Last edit by: WineCountryUA

Previous thread -- Presidential Plus Card Changes

Related thread - General Questions re: MileagePlus Flex PQM

This legacy Chase credit card is not taking new applications. Compiled below is a comparison of current card-derived vs. status-derived benefits.

Overall, the current benefits of the PP and the replacement Club card are nearly identical. The key trade-off is increased redeemable mile (RDM) earnings with the Club card vs. FPQM with the PP card. Basically, the Club card earns an incremental 0.5 RDM / $1 vs. the PP card’s 0.2 PQM / $1. This sets a 2.5 RDM : $1 PQM ratio, which puts a price on PQMs earned this way at $0.025 to $0.050. Given that PQMs cost atleast $0.08 or more each if purchased early in the year via award accelerator, this is a pretty good deal for those who anticipate falling short of the upcoming year’s desired Silver / Gold / Platinum threshold.

Benefits unique to the PP card:

- 1000 FPQM per $5,000 spend (or 0.2 / $1)

- FPQMs are only valid for Premier Silver / Gold / Platinum status, expire 3 years after earning

- 1 RDM / $1 card spend (x2 hotel & rental cars for personal card, x2 restaurants, gas, office supplies for business card)

- Premier Qualifying Dollar (PQD) waiver (no minimum card spend, doesn’t apply to 1K)

Benefits unique to the Club card:

- 1.5 RDM / $1 card spend

- PQD waiver (with $25,000 minimum card spend, doesn’t apply to 1K)

Benefits shared between PP and Club cards:

- $395 annual fee

- United club membership (vs. $450 1K/GS, $500 Platinum, $550 Gold, $550 Silver, $550 GM, +$550 with spouse)

-Waiver of 4 segment on United flights for Premier qualification (removed in 2020)

- Premier Access (group 2 boarding)

- 2 free checked bags (vs. 1 Silver, 2 Gold, 3 Platinum)

- Hyatt Gold Passport Platinum

- Hertz Hertz President's Circle status (vs. Five Star for Premier Silver / Gold) (expiring 31 January 2023)

- CPU on award tickets

- No <21 day award booking fees (vs. $50 Silver, $25 Gold, $0 Platinum)

- No foreign transaction fees

- Concierge service

Benefits compared to Explorer card:

- only $95 annual fee

- only 1 free bag for cardholder and 1 companion

- 1 RDM / $1 card spend, +10,000 bonus after $25,000 card spend)

- 2 single-use club passes

- Premier Access (group 2 boarding)

- Premier Qualifying Dollar waiver (with $25,000 minimum card spend)

Sources (accessed Jan 1, 2015):

Chase United Card Benefits

https://www.chase.com/online/Credit-...ewards-new.htm

United Premier Status Benefits

http://www.united.com/web/en-US/cont...r/default.aspx

United Premier Status Qualification Requirements

Premier status qualification requirements

Prior FlyerTalk thread on Presidential Plus card changes

Presidential Plus Card Changes

Based on post by pstrasma

Related thread - General Questions re: MileagePlus Flex PQM

This legacy Chase credit card is not taking new applications. Compiled below is a comparison of current card-derived vs. status-derived benefits.

Overall, the current benefits of the PP and the replacement Club card are nearly identical. The key trade-off is increased redeemable mile (RDM) earnings with the Club card vs. FPQM with the PP card. Basically, the Club card earns an incremental 0.5 RDM / $1 vs. the PP card’s 0.2 PQM / $1. This sets a 2.5 RDM : $1 PQM ratio, which puts a price on PQMs earned this way at $0.025 to $0.050. Given that PQMs cost atleast $0.08 or more each if purchased early in the year via award accelerator, this is a pretty good deal for those who anticipate falling short of the upcoming year’s desired Silver / Gold / Platinum threshold.

