Last edit by: radonc1

As of 9/18/21: WM loads are no longer free. WM will charge each load (no matter what the size) $3.74 in addition to the money being deposited into your Go Bank account.

GoBank fees and limits:

Cash deposits are limited to $2,500 per day and $3,000 per 30 days, subject to a maximum account balance of $50,000.

The monthly fee will accumulate if the account is dormant. You must call the phone number on the back to close the account.

5/29/19 - There may be a difference in which card gets free loads at WM. Getting the card online through GoBank.com sends out a Visa version. This card may not allow free loads at WM. Reports are that getting the card directly at WM will result in free loads. If anyone can confirm this, please do so.

-----------------------------

Shut down reports:

Please list your load/spend/billpay details (in a single statement/lifetime?) e.g.,

type of load, number of loads, denomination of your gc or mp, amount of your billpay, any actual swipe/dd?

lad2 (closed) - May: $2.7K 9 loads 5DDs - June: $5.5K 5 loads 6DDs - July: $4.6K 6 loads 1DD - August $9.9K 19 loads 1DD - no swipes

TheDapperDon (open) June $4.5k 5 loads. All GCs. 1 swipe. Everything else BP to CC. 1500 most loaded in one day .July - $3489 5 loads. All GCs. Several swipes. No load until below $20 or so remaining.

raghu455 (closed) May $2k 4 loads, june $7k all GCs. All BP to CC.

drdrew450 (closed) 17K in loads, unloaded all through bill pay, less than a month

cuebert (closed) $4.5k in 9 MP loads, BP out. That was fast.

sgideons (closed) May $7k 17 loads, june $17k 27 loads, july $5k 6 loads, september $3.5k 4 loads. Unloaded 90% ACH pull, 5% PP to self, 5% bill pay tool. Closed on September statement date.

MDWCommuter (closed): June only, $8k in 60 loads, all GC. $2k is most loaded in one day. Wrote 2 BP to CC checks, no ATM, no MP loads, no ACH pull, no DD, always carried at least a $1k balance

ArtemK (closed): 1st month - 5/21 - 6/21 - loaded $6,700, 6/21 - 6/30 - $4K loaded, all via GCs. Unloaded all via BP to Citi and Chase. No ATM, no MP loads, no ACH pull, no DD, no swipes.

rdover1 (Closed): 1st month - $23.6k loaded (WM GC), ~$1k spend, rest bill pay (mostly to CC)

rdover1 2nd card (closed): Closed mid cycle, survived 1st month. No bill pay, only MO. Never loaded over ~$4k. Total activity ~$12k.

T3pleShot (closed): 7k in loads at WMT, 10 loads, mostly $500, some $200, $4k billpay to CC, 5 swipes totaling about $25.

ctbarron (open): Month1 - $3.8k loaded, all bill pay out, 1 swipe; Month2 - $3.7k loaded, all bill pay out, few swipes and an ATM WD; Month3 - $4.2k loaded, all bill pay out, few swipes and an ATM WD. Zero membership fee, usually a balance of under $150.

americanindian (closed)- closed after 3 months today. had about 7.5k deposit each month, with lots of small value(<$20) purchases each month. liquidated mostly using bill pay.

rodsren (closed)- the dapperdon warned me. I was closed today after less than 5,500 or loaaing in less than 3 weeks (was going to try to keep it to 7,500 - 10,000 but didn't luck out.)

binnycode (closed, re-opened) - 7x $200 loads + 1x $700 load + 3x $500 over 2 days got me shut down. Called CSR and they re-opened my account, letting me know that "direct deposit would reduce my number of trips to walmart" lol!

tarcapone (open) old version opened October 2014 still alive February 2016. Load $1k/week ($4-$5K per month) nearly every Monday morning. Bill pay out large chunks to Credit cards. (Open) new version Opened November 2015 load $1K per week, but skipping a week each month. Bill pay out large chunks. My $1K/week is always one transaction (2x$500GC).

