Travel card suggestion for this newbie ?

#1

Original Poster

Join Date: May 2018

Posts: 5

Contemplating when to apply for my next 2 (no more than 3) credit cards...looking for a solid value-add travel card(s). I expect to be in the garden until April 2023

Current stats:

FICO 748

AAoA 9yrs

TU report I have 5 inquiries, 3 new credit card opened in 2021

Cap1 Willams Sonoma (3/2021)

Fidelity Rewards (11/2021)

FNBO Evergreen (11/2021)

EX report I have 3 inquiries, same 3 new credit cards.

Home Airline Airport Chicago

Loyalty programs United MileagePlus, American Airlines, Marriott Bonvoy

Accepted Mar 4, Amex EDP upgrade SUB 40k MR points/2k spend/3 months/prorated AF(hits 4/21)

Future stats:

4/2023 will be 2/24 for purposes of Chase consideration

9/2023 TU inquiries will be 3, EX inquires will be 1

To optimize my approval odds and capture a card(s)to round out my travel reward opportunities, should I:

space out applications, one or two in April and then one or two in September

(already have CFF, Chase Marriott Bonvoy Premier considering CSP, CFU or United Explorer) and/or contemplating Citi Premier (already have Citi CC, Citi DC) or Amex Gold (already have Amex EDP and Amex BCP). Other thoughts???

Current stats:

FICO 748

AAoA 9yrs

TU report I have 5 inquiries, 3 new credit card opened in 2021

Cap1 Willams Sonoma (3/2021)

Fidelity Rewards (11/2021)

FNBO Evergreen (11/2021)

EX report I have 3 inquiries, same 3 new credit cards.

Home Airline Airport Chicago

Loyalty programs United MileagePlus, American Airlines, Marriott Bonvoy

Accepted Mar 4, Amex EDP upgrade SUB 40k MR points/2k spend/3 months/prorated AF(hits 4/21)

Future stats:

4/2023 will be 2/24 for purposes of Chase consideration

9/2023 TU inquiries will be 3, EX inquires will be 1

To optimize my approval odds and capture a card(s)to round out my travel reward opportunities, should I:

space out applications, one or two in April and then one or two in September

(already have CFF, Chase Marriott Bonvoy Premier considering CSP, CFU or United Explorer) and/or contemplating Citi Premier (already have Citi CC, Citi DC) or Amex Gold (already have Amex EDP and Amex BCP). Other thoughts???

#2

Join Date: Dec 2021

Location: CMH

Posts: 217

Contemplating when to apply for my next 2 (no more than 3) credit cards...looking for a solid value-add travel card(s). I expect to be in the garden until April 2023

Current stats:

FICO 748

AAoA 9yrs

TU report I have 5 inquiries, 3 new credit card opened in 2021

Cap1 Willams Sonoma (3/2021)

Fidelity Rewards (11/2021)

FNBO Evergreen (11/2021)

EX report I have 3 inquiries, same 3 new credit cards.

Home Airline Airport Chicago

Loyalty programs United MileagePlus, American Airlines, Marriott Bonvoy

Accepted Mar 4, Amex EDP upgrade SUB 40k MR points/2k spend/3 months/prorated AF(hits 4/21)

Future stats:

4/2023 will be 2/24 for purposes of Chase consideration

9/2023 TU inquiries will be 3, EX inquires will be 1

To optimize my approval odds and capture a card(s)to round out my travel reward opportunities, should I:

space out applications, one or two in April and then one or two in September

(already have CFF, Chase Marriott Bonvoy Premier considering CSP, CFU or United Explorer) and/or contemplating Citi Premier (already have Citi CC, Citi DC) or Amex Gold (already have Amex EDP and Amex BCP). Other thoughts???

Current stats:

FICO 748

AAoA 9yrs

TU report I have 5 inquiries, 3 new credit card opened in 2021

Cap1 Willams Sonoma (3/2021)

Fidelity Rewards (11/2021)

FNBO Evergreen (11/2021)

EX report I have 3 inquiries, same 3 new credit cards.

