Timing on WOH Visa $5K spend 2 qualifying nights

#46

Join Date: Dec 2013

Location: Homeless

Programs: Hyatt Glob; Hilton Dia; Marriott AMB; Accor Dia; IHG Dia Amb; GHA Tit

Posts: 4,835

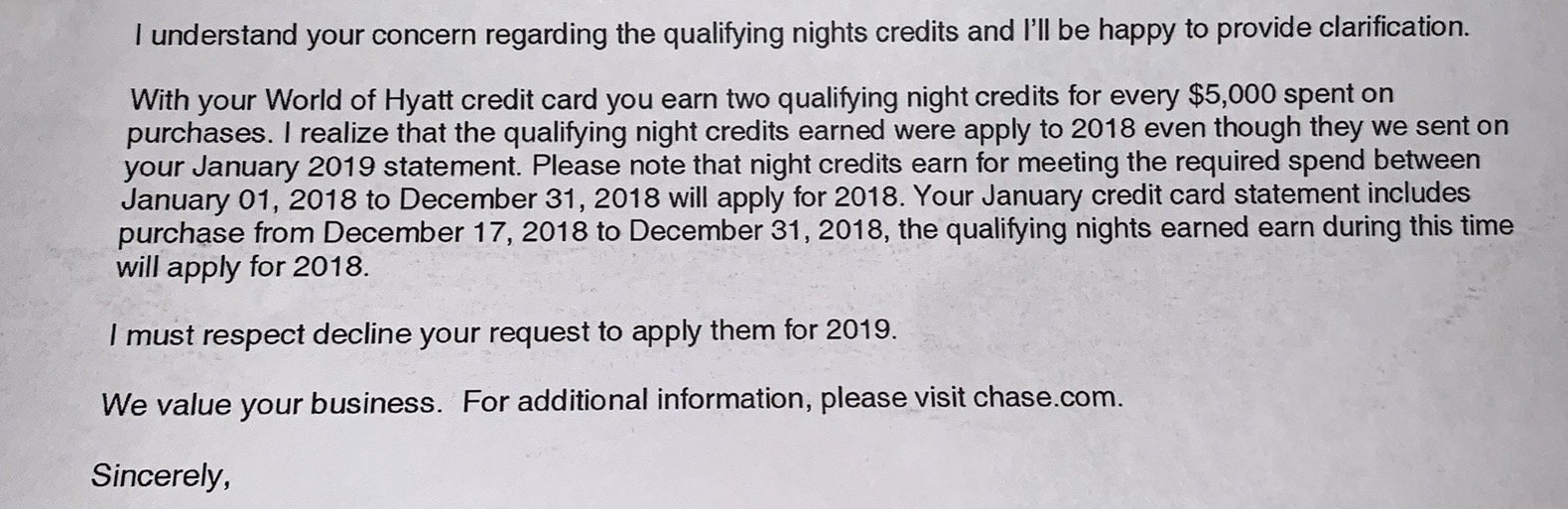

Hello Escape4,

Thank you for contacting Chase in regards to your World of Hyatt account.

We regret to hear of misinformation given by our specialist. We have documented your experience and appreciate you making us aware of the situation.

All purchases for 2018 being January 1, 2018 - December 31, 2018 will be credited towards the tier-qualifying status for 2018. All purchases from January 1, 2019 - December 31, 2019 will be counted towards 2019. All information can be found in the offer details for your World of Hyatt credit card on worldofhyatt.com or chase.com.

Thank you for contacting Chase in regards to your World of Hyatt account.

We regret to hear of misinformation given by our specialist. We have documented your experience and appreciate you making us aware of the situation.

All purchases for 2018 being January 1, 2018 - December 31, 2018 will be credited towards the tier-qualifying status for 2018. All purchases from January 1, 2019 - December 31, 2019 will be counted towards 2019. All information can be found in the offer details for your World of Hyatt credit card on worldofhyatt.com or chase.com.

