Best credit card coversion rate to Asiamiles in 2009? (For FTers based in HK)

#121

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

I too am happy to pass on the SCB Visa Infinite (VI).

Especially given SCB's $300 fee per conversion and the following other offers:

1. SCB AE: $2.5/mile for overseas spending (can be redeemed at same time as VI)

2. DBS Plat: $4/mile for dining

3. DBS AE: $6/mile for AE

4. BEA Plat: $8/mile for bill payments (SCB VI not applicable on bill payments)

That really doesn't leave a lot of spending for "the rest" of Visa spending. Especially given I need to spend around $360,000 on SCB VI to recover the $300 fee for using a $7.5 rate over a $8.0 rate ($360K spending = 48K miles on the SCB VI, 45K miles on the Citi Premiermiles (PM); difference of 3K miles = $300 cash worth using my $0.1/mile valuation (http://www.flyertalk.com/forum/catha...-hk-8.html#114)

Especially given SCB's $300 fee per conversion and the following other offers:

1. SCB AE: $2.5/mile for overseas spending (can be redeemed at same time as VI)

2. DBS Plat: $4/mile for dining

3. DBS AE: $6/mile for AE

4. BEA Plat: $8/mile for bill payments (SCB VI not applicable on bill payments)

That really doesn't leave a lot of spending for "the rest" of Visa spending. Especially given I need to spend around $360,000 on SCB VI to recover the $300 fee for using a $7.5 rate over a $8.0 rate ($360K spending = 48K miles on the SCB VI, 45K miles on the Citi Premiermiles (PM); difference of 3K miles = $300 cash worth using my $0.1/mile valuation (http://www.flyertalk.com/forum/catha...-hk-8.html#114)

#122

Join Date: Mar 2010

Location: HKG

Programs: BA Gold OWE

Posts: 216

Unless if you are an SCB banking customer I don't really think the SCB Visa Infinite is really worth it.

While its rate is $7.5 per 1AM, you have to pay a $300 conversion fee. The Citbank Visa is at $8 per 1AM, but the conversion fee has been waived, so if you after a visa card, it would probably be easier to get the Citibank Visa over the SCB Visa Infinite.

Note the SCB Visa Infinite does have other benefits (the main one being free Priority Pass, but you can get that with the CX Amex as well).

While its rate is $7.5 per 1AM, you have to pay a $300 conversion fee. The Citbank Visa is at $8 per 1AM, but the conversion fee has been waived, so if you after a visa card, it would probably be easier to get the Citibank Visa over the SCB Visa Infinite.

Note the SCB Visa Infinite does have other benefits (the main one being free Priority Pass, but you can get that with the CX Amex as well).

There is also the small issue of the HK$6000 annual fee. Fubon at 6-1 is so much better than anything else out there at the moment aside from the BEA rebate scheme as percysmith stated earlier. My VI renewal is up in September and unless they agree to waive I will definitely get the scissors out!

#123

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

^

There is also the small issue of the HK$6000 annual fee. Fubon at 6-1 is so much better than anything else out there at the moment aside from the BEA rebate scheme as percysmith stated earlier. My VI renewal is up in September and unless they agree to waive I will definitely get the scissors out!

There is also the small issue of the HK$6000 annual fee. Fubon at 6-1 is so much better than anything else out there at the moment aside from the BEA rebate scheme as percysmith stated earlier. My VI renewal is up in September and unless they agree to waive I will definitely get the scissors out!

Note Fubon Asia Miles scheme is terminating on 30 June 10 and they aren't budging on extending the scheme. In fact, the "Sure Win Spending Rewards" for May onwards won't make it to the account in time for the Asia Miles scheme.

After reaching a nice fat round number last Saturday (120,000 points), I've put away the card. Esp now that BEA has extended the 1% part of the 4% rebate scheme to even the threshold amount.

Don't use the scissors on the non-Priority VI card...it's quite an elegant card. I'm pretty sure SCB will let you terminate the card by faxed form.

#124

Join Date: Mar 2010

Location: HKG

Programs: BA Gold OWE

Posts: 216

Is it non-waivable like Amex fees? Maybe at least there's some discounts.

Note Fubon Asia Miles scheme is terminating on 30 June 10 and they aren't budging on extending the scheme. In fact, the "Sure Win Spending Rewards" for May onwards won't make it to the account in time for the Asia Miles scheme.