GoBank fees and limits:

Cash deposits are limited to $2,500 per day and $3,000 per 30 days, subject to a maximum account balance of $50,000.

- Sign up online & through the GoBank app FREE

- Sign up with a starter kit from participating retail stores Purchase a starter kit at a participating retail location ($2.95 or less) + start your account for as little as $20, up to $500

- Monthly Membership FREE in any month that you make qualifying direct deposits totaling at least $500. Otherwise, $8.95 per month. For more details on the Monthly Membership fee

Keep in mind the maximum number of swipes for payment when loading prepaid reloadables including GoBank is THREE. Swiping the prepaid card is considered as FIRST swipe so it leaves you with THREE remaining swipes so plan accordingly.

The monthly fee will accumulate if the account is dormant. You must call the phone number on the back to close the account.

5/29/19 - There may be a difference in which card gets free loads at WM. Getting the card online through GoBank.com sends out a Visa version. This card may not allow free loads at WM. Reports are that getting the card directly at WM will result in free loads. If anyone can confirm this, please do so.

-----------------------------

Shut down reports:

Please list your load/spend/billpay details (in a single statement/lifetime?) e.g.,

type of load, number of loads, denomination of your gc or mp, amount of your billpay, any actual swipe/dd?

lad2 (closed) - May: $2.7K 9 loads 5DDs - June: $5.5K 5 loads 6DDs - July: $4.6K 6 loads 1DD - August $9.9K 19 loads 1DD - no swipes

TheDapperDon (open) June $4.5k 5 loads. All GCs. 1 swipe. Everything else BP to CC. 1500 most loaded in one day .July - $3489 5 loads. All GCs. Several swipes. No load until below $20 or so remaining.

raghu455 (closed) May $2k 4 loads, june $7k all GCs. All BP to CC.

drdrew450 (closed) 17K in loads, unloaded all through bill pay, less than a month

cuebert (closed) $4.5k in 9 MP loads, BP out. That was fast.

sgideons (closed) May $7k 17 loads, june $17k 27 loads, july $5k 6 loads, september $3.5k 4 loads. Unloaded 90% ACH pull, 5% PP to self, 5% bill pay tool. Closed on September statement date.

MDWCommuter (closed): June only, $8k in 60 loads, all GC. $2k is most loaded in one day. Wrote 2 BP to CC checks, no ATM, no MP loads, no ACH pull, no DD, always carried at least a $1k balance

ArtemK (closed): 1st month - 5/21 - 6/21 - loaded $6,700, 6/21 - 6/30 - $4K loaded, all via GCs. Unloaded all via BP to Citi and Chase. No ATM, no MP loads, no ACH pull, no DD, no swipes.

rdover1 (Closed): 1st month - $23.6k loaded (WM GC), ~$1k spend, rest bill pay (mostly to CC)

rdover1 2nd card (closed): Closed mid cycle, survived 1st month. No bill pay, only MO. Never loaded over ~$4k. Total activity ~$12k.

T3pleShot (closed): 7k in loads at WMT, 10 loads, mostly $500, some $200, $4k billpay to CC, 5 swipes totaling about $25.

ctbarron (open): Month1 - $3.8k loaded, all bill pay out, 1 swipe; Month2 - $3.7k loaded, all bill pay out, few swipes and an ATM WD; Month3 - $4.2k loaded, all bill pay out, few swipes and an ATM WD. Zero membership fee, usually a balance of under $150.

americanindian (closed)- closed after 3 months today. had about 7.5k deposit each month, with lots of small value(<$20) purchases each month. liquidated mostly using bill pay.

rodsren (closed)- the dapperdon warned me. I was closed today after less than 5,500 or loaaing in less than 3 weeks (was going to try to keep it to 7,500 - 10,000 but didn't luck out.)

binnycode (closed, re-opened) - 7x $200 loads + 1x $700 load + 3x $500 over 2 days got me shut down. Called CSR and they re-opened my account, letting me know that "direct deposit would reduce my number of trips to walmart" lol!

tarcapone (open) old version opened October 2014 still alive February 2016. Load $1k/week ($4-$5K per month) nearly every Monday morning. Bill pay out large chunks to Credit cards. (Open) new version Opened November 2015 load $1K per week, but skipping a week each month. Bill pay out large chunks. My $1K/week is always one transaction (2x$500GC).

