Last edit by: WineCountryUA

How does this work?

If you use any MP branded Chase credit card and accumulate more then $25,000 of qualified purchases in a calendar year, you will be exempt from the PQD requirement for Premier Silver, Gold or Platinum status. It does not apply to 1K qualification.

Note: PresidentPlus primary cardholders are inherently exempt and do not have a minimum spend requirement.

When is the UA site updated with latest Chase numbers?

Consensus (2017) is this is done weekly but unclear if the same day of the week for everyone (Many believe it is Friday with spend thru the previous weekend)

Over what time period is the spending measured?

The calendar year of the activity, not the billing period based.

What cards are included?

All Chase MileagePlus branded cards including the legacy cards.

Is the Chase TravelBank Card included? Appears yes

For those with multiple cards, it is cumulative spending across all eligible cards that is counted.

Where can I see my year to date spend?

Go to mystatus.united.com, sign in, find on the righthand side "See My Chase Spend" and click on the button

Only visible for those with an eligible card and subject to the PQD requirement (USA residents). When qualified for Plat and 1K is the next level, the PQD waiver no longer applies.

Does the waiver work for authorized cardholders?

No, only the primary account cardholder.

There is only one UA MP account associated with Chase credit cards.

If you use any MP branded Chase credit card and accumulate more then $25,000 of qualified purchases in a calendar year, you will be exempt from the PQD requirement for Premier Silver, Gold or Platinum status. It does not apply to 1K qualification.

Note: PresidentPlus primary cardholders are inherently exempt and do not have a minimum spend requirement.

When is the UA site updated with latest Chase numbers?

Consensus (2017) is this is done weekly but unclear if the same day of the week for everyone (Many believe it is Friday with spend thru the previous weekend)

Over what time period is the spending measured?

The calendar year of the activity, not the billing period based.

What cards are included?

All Chase MileagePlus branded cards including the legacy cards.

Is the Chase TravelBank Card included? Appears yes

For those with multiple cards, it is cumulative spending across all eligible cards that is counted.

Where can I see my year to date spend?

Go to mystatus.united.com, sign in, find on the righthand side "See My Chase Spend" and click on the button

Only visible for those with an eligible card and subject to the PQD requirement (USA residents). When qualified for Plat and 1K is the next level, the PQD waiver no longer applies.

Does the waiver work for authorized cardholders?

No, only the primary account cardholder.

There is only one UA MP account associated with Chase credit cards.

Chase UA PQD Waiver Q&A: when updated, calendar year, cancellation,.. [Consoldiated]

#301

Moderator: United Airlines

Join Date: Jun 2007

Location: SFO

Programs: UA Plat 1.995MM, Hyatt Discoverist, Marriott Plat/LT Gold, Hilton Silver, IHG Plat

Posts: 66,852

It is on a true calendar year basis and not billing periods. and it is generally reported on a weekly / sometimes bi-weekly basis.

#302

FlyerTalk Evangelist

Join Date: Oct 2006

Location: SFO/SJC

Programs: UA Silver, Marriott Gold, Hilton Gold

Posts: 14,884

#303

Join Date: Oct 2009

Location: Colorado Springs, CO

Programs: United Premier Gold

Posts: 252

United Visa PQD Wavier for both primary and additional?

Hey friends,

Thinking about getting the United Explorer Visa. Will the PQD Wavier extend to both my wife and myself (knowing that one is primary card holder, one is additional), or do we both need to be primary's and get separate accounts???

Thinking about getting the United Explorer Visa. Will the PQD Wavier extend to both my wife and myself (knowing that one is primary card holder, one is additional), or do we both need to be primary's and get separate accounts???

#305

FlyerTalk Evangelist

Join Date: Oct 2006

Location: SFO/SJC

Programs: UA Silver, Marriott Gold, Hilton Gold

Posts: 14,884

PQD waiver is only for primary only. So you’d both need separate accounts to get the waiver, and then would need to spend $25K on each card for both of you to get it.

