Last edit by: SanDiego1K

https://www.marketwatch.com/story/chase-is-now-offering-points-on-a-checking-account-but-theres-a-big-catch-2018-09-14

https://money.cnn.com/2018/09/13/news/companies/chase-sapphire-banking/index.html

April 2019: sweetened offer requires 45 days to earn points plus 45 additional days to hold money in account:

https://accounts.chase.com/consumer/banking/online/sapphireUR

Online application

Customers must make at least $75,000 in new deposits, or in investments, to qualify. Those investments must be kept at Chase and cannot be retirement investments. If customers meet those requirements, they will also get access to a new digital investment platform called YouInvest by JPMorgan, which gives commission-free stock and ETF trades with $0 account minimums.

https://money.cnn.com/2018/09/13/news/companies/chase-sapphire-banking/index.html

April 2019: sweetened offer requires 45 days to earn points plus 45 additional days to hold money in account:

https://accounts.chase.com/consumer/banking/online/sapphireUR

Online application

Customers must make at least $75,000 in new deposits, or in investments, to qualify. Those investments must be kept at Chase and cannot be retirement investments. If customers meet those requirements, they will also get access to a new digital investment platform called YouInvest by JPMorgan, which gives commission-free stock and ETF trades with $0 account minimums.

- You need a Sapphire or Freedom credit card to be eligible

- You need to hit the minimum balance within 45 days and maintain it for 90 days

- You need to leave the money in the account for 6 months

- Offer extended to March 5 2019

- As of 4/22/19, Chase.com had an expiration date of 6/15/19 and 90 days duration for the 60,000 UR promotion. https://accounts.chase.com/consumer/banking/online/sapphireUR

- No fees on ATMs worldwide, including refunds on fees charged by non-Chase ATM owners

- No fees on everyday banking, including foreign exchange fees, outgoing wire transfers and stop payments

- Higher ATM withdrawal limits

- Commission-free stock and ETF trades (new You Invest platform)

JPMorgan offers 60,000 points to sign up for its new Sapphire bank account

#31

This tax discussions is really a distraction here. If you get tax question, ask an accountant.

The tax related to credit card rewards is not entirely clear. The CC banks just want to cover themselves to be in compliance. This is the least they want to spend resources on. They would not care if that $300 is called interest income, or something else. I do not care if that $300 comes from CSR or comes from Ritz Carlton card. It does not make a dent in my wallet.

Please discussion credit card related tax issues here:

https://www.flyertalk.com/forum/chas...l#post30204855

The tax related to credit card rewards is not entirely clear. The CC banks just want to cover themselves to be in compliance. This is the least they want to spend resources on. They would not care if that $300 is called interest income, or something else. I do not care if that $300 comes from CSR or comes from Ritz Carlton card. It does not make a dent in my wallet.

Please discussion credit card related tax issues here:

https://www.flyertalk.com/forum/chas...l#post30204855

#32

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,952

Moderator observation

The topic of taxable rewards for bank accounts is well understood. It is an important consideration to some people in evaluating an offer. I accept that it is not important to you, but it will still be discussed.

See this thread for years of evidence:

[Consolidated] 1099s for miles & cash rewards from all banks

It is also well established that credit card rewards are not taxed in the USA, because they represent a partial rebate of the amount spent. If Chase sent you a 1099 for a partial refund of your annual fee that would be an important policy change -or- a mistake. However, if you are unwilling to even look at the 1099 to identify the account that Chase referenced, there cannot be a discussion.

One circumstance that has caught some people out is that credit card referral bonuses are taxable. I will try to find a link to a discussion.

See this thread for years of evidence:

[Consolidated] 1099s for miles & cash rewards from all banks

It is also well established that credit card rewards are not taxed in the USA, because they represent a partial rebate of the amount spent. If Chase sent you a 1099 for a partial refund of your annual fee that would be an important policy change -or- a mistake. However, if you are unwilling to even look at the 1099 to identify the account that Chase referenced, there cannot be a discussion.

One circumstance that has caught some people out is that credit card referral bonuses are taxable. I will try to find a link to a discussion.

Last edited by mia; Sep 14, 2018 at 6:42 pm Reason: Add referral bonus information.

#33

The topic of taxable rewards for bank accounts is well understood. It is an important consideration to some people in evaluating an offer. I accept that it is not important to you, but it will still be discussed.

See this thread for years of evidence:

[Consolidated] 1099s for miles & cash rewards from all banks

It is also well established that credit card rewards are not taxed in the USA, because they represent a partial rebate of the amount spent. If Chase sent you a 1099 for a partial refund of your annual fee that would be an important policy change -or- a mistake. However, if you are unwilling to even look at the 1099 to identify the account that Chase referenced, there cannot be a discussion.