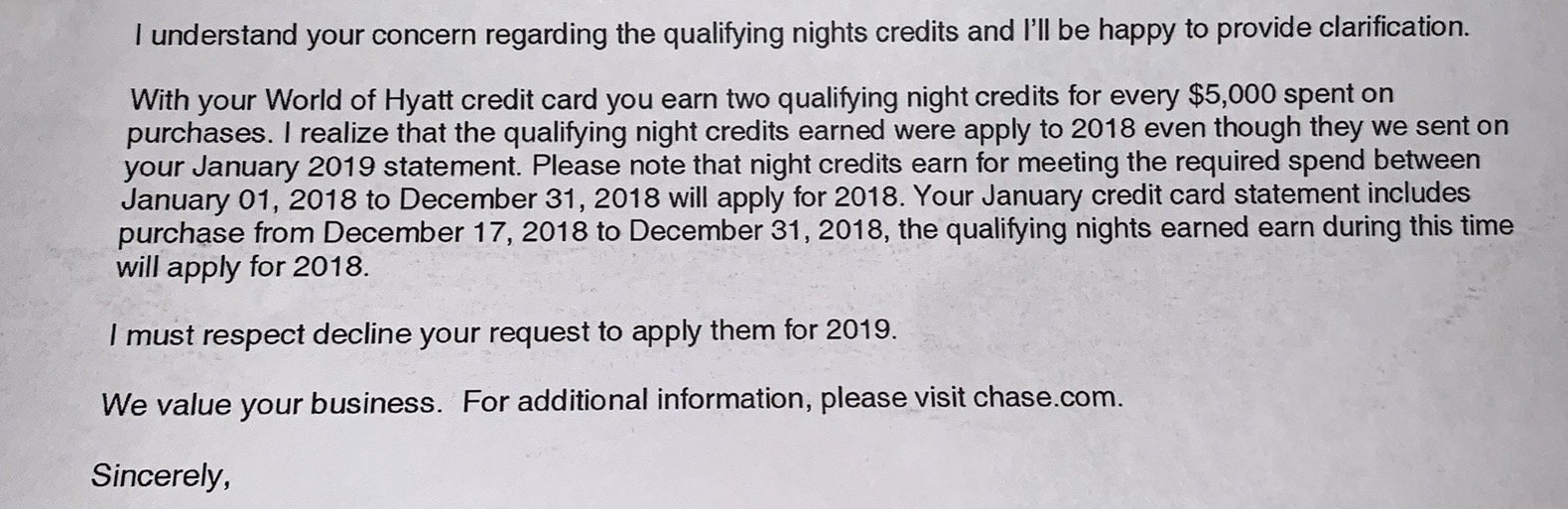

@MarkOK just experienced the opposite of the smoke they are trying to blow up my a$$ and opposite of what supervisors have informed several FTers even after January 1st.

#47

#48

Join Date: Aug 2017

Location: Stilllwater OK (SWO)

Programs: AAdvantage ExecPlat, World of Hyatt Globalist, plain "member" of Marriott, IHG, enterprise, etc.

Posts: 1,844

Is this BS? I do not think this info can be found anywhere so clearly, no. Some goodwilling FTer should correct me if I am wrong and save me some effort to dispute this.

@MarkOK just experienced the opposite of the smoke they are trying to blow up my a$$ and opposite of what supervisors have informed several FTers even after January 1st.

@MarkOK just experienced the opposite of the smoke they are trying to blow up my a$$ and opposite of what supervisors have informed several FTers even after January 1st.

My guess is that perhaps they meant to have stated "All purchases for 2018 being ON STATEMENTS CLOSING January 1, 2018 - December 31, 2018 will be credited towards the tier-qualifying status for 2018. All purchases ON STATEMENTS CLOSING from January 1, 2019 - December 31, 2019 will be counted towards 2019. All information can be found in the offer details for your World of Hyatt credit card on worldofhyatt.com or chase.com"

My job is 40% technical writing (proposals for funding, scientific papers and reports), and it is amazing how easy things are said somewhat imprecisely or incompletely by all of us (me included) on a day to day basis.

