Last edit by: rasheed

BofA has officially refreshed the Bank of America Cash Rewards card. It does not appear any aspect of the rewards program will be getting worse (only new positive options).

BofA has published a comprehensive document indicating the MCC for each bonus category.

BofA has published a pre-release article about the program for customers.

BofA has published a website detailing the 3% categories.

On a calendar monthly basis, a customer can choose a category from a pre-determined list to receive 3% cash rewards. If you do not change the category in a given calendar month, it will stay with what you picked the previous calendar month (or gas if none was ever chosen). You must make the change before the purchase happens (the term "future purchases" is used) because bonus rewards are calculated immediately when transactions post (unlike AmEx, but similar to Chase and Barclays). It seems possible that you could split the month among two categories if you leave the previous calendar month category and then change it later in the new month.

Category selection happens on mobile app or Online Banking website (not by phone call or chat).

Currently, that list is:

Gas (this will be the default if a choice is not selected)

-Pay at the pump (automated fuel dispensers including Costco Gas, Sam's Club and gas stations at grocery stores that categorize as fuel dispensers)

-Pay inside (when the convenience store is categorized as a service station)

-5172 Petroleum and Petroleum Products (*unique to BofA*)

-5541 Service Stations (includes many 7-11s for example)

-5542 Automated Fuel Dispensers (almost all pay at the pump classifies as this one regardless of brand or retailer)

-5983 Fuel Dealers (*unique to BofA*)

This is confirmed from the 3% category choice explanation website.

Online Shopping

This category is actually the most restrictive of all the new choices. In general, a purchase made "online" via website or mobile should count. However, if the merchant is categorized as a service, it will likely not count. Paypal DOES pass along the MCC of the underlying merchant seller. If you are buying physical goods, it should be okay, but if you are buying any virtual item (gift cards, etc.), be aware that it probably will not count.

It appears that BofA did a NOT to include for this category and selected as many services that will not count (including tuition, taxes, healthcare bills, insurance, memberships). It also appears that BofA did NOT exclude any travel merchants where you make the purchase online (OTA/direct airlines/prepaid hotels?). So, it is an overlap of Travel.

MCCs that have confirmed to work (with Online Transaction flag as Y):

-4722 Travel Agencies and Tour Operators

-5300 Wholesale Clubs

-5399 General Merchandise/Misc

-5732 Electronics Stores

-5912 Drug Stores and Pharmacies

-5992 Florists

-8675 Automobile Associations

Paypal okay via online transaction if underlying merchant is in an allowed category.

Any major gift card use such as BHN (common charge prefix for Blackhawk), Cashstar (back-end for many retailer direct online gift card purchases) has been manually removed/deactivated so that they do not pay the 3% part.

Dining

Includes:

-5812 Eating Places and Restaurants

-5813 Drinking Places/Bars

-5814 Fast Food Restaurants

Not likely:

-5462 Bakeries (this is a fixed 2% category with grocery stores noted below )

-5811 Caterers

This is confirmed from the 3% category choice explanation website.

From another BofA card reference:

Travel

BofA went further than all other BofA cards with travel categories for this card:

Note, it includes many, but not all Entertainment categories found in other cards such as Savor or Marvel. Some of the key ones excluded are Movies Theater-related. This card does include theme park tickets (at the ticket booth), but not retail stores or dining in theme parks. This card also has some unusual ones such as airports and art galleries.

Another BofA card that defines travel purchases indicates the following categories

This information needs to be verified (likely through card experience):

a) Airlines, Air Carriers (MCC Codes 3000-3299, 4511); (b) Lodging-Hotels, Motels, Resorts (MCC codes 3501-3999, 7011); (c) Car Rental Agencies (MCC codes 3351-3441, 7512, 4121); (d) Cruise Lines (MCC code 4411); Travel Agencies and Tour Operators (MCC codes 4722, 4416, 4417); (e) Passenger Railways (MCC code 4112); (f) Transportation-Suburban and Local Commuter Passenger, including Ferries (MCC Code 4111); (g) Bus Lines (MCC codes 4131, 4722); (h) Transportation Services-not elsewhere classified (MCC code 4789); (i) Real Estate Agents and Managers-Rentals (MCC code 6513); (j) Timeshares (MCC code 7012); (k) Campgrounds and Trailer Parks (MCC Code 7033); (l) Motor Home and Recreational Vehicle Rental (MCC Code 7519); (m) Tourist Attractions and Exhibits (MCC Code 7991, 5971); (n) Amusement Parks, Carnivals, Circuses, Fortune Tellers (MCC Code 7996); (o) Aquariums, Dolphinariums, Zoos, and Seaquariums (MCC Code 7998); (p) Boat Leases and Boat Rentals (MCC Code 4457); or (q) Recreation Services-not elsewhere classified (MCC Code 7999)

Another list for a different program indicates (looks like it overlaps with the above list):

Drug Stores

-5912 (Drug Stores and Pharmacies)

-5122 (Drug Proprietors and Drug Sundries) (*unique to BofA*)

This is confirmed from the 3% category choice explanation website.