See this thread for years of evidence:

[Consolidated] 1099s for miles & cash rewards from all banks

It is also well established that credit card rewards are not taxed in the USA, because they represent a partial rebate of the amount spent. If Chase sent you a 1099 for a partial refund of your annual fee that would be an important policy change -or- a mistake. However, if you are unwilling to even look at the 1099 to identify the account that Chase referenced, there cannot be a discussion.

Last edited by philemer; Sep 14, 2018 at 7:35 pm Reason: removed unhelpful comment-

#35

FlyerTalk Evangelist

Join Date: Jul 2008

Location: IAH

Programs: DL DM, Hyatt Ist-iest, Stariott Platinum, Hilton Diamond

Posts: 12,783

#36

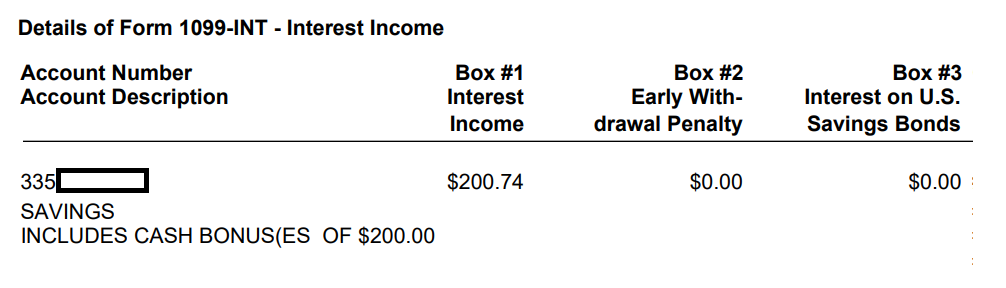

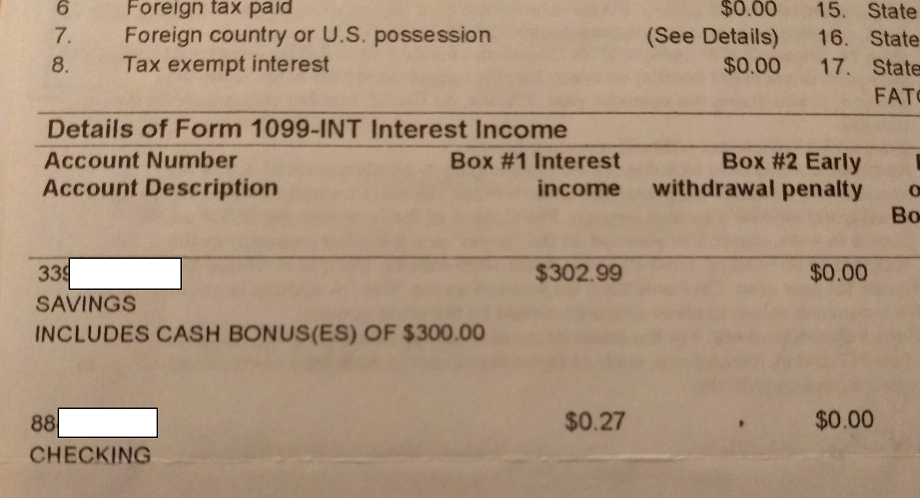

I think that $300 comes from the cash bonus for opening the checking account. But no account # since there was no interest paid.

I got $300 from CSR and $300 from RC CCs. A bunch of $300. That was the only thing paid on tax.... Nothing from CCs then.

Anyhow, this is still a good opportunity to get some URs to stock up....

I got $300 from CSR and $300 from RC CCs. A bunch of $300. That was the only thing paid on tax.... Nothing from CCs then.

Anyhow, this is still a good opportunity to get some URs to stock up....

#37

Join Date: Aug 2012

Posts: 542

I’m surprised at the debate about this. FTers are generally so good about understanding rules. As a few have noted, the tax treatment is not hard or unknown. Credit card points awarded based on spending, whether an initial bonus, or just regular point accrual, are considered purchase price rebate, i.e, a price discount, and thus not taxable bc it doesn’t represent income. On the other hand, amounts offered for signing up for a bank account are treated as interest income. That makes sense, bc you haven’t bought anything to offer a discount or rebate on; rather, you’re being paid (in points rather than money) for giving the bank the use of your money, which is exactly what interest is in the first place.

#39

IRA is part of the brokerage account, taxable, IRA and trust. Excluding employer sponsored retirement, such as 401K etc. HSA is also not included. Business account is not part of this.

