Negatives with USA Amex Platinum card?

#1

Suspended

Original Poster

Join Date: Aug 2019

Posts: 200

Negatives with USA Amex Platinum card?

Seriously thinking getting amex plat or Chase Sapphire Reserve.

Lots of press saying its the best and better than CSR for travellers.

But what are the negatives?

For example. I know when I travel to Oz amex often gets charged 1.5% fee.

Lots of press saying its the best and better than CSR for travellers.

But what are the negatives?

For example. I know when I travel to Oz amex often gets charged 1.5% fee.

#2

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,507

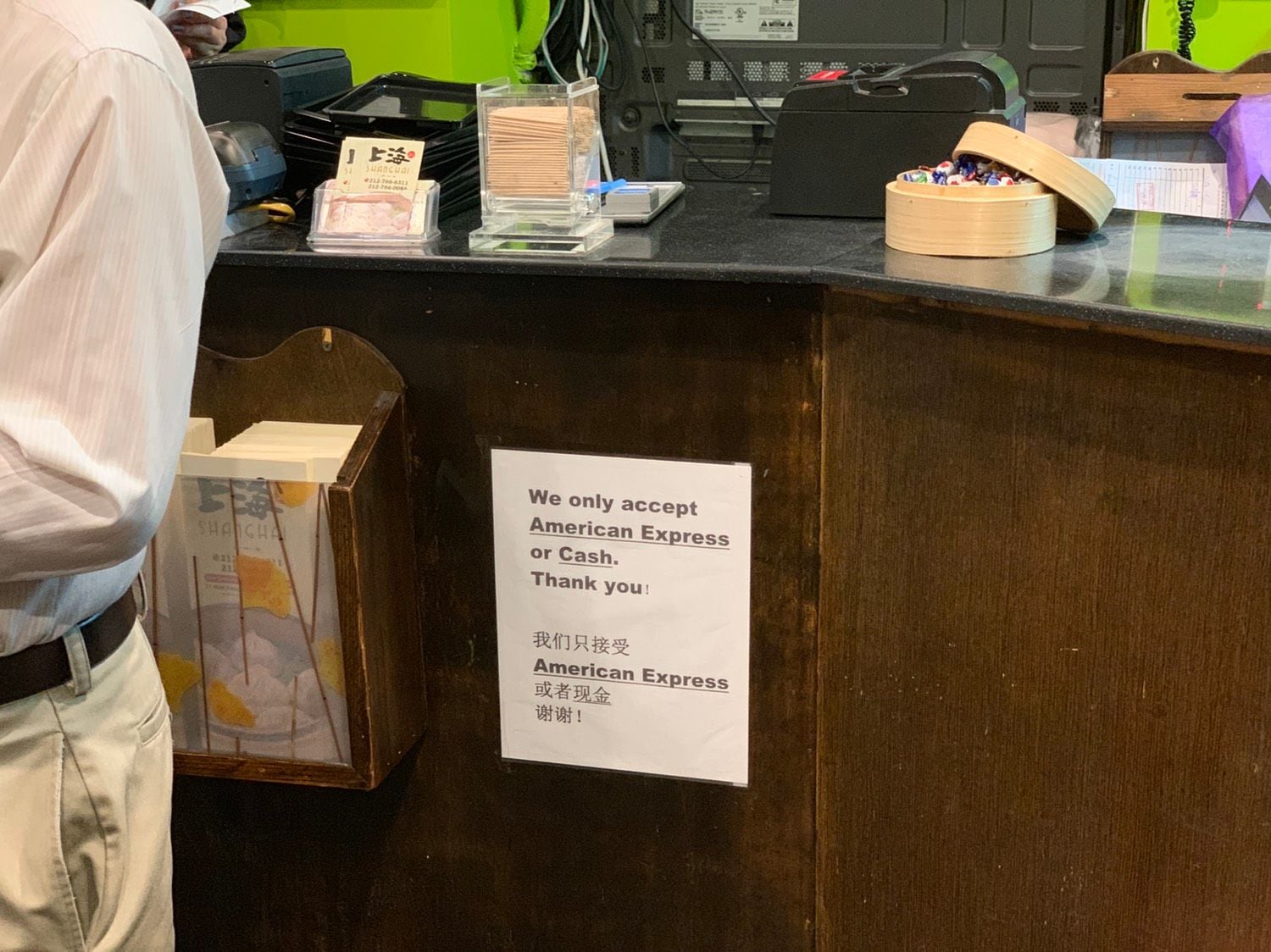

AmEx isn't accepted nearly as often outside the US compared to Visa/MC. In fact, in some places, it's pretty much accepted nowhere.

