Last edit by: sxc

This 2014 and prior thread is now closed. Please continue discussion here: Best Credit card conversion rate to Asiamiles (HK) - 2015

Best credit card conversion rate to Asiamiles (HK) - 2014 and prior

#1891

Suspended

Original Poster

Join Date: May 2006

Location: HKG

Programs: A3, TK *G; JL JGC; SPG,Hilton Gold

Posts: 9,952

i guess autopay via dahsing avios would be best after HKE shutting their central payment centre...? since DBS black is autopay at slow rates. the next best would be citibank.

#1892

Join Date: Nov 2013

Location: Hong Kong

Posts: 47

Dear Percysmith,

I tried to "manufacture" spending by using the cash advance method and withdrew TWD 143,000 each using my Citi Prestige Card & Premiermiles Card this morning at one Citibank's ATM machine in Taipei. I am wondering why the overseas cash advance showed up on my credit card statement in HKD? I thought overseas cash advance count as foreign spending under the current promotion. Citi CS told me to wait for two business days until the cash advances get posted on the system, but so far, it shows as local spending. Can anybody explain what happened to me in these transactions? Has anybody encountered the same problems using cash advance overseas and then the spending appears in the statement as local spending?

Thanks,

Tim

I tried to "manufacture" spending by using the cash advance method and withdrew TWD 143,000 each using my Citi Prestige Card & Premiermiles Card this morning at one Citibank's ATM machine in Taipei. I am wondering why the overseas cash advance showed up on my credit card statement in HKD? I thought overseas cash advance count as foreign spending under the current promotion. Citi CS told me to wait for two business days until the cash advances get posted on the system, but so far, it shows as local spending. Can anybody explain what happened to me in these transactions? Has anybody encountered the same problems using cash advance overseas and then the spending appears in the statement as local spending?

