Last edit by: Boraxo

There are three services to pay your U.S. federal taxes: IRS Pay Your Taxes by Debit or Credit Card or Digital Wallet

pay1040.com 1.87% fee on credit (lowered from 1.99% on 01/02/2023). $2.50 flat fee on debit.

payUSAtax.com - 1.82% fee on credit (rate updated 01/03/2024 from 1.85%). $2.20 flat fee on debit.

Many states also permit online tax payment; check with your state or this list from MasterCard.

The IRS has a system to view payments, and it's good practice to confirm all payments within a short time frame, so that any rare lost payment issue can be disputed.

Be mindful of time zones if paying on the due date as pay1040.com uses CDT timestamp and payusatax.com uses EDT timestamp.

In general, you're allowed 2 payments per processor above per type of tax (annual and quarterlies being 2 different types, for example). They're not billed as cash advance fees. If 6 payments is not enough to pay your bill you can use a service such as plastiq (2.25% fee). If making multiple payments, it is advised you join here to track your payments link , you will be required to give your banking information and will receive a pin via snail mail

(Confirmed 4/2018 in post #429)

Fees are tax-deductible for C-Corps but not individuals (2018 tax reform eliminated "miscellaneous itemized deductions"). The majority of people will not be able to deduct that expense, check with your accountant.

When making multiple payments at or near your credit limit multiple times, allow yourself 3-5 days between payments for the charge to show up on your card and your bank payment to clear. If you wait until April 15th to make payments, you will only be able to clear the first payment.

Best Credit Cards to use/buy cheap points:

- Any credit card to hit minimum spend and achieve signup bonus or spend thresholds.

- BOA Premium Rewards 2.62% Cashback (Card holder needs to be a Preferred Rewards Platinum Honors member)

- Chase INK Premier 2.5% Cashback on purchases over $5k (Points are not transferable to airline or hotel programs)

- Capital One Venture X 2X Cap One Miles/Points (now transfer to most airline partners at 1:1)

- Amex Blue Business Plus 2X Membership Rewards (capped at $50,000 spend per calendar year)

- Chase United Business Club Card, 1.5X United Miles

- BOA Virgin Atlantic World Elite 1.5X Virgin Atlantic Points

- Chase Freedom Unlimited, 1.5X Ultimate Rewards, paired with a premium card (Sapphire Preferred, Sapphire Reserve, INK Preferred, INK Plus)

- Chase INK Unlimited, 1.5X Ultimate Rewards, paired with a premium card (Sapphire Preferred, Sapphire Reserve, INK Preferred, INK Plus)

- Amex Everyday Preferred 1.5X Membership Rewards, (need to make 30 transactions in a month for 50% bonus)

- Amex Business Platinum 1.5X Membership Rewards on purchases over $5K

Big Spend Bonuses:

- Amex Delta Reserve, spend $60k get 30k bonus miles and 30k MQM

- Citi Hilton HHonors Reserve, spend $10k get free weekend night, $40k, Platinum Status

- Chase Southwest, spend $135k get Companion Pass (WN points are redeemed at $.011, @ 1.87% fee, you're essentially buying the companion pass for $847)

- Chase Ritz Carlton Reserve, spend $10k get Gold Status spend $75k get Platinum Status

- Chase World of Hyatt, spend $15k get one free night

Cash Back cards:

Elan Fidelity 2%

Citi Double Cash 2%

Earn Status/Elite qualifying points:

- American, Delta, Alaska, Hyatt

Pre-Funding allowed:

Amex Charge Cards

Pre-Funding not-allowed:

Chase

Quarterly tax due dates: the 15th of April, June, September, January

pay1040.com 1.87% fee on credit (lowered from 1.99% on 01/02/2023). $2.50 flat fee on debit.

payUSAtax.com - 1.82% fee on credit (rate updated 01/03/2024 from 1.85%). $2.20 flat fee on debit.

See this thread about payUSAtax customer service. Many people have reported that they never respond to support requests.

ACI Payments, Inc - 1.98% fee on credit. $2.20 flat fee on debit.Many states also permit online tax payment; check with your state or this list from MasterCard.

The IRS has a system to view payments, and it's good practice to confirm all payments within a short time frame, so that any rare lost payment issue can be disputed.

Be mindful of time zones if paying on the due date as pay1040.com uses CDT timestamp and payusatax.com uses EDT timestamp.