Home Improvement/Furnishings

Very broad list of MCCs.

This is confirmed from the 3% category choice explanation website.

Fixed 2% grocery stores and wholesales clubs

BofA's 2% grocery stores category is broader than AmEx's US supermarket category.

BofA does list the relevant matching description of the merchant for the MCC on the website transactions, but does not expose the actual MCC code.

The card will continue to earn 1% elsewhere and that is not included in the $2500 per quarter spend limit.

There does not appear to be any limitation on location of merchants worldwide to earn rewards as long as the merchant is properly categorized (unlike AmEx). Those customers who had the old Schwab 2% Invest First Visa issued by a BofA affiliate that did not otherwise cancel or proactively change the card when it was discontinued may have received a BofA Cash Rewards card thats does not have an added FTF (beyond Visa's embedded FTF rate) which is different than the card currently offered to customers. This version of the card offers international reward benefits for those customers.

There is a limit of $2500 in 2% or 3% category spending per quarter that will receive the bonus rate. Rewards can be redeemed at face value for any amount at any time. As long as account is in good standing, rewards do not expire. The only reason to hold rewards would be if you plan to qualify for Preferred Rewards and wish to get the relationship bonus rate for older spending when you do redeem the balance.

BofA customer bonuses:

All BofA deposit customers can receive at least a 10% bonus when they earn their reward if their total banking relationship indicates that they have a BofA checking or savings account. This is usually associated by having a BofA online account which has both the deposit and Cash Rewards card on the same login.

Customers who have signed up for Preferred Rewards that requires a deposit relationship balance can currently receive a 25% to 75% redemption bonus. This can tremendously increase the value of the 3% and 2% categories when compared to other cards.

Information on the thresholds for that program are located here: https://www.bankofamerica.com/preferred-rewards/

BofA has published a comprehensive document indicating the MCC for each bonus category.

BofA has published a pre-release article about the program for customers.

BofA has published a website detailing the 3% categories.

On a calendar monthly basis, a customer can choose a category from a pre-determined list to receive 3% cash rewards. If you do not change the category in a given calendar month, it will stay with what you picked the previous calendar month (or gas if none was ever chosen). You must make the change before the purchase happens (the term "future purchases" is used) because bonus rewards are calculated immediately when transactions post (unlike AmEx, but similar to Chase and Barclays). It seems possible that you could split the month among two categories if you leave the previous calendar month category and then change it later in the new month.

Category selection happens on mobile app or Online Banking website (not by phone call or chat).

Currently, that list is:

Gas (this will be the default if a choice is not selected)

-Pay at the pump (automated fuel dispensers including Costco Gas, Sam's Club and gas stations at grocery stores that categorize as fuel dispensers)

-Pay inside (when the convenience store is categorized as a service station)

-5172 Petroleum and Petroleum Products (*unique to BofA*)

-5541 Service Stations (includes many 7-11s for example)

-5542 Automated Fuel Dispensers (almost all pay at the pump classifies as this one regardless of brand or retailer)

-5983 Fuel Dealers (*unique to BofA*)

This is confirmed from the 3% category choice explanation website.

Gas and fuel merchants include merchants whose primary line of business is the sale of automotive gasoline that can be purchased inside the service station or at the automated fuel pump and gasoline purchased at boat marinas, as well as fuel dealers whose primary line of business is the sale of heating oil, propane and other fuels, such as kerosene.

This category is actually the most restrictive of all the new choices. In general, a purchase made "online" via website or mobile should count. However, if the merchant is categorized as a service, it will likely not count. Paypal DOES pass along the MCC of the underlying merchant seller. If you are buying physical goods, it should be okay, but if you are buying any virtual item (gift cards, etc.), be aware that it probably will not count.

It appears that BofA did a NOT to include for this category and selected as many services that will not count (including tuition, taxes, healthcare bills, insurance, memberships). It also appears that BofA did NOT exclude any travel merchants where you make the purchase online (OTA/direct airlines/prepaid hotels?). So, it is an overlap of Travel.

