Last edit by: philemer

The original, pre-2016, thread can be found here: USA EMV cards: Availability, experiences, Q&A (Chip & PIN -or- Chip & Signature) The thread was split to make searching less onerous.

EMV wikipost volunteers: kebosabi

What is EMV?

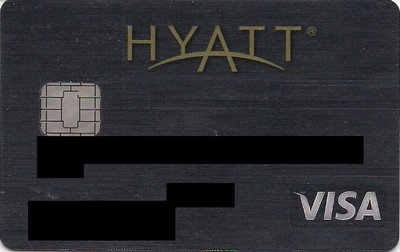

EMV is a defacto global standard of technology where there is a visible microchip on the front of the card. It looks like this:

Who issues them?

See Google Docs spreadsheet in Post #1

SFOAMS also has created a list of excellent webpage that shows US EMV cards in a more interactive interface

Another site, which lets you narrow the search for an EMV card by various parameters, is http://www.spotterswiki.com/emv/index.php.

Several credit unions issue some form of Chip-and-PIN credit cards or prepaid cards. Prepaid EMV cards however are not recommended due to junk fees. USAA (currently restricted to members of military) used to offer Chip-and-PIN cards, but as late has backtracked to Chip-and-Signature priority.

Hey that's a cool Google Docs list! I know others that aren't on that list. How can I help by adding them to the list?

My bad for not putting this into the wiki sooner. Right now, the Google Docs is locked out of editing and only in "read-only" view because there were instances in the past where people would just delete the rows not thinking that it affects others viewing the list.

If you promise not to delete any rows and input all the pertinent info (annual fee, rewards, FTF, etc.), I can provide you with edit access. Just shoot me a PM to kebosabi with your gmail address and I'll provide you edit access.

Thanks for helping out!

As of October 2014, no USA-based card issuer offers Chip-and-PIN priority cards except for BMO Harris (Diners Club) and UN Federal Credit Union. Other major USA-based banks such as BofA, Chase, Citi, as well as others issue Chip-and-Signature cards which may work at many automated kiosks. However, bear in mind the word may is used above is a context where there is no absolute certainty of success for certain environments such as automated kiosks due to different natures of offline and online transactions. It is highly recommended to read Post #3 which lists real life FTer examples on how Chip-and-Signature worked and did not work at various transaction environments.

Can I upgrade it right now?

If it's listed on that Google Docs spreadsheet or SFOAMS' Silk page, wouldn't hurt to call/twitter them for a free upgrade. If you get the response you don't like, hang up, try again.

What is the difference between Chip-and-Signature and Chip-and-PIN?

You insert the chipped card into the slot. The physical contact terminal will read the EMV chip and the terminal will automatically read the preferred cardholder verification methods (called CVM) for that card.

Chip-and-Signature means that the terminal will printout a receipt for you to sign. This is the most prevalent authentication for most US issued EMV cards. Chip-and-Signature helps in a way that it will get through to face-to-face merchant transactions where you and the merchant do not speak the same language.

Chip-and-PIN means that the terminal will prompt you to input a PIN for authentication. Some credit union issued credit cards will have this CVM as secondary if Chip-and-Signature cannot be done. Chip-and-PIN is the more prevalent method of authentication used outside the US, especially in transaction environments where no human interaction is needed (i.e. automated gas pumps, toll roads, train kiosks, etc.).

The Google Docs spreadsheet will list which CVM are used in the EMV cards listed. Some cards can only do Chip-and-Signature. Other cards can do both Chip-and-Signature and Chip-and-PIN. And others might have a third option called No CVM (no authentication needed) which is reserved for low value transactions.

One chip can hold a lot more data, therefore it is capable of doing multiple verification methods. That's one of the great things about EMV over the mag-stripe which can hold very little data.

I want to know for sure what my EMV chip does. Is there anyway I can test out my own EMV card to see what the CVM list is?

alexmt has written up a nice step-by-step procedure on Post #3615.

If most of the EMV cards in the US is the Chip-and-Signature type, doesn't that mean it's still useless abroad?

Depends if you see it as glass half empty or glass half full. See Post #3 for further details on how Chip-and-Signature has worked both successfully and unsuccessfully depending on the merchant transaction environment and use your best judgment whether which one is right for you.

Are there any places in the US that are accepting transactions via the EMV chip?

tmiw has created a dedicated Google maps webpage to show where EMV has been proven to work here: http://emvacceptedhere.com/ Per his Post #4240, feel free to add any places with active EMV terminals if you come across one.

As of 2014/05, the EMV terminals in most Walmarts and Sam's Clubs are being turned on. Hence, the best place to try them out would be your local Walmart or Sam's Club. For other merchants, it's slowly being phased in.

I hope people will post them in the Post your receipt of your 1st EMV based transaction in the US thread. cvarming has shown us an EMV transaction receipt from Brooklyn, NY in Post #2380. I myself had my first EMV based (Chip-and-Signature) transaction in two stores in the Los Angeles area, as shown in detail in Post #2705 (courtesy of WhatWhatTech for pointing these two stores out)

I don't want a chip in my card. I heard horror stories all over the media saying hackers can steal my credit card info from a mile away.

There are two types of chips. One is contactless and the other is contact. Cards can be either one or the other, or both.

In the Google Docs spreadsheet, the cards that are capable of contactless payments are listed seperately under the "RFID or NFC contactless chip" column. If it says yes, then that means it has the ability to do contactless payments. If it says no, it doesn't have that feature.