Then again, the Platinum seems like a card you get mainly for the benefits and not for actual spend (for the most part).

Then again, the Platinum seems like a card you get mainly for the benefits and not for actual spend (for the most part).

#4

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

#5

Join Date: Aug 2017

Programs: Hilton Diamond, IHG Spire Ambassador, Global Entry

Posts: 2,855

- If I had a Centurion lounge at my home airport, that might be a game-changer for me. All I have a is a PP restaurant. With the AMEX, I'd get nothing. With CSR, I get a meal each trip. It might make sense to look at what options are available at your home port. Those can change though.

- The Platinum has a steep AF that takes a lot of effort to break even. Often, people make it seem like being able to break even means that card is right for you. I'm looking to earn rewards, not to essentially pay for a bunch of things I don't need.

- The $200 airline credit isn't impossible, but it's annoying. It's only for 1 airline for the year. Forcing you to lose flexibility for pricing, routing, and timing. Buying drinks and other incidentals that you wouldn't have otherwise bought is no savings.

- Uber credit is easy, if you use Uber every month, and more in December. UberEATS adds more flexibility.

- Saks credit is good if you shop at Saks. Otherwise, it's just another useless benefit (advertisement) disguised as "$120 in value"

- If you buy lots of a flights, the 5x rewards are tough to beat. FHR is also a big perk to luxury travelers. Great rewards on those too. If you are going to use those two categories often, this card greatly increases in value.

With the CSR, it is little effort to get more monies' worth. I get my $300 credit back usually in the first month or two because of the generous categories. No having to limit myself to certain companies and conditions. It is also nearly a guarantee that when I travel, if they accept CC, they will accept my CSR, and there is no FTF. AMEX isn't as widely accepted and it does you no good to spend it on anything in person due to weak returns.

- The Platinum has a steep AF that takes a lot of effort to break even. Often, people make it seem like being able to break even means that card is right for you. I'm looking to earn rewards, not to essentially pay for a bunch of things I don't need.

- The $200 airline credit isn't impossible, but it's annoying. It's only for 1 airline for the year. Forcing you to lose flexibility for pricing, routing, and timing. Buying drinks and other incidentals that you wouldn't have otherwise bought is no savings.

- Uber credit is easy, if you use Uber every month, and more in December. UberEATS adds more flexibility.

- Saks credit is good if you shop at Saks. Otherwise, it's just another useless benefit (advertisement) disguised as "$120 in value"

- If you buy lots of a flights, the 5x rewards are tough to beat. FHR is also a big perk to luxury travelers. Great rewards on those too. If you are going to use those two categories often, this card greatly increases in value.

With the CSR, it is little effort to get more monies' worth. I get my $300 credit back usually in the first month or two because of the generous categories. No having to limit myself to certain companies and conditions. It is also nearly a guarantee that when I travel, if they accept CC, they will accept my CSR, and there is no FTF. AMEX isn't as widely accepted and it does you no good to spend it on anything in person due to weak returns.

#6

A FlyerTalk Posting Legend

Join Date: Sep 2009

Location: Minneapolis: DL DM charter 2.3MM

Programs: A3*Gold, SPG Plat, HyattDiamond, MarriottPP, LHW exAccess, ICI, Raffles Amb, NW PE MM, TWA Gold MM

Posts: 100,404

In addition to FHR, there can be advantages to doing car rental reservations through PTS as for example Hertz gives a grace period on the return in many locations that can save a couple extra hours.