Thanks,

Tim

http://www.hongkongcard.com/forum/fo...w.php?id=12202

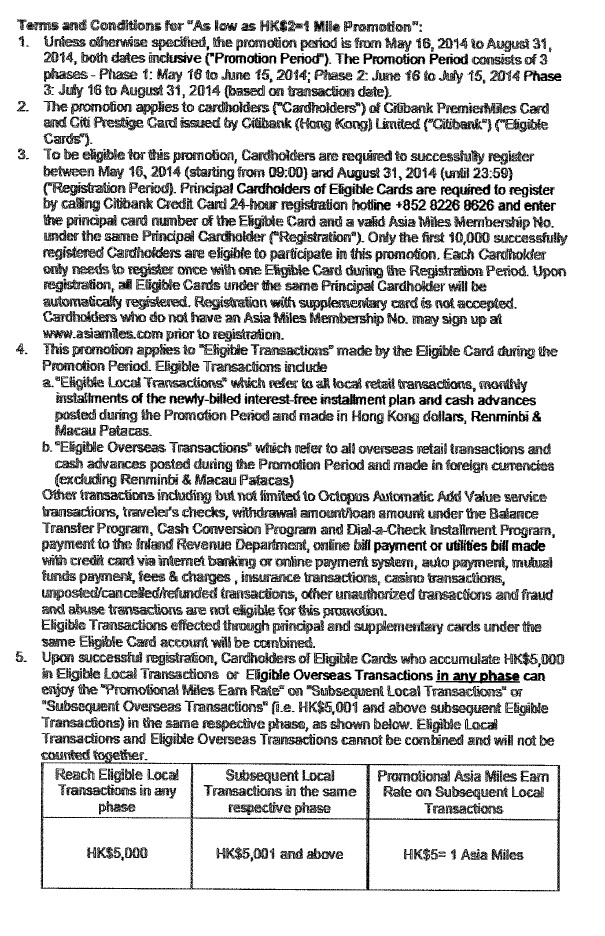

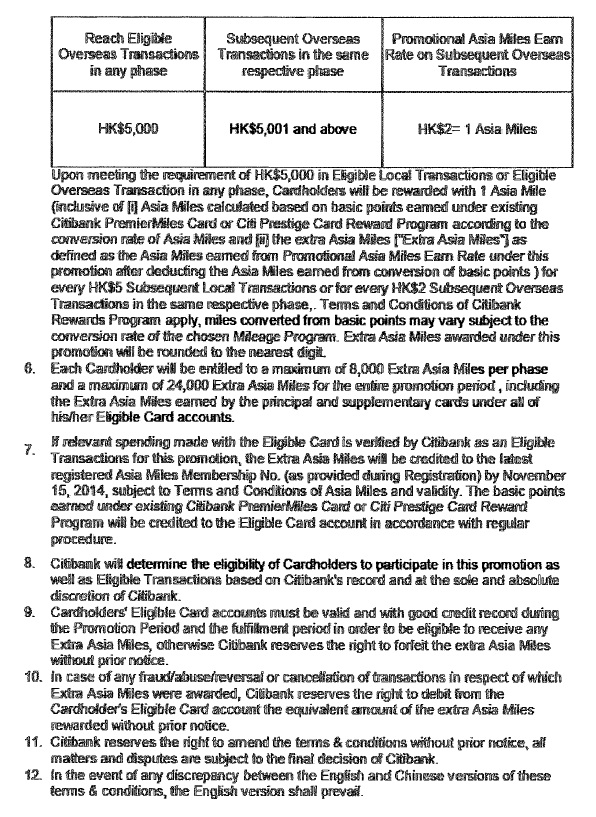

Length of promo: 16/5-31/8

Phases: Phase1: 16/5-15/6, Phase 2: 16/6-15/7, Phase 3: 16/7-31/8

First 10,000 customers

Combined all principal and subsidiary cards under your name (e.g. system won't let me register my Premiermiles after my Prestige)

Registration hotline: 8226 8626

Local spending (HKD/MOP/CNY):

Threshhold $5,000 spending per phase earns normal Prestige ($6/mile)/Premiermiles ($8/mile) rate.

Subsequent spending earns $5/mile

- if Prestige, every subsequent $30 earns 5 basic and 1 extra mile

- if Premiermiles, every subsequent $13.33 earns 1.67 basic and 1 extra mile

Overseas spending (non-HKD/MOP/CNY):

Threshhold $5,000 spending per phase earns normal Prestige/Premiermiles ($4/mile) rate.

Subsequent spending earns $4/mile i.e. every subsequent $4 earns 1 basic and 1 extra mile

---

Max extra miles local and overseas per phase: 8,000 miles (so max spending for local is $245,000/phase (Prestige) $111,666.67/phase (Premiermiles) and overseas is $37,000/phase)

The basic miles will not be converted (so you can choose to earn Avios or whatever)

The extra miles will be converted to AM (need to key in AM number upon registration)

T&C:

Length of promo: 16/5-31/8

Phases: Phase1: 16/5-15/6, Phase 2: 16/6-15/7, Phase 3: 16/7-31/8

First 10,000 customers

Combined all principal and subsidiary cards under your name (e.g. system won't let me register my Premiermiles after my Prestige)

Registration hotline: 8226 8626

Local spending (HKD/MOP/CNY):

Threshhold $5,000 spending per phase earns normal Prestige ($6/mile)/Premiermiles ($8/mile) rate.

Subsequent spending earns $5/mile

- if Prestige, every subsequent $30 earns 5 basic and 1 extra mile

- if Premiermiles, every subsequent $13.33 earns 1.67 basic and 1 extra mile

Overseas spending (non-HKD/MOP/CNY):

Threshhold $5,000 spending per phase earns normal Prestige/Premiermiles ($4/mile) rate.

Subsequent spending earns $4/mile i.e. every subsequent $4 earns 1 basic and 1 extra mile

---

Max extra miles local and overseas per phase: 8,000 miles (so max spending for local is $245,000/phase (Prestige) $111,666.67/phase (Premiermiles) and overseas is $37,000/phase)

The basic miles will not be converted (so you can choose to earn Avios or whatever)

The extra miles will be converted to AM (need to key in AM number upon registration)

T&C:

#1893

Join Date: Aug 2012

Posts: 755

Dear Percysmith,

I tried to "manufacture" spending by using the cash advance method and withdrew TWD 143,000 each using my Citi Prestige Card & Premiermiles Card this morning at one Citibank's ATM machine in Taipei. I am wondering why the overseas cash advance showed up on my credit card statement in HKD? I thought overseas cash advance count as foreign spending under the current promotion. Citi CS told me to wait for two business days until the cash advances get posted on the system, but so far, it shows as local spending. Can anybody explain what happened to me in these transactions? Has anybody encountered the same problems using cash advance overseas and then the spending appears in the statement as local spending?

Thanks,

Tim

I tried to "manufacture" spending by using the cash advance method and withdrew TWD 143,000 each using my Citi Prestige Card & Premiermiles Card this morning at one Citibank's ATM machine in Taipei. I am wondering why the overseas cash advance showed up on my credit card statement in HKD? I thought overseas cash advance count as foreign spending under the current promotion. Citi CS told me to wait for two business days until the cash advances get posted on the system, but so far, it shows as local spending. Can anybody explain what happened to me in these transactions? Has anybody encountered the same problems using cash advance overseas and then the spending appears in the statement as local spending?

