Is this a is a common occurrence. I normally use a credit card and book on the website. Either way itís an inconvenience

#28

Join Date: Jun 2012

Posts: 3,380

How to fix? Wait 1-10 business days for one of the pending transaction to drop

There's almost no use calling the bank or United. Bank won't remove it manually (otherwise the business may lose a legitimate transaction/$), United probably can't do anything (all automated system, doubt you'll get someone to manually push the drop for you)

Long term fix? Get/use a credit card (I know not everyone qualified or wants a credit card). With a credit card, your available credit limit gets temporarily eaten up but won't show up in your balance or requirement payment, none of your money is temporarily taken

There's almost no use calling the bank or United. Bank won't remove it manually (otherwise the business may lose a legitimate transaction/$), United probably can't do anything (all automated system, doubt you'll get someone to manually push the drop for you)

Long term fix? Get/use a credit card (I know not everyone qualified or wants a credit card). With a credit card, your available credit limit gets temporarily eaten up but won't show up in your balance or requirement payment, none of your money is temporarily taken

#29

Join Date: Feb 2015

Programs: united

Posts: 1,636

I bought a flight on the 15th and that payment was posted. However thereís a duplicate charge thatís showing as processing. I contacted United via twitter and they say it should drop off in two days.

Meantime Iím showing $700 as being processed and canít use the money (Iím using my debit card). I did use Apple Pay and this is the first time itís happened to me. As a result Iím not planning on using Apple Pay on the United app ever again.

Is this a is a common occurrence. I normally use a credit card and book on the website. Either way itís an inconvenience

Meantime Iím showing $700 as being processed and canít use the money (Iím using my debit card). I did use Apple Pay and this is the first time itís happened to me. As a result Iím not planning on using Apple Pay on the United app ever again.

Is this a is a common occurrence. I normally use a credit card and book on the website. Either way itís an inconvenience

#30

Join Date: Apr 2010

Location: PNS

Programs: DL FO, UA, AA

Posts: 700

Not sure if I am posting this in the correct thread but lets go and if it needs to be moved, please do so Mods.