Gobank by Greendot - online banking with debit card(2016 onwards)

#1396

Join Date: Dec 2020

Programs: Delta Diamond (MM) | Hertz President's Circle

Posts: 158

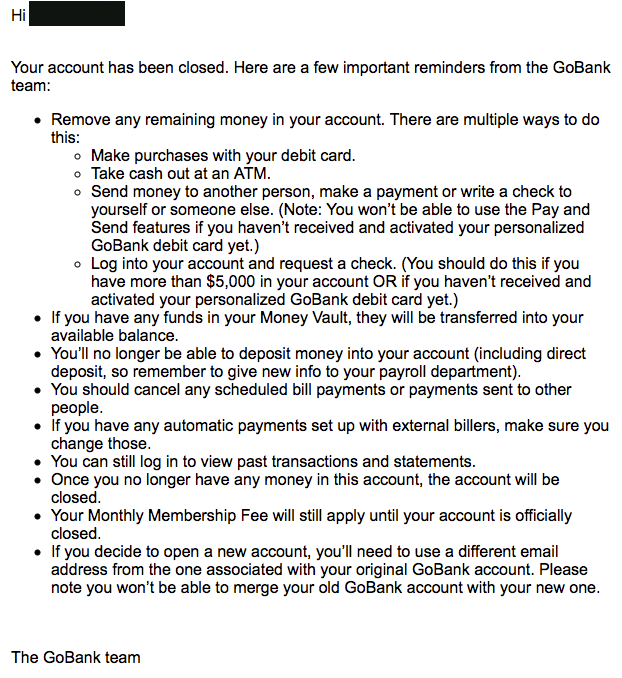

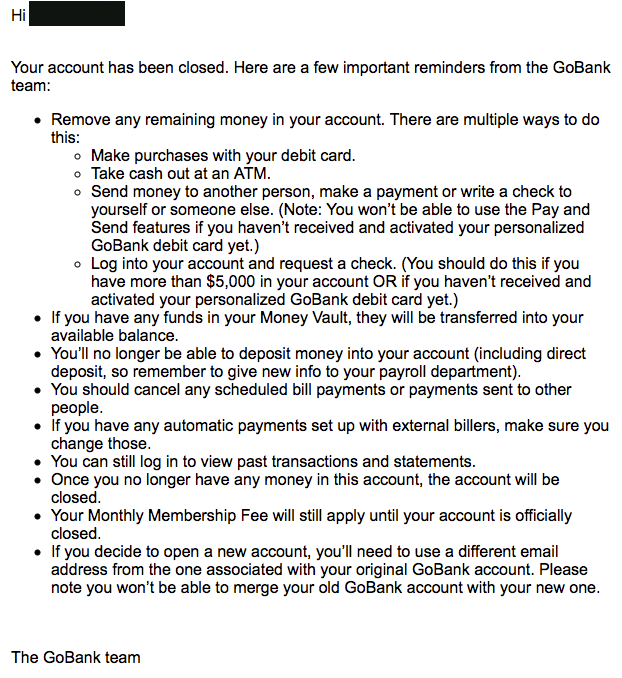

That is NOT a shutdown letter. I've attached what a shutdown letter looks like, below.

This email is timed with the expiry of my GoBank Card expiration date and the invitation to move to their newer product is not consistent with being shutdown. Once you are shutdown, you generally lose all other GreenDot Bank products you currently have and cannot apply for new ones. Including the syntax that I'm a "loyal customer" and inviting me to open a Go2bank account would not be part of a shutdown letter.

