FlightGlobal: United seeks return to New York JFK

#136

Join Date: Oct 2017

Programs: SPG, Marriott, UA, AA, CX, SQ

Posts: 165

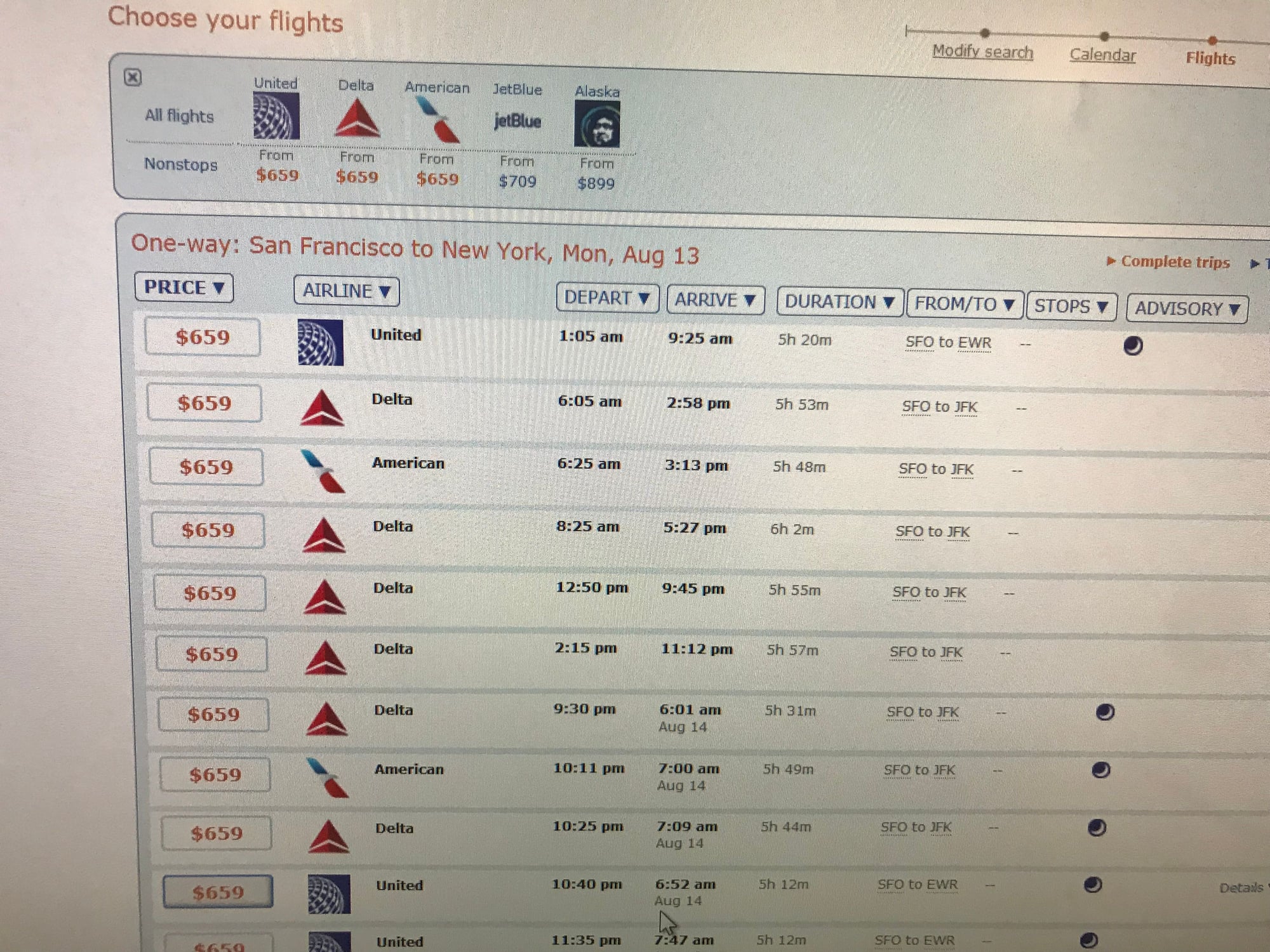

Iíve tried a random Monday do August, hopefully far enough from Labor Day weekend, to have the pricing being reflective of ongoing travel demand.

no matter how you slice and dice it, at best it is inconclusive regarding the premium each can command over their ďnatural market shareĒ. A random check of M/Th/F in the month tell essentially the same story.

so to make declarations that airline X is bottom barrel and airline Y has sooo much more pricing leverage , and claim itís anecdotal, one would essentially need to start with that conclusion and work the data backwards to find a very specific time slot to fit the story line.