If you buy premium economy and above international plane tickets on certain carriers, you can save a lot of money through the IAP. For me it's recently been about 15% on most DL fares, which way more than compensates for the $39 ticketing fee. PTS then becomes your travel agent, which might be a small disadvantage if there are schedule changes, but it's not like an ordinary OLTA.

If you buy premium economy and above international plane tickets on certain carriers, you can save a lot of money through the IAP. For me it's recently been about 15% on most DL fares, which way more than compensates for the $39 ticketing fee. PTS then becomes your travel agent, which might be a small disadvantage if there are schedule changes, but it's not like an ordinary OLTA.

#7

Join Date: Jul 2011

Location: SF Bay Area

Programs: UA MileagePlus (Premier Gold); Hilton HHonors (Gold); Chase Ultimate Rewards; Amex Plat

Posts: 6,675

I have both the Amex Plat and the CSR. The negatives of the Plat are:

- Its Priority Pass cannot be used at restaurants

- Airline credits are annoying to use and get more annoying every year. I used to contribute to my own United gift registry, but United killed that (although that's irrelevant now because last Friday they made changes to MileagePlus Premier qualification that have killed me as a customer too). This year, since there was no United registry, I bought Southwest gift cards. But that option disappeared in July (no longer works). There are still ways around it, like buying a Southwest flight that costs < $100, canceling it, and using the credit for another flight, but see the first sentence. It's annoying.

- The Uber credits are annoying. I burn them on UberEats pickup orders. But since they are doled out in $15 increments per month, with $35 in December, and are use it within the month or lose it, I have to place an UberEats order EVERY single month.

- The Saks Fifth Avenue credits: I have a collection of 3 (and growing) $50 Saks GCs bought at Saks stores. At some point, I'll burn them on a kitchen appliance on their website or something, but it's annoying as hell to have to trek over to Saks every 6 months to use this.

The CSR on the other hand is a card where the benefits are easy to use and one does not have to jump through hoops to use them. Simply charge $300 worth of travel to it every year and you're done. Doesn't matter what vendor, what airline, what hotel, etc.

On the plus side for the Platinum, the Centurion lounges are much nicer than most Priority Pass lounges (if there is one where you travel) and you can get 3 AU cards, all with identical benefits for just $175. So essentially, I play the game of trying to recover the benefits and everyone else in my family gets Amex Platinum benefits for pretty cheap.

- Its Priority Pass cannot be used at restaurants

- Airline credits are annoying to use and get more annoying every year. I used to contribute to my own United gift registry, but United killed that (although that's irrelevant now because last Friday they made changes to MileagePlus Premier qualification that have killed me as a customer too). This year, since there was no United registry, I bought Southwest gift cards. But that option disappeared in July (no longer works). There are still ways around it, like buying a Southwest flight that costs < $100, canceling it, and using the credit for another flight, but see the first sentence. It's annoying.

- The Uber credits are annoying. I burn them on UberEats pickup orders. But since they are doled out in $15 increments per month, with $35 in December, and are use it within the month or lose it, I have to place an UberEats order EVERY single month.

- The Saks Fifth Avenue credits: I have a collection of 3 (and growing) $50 Saks GCs bought at Saks stores. At some point, I'll burn them on a kitchen appliance on their website or something, but it's annoying as hell to have to trek over to Saks every 6 months to use this.

The CSR on the other hand is a card where the benefits are easy to use and one does not have to jump through hoops to use them. Simply charge $300 worth of travel to it every year and you're done. Doesn't matter what vendor, what airline, what hotel, etc.

On the plus side for the Platinum, the Centurion lounges are much nicer than most Priority Pass lounges (if there is one where you travel) and you can get 3 AU cards, all with identical benefits for just $175. So essentially, I play the game of trying to recover the benefits and everyone else in my family gets Amex Platinum benefits for pretty cheap.

#8

Join Date: Jun 2019

Location: CLT

Programs: AA, Amex

Posts: 419

The negatives are the annual fee and acceptance wherever you're traveling. IMO I think you just have to run the numbers for yourself, what a typical year looks like for spending, how you're most likely to redeem reward points, if you can take advantage of the included benefits, etc.

