MS Through Bitcoin Mining

#1

Original Poster

Join Date: Feb 2013

Posts: 14

MS Through Cloud Bitcoin Mining

Hello everyone, been mostly a lurker on the forums here and finally I may have an idea to contribute to the community after the community had helped me so much. (In fact it was MS that I eventually got into cryptocurrency).

I have an idea that I had been sitting on for a while because I wasn't sure how useful it was. It's not the easiest thing and there's quite some risk involved (as you would've guessed when I mentioned Bitcoin). I can simplify the basic idea down to these steps:

There are risks strewn about from step 1 to step 3.

Step 1 risks are that you need to find a trustworthy cloud miner supplier (please consider using my affiliate link above for this step, I have been a GAW customer for more than 3 months now and they have been great, they are also innovators in cloud mining currently).

Step 2 risks are that Bitcoin price can fluctuate as well as the amount of bitcoin you receive each day. You will also need a safe way to convert bitcoin to USD. I have provided links where one can convert BTC to USD.

Step 3 risks are that you are dependent on the market demand for the price you can sell at. If you were to buy miners at GAW, I suggest buying the ZenHashlet. They have the best returns. Each miner is at 20.95. After daily fees, the daily income is about $0.167 per miner. Currently, estimating a safe sellback price of $18 means you need to mine at least $2.95. So $2.95/$0.167 in about 18 days you should have made back the difference. I prefer to take a very safe approach and assume I need to mine for 30 days instead to make up the difference.

Step 4 is the final liquidation and paying off your credit card after everything is said and done. MS cycle complete.

So estimated MS cycle (somewhat safe estimate) is 30 days. It can be longer and it can very well be shorter, it's part of the risk. I would say because of the delayed and trickle in returns, it's a lot like Kiva. Risky investment wise has a feel of Loyal3 to it.

There are a lot of other nuances where you can improve your returns but I found this to be the simplest.

Again and I can't reiterate this enough. This method is risky. I just wanted to share a somewhat unique idea to people, especially people who may have been interested in Bitcoin.

Please feel free to ask me questions.

edit: This has come up a few times so I'll clarify. The product they sell is a share of a miner that is hosted by them. Any horror stories you may have heard of spending a lot of money to buy hardware and then racking up electricity bills will not happen here because of 2 reasons:

1. They are selling just a share of a miner. You can decide how much you want to spend. Instead of thousands of dollars at once, maybe just $21 for 1 hashlet (share).

2. They are hosting the miner, you will not rack up an electricity bill. They charge $0.08 per hashlet (share) and if for some reason maintenance fee > payout you will not have to pay extra. You just get no payout.

edit2: There has been a price drop for the ZenHashlets due to the payouts being lower. GAW does not expect the lower payouts to last forever but no eta on when it will come back up.

I have an idea that I had been sitting on for a while because I wasn't sure how useful it was. It's not the easiest thing and there's quite some risk involved (as you would've guessed when I mentioned Bitcoin). I can simplify the basic idea down to these steps:

- Obtain A Cloud Miner. This is where MS starts. You use your CC to buy hashlets (cloud miner).

- Cash out into fiat (USD) daily as miner generates BTC.

- https://www.coinbase.com/?r=51c4fa1f...=referral-link

- https://www.circle.com/

- https://localbitcoins.com/ (riskiest but best conversion rates)

- Sell miner after mining income + miner sell price =>(greater than or equal to) what you paid

- Convert the BTC from selling miners into USD. MS Cycle complete.

There are risks strewn about from step 1 to step 3.

Step 1 risks are that you need to find a trustworthy cloud miner supplier (please consider using my affiliate link above for this step, I have been a GAW customer for more than 3 months now and they have been great, they are also innovators in cloud mining currently).

Step 2 risks are that Bitcoin price can fluctuate as well as the amount of bitcoin you receive each day. You will also need a safe way to convert bitcoin to USD. I have provided links where one can convert BTC to USD.

Step 3 risks are that you are dependent on the market demand for the price you can sell at. If you were to buy miners at GAW, I suggest buying the ZenHashlet. They have the best returns. Each miner is at 20.95. After daily fees, the daily income is about $0.167 per miner. Currently, estimating a safe sellback price of $18 means you need to mine at least $2.95. So $2.95/$0.167 in about 18 days you should have made back the difference. I prefer to take a very safe approach and assume I need to mine for 30 days instead to make up the difference.

