Vast difference in codeshare ticketing prices

#1

Original Poster

Join Date: Sep 2017

Programs: Air NZ Airpoints silver, Koru member

Posts: 24

Vast difference in codeshare ticketing prices

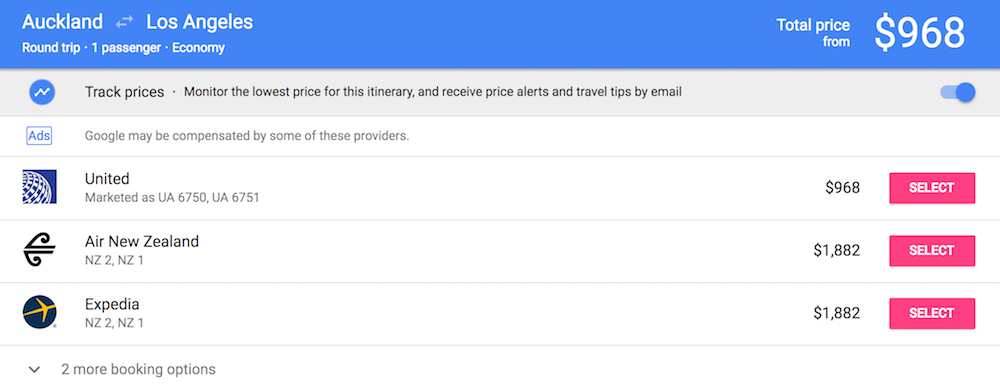

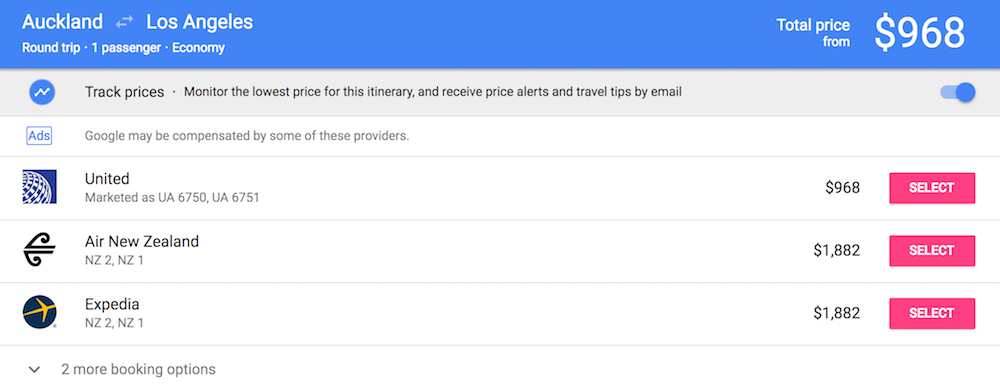

I use Google Flights to compare fares for upcoming travel, with a preference to use Air NZ wherever feasible. On more than one occasion however, the EXACT same Air NZ flight is significantly cheaper when booked using United, than Air NZ.

See below for instance, AKL-LAX return on Air NZ this October is $1882 - or a mere $968 if booked via United. Can someone please explain this to me? I'd like to be loyal to Air NZ and also earn status points but when the fare is nearly double for the same product, it's hard to justify.

See below for instance, AKL-LAX return on Air NZ this October is $1882 - or a mere $968 if booked via United. Can someone please explain this to me? I'd like to be loyal to Air NZ and also earn status points but when the fare is nearly double for the same product, it's hard to justify.

#2

Join Date: Dec 2009

Location: New York, NY

Programs: AA Gold. UA Silver, Marriott Gold, Hilton Diamond, Hyatt (Lifetime Diamond downgraded to Explorist)

Posts: 6,776

Airline pricing is very complex and codeshare pricing adds a new twist to it. Some fares are released at different times and some codeshares have access to seats at cheaper fares before they are released by the operating carrier.

#3

Join Date: Dec 2006

Location: NRT / HND

Programs: AA EXP, NH Plat, Former UA 1K

Posts: 5,665

I see this all the time on NH flights with UA codes. NH will sell out their K, L, T fare buckets before UA even though UA has a smaller percentage of the available seats. For example UA may be offering an L fare on an NH flight when NH themselves will only offer a W fare.

#4

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,450

The two carriers are selling different inventory.

