Citi Double Cash MasterCard unlimited 1% + 1%

#511

Join Date: Oct 2010

Location: Santa Barbara, CA

Posts: 1,277

Does anyone direct deposit from the DC to a non-Citi bank account? I've been doing that since I got the card, to a Bank of America checking. But when I went in to do it just now, I got this.

Hoping it's just a glitch, but if they really want me to make them send me a check every so often instead of an ACH, I will.

Hoping it's just a glitch, but if they really want me to make them send me a check every so often instead of an ACH, I will.

#512

Join Date: Mar 2014

Location: Florida

Posts: 274

Does anyone direct deposit from the DC to a non-Citi bank account? I've been doing that since I got the card, to a Bank of America checking. But when I went in to do it just now, I got this.

Attachment 36346

Hoping it's just a glitch, but if they really want me to make them send me a check every so often instead of an ACH, I will.

Attachment 36346

Hoping it's just a glitch, but if they really want me to make them send me a check every so often instead of an ACH, I will.

#513

Join Date: Oct 2013

Posts: 483

Is it better to receive a check or transfer to checking? Am I losing money by doing statement credits?

Found the answer- if you redeem your cash back as a statement credit, that redemption does not count as paying for the purchase and does not give you an additional 1% cash back. Ergo, you do not get a full 2%.

Found the answer- if you redeem your cash back as a statement credit, that redemption does not count as paying for the purchase and does not give you an additional 1% cash back. Ergo, you do not get a full 2%.

Last edited by Travelz; Jan 1, 2018 at 3:48 pm

#514

Join Date: Jul 2014

Posts: 3,688

IME, when it's a new card, they didn't allow me to do ACH transfer to my bank on my first statement even if I have used that bank to pay for charges. IIRC, this was implemented for two cycles and thereafter, I was able to do a transfer to any bank on file.

#515

FlyerTalk Evangelist

Join Date: Jan 2005

Location: home = LAX

Posts: 25,932

Is it better to receive a check or transfer to checking? Am I losing money by doing statement credits?

Found the answer- if you redeem your cash back as a statement credit, that redemption does not count as paying for the purchase and does not give you an additional 1% cash back. Ergo, you do not get a full 2%.

Found the answer- if you redeem your cash back as a statement credit, that redemption does not count as paying for the purchase and does not give you an additional 1% cash back. Ergo, you do not get a full 2%.

So while it sounds like less, it's not that much less. Ie, the next best cards from major banks earn only 1.5% cash back, and so 1.98% vs 2.00% isn't such a big deal compared to that, IMHO.

But I guess that's one of the reasons why Citi can't legally promote this as a 2% cashback card.

#516

Join Date: Sep 2012

Posts: 4,431

My parents have the Double Cash card and just had a huge purchase that they paid in parts. Because it was twice their credit limit, they paid $15k, waited for the charge to post, immediately paid it off before statement closed, then charged another $15k, paid that off, and now they’re going to make a third payment.

My question is, since this isn’t straight 2x card, will they get the 1% for paying off the balance? Or does the cardholder only get the second 1% for paying off the STATEMENT balance? Because if that’s the case, that 30k they paid won’t show in the statement.

My question is, since this isn’t straight 2x card, will they get the 1% for paying off the balance? Or does the cardholder only get the second 1% for paying off the STATEMENT balance? Because if that’s the case, that 30k they paid won’t show in the statement.

#517

Join Date: Feb 2011

Location: San Francisco, CA

Programs: Amex Platinum, Chase Sapphire Reserve

Posts: 809

I've had this card for a few years now, and it has been in my wallet the whole time - there is always some spend that doesn't fall into a bonus category on other cards. It has low-key become my favorite card going into 2019 as a lot of other cards are slowly losing value. (see: Are travel credit cards really worth it now?)

This is the easiest card to recommend to almost anybody who has decent credit.

This is the easiest card to recommend to almost anybody who has decent credit.

#518

Join Date: Nov 2007

Location: San Diego

Posts: 75

I've had this card for a few years now, and it has been in my wallet the whole time - there is always some spend that doesn't fall into a bonus category on other cards. It has low-key become my favorite card going into 2019 as a lot of other cards are slowly losing value. (see: Are travel credit cards really worth it now?)

This is the easiest card to recommend to almost anybody who has decent credit.

This is the easiest card to recommend to almost anybody who has decent credit.