After reaching a nice fat round number last Saturday (120,000 points), I've put away the card. Esp now that BEA has extended the 1% part of the 4% rebate scheme to even the threshold amount.

Don't use the scissors on the non-Priority VI card...it's quite an elegant card. I'm pretty sure SCB will let you terminate the card by faxed form.

Note Fubon Asia Miles scheme is terminating on 30 June 10 and they aren't budging on extending the scheme. In fact, the "Sure Win Spending Rewards" for May onwards won't make it to the account in time for the Asia Miles scheme.

After reaching a nice fat round number last Saturday (120,000 points), I've put away the card. Esp now that BEA has extended the 1% part of the 4% rebate scheme to even the threshold amount.

Don't use the scissors on the non-Priority VI card...it's quite an elegant card. I'm pretty sure SCB will let you terminate the card by faxed form.

Fubon: I hope you don't mind me asking about the source of your info re Fubon not budging about extending Asia Miles? This would be shocking - didn't they only join last year? What would be the commercial purpose of participating for one year? I was expecting them to extend it like they did with the Sure Win scheme back in Feb... Well if they don't then c'est la vie. The Fubon Elite securities trading offer was the best deal in years for miles accumulation.

VI: Yes 2 years ago it was quite nice but now, sadly, it has paid the price for my spending follies. Can't even see the "Standard Chartered" on the front now.

#125

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

Wirelessly posted (Mozilla/4.0 (compatible; MSIE 6.0; Windows CE; IEMobile 7.11))

Re "Fubon not budging about extending Asia Miles? This would be shocking - didn't they only join last year?"

http://www.fubonbank.com.hk/web/html/cc_cbp00_e.html

"Terms and conditions for Bonus Points Conversion to Asia Miles:

1.

The promotion period of this program commences from 1 July 2009 to 30 June 2010 (subject to the receipt of the redemption application by Fubon Bank (the "Bank")), both days inclusive ("Promotion Period")."

There's only 2 months before the program ends.

It is too risky to assume they'll extend given they've never extended before (unlike Citi PM, DBS Black wellcome offers).

Also note even if they did extend, Fubon points have one year expiry anyway.

Re: "The Fubon Elite securities trading offer was the best deal in years for miles accumulation."

That may be, but I dunno if the Fubon Elite Securities offer is tied to the Fubon Elite Platinum credit card offer. If yes, that will terminate on 30 June 2010 too (per Fubon CS) (the Elite redemption form and website appears to support the CS's interpretation http://www.fubonbank.com.hk/Elite/ht...rds_cat_e.html)

Re "Fubon not budging about extending Asia Miles? This would be shocking - didn't they only join last year?"

http://www.fubonbank.com.hk/web/html/cc_cbp00_e.html

"Terms and conditions for Bonus Points Conversion to Asia Miles:

1.

The promotion period of this program commences from 1 July 2009 to 30 June 2010 (subject to the receipt of the redemption application by Fubon Bank (the "Bank")), both days inclusive ("Promotion Period")."

There's only 2 months before the program ends.

It is too risky to assume they'll extend given they've never extended before (unlike Citi PM, DBS Black wellcome offers).

Also note even if they did extend, Fubon points have one year expiry anyway.

Re: "The Fubon Elite securities trading offer was the best deal in years for miles accumulation."

That may be, but I dunno if the Fubon Elite Securities offer is tied to the Fubon Elite Platinum credit card offer. If yes, that will terminate on 30 June 2010 too (per Fubon CS) (the Elite redemption form and website appears to support the CS's interpretation http://www.fubonbank.com.hk/Elite/ht...rds_cat_e.html)

Last edited by percysmith; Apr 27, 2010 at 5:25 am

#126

Join Date: Jun 2003

Location: Hong Kong

Programs: American Express Centurion

Posts: 131

I too am happy to pass on the SCB Visa Infinite (VI).