Home Airline Airport Chicago

Loyalty programs United MileagePlus, American Airlines, Marriott Bonvoy

Accepted Mar 4, Amex EDP upgrade SUB 40k MR points/2k spend/3 months/prorated AF(hits 4/21)

Future stats:

4/2023 will be 2/24 for purposes of Chase consideration

9/2023 TU inquiries will be 3, EX inquires will be 1

To optimize my approval odds and capture a card(s)to round out my travel reward opportunities, should I:

space out applications, one or two in April and then one or two in September

(already have CFF, Chase Marriott Bonvoy Premier considering CSP, CFU or United Explorer) and/or contemplating Citi Premier (already have Citi CC, Citi DC) or Amex Gold (already have Amex EDP and Amex BCP). Other thoughts???

#4

FlyerTalk Evangelist

Join Date: Dec 2003

Location: Not here; there!

Programs: AA Lifetime Gold

Posts: 29,571

OP: It's tough to make a sound recommendation without knowing a little more about your travel and spend patterns, and what you value most: frequent-flyer miles? frequent-guest (hotel) points? cash credits that can be redeemed for travel?

#6

Join Date: Nov 2021

Programs: DL, WN, B6, Marriot, IHG

Posts: 105

Contemplating when to apply for my next 2 (no more than 3) credit cards...looking for a solid value-add travel card(s). I expect to be in the garden until April 2023

Current stats:

FICO 748

AAoA 9yrs

TU report I have 5 inquiries, 3 new credit card opened in 2021

Cap1 Willams Sonoma (3/2021)

Fidelity Rewards (11/2021)

FNBO Evergreen (11/2021)

EX report I have 3 inquiries, same 3 new credit cards.

Home Airline Airport Chicago

Loyalty programs United MileagePlus, American Airlines, Marriott Bonvoy

Accepted Mar 4, Amex EDP upgrade SUB 40k MR points/2k spend/3 months/prorated AF(hits 4/21)

Future stats:

4/2023 will be 2/24 for purposes of Chase consideration

9/2023 TU inquiries will be 3, EX inquires will be 1

To optimize my approval odds and capture a card(s)to round out my travel reward opportunities, should I:

space out applications, one or two in April and then one or two in September

(already have CFF, Chase Marriott Bonvoy Premier considering CSP, CFU or United Explorer) and/or contemplating Citi Premier (already have Citi CC, Citi DC) or Amex Gold (already have Amex EDP and Amex BCP). Other thoughts???

Current stats:

FICO 748

AAoA 9yrs

TU report I have 5 inquiries, 3 new credit card opened in 2021

Cap1 Willams Sonoma (3/2021)

Fidelity Rewards (11/2021)

FNBO Evergreen (11/2021)

EX report I have 3 inquiries, same 3 new credit cards.

Home Airline Airport Chicago

Loyalty programs United MileagePlus, American Airlines, Marriott Bonvoy

Accepted Mar 4, Amex EDP upgrade SUB 40k MR points/2k spend/3 months/prorated AF(hits 4/21)

Future stats:

4/2023 will be 2/24 for purposes of Chase consideration

9/2023 TU inquiries will be 3, EX inquires will be 1

To optimize my approval odds and capture a card(s)to round out my travel reward opportunities, should I:

space out applications, one or two in April and then one or two in September

(already have CFF, Chase Marriott Bonvoy Premier considering CSP, CFU or United Explorer) and/or contemplating Citi Premier (already have Citi CC, Citi DC) or Amex Gold (already have Amex EDP and Amex BCP). Other thoughts???

#7

Original Poster

Join Date: May 2018

Posts: 5

Thanks! this is super helpful...didn't realize I had options to transfer to other partners depending on where I accumulated the points. Will keep this in mind as I continue my learning journey. I can definitely wait on a Cap1 card to be more desirable. Never liked the 3 report pulls for what I considered 'meh' cards in the past.

#8

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,953

American Express, Capital One, Chase, and Citi all have programs which earn points transferable to airline and hotel programs. They each have their own partners, with some overlap. None of these programs transfer to AA. Only Chase transfers to UA. Both American Express and Chase transfer to Marriott. Typically you must hold a "premium" card to use the Transfer feature. For example, to Transfer from Chase Ultimate Rewards to airlines or hotels you need one of these cards: Sapphire Reserve, Sapphire Preferred or INK Preferred. You can include points earned with other cards, but you need one of those cards to access the feature.

#9

FlyerTalk Evangelist

Join Date: Dec 2003

Location: Not here; there!