Additionally, you can see where they insert the date for these form letters in bold and a slightly different position. I believe this to be where they insert the appropriate 'last-day-of-the-month' date to correspond with when your card expires.

-b.

This email is timed with the expiry of my GoBank Card expiration date and the invitation to move to their newer product is not consistent with being shutdown. Once you are shutdown, you generally lose all other GreenDot Bank products you currently have and cannot apply for new ones. Including the syntax that I'm a "loyal customer" and inviting me to open a Go2bank account would not be part of a shutdown letter.

Additionally, you can see where they insert the date for these form letters in bold and a slightly different position. I believe this to be where they insert the appropriate 'last-day-of-the-month' date to correspond with when your card expires.

-b.

That definitely is a shut down letter.

Have you done things that may have caused Go to shut you down?

I have looked at all my emails and don't have anything like that email that you received.

More importantly, has anyone else received this type of letter. Further DPs would be helpful. (Reddit included)

Have you done things that may have caused Go to shut you down?

I have looked at all my emails and don't have anything like that email that you received.

More importantly, has anyone else received this type of letter. Further DPs would be helpful. (Reddit included)

Last edited by Carrisco; Aug 18, 2021 at 8:34 pm

#1397

Join Date: Dec 2020

Programs: Delta Diamond (MM) | Hertz President's Circle

Posts: 158

When does P2 and P3's debit cards expire? Based on how the date was inserted into my letter, I believe they are just closing accounts and transitioning customers over to Go2bank as the original cards expire...

-b.

-b.

#1398

Join Date: Aug 2015

Posts: 2,061

damn, 1 will expy 11/21; as so, that acct could likely receive a notif next mo

#1400

Join Date: Dec 2020

Programs: Delta Diamond (MM) | Hertz President's Circle

Posts: 158

Bingo.

As far as the date, the way it was in bold and in a different position was peculiar but it does appear to be a static date for all, afterall.

-b.

As far as the date, the way it was in bold and in a different position was peculiar but it does appear to be a static date for all, afterall.

-b.

#1401

Join Date: Mar 2005

Programs: Continental Onepass, Hilton, Marriott, USAir and now UA

Posts: 6,437

So that means that I have to change my DD to the new account (another PIA

) and determine most importantly whether I will still be able to do fee free deposits using VGCs at WM.

) and determine most importantly whether I will still be able to do fee free deposits using VGCs at WM.I have not seen any indication that will be a possibility, but DPs would be hugely appreciated.

#1402

Join Date: Dec 2020

Programs: Delta Diamond (MM) | Hertz President's Circle

Posts: 158

BB VISA is what I'm using at the moment — it's fee-free and loaded via 70-action (which isn't strictly a MC task). I'm axed from BB AMEX and AMEX Serve and I'm pretty sure I remember you were also.

If you're not axed from GreenDot then Walmart Moneycard and GreenDot Unlimited (assuming that's not also being replaced by Go2bank) are also fee-free options the last time I checked, but you have to use the app-generated barcode for the deposits.

-b.

If you're not axed from GreenDot then Walmart Moneycard and GreenDot Unlimited (assuming that's not also being replaced by Go2bank) are also fee-free options the last time I checked, but you have to use the app-generated barcode for the deposits.

-b.

Mine does not expire until 2024 either. It appears that your take is correct. I suspect that more negative DPs will be arriving any time.

So that means that I have to change my DD to the new account (another PIA ) and determine most importantly whether I will still be able to do fee free deposits using VGCs at WM.

) and determine most importantly whether I will still be able to do fee free deposits using VGCs at WM.

I have not seen any indication that will be a possibility, but DPs would be hugely appreciated.

So that means that I have to change my DD to the new account (another PIA

) and determine most importantly whether I will still be able to do fee free deposits using VGCs at WM.