Step 4 is the final liquidation and paying off your credit card after everything is said and done. MS cycle complete.

So estimated MS cycle (somewhat safe estimate) is 30 days. It can be longer and it can very well be shorter, it's part of the risk. I would say because of the delayed and trickle in returns, it's a lot like Kiva. Risky investment wise has a feel of Loyal3 to it.

There are a lot of other nuances where you can improve your returns but I found this to be the simplest.

Again and I can't reiterate this enough. This method is risky. I just wanted to share a somewhat unique idea to people, especially people who may have been interested in Bitcoin.

Please feel free to ask me questions.

edit: This has come up a few times so I'll clarify. The product they sell is a share of a miner that is hosted by them. Any horror stories you may have heard of spending a lot of money to buy hardware and then racking up electricity bills will not happen here because of 2 reasons:

1. They are selling just a share of a miner. You can decide how much you want to spend. Instead of thousands of dollars at once, maybe just $21 for 1 hashlet (share).

2. They are hosting the miner, you will not rack up an electricity bill. They charge $0.08 per hashlet (share) and if for some reason maintenance fee > payout you will not have to pay extra. You just get no payout.

edit2: There has been a price drop for the ZenHashlets due to the payouts being lower. GAW does not expect the lower payouts to last forever but no eta on when it will come back up.

Last edited by aegistar; Oct 21, 2014 at 6:46 am Reason: Edited title so it's clearer that this is cloud mining.

#4

Join Date: Jun 2014

Posts: 74

Have you thought about how difficulty increases affect the outcome? I did this once with an actual miner and got away with small profit, but I will never do it again because there are too many variables and easier methods for MS.

EDIT: That being said, I'm definitely in favor of investing in/utilizing bitcoin, even though it will eventually ruin credit card rewards since transaction fees are essentially nil with Bitcoin.

EDIT: That being said, I'm definitely in favor of investing in/utilizing bitcoin, even though it will eventually ruin credit card rewards since transaction fees are essentially nil with Bitcoin.