As far as the included (read: pre-paid) benefits, I get maybe a couple hundred bucks back. I don't really shop at Saks, but hell I'll cash in a $50 credit on a couple 2 packs of basic tee shirts that I always seem to need or go through. Uber here and there. Airline credit cashed in on 500 mile upgrades on AA. Food and drinks at Centurion lounges a few times a year. Some nice hotel upgrades. Global Entry reimbursement once every however many years if that's not included on your other cards.

I think the worst possible use case would be for general everyday spending (e.g. groceries, gas, restaurants, Amazon) and then redeeming for something that's 1 cent per point. Measly 1% "cash back" in value which you can get on cards with no AF!

On the other hand, the best possible use case would be to use it almost exclusively for flights and hotels and redeem at, well, the highest rate you can. Can get some really good return rates depending on the partner. Thinking I should be well into the double digit range for a percentage return on a reward flight I book next year.

In short - best if you're spending at least several thousand a year on flights and hotels, and better off using other card(s) for other expenses.

As far as the included (read: pre-paid) benefits, I get maybe a couple hundred bucks back. I don't really shop at Saks, but hell I'll cash in a $50 credit on a couple 2 packs of basic tee shirts that I always seem to need or go through. Uber here and there. Airline credit cashed in on 500 mile upgrades on AA. Food and drinks at Centurion lounges a few times a year. Some nice hotel upgrades. Global Entry reimbursement once every however many years if that's not included on your other cards.

I think the worst possible use case would be for general everyday spending (e.g. groceries, gas, restaurants, Amazon) and then redeeming for something that's 1 cent per point. Measly 1% "cash back" in value which you can get on cards with no AF!

On the other hand, the best possible use case would be to use it almost exclusively for flights and hotels and redeem at, well, the highest rate you can. Can get some really good return rates depending on the partner. Thinking I should be well into the double digit range for a percentage return on a reward flight I book next year.

In short - best if you're spending at least several thousand a year on flights and hotels, and better off using other card(s) for other expenses.

#9

Join Date: Mar 2005

Location: CLT

Programs: AA EP, AA AC

Posts: 4,268

The negatives are the annual fee and acceptance wherever you're traveling. IMO I think you just have to run the numbers for yourself, what a typical year looks like for spending, how you're most likely to redeem reward points, if you can take advantage of the included benefits, etc.

As far as the included (read: pre-paid) benefits, I get maybe a couple hundred bucks back. I don't really shop at Saks, but hell I'll cash in a $50 credit on a couple 2 packs of basic tee shirts that I always seem to need or go through. Uber here and there. Airline credit cashed in on 500 mile upgrades on AA. Food and drinks at Centurion lounges a few times a year. Some nice hotel upgrades. Global Entry reimbursement once every however many years if that's not included on your other cards.

I think the worst possible use case would be for general everyday spending (e.g. groceries, gas, restaurants, Amazon) and then redeeming for something that's 1 cent per point. Measly 1% "cash back" in value which you can get on cards with no AF!

On the other hand, the best possible use case would be to use it almost exclusively for flights and hotels and redeem at, well, the highest rate you can. Can get some really good return rates depending on the partner. Thinking I should be well into the double digit range for a percentage return on a reward flight I book next year.

In short - best if you're spending at least several thousand a year on flights and hotels, and better off using other card(s) for other expenses.

As far as the included (read: pre-paid) benefits, I get maybe a couple hundred bucks back. I don't really shop at Saks, but hell I'll cash in a $50 credit on a couple 2 packs of basic tee shirts that I always seem to need or go through. Uber here and there. Airline credit cashed in on 500 mile upgrades on AA. Food and drinks at Centurion lounges a few times a year. Some nice hotel upgrades. Global Entry reimbursement once every however many years if that's not included on your other cards.

I think the worst possible use case would be for general everyday spending (e.g. groceries, gas, restaurants, Amazon) and then redeeming for something that's 1 cent per point. Measly 1% "cash back" in value which you can get on cards with no AF!

