Last edit by: ericdabbs

Updated Dec-2023 (Plastiq Policy URL links do not work when clicked directly from FT. Copy links to address bar to view)

Visa Card Policy

https://support.plastiq.com/s/article/Visa-Card-Policy

American Express Card Policy

https://support.plastiq.com/s/article/American-Express-Card-Policy

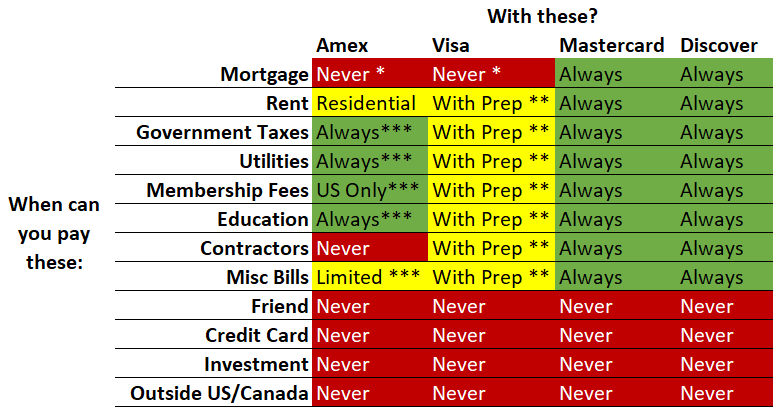

Summary of Supported Payments by Card Brand

https://support.plastiq.com/s/article/supported-payments-by-card-brand

Official word from Plastiq regarding Visa Business cards that was asked which was previously thought it applied to only Visa Personal cards

Plastiq is unable to support mortgage payments on any Visa credit cards. This is an industry-wide mandate that affects all third-party bill payment services. Please note that mortgage payments are also unsupported for credit cards issued by U.S. Bank or Capital One and AMEX.

Plastiq Fees:

Standard Plastiq card payment processing fee is 2.9%. This puts most of the credit cards out of the reward range. Plastiq turns itself into a niche position to earn new card bonus or status threshold. Some CCs may still work.

It makes most of the reward programs not profitable. Use Plastiq to meet welcome bonus spending requirement or to meet certain spend requirements to reach elite status or for large spend bonus. Also take advantage of Plastiq referrals and promotions.

Delivery Fees (The Plastiq Ch. 11 restructure now added some delivery fees):

ACH/EFT/Electronic $0.99

Paper Check $1.49

Wire Transfer: Domestic/International $8.99/$39

This is the thread for 2018 and forward. The previous discussion can be found here.

Updated Nov-2018: A lot of the personal Visa CCs can't be used at Plastiq. Some will be treated as cash advance and won't receive any rewards. Only Capital One personal Visa CCs are not affected. Business Visa CCs are still good. The best CCs are Mastercard and Discover. AmEx CCs can still be used, but not on many of the payment types. Chase personal Visa cards are limited to the cash advance limit (typically 20% of CL). The details are listed as below:

Plastiq Referrals:

Standard Referral: When you refer your friend to Plastiq, after your friend charges $500 or more, your friend will get$500 ($0?) FFDs (fee free dollar) and you'll receive $1,000 ($100) FFDs to spend.

All personal prepaid Gift Cards (GCs) are disallowed. Not sure what "business" gift card can be used.

Successful Credit Cards Used (Posted as Purchase, Visa info outdated)

Note that Plastiq no longer accepts American Express for any transactions as of 2/10/23.

Amex Blue Business Plus

Amex Open SPG Business

AMEX SPG (non-business)

AMEX Delta business

AMEX business platinum and business gold (Canadian)

BofA - Amtrak World MC

BofA - Business Advantage Travel Rewards MC

BofA - Virgin Atlantic MC

Barclaycard Aviator Red/Silver MC

Barclaycard Arrival World MC

Chase Ink Cash Visa

Chase Ink Plus Visa

Chase Ink Preferred Visa

Chase Hyatt Visa (x2)

Chase BA Visa

Chase United MileagePlus Explorer

Chase United MileagePlus Club

Chase Sapphire Preferred (should give 2x, similar to CSR -- probably expired as of 6/5/17)

Chase Sapphire Reserve (3x, coded as travel -- this appears to have expired as of 6/5/17)

Citi Prestige MC

Citi Premier MC

Citi AT&T Access More MC (3x for rent category, misc. government services)

Citi AA Platinum MC

FIA Fidelity Mastercard

US Bank Altitude Reserve Visa

Successful Payees:

AAA (Socal, Santa Ana) insurance: Electronic payment: Processed 5/21 (Sunday), Complete 5/23, Arrived-Posted 5/26

ACS: took about 2 weeks to post

BMW Financial: Processed 10/13, Sent 10/14, Arrived-Posted 10/19

Caliber Home Loans: Processed 12/09, Sent 12/11, Arrived-Posted 12/18

Cedent mortgage

Chase Mortgage (sends check): 2 week turnaround

Citi Mortgage: Electronic - less than 1 week turnaround as of May 2017

Citizen's Auto Finance - Around 1 week.

