Last edit by: CodeAdam10

THIS THREAD IS NOW ARCHIVED.

PLEASE CONTINUE THE DISCUSSION HERE: https://www.flyertalk.com/forum/chase-ultimate-rewards/2031752-chase-ink-business-preferred-2021-onward.html

================================================== ==================================

Additionally: For those who may be automatically excluded due to 5/24, the in-branch Business Rep can submit the application by Mail on your behalf (this avoids the application going through the computer check that would automatically exclude those who are already at 5/24.) First year's annual fee is not waived.

: Some members may have a referral link and would be very grateful if you would use it. See this thread: http://www.flyertalk.com/forum/credi...ost-first.html

1) Should I apply using the link above or go to a nearby brick and mortar branch?

Sometimes there are better offers to be had in the branch (as referenced above). Some in-branch apps had/have the $95 AF waived 1st yr (ymmv). You can also have your banker check to see if you are pre-approved for this card (green screen on the banker's log in). However, it is likely simpler/easier to do a Chase business credit application Online as applying in-branch often requires providing documentation (proof of business, etc).

2) How do the rewards differ from other INK cards?

The bonus categories on this card are different than other cards in the INK family, notably, this card does NOT get a bonus at Office Supply stores, but DOES get the following:

3 Points per $1 on the first $150,000 spent in combined purchases in the following categories each account anniversary year:

- Travel; including airfare, hotels, rental cars, train tickets, and taxis

PLEASE CONTINUE THE DISCUSSION HERE: https://www.flyertalk.com/forum/chase-ultimate-rewards/2031752-chase-ink-business-preferred-2021-onward.html

================================================== ==================================

- 100,000 Chase UR points after $15K spend in 3 months, with $95 annual fee (not waived the first year)

Additionally: For those who may be automatically excluded due to 5/24, the in-branch Business Rep can submit the application by Mail on your behalf (this avoids the application going through the computer check that would automatically exclude those who are already at 5/24.) First year's annual fee is not waived.

: Some members may have a referral link and would be very grateful if you would use it. See this thread: http://www.flyertalk.com/forum/credi...ost-first.html

1) Should I apply using the link above or go to a nearby brick and mortar branch?

Sometimes there are better offers to be had in the branch (as referenced above). Some in-branch apps had/have the $95 AF waived 1st yr (ymmv). You can also have your banker check to see if you are pre-approved for this card (green screen on the banker's log in). However, it is likely simpler/easier to do a Chase business credit application Online as applying in-branch often requires providing documentation (proof of business, etc).

2) How do the rewards differ from other INK cards?

The bonus categories on this card are different than other cards in the INK family, notably, this card does NOT get a bonus at Office Supply stores, but DOES get the following:

3 Points per $1 on the first $150,000 spent in combined purchases in the following categories each account anniversary year:

- Travel; including airfare, hotels, rental cars, train tickets, and taxis

- For reports on what qualifies as travel expenses, see https://www.flyertalk.com/forum/chas...solidated.html

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases made with social media sites and search engines

- 1 Point per $1 on all other purchases (with no limits on the number of points you can earn).

Also, notably, it follows the Sapphire Preferred personal card in offering a bonus when using points to book travel using the Ultimate Rewards web site: Points are worth 25% more when you redeem for travel through Chase Ultimate Rewards®. For example, 80,000 points are worth $1,000 towards travel.*

See discussion on using the UR portal, here: http://www.flyertalk.com/forum/chase...ts-2017-a.html

3) What are the insurance and other benefits provided by this card?

The Benefits Guide is here: https://www.chasebenefits.com/inkpreferred

4) Can I product change from a different INK Card?

Since this card is newly released, options may change in the future, but, at this time, Chase is not permitting product change to Ink Preferred at this time (reported on 11/23/16).

See our ongoing discussion here: http://www.flyertalk.com/forum/chase...16-onward.html

To check app. status find the numbers in the WIKI in this thread: https://www.flyertalk.com/forum/chas...onward-43.html

(888) 269-8690 - Business Credit Card Application Status Line, automated

- Internet, cable and phone services

- Advertising purchases made with social media sites and search engines

- 1 Point per $1 on all other purchases (with no limits on the number of points you can earn).

