Last edit by: RedSun

Ritz-Carlton Rewards Visa Infinite (closed to new applications)

All card offers are dead as of 7/26/18.

Information still available on the Chase SITE.

The previous version of this card was discussed HERE.

(Expired) New Card Bonus ($4,000 spending): Two free night certificates good at any Ritz Carlton (Marriott) properties up to 60,000 points (possible to book any SPG properties later)

(old: at any tier 1-4 Ritz Carlton Hotel after $4k spend).

current offer (dead): https://creditcards.chase.com/a1/rit...n/naepredirect

Things qualifying/not qualifying under $300 annual travel credit

one member wrote: AA is now showing gift cards as "giftcard" rather than general purchase if the csr looks closely. Last year it worked for me, yesterday it did not and csr told me that's why. However, later the same day I also requested the credit by Secure Message (for "baggage fees) and it was approved. Very YMMV now but still doable. 2/10/2017

Southwest Airlines GCs work fairly easily. I've generally bought them for $150 and said they're excess baggage fees.

Frequent Miler has a collection of data points of what has worked in the past. Link

All card offers are dead as of 7/26/18.

Information still available on the Chase SITE.

The previous version of this card was discussed HERE.

(Expired) New Card Bonus ($4,000 spending): Two free night certificates good at any Ritz Carlton (Marriott) properties up to 60,000 points (possible to book any SPG properties later)

(old: at any tier 1-4 Ritz Carlton Hotel after $4k spend).

current offer (dead): https://creditcards.chase.com/a1/rit...n/naepredirect

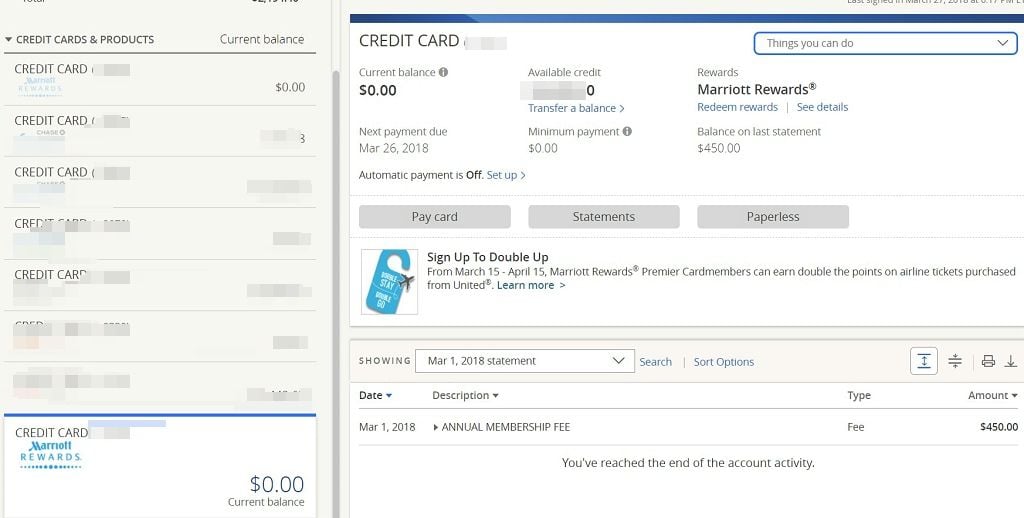

- Annual fee of $450 NOT waived.

- 6 points per dollar at Marriott properties, including SPGs and Ritz-Carltons. (same as all Chase & AmEx Marriott cards)

- 3 points per dollar at restaurants, car rental companies and airline tickets purchased directly from airlines

- 2 points per dollar on all other purchases (same as all Chase & AmEx Marriott cards)

- Annual (anniversary) free night award good at any Marriott (including Ritz) property up to 50,000 MRs.

- Automatic Marriott Gold Status.

- Marriott Platinum Status after $75,000 card spending in a card-member year.