Especially given SCB's $300 fee per conversion and the following other offers:

1. SCB AE: $2.5/mile for overseas spending (can be redeemed at same time as VI)

2. DBS Plat: $4/mile for dining

3. DBS AE: $6/mile for AE

4. BEA Plat: $8/mile for bill payments (SCB VI not applicable on bill payments)

That really doesn't leave a lot of spending for "the rest" of Visa spending. Especially given I need to spend around $360,000 on SCB VI to recover the $300 fee for using a $7.5 rate over a $8.0 rate ($360K spending = 48K miles on the SCB VI, 45K miles on the Citi Premiermiles (PM); difference of 3K miles = $300 cash worth using my $0.1/mile valuation (http://www.flyertalk.com/forum/catha...-hk-8.html#114)

Especially given SCB's $300 fee per conversion and the following other offers:

1. SCB AE: $2.5/mile for overseas spending (can be redeemed at same time as VI)

2. DBS Plat: $4/mile for dining

3. DBS AE: $6/mile for AE

4. BEA Plat: $8/mile for bill payments (SCB VI not applicable on bill payments)

That really doesn't leave a lot of spending for "the rest" of Visa spending. Especially given I need to spend around $360,000 on SCB VI to recover the $300 fee for using a $7.5 rate over a $8.0 rate ($360K spending = 48K miles on the SCB VI, 45K miles on the Citi Premiermiles (PM); difference of 3K miles = $300 cash worth using my $0.1/mile valuation (http://www.flyertalk.com/forum/catha...-hk-8.html#114)

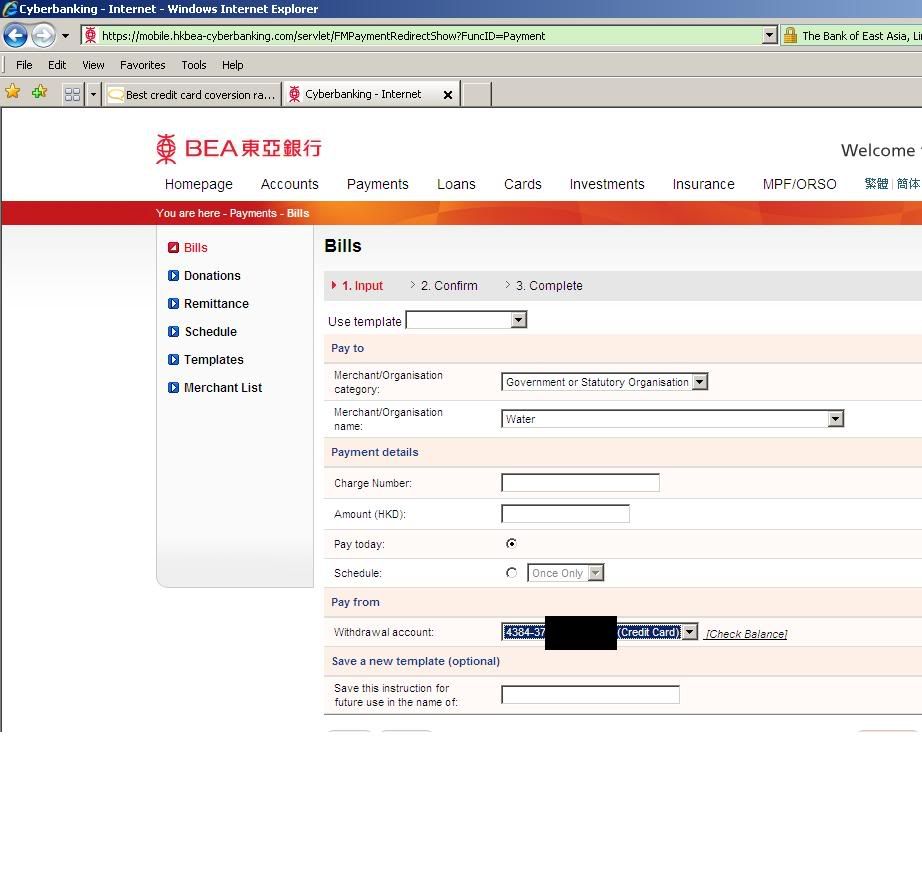

Also, what exactly do you mean by bill payment? Is this an online banking function tied to your credit card? I usually just try to charge everything (whether personal or business expenses) I can to my credit card. I use PPS for merchants that do not take credit cards like PCCW, Water Supplies Dept., et al.,

Is it possible to link up a PPS account to my credit card instead of a bank account so that the transactions are simply billed to my credit card versus being debited directly from my bank account. If so, would this incur any charges? (or would the transactions be billed as a cash advance instead of a purchase?)