On that flight, NZ and UA are revenue sharing regardless who you buy the ticket from. Unless there were a frequent flyer program specific reason to buy from one carrier or the other (e.g., PQD on UA), I wouldn't pay more than a nominal amount to book under the native flight number, and then only because it makes things like changes easier.

On that flight, NZ and UA are revenue sharing regardless who you buy the ticket from. Unless there were a frequent flyer program specific reason to buy from one carrier or the other (e.g., PQD on UA), I wouldn't pay more than a nominal amount to book under the native flight number, and then only because it makes things like changes easier.

#5

Original Poster

Join Date: Sep 2017

Programs: Air NZ Airpoints silver, Koru member

Posts: 24

How is the inventory different? From a customer's perspective, it's the same product (loyalty benefits aside). It seems AirNZ is charging a considerably larger mark-up than the codeshare airline on the SAME inventory.

#7

FlyerTalk Evangelist

Join Date: Apr 2001

Location: MEL CHC

Posts: 21,017

Look at the ".nz" web site.

Google may be looking as USA point of sale (POS).

Not unusual for Aust & NZ airlines to have higher prices with USA POS compared with NZ/Aust POS.

And as above fare bucket availability can come into play.

Codeshares can be complicated. An old post but probably still valid

Google may be looking as USA point of sale (POS).

Not unusual for Aust & NZ airlines to have higher prices with USA POS compared with NZ/Aust POS.

And as above fare bucket availability can come into play.

Codeshares can be complicated. An old post but probably still valid

There are more ways to structure a codeshare agreement than might be apparent on the surface. I've negotiated codeshares that were based upon "hard blocks", "soft blocks", "moving block", "free sales", "revenue sharing", "open sale", "sell and report" and various other systems.

In a "hard block", the operating carrier makes available a fixed number of seats to the marketing carrier. This is usually done on a fixed cost per seat basis. The marketing carrier then applies its own yield management to these seats and sells them in competition with the operating carrier. If the marketing carrier fails to sell all the seats, then they go empty.

In a "soft block", the marketing carrier reserves the right to return to the operating carrier any unsold seats at various given points in time. Their liability to the operating carrier is reduced accordingly. The payments due may vary depending on whether the operating carrier is able to resell the seats returned.

In a "moving block", the marketing carrier guarantees a minimum number of sales over a given period based upon inventory ranges made available by the operating carrier. These ranges may be fluid or prenegotiated or a combination of both depending on specific operational day.

In a "free sale", the marketing carrier sells the operating carrier's inventory without any restrictions at either mutually agreed fares or unilaterally set fares.

In an "open sale", the marketing carrier sells the operating carrier's inventory until the operating carrier stops them from selling any more.

In a "sell and report", the marketing carrier sells the operating carrier's inventory independent of the operating carrier's systems and simply updates the systems subsequently with details of sales completed.

In a "revenue sharing" system, the marketing carrier and the operating carrier share all costs and revenues in pre-determined proportions, irrespective of who the actual cost may be incurred by or where the revenue may have been generated. This is the system used by most alliances who have attained anti-trust immunity.

Beyond this there are further restrictions as to traffic rights and markets in which the codeshares may be marketed and the settlement procedures and whether surcharges may be applicable and literally hundreds of other possibilities.

In a "hard block", the operating carrier makes available a fixed number of seats to the marketing carrier. This is usually done on a fixed cost per seat basis. The marketing carrier then applies its own yield management to these seats and sells them in competition with the operating carrier. If the marketing carrier fails to sell all the seats, then they go empty.

In a "soft block", the marketing carrier reserves the right to return to the operating carrier any unsold seats at various given points in time. Their liability to the operating carrier is reduced accordingly. The payments due may vary depending on whether the operating carrier is able to resell the seats returned.

In a "moving block", the marketing carrier guarantees a minimum number of sales over a given period based upon inventory ranges made available by the operating carrier. These ranges may be fluid or prenegotiated or a combination of both depending on specific operational day.

In a "free sale", the marketing carrier sells the operating carrier's inventory without any restrictions at either mutually agreed fares or unilaterally set fares.

In an "open sale", the marketing carrier sells the operating carrier's inventory until the operating carrier stops them from selling any more.

In a "sell and report", the marketing carrier sells the operating carrier's inventory independent of the operating carrier's systems and simply updates the systems subsequently with details of sales completed.

