Delta new Revenue Management model?

#1

Original Poster

Join Date: Sep 2012

Posts: 1,329

Delta new Revenue Management model?

I've noticed a dramatic increase in Delta's pricing on many routes over the past few days. My guess is they've reworked their revenue models to account for the new (reduced) capacity of each aircraft and are now charging accordingly.

Anyone else notice this? Will be interesting to see who follows suit...

Anyone else notice this? Will be interesting to see who follows suit...

#3

FlyerTalk Evangelist

Join Date: Jul 2003

Posts: 23,020

Anything before August is being impacted by heavy schedule reductions and seat blocking. I doubt there is any dastardly intent here, but rather the revenue management systems having trouble with the very limited supply of seats. It's easy enough to check on EF if there have actually been any new fare filings if you provide some routes and dates. AA and UA have yet to load their July schedule reductions while DL has already done theirs. There's a thread on UA forum about high prices (I suspect it is mostly about June flights as UA cut their June schedule by a similar amount as DL and they are having similar bucket inventory issues).

Last edited by xliioper; Jun 2, 2020 at 5:58 pm

#5

A FlyerTalk Posting Legend

Join Date: Sep 2009

Location: Minneapolis: DL DM charter 2.3MM

Programs: A3*Gold, SPG Plat, HyattDiamond, MarriottPP, LHW exAccess, ICI, Raffles Amb, NW PE MM, TWA Gold MM

Posts: 100,369

If DL has to run flights using at most 60% of the seats on the aircraft, this will obviously raise costs per passenger, so we should expect prices to go up, although not necessarily proportional to what might be naively calculated due to the reduction in capacity. Elasticity of demand matters and costs aren't linear.

OTOH, I suspect that it's a new world in terms of being able to use previous big data and analytics to predict demand, so there will be apparent mistakes in revenue management as well as capacity/route planning.

OTOH, I suspect that it's a new world in terms of being able to use previous big data and analytics to predict demand, so there will be apparent mistakes in revenue management as well as capacity/route planning.

#6

Original Poster

Join Date: Sep 2012

Posts: 1,329

Anything before August is being impacted by heavy schedule reductions and seat blocking. I doubt there is any dastardly intent here, but rather the revenue management systems having trouble with the very limited supply of seats. It's easy enough to check on EF if there have actually been any new fare filings if you provide some routes and dates. AA and UA have yet to load their July schedule reductions while DL has already done theirs. There's a thread on UA forum about high prices (I suspect it is mostly about June flights as UA cut their June schedule by a similar amount as DL and they are having similar bucket inventory issues).

#7

FlyerTalk Evangelist

Join Date: Jul 2003

Posts: 23,020

There are 14-day advance fare caps though July and no advance ones through the end of June. The 14-day advance purchase ones are relatively reasonable, but if you are buying less than 14 days out, it will can be pretty pricey. The 14-day advance one-way Y912TU fare on DTW-LAX is $249, while a K fare (with 7-day advance requirement) is $395. The no advance Y fare cap (Y912T2) is $449. This is still quite a bit less than full-fare Y/B/M fares you would normally see when the lower buckets are empty. M fares on this route are about $644.

#8

Join Date: Jun 2005

Location: Huntsville, AL

Programs: DL DM 1.929MM, Hilton Lifetime Diamond, IHG Platinum, Avis CHM, Marriott Titanium (lifetime gold)

Posts: 7,857

I see many complaints on a facebook forum about Delta fares being too high and also about the lack of food and beverage service. Many claims about status matching and trying the other airlines.

For me, Delta has done enough over the years that I will pay some extra and take a longer connection to stay with the widget. It's been years since my one status match to Continental, and Kevin Pinto did something big for me (don't even remember what it was) and I never used that matched status.

Plus if you go to AA or UA, you are putting yourself in the hands of Doug Parker or Scott Kirby. Neither one of those gentlemen give a flip about their customers. Plus on the few times I fly with AA, something bAAd happens.

