Last edit by: pgary

Do not post referral offers or requests in this thread. All such posts will be deleted.

This thread is dedicated to Q&A about the Chase RR Visa signup bonus offers.

Post important Chase RR Visa news in the RR Visa News ONLY thread. (It will quickly get lost in this thread.)

Post or look for referral offers ONLY in the RR Visa referrals thread in the referrals thread of the credit card forum.

75,000 miles bonus for all Southwest Airlines personal credit cards.

40K + 20K personal Plus

offer: $1,000 spend in three months for 40K. $11,000 more in 12 months for additional 20K. $69 annual fee, not waived the first year.

40K + 20K personal Premier offer. $1,000 spend in three months. $11,000 more in 12 months for additional 20K. $99 annual fee, not waived the first year.

70K Performance Business Card offer. $5,000 spend in three months. $199 annual fee, not waived the first year.

50K personal Plus offer $2,000 spend in three months. $69 annual fee, not waived the first year.

40K personal Plus offer: $1,000 spend in three months. $69 annual fee, not waived the first year.

40K personal Premier offer. $1,000 spend in three months. $99 annual fee, not waived the first year.

50K personal Premier offer. $2,000 spend in three months. $99 annual fee, not waived the first year.

60K Business Premier offer. $3,000 spend in three months. $99 annual fee, not waived the first year.

60K Plus offer. $2,000 spend in three months. $69 annual fee, not waived the first year.

60K personal Premier offer. $2,000 spend in three months. $99 annual fee, not waived the first year.

60K Plus offer. $2,000 spend in three months. $69 annual fee, not waived the first year. Still active 07-July-2017

50K Plus offer. $2,000 spend in three months. $69 annual fee, not waived the first year. Still active 21-Apr-2017

40K Personal Plus offer. $1,000 spend in three months. $69 annual fee, not waived the first year.

50K personal Premier offer. $2,000 spend in three months. $99 annual fee, not waived the first year. Still active 21-Apr-2017

40K Personal Premier offer. $1,000 spend in three months. $99 annual fee, not waived the first year.

50K Business Premier offer. $2,000 spend in three months. $99 annual fee, not waived the first year. Still active 21-Apr-2017

There have been targeted offers of 50K & $100 credit, for example:

http://www.flyertalk.com/forum/24575935-post2302.html

Frequently Asked Questions about Rapid Rewards Visa

1. What are the different card types?

non-business Plus, non-business Premier, business Plus, and business Premier.

Premier cards have a higher annual fee but give 6000 anniversary bonus points vs. 3000 points for the Plus cards. It is generally agreed that you will get the bonus for a new account if you have not had that particular type of RR Visa card before, but Chase appears to be in the process of changing their policies (see below).

Note that prior to RR-2.0, the two types of RR Visa cards were "Classic" ($29 to $39 annual fee) and "Signature" ($59 to $69 annual fee). Plus and Premier are new products for purposes of the (soon to be retired?) "One bonus per product" rule.

2. Is there a zero annual fee version?

No.

3. Can I "churn" these cards? How often can I reapply for the same type card and get the signup bonus?

The official rule has recently changed more than once. Closely check the T&C of your offer as different rules may apply to concurrently available offers. The Inflight offer linked above states:

Referral offers have been seen with a limit of one individual and one business bonus per lifetime (although T&C read by the CSR taking the application differed from those printed on the referral offer).

Actual results sometimes differ from the official rule. People have reported receiving the bonus a second time on the same card type at various intervals even when the bonus was officially once per lifefime per product. Please post your results here.

As of mid-May 2015 Chase has cracked down on applicants who appear to have much less than average attachment to their cards. Specifically, more than 5 applications within the past 24 months is the approximate cutoff: Chase crackdown on churners: Please report your RR Visa approvals/denials here

4. Can I cancel the card and still collect the anniversary bonus?

Yes. Reasonable people disagree on whether this crosses the line of exploiting the card issuer. The anniversary bonus is described a reward for having been a cardmember for the past year, not as a reward for paying the next year's annual fee. Based on that description, the bonus has been earned even if you then cancel the card. As a practical matter, there is a window of only a couple weeks to accomplish this. The bonus points will post on the billing date of the statement containing your new annual fee, which will have posted earlier in the billing cycle. You have 30 days from posting of the annual fee to cancel the card and have the new fee refunded.