In general, you're allowed 2 payments per processor above per type of tax (annual and quarterlies being 2 different types, for example). They're not billed as cash advance fees. If 6 payments is not enough to pay your bill you can use a service such as plastiq (2.25% fee). If making multiple payments, it is advised you join here to track your payments link , you will be required to give your banking information and will receive a pin via snail mail

(Confirmed 4/2018 in post #429)

Fees are tax-deductible for C-Corps but not individuals (2018 tax reform eliminated "miscellaneous itemized deductions"). The majority of people will not be able to deduct that expense, check with your accountant.

When making multiple payments at or near your credit limit multiple times, allow yourself 3-5 days between payments for the charge to show up on your card and your bank payment to clear. If you wait until April 15th to make payments, you will only be able to clear the first payment.

Best Credit Cards to use/buy cheap points:

- Any credit card to hit minimum spend and achieve signup bonus or spend thresholds.

- BOA Premium Rewards 2.62% Cashback (Card holder needs to be a Preferred Rewards Platinum Honors member)

- Chase INK Premier 2.5% Cashback on purchases over $5k (Points are not transferable to airline or hotel programs)

- Capital One Venture X 2X Cap One Miles/Points (now transfer to most airline partners at 1:1)

- Amex Blue Business Plus 2X Membership Rewards (capped at $50,000 spend per calendar year)

- Chase United Business Club Card, 1.5X United Miles

- BOA Virgin Atlantic World Elite 1.5X Virgin Atlantic Points

- Chase Freedom Unlimited, 1.5X Ultimate Rewards, paired with a premium card (Sapphire Preferred, Sapphire Reserve, INK Preferred, INK Plus)

- Chase INK Unlimited, 1.5X Ultimate Rewards, paired with a premium card (Sapphire Preferred, Sapphire Reserve, INK Preferred, INK Plus)

- Amex Everyday Preferred 1.5X Membership Rewards, (need to make 30 transactions in a month for 50% bonus)

- Amex Business Platinum 1.5X Membership Rewards on purchases over $5K

Big Spend Bonuses:

- Amex Delta Reserve, spend $60k get 30k bonus miles and 30k MQM

- Citi Hilton HHonors Reserve, spend $10k get free weekend night, $40k, Platinum Status

- Chase Southwest, spend $135k get Companion Pass (WN points are redeemed at $.011, @ 1.87% fee, you're essentially buying the companion pass for $847)

- Chase Ritz Carlton Reserve, spend $10k get Gold Status spend $75k get Platinum Status

- Chase World of Hyatt, spend $15k get one free night

Cash Back cards:

Elan Fidelity 2%

Citi Double Cash 2%

Earn Status/Elite qualifying points:

- American, Delta, Alaska, Hyatt

Pre-Funding allowed:

Amex Charge Cards

Pre-Funding not-allowed:

Chase

Quarterly tax due dates: the 15th of April, June, September, January

Paying USA income, property or other taxes with a credit card

#766

Moderator: Hyatt; FlyerTalk Evangelist

Join Date: Jun 2015

Location: WAS

Programs: :rolleyes:, DL DM, Mlife Plat, Caesars Diam, Marriott Tit, UA Gold, Hyatt Glob, invol FT beta tester

Posts: 18,916

This is great info thank you. Would the payment fees we paid for using these payment providers be added to deductible tax preparation fees line item in our taxes? I presume the 1099 I will get will have these fees listed.

But the issue I see for me is, these fees I paid about two months ago in present year 2023 were incurred in 2023 1 day before I filed my 2023 return to overpay my 2023 tax return (for 2022) .

Would i be in need of filing a amended 2023 return to itemize these fee expenses (not really worth my time)

or since my fees were incurred in 2023 is what matters, and thus i can itemize them in my upcoming 2024 return (for tax year 2023).

But the issue I see for me is, these fees I paid about two months ago in present year 2023 were incurred in 2023 1 day before I filed my 2023 return to overpay my 2023 tax return (for 2022) .

Would i be in need of filing a amended 2023 return to itemize these fee expenses (not really worth my time)

or since my fees were incurred in 2023 is what matters, and thus i can itemize them in my upcoming 2024 return (for tax year 2023).

2. My non-professional layperson's research suggests that credit card convenience fees are not deductible on personal returns. They may be deductible for a business.

