Last edit by: Boraxo

Chase Private Client

Qualification:

At least $150,000 with Chase Bank in personal and business bank accounts. Also include investments with JP Morgan. Excludes all employer sponsored retirement plans (401K etc.) and other benefits plans such as HSA etc. but includes IRAs managed by Chase. The investments can be managed by JP Morgan (fee based) or self-directed by the clients.

There is no Monthly Service Fee for Chase Private Client Checking when you have one of the following each monthly statement period: an average beginning day balance of $150,000 or more in any combination of this account and linked qualifying deposits and investments or you have a linked Chase Platinum Business Checking account (with $50,000 balance). Otherwise a $35 Monthly Service Fee will apply.

Benefits:

Chase Sapphire Banking Relationship

Qualification:

At least $75,000 with Chase Bank in personal and business bank accounts. Also include investments with JP Morgan. Excludes all employer sponsored retirement plans (401K etc.) and other benefits plans such as HSA etc. The investments can be managed by JP Morgan (fee based) or self-directed by the clients.

Benefits:

The benefits of Chase Private Client and Chase Sapphire Banking are almost identical. The main difference is that CPC has a dedicated private banker vs Sapphire dedicated service line. CPC is for clients who have more sophisticated banking and investment needs and desire a more personal relationship. CPC may have other banking discounts with mortgage, vehicle loans etc.

Before CPC was a way to get around the Chase 5/24 credit application limitation. It was also the backdoor to apply for the JPM Reserve (former Palladium) card. Both have been blocked or eliminated.

Qualification:

At least $150,000 with Chase Bank in personal and business bank accounts. Also include investments with JP Morgan. Excludes all employer sponsored retirement plans (401K etc.) and other benefits plans such as HSA etc. but includes IRAs managed by Chase. The investments can be managed by JP Morgan (fee based) or self-directed by the clients.

There is no Monthly Service Fee for Chase Private Client Checking when you have one of the following each monthly statement period: an average beginning day balance of $150,000 or more in any combination of this account and linked qualifying deposits and investments or you have a linked Chase Platinum Business Checking account (with $50,000 balance). Otherwise a $35 Monthly Service Fee will apply.

Benefits:

- No monthly service fee on Chase Private Client checking or savings accounts.

- A reduced minimum balance requirement on Chase Platinum Business Checking and no monthly fee on Chase Total Business Checking accounts

- No fees for domestic and international wire transfers completed in person, on the phone or online.

- No Chase fee at a non-Chase ATM (including international ATMs). In addition, Chase refunds ATM fees charged by the ATM owners up to five times per statement period.

- No fee for 3 x 5 Safe Deposit Box and a 20% discount for larger boxes (though Chase exited safe deposit business in California)

- No stop payment fees.

- No fees for cashier’s checks, counter checks or money orders.

- When using your debit card, Chase will increase your daily ATM withdrawal limit of up to $2,000 and a daily purchase limit of up to $7,500.

- No exchange rate adjustment fees for debit card usage or ATM withdrawals abroad, making this another great way to save on overseas ATM withdrawals

- A slightly higher sign-up bonus on the Chase Sapphire Preferred Card. Chase Private Client customers can earn 60,000 bonus points after spending $4,000 on their card within three months of account opening, versus 50,000 points for the public offer. (Possibly outdated)

- Mortgage benefits including the ability to leverage Chase’s best rate when you purchase a home with the Chase Private Client Mortgage Rate Purchase Program (based on your total deposits and investments with Chase), a $750 discount on closing costs on all loans, dedicated priority processing and senior underwriting support for loans,

discounts for Home Equity Lines of Creditand direct access to Customer Service Specialists. Note: Chase discontinued new HELOCs in 2020 (existing HELOC accounts are grandfathered with these benefits). Access to the Chase Private Client Arts & Culture program, which includes a card that offers free admission and discounts to museums in about a dozen major US cities. For example, in New York it offers free admission to the American Museum of Natural History for yourself and up to five guests. The card is specific to an individual city, but it appears that Chase is willing to send you new cards when you plan on visiting a particular city.Discontinued.- A private client advisor when you have investments with JP Morgan

Chase Sapphire Banking Relationship

Qualification:

At least $75,000 with Chase Bank in personal and business bank accounts. Also include investments with JP Morgan. Excludes all employer sponsored retirement plans (401K etc.) and other benefits plans such as HSA etc. The investments can be managed by JP Morgan (fee based) or self-directed by the clients.

