Question about Hong Kong issued credit cards

#1

FlyerTalk Evangelist

Original Poster

Join Date: Aug 2010

Location: CPH

Programs: UAMP S, TK M&S E (*G), Marriott LTP, IHG P, SK EBG

Posts: 11,082

Question about Hong Kong issued credit cards

Hi, I asked this question to my friend and somehow they can't answer it, so I'm trying to ask the question here and I hope that FTers in Hong Kong can help me with this.

I have citibank account (from Hong Kong), and I have a credit card with them. I was hit by their crazy exchange rate difference when shops tried to refund my purchases (e.g. for USD to HKD, if you make a purchase the rate is 1 USD to $7.99 and if you are getting a refund you are getting 1 USD to $7.67HKD). I don't care for smaller amount but it hits me real hard when a Japanese optician tried to refund and recharge me for my prescription glasses. I have had credit cards in the UK, Germany, Denmark and Sweden and when I do refunds on those cards they always give me the same rate as if I'm buying something on the date of refund.

Is this common practice in Hong Kong?

TIA!

I have citibank account (from Hong Kong), and I have a credit card with them. I was hit by their crazy exchange rate difference when shops tried to refund my purchases (e.g. for USD to HKD, if you make a purchase the rate is 1 USD to $7.99 and if you are getting a refund you are getting 1 USD to $7.67HKD). I don't care for smaller amount but it hits me real hard when a Japanese optician tried to refund and recharge me for my prescription glasses. I have had credit cards in the UK, Germany, Denmark and Sweden and when I do refunds on those cards they always give me the same rate as if I'm buying something on the date of refund.

Is this common practice in Hong Kong?

TIA!

#3

FlyerTalk Evangelist

Original Poster

Join Date: Aug 2010

Location: CPH

Programs: UAMP S, TK M&S E (*G), Marriott LTP, IHG P, SK EBG

Posts: 11,082

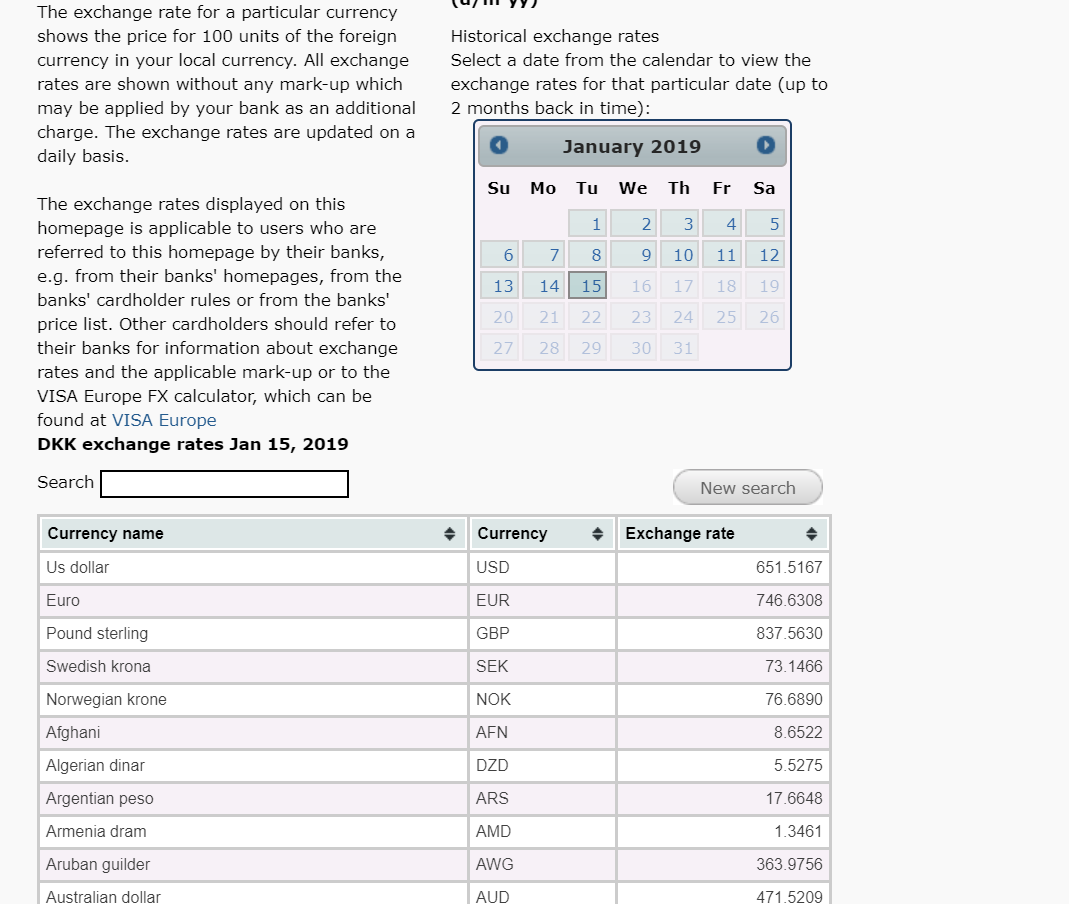

Also I checked with Visa and I don't see they have a buy-sell rate for foreign currency like this - so far I have around USD 250 of various refunds and I'm shocked that banks can grab money like this.

What about AMEX/Mastercard in Hong Kong? Same thing?

#4

Join Date: Oct 2014

Posts: 3,097

There's also the question of exchange rate changes between the date of purchase and the date of refund. You take this risk. I'm awfully sure I've seen a warning about this in Citibank's terms and conditions. Anyway, no matter the bank, I always know I'm going to lose a bit when refunding a foreign currency charge. Not sure I've ever gotten precisely the same back as I was charged.