Monday 8/13 eastbound, nonstop only, cheapest first

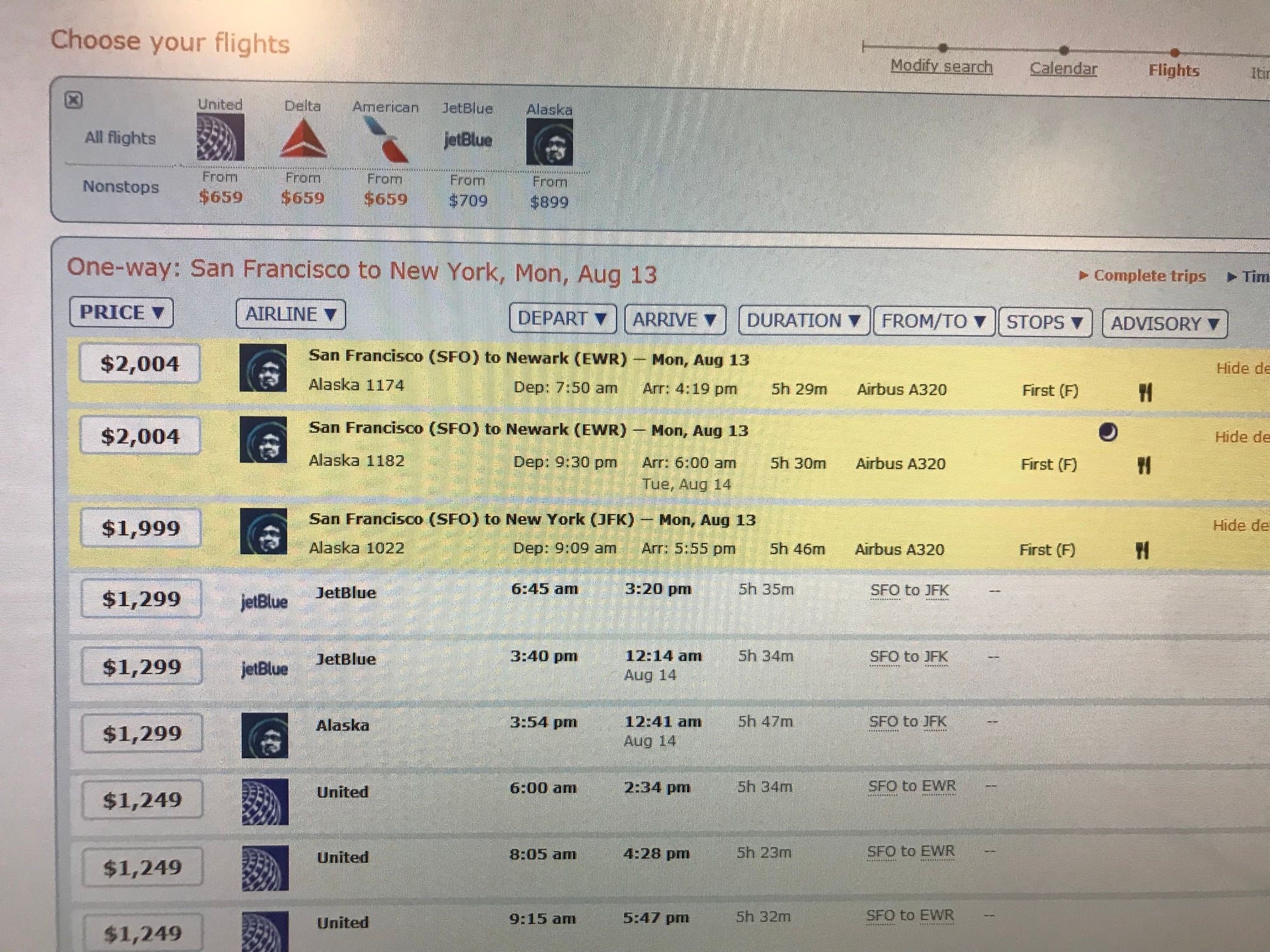

Same search, most expensive first

same search, but limited to the morning departures that are more popular with business travelers