3. Deductions are taken for the tax year in which the expense occurred, even if the expense was related to something for a prior tax year -- by way of analogy, if you receive a taxable refund in 2023 it counts as income for the year 2023 even though it may have been a refund for your 2022 state tax return

4. Tax returns are generally referred to by the tax year they are associated with, not when you file them. You have not filed your 2023 return yet, you are talking about your 2022 return.

We are kinda wandering away from the thread topic, so I would suggest that if you want to drill down further on these topics, you should be talking with a qualified tax professional and not some random jerk like me on the Internet, especially on a site that is not specifically about financial issues.

#767

Moderator: Chase Ultimate Rewards

Join Date: Apr 2005

Location: SFO

Programs: UA 2P, MR LT Plat, IHG Plat, BW Dia, HH Au, Avis PC

Posts: 5,452

Fees related to taxes on a business are probably still deductible on the business's return.

#768

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,290

I've tried to use payUSAtax.com twice now to pay my estimated taxes and both times I was told that the card I wanted to use wasn't accepted and to use another card. I was trying with an Alaska Air Visa card and the Visa logo is on the site. pay1040.com does work. Anyone else having an issue with them?

Tonight, due date for estimated payments, “payUSAtax” rejected an Ink Cash card twice and then accepted an AmEx Delta Biz. I called Chase to confirm the card was good to go. “Pay1040” also rejected the Ink Cash. “ACI Payments, Inc.” accepted the Ink Cash. No pattern or rhyme or reason.

(I sweated this one a bit, it was 8-9-10pm and I’m leaving at 9am for a 5 day quasi MR/MR (mileage run/mattress run) and one of the cards is 2 months old and these changes to meet minimum spend are the only charges planned for both cards. Also did NYS estimated taxes with 2 other cards. Quite pleased that it all worked out.)

Last edited by Dr Jabadski; Jun 25, 2023 at 1:16 pm Reason: typo correction, clarification

#769

Join Date: Feb 2016

Location: New York

Programs: Navy A-4 Skyhawk, B727 FE/FO, S80 FO, B757/767 FO, B737 CA

Posts: 1,342

I’ve also had (in the past) occasional rejections of certain cards with certain (IRS) tax payers, cannot recall past details.

Tonight, due date for estimated payments, “payUSAtax” rejected an Ink Cash card twice and then accepted an AmEx Delta Biz. I called Chase to confirm the card was good to go. “Pay1040” also rejected the Ink Cash. “ACI Payments, Inc.” accepted the Ink Cash. No pattern or rhyme or reason.

(I sweated this one a bit, it was 8-9-10pm and I’m leaving at 9am for a 5 days quasi MR/MR (mileage run/mattress run) and one of the cards is 2 months old and these changes to meet minimum spend are the only charges planned for both cards. Also did NYS estimated taxes with 2 other cards. Quite pleased that it all worked out.)

Tonight, due date for estimated payments, “payUSAtax” rejected an Ink Cash card twice and then accepted an AmEx Delta Biz. I called Chase to confirm the card was good to go. “Pay1040” also rejected the Ink Cash. “ACI Payments, Inc.” accepted the Ink Cash. No pattern or rhyme or reason.

(I sweated this one a bit, it was 8-9-10pm and I’m leaving at 9am for a 5 days quasi MR/MR (mileage run/mattress run) and one of the cards is 2 months old and these changes to meet minimum spend are the only charges planned for both cards. Also did NYS estimated taxes with 2 other cards. Quite pleased that it all worked out.)

#770

Join Date: Dec 2022

Posts: 15

Bought a bunch of BHN VISA gift cards in a recent sale on giftcards.com and have been trying to pay NYC property tax with them. About (200) cards in $100 increments. I'm finding I can only get 3-4 payments to go through per day before they claim "transaction declined" and tell me to call the bank. Never gonna get all these payments through before the due date at this rate. Any ideas?

#771

Moderator: Southwest Airlines, Capital One

Join Date: Sep 1999

Location: California

Programs: WN Companion Pass, A-list preferred, Hyatt Globalist; United Club Lietime (sic) Member

Posts: 21,621

Bought a bunch of BHN VISA gift cards in a recent sale on giftcards.com and have been trying to pay NYC property tax with them. About (200) cards in $100 increments. I'm finding I can only get 3-4 payments to go through per day before they claim "transaction declined" and tell me to call the bank. Never gonna get all these payments through before the due date at this rate. Any ideas?