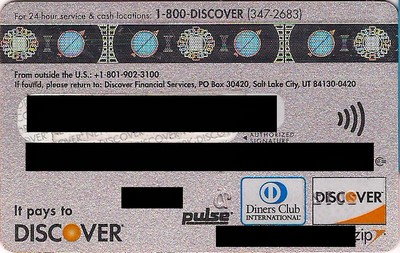

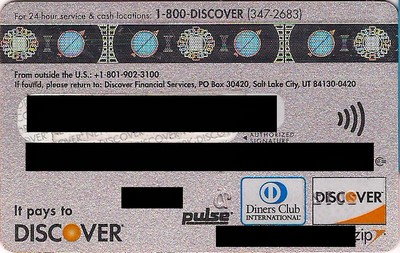

The one that the media has overhyped about hackers "stealing your information wirelessly" was the contactless type like this:

You are worried about this happening, right?

You don't have to worry. EMV is a chip standard that can have both contact and contactless interfaces. With the traditional contact interface, this means you actually have to physically insert the chip into a POS terminal for it to be authorized, like this:

With the contact interface, nothing is wireless. No data is sent out in a stand-alone contact type EMV chip. With the EMV contactless interface, data is sent wirelessly.

Furthermore, contactless chip cards are required to show a symbol (looks like Wi-Fi symbol) somewhere on the card that to denote it's capability as a contactless card. For example, here's an example of a Discover Card with contactless capability (in which Discover calls "Discover ZIP") showing the contactless symbol on the back of the card:

Don't believe everything that the media says. Besides, millions of people all over the world from London to Singapore, uses contactless payments daily in extremely crowded subways and mass transit with nary any problems. There are multiple layers of encrypted securities and keys that are needed to break the code.

Frankly, giving your physical card to a waiter/waitress who takes the card out of your view is much more susceptible to fraud than contactless payments.

Why should I care?

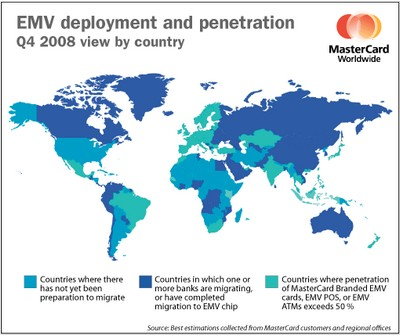

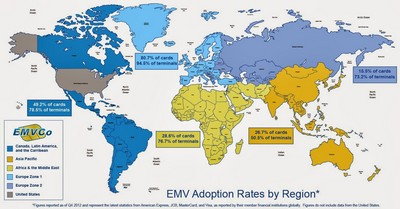

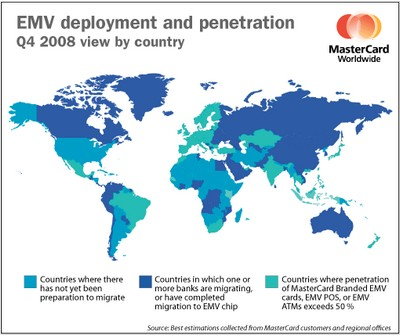

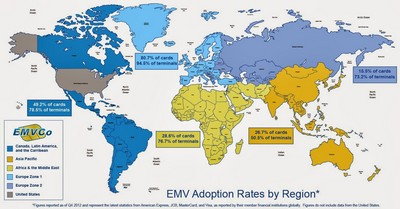

If you are an international traveler, you will want this because majority of the world has or in the process of converting to this payment format.

In fact, in 2012, even North Korea moved to the EMV format, leaving the US as one of the countries in the world that hasn't done so.

In addition, VISA, MC, AMEX, and Discover have all agreed to incentivize the USA shifting to EMV payments by 2015 by shifting liability for fraudulent transactions to merchants if they do not have EMV equipment and the cardholder has an EMV card. So if you travel internationally or would like to get one before the others, you might be interested in getting one.

BS! I had no problems using my card in [insert whereever country], [insert whatever point in time]

If you stick to the tourist path where they have lots of visitors from the US, you should have no problems using your mag-stripe only card in hotels and restaurants, at least for now. But as things can change as things go forward.

However, consider that once you start taking the off-beaten path, go to non-touristy places where they are not familiar with mag-stripes, rent a car and use toll roads, fill up gas, or try to buy train tickets you might end up into a trouble of the machine not recognizing your card because it lacks the chip. Furthermore, a lot of toll roads, gas pumps, and automated ticket machines lack any human assistance to help you when you need it the most.

But [insert credit card company] told me all merchants that display their logo must accept them! All I have to do is report them for violating their agreements, right?

There are several factors against this.

1. You can only speak English. The merchant representative, most likely a part-time clerk earning minimum wage, speaks in a different language, let's say French. If you have no French language skills, how are you going to get your point across? Are you going to whip out your cell phone at exorbitant int'l roaming charges and hope the customer service is going to translate it for you on the spot? Or maybe you might actually know French. But how about Swahili, Farsi, Balinese, or the multiple languages in mainland China?

2. Just like US, the rest of the world's businesses uses part-time minimum wage workers as cashiers to cut down on labor costs. Most of their SOP training manuals are written by MBA types to not to do anything they are not familiar with. Do not expect them to understand the intricate details of credit card mumbo jumbo. You don't expect Taco Bell employees to understand the minute details of Discover-JCB-Union Pay agreements, right? Same thing the other way around: be respectful as a guest in their country, prepare in advance in their ways, avoid being an "ugly American" stereotype.