#137

Join Date: Feb 2002

Location: NYC: UA 1K, DL Platinum, AAirpass, Avis PC

Posts: 4,599

I’ve tried a random Monday do August, hopefully far enough from Labor Day weekend, to have the pricing being reflective of ongoing travel demand.

no matter how you slice and dice it, at best it is inconclusive regarding the premium each can command over their “natural market share”. A random check of M/Th/F in the month tell essentially the same story.

so to make declarations that airline X is bottom barrel and airline Y has sooo much more pricing leverage , and claim it’s anecdotal, one would essentially need to start with that conclusion and work the data backwards to find a very specific time slot to fit the story line.

Monday 8/13 eastbound, nonstop only, cheapest first

Same search, most expensive first

same search, but limited to the morning departures that are more popular with business travelers

As for UA JFK...either acquiring a weakened JetBlue or a situation where they dissolve seems to be the most likely way back in. At the latest conference he said they don't have an organic way to get into JFK now but wouldn't comment about inorganic (code for - acquisition is in the cards).

Kirby's rationale for why he thought it was a negative to leave was pretty contained.

It was that some legacy studio contracts (Disney, Time Warner) were lost in the move. What I don't know if that was just because they left JFK or if it was because they dropped 3 cabin service (which happened before the JFK shift). My guess is it was the latter, and he's combining it into one decision - he specifically mentions first class in his statement.

"The real reason it was a mistake was it let American Airlines in particular go win a bunch of big corporate accounts,” he said. “People like Disney and Time Warner — two big examples — are corporate accounts that had been United exclusive corporate accounts and not only flew United on the transcon [routes] but flew United from L.A. to Heathrow and all across the country.”

“Those are the kind of corporate accounts [where] on-air talent has contracts that say they fly first class,” he said. “They pay first class fares — it’s completely irrelevant what the price is. … We opened the door and let American in on contracts like that.”

In a large complex business as you understand history can be interpreted varying ways when you start having to use second and third order effects to analyze the decision. Some might view revenue more valuable than profit when making decisions (any seasoned asset manager knows some companies / industries tend to trade more on revenue expectations than profit / margin in the near term, while others are the reverse. And for the same company it can change over time).

I remember a UA exec in 2012 telling me they expected to lose 'A lister' pax by eliminating 3 cabin on the transcons - it's not like they did it and said "oh gosh why did we lose those passengers."

At the end of the day Kirby feels it was an opportunity lost, also in Kirby's words AA worked hard to make 3 cabin unviable for UA (not just product wise - fare wise) as it chose to focus on LAX growth and JetBlue's yield dump made it harder to stomach. Meanwhile UA with an already established big west coast hub had less survival need to build up LAX than AA or DL who lacked any meaningful West Coast business center hub.

Out of curiosity what are you seeing at your firm for AA/UA transcon walkup fares in biz at the large corporate negotiated rate?

I remember it being around $999 one way pretty consistently back in the day. Wonder what it is with JetBlue on the scene. And wonder how the talent contracts for premium cabin trend as the studios get further pressure from declining cable TV subscribers. Netflix / Amazon money is in there for now, but on the margin talent in entertainment isn't getting paid what it did even a few years ago.

