Last edit by: philemer

This thread is a continuation of discussion from 2015 - 2017.

Is there currently an offer for this card with a signup bonus?

Yes

Is there currently an offer for this card with a signup bonus?

Yes

- only affiliate 60k links seem to work now; go to https://www.doctorofcredit.com/citi-...ed-first-year/ for a working one and open it in in an Incognito / Private window8

- 80K TYP for $4k spend/3 months. $95 AF waived for first year.

- 30K TYP for $3K spend/3 months, $95 AF waived for first year. Open in private/incognito window for best results.

- Offer not available if you have opened or closed a Preferred, Premier, or Prestige card in the past 24 months.

- 30K TYP for $3K spend/3 months, $95 AF waived for first year. Open in private/incognito window for best results.

- Offer not available if you have opened or closed a Preferred, Premier, or Prestige card in the past 24 months.

Does anybody know when the signup bonus will increase?No. Please don't ask in the thread "just to double-check if anybody knows." Nobody knows.

Can I see the number of TYP earned on an individual purchase?No. The best you can do is visit the Account Details page for your card to see how the merchant for a given transaction was categorized.

What are the bonus categories for the Premier card?

What happens to my TY points if I close my card account?Please see the wiki at Citi ThankYou points - cancel, downgrade & expiration considerationsEffective April 19th, 2015, unless you are participating in a limited-time offer, you will earn:Airlines are classified as merchants that provide air travel. Hotels are classified as merchants that provide sleeping or meeting room accommodations, and may include goods and services that are on a bill for these accommodations by a hotel, motel or inn. Car rental agencies are classified as merchants that provide short-term or long-term rentals of cars. Travel agencies are classified as merchants that provide travel information and booking services, and include travel aggregators and tour operators. Gas stations are classified as merchants that sell fuel for consumer use and may or may not be attended. Commuter transportation is classified as merchants that provide suburban and local mass passenger transportation over regular routes and on regular schedules, including ferries, commuter railways and subways. Taxis/limousines are classified as merchants that provide passenger transportation services for hire and includes horse-drawn cabs and carriages, bicycle taxis, aerial tramways, airport shuttles or cable cars. Passenger railways are classified as merchants that primarily provide long-distance transportation and may include overnight accommodations on the train. Cruise lines are classified as merchants that provide passenger transportation on the open sea or inland waters for the purpose of vacation or pleasure and operate predefined and advertised routes. Bridge and road tolls are classified as merchants who collect fees associated with toll roads, highways and bridges. Parking lots/garages are classified as merchants that provide temporary parking services for automobiles, usually on an hourly, daily or monthly contract or fee basis. Campgrounds and trailer parks are classified as merchants that provide overnight or short-term campsites for recreational vehicles, trailers, campers, or tents. Timeshares are classified as retailers that sell, lease, and rent timeshare real estate and arrange timeshare condominium exchanges. Bus lines are classified passenger bus transportation services that operate on a regular schedule over predetermined routes. Motor home and recreational vehicle rentals are classified as merchants that rent motor homes, RVs, pop-up campers, tent trailers, and other recreational vehicles on a daily, short-term, or extended-term basis. Boat leases and boat rentals are classified as merchants that primarily provide boat rental and leasing services, including fishing boats, non-crew houseboats, sail boats, powerboats, jet skis, and yachts.

Restaurants are classified as dining establishments that primarily prepare food and drinks for immediate consumption by consumers, either on the merchantís premises or packaged for takeout, and include bars, cocktail lounges, discotheques, nightclubs, taverns and fast food restaurants. Sports promoters are classified as merchants that operate and promote live sporting events (professional or semi-professional), and may also include sports stadiums. Theatrical promoters are classified as merchants that operate live theatrical productions or concerts, and include ticketing agencies. Movie theaters are classified as establishments that sell tickets and refreshments for movie productions. Amusement parks (including zoos, circuses and aquariums) are classified as establishments that operate parks or carnivals and offer mechanical rides and games and/or live animal shows. Tourist attractions and museums (including art galleries) are classified as establishments that operate attractions and exhibits for tourists. Record stores are classified as establishments that sell CDs and related items, including online record stores. Video rental stores are classified as merchants that rent DVDs and/or games and related equipment for consumer use, including online video rentals.

We do not determine how merchants or establishments are classified, however, they are generally classified based upon the merchant's primary line of business. We reserve the right to determine which purchases qualify for this offer. Purchases not eligible to receive the additional ThankYou Points include, but are not limited to, purchases made at warehouse clubs, discount stores, department stores and convenience stores.