In a "revenue sharing" system, the marketing carrier and the operating carrier share all costs and revenues in pre-determined proportions, irrespective of who the actual cost may be incurred by or where the revenue may have been generated. This is the system used by most alliances who have attained anti-trust immunity.

Beyond this there are further restrictions as to traffic rights and markets in which the codeshares may be marketed and the settlement procedures and whether surcharges may be applicable and literally hundreds of other possibilities.

#8

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,450

A basic understanding of how airfares work is necessary to understand the pricing differential.

Airlines allocate their inventory of unsold seats among different fare "buckets" - e.g., Y, B, M, etc. Each fare bucket has different fare rules and is thus a different product. Codeshare means different airlines are selling their allocation of seats using their own flight numbers, on their own ticket stock. So what you buy from UA is not the same as what you buy from NZ. Additionally, one carrier may have sold out of its discount inventory whereas the other still has cheap seats left to sell. It gets pretty complex, per the codeshare primer quoted above.

As Mwenenzi notes, point of sale may also be an issue here.

#9

Original Poster

Join Date: Sep 2017

Programs: Air NZ Airpoints silver, Koru member

Posts: 24

Thanks for the responses - it is definitely making more sense now I have a better understanding of the fare buckets. I went back for a closer look at the particular flight I was researching: both were L fares from AKL-LAX, yet the UA price was USD$391 (approx NZD$560) compared with the Air NZ price of NZD$953. Can someone please explain the likely reason behind that?

#10

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,450

Thanks for the responses - it is definitely making more sense now I have a better understanding of the fare buckets. I went back for a closer look at the particular flight I was researching: both were L fares from AKL-LAX, yet the UA price was USD$391 (approx NZD$560) compared with the Air NZ price of NZD$953. Can someone please explain the likely reason behind that?

Different products.

#12

FlyerTalk Evangelist

Join Date: Sep 1999

Location: Toronto, Ontario, Canada

Programs: OWEmerald; STARGold; BonvoyPlat; IHGPlat/Amb; HiltonGold; A|ClubPat; AirMilesPlat

Posts: 38,186

Thanks for the responses - it is definitely making more sense now I have a better understanding of the fare buckets. I went back for a closer look at the particular flight I was researching: both were L fares from AKL-LAX, yet the UA price was USD$391 (approx NZD$560) compared with the Air NZ price of NZD$953. Can someone please explain the likely reason behind that?

#13

Join Date: Apr 2012

Posts: 55

I could not duplicate those fares (are you sure the UA fare is an L, and not a G?), but looking at dates in August, UA has a round-trip L fare (LLE0ZCC2) priced about $400 US cheaper than NZ's L (LKSVAM). Among other differences, the UA fare is nonrefundable and has $250 NZ change fee, while the NZ fare is refundable for a fee of $150 NZ, and has a $50 NZ change fee. The NZ fare also has a 14 day advance purchase requirement, while the UA fare has none.

Different products.

Different products.

Can anyone, with a straight face, justify the practice of changing or even a person paying twice as much to get the option of obtaining a refund (and even then needing to pay an additional fee)? You would need to cancel half your flights to make this worth it. And unless the flight will be sold out, it's almost always still cheaper to just buy a walk-up.

#14

A FlyerTalk Posting Legend

Join Date: Apr 2013

Location: PHX

Programs: AS 75K; UA 1MM; Hyatt Globalist; Marriott LTP; Hilton Diamond (Aspire)

Posts: 56,450

Can anyone, with a straight face, justify the practice of changing or even a person paying twice as much to get the option of obtaining a refund (and even then needing to pay an additional fee)? You would need to cancel half your flights to make this worth it. And unless the flight will be sold out, it's almost always still cheaper to just buy a walk-up.

#15

Join Date: Aug 2007

Location: HOU

Programs: AA EXP, UA 1K

Posts: 285

This is going to be long and technical, but here goes...

Block codeshares where each marketing carrier has a fixed block of seats on the operating carrier flight are pretty rare in modern times. The only carrier I know of that uses them frequently still is QF (mainly on their CZ / CI codeshare flights). From the operating carrier point of view, you don't want to cede that level of pricing control to the marketing carrier. In a block codeshare arrangement the marketing carrier's revenue management team manages their inventory as if it was their own flight so could choose to sell theirentire block in the cheapest class while the operating carrier is holding out for high fares.