Last edited by pdragn78; Jan 22, 2019 at 10:31 pm Reason: typo

#520

Join Date: Mar 2007

Location: SJC/SFO

Programs: WN A+ CP, UA 1MM/*A Gold, Mar LT Tit, IHG Plat, HH Dia

Posts: 6,284

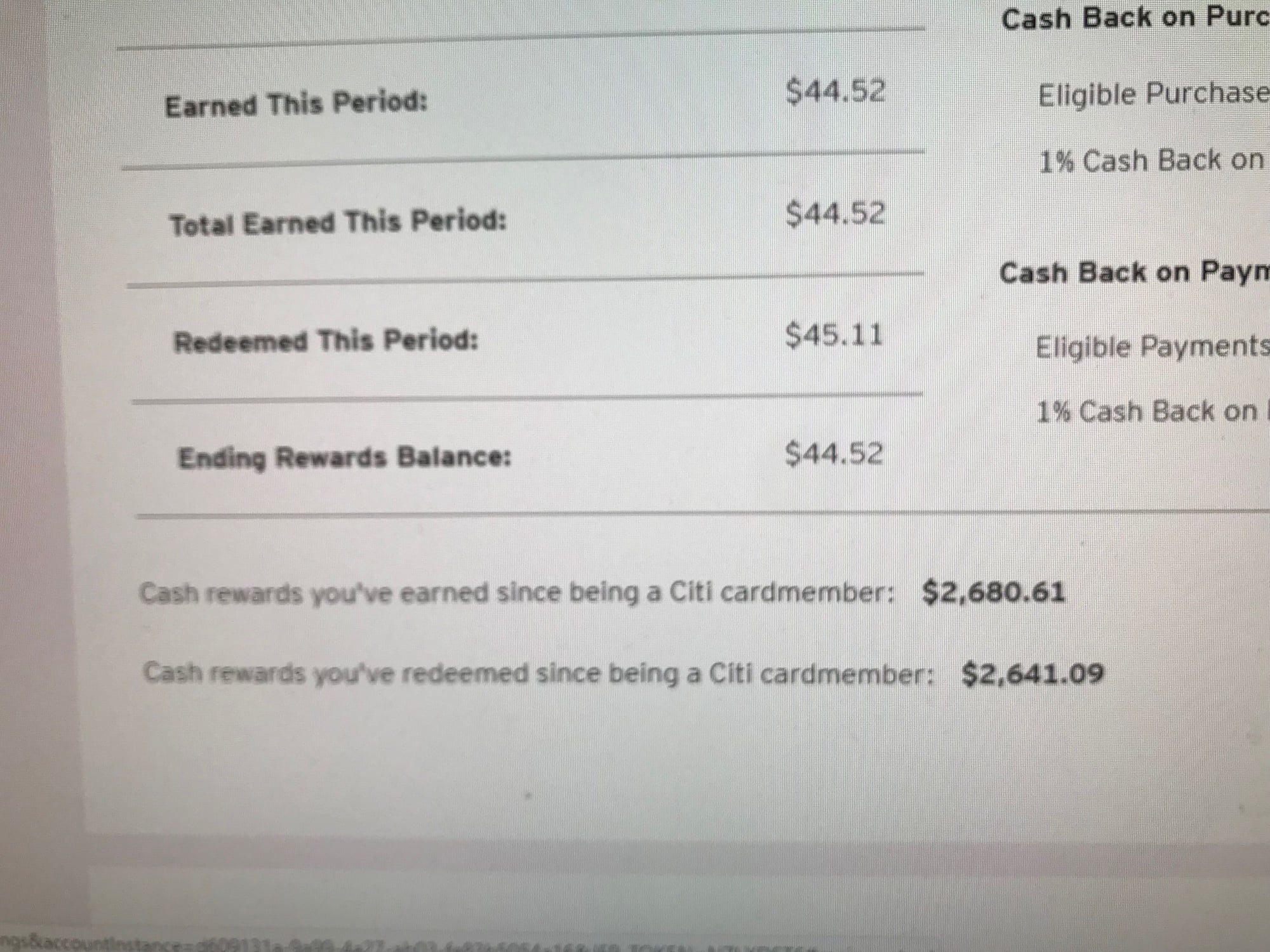

That's a lot of cash back, balwx! You've charged over $140k? I guess my household could do the same over 3-4 years though we don't focus our spend on any one card. I travel enough that I see value in keeping a few airline and hotel cards and combining those CC points with my butt-in-seat/butt-in-bed points and elite status. I'd definitely recommend Citi DC to anyone who's not a frequent traveler.

Last edited by darthbimmer; Jan 27, 2019 at 9:45 pm Reason: misspelling

#521

Join Date: Aug 2012

Location: NJ

Posts: 221

That's a lot of cash back, balwx! You've charged over $140k? I guess my household could do the same over 3-4 years though we don't focus our spend on any one card. I travel enough that I see value in keeping a few airline and hotel cards and combing those CC points with my butt-in-seat/butt-in-bed points and elite status. I'd definitely recommend Citi DC to anyone who's not a frequent traveler.

#524

Join Date: Mar 2017

Programs: HHonors, TrueBlue, Delta SkyMiles, Hyatt Discoverist, Starwood Preferred Guest, American Airlines.

Posts: 2,035

At that point, why not just try to grab the Alliant 2.5% card? You spend well above the break even point when compared to the Double Cash, and then of course you have the 3% back during your first year.

#525

Join Date: Aug 2012

Location: NJ

Posts: 221

Point well taken. I just went to easiest route, since I PC'ed from Citi diamond (something like that)....