Thanks,

Tim

By the way, is it really beneficial to cash advance and enjoy this promo?

Is there DCC for cash advancement?

#1895

Join Date: Oct 2013

Posts: 253

HSBC is running another promo again,

https://www.redhotoffers.hsbc.com.hk...s/may-off-peak

After spending $5,000, each $500 spending gives you a $100 parknshop coupon, maximum $400 coupons, i.e. $2,000 spending.

Note: For the $500 spending, only spending of $500 or above counts and will rounddown to multiple of $500, i.e. spending 700 3 times gets 3 coupons only.

https://www.redhotoffers.hsbc.com.hk...s/may-off-peak

After spending $5,000, each $500 spending gives you a $100 parknshop coupon, maximum $400 coupons, i.e. $2,000 spending.

Note: For the $500 spending, only spending of $500 or above counts and will rounddown to multiple of $500, i.e. spending 700 3 times gets 3 coupons only.

#1896

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

Dear Percysmith,

I tried to "manufacture" spending by using the cash advance method and withdrew TWD 143,000 each using my Citi Prestige Card & Premiermiles Card this morning at one Citibank's ATM machine in Taipei. I am wondering why the overseas cash advance showed up on my credit card statement in HKD? I thought overseas cash advance count as foreign spending under the current promotion. Citi CS told me to wait for two business days until the cash advances get posted on the system, but so far, it shows as local spending. Can anybody explain what happened to me in these transactions? Has anybody encountered the same problems using cash advance overseas and then the spending appears in the statement as local spending?

Thanks,

Tim

I tried to "manufacture" spending by using the cash advance method and withdrew TWD 143,000 each using my Citi Prestige Card & Premiermiles Card this morning at one Citibank's ATM machine in Taipei. I am wondering why the overseas cash advance showed up on my credit card statement in HKD? I thought overseas cash advance count as foreign spending under the current promotion. Citi CS told me to wait for two business days until the cash advances get posted on the system, but so far, it shows as local spending. Can anybody explain what happened to me in these transactions? Has anybody encountered the same problems using cash advance overseas and then the spending appears in the statement as local spending?

Thanks,

Tim

4% cash advance fee even if you've prepaid the account.

Plus 1.95% if it is a forex transaction.

For HK$100 advanced in TW, you're earning 50 miles for $5.95 --> $0.119? Wow

Citi says credit card exchange rates are determined by Visa/Master, so they don't internalise the transaction (c.g. Citibank ATM cards ripoff rates at Citibank non-HK ATMs)

Can you work out the exchange rate of the held amount? Since it's an unposted transaction, if it corresponds to the rate on the transaction day in http://www.visaeurope.com/en/cardhol...nge_rates.aspx , it will more than less likely post in TWD. Ignore what Citi CS says, they rank #2 on my crap plastic and unreliable CS list (#1 is BEA)

#1897

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

Yes, the $5,000 can be comprised of <$500 transactions

The $500 transactions must come after it http://www.hongkongcard.com/forum/fo...?id=12183&p=13 #124 (or can be a one-shot 7,000 transaction http://www.hongkongcard.com/forum/fo...?id=12183&p=20 #196)

#1898

Join Date: Jun 2004

Location: Hong Kong

Programs: CX MPC

Posts: 592

How to tell if CCB Eye transaction processed online?

Just wondering how you work out whether or not any individual CCB Eye transaction has been processed online? Can you find out from some part of the transaction code if you look at your account online? Obviously if that merchant doesn't process transactions online you won't get the 5X bonus and are much better off using another card instead. I've already come across several online merchants who clearly charge your card offline, because they post the transaction several days later. But in other cases, its difficult to tell. Any advice appreciated?

#1899

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

Digittings: this is like Foreign Transaction Fee for HKD - you have to guess (I tried to remove some of the guesswork http://www.hongkongcard.com/forum/fo...w.php?id=11968 )

Nothing on CCB's internet banking and printed statement will give you any information whether individual transactions are eligible for online 5x, unless you can reverse engineer the points awarded since your last statement against your new transactions in their entirety. But generally:

- if the purchase is processed immediately, a receipt is and credit limit is immediately held, yes it's an internet purchase eligible for 5x

Examples: amazon, airline internet ticket purchases, paypal, hotels.com and agoda

- if the purchase is processed later, and credit limit is not immediately held after internet transaction, then this transaction has been sent to some back office for processing:

Example: flower purchases, direct hotel reservations (even if prepaid) (they are worried about no room availability)

