Citi Merchant Offers

#151

Join Date: Sep 2006

Location: SFO

Programs: BA Avios, UA MP, AA, Choice, Club Carlson

Posts: 1,096

I mean I'm willing to try again with some small stuff and see where that goes with Citi.

But I'm in the AMEX and Chase threads all the time and folks celebrate their success with great offers and rarely does it never track.

There's something to be said that the response here with Citi has been net negative. If anything you have to admit that there's a systemic issue with most accounts even though it works for you.

But I'll post my experience if I try it again - it's one of those things where I think it works with some folks and not for others and there is no rhyme nor reason to it, glad it works for you though, certainly wish it did for me!

But I'm in the AMEX and Chase threads all the time and folks celebrate their success with great offers and rarely does it never track.

There's something to be said that the response here with Citi has been net negative. If anything you have to admit that there's a systemic issue with most accounts even though it works for you.

But I'll post my experience if I try it again - it's one of those things where I think it works with some folks and not for others and there is no rhyme nor reason to it, glad it works for you though, certainly wish it did for me!

#152

Join Date: Feb 2006

Location: DCA/IAD

Programs: AA EXP, UA Silver, Marriott Titanium, HHonors Diamond, National Exec, Hertz PC, Nexus

Posts: 409

Two separate orders to trigger transaction?

I'm eyeing the 'spend $250 on jetBlue, get $50 back' offer and I'm curious whether two separate transactions with a combined total of $250 will trigger the credit. I find airline tickets typically show up on statements as separate charges even with a single purchase. That is, if I have a $300 spend for my wife and I in one PNR (two $150 tickets), they will show up on the statement as individual charges. I know for AMEX, this would still trigger the credit, but not sure about Citi.

#154

Join Date: Sep 2015

Location: Boston's north shore

Programs: AS MVP Gold 75k, DL Silver Medallion

Posts: 296

It's pure luck I noticed this thread on FlyerTalk and checked my Citi card for merchant offers after enrolling in an AmEx and learning about merchant offers there.