MCCs that have confirmed to work (with Online Transaction flag as Y):

-4722 Travel Agencies and Tour Operators

-5300 Wholesale Clubs

-5399 General Merchandise/Misc

-5732 Electronics Stores

-5912 Drug Stores and Pharmacies

-5992 Florists

-8675 Automobile Associations

Paypal okay via online transaction if underlying merchant is in an allowed category.

Any major gift card use such as BHN (common charge prefix for Blackhawk), Cashstar (back-end for many retailer direct online gift card purchases) has been manually removed/deactivated so that they do not pay the 3% part.

Dining

Includes:

-5812 Eating Places and Restaurants

-5813 Drinking Places/Bars

-5814 Fast Food Restaurants

Not likely:

-5462 Bakeries (this is a fixed 2% category with grocery stores noted below )

-5811 Caterers

This is confirmed from the 3% category choice explanation website.

From another BofA card reference:

Travel and Dining Category: Dining includes Restaurants, including Fast Food, and Drinking Establishments, such as Bars or Taverns. [..]

BofA went further than all other BofA cards with travel categories for this card:

Airlines, Air Carriers, Airports, Airport Terminals, Flying Fields Amusement Parks, Carnivals, Circuses, Fortune Tellers Aquariums, Dolphinariums, Zoos and Seaquariums Art Dealers and Galleries Boat Leases and Boat Rentals Bus Lines Campgrounds and Trailer Parks Car Rental Agencies Cruise Lines Direct Marketing — Travel-Related Arrangements Services Hotels, Motels, Resorts Motor Home and Recreational Vehicle Rental Package Tour Operators (for use in Germany only) Parking Lots and Garages Real Estate Agents and Managers (Rentals) Recreation Services (not elsewhere classified) Suburban and Local Commuter Passenger Travel, including Ferries Taxicabs and Limousines Timeshares Truck and Trailer Utility Rentals Passenger Railways Toll and Bridge Fees Tourist Attractions and Exhibits Transportation Services (not elsewhere classified) Travel Agencies and Tour Operators

Another BofA card that defines travel purchases indicates the following categories

This information needs to be verified (likely through card experience):

a) Airlines, Air Carriers (MCC Codes 3000-3299, 4511); (b) Lodging-Hotels, Motels, Resorts (MCC codes 3501-3999, 7011); (c) Car Rental Agencies (MCC codes 3351-3441, 7512, 4121); (d) Cruise Lines (MCC code 4411); Travel Agencies and Tour Operators (MCC codes 4722, 4416, 4417); (e) Passenger Railways (MCC code 4112); (f) Transportation-Suburban and Local Commuter Passenger, including Ferries (MCC Code 4111); (g) Bus Lines (MCC codes 4131, 4722); (h) Transportation Services-not elsewhere classified (MCC code 4789); (i) Real Estate Agents and Managers-Rentals (MCC code 6513); (j) Timeshares (MCC code 7012); (k) Campgrounds and Trailer Parks (MCC Code 7033); (l) Motor Home and Recreational Vehicle Rental (MCC Code 7519); (m) Tourist Attractions and Exhibits (MCC Code 7991, 5971); (n) Amusement Parks, Carnivals, Circuses, Fortune Tellers (MCC Code 7996); (o) Aquariums, Dolphinariums, Zoos, and Seaquariums (MCC Code 7998); (p) Boat Leases and Boat Rentals (MCC Code 4457); or (q) Recreation Services-not elsewhere classified (MCC Code 7999)

Another list for a different program indicates (looks like it overlaps with the above list):

How Your Travel Credit Works: A travel credit is applied as a statement credit to your account to offset travel purchases from qualifying merchants in these travel-related categories: airlines, hotels, motels, timeshares, trailer parks, motor home and recreational vehicle rentals, campgrounds, car rental agencies, truck and trailer rental, cruise lines, travel agencies, tour operators and real estate agents, operators of passenger trains, buses, taxis, limousines, ferries, boat rentals, parking lots and garages, tolls and bridge fees, tourist attractions and exhibits like art galleries, amusement parks, carnivals, circuses, aquariums, zoos and the like. Purchases from some merchants that provide travel-related goods and services will not be eligible for a travel credit, like in-flight goods and services, and duty-free airport purchases.

-5912 (Drug Stores and Pharmacies)

-5122 (Drug Proprietors and Drug Sundries) (*unique to BofA*)

This is confirmed from the 3% category choice explanation website.

Home Improvement/Furnishings

Very broad list of MCCs.