#10

FlyerTalk Evangelist

Join Date: Jul 2003

Posts: 23,020

Last edited by xliioper; Jun 2, 2020 at 6:55 pm

#11

Original Poster

Join Date: Sep 2012

Posts: 1,329

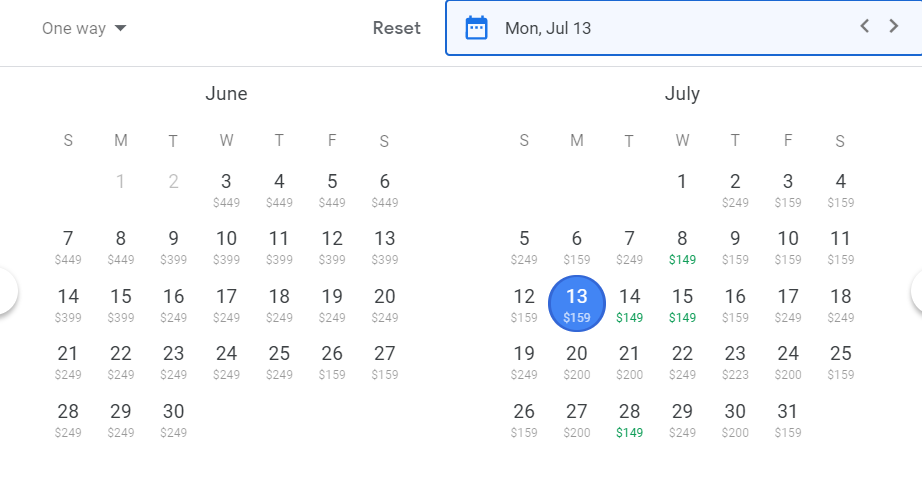

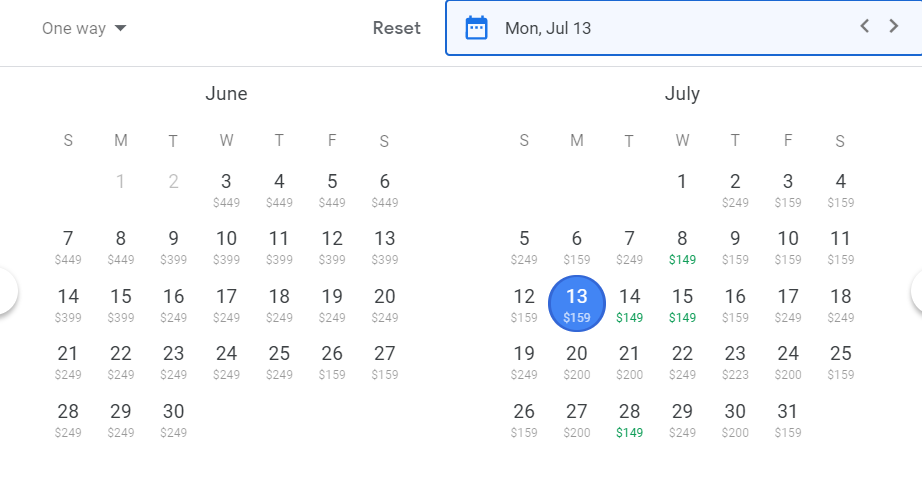

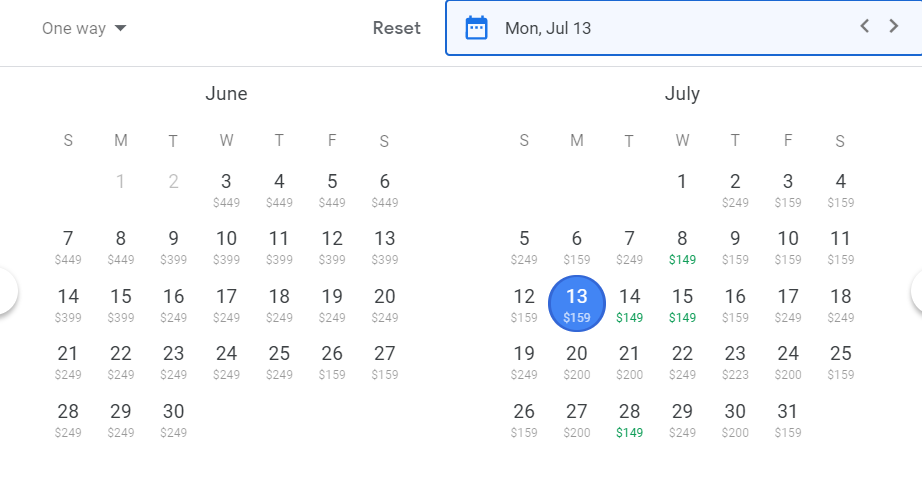

Sorry, not seeing it. $249 is the 14-day advance Y912TU fare cap. Is that the "high" price you are talking about? Here are DL non-stop's on ATL-SFO in June and July. While there are certainly days where the cap is being charged, there are other days where there is inventory in the lower price buckets (typically T/X/V) on some flights. The $149 fares are 21-day advance V basis BE fares (Tue/Wed) and $159 are same for other days of the week. These are the cheapest published fares on the route. Again if you look past the month of July, then you can see there is V bucket on at least one flight everyday (as flights go from 3x daily in July to 10x daily in August as they have not reduced August schedule yet). This is just an artifact of inventory management struggling with the very limited schedule and not really some new strategy.

Regardless of how they got there, it seems DL RM is getting smarter. Let's see if it sticks.