Nothing on CCB's internet banking and printed statement will give you any information whether individual transactions are eligible for online 5x, unless you can reverse engineer the points awarded since your last statement against your new transactions in their entirety. But generally:

- if the purchase is processed immediately, a receipt is and credit limit is immediately held, yes it's an internet purchase eligible for 5x

Examples: amazon, airline internet ticket purchases, paypal, hotels.com and agoda

- if the purchase is processed later, and credit limit is not immediately held after internet transaction, then this transaction has been sent to some back office for processing:

Example: flower purchases, direct hotel reservations (even if prepaid) (they are worried about no room availability)

Last edited by percysmith; Jun 8, 2014 at 12:29 am

#1900

Join Date: Nov 2013

Location: Hong Kong

Posts: 47

Dear Percysmith,

Citi's CS asked me to scanned the receipts of my cash advance and e-mailed it to customer service. Citi told me that they will make internal adjustment and count my cash advance as foreign spending.

I am participating in every single promotion where I can earn extra Asia Miles including the Instant Travel Club, DBS Speed Pass and Citi's HK 2/1 mile promotion.

Too bad we haven't heard anything from Bank of Communication whether they will have the promotions they had from last November to mid-February this year.

Best,

Tim

Citi's CS asked me to scanned the receipts of my cash advance and e-mailed it to customer service. Citi told me that they will make internal adjustment and count my cash advance as foreign spending.

I am participating in every single promotion where I can earn extra Asia Miles including the Instant Travel Club, DBS Speed Pass and Citi's HK 2/1 mile promotion.

Too bad we haven't heard anything from Bank of Communication whether they will have the promotions they had from last November to mid-February this year.

Best,

Tim

#1901

Join Date: Nov 2013

Location: Hong Kong

Posts: 47

It's quite expensive to manufacture spending under this promotion. By the way, can anybody tell me which credit card treats RMB spending as overseas spending?

I have CX AMEX Elite, DBS Black (MasterCard and AMEX).

I have set my 5X/11X on my HSBC Platinum and HSBC Diamond CUP so I am stuck with overseas spending on both cards. I intended to have my HSBC Diamond CUP set for RMB spending, but I was told since I had my HSBC Platinum Card set for overseas spending, my HSBC Diamond CUP will automatically be set for overseas spending as well.

I also have Citi Prestige, Premiermiles and Diners Club, but I think they treat RMB as local spending.

Then I have all CCB's and Bank of Communication's credit cards because I participated in their promotions last year. But they best Asia Miles earning rate is HKD 6/1 Asia Miles.

I also have Standard Chartered Platinum Card, Shop & Gain Card and SC AMEX. Does SC treat RMB as local spending as well?

And finally, I have Fubon Platinum VISA card. Does Fubon treat RMB as local spending?

Any suggestions?

Thanks,

Tim

I have CX AMEX Elite, DBS Black (MasterCard and AMEX).

I have set my 5X/11X on my HSBC Platinum and HSBC Diamond CUP so I am stuck with overseas spending on both cards. I intended to have my HSBC Diamond CUP set for RMB spending, but I was told since I had my HSBC Platinum Card set for overseas spending, my HSBC Diamond CUP will automatically be set for overseas spending as well.

I also have Citi Prestige, Premiermiles and Diners Club, but I think they treat RMB as local spending.

Then I have all CCB's and Bank of Communication's credit cards because I participated in their promotions last year. But they best Asia Miles earning rate is HKD 6/1 Asia Miles.

I also have Standard Chartered Platinum Card, Shop & Gain Card and SC AMEX. Does SC treat RMB as local spending as well?

And finally, I have Fubon Platinum VISA card. Does Fubon treat RMB as local spending?

Any suggestions?

Thanks,

Tim

Seems like a really expensive way to manufacture overseas spending.

4% cash advance fee even if you've prepaid the account.

Plus 1.95% if it is a forex transaction.

For HK$100 advanced in TW, you're earning 50 miles for $5.95 --> $0.119? Wow

Citi says credit card exchange rates are determined by Visa/Master, so they don't internalise the transaction (c.g. Citibank ATM cards ripoff rates at Citibank non-HK ATMs)

Can you work out the exchange rate of the held amount? Since it's an unposted transaction, if it corresponds to the rate on the transaction day in http://www.visaeurope.com/en/cardhol...nge_rates.aspx , it will more than less likely post in TWD. Ignore what Citi CS says, they rank #2 on my crap plastic and unreliable CS list (#1 is BEA)

4% cash advance fee even if you've prepaid the account.

Plus 1.95% if it is a forex transaction.

