Dynamic Currency Conversion (DCC)

#421

Join Date: Nov 2012

Programs: SPG Platinum

Posts: 1,686

This is the unhelpful response I received from Citibank on online banking secure messaging - I think I will just go ahead and file the chargeback and then fight it out formally (https://www.citibank.com.hk/english/...putes-form.pdf and see also https://www.citibank.com.hk/english/...tes-master.pdf - do I really need to call first? I think not):

Surprisingly, Highly ...... Banking Corporation was more constructive in response:

I now have a reference number so assume I should also fill in the charge back form too:https://www.hsbc.com.hk/pws/Componen...Chargeback.pdf

Am I right this is actually the correct Visa doc to cite for Asia/HK? https://www.visa.com.hk/dam/VCOM/dow...les-public.pdf

In which case we are not talking about Reason Code 76 but rather Dispute Condition 12.3

Ref: XYZ

Dear Mr. XXX,

Thank you for your message regarding your enquiry on Dynamic Currency Conversion transaction,

If overseas ATM cash withdrawals/Point-of-sale debit payment transactions is converted into local currency via dynamic currency conversion (i.e. a service offered at certain ATMs/merchants which allows clients to convert a transaction denominated in a foreign currency to Hong Kong dollars at the point of withdrawal/sale), please note that clients acknowledge that the process of conversion and the exchange rates applied will be determined by the relevant ATM operator/ merchant or dynamic currency conversion service provider, as the case may be and not the Bank. The Bank does not determine whether transactions will be converted into local currency via dynamic currency conversion and, the clients are reminded to Please check with the relevant ATM operator/merchant whether such conversion was effected and the relevant foreign currency exchange rates/handling fee applicable before the transactions are entered into. Settling foreign currency transactions in Hong Kong dollars may involve a cost higher than the foreign currency transaction handling fee. In addition, the transaction will be subject to the following charges based on the converted amount in local currency:

(i) An administrative fee of 1.0% levied by VISA if it is a VISA card transaction; or

(ii) An administrative fee of 1.0% levied by other card association if it is an international transaction and/or such other rate(s) as may be determined by us or such other network as applicable

We appreciate your understanding in this matter.

If you have any queries or require further information, please call our Citiphone Banking at 2860 0333.

Thank you for banking with us. It is always a pleasure serving you.

Yours sincerely,

Ivy Liang

for Eric Leung

Customer Service Manager

Citibank (Hong Kong) Limited

Dear Mr. XXX,

Thank you for your message regarding your enquiry on Dynamic Currency Conversion transaction,

If overseas ATM cash withdrawals/Point-of-sale debit payment transactions is converted into local currency via dynamic currency conversion (i.e. a service offered at certain ATMs/merchants which allows clients to convert a transaction denominated in a foreign currency to Hong Kong dollars at the point of withdrawal/sale), please note that clients acknowledge that the process of conversion and the exchange rates applied will be determined by the relevant ATM operator/ merchant or dynamic currency conversion service provider, as the case may be and not the Bank. The Bank does not determine whether transactions will be converted into local currency via dynamic currency conversion and, the clients are reminded to Please check with the relevant ATM operator/merchant whether such conversion was effected and the relevant foreign currency exchange rates/handling fee applicable before the transactions are entered into. Settling foreign currency transactions in Hong Kong dollars may involve a cost higher than the foreign currency transaction handling fee. In addition, the transaction will be subject to the following charges based on the converted amount in local currency:

(i) An administrative fee of 1.0% levied by VISA if it is a VISA card transaction; or

(ii) An administrative fee of 1.0% levied by other card association if it is an international transaction and/or such other rate(s) as may be determined by us or such other network as applicable

We appreciate your understanding in this matter.

If you have any queries or require further information, please call our Citiphone Banking at 2860 0333.

Thank you for banking with us. It is always a pleasure serving you.

Yours sincerely,

Ivy Liang

for Eric Leung

Customer Service Manager

Citibank (Hong Kong) Limited

Dear Mr XXX

Thank you for your email of 11 June 2018 regarding our credit card services.