#138

Join Date: Oct 2017

Programs: SPG, Marriott, UA, AA, CX, SQ

Posts: 165

I searched one way NYC-LAX nonstop in J for tmw Weds 6/20, both ITA Matrix and intranet concur portal. Alaska quotes include JFK and EWR.

outside itís AS $1299, AA DL UA 1609, B6 1699. If Iím reading the frequencies correctly, itís

AA/UA 12x

AS 10x (6 JFK 4 EWR)

DL/B6 9x

intranet (my firm has contracts with AA UA WN B6 but not AS DL)

AA ~$ 715

UA ~$ 770

B6 ~$ 1560

(Iím sharing concur quotes as-is, and wonít draw conclusions based on those)

outside itís AS $1299, AA DL UA 1609, B6 1699. If Iím reading the frequencies correctly, itís

AA/UA 12x

AS 10x (6 JFK 4 EWR)

DL/B6 9x

intranet (my firm has contracts with AA UA WN B6 but not AS DL)

AA ~$ 715

UA ~$ 770

B6 ~$ 1560

(Iím sharing concur quotes as-is, and wonít draw conclusions based on those)

#139

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,453

no matter how you slice and dice it, at best it is inconclusive regarding the premium each can command over their ďnatural market shareĒ. A random check of M/Th/F in the month tell essentially the same story.

so to make declarations that airline X is bottom barrel and airline Y has sooo much more pricing leverage , and claim itís anecdotal, one would essentially need to start with that conclusion and work the data backwards to find a very specific time slot to fit the story line.

so to make declarations that airline X is bottom barrel and airline Y has sooo much more pricing leverage , and claim itís anecdotal, one would essentially need to start with that conclusion and work the data backwards to find a very specific time slot to fit the story line.

So while I find DL's product superior, the difference to me personally is not worth $1000. It's probably worth about $200-300 (but that's not being tested, because there's no DL option within that range).

#140

Join Date: Feb 2002

Location: NYC: UA 1K, DL Platinum, AAirpass, Avis PC

Posts: 4,599

I searched one way NYC-LAX nonstop in J for tmw Weds 6/20, both ITA Matrix and intranet concur portal. Alaska quotes include JFK and EWR.

outside itís AS $1299, AA DL UA 1609, B6 1699. If Iím reading the frequencies correctly, itís

AA/UA 12x

AS 10x (6 JFK 4 EWR)

DL/B6 9x

intranet (my firm has contracts with AA UA WN B6 but not AS DL)

AA ~$ 715

UA ~$ 770

B6 ~$ 1560

(Iím sharing concur quotes as-is, and wonít draw conclusions based on those)

outside itís AS $1299, AA DL UA 1609, B6 1699. If Iím reading the frequencies correctly, itís

AA/UA 12x

AS 10x (6 JFK 4 EWR)

DL/B6 9x

intranet (my firm has contracts with AA UA WN B6 but not AS DL)

AA ~$ 715

UA ~$ 770

B6 ~$ 1560

(Iím sharing concur quotes as-is, and wonít draw conclusions based on those)

#141

Join Date: Dec 2016

Posts: 1,485

As for UA JFK...either acquiring a weakened JetBlue or a situation where they dissolve seems to be the most likely way back in. At the latest conference he said they don't have an organic way to get into JFK now but wouldn't comment about inorganic (code for - acquisition is in the cards).

Interesting AA undercutting here instead of falling in line on last minute avail corporate rates. Part of the make it painful for B6 narrative.

Interesting AA undercutting here instead of falling in line on last minute avail corporate rates. Part of the make it painful for B6 narrative.

Also, just comparing the numbers of JFK/EWR-LAX. AA still has a commanding lead on average fare in this market in spite of what appears to be low J prices. I think their average fares are well over $600. It's in large part to the sparse layout of A321T, but still quite profitable route for them. DL and UA are in the 350 to 400 range, which makes sense since they have hubs on both end and also use wide bodies which have more premium layout. B6 is about $20 to 50 lower than DL/UA depending on the Quarter. Which is fine, since only 10% of cabin is mint and it's a much lower cost product than legacies. AS is the bottom feeder.

On JFK/EWR-SFO, it's a little different. UA obviously dominates and I think they get a lot of connection traffic. Has a huge advantage over DL. AA is still doing well enough (close to $600), but not as well as LAX. DL is up gauging to more wide bodies, so they are seeing better fares numbers now. B6 is probably $20 lower in fare than DL. AS is the bottom feeder.