Instead most codeshares today are freesale, which means the marketing carrier can sell as many seats as they can (or sometimes with a max), but the inventory allocation always comes from the operating carrier.

The most common reasons for discrepancies in codeshare pricing are:

1) Inventory is generally not real time. The marketing carrier receives the inventory allocation from the operating carrier in an AVS message through the GDS. This can cause discrepancies when the operating carrier sells a decent number of seats thus closing inventory buckets, but doesn't trigger a new AVS message to the marketing carriers with the new inventory allocation. In this scenario, sometimes the marketing carrier is able to sell the lower (and outdated) inventory allocation, but sometimes when you go to sell, you'll get a message back that that bucket is no longer available. The operating carrier may set a rule that says, for example, in discount buckets only send 80% of the seats available to the marketing carrier, but that would result in a scenario where the operating carrier is cheaper than the marketing carrier, which isn't the case here.

2) Inventory bucket mapping. If the operating carrier uses 10 buckets in economy, but the marketing carrier uses more or less, two buckets on one carrier can map to one bucket on the other carrier. If not done correctly, it can cause the marketing or operating carrier to fall out of sync price-wise. Assume the operating carrier only has buckets Y and B, but the marketing carrier has Y, B, and H. The codeshare agreement could say that H on the marketing carrier is B on the operating carrier and that Y and B on the marketing carrier are Y on the operating carrier. If the operating carrier closes B, then H closes on the marketing carrier. The operating carrier is now selling Y, but the marketing carrier is selling B. Assuming they both have the same Y price, the marketing carrier must now be selling a lower fare.

3) Fare structure differences. The marketing and operating carriers set their own fares in the market (and outside of a JV) cannot talk about those prices. So the marketing and operating carriers may have different fares for the same bucket or the conditions may differ (advance purchase, min/max stays, etc.). In this case, they are both selling the same bucket, but their fares are different in some way so one is more expensive than the other.

Hope this helps someone out there...

Block codeshares where each marketing carrier has a fixed block of seats on the operating carrier flight are pretty rare in modern times. The only carrier I know of that uses them frequently still is QF (mainly on their CZ / CI codeshare flights). From the operating carrier point of view, you don't want to cede that level of pricing control to the marketing carrier. In a block codeshare arrangement the marketing carrier's revenue management team manages their inventory as if it was their own flight so could choose to sell theirentire block in the cheapest class while the operating carrier is holding out for high fares.

Instead most codeshares today are freesale, which means the marketing carrier can sell as many seats as they can (or sometimes with a max), but the inventory allocation always comes from the operating carrier.

The most common reasons for discrepancies in codeshare pricing are:

1) Inventory is generally not real time. The marketing carrier receives the inventory allocation from the operating carrier in an AVS message through the GDS. This can cause discrepancies when the operating carrier sells a decent number of seats thus closing inventory buckets, but doesn't trigger a new AVS message to the marketing carriers with the new inventory allocation. In this scenario, sometimes the marketing carrier is able to sell the lower (and outdated) inventory allocation, but sometimes when you go to sell, you'll get a message back that that bucket is no longer available. The operating carrier may set a rule that says, for example, in discount buckets only send 80% of the seats available to the marketing carrier, but that would result in a scenario where the operating carrier is cheaper than the marketing carrier, which isn't the case here.

2) Inventory bucket mapping. If the operating carrier uses 10 buckets in economy, but the marketing carrier uses more or less, two buckets on one carrier can map to one bucket on the other carrier. If not done correctly, it can cause the marketing or operating carrier to fall out of sync price-wise. Assume the operating carrier only has buckets Y and B, but the marketing carrier has Y, B, and H. The codeshare agreement could say that H on the marketing carrier is B on the operating carrier and that Y and B on the marketing carrier are Y on the operating carrier. If the operating carrier closes B, then H closes on the marketing carrier. The operating carrier is now selling Y, but the marketing carrier is selling B. Assuming they both have the same Y price, the marketing carrier must now be selling a lower fare.

3) Fare structure differences. The marketing and operating carriers set their own fares in the market (and outside of a JV) cannot talk about those prices. So the marketing and operating carriers may have different fares for the same bucket or the conditions may differ (advance purchase, min/max stays, etc.). In this case, they are both selling the same bucket, but their fares are different in some way so one is more expensive than the other.

Hope this helps someone out there...