We appreciate the opportunity to address your complaint and apologise for any inconvenience you have been caused. Your comments on our services are important. The matter is now under investigation and we will give our reply by 26 June 2018. If our investigation require more time, we will update you on the progress accordingly.

In the meantime, if you would like to know more about our complaint handling procedures, please visit our website at hsbc.com.hk and follow the steps below to view the information:

1.Click on ‘Write, call or send a message’ under the ‘Contact HSBC’ session at the bottom of the home page

2.Select ‘Make a complaint’ under the ‘How can we help?’ section on the left side

If you have any other points you wish to raise, please do not hesitate to contact me on (852) 2996 6388 extension 6028 or [email protected].

Yours sincerely

Phoenix Fung

Senior Customer Relations Manager

Thank you for your email of 11 June 2018 regarding our credit card services.

We appreciate the opportunity to address your complaint and apologise for any inconvenience you have been caused. Your comments on our services are important. The matter is now under investigation and we will give our reply by 26 June 2018. If our investigation require more time, we will update you on the progress accordingly.

In the meantime, if you would like to know more about our complaint handling procedures, please visit our website at hsbc.com.hk and follow the steps below to view the information:

1.Click on ‘Write, call or send a message’ under the ‘Contact HSBC’ session at the bottom of the home page

2.Select ‘Make a complaint’ under the ‘How can we help?’ section on the left side

If you have any other points you wish to raise, please do not hesitate to contact me on (852) 2996 6388 extension 6028 or [email protected].

Yours sincerely

Phoenix Fung

Senior Customer Relations Manager

Am I right this is actually the correct Visa doc to cite for Asia/HK? https://www.visa.com.hk/dam/VCOM/dow...les-public.pdf

In which case we are not talking about Reason Code 76 but rather Dispute Condition 12.3

Last edited by Isochronous; Jun 14, 2018 at 5:00 am

#422

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,773

If overseas ATM cash withdrawals/Point-of-sale debit payment transactions is converted into local currency via dynamic currency conversion (i.e. a service offered at certain ATMs/merchants which allows clients to convert a transaction denominated in a foreign currency to Hong Kong dollars at the point of withdrawal/sale), please note that clients acknowledge that the process of conversion and the exchange rates applied will be determined by the relevant ATM operator/ merchant or dynamic currency conversion service provider, as the case may be and not the Bank. The Bank does not determine whether transactions will be converted into local currency via dynamic currency conversion and, the clients are reminded to Please check with the relevant ATM operator/merchant whether such conversion was effected and the relevant foreign currency exchange rates/handling fee applicable before the transactions are entered into. Settling foreign currency transactions in Hong Kong dollars may involve a cost higher than the foreign currency transaction handling fee. In addition, the transaction will be subject to the following charges based on the converted amount in local currency:

#424

Join Date: Aug 2007

Location: Truth or Consequences, NM

Programs: HH Diamond, Marriott Titanium, Hertz President's Circle, UA Silver, Mobile Passport Unobtanium

Posts: 6,192

#425

Join Date: Apr 2005

Location: SAN

Programs: AA Gold, Bonvoy Gold, DL Gold

Posts: 1,197

Just got back from a week in Ireland. Encountered DCC at the vast majority of merchants (hotels, restaurants, gas stations, small shops) but every time was either asked by the cashier if I wanted to pay in Euro or Dollars or I had the chance to press the corresponding button on the keypad. I noticed several of the readers had a second screen after I pressed Euro that asked the merchant to confirm the customer refused the DCC "offer". I didn't have any issues with merchant pushback, I did observe several other Americans selecting to pay in Dollars including at a very expensive hotel, so there's obviously a lot of money in this for the merchants and banks.