#5

Join Date: Oct 2013

Posts: 252

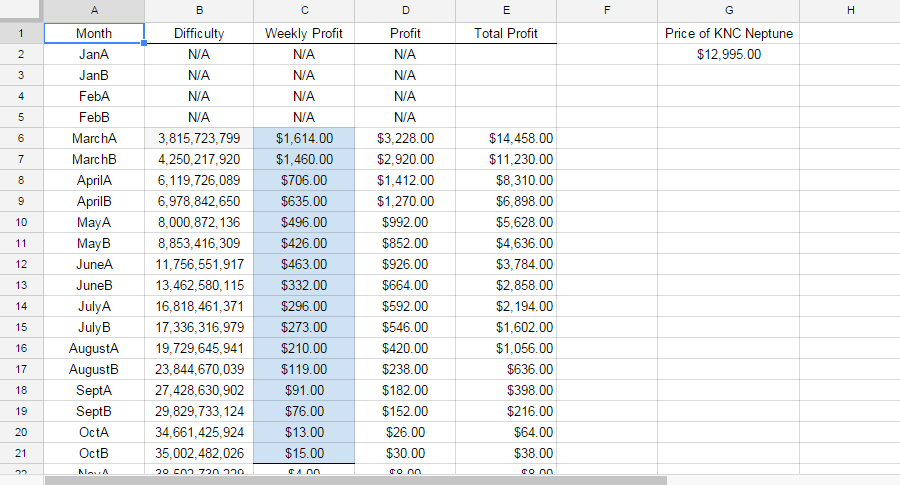

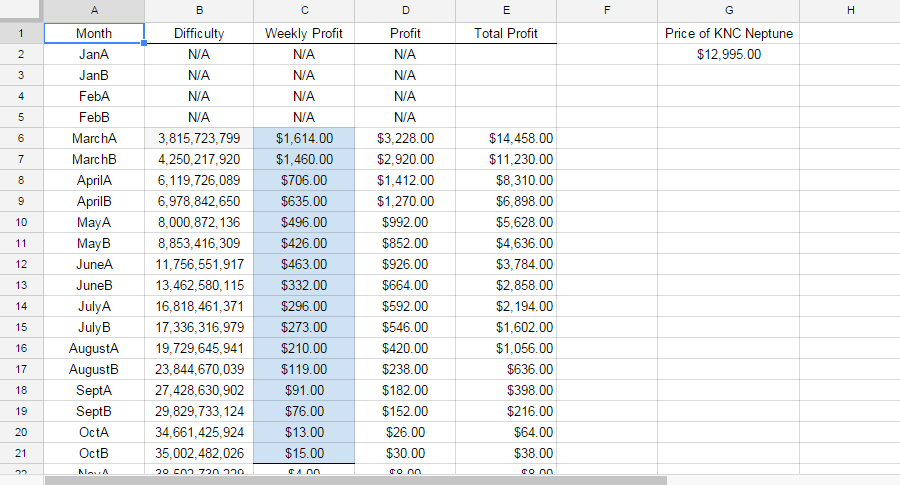

This won't work. Back in March I considered the idea of buying miners and retire rich in a year or two. Luckily, I ran the numbers on a spreadsheet and saw that this was just a scheme destined to make me lose money.

First off, the cost of the equipment is just too high. $2685 for a Hashlet Genesis running at 3,000 GH/s is too expensive. When I considered this idea back on March, I was looking at equipment running at 3.5 TH/s (Tera = 1000 Giga), for a cost of about $12,000. Assuming I got the equipment fast (a week or so), I could generate about $6,000 in profit on the first month (based on my estimates and the assumption that BTC price didn't tank). But the monthly profit quickly deteriorated the following month, and the next, and the next, thanks to the increase in Bitcoin "difficulty". Basically, I needed to get the equipment fast in order to make a small profit. If I didn't get the equipment shipped to my house in 6 weeks, I would barely break even. And I got the equipment after 6 weeks, I was destined to lose money. That doesn't take into account any down time after having the equipment. Basically, this computation assumes 24hr, 7 days a week continuous running of the machines. What if I lost power (which has happened a lot lately)?

So basically what it boils down to: the cost of the equipment is very high, and you will make a small profit if you get the equipment fast. After about 7 months, your ASIC equipment will be making you less than the cost of electricity of running it! And you can't sell it to anyone since this machine doesn't do anything else but mine Bitcoins, and at a very low rate 7 months into its life (unless you scam someone with the BTC dream that is). The people making the money are the ones manufacturing the machines and selling them at near "breakeven" price (breakeven to the ppl buying the equipment). Basically the demand of BTC miners drive the price up to that almost breakeven price. You do make money if you get the equipment running very quickly after buying it.

P.S. I just compared my Difficulty predictions to the current actual Difficulty. Back then, my spreadsheet had a Difficulty of 55,000,000,000 for October 15, 2014. The prediction was off by a lot actually. The current Difficulty is 35,000,000,000. What that means is that you could get the equipment later than what my above post suggests, and still make money. But still, you are at the mercy of the price of BTC vs USD. The BTC price went up on the spring, but has been coming down. There are two many uncontrolled variables in this game, so it is way more risky than MS. And as opposed to MS, there's no guarantee of making money.

Kudos to OP for thinking outside the box, and linking 2 completely different money making schemes together. I still think it is better to just do both separately (mine BTC with the best equipment on the market, and MS like we've been doing).

First off, the cost of the equipment is just too high. $2685 for a Hashlet Genesis running at 3,000 GH/s is too expensive. When I considered this idea back on March, I was looking at equipment running at 3.5 TH/s (Tera = 1000 Giga), for a cost of about $12,000. Assuming I got the equipment fast (a week or so), I could generate about $6,000 in profit on the first month (based on my estimates and the assumption that BTC price didn't tank). But the monthly profit quickly deteriorated the following month, and the next, and the next, thanks to the increase in Bitcoin "difficulty". Basically, I needed to get the equipment fast in order to make a small profit. If I didn't get the equipment shipped to my house in 6 weeks, I would barely break even. And I got the equipment after 6 weeks, I was destined to lose money. That doesn't take into account any down time after having the equipment. Basically, this computation assumes 24hr, 7 days a week continuous running of the machines. What if I lost power (which has happened a lot lately)?