You may earn ThankYou Points as long as your Card Account is open and current. If your Card Account is closed, you will not be able to earn ThankYou Points and you will lose any accumulated ThankYou Points that have not been transferred to your ThankYou Member Account. Balance transfers, cash advances, convenience checks, returned purchases, disputed or unauthorized purchases/fraudulent transactions, finance charges, Card Account fees, and fees for services and programs you elect to receive through us do not earn ThankYou Points unless otherwise specified.

If you do not already have a ThankYou Rewards Member Account ("ThankYou Member Account"), one will be set up for you. ThankYou Points earned from purchases post to your Card Account at the close of each billing cycle, and at that time we will transfer the ThankYou Points you earned to your ThankYou Member Account. (Bonus ThankYou Points may take one to two additional billing cycles to post to your Card Account.) ThankYou Points are not eligible for redemption until they are transferred to your ThankYou Member Account. ThankYou Points may not be redeemed and may be lost if your Card Account is not open or current.- Offer not available if you have opened or closed a Preferred, Premier, or Prestige card in the past 24 months.

- 3 ThankYou Points for every dollar you spend on purchases at airlines, hotels, car rental agencies, travel agencies, gas stations, commuter transportation, taxi/limousines, passenger railways, cruise lines, bridge and road tolls, parking lots/garages, campgrounds and trailer parks, time shares, bus lines, motor home/RV rental and boat rentals;

- 2 ThankYou Points for every dollar you spend on purchases at restaurants and on select entertainment merchants, including sports promoters, theatrical promoters, movie theaters, amusement parks, tourist attractions, record stores and video rental stores; and

- 1 ThankYou Point for every dollar you spend on other purchases.

- Offer not available if you have opened or closed a Preferred, Premier, or Prestige card in the past 24 months.

Citi Premier MasterCard (60,000 points for $4,000 spend in 3 months)

#541

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

That's good. But, I don't think Amex care about purchasing third party GCs for promotions such as x10 bonus points or Amex Offers as they do on SUB. I have had no issue for points promotion or Amex Offers with purchasing GCs (I still don't touch Visa/MC GCs, though because they are too risky for me).

LAX

LAX

#542

Join Date: Nov 2004

Location: Los Angeles, CA; Philadelphia, PA

Programs: OZ Diamond

Posts: 6,134

LAX

#543

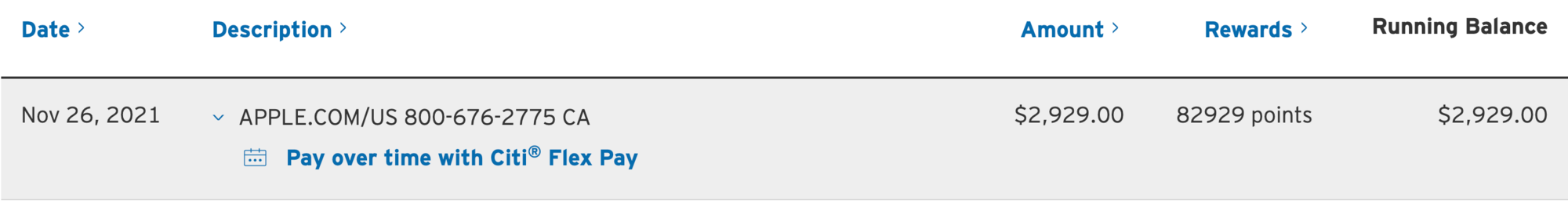

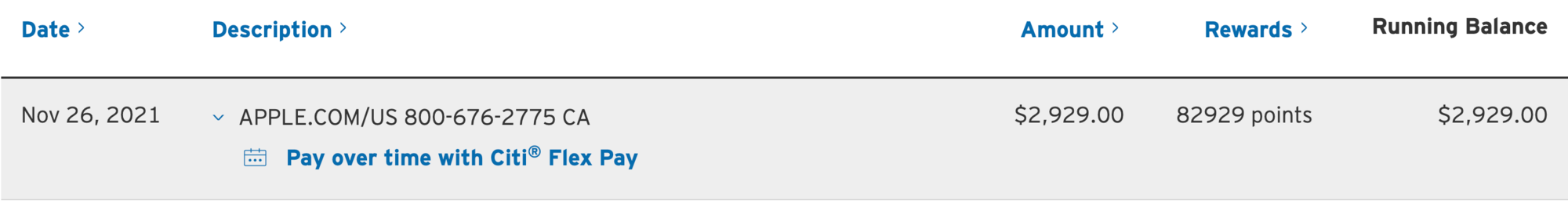

It's funny that Citi shows you your bonus points earned as earned on a single transaction once the final transaction pushes you over the $4k spend for the SUB.