Also, notably, it follows the Sapphire Preferred personal card in offering a bonus when using points to book travel using the Ultimate Rewards web site: Points are worth 25% more when you redeem for travel through Chase Ultimate Rewards®. For example, 80,000 points are worth $1,000 towards travel.*

See discussion on using the UR portal, here: http://www.flyertalk.com/forum/chase...ts-2017-a.html

3) What are the insurance and other benefits provided by this card?

The Benefits Guide is here: https://www.chasebenefits.com/inkpreferred

4) Can I product change from a different INK Card?

Since this card is newly released, options may change in the future, but, at this time, Chase is not permitting product change to Ink Preferred at this time (reported on 11/23/16).

See our ongoing discussion here: http://www.flyertalk.com/forum/chase...16-onward.html

To check app. status find the numbers in the WIKI in this thread: https://www.flyertalk.com/forum/chas...onward-43.html

(888) 269-8690 - Business Credit Card Application Status Line, automated

================================================== ================================================== ==========================================

Landing page for all INK cards: https://creditcards.chase.com/a1/ink-business-compare-cards/nov?CELL=6RRW&jp_cmp=cc/Ink-General_Brand_Exact_Ink_SEM_US_Desktop_Standard_NA/sea/p56076138828/Business+Card+-+Chase+-+Ink&ds_rl=1268784&ds_rl=1238366&ds_rl=1238420&gcl id=EAIaIQobChMIoIqR-oic7QIV1x6tBh3k0gDyEAAYASAAEgItB_D_BwE&gclsrc=aw.d s

Chase Ink Business Preferred (2016 - 2020 ARCHIVED)

#511

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,952

Telephone bills list lines, not devices. How does the insurer verify that the physical telephone is used on one of the billed lines? I know this can be done if the telephone service provider collects the right technical data, but curious what Chase's insurer requires for documentation.

#512

Join Date: Aug 2007

Location: Truth or Consequences, NM

Programs: HH Diamond, Marriott Titanium, Hertz President's Circle, UA Silver, Mobile Passport Unobtanium

Posts: 6,192

Telephone bills list lines, not devices. How does the insurer verify that the physical telephone is used on one of the billed lines? I know this can be done if the telephone service provider collects the right technical data, but curious what Chase's insurer requires for documentation.

#513

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,740

No, not personal experiences but read about the info from reddit when there were Thanksgiving deals at WalMart and Best Buy.- people were discussing on the protection plan offered by CC, and under which type of purchases the plan would offer protection. Several posters said they called and were told that the phone needed to be on the financed monthly plan.

#514

Join Date: Aug 2007

Location: Truth or Consequences, NM

Programs: HH Diamond, Marriott Titanium, Hertz President's Circle, UA Silver, Mobile Passport Unobtanium

Posts: 6,192

No, not personal experiences but read about the info from reddit when there were Thanksgiving deals at WalMart and Best Buy.- people were discussing on the protection plan offered by CC, and under which type of purchases the plan would offer protection. Several posters said they called and were told that the phone needed to be on the financed monthly plan.

#515

Just wanted to confirm that my $1,179 iPhone X purchase from Verizon Wireless's website for home delivery DID in fact net me the 3x points for telecom.

Awesome!

Another interesting point is that paying my eBay monthly bill ALSO netted me 3x points....

Awesome!

Another interesting point is that paying my eBay monthly bill ALSO netted me 3x points....