3. You are a guest in their country. You are a minority. If 99.9% of their country's people and other tourists from around the world uses EMV, do you really think they are going to accomodate the 0.1% of American tourists who only have mag-stripes credit cards?

4. Again, you are a guest in their country. How would you, as an American standing in line, react if a Chinese tourist was clogging up the lines at a local Taco Bell because the clerk doesn't understand the Discover-Union Pay agreement and has trouble communicating between Mandarin spoken by the tourist and English spoken by the Taco Bell clerk? Same way the other way around. You do not want to clog up the lines for everyone. The less hassle, the better.

5. VISA and MC make tons of money from merchants in that country. Say SNCF French Rail. It's a billion dollar company in France. Do you think VISA is going to pull the plug of their relationship with SNCF because SNCF refuses to do mag-stripe processing at their unmanned train station kiosk? Of course not. Be realistic.

6. And lastly, if you're up against an unstaffed toll kiosk, gas pump or train ticket machine, are you going to yell curses at the machine?

But I want my credit card to be able to be used in the US too!

No worries. They have not gotten rid of the mag-stripe on the back of the card for backward compatibility reasons, just like we still have embossed numbers on our cards for backwards compatibility to using those old carbon copy imprinters.

[insert own Hyatt card image front and back together with red arrows pointing to all the backward compatibility features]

You use the chip on the front of the card abroad (for now), and the mag-stripe just like any other card for the US. Basically, you're increasing your credit card's acceptance rate by getting a card that both via the chip and the mag-stripe. You're getting a better deal for free.

And when 2015 comes along and US switches to EMV, you'll be way ahead of everyone else too!

So why did the rest of the world and the US moved/moving toward EMV?

Primarily, due to fraud concerns. You see, the mag-stripe has been with us since the 1950s. It may have been the most high tech thing back in the day, but with the technology that is available today, any shmo can pick up a $100 USB magnetic card skimming device off of eBay and get your credit card info.

And unlike skimming off contactless cards which actually need the person to have l33t programming skills, skimming off a magnetic stripe has become so ubiquitous that nary a day goes about skimming fraud going on somewhere in America, from gas pumps, Michael's stores (2011), Target breaches (2013), restaurant waiters/waitresses, to even McDonald's drive thrus.

https://www.google.com/search?q=skimming+fraud

These type of fraud used to be prevalent in Europe. But once they started switching over to EMV starting over 2 decades ago, this type of fraud went elsewhere. It went over to Asia, Canada and Mexico, Latin America, etc. etc. until they too began implementing EMV to combat skimming fraud. The US is practically the only country left that hasn't done so, therefore all the fraud that used to take place elsewhere is now happening here.

But EMV is old and it's not fool proof. Shouldn't we just skip over it and do something new instead?

Yes, EMV is old. It was developed in the 1990s and its smart card payment predecessor was first introduced in France. But as of today, it has become the defacto global standard of payments.

But then, what else is there? There is no other de facto global standard of payments alternative. For example, if we decide to skip over it and do something new, hypothetically like DNA matching technology, it still means US int'l travelers will continue to have problems abroad with useless plastic acceptance because no other country is using this DNA matching technology except the US.

Besides, nothing is fool proof. You can say that the bank vault isn't fool proof because you can crack it open if enough C4 is used. But your average low-life scumbag isn't likely to get military grade C4 easily either. But the bank vault does make it harder to get the bank's money over say a petty cash box. That's the point here. EMV is akin to a security tight bank vault, the old mag-stripe is akin to a petty cash box lying around inside the drawer.

I'm a business owner and I don't think EMV is going to take off. I'm not going to spend extra hundreds of dollars to upgrade my credit card machine. Convince me other wise why I should.

I can understand the added extra cost to your business once this switchover takes place. But before even saying that, look at your existing POS terminal. Does it have a slot somewhere to insert a card?

Most likely, if you had replaced your POS terminal within the past five years, you already have an EMV capable terminal. EMV is basically just not turned on yet from the processor and acquirer side.

If you have an EMV capable terminal, then a best bet would be to contact your acquirer to have the EMV feature turned on. You did your end of the deal already by having an EMV capable terminal, it is now the acquirers' responsibility to turn it on in accordance to the EMV switchover mandate.

And if you don't, you are going to replace your POS terminal anyway from common wear and tear. It isn't a hard switch-over. You can continue to use your POS terminal until it dies out because EMV cardholders will still have the mag-stripe on the back. And by the time your non-EMV capable POS terminal is up for replacement the market will be full with these newer POS terminals that can accept the mag-stripe, EMV, as well as contactless payments.

In addition, you may also want to check with your acquirer or processor about EMV capable terminals. Some of them are willing to replace your terminal for free in preparation for the US EMV switchover. Call and ask for details.

But what's in it for me? I'm the one that has to pay for the upgrade.

All the major card networks have given incentives for merchants for the upcoming EMV switchover.

If 75% or more of your credit card transactions are done on an EMV contact and contactless terminal, they are going to waive your annual PCI-DSS fees, which usually costs you around $5.00-$19.95/month per terminal. The overall long term cost savings of those compliance fees will be larger than the cost of an one time upgrade for the terminal.