So basically what it boils down to: the cost of the equipment is very high, and you will make a small profit if you get the equipment fast. After about 7 months, your ASIC equipment will be making you less than the cost of electricity of running it! And you can't sell it to anyone since this machine doesn't do anything else but mine Bitcoins, and at a very low rate 7 months into its life (unless you scam someone with the BTC dream that is). The people making the money are the ones manufacturing the machines and selling them at near "breakeven" price (breakeven to the ppl buying the equipment). Basically the demand of BTC miners drive the price up to that almost breakeven price. You do make money if you get the equipment running very quickly after buying it.

P.S. I just compared my Difficulty predictions to the current actual Difficulty. Back then, my spreadsheet had a Difficulty of 55,000,000,000 for October 15, 2014. The prediction was off by a lot actually. The current Difficulty is 35,000,000,000. What that means is that you could get the equipment later than what my above post suggests, and still make money. But still, you are at the mercy of the price of BTC vs USD. The BTC price went up on the spring, but has been coming down. There are two many uncontrolled variables in this game, so it is way more risky than MS. And as opposed to MS, there's no guarantee of making money.

Kudos to OP for thinking outside the box, and linking 2 completely different money making schemes together. I still think it is better to just do both separately (mine BTC with the best equipment on the market, and MS like we've been doing).

Last edited by andres17; Oct 14, 2014 at 10:10 pm

#6

Join Date: Oct 2013

Posts: 252

Out of curiosity, I wanted to see if my decision not to spend $13,000 + shipping on a KNC Nepture rig back in March was a good one. I updated my sheet with actual (not predicted) difficulty numbers and actual BTC to USD price. The results says that I had to get the equipment right on the first week of March to squeak a small profit of $14,458-$12,995 = $1,463. This, assuming the rig was running 24 hours all the time.

Since this equipment was being shipped from Europe, I doubt I would have got the equipment on the first week of March. My guess, I would have got the equipment at the beginning of April, and would have lost about $4-$5k in this adventure.

This exercise shows me that these ASIC rigs are priced at almost breakeven point. After all, why would these companies sell them for less than what they themselves could make by mining BTC?

Since this equipment was being shipped from Europe, I doubt I would have got the equipment on the first week of March. My guess, I would have got the equipment at the beginning of April, and would have lost about $4-$5k in this adventure.

This exercise shows me that these ASIC rigs are priced at almost breakeven point. After all, why would these companies sell them for less than what they themselves could make by mining BTC?

#7

Join Date: Sep 2011

Posts: 12

If you wanted to look at this from the perspective of MS, my suggestion would be to consider it starting with the transaction fees. You will have to pay some percentage in order to convert your bitcoins back to fiat. There is of course a lot of risk in the value of the Bitcoins (they could go up, or they could go down) - but even if they don't move, is this strategy better than existing opportunities where you can swipe your card, eat a transaction fee, and take home points?

#8

Join Date: Jun 2014

Posts: 41

Hello everyone, been mostly a lurker on the forums here and finally I may have an idea to contribute to the community after the community had helped me so much. (In fact it was MS that I eventually got into cryptocurrency).

I have an idea that I had been sitting on for a while because I wasn't sure how useful it was. It's not the easiest thing and there's quite some risk involved (as you would've guessed when I mentioned Bitcoin). I can simplify the basic idea down to these steps:[LIST=1][*]Obtain A Cloud Miner. This is where MS starts. You use your CC to buy hashlets (cloud miner).

Please feel free to ask me questions.

I have an idea that I had been sitting on for a while because I wasn't sure how useful it was. It's not the easiest thing and there's quite some risk involved (as you would've guessed when I mentioned Bitcoin). I can simplify the basic idea down to these steps:[LIST=1][*]Obtain A Cloud Miner. This is where MS starts. You use your CC to buy hashlets (cloud miner).

Please feel free to ask me questions.

Also, your affiliate link doesn't seem to work for me.