Benefits:

- No monthly service fee on Chase Sapphire checking or savings accounts.

- One no fee Chase Total Business Checking account (may have been removed)

- No fees for domestic and international wire transfers completed in person, on the phone or online.

- No Chase fee at a non-Chase ATM (including international ATMs). In addition, Chase refunds ATM fees charged by the ATM owners up to five times per statement period.

- No fee for 3 x 5 Safe Deposit Box and a 20% discount for larger boxes.

- No stop payment fees.

- No fees on the first four overdrafts during the current the prior 12 statement periods

- No fees for cashier’s checks, counter checks or money orders.

- When using your debit card, Chase will increase your daily ATM withdrawal limits.

- No exchange rate adjustment fees for debit card usage or ATM withdrawals abroad, making this another great way to save on overseas ATM withdrawals

- 24/4 dedicated Chase Sapphire banking service line

The benefits of Chase Private Client and Chase Sapphire Banking are almost identical. The main difference is that CPC has a dedicated private banker vs Sapphire dedicated service line. CPC is for clients who have more sophisticated banking and investment needs and desire a more personal relationship. CPC may have other banking discounts with mortgage, vehicle loans etc.

Before CPC was a way to get around the Chase 5/24 credit application limitation. It was also the backdoor to apply for the JPM Reserve (former Palladium) card. Both have been blocked or eliminated.

Chase Private Client

#196

It's essentially an open line of credit on your non-retirement securities. I don't have my assets managed by JP Morgan (everything is self-directed) but my investment advisor set it up.

Separately, I wish Private Client came with annual fee discounts on some credit cards like Citigold offers on the Prestige card.

Separately, I wish Private Client came with annual fee discounts on some credit cards like Citigold offers on the Prestige card.

#197

Join Date: Jul 2004

Location: Thailand

Programs: Marriott LT Titanium; IHG Diamond Ambassador

Posts: 1,150

Smart money never sells they leverage using collateralized debt.

#198

So if I'm cash poor but heavily invested in stocks and want to buy a car or property my options are to sell stocks and pay cap gains (out the future value my positions and cap gains hit) or I take out a loan against my portfolio and continuously roll the loan forward only paying the interest.

Smart money never sells they leverage using collateralized debt.

Smart money never sells they leverage using collateralized debt.

Again, this is not much different from having margin account. Probably have a lower interest compared with unsecured loans. Both mortgages and car loans do not count since they are already secured.

#199

FlyerTalk Evangelist

Join Date: Aug 2009

Location: ZOA, SFO, HKG

Programs: UA 1K 0.9MM, Marriott Gold, HHonors Gold, Hertz PC, SBux Gold, TSA Pre✓

Posts: 13,811

Also - this arrangement is similar to HELOC. They are investors who are cash poor using HELOC to pay for personal stuffs.

#200

Join Date: Jun 2017

Location: SEA/NYC/IAD

Programs: UA 1K, Marriott Titanium, Hyatt Explorist

Posts: 1,919

Do you know whether the (international) ATM fee reimbursement occurs at time of withdrawal (i.e. Fidelity Visa does this) or at end of month (i.e. Schwab does this)?

#201

Join Date: Jan 2003

Location: New York, NY, USA

Programs: UA 1K - 2.1MM, HH LT Diamond, IHG Diamond, Bonvoy LT Titanium, Hyatt Glob

Posts: 766

Both Domestic and International at the time of the withdrawal. You’ll see the reimbursement post the next business day as a credit showing the address of the ATM.

#203

Join Date: Apr 2019

Programs: SAS Gold, Aegean Gold, Marriott Titanium, Hilton Gold

Posts: 204

Does this only work if Chase is charged the fee? What if the ATM charges me a fee directly - will Chase reimburse those too?

#204

Join Date: Oct 2006

Location: USA

Programs: DL PM, Hyatt Globalist

Posts: 2,367

#205

Join Date: Apr 2019

Programs: SAS Gold, Aegean Gold, Marriott Titanium, Hilton Gold

Posts: 204

#206

FlyerTalk Evangelist

Join Date: Oct 2006

Location: SFO/SJC

Programs: UA Silver, Marriott Gold, Hilton Gold

Posts: 14,884

I believe the fee portion is coded differently, so Chase knows that is the portion that gets reimbursed. Used my card in multiple countries (mostly EU and Asia, as well as non-Chase ATMs in the US, both bank ATMs and third-party), and have never failed to see tees reimbursed.