Thanks in advance -

around the world

#127

Join Date: Jan 2008

Location: Hong Kong

Programs: BA Gold, JGC Sapphire, OZ Diamond, AF Silver, CX GR, Marriott Lifetime SL

Posts: 3,598

DBS Plat Visa comes next with 1 Miles / HKD 4 with HKD 100 fee

- If you combine their any restaurant 1 Miles / HKD 4 then the fee is not a deal breaker, and might make your life easier and 1 less plastic in your waller

Also, what exactly do you mean by bill payment? Is this an online banking function tied to your credit card? I usually just try to charge everything (whether personal or business expenses) I can to my credit card. I use PPS for merchants that do not take credit cards like PCCW, Water Supplies Dept., et al.,

Is it possible to link up a PPS account to my credit card instead of a bank account so that the transactions are simply billed to my credit card versus being debited directly from my bank account. If so, would this incur any charges? (or would the transactions be billed as a cash advance instead of a purchase?)

Thanks in advance -

around the world

Thanks in advance -

around the world

Hang Seng do it as a purchase transaction but with no points, which they used to

DBS assume it as cash advance

Last edited by ChrisLi; Apr 27, 2010 at 4:50 am Reason: formatting

#128

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

#129

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

Sure? I'm pretty sure they don't.

But DBS only gives $12/mile, whereas BEA Platinum gives $8/mile with $100/10,000 mile fee.

HSBC Platinum gives RewardCash like normal purchases which can be converted to miles for $16.67 spending/1 mile.

BoC Platinum, DBS Black and Platinum and Bankcomm all cards give miles for bill payments at $12/1 mile.

(Bankcomm's 2009 3X/5X promotions even covered bill payments. In the Feb-Mar 2010 promotion they've wised up and banned bill payments from the promotions).

Fubon Platinum gives double points even for bill payments (i.e. $6/1 mile) but also subject to the redemption program deadline above (I paid for a PCCW land line bill last month and have been credited with double points).

Definitely going for BEA Platinum.

But DBS only gives $12/mile, whereas BEA Platinum gives $8/mile with $100/10,000 mile fee.

HSBC Platinum gives RewardCash like normal purchases which can be converted to miles for $16.67 spending/1 mile.

BoC Platinum, DBS Black and Platinum and Bankcomm all cards give miles for bill payments at $12/1 mile.

(Bankcomm's 2009 3X/5X promotions even covered bill payments. In the Feb-Mar 2010 promotion they've wised up and banned bill payments from the promotions).

Fubon Platinum gives double points even for bill payments (i.e. $6/1 mile) but also subject to the redemption program deadline above (I paid for a PCCW land line bill last month and have been credited with double points).

Definitely going for BEA Platinum.

Last edited by percysmith; Apr 27, 2010 at 5:34 am

#130

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

Yep. Bank directly credits merchant and much less merchant discount is paid (if any, in IRD's case). Visa protection for the consumer (like chargeback) do not apply. The only way banks can make money is if you don't pay back all of it in the statement due date and they get to charge you Finance Charge APR.

#131

Join Date: Jun 2003

Location: Hong Kong

Programs: American Express Centurion

Posts: 131

What bills can be paid through bill payment... my Salaries Tax Bill, Company Profits Tax Bill, others? I am assuming everything government would be covered plus much more... right? Do banks impose limits per transaction or on the amount of miles I could earn per transaction or annually?

If I have a SpeedPost account and bill all my shipments to that, would I then be able to pay my monthly bill through Bill Payment and earn points?

If I understand you correctly this is a completely separate service from PPS, right?

Thanks in advance -

around the world

#132

Ambassador, Hong Kong and Macau

Join Date: May 2009

Location: HKG

Programs: Non-top tier Asia Miles member

Posts: 19,799

But I don't have a SpeedPost account.

I know they accept Visa, MC over the counter...just paid for Speedpost by Visa yesterday. I think I even managed an AE transaction at the post office last year.

Of course account sending is conveninent...

Yes, substitute to PPS.

#133

Join Date: Jun 2003

Location: Hong Kong

Programs: American Express Centurion

Posts: 131

percysmith:

Thanks for taking the time to reply. A few more questions...:

1) If one is using bill payment, does the corresponding credit card have to be issued by the same bank or can any credit card be used regardless of issuer? Simply put, if my personal and company accounts are held with Hang Seng Bank, do I need to use my company or personal card issued by HSB or can I use any credit card?