#426

Join Date: Nov 2012

Programs: SPG Platinum

Posts: 1,686

Just got back from a week in Ireland. Encountered DCC at the vast majority of merchants (hotels, restaurants, gas stations, small shops) but every time was either asked by the cashier if I wanted to pay in Euro or Dollars or I had the chance to press the corresponding button on the keypad. I noticed several of the readers had a second screen after I pressed Euro that asked the merchant to confirm the customer refused the DCC "offer". I didn't have any issues with merchant pushback, I did observe several other Americans selecting to pay in Dollars including at a very expensive hotel, so there's obviously a lot of money in this for the merchants and banks.

#427

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,056

I have observed this as well, which is ironic considering many American credit cards now feature a 0% foreign transaction fee. It's even worse when someone is using a card with a 3% foreign transaction fee and falls for DCC. While their ignorance costs them, what gets me frustrated is this conditions merchants into opting in people as the default.

#428

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,502

I have observed this as well, which is ironic considering many American credit cards now feature a 0% foreign transaction fee. It's even worse when someone is using a card with a 3% foreign transaction fee and falls for DCC. While their ignorance costs them, what gets me frustrated is this conditions merchants into opting in people as the default.

#429

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,056

Could it be because banks and credit unions don't seem to tell their customers about it? I searched for "dcc" in Google just now and it didn't show anything close to the topic of this thread. "DCC card" does, but it's a mix of anti-DCC stuff from blogs and pro-DCC stuff from payment processors.