#207

Join Date: Apr 2019

Programs: SAS Gold, Aegean Gold, Marriott Titanium, Hilton Gold

Posts: 204

yes, Chase does not charge a fee on their end for withdrawals, and reimburses any fee that is charged by the ATM operator. As previously mentioned, it is typically reimbursed next business day. Consistently for me both US and international.

I believe the fee portion is coded differently, so Chase knows that is the portion that gets reimbursed. Used my card in multiple countries (mostly EU and Asia, as well as non-Chase ATMs in the US, both bank ATMs and third-party), and have never failed to see tees reimbursed.

I believe the fee portion is coded differently, so Chase knows that is the portion that gets reimbursed. Used my card in multiple countries (mostly EU and Asia, as well as non-Chase ATMs in the US, both bank ATMs and third-party), and have never failed to see tees reimbursed.

#208

Join Date: Oct 2006

Location: USA

Programs: DL PM, Hyatt Globalist

Posts: 2,367

#209

Join Date: Aug 2010

Location: California

Programs: American, SWA, United, IHG,Hilton, Hyatt, Marriott

Posts: 1,843

I hardly ever use ATM. Other then when I go on international travel. And I always try to use chase atms too. But couple weeks ago I was picking up food and they only took cash. And I didnt have enough. Was shy a few bucks. So used the atm that was in the restaurant.

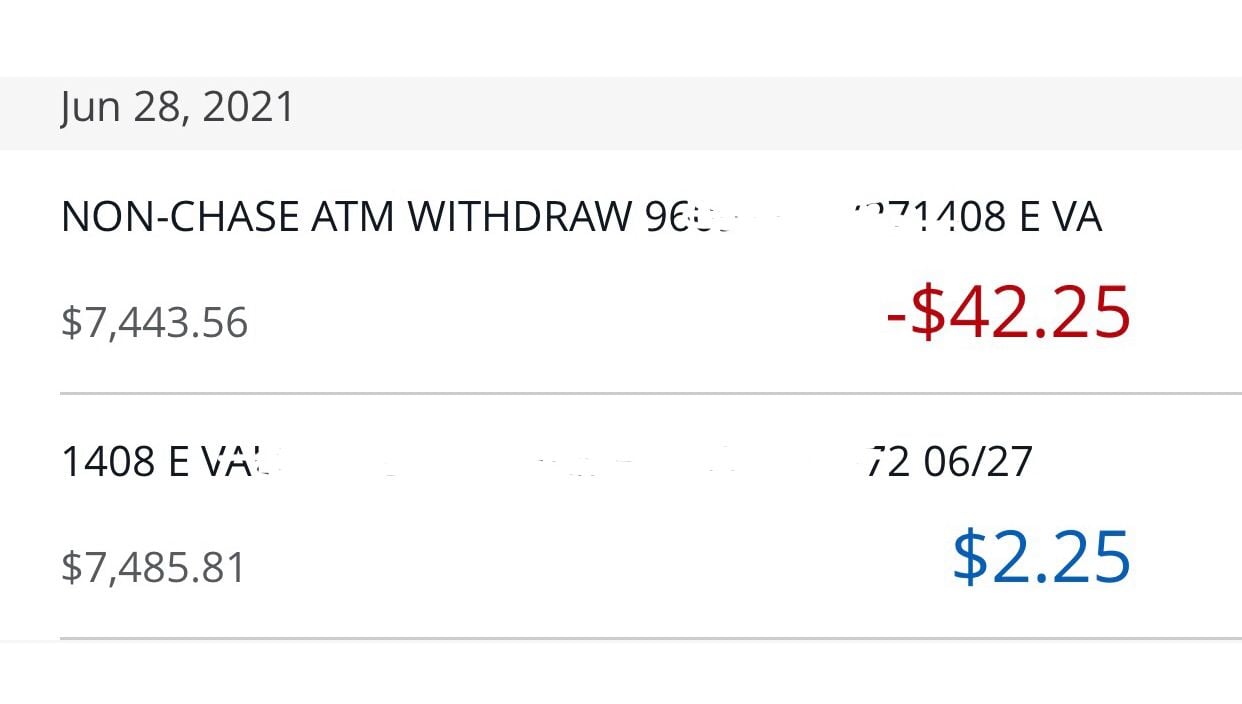

This is how the ATM fee shows up.