The downside is that once EMV switchover happens and if you do not have a POS terminal that is able to accept EMV, the fraud liability shifts over to the merchant.

I own several fast food franchises. If I upgrade my POS terminals at all of my restaurants, it's going to cost me thousands, if not millions. I don't think anyone is going to use a fake credit card to buy $5 burgers. And if they do, wouldn't it be cheaper for me to eat the fraud cost?

Remember also that fraud isn't just committed by dishonest customers using fraudulent cards. Fraud can also happen with dishonest employees skimming off credit card data from the mag-stripe as in the case of a teenage McDonald's drive thru employee skimming off $13,000 of customers' credit cards in Olympia, WA. Consider the public relations fall out that your business may have if this happens (i.e. the big Target breach of 2013, where someone used a mag stripe card to load malware INTO Target's system). Is it worth risking to take such a huge PR disaster?

EMV wikipost volunteers: kebosabi

What is EMV?

EMV is a defacto global standard of technology where there is a visible microchip on the front of the card. It looks like this:

Who issues them?

See Google Docs spreadsheet in Post #1

SFOAMS also has created a list of excellent webpage that shows US EMV cards in a more interactive interface

Another site, which lets you narrow the search for an EMV card by various parameters, is http://www.spotterswiki.com/emv/index.php.

Several credit unions issue some form of Chip-and-PIN credit cards or prepaid cards. Prepaid EMV cards however are not recommended due to junk fees. USAA (currently restricted to members of military) used to offer Chip-and-PIN cards, but as late has backtracked to Chip-and-Signature priority.

Hey that's a cool Google Docs list! I know others that aren't on that list. How can I help by adding them to the list?

My bad for not putting this into the wiki sooner. Right now, the Google Docs is locked out of editing and only in "read-only" view because there were instances in the past where people would just delete the rows not thinking that it affects others viewing the list.

If you promise not to delete any rows and input all the pertinent info (annual fee, rewards, FTF, etc.), I can provide you with edit access. Just shoot me a PM to kebosabi with your gmail address and I'll provide you edit access.

Thanks for helping out!

As of October 2014, no USA-based card issuer offers Chip-and-PIN priority cards except for BMO Harris (Diners Club) and UN Federal Credit Union. Other major USA-based banks such as BofA, Chase, Citi, as well as others issue Chip-and-Signature cards which may work at many automated kiosks. However, bear in mind the word may is used above is a context where there is no absolute certainty of success for certain environments such as automated kiosks due to different natures of offline and online transactions. It is highly recommended to read Post #3 which lists real life FTer examples on how Chip-and-Signature worked and did not work at various transaction environments.

Can I upgrade it right now?

If it's listed on that Google Docs spreadsheet or SFOAMS' Silk page, wouldn't hurt to call/twitter them for a free upgrade. If you get the response you don't like, hang up, try again.

What is the difference between Chip-and-Signature and Chip-and-PIN?

You insert the chipped card into the slot. The physical contact terminal will read the EMV chip and the terminal will automatically read the preferred cardholder verification methods (called CVM) for that card.

Chip-and-Signature means that the terminal will printout a receipt for you to sign. This is the most prevalent authentication for most US issued EMV cards. Chip-and-Signature helps in a way that it will get through to face-to-face merchant transactions where you and the merchant do not speak the same language.

Chip-and-PIN means that the terminal will prompt you to input a PIN for authentication. Some credit union issued credit cards will have this CVM as secondary if Chip-and-Signature cannot be done. Chip-and-PIN is the more prevalent method of authentication used outside the US, especially in transaction environments where no human interaction is needed (i.e. automated gas pumps, toll roads, train kiosks, etc.).

The Google Docs spreadsheet will list which CVM are used in the EMV cards listed. Some cards can only do Chip-and-Signature. Other cards can do both Chip-and-Signature and Chip-and-PIN. And others might have a third option called No CVM (no authentication needed) which is reserved for low value transactions.

One chip can hold a lot more data, therefore it is capable of doing multiple verification methods. That's one of the great things about EMV over the mag-stripe which can hold very little data.

I want to know for sure what my EMV chip does. Is there anyway I can test out my own EMV card to see what the CVM list is?

alexmt has written up a nice step-by-step procedure on Post #3615.

If most of the EMV cards in the US is the Chip-and-Signature type, doesn't that mean it's still useless abroad?

Depends if you see it as glass half empty or glass half full. See Post #3 for further details on how Chip-and-Signature has worked both successfully and unsuccessfully depending on the merchant transaction environment and use your best judgment whether which one is right for you.

Are there any places in the US that are accepting transactions via the EMV chip?

tmiw has created a dedicated Google maps webpage to show where EMV has been proven to work here: http://emvacceptedhere.com/ Per his Post #4240, feel free to add any places with active EMV terminals if you come across one.

As of 2014/05, the EMV terminals in most Walmarts and Sam's Clubs are being turned on. Hence, the best place to try them out would be your local Walmart or Sam's Club. For other merchants, it's slowly being phased in.

I hope people will post them in the Post your receipt of your 1st EMV based transaction in the US thread. cvarming has shown us an EMV transaction receipt from Brooklyn, NY in Post #2380. I myself had my first EMV based (Chip-and-Signature) transaction in two stores in the Los Angeles area, as shown in detail in Post #2705 (courtesy of WhatWhatTech for pointing these two stores out)

I don't want a chip in my card. I heard horror stories all over the media saying hackers can steal my credit card info from a mile away.

