Last edit by: pgary

Do not post referral offers or requests in this thread. All such posts will be deleted.

This thread is dedicated to Q&A about the Chase RR Visa signup bonus offers.

Post important Chase RR Visa news in the RR Visa News ONLY thread. (It will quickly get lost in this thread.)

Post or look for referral offers ONLY in the RR Visa referrals thread in the referrals thread of the credit card forum.

75,000 miles bonus for all Southwest Airlines personal credit cards.

40K + 20K personal Plus

offer: $1,000 spend in three months for 40K. $11,000 more in 12 months for additional 20K. $69 annual fee, not waived the first year.

40K + 20K personal Premier offer. $1,000 spend in three months. $11,000 more in 12 months for additional 20K. $99 annual fee, not waived the first year.

70K Performance Business Card offer. $5,000 spend in three months. $199 annual fee, not waived the first year.

50K personal Plus offer $2,000 spend in three months. $69 annual fee, not waived the first year.

40K personal Plus offer: $1,000 spend in three months. $69 annual fee, not waived the first year.

40K personal Premier offer. $1,000 spend in three months. $99 annual fee, not waived the first year.

50K personal Premier offer. $2,000 spend in three months. $99 annual fee, not waived the first year.

60K Business Premier offer. $3,000 spend in three months. $99 annual fee, not waived the first year.

60K Plus offer. $2,000 spend in three months. $69 annual fee, not waived the first year.

60K personal Premier offer. $2,000 spend in three months. $99 annual fee, not waived the first year.

60K Plus offer. $2,000 spend in three months. $69 annual fee, not waived the first year. Still active 07-July-2017

50K Plus offer. $2,000 spend in three months. $69 annual fee, not waived the first year. Still active 21-Apr-2017

40K Personal Plus offer. $1,000 spend in three months. $69 annual fee, not waived the first year.

50K personal Premier offer. $2,000 spend in three months. $99 annual fee, not waived the first year. Still active 21-Apr-2017

40K Personal Premier offer. $1,000 spend in three months. $99 annual fee, not waived the first year.

50K Business Premier offer. $2,000 spend in three months. $99 annual fee, not waived the first year. Still active 21-Apr-2017

There have been targeted offers of 50K & $100 credit, for example:

http://www.flyertalk.com/forum/24575935-post2302.html

Frequently Asked Questions about Rapid Rewards Visa

1. What are the different card types?

non-business Plus, non-business Premier, business Plus, and business Premier.

Premier cards have a higher annual fee but give 6000 anniversary bonus points vs. 3000 points for the Plus cards. It is generally agreed that you will get the bonus for a new account if you have not had that particular type of RR Visa card before, but Chase appears to be in the process of changing their policies (see below).

Note that prior to RR-2.0, the two types of RR Visa cards were "Classic" ($29 to $39 annual fee) and "Signature" ($59 to $69 annual fee). Plus and Premier are new products for purposes of the (soon to be retired?) "One bonus per product" rule.

2. Is there a zero annual fee version?

No.

3. Can I "churn" these cards? How often can I reapply for the same type card and get the signup bonus?

The official rule has recently changed more than once. Closely check the T&C of your offer as different rules may apply to concurrently available offers. The Inflight offer linked above states:

Referral offers have been seen with a limit of one individual and one business bonus per lifetime (although T&C read by the CSR taking the application differed from those printed on the referral offer).

Actual results sometimes differ from the official rule. People have reported receiving the bonus a second time on the same card type at various intervals even when the bonus was officially once per lifefime per product. Please post your results here.

As of mid-May 2015 Chase has cracked down on applicants who appear to have much less than average attachment to their cards. Specifically, more than 5 applications within the past 24 months is the approximate cutoff: Chase crackdown on churners: Please report your RR Visa approvals/denials here

4. Can I cancel the card and still collect the anniversary bonus?

Yes. Reasonable people disagree on whether this crosses the line of exploiting the card issuer. The anniversary bonus is described a reward for having been a cardmember for the past year, not as a reward for paying the next year's annual fee. Based on that description, the bonus has been earned even if you then cancel the card. As a practical matter, there is a window of only a couple weeks to accomplish this. The bonus points will post on the billing date of the statement containing your new annual fee, which will have posted earlier in the billing cycle. You have 30 days from posting of the annual fee to cancel the card and have the new fee refunded.

5. Does the annual fee count toward the spending threshold for the signup bonus?

No.