#12

FlyerTalk Evangelist

Join Date: Jul 2003

Posts: 23,020

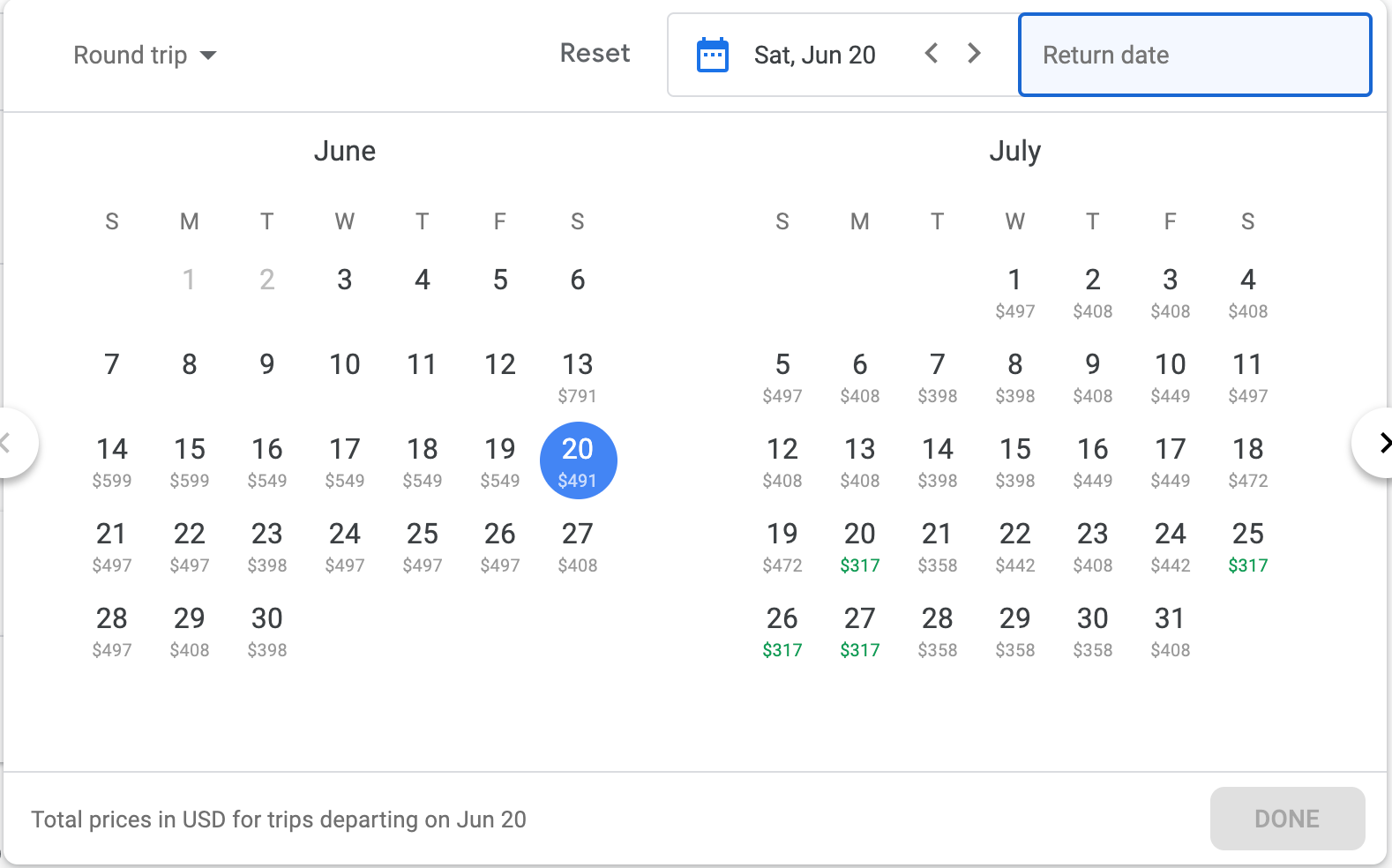

Yes, $497 is just the fare cap in both directions (it's actually $248.10 one-way). Doing a roundtrip search somewhat distorts things as you can't combine a BE fare with a non-BE fare in a roundtrip booking. So if you get a fare cap in one direction (which is main cabin), you can't combine with a potentially lower BE fare in the other and you mostly end up with the fare cap in both directions. If you book as two one-way's, you could potentially combine the fare cap with a BE fare. Note that the fare cap fares are Y fares, they earn a 50% MQM bonus.

Last edited by xliioper; Jun 2, 2020 at 9:32 pm

#15

FlyerTalk Evangelist

Join Date: Jul 2001

Location: Phoenix, AZ

Programs: HH Gold, AA Gold

Posts: 10,457

If DL has to run flights using at most 60% of the seats on the aircraft, this will obviously raise costs per passenger, so we should expect prices to go up, although not necessarily proportional to what might be naively calculated due to the reduction in capacity. Elasticity of demand matters and costs aren't linear.

OTOH, I suspect that it's a new world in terms of being able to use previous big data and analytics to predict demand, so there will be apparent mistakes in revenue management as well as capacity/route planning.

OTOH, I suspect that it's a new world in terms of being able to use previous big data and analytics to predict demand, so there will be apparent mistakes in revenue management as well as capacity/route planning.