There are two types of chips. One is contactless and the other is contact. Cards can be either one or the other, or both.

In the Google Docs spreadsheet, the cards that are capable of contactless payments are listed seperately under the "RFID or NFC contactless chip" column. If it says yes, then that means it has the ability to do contactless payments. If it says no, it doesn't have that feature.

The one that the media has overhyped about hackers "stealing your information wirelessly" was the contactless type like this:

You are worried about this happening, right?

You don't have to worry. EMV is a chip standard that can have both contact and contactless interfaces. With the traditional contact interface, this means you actually have to physically insert the chip into a POS terminal for it to be authorized, like this:

With the contact interface, nothing is wireless. No data is sent out in a stand-alone contact type EMV chip. With the EMV contactless interface, data is sent wirelessly.

Furthermore, contactless chip cards are required to show a symbol (looks like Wi-Fi symbol) somewhere on the card that to denote it's capability as a contactless card. For example, here's an example of a Discover Card with contactless capability (in which Discover calls "Discover ZIP") showing the contactless symbol on the back of the card:

Don't believe everything that the media says. Besides, millions of people all over the world from London to Singapore, uses contactless payments daily in extremely crowded subways and mass transit with nary any problems. There are multiple layers of encrypted securities and keys that are needed to break the code.

Frankly, giving your physical card to a waiter/waitress who takes the card out of your view is much more susceptible to fraud than contactless payments.

Why should I care?

If you are an international traveler, you will want this because majority of the world has or in the process of converting to this payment format.

In fact, in 2012, even North Korea moved to the EMV format, leaving the US as one of the countries in the world that hasn't done so.

In addition, VISA, MC, AMEX, and Discover have all agreed to incentivize the USA shifting to EMV payments by 2015 by shifting liability for fraudulent transactions to merchants if they do not have EMV equipment and the cardholder has an EMV card. So if you travel internationally or would like to get one before the others, you might be interested in getting one.

BS! I had no problems using my card in [insert whereever country], [insert whatever point in time]

If you stick to the tourist path where they have lots of visitors from the US, you should have no problems using your mag-stripe only card in hotels and restaurants, at least for now. But as things can change as things go forward.

However, consider that once you start taking the off-beaten path, go to non-touristy places where they are not familiar with mag-stripes, rent a car and use toll roads, fill up gas, or try to buy train tickets you might end up into a trouble of the machine not recognizing your card because it lacks the chip. Furthermore, a lot of toll roads, gas pumps, and automated ticket machines lack any human assistance to help you when you need it the most.

But [insert credit card company] told me all merchants that display their logo must accept them! All I have to do is report them for violating their agreements, right?

There are several factors against this.

1. You can only speak English. The merchant representative, most likely a part-time clerk earning minimum wage, speaks in a different language, let's say French. If you have no French language skills, how are you going to get your point across? Are you going to whip out your cell phone at exorbitant int'l roaming charges and hope the customer service is going to translate it for you on the spot? Or maybe you might actually know French. But how about Swahili, Farsi, Balinese, or the multiple languages in mainland China?

2. Just like US, the rest of the world's businesses uses part-time minimum wage workers as cashiers to cut down on labor costs. Most of their SOP training manuals are written by MBA types to not to do anything they are not familiar with. Do not expect them to understand the intricate details of credit card mumbo jumbo. You don't expect Taco Bell employees to understand the minute details of Discover-JCB-Union Pay agreements, right? Same thing the other way around: be respectful as a guest in their country, prepare in advance in their ways, avoid being an "ugly American" stereotype.

3. You are a guest in their country. You are a minority. If 99.9% of their country's people and other tourists from around the world uses EMV, do you really think they are going to accomodate the 0.1% of American tourists who only have mag-stripes credit cards?

4. Again, you are a guest in their country. How would you, as an American standing in line, react if a Chinese tourist was clogging up the lines at a local Taco Bell because the clerk doesn't understand the Discover-Union Pay agreement and has trouble communicating between Mandarin spoken by the tourist and English spoken by the Taco Bell clerk? Same way the other way around. You do not want to clog up the lines for everyone. The less hassle, the better.

5. VISA and MC make tons of money from merchants in that country. Say SNCF French Rail. It's a billion dollar company in France. Do you think VISA is going to pull the plug of their relationship with SNCF because SNCF refuses to do mag-stripe processing at their unmanned train station kiosk? Of course not. Be realistic.

6. And lastly, if you're up against an unstaffed toll kiosk, gas pump or train ticket machine, are you going to yell curses at the machine?

But I want my credit card to be able to be used in the US too!

No worries. They have not gotten rid of the mag-stripe on the back of the card for backward compatibility reasons, just like we still have embossed numbers on our cards for backwards compatibility to using those old carbon copy imprinters.

[insert own Hyatt card image front and back together with red arrows pointing to all the backward compatibility features]

You use the chip on the front of the card abroad (for now), and the mag-stripe just like any other card for the US. Basically, you're increasing your credit card's acceptance rate by getting a card that both via the chip and the mag-stripe. You're getting a better deal for free.

And when 2015 comes along and US switches to EMV, you'll be way ahead of everyone else too!

So why did the rest of the world and the US moved/moving toward EMV?

Primarily, due to fraud concerns. You see, the mag-stripe has been with us since the 1950s. It may have been the most high tech thing back in the day, but with the technology that is available today, any shmo can pick up a $100 USB magnetic card skimming device off of eBay and get your credit card info.