#306

Join Date: Oct 2009

Location: Colorado Springs, CO

Programs: United Premier Gold

Posts: 252

#307

formerly skyccord

Join Date: Jul 2012

Location: NYC

Programs: United Premier Platinum, Hertz President Circle, Marriott/SPG Premier Plat Elite, Avis Preferred

Posts: 269

Do you fly separately a lot? Because if you don't. Whoever has status extends those benefits to whoever is on the same itinerary as them.

#308

Join Date: Dec 2018

Posts: 21

Chase spending PQD waiver questions

1. Found the answer!

2. Does the balance have to be paid off for it to be reported?

3. If my current billing period ends on Jan 7th 2019 but I spend 25k before Dec 31st, will it qualify for the waiver?

4. If I purchase something for $25 K on Dec 28th and then return it on January 8th, would Chase/United remove my waiver consdering that it would be the following year?

I only have 6k in PQDs but 80k PQMs and want to get the waiver so I can go up to Platinum.

2. Does the balance have to be paid off for it to be reported?

3. If my current billing period ends on Jan 7th 2019 but I spend 25k before Dec 31st, will it qualify for the waiver?

4. If I purchase something for $25 K on Dec 28th and then return it on January 8th, would Chase/United remove my waiver consdering that it would be the following year?

I only have 6k in PQDs but 80k PQMs and want to get the waiver so I can go up to Platinum.

Last edited by UAEWR; Dec 25, 2018 at 1:17 pm

#309

Join Date: May 2010

Location: AVP & PEK

Programs: UA 1K 1.8MM

Posts: 6,349

#310

FlyerTalk Evangelist

Join Date: Aug 2017

Programs: AS 75K, DL Silver, UA Platinum, Hilton Gold, Hyatt Discoverist, Marriott Platinum + LT Gold

Posts: 10,502

1. Found the answer!

2. Does the balance have to be paid off for it to be reported?

3. If my current billing period ends on Jan 7th 2019 but I spend 25k before Dec 31st, will it qualify for the waiver?

4. If I purchase something for $25 K on Dec 28th and then return it on January 8th, would Chase/United remove my waiver consdering that it would be the following year?

I only have 6k in PQDs but 80k PQMs and want to get the waiver so I can go up to Platinum.

2. Does the balance have to be paid off for it to be reported?

3. If my current billing period ends on Jan 7th 2019 but I spend 25k before Dec 31st, will it qualify for the waiver?

4. If I purchase something for $25 K on Dec 28th and then return it on January 8th, would Chase/United remove my waiver consdering that it would be the following year?

I only have 6k in PQDs but 80k PQMs and want to get the waiver so I can go up to Platinum.

#311

Join Date: Dec 2004

Location: SFO

Programs: BART Platinum, AA Plat Pro

Posts: 1,158

I’d assume not, though I’ve never seen any DPs. But UA/Chase probably aren’t very concerned simply because it’s not a sustainable strategy. You’d now be $25k in the hole for 2019, so if you want to get the PQD waiver again you’ll have to spend a full $50k next year.

#312

Join Date: Mar 2014

Location: PWM

Programs: AA Plat

Posts: 1,335

The only thing I'm sure of is my Tracker updates on Fridays :P

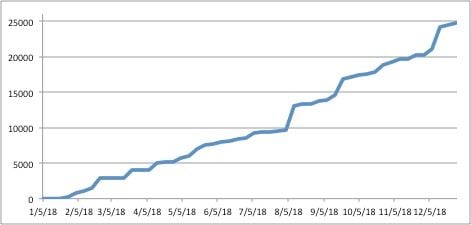

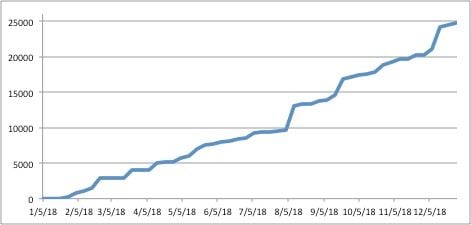

For me, the Tracker updates early Friday morning. In fact, I've recorded my spend on mystatus for the past year.