#40

Join Date: Mar 2017

Programs: HHonors, TrueBlue, Delta SkyMiles, Hyatt Discoverist, Starwood Preferred Guest, American Airlines.

Posts: 2,035

This account is a no-brainer, even for those who don't have $75k to stash in the checking/investment account.

Just think about it.... You have $10,000 in the account to invest. You get free checks, unlimited free trades (to profit from in the stock market), waived overdrafts, free wire transfers, no FTF's on your debit card, zero non-Chase ATM fees, unlimited ATM reimbursements, etc., all for $25 a month.

My current direct deposit is to Charles Schwab, but my overall profit gain is better with the Sapphire Checking account - especially because I trade frequently and keep stocks short term to profit.

Just think about it.... You have $10,000 in the account to invest. You get free checks, unlimited free trades (to profit from in the stock market), waived overdrafts, free wire transfers, no FTF's on your debit card, zero non-Chase ATM fees, unlimited ATM reimbursements, etc., all for $25 a month.

My current direct deposit is to Charles Schwab, but my overall profit gain is better with the Sapphire Checking account - especially because I trade frequently and keep stocks short term to profit.

#41

Join Date: Mar 2012

Location: Boulder

Programs: AA Plat, CX Silver

Posts: 2,361

It's interesting, and if I can move my Roth IRA over for a few months then maybe I'll do it for the bonus, but so far I haven't seen anything that would seriously tempt me away from Schwab for checking and Vanguard for investing. But then, I haven't traded an individual share in years so I may just not be the target market here.

#42

This account is a no-brainer, even for those who don't have $75k to stash in the checking/investment account.

Just think about it.... You have $10,000 in the account to invest. You get free checks, unlimited free trades (to profit from in the stock market), waived overdrafts, free wire transfers, no FTF's on your debit card, zero non-Chase ATM fees, unlimited ATM reimbursements, etc., all for $25 a month.

My current direct deposit is to Charles Schwab, but my overall profit gain is better with the Sapphire Checking account - especially because I trade frequently and keep stocks short term to profit.

Just think about it.... You have $10,000 in the account to invest. You get free checks, unlimited free trades (to profit from in the stock market), waived overdrafts, free wire transfers, no FTF's on your debit card, zero non-Chase ATM fees, unlimited ATM reimbursements, etc., all for $25 a month.

My current direct deposit is to Charles Schwab, but my overall profit gain is better with the Sapphire Checking account - especially because I trade frequently and keep stocks short term to profit.

If Fidelity or Schwabs ever offer free trades (even 100/year), I'd stay with them. But they only do that for the promotion.

#43

It's interesting, and if I can move my Roth IRA over for a few months then maybe I'll do it for the bonus, but so far I haven't seen anything that would seriously tempt me away from Schwab for checking and Vanguard for investing. But then, I haven't traded an individual share in years so I may just not be the target market here.

#44

Join Date: Mar 2012

Location: Boulder

Programs: AA Plat, CX Silver

Posts: 2,361

In Vanguard's case, a corporate structure better aligned with their customers' interests than that of most other firms. Vanguard has no shareholders—it is owned by its customers. I trust them far more than I trust Chase.

This is clear in their fee structures: I've never paid much attention to JP Morgan's mutual funds, but a quick glance shows fees commonly above 0.75% or even 1%, whereas Vanguard's equivalent funds charge less than 0.05%.

And yes, free ETF trades when trading their house ETFs. Same as most fund providers.

This is clear in their fee structures: I've never paid much attention to JP Morgan's mutual funds, but a quick glance shows fees commonly above 0.75% or even 1%, whereas Vanguard's equivalent funds charge less than 0.05%.

And yes, free ETF trades when trading their house ETFs. Same as most fund providers.

#45

It's interesting, and if I can move my Roth IRA over for a few months then maybe I'll do it for the bonus, but so far I haven't seen anything that would seriously tempt me away from Schwab for checking and Vanguard for investing. But then, I haven't traded an individual share in years so I may just not be the target market here.

In Vanguard's case, a corporate structure better aligned with their customers' interests than that of most other firms. Vanguard has no shareholders—it is owned by its customers. I trust them far more than I trust Chase.

This is clear in their fee structures: I've never paid much attention to JP Morgan's mutual funds, but a quick glance shows fees commonly above 0.75% or even 1%, whereas Vanguard's equivalent funds charge less than 0.05%.

And yes, free ETF trades when trading their house ETFs. Same as most fund providers.

This is clear in their fee structures: I've never paid much attention to JP Morgan's mutual funds, but a quick glance shows fees commonly above 0.75% or even 1%, whereas Vanguard's equivalent funds charge less than 0.05%.

And yes, free ETF trades when trading their house ETFs. Same as most fund providers.