Imo, most of these numbers are based on network advantages.

#142

Join Date: Feb 2002

Location: NYC: UA 1K, DL Platinum, AAirpass, Avis PC

Posts: 4,599

I don't get the part about making it painful for B6. They are really profitable in JFK. Most likely more profitable than UA at EWR. And they are rolling in the money on mint right now. Especially on JFK-LAX. They've been able to ramp it up to 11 daily vs 4 daily when they first started. If they can sell J seat at a higher price than AA, then that seems to be a good thing.

Also, just comparing the numbers of JFK/EWR-LAX. AA still has a commanding lead on average fare in this market in spite of what appears to be low J prices. I think their average fares are well over $600. It's in large part to the sparse layout of A321T, but still quite profitable route for them. DL and UA are in the 350 to 400 range, which makes sense since they have hubs on both end and also use wide bodies which have more premium layout. B6 is about $20 to 50 lower than DL/UA depending on the Quarter. Which is fine, since only 10% of cabin is mint and it's a much lower cost product than legacies. AS is the bottom feeder.

On JFK/EWR-SFO, it's a little different. UA obviously dominates and I think they get a lot of connection traffic. Has a huge advantage over DL. AA is still doing well enough (close to $600), but not as well as LAX. DL is up gauging to more wide bodies, so they are seeing better fares numbers now. B6 is probably $20 lower in fare than DL. AS is the bottom feeder.

Imo, most of these numbers are based on network advantages.

Also, just comparing the numbers of JFK/EWR-LAX. AA still has a commanding lead on average fare in this market in spite of what appears to be low J prices. I think their average fares are well over $600. It's in large part to the sparse layout of A321T, but still quite profitable route for them. DL and UA are in the 350 to 400 range, which makes sense since they have hubs on both end and also use wide bodies which have more premium layout. B6 is about $20 to 50 lower than DL/UA depending on the Quarter. Which is fine, since only 10% of cabin is mint and it's a much lower cost product than legacies. AS is the bottom feeder.

On JFK/EWR-SFO, it's a little different. UA obviously dominates and I think they get a lot of connection traffic. Has a huge advantage over DL. AA is still doing well enough (close to $600), but not as well as LAX. DL is up gauging to more wide bodies, so they are seeing better fares numbers now. B6 is probably $20 lower in fare than DL. AS is the bottom feeder.

Imo, most of these numbers are based on network advantages.

Virgin America was given enough pain to get bought out by Alaska, even while their transcons were very profitable. They just weren't profitable enough, especially after B6 moved in, and that limited expansion potential elsewhere. DL/AA/UA were thrilled by that, and B6 is the next short stack at the mainland airline poker table.

Alaska is midsize but has much larger share at SEA than B6 at JFK or BOS, and has one of the biggest barrier to entry profit centers in the business - its Alaska operations.

DL is pressing hard by dumping Delta ONE capacity flight for flight on other Mint markets out of JFK, and both UA and DL are pressing on Boston.

As passengers keeping JetBlue around is a good thing, but the history of the industry is for the mid sized airlines to get absorbed. Not saying it will happen imminently, but the rational action for the network carriers is to try and push JetBlue out of the market by dumping capacity against their most profitable opportunities.

#143

Join Date: Oct 2017

Programs: SPG, Marriott, UA, AA, CX, SQ

Posts: 165

The only reason I'm flying UA is because they're $1000 cheaper than DL.

So while I find DL's product superior, the difference to me personally is not worth $1000. It's probably worth about $200-300 (but that's not being tested, because there's no DL option within that range).

So while I find DL's product superior, the difference to me personally is not worth $1000. It's probably worth about $200-300 (but that's not being tested, because there's no DL option within that range).

if the difference is largely or fully explained by JFK vs EWR and better carrier reputation, then one should be seeing AA (and partially B6) commanding a similar pricing premium over UA. If one simply reads average fare data without the proper context, then the fare divergence of AA/UA vs AA/DL isnít properly explained. Thereís no point to discuss data with those who just wants to trash UA, but canít explain the AA-DL gap in the exact same set of numbers.