#516

Join Date: Mar 2011

Posts: 114

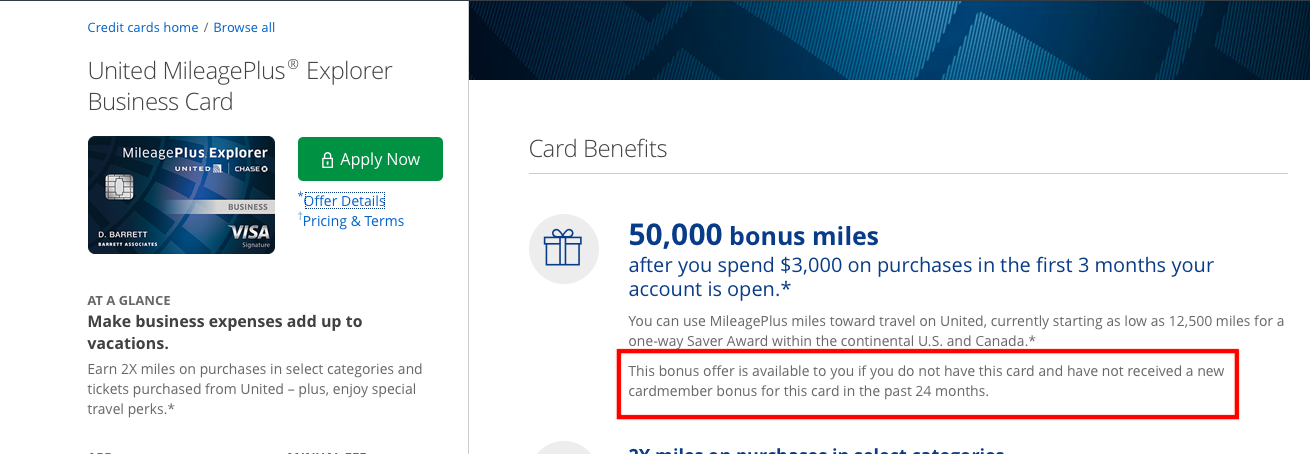

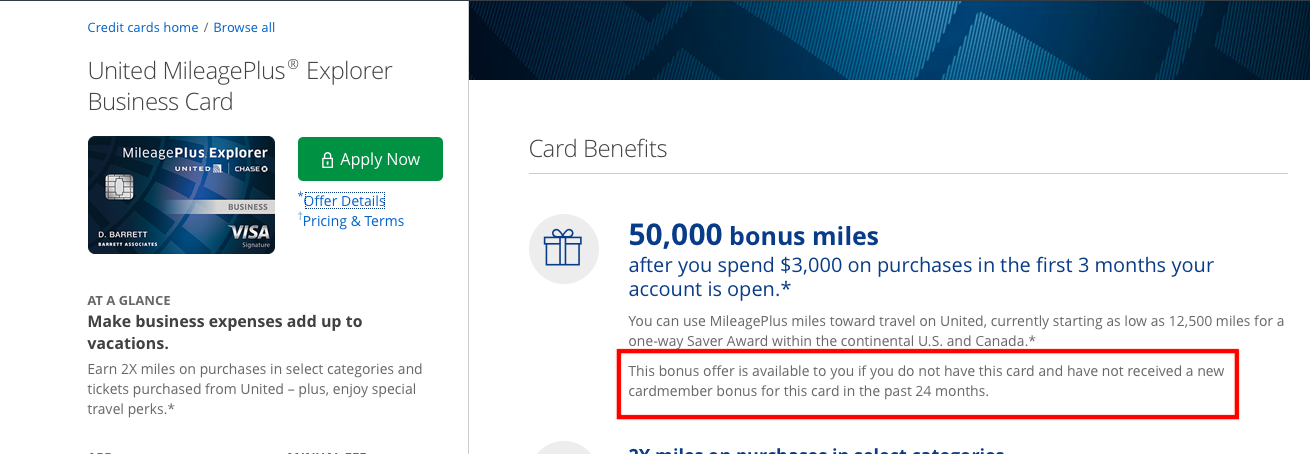

No One Bonus per 24 months for Ink Business Preferred

Just closed my Ink Business Preferred as the annual fee hit.

Now I saw on the Chase homepage that the current 80k offer doesn't include the typical "This bonus offer is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months." language.

So I'm wondering if I can just re-apply for the card in a week or so to get the bonus again. Anyone having any experience / thoughts on this?

Now I saw on the Chase homepage that the current 80k offer doesn't include the typical "This bonus offer is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months." language.