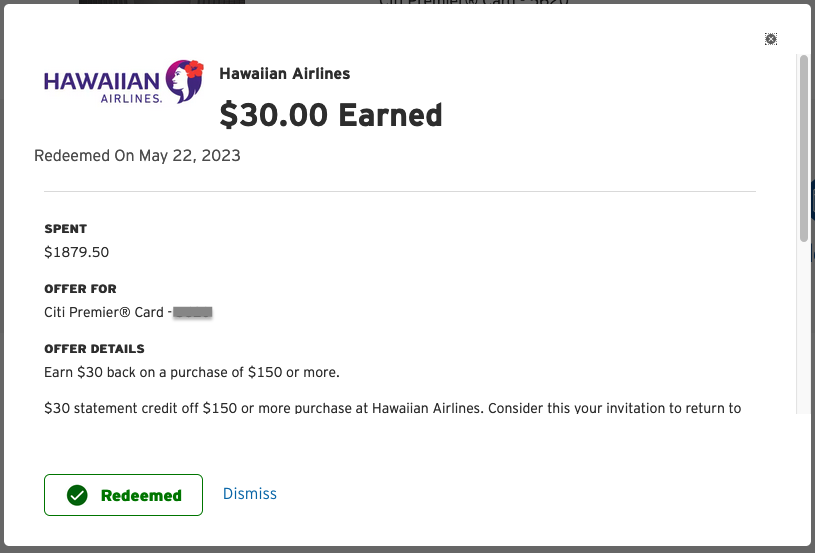

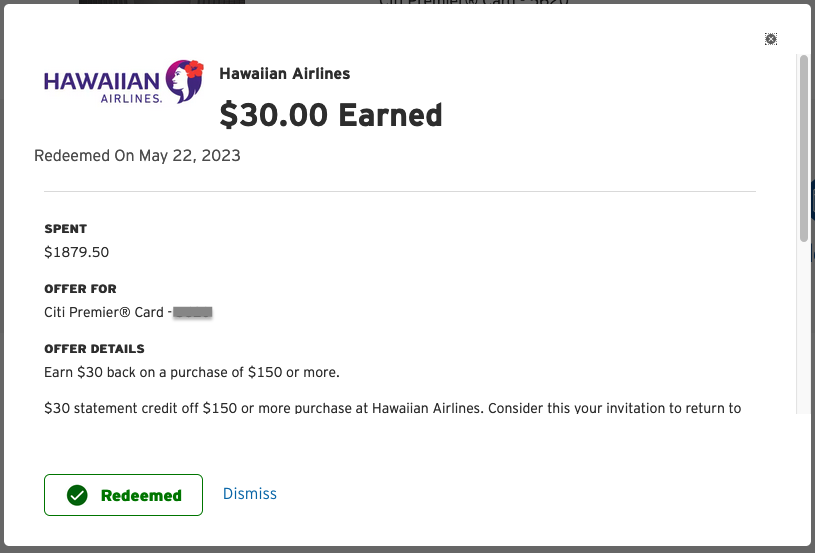

We just booked our first ever trip to Hawai'i, and I had a $30 Citi offer off any Hawaiian Airlines purchase over $150. A single J seat from New England easily sailed over that spending threshold!

Booked tickets on May 18; offer shows as Earned on May 22nd.

We just booked our first ever trip to Hawai'i, and I had a $30 Citi offer off any Hawaiian Airlines purchase over $150. A single J seat from New England easily sailed over that spending threshold!

Booked tickets on May 18; offer shows as Earned on May 22nd.

#155

Join Date: Sep 2011

Programs: UA*G, TK*G, Priority Club Platinum

Posts: 97

I had a fairly lucrative hotels.com offers, which did not post and it has been quite the ride. Exchanged several emails with Citi reps, who came back that I should contact the merchant. I told them that this makes no sense since I activated the offer on their website and they both that I activated the offer and that I met the spending requirement. I just called them and they, again, said that I should contact the merchant. I told them that they would (rightly) say that they see I have paid with card number XXXX but that they have nothing to do with whatever offer I may or may not have activated on citi.com. The rep then said I should call the TYP department. I told her that they will have nothing to do with that either as this is not about TYP.

What is this? And does anyone have had success calling/emailing Citi to get their merchant offer honored when it didn't post automatically?

Their thoroughly bad handling of this makes me like my Chase Sapphire Reserve even more, where all my merchant offers post without problem. As someone said on here earlier, this is clearly a net negative for them.

What is this? And does anyone have had success calling/emailing Citi to get their merchant offer honored when it didn't post automatically?

Their thoroughly bad handling of this makes me like my Chase Sapphire Reserve even more, where all my merchant offers post without problem. As someone said on here earlier, this is clearly a net negative for them.

#156

Join Date: Feb 2012

Posts: 4,470

You're right that offers posted on Citi's platform should be resolved by the bank. Unrelated to that, one should always approach a deal involving hotels.com (or similar sounding booking sites) with very low expectations. They are habitual liars as far as deals promising rebates after the stay is over.

#158

Join Date: Sep 2011

Programs: UA*G, TK*G, Priority Club Platinum

Posts: 97

You're right that offers posted on Citi's platform should be resolved by the bank. Unrelated to that, one should always approach a deal involving hotels.com (or similar sounding booking sites) with very low expectations. They are habitual liars as far as deals promising rebates after the stay is over.

#159

Join Date: Oct 2015

Location: HNL

Posts: 148

Anyways, I'm here again to say that I love citi offers and have had remarkably few issues and I have done serious numbers here.

#160

Join Date: Jul 2010

Posts: 1

What is the best method to contact Citi about merchant offers that failed to trigger? I got the Circle K 10% off fuel offer on 3 cards. Made $35+ purchases a few times more than a month ago, still nothing. The offer still shows under "Enrolled," it has not moved to "Redeemed."

Circle K Fuel 10% back

Expires on Apr 30, 2023 | 20 days left

OFFER DETAILS

Earn 10% back on a purchase of $35 or more.

Circle K Fuel 10% back

Expires on Apr 30, 2023 | 20 days left

OFFER DETAILS

Earn 10% back on a purchase of $35 or more.

I specifically went to a Circle K because of this offer (my usual is Costco), and got nothing in return.

Citi is screwing us over with offers nobody at Citi knows about, and can't service. Incompetent service and a flaky platform. Amex Offers are superior in experience delivery. Triggered immediately upon use, and I get the money back within 2-3 business days, if even that. Citi shouldn't be offering things it can't service. Citi, in general, is just incompetent - impossible to reach a human; when you do, it's someone in India you can't understand; and then after all that laboring, they can't do jack squat. Quitting my Citi cards, and moving the spend to Wells Fargo, Chase and Amex. Ridiculous.

#161

Join Date: Aug 2007

Posts: 151

Same for me. When I called the general customer service line, they had no idea what a 'Merchant Offer' was, pushed me over to the Rewards / ThankYou department. And those guys didn't know what a Merchant Offer was. Moronic.