$100 companion airfare discount booked through Visa Infinite website.- $100 statement credit for Global Entry after the Global Entry program application fee is charged to an eligible card.

- $300 Annual (calendar) Travel Credit "Only the following types of non-ticket purchases qualify for this offer: airline lounge day pass, or towards a yearly lounge membership of your choice; airline seat upgrades; airline baggage fees; in-flight Internet/entertainment; in-flight meals."

- Three (3) Ritz Carlton Club Level upgrade certificates each year for up to 7 nights each stay. The stays must be paid stays, excluding point redemption and award night.

- Troon Rewards and PRIVÉ ACCESS golf benefits

- $100 credit for qualifying dining, spa or other hotel recreational activities. Use the credit with any paid stay at The Ritz-Carlton of two nights or more OR get a $100 hotel credit per stay at all Marriott luxury properties. Advance reservations are required. Valid only on non-discounted rates. Cannot be combined with any packages, discounts, negotiated corporate or group rates or point-redemption bookings.

Things qualifying/not qualifying under $300 annual travel credit

one member wrote: AA is now showing gift cards as "giftcard" rather than general purchase if the csr looks closely. Last year it worked for me, yesterday it did not and csr told me that's why. However, later the same day I also requested the credit by Secure Message (for "baggage fees) and it was approved. Very YMMV now but still doable. 2/10/2017

Southwest Airlines GCs work fairly easily. I've generally bought them for $150 and said they're excess baggage fees.

Frequent Miler has a collection of data points of what has worked in the past. Link

Ritz-Carlton Visa Infinite - closed for applications 7.26.2018 (2016-2021)

#1561

Suspended

Join Date: Oct 2011

Location: LAX

Programs: AAdvantage EXPLAT, Hilton Diamond, SPG/Marriott Gold, IHG Platinum, Citi Exec MC, Amex Plat

Posts: 1,443

If you haven't been actively lowering your Chase limits when you get new Chase cards (which it seems like is the case) then I'd recommend freeing up some space for the card ahead of time by lower your limits. I usually ensure that my current is about $20k lower than any prior maximum I've had with Chase. So if $57k is the max you've had with chase in total then I'd decrease to $35k total or so.

#1562

Join Date: Aug 2014

Posts: 736

In my opinion the answer is yes, simply because at a lower total CL you pose a lower threat since you could theoretically do less damage - all else considered equal. I imagine that someone with a medium-to-high BustOut score with $30k current total CL is less likely to get shutdown that someone with the same BustOut score who already has $70k total CL and applies for a new card. Some factors of the BustOut score are discussed publicly by Experian in its whitepapers and such but obviously all factors are not known. However, I imagine each issuer uses a combination of BustOut Score (which is the score from the consumer) + risk associated with the actual bank (high CL, low CL, relationship, bank deposits, suspicious behavior within accounts like MOs and gift card purchasing, etc.).

#1563

Join Date: Aug 2013

Posts: 171

Any reports of Chase matching to three free nights lately? I know that generally died 3-4 months ago - my wife just picked up the card and wondering if it is even worth a DM.

#1564

Join Date: Sep 2013

Posts: 93

Can I downgrade this card to mariott reward card

which has $85 annual fee and one free night each year? An I have the mariott card already.

which has $85 annual fee and one free night each year? An I have the mariott card already.

#1570

Just wonder why anyone would want to PC the Ritz card shortly after paying the $450 AF? Ritz AF is posted on the very first day of card openning.

#1571

Suspended

Join Date: Dec 2017

Posts: 60

I'm wondering why anyone would pay the Ritz AF at all? All you have to do is reduce credit line to $1,500 and the AF is automatically reimbursed for the first year.

#1573

Join Date: Mar 2017

Programs: HHonors, TrueBlue, Delta SkyMiles, Hyatt Discoverist, Starwood Preferred Guest, American Airlines.

Posts: 2,035

#1574

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

Extensively discussed throughout this thread. Use Search this thread with the term: $1,500