#544

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

#545

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,933

And in case you were "hiding", be aware that Amex can only see that (if they even want to look) at stores that send L3 information. Not all grocery stores send L3 information. But maybe the particular store you used does?

Without L3 information, Amex cannot tell what you bought on a purchase were you bought several things, and only one of those several things was a gift card. And that's why you shouldn't buy gift cards as a stand-alone purchase if you're worried about this.

The other factor is how many. I probably only did one or two gift cards (each of them $100 Amazon or Delta Airlines or such) per SUB (because I was not trying to max out anything on the credit card side, I was trying get my monthly Kroger fuel points up). So maybe it makes a difference how many gift cards you use for a SUB at Amex?

I have never had problems with an Amex SUB where I had one or two gift cards at my local Ralphs (division of Kroger). But was that because my local Ralphs doesn't send L3 info, or is it because I "hid" them well enough, or what?

Meanwhile, I don't recall ever reading on FT of any other bank other than Amex using L3 info. So in absence of knowledge of L3 info being used by other banks, I'd say definitely "burying" your gift cards among "real" groceries on the same purchase should work fine at all other banks, until we hear a DP that they didn't.

#546

Join Date: Oct 2003

Location: DFW

Programs: AAdvantage LT GLD 1.806MM

Posts: 260

Wife applied for Citi Premier today, and was declined. She called Citi to ask for reason, and they said "Insufficient credit history on several accounts. Decision was made using information from Experian credit report." My wife advised that one of the recent accounts in her credit report is an authorized user card on my AMEX account. She has opened 1 card in the past 1 year (365 days), on 7/15/2021, and the authorized user card was added 6/17/2021. Her Experian credit score is 840.

The agent advised to get the credit report from Experian to verify all information is correct (we've already done that, everything is correct), and that all credit card accounts are reporting to Experian (as far as I can see, all the accounts are reporting regularly).

Is it worth calling the reconsideration line again to ask for approval? The reason Citi gave seems wishy-washy and non-specific, so I'm not sure what information we can provide to get my wife approved. Anyone have advice on what next steps could be?

Thanks.

The agent advised to get the credit report from Experian to verify all information is correct (we've already done that, everything is correct), and that all credit card accounts are reporting to Experian (as far as I can see, all the accounts are reporting regularly).

Is it worth calling the reconsideration line again to ask for approval? The reason Citi gave seems wishy-washy and non-specific, so I'm not sure what information we can provide to get my wife approved. Anyone have advice on what next steps could be?

Thanks.

#547

Join Date: Mar 2013

Location: Dayton

Programs: Hilton Gold, IHG Platinum, United, AAdvantage

Posts: 223

I already have a Citi Premier card, open for more than 3 years. Can I apply for 2nd Citi Premier card and get a bonus if I already have 1?

Last edited by animesh42001; Dec 23, 2021 at 11:40 am

#548

Join Date: Jan 2014

Location: TYS/BNA/ATL

Programs: UR, TYP, MR, C1, AA, UA, WN, BA, AS, AV, AC, Choice, Hyatt, IHG, Hilton, Wyndham, Marriott

Posts: 1,973

#549

Join Date: Jun 2009

Posts: 2,135

Citi premier card denial

guys - got denied for this card and the automated system said 'amount of outstanding credit is too high when compared to stated income'. My question - does outstanding credit refer to how much balance I have with my credit cards or the credit limit these companies have awarded me? If it's the former, I actually only have a $300 balance so it's odd they would not approve. Thanks

#551

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

I believe it refers to the amount of your credit limits, not your balances.

#553

Join Date: Jun 2009

Posts: 2,135

ok is there a way to get to a real person at the citi reconsideration line? I just got an automated response at (866) 441-7409

#554

FlyerTalk Evangelist

Join Date: Mar 2010

Programs: DL, OZ, AC, AS, AA, BA, Hilton, Hyatt, Marriott, IHG

Posts: 19,896

All the blogs are reporting that the 80k offer is about to end. Does anyone here know the actual date?

#555

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

It seems that way to me too. Based on what I saw with credit limit increases on AA cards, it seems they may tailor some of them based on the total credit lines showing in the accessed credit report and use that along with the most recent reported income figure for the applicants. I would be surprised if it didn’t work much the same way to some extent for new credit card account applicants too.