CRA Personal Tax & GST/HST remittances

Firstmark Services (student loan, electronically remitted)

Fidelity Bank (Mortgage) https://www.fidelitybank.com/ks/Home.aspx

Flagstar Bank (Mortgage), electronic payment, posts in 2-3 days.

George Mason University: Over a week and a half.

Infiniti Financial: Processed 10/13, Sent 10/14, Arrived-Posted 10/21

Lexus Financial. Processed 3/9/16, Posted 3/14/19

Morgan Stanley Home Loans: Processed 01/14, Sent 01/15, Arrived-Posted 01/21

NA Shade & Associates LLC

National Grid Electric MA: 1 week turnaround

National Grid Gas MA: 3 week turnaround, sends physical check

Nationstar Mortgage, electionic payment, post in 2-3 days.

New York Community Bank (NYCB) Mortgage: check mailed by Plastiq 4/27, posted 5/1.

NewRez Mortgage, Sent 9/20 Arrived 9/30

"NJ City" Tax: Processed 01/21, Sent 01/22, Arrived-Posted 02/01

Penfed Mortgage: 1 week turnaround

PennyMac Mortgage: 1-1.5wk turnaround

SCE (So Cal Edison)

SoCal gas

TCF Mortgage: 1.5 week turnaround

TD Bank Mortgage (EFT)

Toyota Financial

Wawanesa USA Insurance

Wells Fargo Mortgage: Processed 10/8, Sent 10/9, Arrived-Posted 10/16

Wells Fargo Mortgage: Processed 8/6, Sent 8/9, Posted 8/16

Restrictions:

New VISA payments are not being accepted for mortgages.

*Visa Gift Card by Blackhawk does not seem to be working

Visa Card Policy

https://support.plastiq.com/s/article/Visa-Card-Policy

American Express Card Policy

https://support.plastiq.com/s/article/American-Express-Card-Policy

Summary of Supported Payments by Card Brand

https://support.plastiq.com/s/article/supported-payments-by-card-brand

Official word from Plastiq regarding Visa Business cards that was asked which was previously thought it applied to only Visa Personal cards

Plastiq is unable to support mortgage payments on any Visa credit cards. This is an industry-wide mandate that affects all third-party bill payment services. Please note that mortgage payments are also unsupported for credit cards issued by U.S. Bank or Capital One and AMEX.

Plastiq Fees:

Standard Plastiq card payment processing fee is 2.9%. This puts most of the credit cards out of the reward range. Plastiq turns itself into a niche position to earn new card bonus or status threshold. Some CCs may still work.

It makes most of the reward programs not profitable. Use Plastiq to meet welcome bonus spending requirement or to meet certain spend requirements to reach elite status or for large spend bonus. Also take advantage of Plastiq referrals and promotions.

Delivery Fees (The Plastiq Ch. 11 restructure now added some delivery fees):

ACH/EFT/Electronic $0.99

Paper Check $1.49

Wire Transfer: Domestic/International $8.99/$39

This is the thread for 2018 and forward. The previous discussion can be found here.

Updated Nov-2018: A lot of the personal Visa CCs can't be used at Plastiq. Some will be treated as cash advance and won't receive any rewards. Only Capital One personal Visa CCs are not affected. Business Visa CCs are still good. The best CCs are Mastercard and Discover. AmEx CCs can still be used, but not on many of the payment types. Chase personal Visa cards are limited to the cash advance limit (typically 20% of CL). The details are listed as below:

Plastiq Referrals:

Standard Referral: When you refer your friend to Plastiq, after your friend charges $500 or more, your friend will get

All personal prepaid Gift Cards (GCs) are disallowed. Not sure what "business" gift card can be used.

Successful Credit Cards Used (Posted as Purchase, Visa info outdated)

Note that Plastiq no longer accepts American Express for any transactions as of 2/10/23.