In your case, I would definately escalate as to why you were given the full 16 nights that should have been credited with your Jan 2019 statement

#49

Suspended

Join Date: Oct 2017

Location: Miami, Florida

Programs: AA ExPlat, Hyatt Globalist, IHG Spire, Hilton Gold

Posts: 4,009

Data Point:

My statement closed Jan 20. I had about 2.2K dollars in spend on my WoH card since December 20th. On that Dec 20 statement, my rolling extra towards my next 2 nights was something close to 3-4K.

I got 2 EQDs posted to my account yesterday with my statement.

My guess (which matches my expectation) is that the 5K is just on a continuous roll. When you close a statement that exceeds that roll, you get credit then and there. Chase isn't going to split up spending between the years midcycle. My bet with the 15K/cat1-4 count is that it resets on your anniversary statement date.

My statement closed Jan 20. I had about 2.2K dollars in spend on my WoH card since December 20th. On that Dec 20 statement, my rolling extra towards my next 2 nights was something close to 3-4K.

I got 2 EQDs posted to my account yesterday with my statement.

My guess (which matches my expectation) is that the 5K is just on a continuous roll. When you close a statement that exceeds that roll, you get credit then and there. Chase isn't going to split up spending between the years midcycle. My bet with the 15K/cat1-4 count is that it resets on your anniversary statement date.

Is this BS? I do not think this info can be found anywhere so clearly, no. Some goodwilling FTer should correct me if I am wrong and save me some effort to dispute this.

@MarkOK just experienced the opposite of the smoke they are trying to blow up my a$$ and opposite of what supervisors have informed several FTers even after January 1st.

@MarkOK just experienced the opposite of the smoke they are trying to blow up my a$$ and opposite of what supervisors have informed several FTers even after January 1st.

#50

#51

Suspended

Join Date: Oct 2017

Location: Miami, Florida

Programs: AA ExPlat, Hyatt Globalist, IHG Spire, Hilton Gold

Posts: 4,009

Customer service reps get things wrong all the time. It never made any sense that any full $5,000 increments spent in 2018 would count in 2019.

It’s not even clear that the Chase people got anything wrong, rather than people not clearly asking what would happen with full $5,000 increments spent after the Dec. statement closed and before Jan. 1.

It’s not even clear that the Chase people got anything wrong, rather than people not clearly asking what would happen with full $5,000 increments spent after the Dec. statement closed and before Jan. 1.

#52

Join Date: Aug 2017

Location: Stilllwater OK (SWO)

Programs: AAdvantage ExecPlat, World of Hyatt Globalist, plain "member" of Marriott, IHG, enterprise, etc.

Posts: 1,844

Customer service reps get things wrong all the time. It never made any sense that any full $5,000 increments spent in 2018 would count in 2019.

It’s not even clear that the Chase people got anything wrong, rather than people not clearly asking what would happen with full $5,000 increments spent after the Dec. statement closed and before Jan. 1.

So, I investigated further. My rolling extra towards my next 5,000 dollars was at 3846.02 after my December 20th statement cycle. I spent 1345.28 before December 31st -- thus, I completed my 5K block in 2018. After Jan 1, I only spent another 1000 or so on the card - not enough to earn the 2 credits for 2019 that I got.

So, I stand by my data, and gut feeling, that Chase isn't in the business of parsing out statements and backlogging credit card spend.

#53

Suspended

Join Date: Oct 2017

Location: Miami, Florida

Programs: AA ExPlat, Hyatt Globalist, IHG Spire, Hilton Gold

Posts: 4,009

Some data above suggests that could be true, but I comnpletely find it surprising that Chase will parse out spending data between years on the Jan statement and backlog night credits to a previous year with Hyatt.

So, I investigated further. My rolling extra towards my next 5,000 dollars was at 3846.02 after my December 20th statement cycle. I spent 1345.28 before December 31st -- thus, I completed my 5K block in 2018. After Jan 1, I only spent another 1000 or so on the card - not enough to earn the 2 credits for 2019 that I got.