Air Conditioning and Refrigeration Repair Shops Antique Shops for Sales, Repairs and Restoration Services Architectural, Engineering and Surveying Services Building Materials, Lumber Stores, Carpentry Carpet and Upholstery Cleaning Contractors, Concrete Crystal and Glassware Stores Drapery, Upholstery and Window Coverings Stores Electrical Contractors Electrical Parts and Equipment Equipment, Furniture and Home Furnishings Stores (except Appliances) Equipment, Tool, Furniture and Appliance Rental and Leasing Fireplace, Fireplace Screens and Accessories Stores Floor Covering Stores Florist Suppliers, Nursery Stock and Flowers Furniture Reupholstering, Repair and Refinishing General Contractor/Residential Building Glass, Paint, Wallpaper Stores Hardware Equipment and Supplies Hardware Stores Heating, Plumbing, Air Conditioning Contractors Home Supply Warehouse Stores Household Appliance Stores Landscaping and Horticultural Services Lawn and Garden Supply Stores Masonry, Stonework, Tile Setting, Plastering, Insulation Contractors Miscellaneous House Furnishing Specialty Shops Office and Commercial Furniture Paints, Varnishes and Supplies Plumbing and Heating Equipment and Supplies Roof, Siding and Sheet Metal Work Contractors Special Trade Contractor (not elsewhere classified)

Fixed 2% grocery stores and wholesales clubs

Purchases made at eligible grocery store merchants and wholesale clubs, which include supermarkets, freezer/meat lockers, candy, nut or confection stores, dairy product stores, and bakeries. Excluded from this Bonus Category are superstores and smaller stores (like drug stores and convenience stores) that sell groceries and other products.

BofA does list the relevant matching description of the merchant for the MCC on the website transactions, but does not expose the actual MCC code.

The card will continue to earn 1% elsewhere and that is not included in the $2500 per quarter spend limit.

There does not appear to be any limitation on location of merchants worldwide to earn rewards as long as the merchant is properly categorized (unlike AmEx). Those customers who had the old Schwab 2% Invest First Visa issued by a BofA affiliate that did not otherwise cancel or proactively change the card when it was discontinued may have received a BofA Cash Rewards card thats does not have an added FTF (beyond Visa's embedded FTF rate) which is different than the card currently offered to customers. This version of the card offers international reward benefits for those customers.

There is a limit of $2500 in 2% or 3% category spending per quarter that will receive the bonus rate. Rewards can be redeemed at face value for any amount at any time. As long as account is in good standing, rewards do not expire. The only reason to hold rewards would be if you plan to qualify for Preferred Rewards and wish to get the relationship bonus rate for older spending when you do redeem the balance.

BofA customer bonuses:

All BofA deposit customers can receive at least a 10% bonus when they earn their reward if their total banking relationship indicates that they have a BofA checking or savings account. This is usually associated by having a BofA online account which has both the deposit and Cash Rewards card on the same login.

Customers who have signed up for Preferred Rewards that requires a deposit relationship balance can currently receive a 25% to 75% redemption bonus. This can tremendously increase the value of the 3% and 2% categories when compared to other cards.

Information on the thresholds for that program are located here: https://www.bankofamerica.com/preferred-rewards/

Bank of America Cash Rewards - 3% category qualifying options

#196

Join Date: Jan 2020

Posts: 6

#197

Join Date: Apr 2009

Posts: 681

#199

Join Date: Apr 2009

Posts: 681

And a 2.5% fee is less than a 5% rebate, at least where I come from.

#200

Join Date: Dec 2004

Posts: 7,903

I did a couple purchases at eBay via Paypal. One I chose Paypal to pay, the other I chose CC but it got processed through Paypal anyway. Both show online as "Y" for Online Transaction. My statement does not close for another week to know for sure that it is coded for the online category bonus, but that is a good sign to me. Both my purchases were for old coins. Here is the text shown in the transaction details on the website for one of the transactions:

Transaction date:01/20/2019

Card type:Visa

Transaction type:Purchases

Merchant description:MISCELLANEOUS AND SPECIALTY RETAIL STORES

Merchant information:402-935-7733 , CAReference number:5596

Merchant Name: PAYPAL *XXXXXXXXXXXXXXXXXXXXXXXX (Name changed)

Transaction Category: Shopping & Entertainment: General Merchandise

Online Transaction:Y

Transaction date:01/20/2019

Card type:Visa

Transaction type:Purchases

Merchant description:MISCELLANEOUS AND SPECIALTY RETAIL STORES

Merchant information:402-935-7733 , CAReference number:5596

Merchant Name: PAYPAL *XXXXXXXXXXXXXXXXXXXXXXXX (Name changed)

Transaction Category: Shopping & Entertainment: General Merchandise

Online Transaction:Y

#201

Join Date: Jul 2017

Posts: 95

Gah, just went over the category limit without knowing it and kept using the card for that 3% category, yet again!