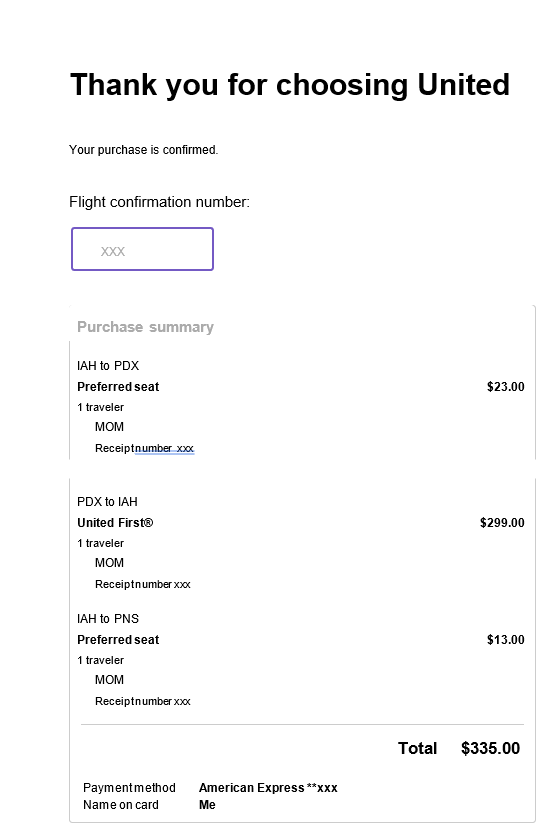

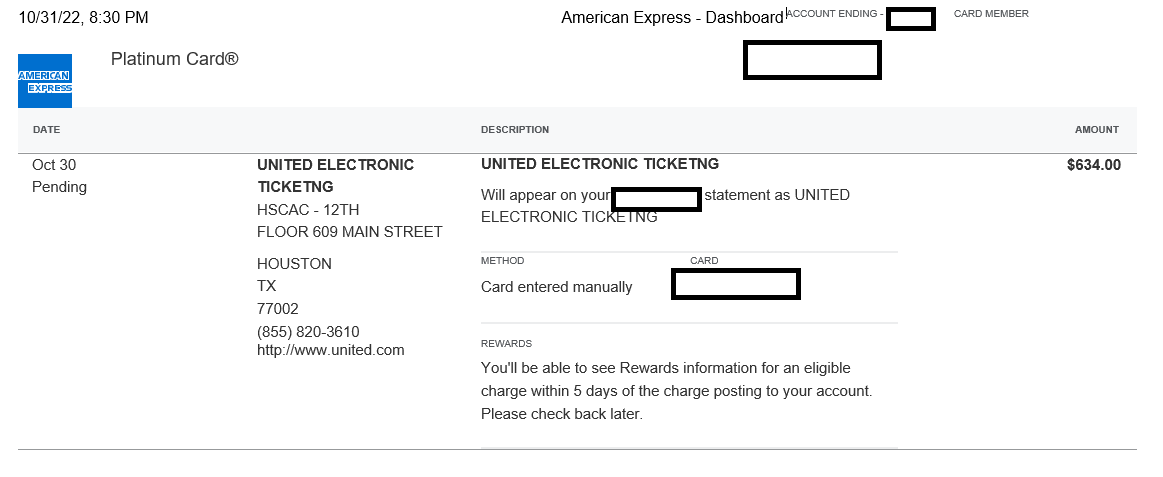

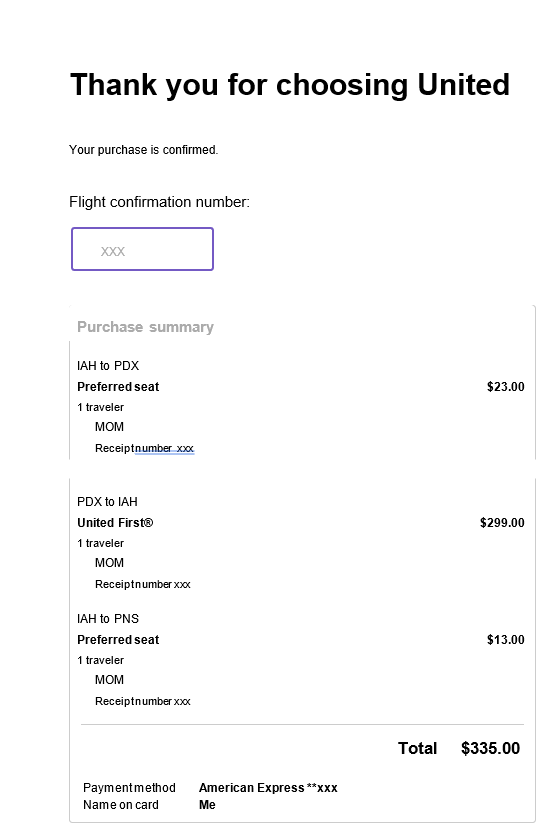

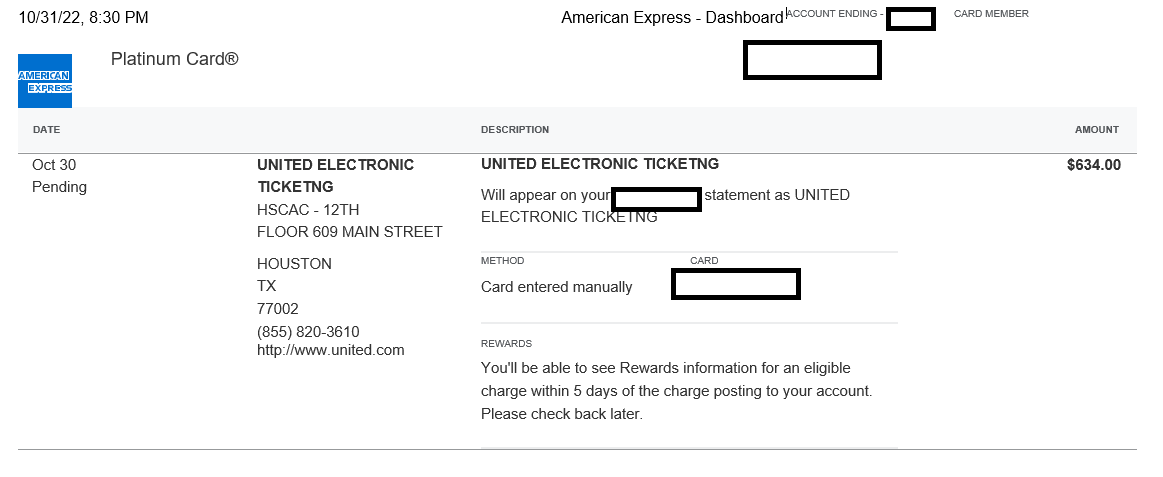

So. My sister bought a ticket for my mom for travel next week. PNS-IAH-PDX round trip. I decided to purchase some upgraded seats for her. Total came out to $335.00 You can see the emails below. What ended up happening is that i was charged $634.00 on my Amex. I was double charged for her F upgrade from PDX-IAH. I spent over 2 hours on the phone to try to figure out what was going on. I was finally able to speak to a "supervisor" after many requests as the agent(s) could not figure out what was going on. I was told by the supervisor that this was a mistake and it would be "taken care of". I did not, and do not believe this. What can I do about this. Screenshots below(in order) and any advice would be appreciated.

First Email From United (Above).

Second Email From United (Above).

What United Charged to My Amex (Above).

So. My sister bought a ticket for my mom for travel next week. PNS-IAH-PDX round trip. I decided to purchase some upgraded seats for her. Total came out to $335.00 You can see the emails below. What ended up happening is that i was charged $634.00 on my Amex. I was double charged for her F upgrade from PDX-IAH. I spent over 2 hours on the phone to try to figure out what was going on. I was finally able to speak to a "supervisor" after many requests as the agent(s) could not figure out what was going on. I was told by the supervisor that this was a mistake and it would be "taken care of". I did not, and do not believe this. What can I do about this. Screenshots below(in order) and any advice would be appreciated.

First Email From United (Above).

Second Email From United (Above).

What United Charged to My Amex (Above).