So, I stand by my data, and gut feeling, that Chase isn't in the business of parsing out statements and backlogging credit card spend.

So, I investigated further. My rolling extra towards my next 5,000 dollars was at 3846.02 after my December 20th statement cycle. I spent 1345.28 before December 31st -- thus, I completed my 5K block in 2018. After Jan 1, I only spent another 1000 or so on the card - not enough to earn the 2 credits for 2019 that I got.

So, I stand by my data, and gut feeling, that Chase isn't in the business of parsing out statements and backlogging credit card spend.

With Chase, spending that occurs within a few days of a closing date doesn’t always count for that statement for points purposes. That’s probably what explains your situation, since $200 in either direction would have been enough to put you over or under $5,000.

Chase has also been doing this exact thing for several years with its United cards, so there’s no new functionality required.

#54

Join Date: Dec 2013

Location: Homeless

Programs: Hyatt Glob; Hilton Dia; Marriott AMB; Accor Dia; IHG Dia Amb; GHA Tit

Posts: 4,835

Since this is most likely automated, I would be very surprised if the way they handled my account was different than the way they handled other accounts.

#55

Join Date: Nov 2014

Location: MCI

Posts: 698

Interesting. So a couple of thoughts/questions on this:

Given escape4's post, seems like the easy way to remember is that calendar year spends only count for that calendar year....regardless of when the statement closes for that spend (ie Dec spends that show up on Jan statements.) (please correct me if I'm wrong in drawing this conclusion from the posts here)

With this in mind then, would it be strategic to position more spend at the beginning of the year and, optimally, not do much spend in Nov/Dec so that it's not "wasted"? (ie, what good is it to spend $$$ at the end of december....if it only counts toward that calendar year....)

Also for those who have the World of Hyatt card, I assume both of the below nights do NOT carryover and "stack" if you don't use it in the year it is earned:

The annual anniversary night

The 15k spend bonus night

If you don't use either of them after 1 year of being eligible for them, I assume they are lost? (IE, you cannot wait to the 2nd year and use 3 nights in a row?)

Given escape4's post, seems like the easy way to remember is that calendar year spends only count for that calendar year....regardless of when the statement closes for that spend (ie Dec spends that show up on Jan statements.) (please correct me if I'm wrong in drawing this conclusion from the posts here)

With this in mind then, would it be strategic to position more spend at the beginning of the year and, optimally, not do much spend in Nov/Dec so that it's not "wasted"? (ie, what good is it to spend $$$ at the end of december....if it only counts toward that calendar year....)

Also for those who have the World of Hyatt card, I assume both of the below nights do NOT carryover and "stack" if you don't use it in the year it is earned:

The annual anniversary night

The 15k spend bonus night

If you don't use either of them after 1 year of being eligible for them, I assume they are lost? (IE, you cannot wait to the 2nd year and use 3 nights in a row?)

#56

Suspended

Join Date: Oct 2017

Location: Miami, Florida

Programs: AA ExPlat, Hyatt Globalist, IHG Spire, Hilton Gold

Posts: 4,009

With this in mind then, would it be strategic to position more spend at the beginning of the year and, optimally, not do much spend in Nov/Dec so that it's not "wasted"? (ie, what good is it to spend $$$ at the end of december....if it only counts toward that calendar year....)

Also for those who have the World of Hyatt card, I assume both of the below nights do NOT carryover and "stack" if you don't use it in the year it is earned:

The annual anniversary night

The 15k spend bonus night

If you don't use either of them after 1 year of being eligible for them, I assume they are lost? (IE, you cannot wait to the 2nd year and use 3 nights in a row?)

The annual anniversary night

The 15k spend bonus night

If you don't use either of them after 1 year of being eligible for them, I assume they are lost? (IE, you cannot wait to the 2nd year and use 3 nights in a row?)

