2013 App-O-Rama (AOR) and Churn Advice Archive

#1216

Join Date: Nov 2011

Location: SFO/SJC

Programs: whatever comes with CCs

Posts: 1,082

You and Rambro should make a point of using all your new cards, just a bit, and paying the bill on time or, even better--pay them early, before the statement posts. Then you will truly be establishing a good track record with the banks. Barclays especially hates sock drawers.

I think with the numerous manufactured spend activities available today, it should be relatively easy to give each card some love. The occasional online purchase for the less rewarding cards keeps you in good stead with the issuers.

Citi has been sending me $25 credit for $500 purchases for my unused card. I think ignoring them for a while also has its benefits.

#1217

Join Date: Jun 2012

Location: In CT,left my heart in Leicester.

Programs: Work in progress.

Posts: 1,237

Here's the plan.

Like MintCilantro, I've frozen my Experian. I haven't bothered freezing EQ or TU because I have very few inquiries there and don't mind either of them getting used.

Cards that I've zeroed down on. (In order of application)

Chase Ink Bold 50k

CITI AA Visa 50k

Hawaiian Air Biz 35k

Virgin Atlantic 65k

Charles Shwabb Checking Account

8 days later.

CITI AA 50k.

_____________________________________________

Any other good cards, that I should think about getting?

Thoughts on my list?

_____________________________________________

I am also going to close my Amex Biz Plat.

Since I am not in a hurry to transfer them to any other airline, what (no-fee) card could I get, to just park them for a while?

I understand that I'd lose the ability to transfer the points out,

but I'm pretty sure that there'll be an offer sometime this year or the next for a personal Gold or Plat card, and I'll apply for it then and regain the ability.

_____________________________________________

Cards that I have right now.

Chase: British Airways, Priority Club, Marriott, Sapphire Preferred, United.

Barclays: US Airways

US Bank: Club Carlson

CITI: one AA Plat.

Amex: Hilton and Biz Plat.

Last edited by jatink129; Jul 17, 2013 at 3:32 pm

#1218

Join Date: Feb 2013

Location: PHL, maybe EWR

Programs: Plat IHG, Marriott Rewards Silver, CSP, Ink Bold, USDM, *Wood Gold, AA, Club Carl

Posts: 285

What credit monitoring service is that?

Here's the plan.

Like MintCilantro, I've frozen my Experian. I haven't bothered freezing EQ or TU because I have very few inquiries there and don't mind either of them getting used.

Cards that I've zeroed down on. (In order of application)

Chase Ink Bold 50k

CITI AA Visa 50k

Hawaiian Air Biz 35k

Virgin Atlantic 65k

Charles Shwabb Checking Account

8 days later.

CITI AA 50k.

_____________________________________________

Any other good cards, that I should think about getting?

Thoughts on my list?

_____________________________________________

I am also going to close my Amex Biz Plat.

Since I am not in a hurry to transfer them to any other airline, what (no-fee) card could I get, to just park them for a while?

I understand that I'd lose the ability to transfer the points out,

but I'm pretty sure that there'll be an offer sometime this year or the next for a personal Gold or Plat card, and I'll apply for it then and regain the ability.

_____________________________________________

Cards that I have right now.

Chase: British Airways, Priority Club, Marriott, Sapphire Preferred, United.

Barclays: US Airways

US Bank: Club Carlson

CITI: one AA Plat.

Amex: Hilton and Biz Plat.

Here's the plan.

Like MintCilantro, I've frozen my Experian. I haven't bothered freezing EQ or TU because I have very few inquiries there and don't mind either of them getting used.

Cards that I've zeroed down on. (In order of application)

Chase Ink Bold 50k

CITI AA Visa 50k

Hawaiian Air Biz 35k

Virgin Atlantic 65k

Charles Shwabb Checking Account

8 days later.

CITI AA 50k.

_____________________________________________

Any other good cards, that I should think about getting?

Thoughts on my list?

_____________________________________________

I am also going to close my Amex Biz Plat.

Since I am not in a hurry to transfer them to any other airline, what (no-fee) card could I get, to just park them for a while?

I understand that I'd lose the ability to transfer the points out,

but I'm pretty sure that there'll be an offer sometime this year or the next for a personal Gold or Plat card, and I'll apply for it then and regain the ability.

_____________________________________________

Cards that I have right now.

Chase: British Airways, Priority Club, Marriott, Sapphire Preferred, United.

Barclays: US Airways

US Bank: Club Carlson

CITI: one AA Plat.

Amex: Hilton and Biz Plat.