So I'm wondering if I can just re-apply for the card in a week or so to get the bonus again. Anyone having any experience / thoughts on this?

#517

Join Date: Sep 2011

Posts: 1,857

Just closed my Ink Business Preferred as the annual fee hit.

Now I saw on the Chase homepage that the current 80k offer doesn't include the typical "This bonus offer is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months." language.

So I'm wondering if I can just re-apply for the card in a week or so to get the bonus again. Anyone having any experience / thoughts on this?

Now I saw on the Chase homepage that the current 80k offer doesn't include the typical "This bonus offer is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months." language.

So I'm wondering if I can just re-apply for the card in a week or so to get the bonus again. Anyone having any experience / thoughts on this?

#518

Join Date: Jun 2016

Posts: 3

5/24 rule

I will be forming an LLC with a partner in the next couple months and I am looking to sign up for this card (and probably the Ink Business Cash card as well) to use for all business purchases. This is my first foray into small business and thus also the first time I have ever applied for a business card. How is the 5/24 rule applied if the card is opened under the LLC's name? Do they look at card application history from whatever SSN is used on the application? If so, I am definitely currently over 5 and would be denied. Also, are there any business requirements in order to qualify for the card? My credit score is in the 790-800 range but as I said, it will be a new business starting with almost zero assets (aside from the 20 acre property the LLC will "own") and will not likely turn any profit for 2-3+ years.

#519

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,952

#520

Join Date: Oct 2010

Posts: 113

I got a mailer that states visit: getinkpreferred.com with an invitation number. Does that have any benefit in getting approved? I have 800+ credit but also know I'm over 5/24 and don't have a real business. Only do $8k-$10k year on ebay and other such sales. I have had the card before but got the Bonus way back in 2014.

Last edited by beltline; Jan 16, 2018 at 5:12 pm

#521

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,952

#522

Join Date: Sep 2015

Location: SFO

Posts: 3,878

Recently approved for this card...should arrive in a few days. The card has not shown up on my combined personal and business login. Is this typical?

#523

FlyerTalk Evangelist

Join Date: Jul 2003

Location: Florida

Posts: 29,740

The only reason this would happen is the profile on the new card does not match exactly with your business log in profile. Tech support can add different profiles under same log in but they cannot modify the profile. For whatever reason my Ink Cash which is the oldest Ink I have, has a different profile so in my Chase Online it is listed separately after the other business cards, all by itself under a different profile, followed by personal cards under personal profile.

As a reference point, my CIP was approved the next morning after application by way of its appearance online. My husband's CIP showed up online literally within the next minute he got an instant approval as I immediately logged in his account after his instant approval and the card was already there.

#524

Join Date: Aug 2016

Posts: 58

How long ago did you get approved? Mine showed up in my combined personal/business login pretty quickly (i think the next day).

#525

Join Date: Sep 2015

Location: SFO

Posts: 3,878

No.

The only reason this would happen is the profile on the new card does not match exactly with your business log in profile. Tech support can add different profiles under same log in but they cannot modify the profile. For whatever reason my Ink Cash which is the oldest Ink I have, has a different profile so in my Chase Online it is listed separately after the other business cards, all by itself under a different profile, followed by personal cards under personal profile.

As a reference point, my CIP was approved the next morning after application by way of its appearance online. My husband's CIP showed up online literally within the next minute he got an instant approval as I immediately logged in his account after his instant approval and the card was already there.

The only reason this would happen is the profile on the new card does not match exactly with your business log in profile. Tech support can add different profiles under same log in but they cannot modify the profile. For whatever reason my Ink Cash which is the oldest Ink I have, has a different profile so in my Chase Online it is listed separately after the other business cards, all by itself under a different profile, followed by personal cards under personal profile.

As a reference point, my CIP was approved the next morning after application by way of its appearance online. My husband's CIP showed up online literally within the next minute he got an instant approval as I immediately logged in his account after his instant approval and the card was already there.

Applied on Saturday, received 30 day notice. Called yesterday and was notified of approval.