#57

Join Date: Nov 2014

Location: MCI

Posts: 698

There’s only “wasted spend” if people spend full $5,000 increments late in a year that don’t push the person over a qualifying threshold — e.g., 60 nights for Globalist. Any portion below $5,000 from late in a year appears to carry over to the next year, so that’s not wasted, either.

Correct. Those nights are good for either 6 or 12 months, and are clearly labeled with the expiration date.

Correct. Those nights are good for either 6 or 12 months, and are clearly labeled with the expiration date.

Thanks for the fast reply and your insight/time! ^

#58

Join Date: Mar 2018

Location: Virginia

Programs: Hyatt / SPG

Posts: 101

I’m pissed! I spent over $10,000 around the holidays thinking 4 EQN will apply for 2019 since my statement closed in January. Chase freaking back dated everything to 2018. Ugh

Welp now we have an answer its base on spending date not statement date

Welp now we have an answer its base on spending date not statement date

#59

Join Date: Nov 2014

Location: MCI

Posts: 698

#60

Join Date: Jan 2015

Programs: Hyatt Diamond; HHonors Dia; Langham Voyager; Marriot & SPG Gold; UA Gold; AA Plat

Posts: 54

Strategic spend-timing

Got my WoH Visa in September, 2018.

The 5-night Card-Holding credits for 2018 appeared in my night-count tally before the card had even landed in my mailbox. (Annoyingly, as per usual Hyatt IT lameness, there's no line item in my WoH account describing those 5-night credits ~ the total simply went up by 5). Those 5 credits, plus my remaining stays for 2018, got me just over the line to 56 nights for the 2018 Calendar year. Strategically spent ~$3400 during Sept~December on the WoH Visa card. This got me the initial 40k bonus points offer on $3k spend in first 3 months.

5-night Card Holding credits for 2019 appeared on my WoH account in mid-January.

Hit ~$5200 cumulative spend some time in late January. This triggered the 2-night credits for Rolling $5k spend meter.

Will hit surpass the $6k total spend by end of February for the 20k additional bonus points offer on $6k Total spend in first 6 months.

Will certainly hit second Rolling $5k spend meter in 2019, possibly even a third.

That's 9-night credits (possibly 12) for 2019 for using the card. And I'll need them, as my travel has been curtailed somewhat lately. Will hopefully make it to 55 again this year. Have been Diamond since 2014. Hitting the *re-increased* 60-nights during 2020 is gonna be a stretch. Lions share of the $6k minimum spend for the 60k total sign-up bonus was/will be Hyatt spend for the 4x (add'l ~ 24k points) so account point balance has gotten a healthy boost :-)

The 5-night Card-Holding credits for 2018 appeared in my night-count tally before the card had even landed in my mailbox. (Annoyingly, as per usual Hyatt IT lameness, there's no line item in my WoH account describing those 5-night credits ~ the total simply went up by 5). Those 5 credits, plus my remaining stays for 2018, got me just over the line to 56 nights for the 2018 Calendar year. Strategically spent ~$3400 during Sept~December on the WoH Visa card. This got me the initial 40k bonus points offer on $3k spend in first 3 months.

5-night Card Holding credits for 2019 appeared on my WoH account in mid-January.

Hit ~$5200 cumulative spend some time in late January. This triggered the 2-night credits for Rolling $5k spend meter.

Will hit surpass the $6k total spend by end of February for the 20k additional bonus points offer on $6k Total spend in first 6 months.

Will certainly hit second Rolling $5k spend meter in 2019, possibly even a third.

That's 9-night credits (possibly 12) for 2019 for using the card. And I'll need them, as my travel has been curtailed somewhat lately. Will hopefully make it to 55 again this year. Have been Diamond since 2014. Hitting the *re-increased* 60-nights during 2020 is gonna be a stretch. Lions share of the $6k minimum spend for the 60k total sign-up bonus was/will be Hyatt spend for the 4x (add'l ~ 24k points) so account point balance has gotten a healthy boost :-)

Last edited by yoganeck; Feb 7, 2019 at 6:44 pm