5. Does the annual fee count toward the spending threshold for the signup bonus?

No.

6. When will my signup bonus post to my Rapid Rewards account?

If you have met the spending threshold at least several days before your statement date, the bonus will normally post 2 days after your statement date, not when you actually spent the money! Cutting the timing or the spending amount too closely is not advisable. Mistakes can happen.

7. My statement shows sufficient purchases to meet the spending threshold. Why didn't I receive the bonus?

This can happen if you met the spending threshold just a few days before the statement date. It appears that accounts are flagged for meeting the spending threshold independently of the statement generation process and less frequently than daily.

8. How can I determine my statement date?

You should call Chase (phone number on back of card) to check your next statement date. Credit card companies are now required to have payments due on the same numerical day of each month, which means closing dates vary throughout the year. (Before reforms enacted after the financial crisis, RR Visa cards had constant closing dates rather than constant due dates.) The closing date should remain within the same small range unless you request a change of your payment due date. When you request a change, Chase normally can delay your next statement but cannot accelerate it. If you are unwisely taking the risk of cutting your timing too close, you should call Chase more than once to confirm your next statement date.

9. I accidentally crossed the spending threshold in December rather than January. Can I return a large purchase to bring my spending back below the threshold?

Unlikely. It appears that the sweep to check spending threshold does not un-flag an account previously flagged as meeting the threshold. It's not even clear whether the sweep counts returns at all. If you realize the error before the statement closes and you have a payment due date change available, you might be able to push the December closing date into January.

10. Can I apply for a credit card in my wife's name but my Rapid Rewards number, so that the points funnel into my account?

People have tried this. Some have succeeded. Others have reported that Chase closed the account and posted no Rapid Rewards points. Do you feel lucky? Programs can become very aggressive when they suspect members of defrauding the program by using non-matching names. When you game the system you are only on solid ground if you follow the rules to the letter. Breaking the rules means that the program can penalize you if they want to, and believe me: They want to.

11. Can I scam this system in any other way? I just had a clever idea.

There is nothing new under the sun here on FlyerTalk. If it relates to established program rules and it isn't discussed here you can be confident your idea will not work.

This thread is dedicated to Q&A about the Chase RR Visa signup bonus offers.

Post important Chase RR Visa news in the RR Visa News ONLY thread. (It will quickly get lost in this thread.)

Post or look for referral offers ONLY in the RR Visa referrals thread in the referrals thread of the credit card forum.

75,000 miles bonus for all Southwest Airlines personal credit cards.

- 40,000 points when you spend $1,000 within 3 months.

- 35,000 points when you spend $5,000 within 6 months.

- Southwest Airlines Rapid RewardsŪ Plus Card. $69 annual fee, not waived the first year.

- Southwest Rapid RewardsŪ Premier Credit Card. $99 annual fee, not waived the first year.

offer: $1,000 spend in three months for 40K. $11,000 more in 12 months for additional 20K. $69 annual fee, not waived the first year.

40K + 20K personal Premier offer. $1,000 spend in three months. $11,000 more in 12 months for additional 20K. $99 annual fee, not waived the first year.

70K Performance Business Card offer. $5,000 spend in three months. $199 annual fee, not waived the first year.

40K personal Plus offer: $1,000 spend in three months. $69 annual fee, not waived the first year.

40K personal Premier offer. $1,000 spend in three months. $99 annual fee, not waived the first year.

60K Business Premier offer. $3,000 spend in three months. $99 annual fee, not waived the first year.

There have been targeted offers of 50K & $100 credit, for example:

http://www.flyertalk.com/forum/24575935-post2302.html

Frequently Asked Questions about Rapid Rewards Visa

1. What are the different card types?

non-business Plus, non-business Premier, business Plus, and business Premier.

Premier cards have a higher annual fee but give 6000 anniversary bonus points vs. 3000 points for the Plus cards. It is generally agreed that you will get the bonus for a new account if you have not had that particular type of RR Visa card before, but Chase appears to be in the process of changing their policies (see below).

Note that prior to RR-2.0, the two types of RR Visa cards were "Classic" ($29 to $39 annual fee) and "Signature" ($59 to $69 annual fee). Plus and Premier are new products for purposes of the (soon to be retired?) "One bonus per product" rule.