#10

Original Poster

Join Date: Feb 2013

Posts: 14

#11

Original Poster

Join Date: Feb 2013

Posts: 14

This won't work. Back in March I considered the idea of buying miners and retire rich in a year or two. Luckily, I ran the numbers on a spreadsheet and saw that this was just a scheme destined to make me lose money.

First off, the cost of the equipment is just too high. $2685 for a Hashlet Genesis running at 3,000 GH/s is too expensive. When I considered this idea back on March, I was looking at equipment running at 3.5 TH/s (Tera = 1000 Giga), for a cost of about $12,000. Assuming I got the equipment fast (a week or so), I could generate about $6,000 in profit on the first month (based on my estimates and the assumption that BTC price didn't tank). But the monthly profit quickly deteriorated the following month, and the next, and the next, thanks to the increase in Bitcoin "difficulty". Basically, I needed to get the equipment fast in order to make a small profit. If I didn't get the equipment shipped to my house in 6 weeks, I would barely break even. And I got the equipment after 6 weeks, I was destined to lose money. That doesn't take into account any down time after having the equipment. Basically, this computation assumes 24hr, 7 days a week continuous running of the machines. What if I lost power (which has happened a lot lately)?

So basically what it boils down to: the cost of the equipment is very high, and you will make a small profit if you get the equipment fast. After about 7 months, your ASIC equipment will be making you less than the cost of electricity of running it! And you can't sell it to anyone since this machine doesn't do anything else but mine Bitcoins, and at a very low rate 7 months into its life (unless you scam someone with the BTC dream that is). The people making the money are the ones manufacturing the machines and selling them at near "breakeven" price (breakeven to the ppl buying the equipment). Basically the demand of BTC miners drive the price up to that almost breakeven price. You do make money if you get the equipment running very quickly after buying it.

P.S. I just compared my Difficulty predictions to the current actual Difficulty. Back then, my spreadsheet had a Difficulty of 55,000,000,000 for October 15, 2014. The prediction was off by a lot actually. The current Difficulty is 35,000,000,000. What that means is that you could get the equipment later than what my above post suggests, and still make money. But still, you are at the mercy of the price of BTC vs USD. The BTC price went up on the spring, but has been coming down. There are two many uncontrolled variables in this game, so it is way more risky than MS. And as opposed to MS, there's no guarantee of making money.

Kudos to OP for thinking outside the box, and linking 2 completely different money making schemes together. I still think it is better to just do both separately (mine BTC with the best equipment on the market, and MS like we've been doing).

First off, the cost of the equipment is just too high. $2685 for a Hashlet Genesis running at 3,000 GH/s is too expensive. When I considered this idea back on March, I was looking at equipment running at 3.5 TH/s (Tera = 1000 Giga), for a cost of about $12,000. Assuming I got the equipment fast (a week or so), I could generate about $6,000 in profit on the first month (based on my estimates and the assumption that BTC price didn't tank). But the monthly profit quickly deteriorated the following month, and the next, and the next, thanks to the increase in Bitcoin "difficulty". Basically, I needed to get the equipment fast in order to make a small profit. If I didn't get the equipment shipped to my house in 6 weeks, I would barely break even. And I got the equipment after 6 weeks, I was destined to lose money. That doesn't take into account any down time after having the equipment. Basically, this computation assumes 24hr, 7 days a week continuous running of the machines. What if I lost power (which has happened a lot lately)?

So basically what it boils down to: the cost of the equipment is very high, and you will make a small profit if you get the equipment fast. After about 7 months, your ASIC equipment will be making you less than the cost of electricity of running it! And you can't sell it to anyone since this machine doesn't do anything else but mine Bitcoins, and at a very low rate 7 months into its life (unless you scam someone with the BTC dream that is). The people making the money are the ones manufacturing the machines and selling them at near "breakeven" price (breakeven to the ppl buying the equipment). Basically the demand of BTC miners drive the price up to that almost breakeven price. You do make money if you get the equipment running very quickly after buying it.

P.S. I just compared my Difficulty predictions to the current actual Difficulty. Back then, my spreadsheet had a Difficulty of 55,000,000,000 for October 15, 2014. The prediction was off by a lot actually. The current Difficulty is 35,000,000,000. What that means is that you could get the equipment later than what my above post suggests, and still make money. But still, you are at the mercy of the price of BTC vs USD. The BTC price went up on the spring, but has been coming down. There are two many uncontrolled variables in this game, so it is way more risky than MS. And as opposed to MS, there's no guarantee of making money.