6. When will my signup bonus post to my Rapid Rewards account?

If you have met the spending threshold at least several days before your statement date, the bonus will normally post 2 days after your statement date, not when you actually spent the money! Cutting the timing or the spending amount too closely is not advisable. Mistakes can happen.

7. My statement shows sufficient purchases to meet the spending threshold. Why didn't I receive the bonus?

This can happen if you met the spending threshold just a few days before the statement date. It appears that accounts are flagged for meeting the spending threshold independently of the statement generation process and less frequently than daily.

8. How can I determine my statement date?

You should call Chase (phone number on back of card) to check your next statement date. Credit card companies are now required to have payments due on the same numerical day of each month, which means closing dates vary throughout the year. (Before reforms enacted after the financial crisis, RR Visa cards had constant closing dates rather than constant due dates.) The closing date should remain within the same small range unless you request a change of your payment due date. When you request a change, Chase normally can delay your next statement but cannot accelerate it. If you are unwisely taking the risk of cutting your timing too close, you should call Chase more than once to confirm your next statement date.

9. I accidentally crossed the spending threshold in December rather than January. Can I return a large purchase to bring my spending back below the threshold?

Unlikely. It appears that the sweep to check spending threshold does not un-flag an account previously flagged as meeting the threshold. It's not even clear whether the sweep counts returns at all. If you realize the error before the statement closes and you have a payment due date change available, you might be able to push the December closing date into January.

10. Can I apply for a credit card in my wife's name but my Rapid Rewards number, so that the points funnel into my account?

People have tried this. Some have succeeded. Others have reported that Chase closed the account and posted no Rapid Rewards points. Do you feel lucky? Programs can become very aggressive when they suspect members of defrauding the program by using non-matching names. When you game the system you are only on solid ground if you follow the rules to the letter. Breaking the rules means that the program can penalize you if they want to, and believe me: They want to.

11. Can I scam this system in any other way? I just had a clever idea.

There is nothing new under the sun here on FlyerTalk. If it relates to established program rules and it isn't discussed here you can be confident your idea will not work.

This thread is dedicated to Q&A about the Chase RR Visa signup bonus offers.

Post important Chase RR Visa news in the RR Visa News ONLY thread. (It will quickly get lost in this thread.)

Post or look for referral offers ONLY in the RR Visa referrals thread in the referrals thread of the credit card forum.

75,000 miles bonus for all Southwest Airlines personal credit cards.

- 40,000 points when you spend $1,000 within 3 months.

- 35,000 points when you spend $5,000 within 6 months.

- Southwest Airlines Rapid Rewards® Plus Card. $69 annual fee, not waived the first year.

- Southwest Rapid Rewards® Premier Credit Card. $99 annual fee, not waived the first year.

offer: $1,000 spend in three months for 40K. $11,000 more in 12 months for additional 20K. $69 annual fee, not waived the first year.

40K + 20K personal Premier offer. $1,000 spend in three months. $11,000 more in 12 months for additional 20K. $99 annual fee, not waived the first year.

70K Performance Business Card offer. $5,000 spend in three months. $199 annual fee, not waived the first year.

40K personal Plus offer: $1,000 spend in three months. $69 annual fee, not waived the first year.

40K personal Premier offer. $1,000 spend in three months. $99 annual fee, not waived the first year.

60K Business Premier offer. $3,000 spend in three months. $99 annual fee, not waived the first year.

There have been targeted offers of 50K & $100 credit, for example:

http://www.flyertalk.com/forum/24575935-post2302.html

Frequently Asked Questions about Rapid Rewards Visa

1. What are the different card types?

non-business Plus, non-business Premier, business Plus, and business Premier.

Premier cards have a higher annual fee but give 6000 anniversary bonus points vs. 3000 points for the Plus cards. It is generally agreed that you will get the bonus for a new account if you have not had that particular type of RR Visa card before, but Chase appears to be in the process of changing their policies (see below).

Note that prior to RR-2.0, the two types of RR Visa cards were "Classic" ($29 to $39 annual fee) and "Signature" ($59 to $69 annual fee). Plus and Premier are new products for purposes of the (soon to be retired?) "One bonus per product" rule.

2. Is there a zero annual fee version?

No.

3. Can I "churn" these cards? How often can I reapply for the same type card and get the signup bonus?

The official rule has recently changed more than once. Closely check the T&C of your offer as different rules may apply to concurrently available offers. The Inflight offer linked above states:

This bonus offer is available to you as long as you have not received a new cardmember bonus for this product in the past twenty four months.