2. Is there a zero annual fee version?

No.

3. Can I "churn" these cards? How often can I reapply for the same type card and get the signup bonus?

The official rule has recently changed more than once. Closely check the T&C of your offer as different rules may apply to concurrently available offers. The Inflight offer linked above states:

This bonus offer is available to you as long as you have not received a new cardmember bonus for this product in the past twenty four months.

Actual results sometimes differ from the official rule. People have reported receiving the bonus a second time on the same card type at various intervals even when the bonus was officially once per lifefime per product. Please post your results here.

As of mid-May 2015 Chase has cracked down on applicants who appear to have much less than average attachment to their cards. Specifically, more than 5 applications within the past 24 months is the approximate cutoff: Chase crackdown on churners: Please report your RR Visa approvals/denials here

4. Can I cancel the card and still collect the anniversary bonus?

Yes. Reasonable people disagree on whether this crosses the line of exploiting the card issuer. The anniversary bonus is described a reward for having been a cardmember for the past year, not as a reward for paying the next year's annual fee. Based on that description, the bonus has been earned even if you then cancel the card. As a practical matter, there is a window of only a couple weeks to accomplish this. The bonus points will post on the billing date of the statement containing your new annual fee, which will have posted earlier in the billing cycle. You have 30 days from posting of the annual fee to cancel the card and have the new fee refunded.

5. Does the annual fee count toward the spending threshold for the signup bonus?

No.

6. When will my signup bonus post to my Rapid Rewards account?

If you have met the spending threshold at least several days before your statement date, the bonus will normally post 2 days after your statement date, not when you actually spent the money! Cutting the timing or the spending amount too closely is not advisable. Mistakes can happen.

7. My statement shows sufficient purchases to meet the spending threshold. Why didn't I receive the bonus?

This can happen if you met the spending threshold just a few days before the statement date. It appears that accounts are flagged for meeting the spending threshold independently of the statement generation process and less frequently than daily.

8. How can I determine my statement date?

You should call Chase (phone number on back of card) to check your next statement date. Credit card companies are now required to have payments due on the same numerical day of each month, which means closing dates vary throughout the year. (Before reforms enacted after the financial crisis, RR Visa cards had constant closing dates rather than constant due dates.) The closing date should remain within the same small range unless you request a change of your payment due date. When you request a change, Chase normally can delay your next statement but cannot accelerate it. If you are unwisely taking the risk of cutting your timing too close, you should call Chase more than once to confirm your next statement date.

9. I accidentally crossed the spending threshold in December rather than January. Can I return a large purchase to bring my spending back below the threshold?

Unlikely. It appears that the sweep to check spending threshold does not un-flag an account previously flagged as meeting the threshold. It's not even clear whether the sweep counts returns at all. If you realize the error before the statement closes and you have a payment due date change available, you might be able to push the December closing date into January.

10. Can I apply for a credit card in my wife's name but my Rapid Rewards number, so that the points funnel into my account?

People have tried this. Some have succeeded. Others have reported that Chase closed the account and posted no Rapid Rewards points. Do you feel lucky? Programs can become very aggressive when they suspect members of defrauding the program by using non-matching names. When you game the system you are only on solid ground if you follow the rules to the letter. Breaking the rules means that the program can penalize you if they want to, and believe me: They want to.

11. Can I scam this system in any other way? I just had a clever idea.

There is nothing new under the sun here on FlyerTalk. If it relates to established program rules and it isn't discussed here you can be confident your idea will not work.

Discussion of Chase RR Visa 40K-75K sigunup points offers -- NO REFERRALS!