And unlike skimming off contactless cards which actually need the person to have l33t programming skills, skimming off a magnetic stripe has become so ubiquitous that nary a day goes about skimming fraud going on somewhere in America, from gas pumps, Michael's stores (2011), Target breaches (2013), restaurant waiters/waitresses, to even McDonald's drive thrus.

https://www.google.com/search?q=skimming+fraud

These type of fraud used to be prevalent in Europe. But once they started switching over to EMV starting over 2 decades ago, this type of fraud went elsewhere. It went over to Asia, Canada and Mexico, Latin America, etc. etc. until they too began implementing EMV to combat skimming fraud. The US is practically the only country left that hasn't done so, therefore all the fraud that used to take place elsewhere is now happening here.

But EMV is old and it's not fool proof. Shouldn't we just skip over it and do something new instead?

Yes, EMV is old. It was developed in the 1990s and its smart card payment predecessor was first introduced in France. But as of today, it has become the defacto global standard of payments.

But then, what else is there? There is no other de facto global standard of payments alternative. For example, if we decide to skip over it and do something new, hypothetically like DNA matching technology, it still means US int'l travelers will continue to have problems abroad with useless plastic acceptance because no other country is using this DNA matching technology except the US.

Besides, nothing is fool proof. You can say that the bank vault isn't fool proof because you can crack it open if enough C4 is used. But your average low-life scumbag isn't likely to get military grade C4 easily either. But the bank vault does make it harder to get the bank's money over say a petty cash box. That's the point here. EMV is akin to a security tight bank vault, the old mag-stripe is akin to a petty cash box lying around inside the drawer.

I'm a business owner and I don't think EMV is going to take off. I'm not going to spend extra hundreds of dollars to upgrade my credit card machine. Convince me other wise why I should.

I can understand the added extra cost to your business once this switchover takes place. But before even saying that, look at your existing POS terminal. Does it have a slot somewhere to insert a card?

Most likely, if you had replaced your POS terminal within the past five years, you already have an EMV capable terminal. EMV is basically just not turned on yet from the processor and acquirer side.

If you have an EMV capable terminal, then a best bet would be to contact your acquirer to have the EMV feature turned on. You did your end of the deal already by having an EMV capable terminal, it is now the acquirers' responsibility to turn it on in accordance to the EMV switchover mandate.

And if you don't, you are going to replace your POS terminal anyway from common wear and tear. It isn't a hard switch-over. You can continue to use your POS terminal until it dies out because EMV cardholders will still have the mag-stripe on the back. And by the time your non-EMV capable POS terminal is up for replacement the market will be full with these newer POS terminals that can accept the mag-stripe, EMV, as well as contactless payments.

In addition, you may also want to check with your acquirer or processor about EMV capable terminals. Some of them are willing to replace your terminal for free in preparation for the US EMV switchover. Call and ask for details.

But what's in it for me? I'm the one that has to pay for the upgrade.

All the major card networks have given incentives for merchants for the upcoming EMV switchover.

If 75% or more of your credit card transactions are done on an EMV contact and contactless terminal, they are going to waive your annual PCI-DSS fees, which usually costs you around $5.00-$19.95/month per terminal. The overall long term cost savings of those compliance fees will be larger than the cost of an one time upgrade for the terminal.

The downside is that once EMV switchover happens and if you do not have a POS terminal that is able to accept EMV, the fraud liability shifts over to the merchant.

I own several fast food franchises. If I upgrade my POS terminals at all of my restaurants, it's going to cost me thousands, if not millions. I don't think anyone is going to use a fake credit card to buy $5 burgers. And if they do, wouldn't it be cheaper for me to eat the fraud cost?

Remember also that fraud isn't just committed by dishonest customers using fraudulent cards. Fraud can also happen with dishonest employees skimming off credit card data from the mag-stripe as in the case of a teenage McDonald's drive thru employee skimming off $13,000 of customers' credit cards in Olympia, WA. Consider the public relations fall out that your business may have if this happens (i.e. the big Target breach of 2013, where someone used a mag stripe card to load malware INTO Target's system). Is it worth risking to take such a huge PR disaster?

USA EMV cards: Availability, Q&A (Chip & PIN or Signature) [2016]

#16

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,501

2016 onward: USA EMV cards: Availability, Q&A (Chip & PIN or Signature)

So the HSBC Debit MasterCard is not only EMV contactless but also is offline PIN preferring on the common AID. It also supports online PIN before signature and no CVM is last. It also supports PIN changes with issuer scripts (tested at Walmart). Very good US alternative to the revolt card with Contactless!

#17

Join Date: Apr 2015

Posts: 489

Sounds like online PIN isn't supported at the places you've tried to use those cards. Whether that's a temporary thing or the final configuration at those locations is unknown.

Is this from cardpeek? I was under the impression that offline PIN is impossible on US debit cards regardless of the AID.

Is this from cardpeek? I was under the impression that offline PIN is impossible on US debit cards regardless of the AID.

#18

FlyerTalk Evangelist

Join Date: Aug 2001

Location: RSW

Programs: Delta - Silver; UA - Silver; HHonors - Diamond; IHG - Spire Ambassador; Marriott Bonvoy - Titanium

Posts: 14,185

Seems odd all these American terminals would be offline primary, when offline pin is incredibly rare to non-existent on American-issued cards?