Actual results sometimes differ from the official rule. People have reported receiving the bonus a second time on the same card type at various intervals even when the bonus was officially once per lifefime per product. Please post your results here.

As of mid-May 2015 Chase has cracked down on applicants who appear to have much less than average attachment to their cards. Specifically, more than 5 applications within the past 24 months is the approximate cutoff: Chase crackdown on churners: Please report your RR Visa approvals/denials here

4. Can I cancel the card and still collect the anniversary bonus?

Yes. Reasonable people disagree on whether this crosses the line of exploiting the card issuer. The anniversary bonus is described a reward for having been a cardmember for the past year, not as a reward for paying the next year's annual fee. Based on that description, the bonus has been earned even if you then cancel the card. As a practical matter, there is a window of only a couple weeks to accomplish this. The bonus points will post on the billing date of the statement containing your new annual fee, which will have posted earlier in the billing cycle. You have 30 days from posting of the annual fee to cancel the card and have the new fee refunded.

5. Does the annual fee count toward the spending threshold for the signup bonus?

No.

6. When will my signup bonus post to my Rapid Rewards account?

If you have met the spending threshold at least several days before your statement date, the bonus will normally post 2 days after your statement date, not when you actually spent the money! Cutting the timing or the spending amount too closely is not advisable. Mistakes can happen.

7. My statement shows sufficient purchases to meet the spending threshold. Why didn't I receive the bonus?

This can happen if you met the spending threshold just a few days before the statement date. It appears that accounts are flagged for meeting the spending threshold independently of the statement generation process and less frequently than daily.

8. How can I determine my statement date?

You should call Chase (phone number on back of card) to check your next statement date. Credit card companies are now required to have payments due on the same numerical day of each month, which means closing dates vary throughout the year. (Before reforms enacted after the financial crisis, RR Visa cards had constant closing dates rather than constant due dates.) The closing date should remain within the same small range unless you request a change of your payment due date. When you request a change, Chase normally can delay your next statement but cannot accelerate it. If you are unwisely taking the risk of cutting your timing too close, you should call Chase more than once to confirm your next statement date.

9. I accidentally crossed the spending threshold in December rather than January. Can I return a large purchase to bring my spending back below the threshold?

Unlikely. It appears that the sweep to check spending threshold does not un-flag an account previously flagged as meeting the threshold. It's not even clear whether the sweep counts returns at all. If you realize the error before the statement closes and you have a payment due date change available, you might be able to push the December closing date into January.

10. Can I apply for a credit card in my wife's name but my Rapid Rewards number, so that the points funnel into my account?

People have tried this. Some have succeeded. Others have reported that Chase closed the account and posted no Rapid Rewards points. Do you feel lucky? Programs can become very aggressive when they suspect members of defrauding the program by using non-matching names. When you game the system you are only on solid ground if you follow the rules to the letter. Breaking the rules means that the program can penalize you if they want to, and believe me: They want to.

11. Can I scam this system in any other way? I just had a clever idea.

There is nothing new under the sun here on FlyerTalk. If it relates to established program rules and it isn't discussed here you can be confident your idea will not work.

Discussion of Chase RR Visa 40K-75K sigunup points offers -- NO REFERRALS!

#3841

Join Date: Jan 2009

Location: 30 minutes south of EWR

Programs: UA 1k MM;*A Lifetime Gold; Marriott Lifetime Platinum; HiltonHonors Gold. Hyatt Globalist

Posts: 7,816

Which one did you apply to first? If you applied for the business card first, I'm betting the Premier card application didn't even go through. A lot of times when you attempt to apply to two different Southwest cards back to back, the web page attempts to redirect you thinking you have already applied. What you need to do is either clear out all cookies and browsing history, use a different browser all together or apply from a smartphone.

I will wait a little while and if I do not hear anything from Chase, I will ask my Private Client Banker to follow up for me. She is awesome and generally fixes things for me pretty quickly.

#3843

Join Date: Oct 2006

Posts: 325

I was thinking of applying for a personal and business card. I am well under the 5/24 rule but is the a formula on which one to apply for first, apply for both on same day or perhaps wait some time between applications.

Which ever way would possibly work in my favor as I attempt to go for a companion pass. Score is in the 800+ so not too many strikes against me I hope.

Any information or data points you could point me towards as I look to apply would be appreciated.