Benefits unique to the PP card:

- 1000 FPQM per $5,000 spend (or 0.2 / $1)

- FPQMs are only valid for Premier Silver / Gold / Platinum status, expire 3 years after earning

- 1 RDM / $1 card spend (x2 hotel & rental cars for personal card, x2 restaurants, gas, office supplies for business card)

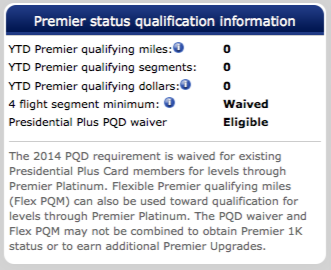

- Premier Qualifying Dollar (PQD) waiver (no minimum card spend, doesn’t apply to 1K)

Benefits unique to the Club card:

- 1.5 RDM / $1 card spend

- PQD waiver (with $25,000 minimum card spend, doesn’t apply to 1K)

Benefits shared between PP and Club cards:

- $395 annual fee

- United club membership (vs. $450 1K/GS, $500 Platinum, $550 Gold, $550 Silver, $550 GM, +$550 with spouse)

-

- Premier Access (group 2 boarding)

- 2 free checked bags (vs. 1 Silver, 2 Gold, 3 Platinum)

- Hyatt Gold Passport Platinum

- Hertz Hertz President's Circle status (vs. Five Star for Premier Silver / Gold) (expiring 31 January 2023)

- CPU on award tickets

- No <21 day award booking fees (vs. $50 Silver, $25 Gold, $0 Platinum)

- No foreign transaction fees

- Concierge service

Benefits compared to Explorer card:

- only $95 annual fee

- only 1 free bag for cardholder and 1 companion

- 1 RDM / $1 card spend, +10,000 bonus after $25,000 card spend)

- 2 single-use club passes

- Premier Access (group 2 boarding)

- Premier Qualifying Dollar waiver (with $25,000 minimum card spend)

Sources (accessed Jan 1, 2015):

Chase United Card Benefits

https://www.chase.com/online/Credit-...ewards-new.htm

United Premier Status Benefits

http://www.united.com/web/en-US/cont...r/default.aspx

United Premier Status Qualification Requirements

Premier status qualification requirements

Prior FlyerTalk thread on Presidential Plus card changes

Presidential Plus Card Changes

Based on post by pstrasma

PresidentialPlus credit card - Benefits, Q&A, .... (impact of 2019 & 2020 MP changes)

#48

Join Date: May 2006

Location: EWR

Programs: UA Silver, MRP Platinum, Marriott Vacation Club Chairman, SPG Platinum, Cunard Platinum,

Posts: 967

If you are referring to the PQD requirement. The Club cardholders get a waiver if the spend $25K with Chase MP cards in 2014. All the Chase MP cards have this option.

The PresPlus cardholders get the waiver without any spend requirement. (although given the nature of the card and likely customers, suspect many would meet the $25K spend value)

The PresPlus cardholders get the waiver without any spend requirement. (although given the nature of the card and likely customers, suspect many would meet the $25K spend value)

I rarely use this card since I've switched to the Chase Sapphire Card for almost everything. The only time I use the Presidential Plus Master card is to buy tickets on the UA website. I did use it a lot this holiday season when one website I frequented gave free shipping if using a Master Card.

I'm so happy I don't need to spend $25000 on my card because Flex Miles don't seem valuable enough to me.

If I decide to buy PQMs to downgrade to Platinum from 1K this year then the only money I will be out is the dollars spent on purchasing PQMs. Am I correct? Thanks a lot

Marylyn

#49

Join Date: Dec 2004

Location: JFK

Posts: 255

http://www.usairways.com/en-US/trave...b/default.html

I havent seen anything about this from chase, but the access to USair is only through march. How come amex is sending that out to everyone and chase is quiet?

I havent seen anything about this from chase, but the access to USair is only through march. How come amex is sending that out to everyone and chase is quiet?

#50

Join Date: Feb 2001

Location: Montebello, CA, USA

Posts: 2,365

Because US Airways leaving Star Alliance has nothing to do with Chase? Chase provides United Club membership, which in turn has reciprocal access to other Star Alliance lounges. Chase has no control over who enters or leaves Star Alliance.

#51

Join Date: Nov 2013

Location: CO

Programs: UA OG-1K, Marriott Plat, Hertz PC

Posts: 1,360

I've been putting most of my travel (air, hotel, meals- car is separate on corp card) on a Marriott card. I switched most of my travel to United so I made 1K for this year. I'm looking at getting a United card. I haven't heard much about the Presidential card. Looking thru all the benefits:

The travel protection looks ok, but with two small kids we don't travel/fly very often. My work travel I don't worry about- I'll just expense anything that comes up. I have travel medical insurance thru work and I drive rental cars like I rented them since I'm covered at work...

I have a United Club pass that expires at the end of Feb., and I was thinking about not re-upping. I thought this might be a good way to get the pass with the Pres or the Club.

If you go with the Club or the Pres you gain club access, do you not get the bonus miles that the Explorer card gives for signing up?

Are the Explorer, Club and Pres deals the same everywhere, or do they vary by time (special deals) or sign up place (web ad, United site, airport kiosk, mailed offer?)

Like I said, I'm 1K this year, I plan on making the miles and PQD this year. I should at least make Platinum, so I don't see the flex miles or access (outside of the club) real benefits. The award thing is interesting since I do have a trip I need to ticket soon for Hawaii in late 2014, but that is a one-off in the next 24 months.

What is the best card for a 1K to get?

The travel protection looks ok, but with two small kids we don't travel/fly very often. My work travel I don't worry about- I'll just expense anything that comes up. I have travel medical insurance thru work and I drive rental cars like I rented them since I'm covered at work...

I have a United Club pass that expires at the end of Feb., and I was thinking about not re-upping. I thought this might be a good way to get the pass with the Pres or the Club.

If you go with the Club or the Pres you gain club access, do you not get the bonus miles that the Explorer card gives for signing up?

Are the Explorer, Club and Pres deals the same everywhere, or do they vary by time (special deals) or sign up place (web ad, United site, airport kiosk, mailed offer?)

Like I said, I'm 1K this year, I plan on making the miles and PQD this year. I should at least make Platinum, so I don't see the flex miles or access (outside of the club) real benefits. The award thing is interesting since I do have a trip I need to ticket soon for Hawaii in late 2014, but that is a one-off in the next 24 months.

What is the best card for a 1K to get?

#52

Join Date: May 2009

Location: PHL

Posts: 2,842

I've been putting most of my travel (air, hotel, meals- car is separate on corp card) on a Marriott card. I switched most of my travel to United so I made 1K for this year. I'm looking at getting a United card. I haven't heard much about the Presidential card. Looking thru all the benefits:

The travel protection looks ok, but with two small kids we don't travel/fly very often. My work travel I don't worry about- I'll just expense anything that comes up. I have travel medical insurance thru work and I drive rental cars like I rented them since I'm covered at work...

I have a United Club pass that expires at the end of Feb., and I was thinking about not re-upping. I thought this might be a good way to get the pass with the Pres or the Club.

If you go with the Club or the Pres you gain club access, do you not get the bonus miles that the Explorer card gives for signing up?

Are the Explorer, Club and Pres deals the same everywhere, or do they vary by time (special deals) or sign up place (web ad, United site, airport kiosk, mailed offer?)

Like I said, I'm 1K this year, I plan on making the miles and PQD this year. I should at least make Platinum, so I don't see the flex miles or access (outside of the club) real benefits. The award thing is interesting since I do have a trip I need to ticket soon for Hawaii in late 2014, but that is a one-off in the next 24 months.

What is the best card for a 1K to get?

The travel protection looks ok, but with two small kids we don't travel/fly very often. My work travel I don't worry about- I'll just expense anything that comes up. I have travel medical insurance thru work and I drive rental cars like I rented them since I'm covered at work...

I have a United Club pass that expires at the end of Feb., and I was thinking about not re-upping. I thought this might be a good way to get the pass with the Pres or the Club.

If you go with the Club or the Pres you gain club access, do you not get the bonus miles that the Explorer card gives for signing up?

Are the Explorer, Club and Pres deals the same everywhere, or do they vary by time (special deals) or sign up place (web ad, United site, airport kiosk, mailed offer?)

Like I said, I'm 1K this year, I plan on making the miles and PQD this year. I should at least make Platinum, so I don't see the flex miles or access (outside of the club) real benefits. The award thing is interesting since I do have a trip I need to ticket soon for Hawaii in late 2014, but that is a one-off in the next 24 months.

What is the best card for a 1K to get?

#53

Join Date: Apr 2009

Location: Houston

Programs: UA GS 2.6MM & Lifetime UC, Qantas Platinum, Hilton Lifetime Diamond, Bonvoy Platinum, HawaiianMiles

Posts: 8,682

I've been putting most of my travel (air, hotel, meals- car is separate on corp card) on a Marriott card. I switched most of my travel to United so I made 1K for this year. I'm looking at getting a United card. I haven't heard much about the Presidential card. Looking thru all the benefits:

The travel protection looks ok, but with two small kids we don't travel/fly very often. My work travel I don't worry about- I'll just expense anything that comes up. I have travel medical insurance thru work and I drive rental cars like I rented them since I'm covered at work...

I have a United Club pass that expires at the end of Feb., and I was thinking about not re-upping. I thought this might be a good way to get the pass with the Pres or the Club.

If you go with the Club or the Pres you gain club access, do you not get the bonus miles that the Explorer card gives for signing up?

Are the Explorer, Club and Pres deals the same everywhere, or do they vary by time (special deals) or sign up place (web ad, United site, airport kiosk, mailed offer?)

Like I said, I'm 1K this year, I plan on making the miles and PQD this year. I should at least make Platinum, so I don't see the flex miles or access (outside of the club) real benefits. The award thing is interesting since I do have a trip I need to ticket soon for Hawaii in late 2014, but that is a one-off in the next 24 months.

What is the best card for a 1K to get?

The travel protection looks ok, but with two small kids we don't travel/fly very often. My work travel I don't worry about- I'll just expense anything that comes up. I have travel medical insurance thru work and I drive rental cars like I rented them since I'm covered at work...

I have a United Club pass that expires at the end of Feb., and I was thinking about not re-upping. I thought this might be a good way to get the pass with the Pres or the Club.

If you go with the Club or the Pres you gain club access, do you not get the bonus miles that the Explorer card gives for signing up?

Are the Explorer, Club and Pres deals the same everywhere, or do they vary by time (special deals) or sign up place (web ad, United site, airport kiosk, mailed offer?)

Like I said, I'm 1K this year, I plan on making the miles and PQD this year. I should at least make Platinum, so I don't see the flex miles or access (outside of the club) real benefits. The award thing is interesting since I do have a trip I need to ticket soon for Hawaii in late 2014, but that is a one-off in the next 24 months.

What is the best card for a 1K to get?

#54

Join Date: Sep 2010

Location: San Francisco Bay Area

Posts: 5,825

There really are not a lot of choices...

United: Club Card or Explorer (see existing threads) https://creditcards.chase.com/airlin...ireprefsplit=2

Neutral: Chase Sapphire Preferred (transfer points to Marriott and UA) 2X Points on travel and dining

Other neutral cards that bonus your travel spend with extra points

United: Club Card or Explorer (see existing threads) https://creditcards.chase.com/airlin...ireprefsplit=2

Neutral: Chase Sapphire Preferred (transfer points to Marriott and UA) 2X Points on travel and dining

Other neutral cards that bonus your travel spend with extra points

#55

Formerly known as mmihalik

Join Date: Sep 2000

Location: Oregon

Posts: 109

Friend had Explorer Card, and upgraded to United Club Card. Flies infrequently with his spouse, but likes the club access. His analysis (and he is a penny pincer) is that it is worth it, considering the few times he uses the Club would cost $50 for each of them. Respite on busy travel days is a good thing. He does not have any MP status as he doesn't travel much anymore. 2 free checked bags helps, too.

I have the Presidential Card, and travel frequently. The PQM miles helped me top my account to reach Platinum the last 3 years, and son has benefited from the several FC upgrades on the award tickets I've given him the past several years. Club access is worth it for my wife and me too. Those gin&tonic costs do add up. :-)

As others have noted, just really need to look at whether you can afford the $395 fee, which is less than the cost of United Club membership alone. And can actually use the benefits.

I have the Presidential Card, and travel frequently. The PQM miles helped me top my account to reach Platinum the last 3 years, and son has benefited from the several FC upgrades on the award tickets I've given him the past several years. Club access is worth it for my wife and me too. Those gin&tonic costs do add up. :-)

As others have noted, just really need to look at whether you can afford the $395 fee, which is less than the cost of United Club membership alone. And can actually use the benefits.

#56

Join Date: Nov 2013

Location: CO

Programs: UA OG-1K, Marriott Plat, Hertz PC

Posts: 1,360

Thanks for the insights. This webpage makes no mention of the Pres not being open to new members. I guess that's why I hadn't heard much about it.

https://www.chase.com/online/Credit-...nefits-new.htm

Since its Plus vs Club, I'll take it to that topic.

Thanks

https://www.chase.com/online/Credit-...nefits-new.htm

Since its Plus vs Club, I'll take it to that topic.