#4306

Join Date: Feb 2015

Posts: 595

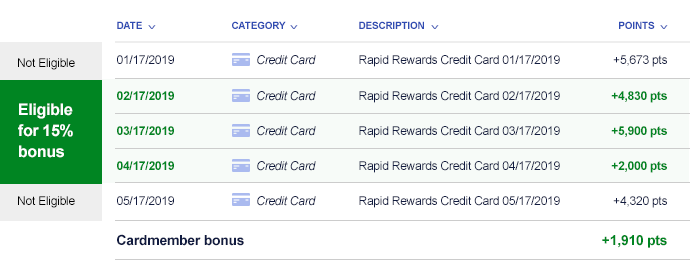

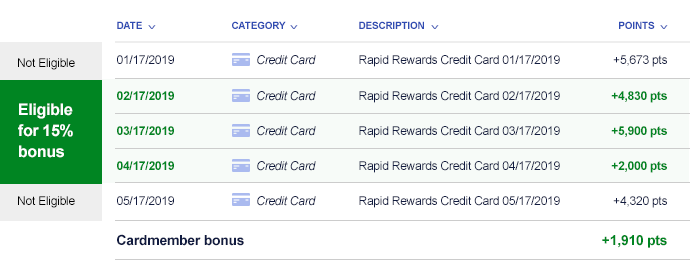

check bonus offers in ur RR acct. 15% bonus on all points earned 2/1 to Apr 30. Any1 who MS can get an easy 15k bonus ($100k limit). terms say does not apply to CC bonus pts trnsfrrd.Earn 15% bonus points

Register to earn up to 15,000 bonus points this year.

When you have at least 10,000 points post to your Rapid RewardsŪ account between 2/1/19 and 4/30/19 under the category of 'Credit Card', you'll be eligible for a 15% bonus (up to 15,000 bonus points*).

For example, if you have 3,500 points from your Rapid Rewards Credit Card post to your account each month during February, March, and April, you'll earn 1,575 bonus points from Southwest.

Those 1,575 bonus points will count toward Companion Pass, too!

Here is what it could look like in your Rapid Rewards Account:

For example, if you have 3,500 points from your Rapid Rewards Credit Card post to your account each month during February, March, and April, you'll earn 1,575 bonus points from Southwest.

Those 1,575 bonus points will count toward Companion Pass, too!

Here is what it could look like in your Rapid Rewards Account:

#4307

Join Date: Jun 2015

Posts: 1,727

#4310

Join Date: Jun 2013

Posts: 39

#4313

Join Date: Jan 2017

Programs: SW, AA, AS, UA

Posts: 16

I am 3/24. Took a chance and used the link on 4262 on 2/11/19 and was instantly approved for the Premier. The approval splash page did not have any info regarding an application number or CSR phone number to call to confirm the sign up bonus or min spend requirement. I'm going to send a secure message to see what I can find out.

#4317

Join Date: Nov 2015

Location: St. Louis, MO

Programs: Southwest Companion Pass

Posts: 790

#4318

Join Date: Jan 2017

Programs: SW, AA, AS, UA

Posts: 16

I am 3/24. Took a chance and used the link on 4262 on 2/11/19 and was instantly approved for the Premier. The approval splash page did not have any info regarding an application number or CSR phone number to call to confirm the sign up bonus or min spend requirement. I'm going to send a secure message to see what I can find out.

#4319

Join Date: Jul 2014

Location: Austin, TX

Posts: 1,012

Data point: My first statement closed on a new Priority card (promo: 50k after $2k spend) but only 2300 points posted, despite the 2k threshold being met about a week prior to the closing date. Our usual experience--perhaps not universal--has always been that the bonus is included on the statement for the period in which the minimum spend is completed (as it was on a new southwest business card last month). Granted, the T&C allow for 8 weeks. I contacted Chase and was told simply that a review shows I had met the minimum spend and the bonus would be on my next statement. Fair enough.

I'm curious as to whether southwest has the discretion to slow-roll these new account bonuses and is doing so to forego the issuance of at least some companion passes until after the initial Hawaii roll-out. IIRC, I read an article suggesting that southwest is quick to issue bonuses towards the end of the year to keep the issuance of companion passes in January to a minimum, but I have no idea whether that's actually true.

I'm curious as to whether southwest has the discretion to slow-roll these new account bonuses and is doing so to forego the issuance of at least some companion passes until after the initial Hawaii roll-out. IIRC, I read an article suggesting that southwest is quick to issue bonuses towards the end of the year to keep the issuance of companion passes in January to a minimum, but I have no idea whether that's actually true.

#4320

Moderator: Chase Ultimate Rewards

Join Date: Apr 2005

Location: SFO

Programs: UA 2P, MR LT Plat, IHG Plat, BW Dia, HH Au, Avis PC

Posts: 5,453

This seems to be a fairly common occurrence with Chase co-branded cards, where meeting the spend target within 10 days of statement close sometimes results in only spend points posting. Bonus then posts on the next statement. Lots of reports in the IHG card thread, for example.