) and determine most importantly whether I will still be able to do fee free deposits using VGCs at WM.I have not seen any indication that will be a possibility, but DPs would be hugely appreciated.

#1403

Join Date: Dec 2008

Location: DUB-BOS

Programs: various

Posts: 3,689

BB VISA is what I'm using at the moment — it's fee-free and loaded via 70-action (which isn't strictly a MC task). I'm axed from BB AMEX and AMEX Serve and I'm pretty sure I remember you were also.

If you're not axed from GreenDot then Walmart Moneycard and GreenDot Unlimited (assuming that's not also being replaced by Go2bank) are also fee-free options the last time I checked, but you have to use the app-generated barcode for the deposits.

-b.

If you're not axed from GreenDot then Walmart Moneycard and GreenDot Unlimited (assuming that's not also being replaced by Go2bank) are also fee-free options the last time I checked, but you have to use the app-generated barcode for the deposits.

-b.

Shame as it was a good way to get rid of office store 200s, but at least I can use the next 2 months to get rid of some float

What is BB Visa?

Also I was under the impression that GD or WM Moneycard were much more fragile than GoBank with shutdowns being more likely, is this correct?

pm if necessary

#1404

Join Date: Mar 2005

Programs: Continental Onepass, Hilton, Marriott, USAir and now UA

Posts: 6,437

#1405

Join Date: Dec 2008

Location: DUB-BOS

Programs: various

Posts: 3,689

#1406

Join Date: Dec 2020

Programs: Delta Diamond (MM) | Hertz President's Circle

Posts: 158

They're different "supporting" companies (banks), totally. AMEX was the reason we were banned from BB AMEX, not BB itself.

With BB VISA, MB isn't given the 'blacklist" of sorts...

As far as loading BB VISA, I discovered the hard way that you can't directly load subaccounts. I'm sure this is common knowledge among those that are more familiar with the product but I learned the hard way. The weird part was that it actually pulls the value off of the VGC but then refunds it when the load is ultimately rejected.

I don't want to go too far off-topic but keep monthly load totals below $5K and it should be fairly smooth sailing.

-b.

With BB VISA, MB isn't given the 'blacklist" of sorts...

As far as loading BB VISA, I discovered the hard way that you can't directly load subaccounts. I'm sure this is common knowledge among those that are more familiar with the product but I learned the hard way. The weird part was that it actually pulls the value off of the VGC but then refunds it when the load is ultimately rejected.

I don't want to go too far off-topic but keep monthly load totals below $5K and it should be fairly smooth sailing.

-b.

Last edited by Carrisco; Aug 19, 2021 at 11:59 pm

#1407

Join Date: Mar 2005

Programs: Continental Onepass, Hilton, Marriott, USAir and now UA

Posts: 6,437

As far as loading BB VISA, I discovered the hard way that you can't directly load subaccounts. I'm sure this is common knowledge among those that are more familiar with the product but I learned the hard way. The weird part was that it actually pulls the value off of the VGC but then refunds it when the load is ultimately rejected.

I don't want to go too far off-topic but keep monthly load totals below $5K and it should be fairly smooth sailing.

-b.

I don't want to go too far off-topic but keep monthly load totals below $5K and it should be fairly smooth sailing.

-b.

I am far more conservative in my use of this card than you, so if your numbers are ok, then I have nothing to worry about.

#1408

Join Date: Dec 2008

Location: DUB-BOS

Programs: various

Posts: 3,689

So you are saying there are no issues loading the primary BB Visa at WM using Gebits?

The issues only arise if attempting to load sub-accounts or by going too hard on the primary account.

#1409

Join Date: Mar 2005

Programs: Continental Onepass, Hilton, Marriott, USAir and now UA

Posts: 6,437

You cannot load anything onto a sub-account. You can only move money from it's primary account (the one you created it from) to it. However, it works just like a debit card in all other respects, as far as I can tell.

I have no direct knowledge on abuse of an account. I am very conservative with my activities.