Kudos to OP for thinking outside the box, and linking 2 completely different money making schemes together. I still think it is better to just do both separately (mine BTC with the best equipment on the market, and MS like we've been doing).

Also part of the strategy for this MS is to not hold onto your hashlet. GAW also has a built in market where you can sell hashlets to other users. The idea is to buy hashlets, mine to cover any transaction fees then sell the hashlet to obtain the rest in BTC. Then convert BTC to fiat to complete cycle.

#12

Original Poster

Join Date: Feb 2013

Posts: 14

If you wanted to look at this from the perspective of MS, my suggestion would be to consider it starting with the transaction fees. You will have to pay some percentage in order to convert your bitcoins back to fiat. There is of course a lot of risk in the value of the Bitcoins (they could go up, or they could go down) - but even if they don't move, is this strategy better than existing opportunities where you can swipe your card, eat a transaction fee, and take home points?

This is by no means a strategy that is easy or maybe even worth the time. However, with so many MS avenues closing down, this is just another take on MS if someone is interested in cryptocurrency.

#13

Join Date: Jan 2014

Location: Boston

Posts: 29

I know very little of the complexities of Bitcoin, but one of my friends invested a few thousand into a miner. He only used it a month and in that month racked up an electricity bill of $600 + . So for me this is a no go for MS.

#14

Original Poster

Join Date: Feb 2013

Posts: 14

So the key here is that they are hosting the hardware and taking care of it. You will not rack up that electricity bill.

#15

Join Date: Oct 2013

Posts: 252

Definitely agree with what you've said. Hardware mining is near impossible to ROI right now. However, GAW is innovating. They have products called hashlets which is essentially a share of a miner that they host. These cost a lot less. You can get a ZenHashlet for $20 so you can definitely start slow.

Also part of the strategy for this MS is to not hold onto your hashlet. GAW also has a built in market where you can sell hashlets to other users. The idea is to buy hashlets, mine to cover any transaction fees then sell the hashlet to obtain the rest in BTC. Then convert BTC to fiat to complete cycle.

Also part of the strategy for this MS is to not hold onto your hashlet. GAW also has a built in market where you can sell hashlets to other users. The idea is to buy hashlets, mine to cover any transaction fees then sell the hashlet to obtain the rest in BTC. Then convert BTC to fiat to complete cycle.

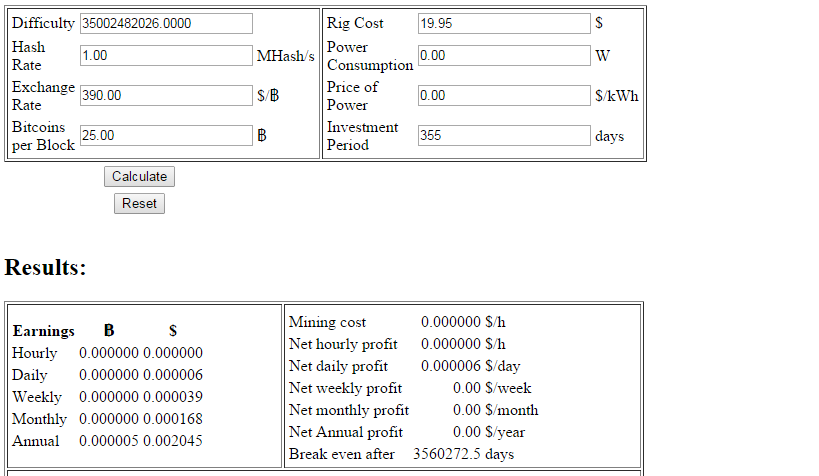

But plugging the numbers in a BTC profitability calculator yields no return at that price. I'm using the current difficulty of 35 Billion, and $0 cost for electricity (you said there are maintenance costs, which I didn't add).

The results are super bad. It takes 3.5 million days to get your money back! I must be doing something wrong because otherwise this products would not even exists. Here is my inputs on the Bitcoin profitability calculator, and the results below: