Stockpiling Points for retirement

#31

FlyerTalk Evangelist

Join Date: Aug 2002

Location: Intermountain West

Programs: Too many to list

Posts: 12,080

#32

Join Date: Nov 2017

Posts: 3,359

At the very least you'll want to read the fine print before you travel in the insurance documents because the last you want is to be stranded in gods know where without any coverage.

Safe Travels,

James

#33

FlyerTalk Evangelist

Join Date: Aug 2002

Location: Intermountain West

Programs: Too many to list

Posts: 12,080

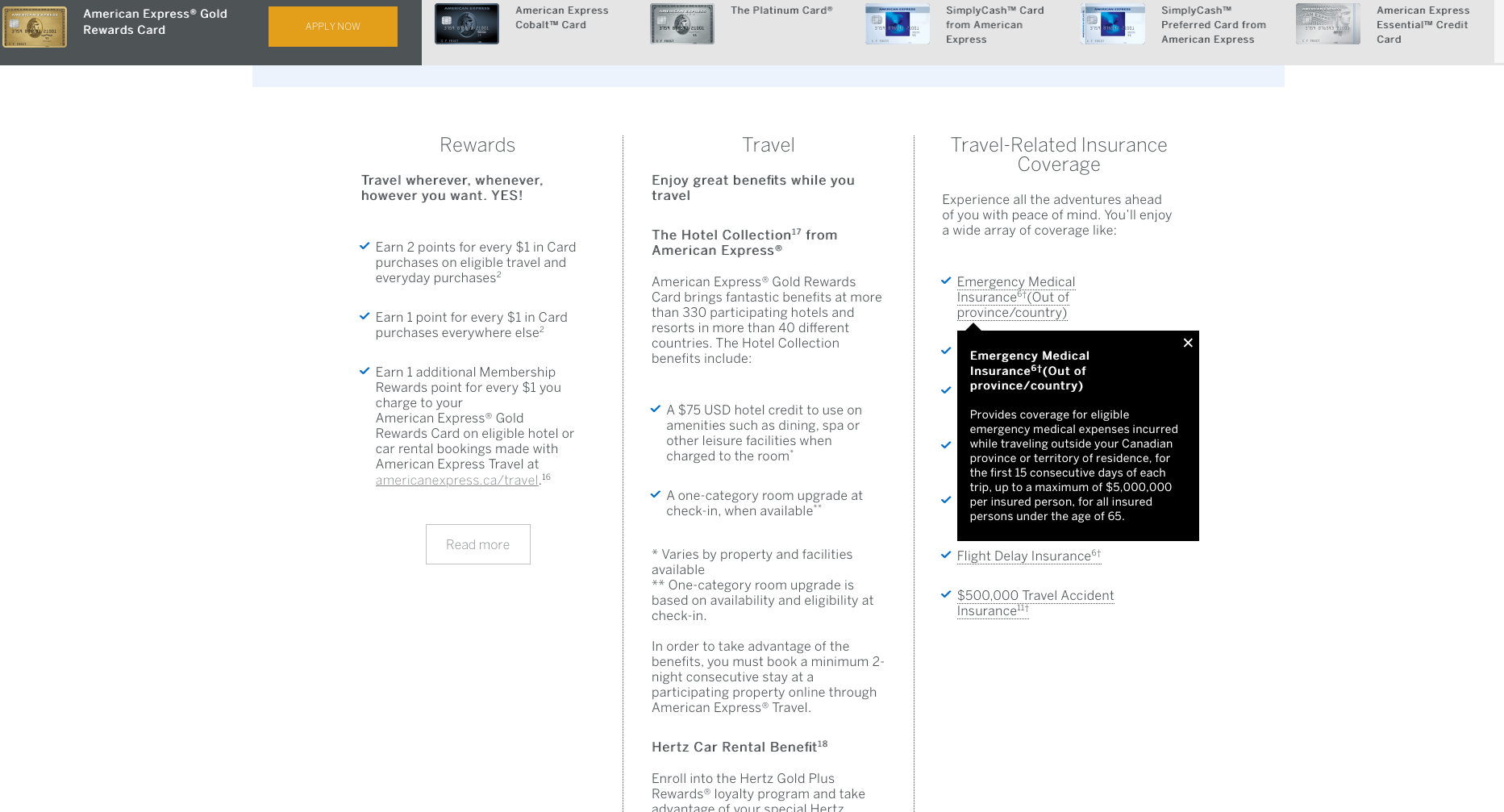

The point I'm trying to make is that it's common for travel insurance issued by credit card companies to end insurance at age 65. I'm using my card from a reputable bank but I suspect this is common practice across the industry regardless of whether you are a Canadian or American.

At the very least you'll want to read the fine print before you travel in the insurance documents because the last you want is to be stranded in gods know where without any coverage.

Safe Travels,

James

At the very least you'll want to read the fine print before you travel in the insurance documents because the last you want is to be stranded in gods know where without any coverage.

Safe Travels,

James

#35

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

In general holders of USA-issued cards would not be relying on Medical insurance provided by the card, at any age. The travel insurance provided by Chase Sapphire Reserve and Citi Prestige have no maximum age restrictions on any benefit, but the medical insurance elements have low limits (Chase $2,500) or are not offered (Citi). Medical Evacuation coverage is provided by both, but if your condition can be treated locally you need another means of payment.

#37

Join Date: Jun 2016

Location: Prince Edward Island

Programs: Air Canada P25K, Hilton Honors Gold, Marriott Gold, MGM Gold

Posts: 1,582

Travel Insurance is a broad term which encompasses Trip Cancellation/Interruption, Trip Delay, Luggage Delay/Damage/Loss. Accidental Death, Medical, etc. In the posted image one element (Medical ) ends at age 65. Do the other elements also end?

In general holders of USA-issued cards would not be relying on Medical insurance provided by the card, at any age.

In general holders of USA-issued cards would not be relying on Medical insurance provided by the card, at any age.

#38

A FlyerTalk Posting Legend

Join Date: Sep 2009

Location: Minneapolis: DL DM charter 2.3MM

Programs: A3*Gold, SPG Plat, HyattDiamond, MarriottPP, LHW exAccess, ICI, Raffles Amb, NW PE MM, TWA Gold MM

Posts: 100,399

I think that's the main difference (and cause for confusion). Since Americans have to buy private medical insurance (or get it through work), I assume they would rely on this for travel medical expenses as well. In Canada, many people don't have any private medical insurance since most costs are covered by public health care, but this doesn't cover much for out-of-province medical expenses. So, credit cards often provide travel medical insurance up to age 65, as an alternative to buying a 1-2 week travel medical policy for a specific trip. Other travel insurance items (like trip cancellation, etc.) don't have age limits since aging doesn't significantly increase your reliance on these items.

#39

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,933

That's a way better return on money spent than either buying miles or using a credit card you already have (which probably only earns 1 or at most 2 miles per dollars spent on most things).

Now, there's limits on how often you can do this (you can get at least 4 AA cards every 2 years, and at least 2 United cards every 2.3 years or so, if you're not getting much else in the way of new cards), but up to those limits, it's hard to think of a better value in getting miles for either paying something (an annual fee) or just shifting your credit card spend to another credit card for 3 months. (Though if you don't normally spend $3000 on credit cards in 3 months, you might have to time it for when you do, or pay some stuff ahead, or buy some store gift cards you'll use later, etc, etc.)

#40

Join Date: Nov 2013

Programs: AA Lifetime Platinum; Amex Plat; Four Seasons; Fairmont; HH; etc.; "Retirees-In-Training"

Posts: 658

I wanted to mention that there are other alternatives to making sure that you have funds in retirement for travel. People have mentioned investments, but I also wanted to bring up the idea of debt reduction. The most stable retirees I know are those without debt. They have more freedom with how they use their money.

One other idea is to start a special savings or investment account for travel. Put a budgeted monthly amount into this account. You could have quite the travel nest egg after 14 years.

My final point is to make sure that you strike a balance between always putting things off because you are planning for a future trip, a future (fill in the blank) and taking the time to enjoy the moments now. No one knows what the future holds. You don't want to enter retirement without any preparations, but you don't want to put your life on hold for 14 years either.

Spending miles in a reasonable amount of time after you accumulate them makes sense on several levels.

One other idea is to start a special savings or investment account for travel. Put a budgeted monthly amount into this account. You could have quite the travel nest egg after 14 years.

My final point is to make sure that you strike a balance between always putting things off because you are planning for a future trip, a future (fill in the blank) and taking the time to enjoy the moments now. No one knows what the future holds. You don't want to enter retirement without any preparations, but you don't want to put your life on hold for 14 years either.

Spending miles in a reasonable amount of time after you accumulate them makes sense on several levels.

1) Make SURE you read ALL the fine print of any travel insurance (or regular medical insurance). Charge card coverage often excludes any claims due to pre-existing conditions, and the definition of that can vary. Don't depend entirely on what you read online, as there is so much variance from policy to policy, country to country, USA state to state, etc.

2) See CruiseCritic.com's travel insurance sub-forum, as most of the topics are not cruise specific:

https://boards.cruisecritic.com/forumdisplay.php?f=635

Now, pt flyer brings up an important but sensitive subject: Don't postpone all pleasures/plans for "after retirement". Not everyone, er, gets there, or gets there in good condition.

(We, personally, waited too long to start those dream travels, and although we've been making up for it with a vengeance

there are a few that we will now not be able to do, ever. We've also had some health issues that almost derailed much serious travel in the future, but it turned out not to, thank goodness. But health/life are fragile...)

there are a few that we will now not be able to do, ever. We've also had some health issues that almost derailed much serious travel in the future, but it turned out not to, thank goodness. But health/life are fragile...)We had hoarded "awards" for ages, but only from charge card spending, so we had a couple million points, with a combination of AAdvantage and Amex Plat Membership Rewards. The AAdvantage can, as OP mentioned, be purchased for "reasonable cost" during bonus offer throughout the year. But "points" are most valuable when used for international premium cabin travel. Domestic coach... not so much. So think about where/how you plan to use them.

If you've been purchasing them, or plan to purchase them, for years, just how many do you have? (No need to post, but think amongst yourself

). You may want to stop the purchasing and accumulate by charging just about everything. It can add up over the years...

). You may want to stop the purchasing and accumulate by charging just about everything. It can add up over the years...Meanwhile, we have landed on the hedonic treadmill and found that we really do enjoy (!!!!) international premium cabin travel, including F. Interestingly, the points needed to bump from J to F are quite reasonable. F seat availability is another thing entirely. (Hence, we've started using a service we learned of here on FT, and had great luck with our preferences. NICE!)

Point is, we are really blowing through some of those points, and that makes us HAPPY. Very Happy.

It turns out in our case that we are mostly using AAdvantage points, which are the ones that can be purchased. In a few cases, we could use either AAdvantage or Amex MR, so we've left the latter in the bank when possible.

As with the warnings above, those points we were hoarding got devalued, but we just don't care. We are using them now, and loving it. We could NOT purchase this many, nor could we charge (or get bonuses) for the amount we've spent in just a couple of years. (There are restrictions on how many AAdvantage points can be purchased per year, not including the bonus points.) And the sign-up bonuses are getting harder and harder to get in multiples.

So to OP: Do you really need to *buy* more now, or can you accumulate more by charging?

And, importantly, have you taken *any* of those dream trips yet?

Perhaps it's time?

GC

#41

Join Date: Nov 2017

Posts: 3,359

Also keep in that the older you get the harder it becomes to travel since you won't have the same energy and stamina you once had. Travelling with my father last year in the UK, I noticed we couldn't get out to do all the things I wanted to do because it required too much trekking. A lot of the travel I'm doing now (i.e. hiking the Canadian arctic) I doubt I'll be able to do so well in 10 years or at all even in 20 years time. I can guarantee you that you'll be travelling to fewer places when you're 75 than you are when you're 55! Now is also a great time to travel, airfares are at all time lows (mainly due to low oil prices and low inflationary pressure globally) and hotels are generally inexpensive. Who knows in 20 years if it will be as affordable to travel in real-money terms as it is today.

My advice is to develop a travel bucket list of the places you want to see (perhaps purchase/take out world travel books from a library) and the cost for such travel. I'd then put together a spreadsheet of these places with the plan of visiting 2 places while you're working (once in the summer and once during XMAS break) and perhaps 4 trips a year when you retire. I'd then identify the places that will be more difficult for you to travel in the farther out (i.e. flight to Australia where you'll be in a cramped economy seat for 14+ hours each way) and prioritize travelling to those first. By the time you're 75 or 80 you're trips should be much smaller (most likely domestic to like Fort Lauderdale where it's nice and warm and you don't have to sit in a cramped metal tube for hours on end). Once you've figured that out you should have a good sense of how much you need to save for today's travel and how much you'll want to save for tomorrow's journey.

Hope that helps.

Safe Travels,

James

#42

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,933

Couldn't agree with you more. One of the defining moments of my life so far (I'm 30), happened back was when I was 22. Long story short I went from University student to hospital ICU in a matter of hours (due to appendicitis and hole in colon caused by Crohn's disease) then spending over a month in hospital recovering. The whole experience reminded me of how precious life is and I made a promise to myself not to be the type of person who puts goals into the someday category because someday can never come. Fortunately, I've since fully recovered from that episode.

Also keep in that the older you get the harder it becomes to travel since you won't have the same energy and stamina you once had. Travelling with my father last year in the UK, I noticed we couldn't get out to do all the things I wanted to do because it required too much trekking. A lot of the travel I'm doing now (i.e. hiking the Canadian arctic) I doubt I'll be able to do so well in 10 years or at all even in 20 years time. I can guarantee you that you'll be travelling to fewer places when you're 75 than you are when you're 55! Now is also a great time to travel, airfares are at all time lows (mainly due to low oil prices and low inflationary pressure globally) and hotels are generally inexpensive. Who knows in 20 years if it will be as affordable to travel in real-money terms as it is today.

My advice is to develop a travel bucket list of the places you want to see (perhaps purchase/take out world travel books from a library) and the cost for such travel. I'd then put together a spreadsheet of these places with the plan of visiting 2 places while you're working (once in the summer and once during XMAS break) and perhaps 4 trips a year when you retire. I'd then identify the places that will be more difficult for you to travel in the farther out (i.e. flight to Australia where you'll be in a cramped economy seat for 14+ hours each way) and prioritize travelling to those first. By the time you're 75 or 80 you're trips should be much smaller (most likely domestic to like Fort Lauderdale where it's nice and warm and you don't have to sit in a cramped metal tube for hours on end). Once you've figured that out you should have a good sense of how much you need to save for today's travel and how much you'll want to save for tomorrow's journey.

Hope that helps.

Safe Travels,

James

Also keep in that the older you get the harder it becomes to travel since you won't have the same energy and stamina you once had. Travelling with my father last year in the UK, I noticed we couldn't get out to do all the things I wanted to do because it required too much trekking. A lot of the travel I'm doing now (i.e. hiking the Canadian arctic) I doubt I'll be able to do so well in 10 years or at all even in 20 years time. I can guarantee you that you'll be travelling to fewer places when you're 75 than you are when you're 55! Now is also a great time to travel, airfares are at all time lows (mainly due to low oil prices and low inflationary pressure globally) and hotels are generally inexpensive. Who knows in 20 years if it will be as affordable to travel in real-money terms as it is today.

My advice is to develop a travel bucket list of the places you want to see (perhaps purchase/take out world travel books from a library) and the cost for such travel. I'd then put together a spreadsheet of these places with the plan of visiting 2 places while you're working (once in the summer and once during XMAS break) and perhaps 4 trips a year when you retire. I'd then identify the places that will be more difficult for you to travel in the farther out (i.e. flight to Australia where you'll be in a cramped economy seat for 14+ hours each way) and prioritize travelling to those first. By the time you're 75 or 80 you're trips should be much smaller (most likely domestic to like Fort Lauderdale where it's nice and warm and you don't have to sit in a cramped metal tube for hours on end). Once you've figured that out you should have a good sense of how much you need to save for today's travel and how much you'll want to save for tomorrow's journey.

Hope that helps.

Safe Travels,

James

You could change planes "normally" or (perhaps at some additional cost but also additional comfort) you could stop over for a day (or more) at each place.

And such "slower" travel is also more compatible with the greater time available you have once retired.

But OTOH flying 14 hours in lie-flat business with direct aisle access is not at all the same as flying 14 hours in a cramped economy seat. And isn't that the point of collecting tons of miles?

Gosh, if you get enough miles (at US-based airlines), you can use miles for "last seat" ("anytime") awards, and then you don't have to worry about "availability". (But don't forget that there are obscure airlines -- which don't all show up on their partners' domestic booking sites -- that fly to Australia via, for example, Fiji, that sometimes have saver availability that most people don't even know how to look up.)

Gosh, if you get enough miles (at US-based airlines), you can use miles for "last seat" ("anytime") awards, and then you don't have to worry about "availability". (But don't forget that there are obscure airlines -- which don't all show up on their partners' domestic booking sites -- that fly to Australia via, for example, Fiji, that sometimes have saver availability that most people don't even know how to look up.)

#43

Join Date: Nov 2017

Posts: 3,359

Travel While You Can!

Do you realize that' it's possible to fly to Australia using many shorter flights instead one long one? UA flies lower 48 -> Honolulu -> Guam -.> Australia. Each hop isn't much longer than a lower 48 transcon.

You could change planes "normally" or (perhaps at some additional cost but also additional comfort) you could stop over for a day (or more) at each place.

And such "slower" travel is also more compatible with the greater time available you have once retired.

But OTOH flying 14 hours in lie-flat business with direct aisle access is not at all the same as flying 14 hours in a cramped economy seat. And isn't that the point of collecting tons of miles? Gosh, if you get enough miles (at US-based airlines), you can use miles for "last seat" ("anytime") awards, and then you don't have to worry about "availability". (But don't forget that there are obscure airlines -- which don't all show up on their partners' domestic booking sites -- that fly to Australia via, for example, Fiji, that sometimes have saver availability that most people don't even know how to look up.)

Gosh, if you get enough miles (at US-based airlines), you can use miles for "last seat" ("anytime") awards, and then you don't have to worry about "availability". (But don't forget that there are obscure airlines -- which don't all show up on their partners' domestic booking sites -- that fly to Australia via, for example, Fiji, that sometimes have saver availability that most people don't even know how to look up.)

You could change planes "normally" or (perhaps at some additional cost but also additional comfort) you could stop over for a day (or more) at each place.

And such "slower" travel is also more compatible with the greater time available you have once retired.

But OTOH flying 14 hours in lie-flat business with direct aisle access is not at all the same as flying 14 hours in a cramped economy seat. And isn't that the point of collecting tons of miles?

Gosh, if you get enough miles (at US-based airlines), you can use miles for "last seat" ("anytime") awards, and then you don't have to worry about "availability". (But don't forget that there are obscure airlines -- which don't all show up on their partners' domestic booking sites -- that fly to Australia via, for example, Fiji, that sometimes have saver availability that most people don't even know how to look up.)

Gosh, if you get enough miles (at US-based airlines), you can use miles for "last seat" ("anytime") awards, and then you don't have to worry about "availability". (But don't forget that there are obscure airlines -- which don't all show up on their partners' domestic booking sites -- that fly to Australia via, for example, Fiji, that sometimes have saver availability that most people don't even know how to look up.)Also keep in mind that TPAC is always a rougher flight than TATL. Every time I do a TPAC we always encounter rough turbulence the like of which I've never seen doing a TATL (maybe some FTers can discuss why this is?). Flying in J helps but regardless of fare class you'll still notice it and being on a tube for 14+ hours is still strenuous.

I think what's missing here in the discussion is the "hit by a truck" factor which is the unpredictability of life. You may be healthy right now but who knows maybe tomorrow you wake up sick and the doctor tells you you've got cancer and 6 months to live. It would suck if you saved everything up for this one moment at the end of your career only to find out you won't enjoy it.

We are living in such a unique time in the travel industry, fares haven't been as low as they are now, the ease and convenience of travel thanks to innovations in travel like online booking and streamlined security and immigration processes (i.e. Schengen and Global Entry). Carriers are only starting to cut back on services like meals on board, checked bags, seat pitch, etc.

There's no benefit to stockpiling because miles will get devalued over time. I can also guarantee you travel will be more expensive and a hassle in 10 years time when the petro-dollar regains its momentum (which it will).

Bottom Line : You gotta get some travel in now and keep increasing the dosage over time.

Safe Travels,

James