My gut feeling was that each update includes charges made 10 to 3 days prior. I recently tried to parse out which transactions are included in each update but I found it was not a simple task. For example, one week it thought I spent only $29 but the only 2 transactions that added up to that amount posted on the same day and were surrounded by other charges! Another week had $0 change but the preceding 2 weeks were full of charges. I thought maybe they were using transact dates instead of post dates but that wouldn't account for these discrepancies either.

Even more puzzling, when I added up my total YTD spend in Mint as of Dec 27, I was ~$300 short of the Tracker's figure. It's not returns or the annual fee either (those were accounted for in Mint). I have an AU but all of their transactions would make more than a ~300 deficit.

Mysteriously, the latest update (Dec 28) shows new spend of $334 but there was no way I could have spent that much in a 7 day period, especially since I stopped using my card after Dec 20 to get a better reading. So maybe Chase has back some of the "lost" spending?

Anyways, my recommendation is to meet the spend early and go by the official number. Usually I wouldn't bother trying to cut it so close (in terms of time, not spend; last year I finished with $25008) but I don't have any other MSRs (spend reqs for credit card sign up bonuses) so I wanted to optimize my spend. No use in spending an extra $1000 that could count toward next year's spend.

Update: Finished at 25004. Had to email Chase since the tracker site didn't show last year's spend.

My gut feeling was that each update includes charges made 10 to 3 days prior. I recently tried to parse out which transactions are included in each update but I found it was not a simple task. For example, one week it thought I spent only $29 but the only 2 transactions that added up to that amount posted on the same day and were surrounded by other charges! Another week had $0 change but the preceding 2 weeks were full of charges. I thought maybe they were using transact dates instead of post dates but that wouldn't account for these discrepancies either.

Even more puzzling, when I added up my total YTD spend in Mint as of Dec 27, I was ~$300 short of the Tracker's figure. It's not returns or the annual fee either (those were accounted for in Mint). I have an AU but all of their transactions would make more than a ~300 deficit.

Mysteriously, the latest update (Dec 28) shows new spend of $334 but there was no way I could have spent that much in a 7 day period, especially since I stopped using my card after Dec 20 to get a better reading. So maybe Chase has back some of the "lost" spending?

Anyways, my recommendation is to meet the spend early and go by the official number. Usually I wouldn't bother trying to cut it so close (in terms of time, not spend; last year I finished with $25008) but I don't have any other MSRs (spend reqs for credit card sign up bonuses) so I wanted to optimize my spend. No use in spending an extra $1000 that could count toward next year's spend.

Update: Finished at 25004. Had to email Chase since the tracker site didn't show last year's spend.

Last edited by sexykitten7; Feb 13, 2019 at 10:45 am Reason: Changed 400 to 300, updated

#314

FlyerTalk Evangelist

Join Date: Oct 2006

Location: SFO/SJC

Programs: UA Silver, Marriott Gold, Hilton Gold

Posts: 14,884

Account summary on the regular MP summary should show the line ‘Credit Card spend PQD waiver’ with either met or not met. At least I still see that on the app. Of course, that’ll change when the zeros show up again in a few hours.

#315

Join Date: Jun 2018

Posts: 489

Mine showing the year end snapshot also...PQD ($500 short) but I hit the spend waiver in Oct.

Account summary on the regular MP summary should show the line ‘Credit Card spend PQD waiver’ with either met or not met. At least I still see that on the app. Of course, that’ll change when the zeros show up again in a few hours.

Worked but showing "not met"

Statement with Chase closed on the 21st with 7k bill.

Account was 4k short of the waiver so I'm hoping it'll still show

We spend alot.....but not that much

We spend alot.....but not that much