As to Citibank (HK) and foreign transactions generally, I just had an AirAsia purchase in HKD rejected by Citibank. When I called, they said their system rejected it because the billing was in HKD. If AirAsia had billed in another currency, no problem.

I know some banks in HK charge a foreign transaction fee on HKD charges if the charge arises outside Hong Kong. But this is the first time I've encountered a complete block. Not happy with Citibank! And I find no warning in their terms and conditions that they do this.

As to Citibank (HK) and foreign transactions generally, I just had an AirAsia purchase in HKD rejected by Citibank. When I called, they said their system rejected it because the billing was in HKD. If AirAsia had billed in another currency, no problem.

I know some banks in HK charge a foreign transaction fee on HKD charges if the charge arises outside Hong Kong. But this is the first time I've encountered a complete block. Not happy with Citibank! And I find no warning in their terms and conditions that they do this.

#5

Suspended

Join Date: Jun 2002

Location: Hong Kong

Programs: None any more

Posts: 11,017

I can only speak with confidence for HSBC and Citibank Visa cards in HK - for both, you take the hit.

If I ever did this in my Amex or Mastercard days I can't remember the details, sorry.

If I ever did this in my Amex or Mastercard days I can't remember the details, sorry.

#7

Join Date: Sep 2012

Location: NW London and NW Sydney

Programs: BA Diamond, Hilton Bronze, A3 Diamond, IHG *G

Posts: 6,344

Anyway I suppose that's how HSBC is funding the ~6% rewardcash on overseas spending. It remains to be seen if I'll actually get this 6% (didn't try last year)

#9

Join Date: Dec 2016

Programs: MP, BR

Posts: 375

I'm actually surprised banks in other countries gives the same rate when refunding - what if there was significant change in the exchange rate? There are several factors here: buy/sell spread of the currency, foreign exchange charge imposed by the bank, exchange rate fluctuations. Most of the time you probably get the short end of the stick when getting a refund but I've also experienced "exchange gains" when I bought ticket for an foreign event that was eventually cancelled.

#10

Join Date: Sep 2012

Location: NW London and NW Sydney

Programs: BA Diamond, Hilton Bronze, A3 Diamond, IHG *G

Posts: 6,344

I'm actually surprised banks in other countries gives the same rate when refunding - what if there was significant change in the exchange rate? There are several factors here: buy/sell spread of the currency, foreign exchange charge imposed by the bank, exchange rate fluctuations. Most of the time you probably get the short end of the stick when getting a refund but I've also experienced "exchange gains" when I bought ticket for an foreign event that was eventually cancelled.

You only get the same rate when the transaction is voided, e.g. when there is fraud or a mistake or DCC that you didn't agree to, so the entire transaction is cancelled.

Otherwise you just get the card network's prevailing rate on the day. What happens if you refund to a different card - how would they know what you originally paid? (When you refund something in person and the sales staff forgets to check that you are refunding to the same card you paid with - so you put in a debit card and keep your credit card points)

I think the reason "exchange gains" are rare is because Visa itself has a 0.25-0.5% spread on its rates, plus in Europe at least they are determined the day before, while MC rates tend to have a lower spread and are determined the day after.

On the BA board many people made gains when their mistake fares were refunded

#11

Join Date: Oct 2014

Posts: 3,097

I just checked a recent HSBC statement, and on November 15 I received an RMB refund processed at 1.10573, while RMB charges over the next few days were processed at 1.15105 and thereabouts. So the spread does suggest HSBC charges its foreign transaction fee both coming and going.

It's complete profit for the bank, since all the exchange work is done by the Visa/MC networks. HSBC settles in HKD with the network just as it does for local charges in HKD. In a word, foreign transaction fees are a ripoff.

It's complete profit for the bank, since all the exchange work is done by the Visa/MC networks. HSBC settles in HKD with the network just as it does for local charges in HKD. In a word, foreign transaction fees are a ripoff.

#12

FlyerTalk Evangelist

Original Poster

Join Date: Aug 2010

Location: CPH

Programs: UAMP S, TK M&S E (*G), Marriott LTP, IHG P, SK EBG

Posts: 11,082

I just checked a recent HSBC statement, and on November 15 I received an RMB refund processed at 1.10573, while RMB charges over the next few days were processed at 1.15105 and thereabouts. So the spread does suggest HSBC charges its foreign transaction fee both coming and going.

It's complete profit for the bank, since all the exchange work is done by the Visa/MC networks. HSBC settles in HKD with the network just as it does for local charges in HKD. In a word, foreign transaction fees are a ripoff.

It's complete profit for the bank, since all the exchange work is done by the Visa/MC networks. HSBC settles in HKD with the network just as it does for local charges in HKD. In a word, foreign transaction fees are a ripoff.

I do understand that currency fluctuates over time, however using a totally different rate is just wrong especially I'm not actually buying the currency.

At least for the cards that I have there's only 1 exchange rate per currency, not buy and sell rate. When there's a refund they will look at what's the rate of that date - and applied it on the cancelled transactions, yeah some days it's in my favour and some days not - but it's not like this!

I have to put it in the same card that I made my purchase with (it's the US they don't want credit card fraud).

#13

#15

FlyerTalk Evangelist

Original Poster

Join Date: Aug 2010

Location: CPH

Programs: UAMP S, TK M&S E (*G), Marriott LTP, IHG P, SK EBG

Posts: 11,082

There's no AMEX in DK and in Sweden it's 2% - both directions! I think refunding any purchases with a different exchange rate is simply wrong. It's difference if I'm drawing cash but the card company have already robbed me once and they robbed me double when a shop refunded me! I paid 7.99 and got back 7.67 (I can understand if it's 7.8).