For HK$100 advanced in TW, you're earning 50 miles for $5.95 --> $0.119? Wow

Citi says credit card exchange rates are determined by Visa/Master, so they don't internalise the transaction (c.g. Citibank ATM cards ripoff rates at Citibank non-HK ATMs)

Can you work out the exchange rate of the held amount? Since it's an unposted transaction, if it corresponds to the rate on the transaction day in http://www.visaeurope.com/en/cardhol...nge_rates.aspx , it will more than less likely post in TWD. Ignore what Citi CS says, they rank #2 on my crap plastic and unreliable CS list (#1 is BEA)

#1902

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

It's quite expensive to manufacture spending under this promotion. By the way, can anybody tell me which credit card treats RMB spending as overseas spending?

I have CX AMEX Elite, DBS Black (MasterCard and AMEX).

I have set my 5X/11X on my HSBC Platinum and HSBC Diamond CUP so I am stuck with overseas spending on both cards. I intended to have my HSBC Diamond CUP set for RMB spending, but I was told since I had my HSBC Platinum Card set for overseas spending, my HSBC Diamond CUP will automatically be set for overseas spending as well.

I also have Citi Prestige, Premiermiles and Diners Club, but I think they treat RMB as local spending.

Then I have all CCB's and Bank of Communication's credit cards because I participated in their promotions last year. But they best Asia Miles earning rate is HKD 6/1 Asia Miles.

I also have Standard Chartered Platinum Card, Shop & Gain Card and SC AMEX. Does SC treat RMB as local spending as well?

And finally, I have Fubon Platinum VISA card. Does Fubon treat RMB as local spending?

Any suggestions?

Thanks,

Tim

I have CX AMEX Elite, DBS Black (MasterCard and AMEX).

I have set my 5X/11X on my HSBC Platinum and HSBC Diamond CUP so I am stuck with overseas spending on both cards. I intended to have my HSBC Diamond CUP set for RMB spending, but I was told since I had my HSBC Platinum Card set for overseas spending, my HSBC Diamond CUP will automatically be set for overseas spending as well.

I also have Citi Prestige, Premiermiles and Diners Club, but I think they treat RMB as local spending.

Then I have all CCB's and Bank of Communication's credit cards because I participated in their promotions last year. But they best Asia Miles earning rate is HKD 6/1 Asia Miles.

I also have Standard Chartered Platinum Card, Shop & Gain Card and SC AMEX. Does SC treat RMB as local spending as well?

And finally, I have Fubon Platinum VISA card. Does Fubon treat RMB as local spending?

Any suggestions?

Thanks,

Tim

Fubon has the best earn rate of the four, plus lowest foreign currency translation fee (1.85%). You have to be prepared to complete your transaction and have it posted before 30 June and redeem all your miles on or before that date, because they haven't announced an extension of Asia miles redemption beyond 30 June 2014 (they have extended weeks before previous deadlines in the past, but there is always the possibility that they may not).

#1903

Join Date: Oct 2013

Posts: 253

bmtsang:

Yes, the $5,000 can be comprised of <$500 transactions

The $500 transactions must come after it http://www.hongkongcard.com/forum/fo...?id=12183&p=13 #124 (or can be a one-shot 7,000 transaction http://www.hongkongcard.com/forum/fo...?id=12183&p=20 #196)

Yes, the $5,000 can be comprised of <$500 transactions

The $500 transactions must come after it http://www.hongkongcard.com/forum/fo...?id=12183&p=13 #124 (or can be a one-shot 7,000 transaction http://www.hongkongcard.com/forum/fo...?id=12183&p=20 #196)

#1904

Join Date: Nov 2013

Location: Hong Kong

Posts: 47

I hardly ever use my DBS Black Mastercard or AMEX Card. I actually find it quite attractive for me to pay my monthly rental expense of HKD 24,000 under this promotion. It's better than using my Standard Chartered AMEX to pay for my rent.

http://www.dbs.com.hk/en/consumer/cr..._speedpass.htm

$0.12/mile, plus a spend requirement. I personally won't do it.

But I think there're some of you here who want to buy miles at $0.12 (psychiatrist with SCB), so I post it FYI.

$0.12/mile, plus a spend requirement. I personally won't do it.

But I think there're some of you here who want to buy miles at $0.12 (psychiatrist with SCB), so I post it FYI.

#1905

Join Date: Jun 2004

Location: Hong Kong

Programs: CX MPC

Posts: 592

Digittings: this is like Foreign Transaction Fee for HKD - you have to guess (I tried to remove some of the guesswork http://www.hongkongcard.com/forum/fo...w.php?id=11968 )