#772

Join Date: Sep 2003

Posts: 265

Bought a bunch of BHN VISA gift cards in a recent sale on giftcards.com and have been trying to pay NYC property tax with them. About (200) cards in $100 increments. I'm finding I can only get 3-4 payments to go through per day before they claim "transaction declined" and tell me to call the bank. Never gonna get all these payments through before the due date at this rate. Any ideas?

#774

Join Date: Dec 2022

Posts: 15

Maybe. Estimated tax never had this issue. Only property tax.

#775

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,290

Bought a bunch of BHN VISA gift cards in a recent sale on giftcards.com and have been trying to pay NYC property tax with them. About (200) cards in $100 increments. I'm finding I can only get 3-4 payments to go through per day before they claim "transaction declined" and tell me to call the bank. Never gonna get all these payments through before the due date at this rate. Any ideas?

BREAK

I’ve also had (in the past) occasional rejections of certain cards with certain (IRS) tax payment websites, cannot recall past details.

Tonight, due date for estimated payments, “payUSAtax” rejected an Ink Cash card twice and then accepted an AmEx Delta Biz. I called Chase to confirm the card was good to go. “Pay1040” also rejected the Ink Cash. “ACI Payments, Inc.” accepted the Ink Cash. No pattern or rhyme or reason.

(I sweated this one a bit, it was 8-9-10pm and I’m leaving at 9am for a 5 day quasi MR/MR (mileage run/mattress run) and one of the cards is 2 months old and these changes to meet minimum spend are the only charges planned for both cards. Also did NYS estimated taxes with 2 other cards. Quite pleased that it all worked out.)

Tonight, due date for estimated payments, “payUSAtax” rejected an Ink Cash card twice and then accepted an AmEx Delta Biz. I called Chase to confirm the card was good to go. “Pay1040” also rejected the Ink Cash. “ACI Payments, Inc.” accepted the Ink Cash. No pattern or rhyme or reason.

(I sweated this one a bit, it was 8-9-10pm and I’m leaving at 9am for a 5 day quasi MR/MR (mileage run/mattress run) and one of the cards is 2 months old and these changes to meet minimum spend are the only charges planned for both cards. Also did NYS estimated taxes with 2 other cards. Quite pleased that it all worked out.)

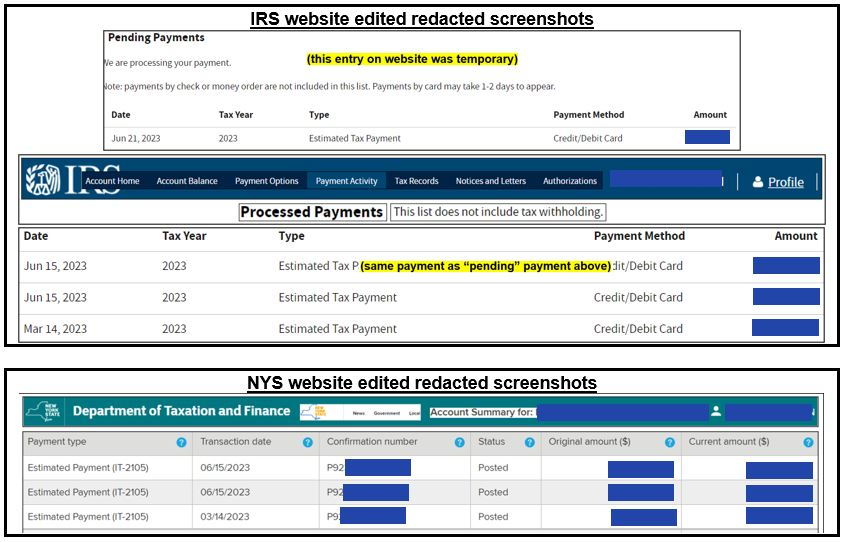

FWIW for any New York state taxpayers here, online NYS tax payments posted online on 6/20/23 with posting date of 6/15/23. Amazing that NYS actually performs one function of government better than the IRS

.

.(After making payments on 6/15/23 no logins to either website until 6/20/23.)