#1219

Suspended

Join Date: Jan 2013

Location: LAX/SNA

Programs: AA, Hilton Gold

Posts: 3,887

I am also going to close my Amex Biz Plat.

Since I am not in a hurry to transfer them to any other airline, what (no-fee) card could I get, to just park them for a while?

I understand that I'd lose the ability to transfer the points out,

but I'm pretty sure that there'll be an offer sometime this year or the next for a personal Gold or Plat card, and I'll apply for it then and regain the ability.

Since I am not in a hurry to transfer them to any other airline, what (no-fee) card could I get, to just park them for a while?

I understand that I'd lose the ability to transfer the points out,

but I'm pretty sure that there'll be an offer sometime this year or the next for a personal Gold or Plat card, and I'll apply for it then and regain the ability.

Last edited by PainCorp; Jul 17, 2013 at 5:36 pm

#1220

Join Date: Jun 2012

Location: In CT,left my heart in Leicester.

Programs: Work in progress.

Posts: 1,237

It's from USAA.

Called CreditCheck Monitoring Premium. $12.95 a month for a monthly three bureau report.

https://www.usaa.com/inet/pages/cred..._creditmonitor

I don't know if you can sign up if you're NOT a USAA member, but try and see.

Either way, it's fairly simple to become a USAA member.

Called CreditCheck Monitoring Premium. $12.95 a month for a monthly three bureau report.

https://www.usaa.com/inet/pages/cred..._creditmonitor

I don't know if you can sign up if you're NOT a USAA member, but try and see.

Either way, it's fairly simple to become a USAA member.

#1221

Join Date: Jun 2012

Location: In CT,left my heart in Leicester.

Programs: Work in progress.

Posts: 1,237

So I'll just apply for the Blue anew, and keep my MR points alive.

This works out fairly well, because next, I'll apply for a Plat (or Gold) personal when a good offer comes along, and by the time it's time to cancel that card, I'd have re-qualified to apply for a business card and get the bonus points.

Meanwhile the blue card will keep the points alive, since I have no real need to transfer them out right now.

P.S- What's the best offer on them right now? 10k right?

P.P.S- I couldn't see any difference between the biz and personal blue. Is there?

#1223

Join Date: Jun 2013

Posts: 194

You and Rambro should make a point of using all your new cards, just a bit, and paying the bill on time or, even better--pay them early, before the statement posts. Then you will truly be establishing a good track record with the banks. Barclays especially hates sock drawers.

#1224

Join Date: Jun 2012

Location: In CT,left my heart in Leicester.

Programs: Work in progress.

Posts: 1,237

#1225

Suspended

Join Date: Jan 2013

Location: LAX/SNA

Programs: AA, Hilton Gold

Posts: 3,887

I don't think they can see the balance history, just the most recently reported balance. Unless I'm missing something.

#1226

#1227

FlyerTalk Evangelist

Join Date: Feb 2005

Location: PHX & AGP

Programs: AA Lifetime PLT, Bonvoy Lifetime Titanium, Hilton Gold

Posts: 11,453

Having a balance at statement close helps with the bank not the credit agency. Remember, you aren't being charged interested on the balance until it rolls over to the following months statement.

#1228

Suspended

Join Date: Jan 2013

Location: LAX/SNA

Programs: AA, Hilton Gold

Posts: 3,887

Uh, that's exactly what I was saying....but the bank can see the history no matter what, so it doesn't matter for them if it posts with a balance or not, they'll be able to see it was used.

#1229

Join Date: Nov 2011

Location: SFO/SJC

Programs: whatever comes with CCs

Posts: 1,082

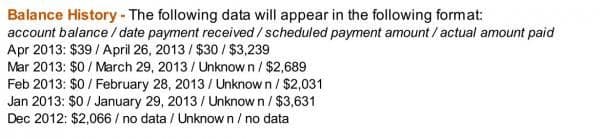

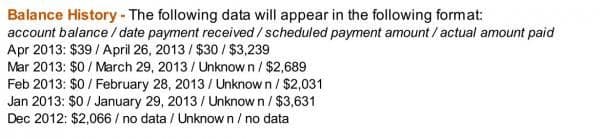

I think your payment gets reported and if your balance is zero the bank could draw a conclusion. I saw this in a recent credit report

#1230

Join Date: Jul 2013

Posts: 18

You and Rambro should make a point of using all your new cards, just a bit, and paying the bill on time or, even better--pay them early, before the statement posts. Then you will truly be establishing a good track record with the banks. Barclays especially hates sock drawers.