I specifically went to a Circle K because of this offer (my usual is Costco), and got nothing in return.

Citi is screwing us over with offers nobody at Citi knows about, and can't service. Incompetent service and a flaky platform. Amex Offers are superior in experience delivery. Triggered immediately upon use, and I get the money back within 2-3 business days, if even that. Citi shouldn't be offering things it can't service. Citi, in general, is just incompetent - impossible to reach a human; when you do, it's someone in India you can't understand; and then after all that laboring, they can't do jack squat. Quitting my Citi cards, and moving the spend to Wells Fargo, Chase and Amex. Ridiculous.

I specifically went to a Circle K because of this offer (my usual is Costco), and got nothing in return.

Citi is screwing us over with offers nobody at Citi knows about, and can't service. Incompetent service and a flaky platform. Amex Offers are superior in experience delivery. Triggered immediately upon use, and I get the money back within 2-3 business days, if even that. Citi shouldn't be offering things it can't service. Citi, in general, is just incompetent - impossible to reach a human; when you do, it's someone in India you can't understand; and then after all that laboring, they can't do jack squat. Quitting my Citi cards, and moving the spend to Wells Fargo, Chase and Amex. Ridiculous.

#162

Join Date: Feb 2006

Location: DCA/IAD

Programs: AA EXP, UA Silver, Marriott Titanium, HHonors Diamond, National Exec, Hertz PC, Nexus

Posts: 409

giftcards.com

I have this long-standing issue dating back to probably September of last year where when I add giftcards.com offers (1.5% back) to two of my three Citi cards, they don't stay registered. So when I click on the 'add offer' button, I get the green banner indicating I've successfully added the offer and I can even see the offer when I look at the 'enrolled' page. However, if I go back in the next day, the offer shows up on the available offers page, not the 'enrolled' page. I have this problem on my Citi AAdvantage Executive and Citi AAdvantage Rewards+, but not my Citi Premier. Last year I called Citi when I didn't get the cash back due to the issue and they gave me a courtesy credit for the amount, but they didn't even engage with me on the persistent problem I am having with registration. I've never had this problem when adding other merchant offers and I get my cash back with no issues when I redeem them.

I'm curious whether others have had this problem and whether there is any way to get Citi's help resolving the matter.

I'm curious whether others have had this problem and whether there is any way to get Citi's help resolving the matter.

#163

Join Date: Feb 2022

Posts: 18

I have this long-standing issue dating back to probably September of last year where when I add giftcards.com offers (1.5% back) to two of my three Citi cards, they don't stay registered. So when I click on the 'add offer' button, I get the green banner indicating I've successfully added the offer and I can even see the offer when I look at the 'enrolled' page. However, if I go back in the next day, the offer shows up on the available offers page, not the 'enrolled' page. I have this problem on my Citi AAdvantage Executive and Citi AAdvantage Rewards+, but not my Citi Premier. Last year I called Citi when I didn't get the cash back due to the issue and they gave me a courtesy credit for the amount, but they didn't even engage with me on the persistent problem I am having with registration. I've never had this problem when adding other merchant offers and I get my cash back with no issues when I redeem them.

I'm curious whether others have had this problem and whether there is any way to get Citi's help resolving the matter.

I'm curious whether others have had this problem and whether there is any way to get Citi's help resolving the matter.

Now it showed up on my Citi Premier again. I add it one day and the next day it appears again but it shows it as if I didn't enroll already.

#164

Join Date: Mar 2011

Location: PHL

Programs: US; AA; UA; Hilton Gold; Club Carlson Gold; IHG Platinum;

Posts: 388

Dell offer

Does anyone know how Dell offer works. It says "Earn 5% back on any purchase.... Max award is a $75 statement credit. May be redeemed 10 times by the offer end date."

Is the total max $75 per account or $75 max per redemption? If I make ten purchases for $1500 each, would I get $75 or $750 back?

Is the total max $75 per account or $75 max per redemption? If I make ten purchases for $1500 each, would I get $75 or $750 back?

#165

Join Date: Aug 2019

Posts: 404

Does anyone know how Dell offer works. It says "Earn 5% back on any purchase.... Max award is a $75 statement credit. May be redeemed 10 times by the offer end date."

Is the total max $75 per account or $75 max per redemption? If I make ten purchases for $1500 each, would I get $75 or $750 back?

Is the total max $75 per account or $75 max per redemption? If I make ten purchases for $1500 each, would I get $75 or $750 back?