On the other hand, the best possible use case would be to use it almost exclusively for flights and hotels and redeem at, well, the highest rate you can. Can get some really good return rates depending on the partner. Thinking I should be well into the double digit range for a percentage return on a reward flight I book next year.

In short - best if you're spending at least several thousand a year on flights and hotels, and better off using other card(s) for other expenses.

Safe Travels

#10

Join Date: Jul 2014

Location: Western US

Programs: Costco Executive Member, Amazon Optimus Prime

Posts: 1,251

For those who might be eligible for the Schwab Amex Plat - which has various levels of reduced fees - it is pretty attractive and a better value proposition as a keeper IMO.

I downgraded my CSR to a CF, since I have other Visa Infinite cards whose benefits packages I like better.

Also, as others have noted, you can't really get by with only an Amex card, even in a major US metro area. Far too many places just won't accept Amex, and that has been a concern as long as I've been brandishing plastic (now metal)

I downgraded my CSR to a CF, since I have other Visa Infinite cards whose benefits packages I like better.

Also, as others have noted, you can't really get by with only an Amex card, even in a major US metro area. Far too many places just won't accept Amex, and that has been a concern as long as I've been brandishing plastic (now metal)

#11

Join Date: Apr 2002

Location: Atlanta Metro

Programs: DL , AC, BA, Hhonors Diamond, IH Platinum, Bonvoy Gold, Hyatt Discoverist

Posts: 2,354

If you're flying DL a lot and are not Diamond, the Platinum Skyclub access is an awesome benefit.

Don't underestimate the CSR travel site redemption. Great deals there, usually better than transferring to travel partners. (And you'll earn more miles for those flights.)

Don't underestimate the CSR travel site redemption. Great deals there, usually better than transferring to travel partners. (And you'll earn more miles for those flights.)

#12

A FlyerTalk Posting Legend

Join Date: Sep 2009

Location: Minneapolis: DL DM charter 2.3MM

Programs: A3*Gold, SPG Plat, HyattDiamond, MarriottPP, LHW exAccess, ICI, Raffles Amb, NW PE MM, TWA Gold MM

Posts: 100,404

If you're flying DL a lot and are not Diamond, the Platinum Skyclub access is an awesome benefit.

Don't underestimate the CSR travel site redemption. Great deals there, usually better than transferring to travel partners. (And you'll earn more miles for those flights.)

Don't underestimate the CSR travel site redemption. Great deals there, usually better than transferring to travel partners. (And you'll earn more miles for those flights.)

#13

Join Date: Oct 2019

Location: PDX, OGG or between the two

Programs: AS 75K

Posts: 2,864

The lack of acceptance is a deal breaker for me with Amex. I just signed up for CSR and so far it's working well. One potential additional benefit I found was transferring points from other Chase cards and getting the 1.5X on travel redemption through the Chase Rewards site (which is essentially Expedia). So, I use a Chase card for my business that gets 5X points on telephone, office supply stores and cable TV then xfer those points over to the CSR so I'm essentially getting 7.5% on a few categories that I use a lot for my business. Same card gives me 2X on fuel so with the 1.5X I'm getting 3X total on fuel which in my company is quite a chunk.

Sorry for the wandering answer but again, I just can't see dealing with Amex when Visa is so widely accepted.

Sorry for the wandering answer but again, I just can't see dealing with Amex when Visa is so widely accepted.

#14

Join Date: Jul 2011

Location: SF Bay Area

Programs: UA MileagePlus (Premier Gold); Hilton HHonors (Gold); Chase Ultimate Rewards; Amex Plat

Posts: 6,675

#15

A FlyerTalk Posting Legend

Join Date: Sep 2009

Location: Minneapolis: DL DM charter 2.3MM

Programs: A3*Gold, SPG Plat, HyattDiamond, MarriottPP, LHW exAccess, ICI, Raffles Amb, NW PE MM, TWA Gold MM

Posts: 100,404

I don't know whether it's still true, but at one time Niemann Marcus accepted only AmEx cards in their stores.