#19

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,501

Speaking of the latter, how is Square's new reader not a violation of Visa/MC/EMV requirements? Supposedly a terminal manufacturer has to include some sort of ability to add a PIN pad in the future if the device doesn't already come with one.

#20

Join Date: Aug 2008

Programs: HHonors Gold, Marriott Lifetime Gold, IHG Gold, OZ*G, AA Gold, AS MVP

Posts: 1,874

Online PIN is on the card, just below offline PIN on the CVM list. While having online PIN first would make things like PIN changes more convenient, offline PIN first is probably better for card acceptance; some terminals outside the US are apparently badly misconfigured and will try online PIN despite not supporting it.

#21

Join Date: Jul 2007

Posts: 1,762

Even worse than that in some places. Long story short, I maxed out the PIN tries on my card (don't ask). Not a single POS terminal or ATM I've tried here in Shanghai can reset it. POS terminals here go from "PIN tries exceeded" to "enter online PIN" to "Online transaction rejected, PIN tries exceeded", ATMs say "PIN tries exceeded, contact issuer" even after Revolut support staff say they've reset it (but whatever the ATM/POS does triggers the block again, because when I call in again they find that they have to unblock it again).

#22

Join Date: Nov 2012

Posts: 3,537

Theoretically, terminals that support one type of PIN in the US are required to support both, but that obviously isn't being enforced. The US, like the UK, has a lot of terminals that don't support online PIN. But a card with offline PIN primary using offline PIN doesn't mean the terminal doesn't support online PIN. To determine that, you need to try a card with online PIN as the primary CVM.

Even an offline PIN card using signature doesn't mean the terminal doesn't support online PIN. Here in the UK the normal CVM order is offline PIN/signature/online PIN/no CVM.

#23

Join Date: Jul 2007

Posts: 1,762

...and I'm oncee again going to be the contrary minded in the room. Ready. What fxxxxing difference does it make to me a consumer if the card uses an offline or online pin? Why should I care? We keep going around and around on the same things which after a while, in all due respect to everybody, gets boring. All I am interested and to my way of thinking all anybody here should be worrying about is where and when the card works domestically (everywhere whether it's signature or pin prefered, whether it's offline or online pin) so it's a moot point domesticlly. And we are seeing fewer and fewer complaints here of difficulties using emv compliant cards internationally again whether they are signature or pin be it offline or online preferred. Anything else to us as consumers is totally irrelevent.

Now if anybody can explain to me what I'm missing, I will be glad to listen.

Now if anybody can explain to me what I'm missing, I will be glad to listen.

#24

Join Date: Nov 2012

Posts: 3,537

...and I'm oncee again going to be the contrary minded in the room. Ready. What fxxxxing difference does it make to me a consumer if the card uses an offline or online pin. Why should I care? We keep going around and around on the same things which after a while, in all due respect to everybody, gets boring. All I am interested and to my way of thinking all anybody here should be worrying about is where and when the card works domestically (everywhere whether it's signature or pin prefered, whether it's offline or online pin) so it's a moot point domesticlly. And we are seeing fewer and fewer complaints hete of difficulties using emv compliant cards internationally again whether they are signature or pin be it offline or online preferred. Anything else to us as consumers is totally irrelevent.

Now if anybody can explain to me what I'm missing, I will be glad to listen.

Now if anybody can explain to me what I'm missing, I will be glad to listen.

#25

Join Date: Jul 2007

Posts: 1,762

Allie, I said in all due respect. The fact is many of the regulars who started the thread long ago have disappeared. I still come by but mostly for information of any places where there are problems using cards.

And let me ask you a sincere question without any rancor or attempt to be smug or not courteous or whatever but here goes. What difference does it make to me as a consumer if the merchant's terminal uses an offline or online pin? What difference does it make if the merchant uses signature? Now I have the same complaint you have about self service terminals where if you use a signature preferred card for a small purchase, you have to wait for assistance to complete the transaction. I dispise that as much as you do as I do for being asked for ID (illegally) on signature transactions. I get it. So a case could be made about signature vs pin. But for pete's sake, unless I am badly missing something, why should I or any consumer care if there is an offline or online pin? The only thing I really want outside the USA is not to bother with signatures for small purchases. Get that and I'll be as happy as a pig rolling around in mud.

And let me ask you a sincere question without any rancor or attempt to be smug or not courteous or whatever but here goes. What difference does it make to me as a consumer if the merchant's terminal uses an offline or online pin? What difference does it make if the merchant uses signature? Now I have the same complaint you have about self service terminals where if you use a signature preferred card for a small purchase, you have to wait for assistance to complete the transaction. I dispise that as much as you do as I do for being asked for ID (illegally) on signature transactions. I get it. So a case could be made about signature vs pin. But for pete's sake, unless I am badly missing something, why should I or any consumer care if there is an offline or online pin? The only thing I really want outside the USA is not to bother with signatures for small purchases. Get that and I'll be as happy as a pig rolling around in mud.

#26

Join Date: Nov 2012

Posts: 3,537

Allie, I said in all due respect. The fact is many of the regulars who started the thread long ago have disappeared. I still come by but mostly for information of any places where there are problems using cards.