Secondly are you simply buying public rack rates or the savings are part of the negotiated corporate rates?

in my concur result above, JetBlue is faring far higher than AA, and much closer to the public rates. and thatís most likely the idiosyncratic nature of the custom negotiated rates that have little relation to AAís pricing power. DL is essentially the public rate. No one credible will be claiming B6 has a pricing PREMIUM of more than 50% over AA.

#144

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,453

I think you're reading more into my OP than was intended. I wasn't making any broad comments about pricing, I was noting that I'm only flying UA because it's $1000 cheaper than a DL itinerary that would fit my schedule. Outbound redeye August 17, return evening of August 19. UA I have farelocked for $1317, DL equivalent is $2330.

And if you want to call criticizing UA's t-con product "UA bashing," fine, but I believe the t-con product deserves criticism. The lounge experience is poor at both ends, the aircraft are tired, worn, and often dirty, and the service quite inconsistent.

#145

Join Date: Feb 2015

Programs: united

Posts: 1,636

Yes painful is a relative thing - 'pain' can still be profitable, but when it's less so, there's less to fund the less profitable areas and expansion.

Virgin America was given enough pain to get bought out by Alaska, even while their transcons were very profitable. They just weren't profitable enough, especially after B6 moved in, and that limited expansion potential elsewhere. DL/AA/UA were thrilled by that, and B6 is the next short stack at the mainland airline poker table.

Alaska is midsize but has much larger share at SEA than B6 at JFK or BOS, and has one of the biggest barrier to entry profit centers in the business - its Alaska operations.

DL is pressing hard by dumping Delta ONE capacity flight for flight on other Mint markets out of JFK, and both UA and DL are pressing on Boston.

As passengers keeping JetBlue around is a good thing, but the history of the industry is for the mid sized airlines to get absorbed. Not saying it will happen imminently, but the rational action for the network carriers is to try and push JetBlue out of the market by dumping capacity against their most profitable opportunities.

Virgin America was given enough pain to get bought out by Alaska, even while their transcons were very profitable. They just weren't profitable enough, especially after B6 moved in, and that limited expansion potential elsewhere. DL/AA/UA were thrilled by that, and B6 is the next short stack at the mainland airline poker table.

Alaska is midsize but has much larger share at SEA than B6 at JFK or BOS, and has one of the biggest barrier to entry profit centers in the business - its Alaska operations.

DL is pressing hard by dumping Delta ONE capacity flight for flight on other Mint markets out of JFK, and both UA and DL are pressing on Boston.

As passengers keeping JetBlue around is a good thing, but the history of the industry is for the mid sized airlines to get absorbed. Not saying it will happen imminently, but the rational action for the network carriers is to try and push JetBlue out of the market by dumping capacity against their most profitable opportunities.

Most of the previous situations involved carriers who competed on price for economy class passengers. JetBlue Mint competes on service. People will pay more for it because it is seen as superior.

#146

FlyerTalk Evangelist

Join Date: Oct 2001

Location: Austin, TX

Posts: 21,402

Furthermore, from what I've seen, B6 has been introducing Mint with fares far below what other carriers were charging. So, it seems that they are attempting to compete on price.

#147

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,453

The sub-$1500 front cabin fares we currently enjoy simply would not exist were it not for B6.

#148

Join Date: Jan 2005

Location: New York, NY

Programs: UA, AA, DL, Hertz, Avis, National, Hyatt, Hilton, SPG, Marriott

Posts: 9,451

I don't get the part about making it painful for B6. They are really profitable in JFK. Most likely more profitable than UA at EWR. And they are rolling in the money on mint right now. Especially on JFK-LAX. They've been able to ramp it up to 11 daily vs 4 daily when they first started. If they can sell J seat at a higher price than AA, then that seems to be a good thing.

#149

Join Date: Dec 2016

Posts: 1,485

In Q1, B6 pre-tax margin is 6.3, UA is 2.0 and DL is 7.2%. And B6 actually had higher margin that DL in Q2/Q3 last year. So it's very profitable in competitive environment.