Amex Blue Business Plus

Amex Open SPG Business

AMEX SPG (non-business)

AMEX Delta business

AMEX business platinum and business gold (Canadian)

BofA - Amtrak World MC

BofA - Business Advantage Travel Rewards MC

BofA - Virgin Atlantic MC

Barclaycard Aviator Red/Silver MC

Barclaycard Arrival World MC

Chase Ink Cash Visa

Chase Ink Plus Visa

Chase Ink Preferred Visa

Chase Hyatt Visa (x2)

Chase BA Visa

Chase United MileagePlus Explorer

Chase United MileagePlus Club

Chase Sapphire Preferred (should give 2x, similar to CSR -- probably expired as of 6/5/17)

Chase Sapphire Reserve (3x, coded as travel -- this appears to have expired as of 6/5/17)

Citi Prestige MC

Citi Premier MC

Citi AT&T Access More MC (3x for rent category, misc. government services)

Citi AA Platinum MC

FIA Fidelity Mastercard

US Bank Altitude Reserve Visa

Successful Payees:

AAA (Socal, Santa Ana) insurance: Electronic payment: Processed 5/21 (Sunday), Complete 5/23, Arrived-Posted 5/26

ACS: took about 2 weeks to post

BMW Financial: Processed 10/13, Sent 10/14, Arrived-Posted 10/19

Caliber Home Loans: Processed 12/09, Sent 12/11, Arrived-Posted 12/18

Cedent mortgage

Chase Mortgage (sends check): 2 week turnaround

Citi Mortgage: Electronic - less than 1 week turnaround as of May 2017

Citizen's Auto Finance - Around 1 week.

CRA Personal Tax & GST/HST remittances

Firstmark Services (student loan, electronically remitted)

Fidelity Bank (Mortgage) https://www.fidelitybank.com/ks/Home.aspx

Flagstar Bank (Mortgage), electronic payment, posts in 2-3 days.

George Mason University: Over a week and a half.

Infiniti Financial: Processed 10/13, Sent 10/14, Arrived-Posted 10/21

Lexus Financial. Processed 3/9/16, Posted 3/14/19

Morgan Stanley Home Loans: Processed 01/14, Sent 01/15, Arrived-Posted 01/21

NA Shade & Associates LLC

National Grid Electric MA: 1 week turnaround

National Grid Gas MA: 3 week turnaround, sends physical check

Nationstar Mortgage, electionic payment, post in 2-3 days.

New York Community Bank (NYCB) Mortgage: check mailed by Plastiq 4/27, posted 5/1.

NewRez Mortgage, Sent 9/20 Arrived 9/30

"NJ City" Tax: Processed 01/21, Sent 01/22, Arrived-Posted 02/01

Penfed Mortgage: 1 week turnaround

PennyMac Mortgage: 1-1.5wk turnaround

SCE (So Cal Edison)

SoCal gas

TCF Mortgage: 1.5 week turnaround

TD Bank Mortgage (EFT)

Toyota Financial

Wawanesa USA Insurance

Wells Fargo Mortgage: Processed 10/8, Sent 10/9, Arrived-Posted 10/16

Wells Fargo Mortgage: Processed 8/6, Sent 8/9, Posted 8/16

Restrictions:

New VISA payments are not being accepted for mortgages.

*Visa Gift Card by Blackhawk does not seem to be working

Plastiq for rent, tuition, utilities, etc.(2018 onwards)

#76

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,932

Speculation:

Perhaps they simply chose the categories they wanted, and didn't give much though to the others?

Or perhaps they'd had some negative experiences with fraud with the contractor category that they didn't have with membership fees, for example? (Membership Fees are most likely to go to payees already in Plastiq's verified system, and that Amex can probably look up and verify is legitimate, but contractors are likely to often go to a "contractor" that Plastiq has never heard of and that Amex has a hard time verifying.

Keep in mihd that of the 4 networks listed above, only Amex and Discover are mostly issued by one bank each. (The other two are issued by zillions of banks each.) So Amex and Discover presumably made their decisions at the bank level, while MC and Visa had to be at the network level.

And that while Chase's or BofA's opinions about categories might not have factored into Visa, Amex-the-bank's opinions about categories likely factored into Amex the network. And Amex-the-bank is at the forefront of banks excluding certain "smells like money equivalents" merchants (or in this case categories) from earning points. So I see Amex-the-network limiting the categories in Plastiq as being rather similar to Amex-the-bank excluding Simon's Mall purchases from qualifying for any points earning / bonuses.

Last edited by sdsearch; Mar 28, 2018 at 3:04 pm

#77

Join Date: Aug 2017

Posts: 106

#78

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,932

#79

Join Date: Dec 2004

Location: SFO

Programs: BART Platinum, AA Plat Pro

Posts: 1,158

The rumored Barclays Arrival Premier MC is potentially interesting in conjunction with Plastiq, since it purportedly earns 2x on all purchases plus a 15k (25k) bonus for hitting $15k ($25k) total spend in a year. That effectively makes it a 3x everywhere card, albeit with a $150 AF, and we're not yet sure what the transfer partners are (probably won't be as wide a range as the big players like Chase, AmEx, and Citi). Arguably not as good as AmEx BBP after you account for the AF and likely weaker transfer partners, but if it's a MC you'll be able to use it for a lot more payees than AmEx currently works for.