And let me ask you a sincere question without any rancor or attempt to be smug or not courteous or whatever but here goes. What difference does it make to me as a consumer if the merchant's terminal uses an offline or online pin? What difference does it make if the merchant uses signature? Now I have the same complaint you have about self service terminals where if you use a signature preferred card for a small purchase, you have to wait for assistance to complete the transaction. I dispise that as much as you do as I do for being asked for ID (illegally) on signature transactions. I get it. So a case could be made about signature vs pin. But for pete's sake, unless I am badly missing something, why should I or any consumer care if there is an offline or online pin? The only thing I really want outside the USA is not to bother with signatures for small purchases. Get that and I'll be as happy as a pig rolling around in mud.

And let me ask you a sincere question without any rancor or attempt to be smug or not courteous or whatever but here goes. What difference does it make to me as a consumer if the merchant's terminal uses an offline or online pin? What difference does it make if the merchant uses signature? Now I have the same complaint you have about self service terminals where if you use a signature preferred card for a small purchase, you have to wait for assistance to complete the transaction. I dispise that as much as you do as I do for being asked for ID (illegally) on signature transactions. I get it. So a case could be made about signature vs pin. But for pete's sake, unless I am badly missing something, why should I or any consumer care if there is an offline or online pin? The only thing I really want outside the USA is not to bother with signatures for small purchases. Get that and I'll be as happy as a pig rolling around in mud.

1. Online PIN preferring cards, you can change PIN instantly and online - it's much more convenient. If you mistype your PIN, it takes longer though before you can try again. Most importantly, there may be acceptance issues, ideally terminals should go to the next CVM but some terminals think they support online PIN, but they're not properly configured - resulting in transaction failure.

2. Offline PIN preferring cards, a bit faster, better acceptance (as close to universal as it gets in this world). But a hassle to reset locked out PINs and to change PIN.

#27

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,501

Even worse than that in some places. Long story short, I maxed out the PIN tries on my card (don't ask). Not a single POS terminal or ATM I've tried here in Shanghai can reset it. POS terminals here go from "PIN tries exceeded" to "enter online PIN" to "Online transaction rejected, PIN tries exceeded", ATMs say "PIN tries exceeded, contact issuer" even after Revolut support staff say they've reset it (but whatever the ATM/POS does triggers the block again, because when I call in again they find that they have to unblock it again).

Considering all the domestic merchants who continue to have customer-inaccessible terminals yet not have PIN disabled, it's not a moot point yet.

#28

Join Date: Oct 2014

Programs: Skymiles

Posts: 3,250

I was about half drunk during this but not too drunk to utilize my chip card.

They had a Clover Mobile (a clover device plugged into the headphone jack of an iPhone) with a chip and a swipe reader. I was ordering my hot dog and she inserted my card because it had a chip. The transaction then just got stuck on processing (probably due to the fact that there was over 40,000 people in the area all with cell phones). Instead of trying again she just told me it declined. I travel light so it was the only credit card I had on me, and there was plenty of available credit on the card.

I told her try again after taking a bite into the hot dog already, and then lo and behold it worked.

Case in point, I guess would be cellular terminals and cell phone based terminals won't work that well when you're in a crowd of 40,000. The people with Square readers ended up processing in offline mode and it hit my account this morning. Some outdoor street vendors used wifi from nearby buildings.

They had a Clover Mobile (a clover device plugged into the headphone jack of an iPhone) with a chip and a swipe reader. I was ordering my hot dog and she inserted my card because it had a chip. The transaction then just got stuck on processing (probably due to the fact that there was over 40,000 people in the area all with cell phones). Instead of trying again she just told me it declined. I travel light so it was the only credit card I had on me, and there was plenty of available credit on the card.

I told her try again after taking a bite into the hot dog already, and then lo and behold it worked.

Case in point, I guess would be cellular terminals and cell phone based terminals won't work that well when you're in a crowd of 40,000. The people with Square readers ended up processing in offline mode and it hit my account this morning. Some outdoor street vendors used wifi from nearby buildings.

#29

FlyerTalk Evangelist

Join Date: Jan 2014

Location: San Diego, CA

Programs: GE, Marriott Platinum

Posts: 15,501

I was about half drunk during this but not too drunk to utilize my chip card.

They had a Clover Mobile (a clover device plugged into the headphone jack of an iPhone) with a chip and a swipe reader. I was ordering my hot dog and she inserted my card because it had a chip. The transaction then just got stuck on processing (probably due to the fact that there was over 40,000 people in the area all with cell phones). Instead of trying again she just told me it declined. I travel light so it was the only credit card I had on me, and there was plenty of available credit on the card.

I told her try again after taking a bite into the hot dog already, and then lo and behold it worked.

Case in point, I guess would be cellular terminals and cell phone based terminals won't work that well when you're in a crowd of 40,000. The people with Square readers ended up processing in offline mode and it hit my account this morning. Some outdoor street vendors used wifi from nearby buildings.

They had a Clover Mobile (a clover device plugged into the headphone jack of an iPhone) with a chip and a swipe reader. I was ordering my hot dog and she inserted my card because it had a chip. The transaction then just got stuck on processing (probably due to the fact that there was over 40,000 people in the area all with cell phones). Instead of trying again she just told me it declined. I travel light so it was the only credit card I had on me, and there was plenty of available credit on the card.

I told her try again after taking a bite into the hot dog already, and then lo and behold it worked.

Case in point, I guess would be cellular terminals and cell phone based terminals won't work that well when you're in a crowd of 40,000. The people with Square readers ended up processing in offline mode and it hit my account this morning. Some outdoor street vendors used wifi from nearby buildings.

#30

Join Date: Sep 2014

Posts: 1,722