Programs: AA Lifetime Gold

Posts: 29,571

Each FFP has its own redemption rates, rules, and fees. For example, in some cases, it's cheaper to book a flight on AA with British Airways Avios, than it is to book the same flight with AAdvantage miles. That's why it's so important to get a better sense of your flying patterns, both on tickets you pay cash for, and tickets you hope to get by redeeming miles.

#10

Original Poster

Join Date: May 2018

Posts: 5

Well at the moment, I'm using my AMEX cards more than my Chase, so I'm accumulating MR points and thinking about a trip to Las Vegas late summer. Would I need a premium AMEX card to transfer to a particular airline flying out of Chicago to Las Vegas?? I'm using this planned excursion as my test scenario for how I want to go forward with accumulating points and miles, that's why I projected out to 2023 for capturing the appropriate travel card. But I'll keep looking at my spending and preferences to help sort through all the options. As long as it continues to be fun, I'm fine with trying something, not liking it, and trying something else.

#11

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,953

Transfer Membership Rewards points to which airline or hotel program?

#12

FlyerTalk Evangelist

Join Date: Dec 2003

Location: Not here; there!

Programs: AA Lifetime Gold

Posts: 29,571

#13

Join Date: Nov 2021

Programs: DL, WN, B6, Marriot, IHG

Posts: 105

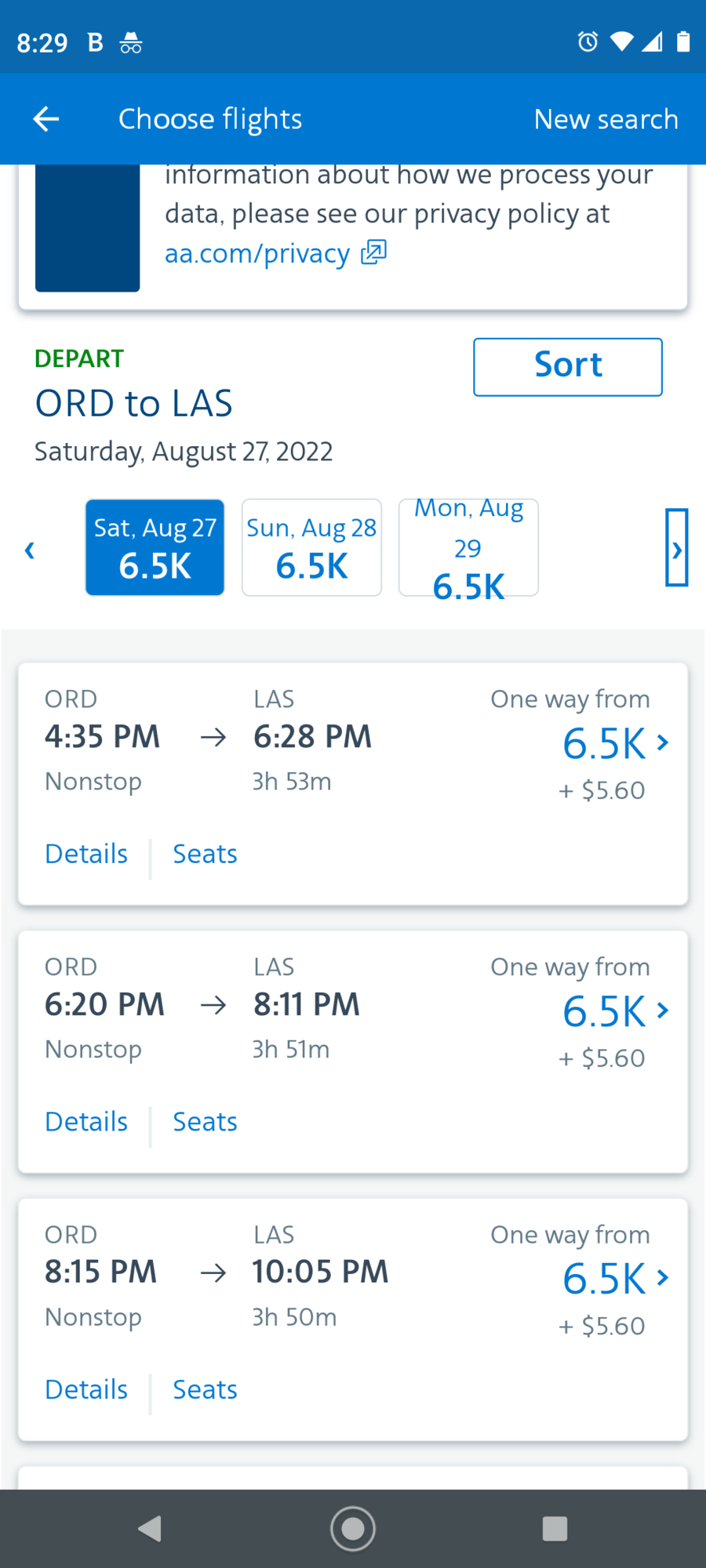

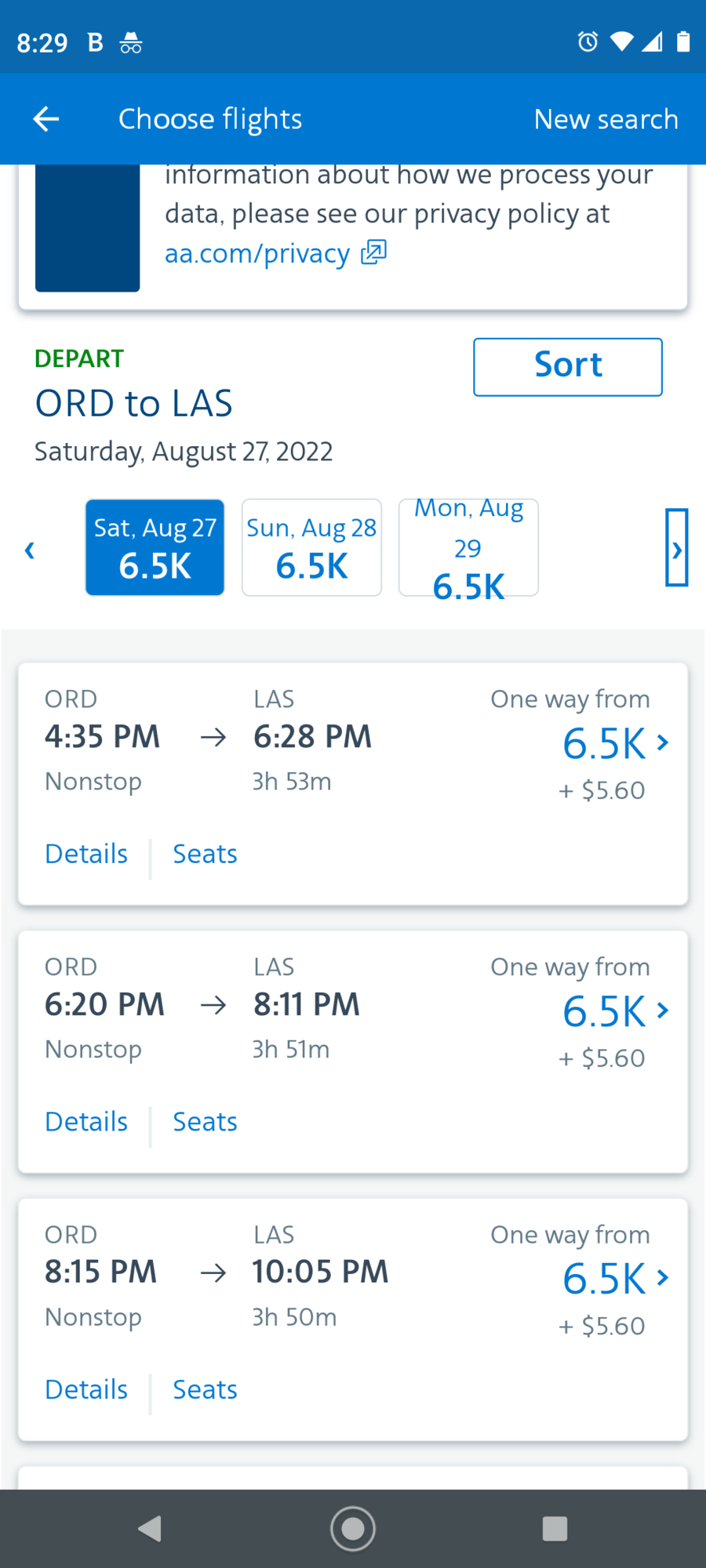

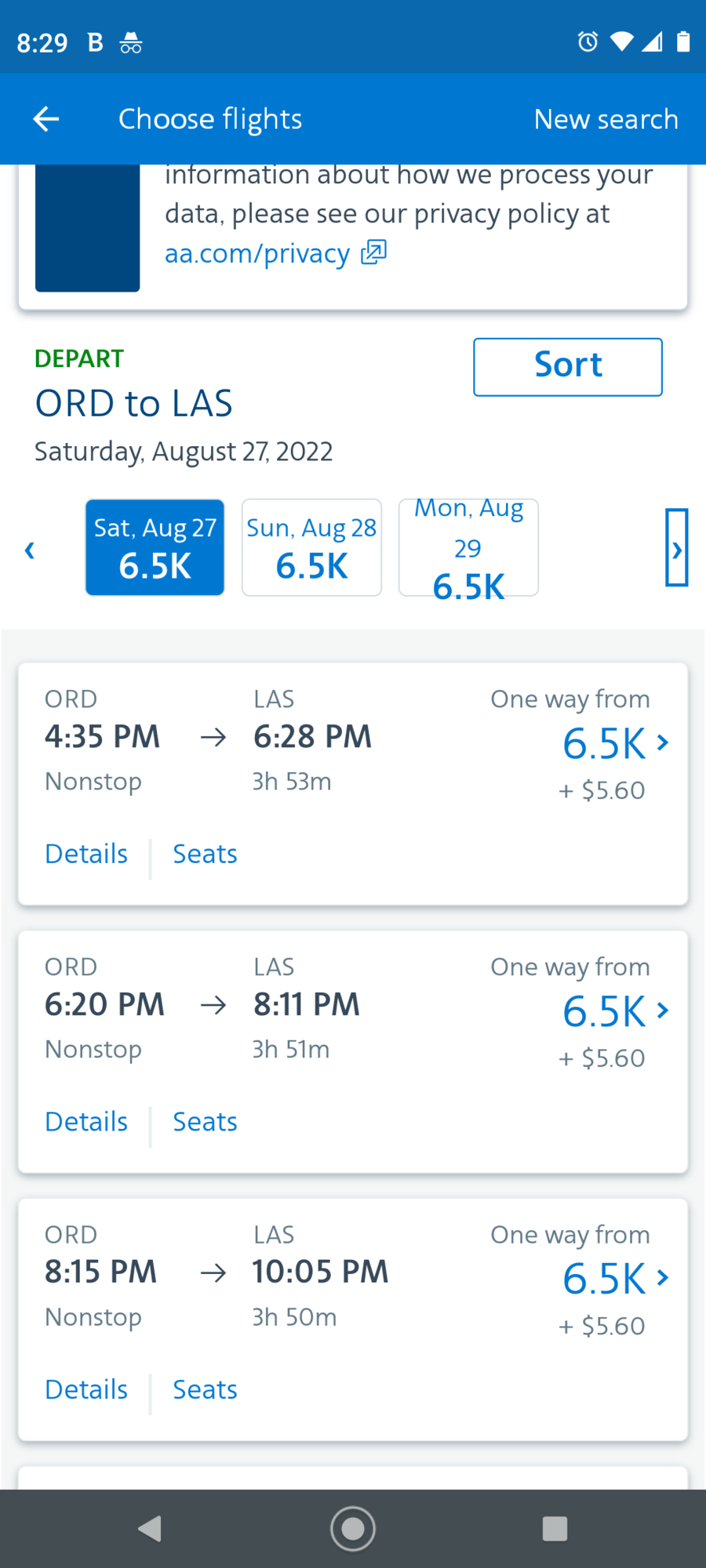

In late August, the majors (AA, UA, and WN) are currently charging $195 for a one-way in Economy CHI-LAS. But on several dates, AA is offering an Economy "Web Special" award on selected nonstops on that route for just 6,500 AA miles + $5.60. That's a redemption value of almost 3.0 cents/mile, which is pretty good for domestic Economy Travel. So maybe go for a Citi or Barclays AAdvantage card for now. (And holding either card would give you a free checked bag on AA domestic flights.)

#14

FlyerTalk Evangelist

Join Date: Dec 2003

Location: Not here; there!

Programs: AA Lifetime Gold

Posts: 29,571

Good point. With AMEX MR, the only domestic airlines you can transfer to are Delta, Hawaiian and jetBlue. Delta Skymiles aren't that valuable, especially when it comes to international travel. I don't know about Hawaiian. jetBlue is a partner of AA, so you can book AA flights via jetBlue with MR points.