2) Can AE or Diners be used for Bill Payment for is it Visa/MasterCard only? Who makes this determination? Is it the bank that you have your registered bill payment account with, the credit card issuer, or the merchants that chose to receive payments via bill payment? I took a look at the 'Bill Payee List' on the Hang Seng website and noticed that some merchants accept payment only by bank account, others only credit card, others both.

3) Is there any charge to use bill payment? Do banks impose fees if you use a credit card that was not issued by their bank?

4) Is there a standard list of bill payment payees among different banks or does it vary?

5) It seems like this service basically renders PPS useless ... right?

around the world

Thanks for taking the time to reply. A few more questions...:

1) If one is using bill payment, does the corresponding credit card have to be issued by the same bank or can any credit card be used regardless of issuer? Simply put, if my personal and company accounts are held with Hang Seng Bank, do I need to use my company or personal card issued by HSB or can I use any credit card?

2) Can AE or Diners be used for Bill Payment for is it Visa/MasterCard only? Who makes this determination? Is it the bank that you have your registered bill payment account with, the credit card issuer, or the merchants that chose to receive payments via bill payment? I took a look at the 'Bill Payee List' on the Hang Seng website and noticed that some merchants accept payment only by bank account, others only credit card, others both.

3) Is there any charge to use bill payment? Do banks impose fees if you use a credit card that was not issued by their bank?

4) Is there a standard list of bill payment payees among different banks or does it vary?

5) It seems like this service basically renders PPS useless ... right?

around the world

Last edited by around the world; Apr 27, 2010 at 9:28 am

#134

Join Date: Jan 2008

Location: Hong Kong

Programs: BA Gold, JGC Sapphire, OZ Diamond, AF Silver, CX GR, Marriott Lifetime SL

Posts: 3,598

Sorry I mis-read assuming the OP is paying another credit card bill with a credit card, e.g. pay Dah Sing Bank Bill with Hang Seng Credit Card.

I milk 200+ cash dollar by doing that before they ban it.

PPS does not accept credit card directly. All Credit Card bill payment has to be done via Credit Card Issuing Bank.

As answered in other reply, it really depends on the fine prints from different issuing banks.

I milk 200+ cash dollar by doing that before they ban it.

Is it possible to link up a PPS account to my credit card instead of a bank account so that the transactions are simply billed to my credit card versus being debited directly from my bank account. If so, would this incur any charges? (or would the transactions be billed as a cash advance instead of a purchase?)

As answered in other reply, it really depends on the fine prints from different issuing banks.

Last edited by ChrisLi; Apr 27, 2010 at 10:07 am

#135

Join Date: Jan 2008

Location: Hong Kong

Programs: BA Gold, JGC Sapphire, OZ Diamond, AF Silver, CX GR, Marriott Lifetime SL

Posts: 3,598

percysmith:

Thanks for taking the time to reply. A few more questions...:

1) If one is using bill payment, does the corresponding credit card have to be issued by the same bank or can any credit card be used regardless of issuer? Simply put, if my personal and company accounts are held with Hang Seng Bank, do I need to use my company or personal card issued by HSB or can I use any credit card?

Thanks for taking the time to reply. A few more questions...:

1) If one is using bill payment, does the corresponding credit card have to be issued by the same bank or can any credit card be used regardless of issuer? Simply put, if my personal and company accounts are held with Hang Seng Bank, do I need to use my company or personal card issued by HSB or can I use any credit card?

Hang Seng Bank has a special list that some bill can be pay only with credit card only and some only by bank account only. See the list here

http://www.hangseng.com/pib/eng/oth/...bShopBank.html

2) Can AE or Diners be used for Bill Payment for is it Visa/MasterCard only? Who makes this determination? Is it the bank that you have your registered bill payment account with, the credit card issuer, or the merchants that chose to receive payments via bill payment? I took a look at the 'Bill Payee List' on the Hang Seng website and noticed that some merchants accept payment only by bank account, others only credit card, others both.

DBS Example :

http://hk.dbs.com/en/ratesfees/pdf/ba28.pdf

http://hk.dbs.com/en/ratesfees/pdf/ba28.pdfI clear my DBS Credit Card / CX AMEX / SCB CC via PPS, withdrawing fund from my HSBC account.

Technically I can use my Hang Seng CC to clear my SCB accounts, but it brings me 0 points with the only bonus to delay my cash payment for 1 month

Happy Miles Hunting