~SH

Which ever way would possibly work in my favor as I attempt to go for a companion pass. Score is in the 800+ so not too many strikes against me I hope.

Any information or data points you could point me towards as I look to apply would be appreciated.

~SH

#3845

Join Date: Oct 2015

Location: LAS

Posts: 6

I was thinking of applying for a personal and business card. I am well under the 5/24 rule but is the a formula on which one to apply for first, apply for both on same day or perhaps wait some time between applications.

Which ever way would possibly work in my favor as I attempt to go for a companion pass. Score is in the 800+ so not too many strikes against me I hope.

Any information or data points you could point me towards as I look to apply would be appreciated.

~SH

Which ever way would possibly work in my favor as I attempt to go for a companion pass. Score is in the 800+ so not too many strikes against me I hope.

Any information or data points you could point me towards as I look to apply would be appreciated.

~SH

#3846

Join Date: Jul 2001

Posts: 3,973

It's one of the spreadsheet options for downloading activity on the Chase site: https://en.wikipedia.org/wiki/Comma-separated_values

#3847

Join Date: Sep 2017

Posts: 56

Went over $2k spend on both personal cards just after the holiday. I'm assuming bonus points will hit account when statements close, mid-month for one and a little later for the other? First time earning CP so just looking to confirm timing. Also, Chase had quoted me a date of January 23 to hit the minimum spend for each card, but noticed that those messages have disappeared (wasn't aware that they expired from your inbox). I'm guessing Chase can access a record of older messages in case there's any funny stuff with the bonuses not posting for some reason?

#3848

Join Date: Apr 2003

Location: MCI

Programs: AA, DL, WN, HHonors Diamond, IHG Platinum, Marriott, Hyatt

Posts: 249

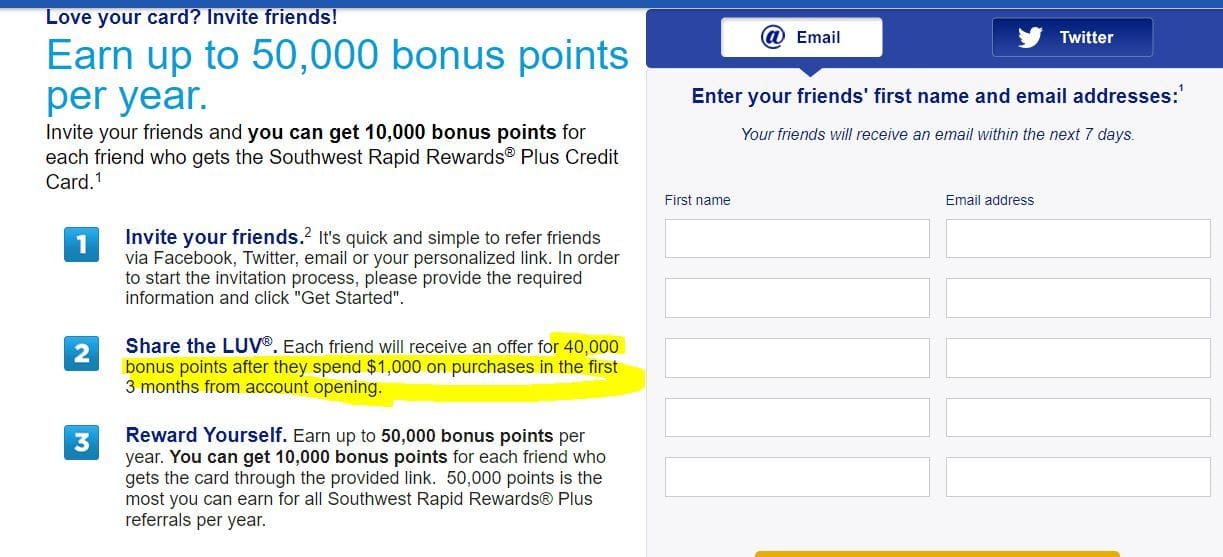

The only referral link I see through my account is for 50,000 TOTAL miles for the current referring cardholder -- for a total of five referrals @ 10,000 each. The actual card bonus for the applicant is 40,000. At least that is what comes up from my Chase Online account.

#3849

Join Date: Oct 2010

Location: SDF

Programs: Delta, Southwest, Hyatt

Posts: 153

The only referral link I see through my account is for 50,000 TOTAL miles for the current referring cardholder -- for a total of five referrals @ 10,000 each. The actual card bonus for the applicant is 40,000. At least that is what comes up from my Chase Online account.

