Different credit limits same bank?

#1

Original Poster

Join Date: Feb 2006

Location: Verdi, NV, SFO & Olympic (aka Squaw )Valley.

Programs: Ikon Pass Full + AS Gold + Marriott Titanium + Hilton Gold. Recovering UA Plat. LT lounge AA+DL+UA

Posts: 3,823

Different credit limits same bank?

Like many of us I have more than one credit card. I get that every financial institution has its own risk tolerances (and information), so it is not surprising that Bank of America would give a different credit limit than Citi or Amex.

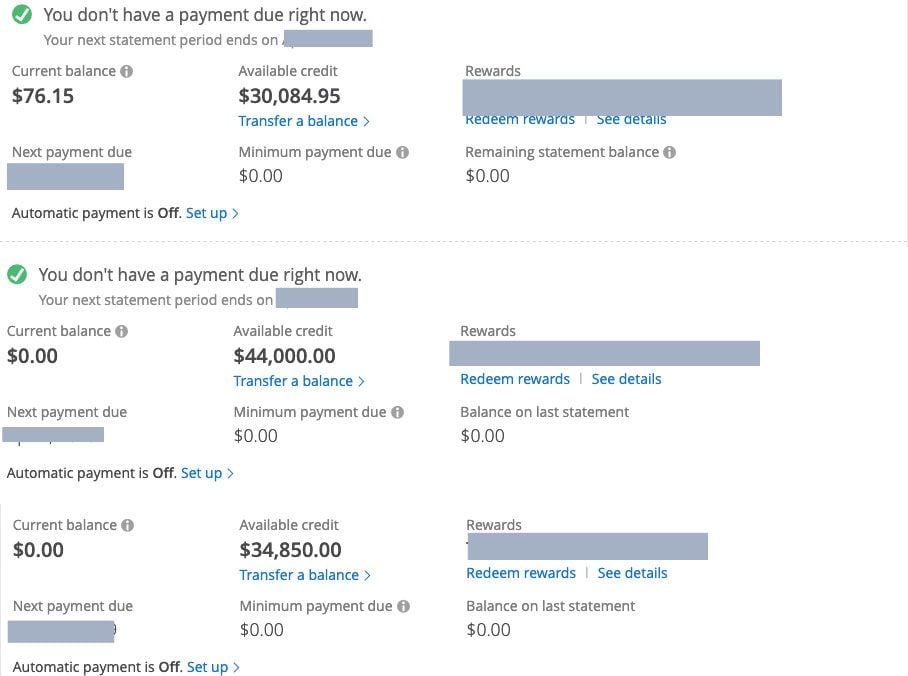

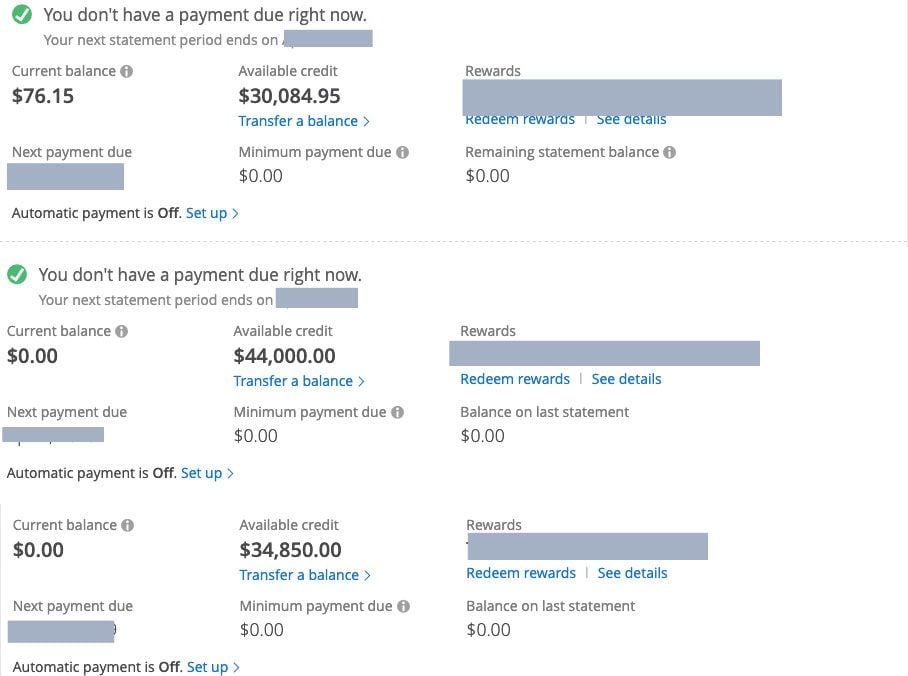

What is strange is that I have three Chase credit cards, and they all have different credit limits. Chase is the counter-party on all three accounts, so there should be no big difference in my relationship with the bank. For what it is worth the two accounts with big limits are premium cards, and most of my Chase spend (±100k/year) goes on the lower limit card.

Any thoughts?

What is strange is that I have three Chase credit cards, and they all have different credit limits. Chase is the counter-party on all three accounts, so there should be no big difference in my relationship with the bank. For what it is worth the two accounts with big limits are premium cards, and most of my Chase spend (±100k/year) goes on the lower limit card.

Any thoughts?

#2

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

This is normal. There is a maximum amount that each issuer is willing to lend to you. As the combined limits of your cards approach that limit the issuer may reallocate limits, issue cards with lower limits, or simply decline applications.

#3

Moderator: Budget Travel forum & Credit Card Programs, FlyerTalk Evangelist

Join Date: Aug 2002

Location: YYJ/YVR and back on Van Isle ....... for now

Programs: UA lifetime MM / *A Gold

Posts: 14,428

Yup, at one time I had three Chase cards and the credit limits were wildly different, even though I had the same job and same pay at the different times I applied for them.

#4

Join Date: Dec 2009

Location: New York, NY

Programs: AA Gold. UA Silver, Marriott Gold, Hilton Diamond, Hyatt (Lifetime Diamond downgraded to Explorist)

Posts: 6,776

It's pretty standard for banks to give higher credit lines on premium cards as they tend to make the most money from premium users. Your spending habits may be outside that standard. Have you tried messaging or calling Chase to reallocate some of your credit from one card to the other to match your spending pattern?

I have 4 amex cards (3 credit and 1 charge) I had a $8k limit on the no annual fee Amex Everyday, got a $19,500 on my Amex Hilton(14 months ago) and $15,400 on the SPG card (recently). Two weeks after the SPG card I got a notice from CreditKarma that Amex had reduced the credit line on my Amex Everyday to $3500. Obviously with the addition of the SPG card I had reached a credit tipping point for Amex, even though they issue me a new card without a credit check, and they reduced the credit line on the card I almost never used ($7.50 in past 15 months) and was the annual fee free one.

I have 4 amex cards (3 credit and 1 charge) I had a $8k limit on the no annual fee Amex Everyday, got a $19,500 on my Amex Hilton(14 months ago) and $15,400 on the SPG card (recently). Two weeks after the SPG card I got a notice from CreditKarma that Amex had reduced the credit line on my Amex Everyday to $3500. Obviously with the addition of the SPG card I had reached a credit tipping point for Amex, even though they issue me a new card without a credit check, and they reduced the credit line on the card I almost never used ($7.50 in past 15 months) and was the annual fee free one.