Yes painful is a relative thing - 'pain' can still be profitable, but when it's less so, there's less to fund the less profitable areas and expansion.

Virgin America was given enough pain to get bought out by Alaska, even while their transcons were very profitable. They just weren't profitable enough, especially after B6 moved in, and that limited expansion potential elsewhere. DL/AA/UA were thrilled by that, and B6 is the next short stack at the mainland airline poker table.

Alaska is midsize but has much larger share at SEA than B6 at JFK or BOS, and has one of the biggest barrier to entry profit centers in the business - its Alaska operations.

DL is pressing hard by dumping Delta ONE capacity flight for flight on other Mint markets out of JFK, and both UA and DL are pressing on Boston.

As passengers keeping JetBlue around is a good thing, but the history of the industry is for the mid sized airlines to get absorbed. Not saying it will happen imminently, but the rational action for the network carriers is to try and push JetBlue out of the market by dumping capacity against their most profitable opportunities.

Virgin America was given enough pain to get bought out by Alaska, even while their transcons were very profitable. They just weren't profitable enough, especially after B6 moved in, and that limited expansion potential elsewhere. DL/AA/UA were thrilled by that, and B6 is the next short stack at the mainland airline poker table.

Alaska is midsize but has much larger share at SEA than B6 at JFK or BOS, and has one of the biggest barrier to entry profit centers in the business - its Alaska operations.

DL is pressing hard by dumping Delta ONE capacity flight for flight on other Mint markets out of JFK, and both UA and DL are pressing on Boston.

As passengers keeping JetBlue around is a good thing, but the history of the industry is for the mid sized airlines to get absorbed. Not saying it will happen imminently, but the rational action for the network carriers is to try and push JetBlue out of the market by dumping capacity against their most profitable opportunities.

On the matter of mint routes, it's been really profitable on all except BOS-SEA. If you don't want to take my word for it, I can provide you some numbers to think about later. But routes like JFK-SAN and FLL-LAX that were not previously thought of as premium markets are generating very high profit margins. And there are still new ones they can add like FLL-SEA and EWR/IAD-LAX/SFO provided that they can get enough gate access.

On the topic of UA/DL countering mint, it was very defensive moves because they were seeing high yielding customers move. In Q2 of 2017, B6 generated higher fare on BOS-SFO than UA for the first time. UA countered by dumping large amount of flat bed capacity on this route. But if you actually look at the route performances, B6 is still making plenty of money on it. DL on the other hand is getting crushed, VX is not making money anymore and UA is making very little money.

DL's announcement of D1 JFK-SEA/LAS/SAN were more for the optics. It only deployed one additional flat bed on JFK-LAS. The other D1 flights on JFK-SEA/SAN were already using flat bed. And again that was due to B6 generating higher fare on JFK-SAN than DL in Q4 of 2017. And at BOS, DL is bleeding money on a lot of routes right now without making things difficult for B6.

#150

Join Date: Feb 2002

Location: NYC: UA 1K, DL Platinum, AAirpass, Avis PC

Posts: 4,599

https://skift.com/2017/04/21/united-...rong-decision/

“We have about 15 percent margins here in Newark,” he told employees. “We estimate Delta in New York has a 4 percent profit margin, even when times are good. And American is somewhere in between.

JetBlue as a whole ran a 14% operating margin in 2017 but that was down from 20% in 2016 and 2015, and up from around 8% before that. it's hard to say what's Mint and what's simply fuel, but they at least publicly say they are pleased with Mint margin. But even before Mint JetBlue ran a decent operating margin with a NY centric operation by being a niche lower cost carrier.

The more I think, I believe Kirby's other reason for believing it was a mistake was diverting JFK capacity away from JetBlue. But that's something that's he'd be reticent to say in a public forum because it offers up anticompetitive evidence if they or AA / DL ever decide to acquire Jetblue. Remember these 'want back into JFK' statements are coming around the same time as some of the rumors of someone (including UA) wanting to acquire JetBlue.

http://www.chicagobusiness.com/artic...cquire-jetblue