#3850

Join Date: Dec 2012

Location: ORD/AUS

Programs: SW A-List and HH Diamond

Posts: 188

That's odd. I just checked both of mine (Plus and Premier), and they both still have the 50,000 signup bonus.

How long have you been a card holder? Could that have any impact?

How long have you been a card holder? Could that have any impact?

Hmm, as of today, my referral page looks different and mentions 40,000 point bonus on both versions of the card, whereas yesterday it said 50,000. Also it no longer shows the direct link to give for referrals, but give options for email and twitter. (The email option takes days to arrive by the way). My previously generated referral links still do both bring up the 50,000 point offer, with a redirect like they always have.

#3851

Join Date: Aug 2017

Posts: 98

I was thinking of applying for a personal and business card. I am well under the 5/24 rule but is the a formula on which one to apply for first, apply for both on same day or perhaps wait some time between applications.

Which ever way would possibly work in my favor as I attempt to go for a companion pass. Score is in the 800+ so not too many strikes against me I hope.

Any information or data points you could point me towards as I look to apply would be appreciated.

~SH

Which ever way would possibly work in my favor as I attempt to go for a companion pass. Score is in the 800+ so not too many strikes against me I hope.

Any information or data points you could point me towards as I look to apply would be appreciated.

~SH

#3854

Join Date: Oct 2010

Location: SDF

Programs: Delta, Southwest, Hyatt

Posts: 153

Mine do that too now.  I did refer a number of people over the last few days with my 50,000 links and many told me they already applied, so hoping for the best for them. I did take screenshots of the 50,000 point landing page for both my plus and premier referral links so if anyone applied off my links and need those I'd be happy to send them. I think anyone who's already applied will be fine, but if you waited you'll have to keep on waiting for the next 50,000 offer.

I did refer a number of people over the last few days with my 50,000 links and many told me they already applied, so hoping for the best for them. I did take screenshots of the 50,000 point landing page for both my plus and premier referral links so if anyone applied off my links and need those I'd be happy to send them. I think anyone who's already applied will be fine, but if you waited you'll have to keep on waiting for the next 50,000 offer.

I did refer a number of people over the last few days with my 50,000 links and many told me they already applied, so hoping for the best for them. I did take screenshots of the 50,000 point landing page for both my plus and premier referral links so if anyone applied off my links and need those I'd be happy to send them. I think anyone who's already applied will be fine, but if you waited you'll have to keep on waiting for the next 50,000 offer.

I did refer a number of people over the last few days with my 50,000 links and many told me they already applied, so hoping for the best for them. I did take screenshots of the 50,000 point landing page for both my plus and premier referral links so if anyone applied off my links and need those I'd be happy to send them. I think anyone who's already applied will be fine, but if you waited you'll have to keep on waiting for the next 50,000 offer.

#3855

Join Date: Dec 2004

Programs: WN, DL, UA, AA, Hilton, Marriott, IHG

Posts: 1,303

Mine do that too now.  I did refer a number of people over the last few days with my 50,000 links and many told me they already applied, so hoping for the best for them. I did take screenshots of the 50,000 point landing page for both my plus and premier referral links so if anyone applied off my links and need those I'd be happy to send them. I think anyone who's already applied will be fine, but if you waited you'll have to keep on waiting for the next 50,000 offer.

I did refer a number of people over the last few days with my 50,000 links and many told me they already applied, so hoping for the best for them. I did take screenshots of the 50,000 point landing page for both my plus and premier referral links so if anyone applied off my links and need those I'd be happy to send them. I think anyone who's already applied will be fine, but if you waited you'll have to keep on waiting for the next 50,000 offer.

I did refer a number of people over the last few days with my 50,000 links and many told me they already applied, so hoping for the best for them. I did take screenshots of the 50,000 point landing page for both my plus and premier referral links so if anyone applied off my links and need those I'd be happy to send them. I think anyone who's already applied will be fine, but if you waited you'll have to keep on waiting for the next 50,000 offer.

I did refer a number of people over the last few days with my 50,000 links and many told me they already applied, so hoping for the best for them. I did take screenshots of the 50,000 point landing page for both my plus and premier referral links so if anyone applied off my links and need those I'd be happy to send them. I think anyone who's already applied will be fine, but if you waited you'll have to keep on waiting for the next 50,000 offer.