Last edited by Dr Jabadski; Jun 25, 2023 at 1:21 pm Reason: avoid consecutive posts

#776

Join Date: Dec 2022

Posts: 15

Success: Found if you pay via Paypal (same 2% fees) theres no daily limit, or at least not one I've hit yet

Giftcards.com was selling $100 gift cards for $95.59 (inclusive of activation fee) each for their summer sale. This was less of a hassle when they were doing sales on larger cards (eg last year was $250 per card).

In terms of the math, NYC charges 2% on CC or Paypal transactions. So each card provides a $98.04 payment towards tax after losing $1.96 in CC fees. So about 2.56% (or $2.45) in "savings" per transaction or $490 total across 200 cards. Assuming you use a 2% cash back card it's another $382~ in cash back. Total "benefit" for 200 cards is $872. i generally do it for points or frequent flyer miles, instead of cash back which depending on how you value them could be more or less than 2%.

Is it worth the effort? Probably not the best use of your time, but you could say that about any manufactured spending. But it lets me generate card spend in an area i'd normally just be wiring in payment for, and why not save 4% on stupid high NYC property tax?

In terms of the math, NYC charges 2% on CC or Paypal transactions. So each card provides a $98.04 payment towards tax after losing $1.96 in CC fees. So about 2.56% (or $2.45) in "savings" per transaction or $490 total across 200 cards. Assuming you use a 2% cash back card it's another $382~ in cash back. Total "benefit" for 200 cards is $872. i generally do it for points or frequent flyer miles, instead of cash back which depending on how you value them could be more or less than 2%.

Is it worth the effort? Probably not the best use of your time, but you could say that about any manufactured spending. But it lets me generate card spend in an area i'd normally just be wiring in payment for, and why not save 4% on stupid high NYC property tax?

#777

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,290

“If you pay” what; NYC property taxes, NYS taxes, or IRS? Is that based on paying from a (previously) funded PayPal account or paying via PayPal from a linked bank account or credit card? As per the PayPal website “Sending domestic personal transactions Payment method Cards 2.90% + fixed fee”, is use of PayPal as described not considered “Sending domestic personal transactions”? Thanks again.

#778

Join Date: Dec 2022

Posts: 15

“If you pay” what; NYC property taxes, NYS taxes, or IRS? Is that based on paying from a (previously) funded PayPal account or paying via PayPal from a linked bank account or credit card? As per the PayPal website “Sending domestic personal transactions Payment method Cards 2.90% + fixed fee”, is use of PayPal as described not considered “Sending domestic personal transactions”? Thanks again.

NYS estimated tax doesn't seem to have any limits on number of payments or cards so I didn't need to look for other options there. NYS has a slightly higher fee of 2.20% on credit cards, so again it depends on if that math works out for your needs and how much the card costs you.

IRS limits to 2 payments per quarter per SSN per payment site so splitting it up across gift cards doesn't work. The best I've found there is using a 2% card on sites that only charger 1.85-1.98% fees. Whether that is worth it depends on the size of your estimated tax bill and your credit limit. Eg in the best case that's 0.15%, or $1.50 "savings" on every $1k in tax payments. When you get to the number that's "worth it" you likely exceed your limit or don't care enough cause you're Daddy Warbucks rich.

All of these are probably pretty terrible ways to liquidate gift cards, but I'm not sure of a better one these days.

Last edited by trialsandmiles; Jun 27, 2023 at 3:39 am

#779

Join Date: Feb 2011

Location: NYC suburbs

Programs: UA LT Gold (BIS), AA LT Plat (CC SUBs & BD), Hilton Dia (CC), Hyatt Glob (BIB), et. al.

Posts: 3,290

Thank you for the lessons, very gracious. I rarely use gift cards, mostly gave up on MS once the low hanging fruit of Vanilla Reloads and Target RedCard stopped. And I’m loath to do anything at a Walmart, I’d sooner gouge my own eyeballs out with a red hot fire poker than deal with Walmart Customer Service  . I see the rewards of MS, just not worth the squeeze (or is it the juice) to me

. I see the rewards of MS, just not worth the squeeze (or is it the juice) to me  . Thanks again.

. Thanks again.

. I see the rewards of MS, just not worth the squeeze (or is it the juice) to me

. I see the rewards of MS, just not worth the squeeze (or is it the juice) to me  . Thanks again.

. Thanks again.

#780

Join Date: Dec 2022

Posts: 15

Same. Not to.mention they don't have any physical stores in NYC, so most MS options there involve going to New Jersey. Some consider that worse than the customer service.