Has anyone else come up with a reliable way to calculate where you're at with regard to the $2,500 per quarter? I'm clearly failing at this.

B of A really needs to either give us a meter like the airline credit for the Premium Rewards has or the ability to set some form of notification alert when the limit is reached. The fact that I've gone over multiple times now negates that 3% category, which just sucks.

Maybe I should forget this stupid Cash Rewards card and stick with the 2.62% of the Premium Rewards which needs no oversight or thinking to take advantage of.

Has anyone else come up with a reliable way to calculate where you're at with regard to the $2,500 per quarter? I'm clearly failing at this.

B of A really needs to either give us a meter like the airline credit for the Premium Rewards has or the ability to set some form of notification alert when the limit is reached. The fact that I've gone over multiple times now negates that 3% category, which just sucks.

Maybe I should forget this stupid Cash Rewards card and stick with the 2.62% of the Premium Rewards which needs no oversight or thinking to take advantage of.

#202

Join Date: Nov 2004

Location: Los Angeles, CA; Philadelphia, PA

Programs: OZ Diamond

Posts: 6,134

Not sure if anyone has reported this DP before, but travel insurance (direct on insurer's website) does NOT count as "travel." I knew it won't count as "online" purchase because any insurance is specifically excluded, but I thought travel insurance may at least be considered travel-related. Oh, well.

LAX

LAX

#206

Join Date: Apr 2009

Posts: 681

#207

Join Date: Apr 2009

Posts: 681

Not sure if anyone has reported this DP before, but travel insurance (direct on insurer's website) does NOT count as "travel." I knew it won't count as "online" purchase because any insurance is specifically excluded, but I thought travel insurance may at least be considered travel-related. Oh, well.

LAX

LAX

#208

Join Date: Jul 2017

Posts: 95

#209

Join Date: Jun 2008

Location: BAY AREA

Posts: 1,125

BofA online category is really not reliable. I have two BofA cash cards. I've always used one card for online and the card for gas station. So decided to use the second BofA card for online since I'm using Chase freedom for gas. I charged 500 on first BofA card and it posted as online category nand I got my 5.25%. The second card I charged 1800 and I only got 1.75% although the charge shows Y for online. Both of these charges were made thru PayPal and same merchant just different amounts. Both cards haven't reached the 2500 quarter limit. This is forth time I get screwed with the cash card.

#210

Join Date: Aug 2016

Posts: 81

There's a lot to unpack there. You didn't mention if you changed your category selection from gas to online shopping, did you? I presume you did.

The peril with any of these category bonus type cards is the capricious nature of how merchants code the purchase. While I personally find the Cash Rewards card to be ridiculously generous (to the point where, like the wonderful Citi Forward card of yore, I wonder how long it will last), I've been burnt a few times myself. I have the Premium Rewards card too, so each time I have to decide if I want the 1.5x bird in hand with the PR or the bird in bush 3x of the CR. The bright side is that you probably only forewent maybe $16 as a result of the coding error.

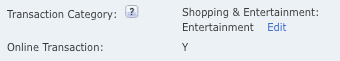

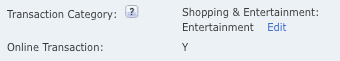

It's important to note that the online transaction flag has to be set to Y, and the transaction category has to be in an unrestricted category, like so…

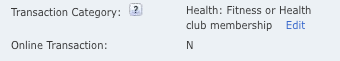

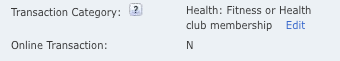

I was burned last month on an MLB ticket purchase because both the transaction flag was N, and the box office listed the transaction has a fitness club membership

Check the category of each Paypal purchase, and I can almost assure you that the retailer/vender used two different categories for each purchase—or you forgot to change your 3x category selection.

The peril with any of these category bonus type cards is the capricious nature of how merchants code the purchase. While I personally find the Cash Rewards card to be ridiculously generous (to the point where, like the wonderful Citi Forward card of yore, I wonder how long it will last), I've been burnt a few times myself. I have the Premium Rewards card too, so each time I have to decide if I want the 1.5x bird in hand with the PR or the bird in bush 3x of the CR. The bright side is that you probably only forewent maybe $16 as a result of the coding error.

It's important to note that the online transaction flag has to be set to Y, and the transaction category has to be in an unrestricted category, like so…

I was burned last month on an MLB ticket purchase because both the transaction flag was N, and the box office listed the transaction has a fitness club membership

Check the category of each Paypal purchase, and I can almost assure you that the retailer/vender used two different categories for each purchase—or you forgot to change your 3x category selection.