Thanks

#57

Join Date: Jan 2009

Location: TUL

Programs: AA EXP 2MM; Marriott Titanium; Hilton Diamond; Hyatt Explorist; Vistana 5* Elite; Nat'l Exec Elite

Posts: 6,177

Thanks for the insights. This webpage makes no mention of the Pres not being open to new members. I guess that's why I hadn't heard much about it.

https://www.chase.com/online/Credit-...nefits-new.htm

Since its Plus vs Club, I'll take it to that topic.

Thanks

https://www.chase.com/online/Credit-...nefits-new.htm

Since its Plus vs Club, I'll take it to that topic.

Thanks

#58

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.99MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,770

#59

Join Date: Nov 2006

Location: SEA

Programs: AS MVPG 75k, UA zilch, IHG Spire, Marriott Plat, Hyatt Plat, Hertz Gold, Avis Presidents

Posts: 1,302

Coming up on the point where I make the decision to keep or kill this card. At this point the only compelling reason to keep it is for /future/ speculative use. By this I mean - I fly both domestic and int'l out of seattle; int'l typically in paid business class, total of 100-120k/yr EQM. In the past I've aimed for *a and been pretty happy, but now that AS treats all partners as elite qualifying, I'm 99% sure I'll stick with their partners especially while DL is still in the mix given their many Asia options. Should they leave as a partner with AS, that's a new problem. If I dropped the PP card I'd pick up an amex platinum for net of 250 and get access to AS, DL, and other PriorityP clubs (when I'm not on a J tix I'm usually solo). But losing the minimum spend exemption feels like it'd be a big thing to walk away from - but is it worth 400 for just that, and likely 400 every year for the next few years on the chance that I shift back to UA?

The UA club in sea is too far away from the AS gates now to bother going, so boardroom access is even more compelling to have. And the UA clubs seem to have gone downhill quite a bit this past year, and that's not likely to change. If only the were closer or AS BR served more than 3 drinks, it'd all be easier

I know everyone's got to make their own decisions but this is really 'on the bubble' for me. Hell, I've even considered getting the Amex card and keeping both memberships for a bit just to see.

The UA club in sea is too far away from the AS gates now to bother going, so boardroom access is even more compelling to have. And the UA clubs seem to have gone downhill quite a bit this past year, and that's not likely to change. If only the were closer or AS BR served more than 3 drinks, it'd all be easier

I know everyone's got to make their own decisions but this is really 'on the bubble' for me. Hell, I've even considered getting the Amex card and keeping both memberships for a bit just to see.

#60

Join Date: Nov 2003

Location: Houston

Programs: UA: MM

Posts: 844

Coming up on the point where I make the decision to keep or kill this card. At this point the only compelling reason to keep it is for /future/ speculative use. By this I mean - I fly both domestic and int'l out of seattle; int'l typically in paid business class, total of 100-120k/yr EQM. In the past I've aimed for *a and been pretty happy, but now that AS treats all partners as elite qualifying, I'm 99% sure I'll stick with their partners especially while DL is still in the mix given their many Asia options. Should they leave as a partner with AS, that's a new problem. If I dropped the PP card I'd pick up an amex platinum for net of 250 and get access to AS, DL, and other PriorityP clubs (when I'm not on a J tix I'm usually solo). But losing the minimum spend exemption feels like it'd be a big thing to walk away from - but is it worth 400 for just that, and likely 400 every year for the next few years on the chance that I shift back to UA?

The UA club in sea is too far away from the AS gates now to bother going, so boardroom access is even more compelling to have. And the UA clubs seem to have gone downhill quite a bit this past year, and that's not likely to change. If only the were closer or AS BR served more than 3 drinks, it'd all be easier

I know everyone's got to make their own decisions but this is really 'on the bubble' for me. Hell, I've even considered getting the Amex card and keeping both memberships for a bit just to see.

The UA club in sea is too far away from the AS gates now to bother going, so boardroom access is even more compelling to have. And the UA clubs seem to have gone downhill quite a bit this past year, and that's not likely to change. If only the were closer or AS BR served more than 3 drinks, it'd all be easier

I know everyone's got to make their own decisions but this is really 'on the bubble' for me. Hell, I've even considered getting the Amex card and keeping both memberships for a bit just to see.

But then again, I'm not flying that much so why worry...

In your case I can see the value of the AMX over the PP. And, who knows how long that spend exemption will be around.

FWIW

DLM