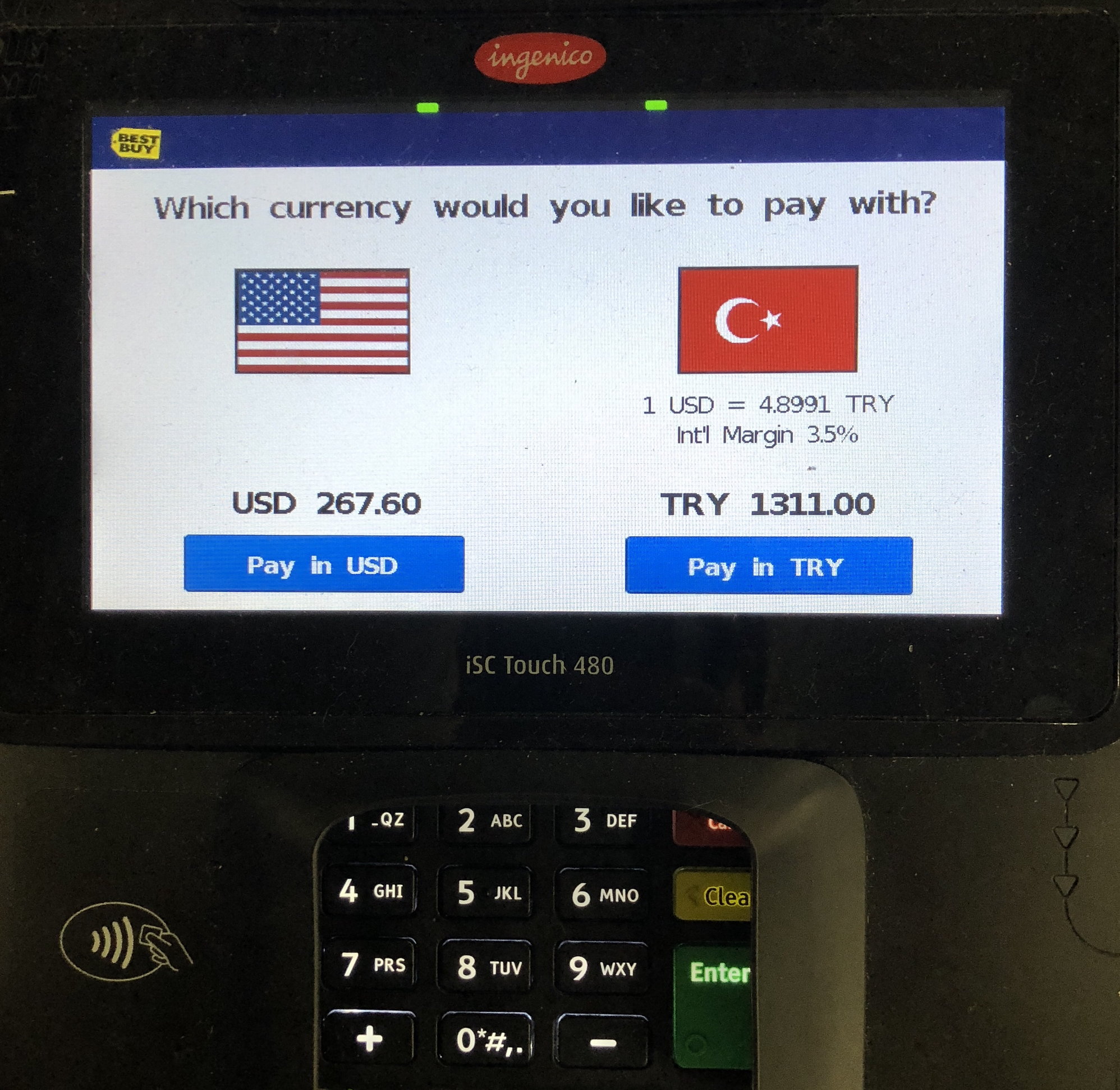

To think of this another way, read some of the posts from people using their non-USD cards in the US. DCC is all around us, but we rarely see it. I have asked friends using non-USD cards about their experiences, and many chain stores and even a few restaurants offer DCC. I think the reason why it's not been highlighted as a problem in the US is the implementations are relatively benign, at least in the retail setting. All stores that I've seen with DCC have customer facing terminals, and the choice clearly appears on the terminal, like the Best Buy example above. The few times I've witnessed it personally, the cashier appeared to have no input on the DCC offer. It's not like some other parts of the world where you know that the cashiers and/or management have a good idea of what's happening yet steer (or worse force) customers into DCC.

#430

Join Date: Jul 2014

Posts: 71

Just had something strange occur with Paypal. I used a US Visa card through Paypal to pay for a ride in Colombia using Cabify, a Spanish ride-hailing company similar to Uber. I had previously made sure I had selected on Paypal to be charged on my seller's currency (ride price was quoted in COP and invoice was in COP), however I got charged directly in USD when I look at my statement or my Paypal invoice. The weird thing is the exchange rate was ok and almost the same as other transactions made in person in COP. I guess this is not really DCC. Anyone else experience something similar with Paypal?

Last edited by viag8; Jul 17, 2018 at 9:58 am Reason: typos

#431

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,502

To think of this another way, read some of the posts from people using their non-USD cards in the US. DCC is all around us, but we rarely see it. I have asked friends using non-USD cards about their experiences, and many chain stores and even a few restaurants offer DCC. I think the reason why it's not been highlighted as a problem in the US is the implementations are relatively benign, at least in the retail setting. All stores that I've seen with DCC have customer facing terminals, and the choice clearly appears on the terminal, like the Best Buy example above. The few times I've witnessed it personally, the cashier appeared to have no input on the DCC offer. It's not like some other parts of the world where you know that the cashiers and/or management have a good idea of what's happening yet steer (or worse force) customers into DCC.

#432

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,056

Just had something strange occur with Paypal. I used a US Visa card through Paypal to pay for a ride in Colombia using Cabify, a Spanish ride-hailing company similar to Uber. I had previously made sure I had selected on Paypal to be charged on my seller's currency (ride price was quoted in COP and invoice was in COP), however I got charged directly in USD when I look at my statement or my Paypal invoice. The weird thing is the exchange rate was ok and almost the same as other transactions made in person in COP. I guess this is not really DCC. Anyone else experience something similar with Paypal?

#433

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,056

On that note, I kinda wish Revolut didn't cancel US accounts so I could see how DCC works in the US. At the same time, I'm not sure how useful it'd have been since it was a PIN preferring card (as mentioned in other threads, I've had issues with my other such cards in the past thanks to smaller businesses tending to not have customer accessible terminals).

#435

Original Poster

Join Date: Jul 2009

Location: SJC

Programs: AA, AS, Marriott

Posts: 6,056