#81

Join Date: Jul 2014

Posts: 3,688

check recent reports on DOC and reddit that says funding bank accounts (BMO included ) with AXP has been shut down by the rats. IOW, it doesn't work to meet MSR for ANY AXP CC. you can still try it and report if your experience is different.

#82

Join Date: Aug 2017

Posts: 106

As per Doc, it won't be available for PC initially: https://www.doctorofcredit.com/rumor...ival-premiere/

#83

Join Date: Sep 2015

Posts: 575

Here's the actual list from an earlier post in this thread:

As to why, I doubt anyone "knows", we can only "speculate".

Speculation:

Perhaps they simply chose the categories they wanted, and didn't give much though to the others?

Or perhaps they'd had some negative experiences with fraud with the contractor category that they didn't have with membership fees, for example? (Membership Fees are most likely to go to payees already in Plastiq's verified system, and that Amex can probably look up and verify is legitimate, but contractors are likely to often go to a "contractor" that Plastiq has never heard of and that Amex has a hard time verifying.

Keep in mihd that of the 4 networks listed above, only Amex and Discover are mostly issued by one bank each. (The other two are issued by zillions of banks each.) So Amex and Discover presumably made their decisions at the bank level, while MC and Visa had to be at the network level.

And that while Chase's or BofA's opinions about categories might not have factored into Visa, Amex-the-bank's opinions about categories likely factored into Amex the network. And Amex-the-bank is at the forefront of banks excluding certain "smells like money equivalents" merchants (or in this case categories) from earning points. So I see Amex-the-network limiting the categories in Plastiq as being rather similar to Amex-the-bank excluding Simon's Mall purchases from qualifying for any points earning / bonuses.

As to why, I doubt anyone "knows", we can only "speculate".

Speculation:

Perhaps they simply chose the categories they wanted, and didn't give much though to the others?

Or perhaps they'd had some negative experiences with fraud with the contractor category that they didn't have with membership fees, for example? (Membership Fees are most likely to go to payees already in Plastiq's verified system, and that Amex can probably look up and verify is legitimate, but contractors are likely to often go to a "contractor" that Plastiq has never heard of and that Amex has a hard time verifying.

Keep in mihd that of the 4 networks listed above, only Amex and Discover are mostly issued by one bank each. (The other two are issued by zillions of banks each.) So Amex and Discover presumably made their decisions at the bank level, while MC and Visa had to be at the network level.

And that while Chase's or BofA's opinions about categories might not have factored into Visa, Amex-the-bank's opinions about categories likely factored into Amex the network. And Amex-the-bank is at the forefront of banks excluding certain "smells like money equivalents" merchants (or in this case categories) from earning points. So I see Amex-the-network limiting the categories in Plastiq as being rather similar to Amex-the-bank excluding Simon's Mall purchases from qualifying for any points earning / bonuses.

#84

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,932

Well, assuming the contractor doesn't charge you anything near 2.5% for paying with an Amex, you should always check whether you can pay them directly, because you have to pay a 2.5% fee when paying through Plastiq. So IMHO it doesn't make sense to use Plastiq if you can pay someone directly, as they rarely require that high a fee for using a credit card (if any fee at all). Plus the payment tends to be faster going direct (if Plastiq doesn't know how to pay the contractor electronically, which they don't tend to if you they didn't know about the contractor until you told them, they send a check by snail mail!).

#85

Join Date: Sep 2015

Posts: 575

Well, assuming the contractor doesn't charge you anything near 2.5% for paying with an Amex, you should always check whether you can pay them directly, because you have to pay a 2.5% fee when paying through Plastiq. So IMHO it doesn't make sense to use Plastiq if you can pay someone directly, as they rarely require that high a fee for using a credit card (if any fee at all). Plus the payment tends to be faster going direct (if Plastiq doesn't know how to pay the contractor electronically, which they don't tend to if you they didn't know about the contractor until you told them, they send a check by snail mail!).

#86

Join Date: Sep 2011

Location: SNA

Programs: AA EXP, Hilton Diamond, Hyatt Globalist, IHG Plat, Marriott Gold, National EE

Posts: 1,204

Unfortunately I have been quoted anywhere up to 5% by our business's vendors when trying to pay via credit card, or just outright refused. Obviously free is better, but Plastiq serves a useful niche for our payables.

#88

#89

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,932

#90