Last edit by: mia

BE AWARE: Access Investing is closing to new sign-ups in 2022, and the future of what will happen to existing accounts has not been communicated directly to current clients.

Morgan Stanley announcement: https://www.morganstanley.com/press-...fering-updates

Interview with the head of E*Trade indicating that accounts will move to E*Trade: https://www.fa-mag.com/news/firms-co...ors-70179.html

Importantly, as of November 2022 E*Trade accounts do NOT qualify as an eligible brokerage account for the CashPlus account fee waiver and E*Trade accounts are NOT eligible Morgan Stanley accounts for applying for and/or retaining an American Express Platinum card from Morgan Stanley.

If you're willing to risk incurring a few hundred dollars in fees chasing this deal, continue reading.

To open a Morgan Stanley co-branded American Express card you MUST be a Morgan Stanley client. You can satisfy this requirement by opening an Access Investing account with a $5,000 investment. Access Investing is a Robo (automated) product: https://www.morganstanley.com/what-w...sting/my-goals

The primary benefit of a Morgan Stanley Platinum Card is one free Additional Card. Optionally, if you also open a CashPlus Platinum account, deposit $25,000 and meet activity requirements, you become eligible for an Engagement Bonus which offsets the Platinum Card's annual fee. Note: If you don't have a qualifying investment account, or if your only investment account is an Access Investing account, there is no longer an Engagement Bonus paid in the first year of having the CashPlus Platinum account.

Recommended step-by-step guide if goal is MS AmEx Platinum card with bonus and effectively no annual fee as of 8/1/21:

- Open MS Access Investing account (to establish the MS relationship) using online application with $5,000.

- Wait a few days.

- Open Platinum CashPlus account (requires existing MS relationship), must be opened by phone or through an advisor, cannot be done online.

- Fund Platinum CashPlus account with $25K.

- Wait a few days.

- Confirm CashPlus account's Account Fee Status page shows “Morgan Stanley Investment Relationship = Yes”.

- Apply for MS AmEx Platinum Card via the link that shows up in the CashPlus account once it's open.

- $5,000 monthly deposit or Social Security deposit in any amount and $25,000 Average Daily Cash Balance in the Bank Deposit Program to avoid Platinum CashPlus Monthly Account Fee.

- Meet minimum spending requirement on the AmEx Platinum card, as of 8/1/21: $6,000 within 6 months to receive sign-up bonus.

- Confirm $695 Annual Engagement Bonus posts to Platinum CashPlus account approximately 6 weeks after credit card approval. (As of 8/1/21, considerable discussion as to whether the FIRST Annual Engagement Bonus is paid within first few months of credit card account opening or at about 1 year after credit card account opening.)

- $1,000+ yearly spending requirement on the AmEx Platinum card needed to avoid having to pay taxes on the Engagement Bonus. (This language was removed from the disclosure statement after the Engagement Bonus was increased to $695.)

- Enjoy the sign-up bonus and all other AmEx Plat perks, don’t eat or drink too much .

.

Notes:

All accounts can be opened the same day, best to wait a few days between account openings/applications to ensure each successive account is fully integrated into MS systems to avoid problems.

Few or no reports of MS AmEx Platinum credit card applications being declined for people with Access Investing and Platinum CashPlus accounts, seems once that MS relationship has been established, credit card approval is almost automatic.

The credit card will count toward Chase’s 5/24.

Premier CashPlus not eligible for $695 Annual Engagement Bonus for the MS AmEx Platinum Card.

MS launched Access Investing in December 2017, launched CashPlus in January 2020.

Morgan Stanley announcement: https://www.morganstanley.com/press-...fering-updates

Interview with the head of E*Trade indicating that accounts will move to E*Trade: https://www.fa-mag.com/news/firms-co...ors-70179.html

Importantly, as of November 2022 E*Trade accounts do NOT qualify as an eligible brokerage account for the CashPlus account fee waiver and E*Trade accounts are NOT eligible Morgan Stanley accounts for applying for and/or retaining an American Express Platinum card from Morgan Stanley.

If you're willing to risk incurring a few hundred dollars in fees chasing this deal, continue reading.

To open a Morgan Stanley co-branded American Express card you MUST be a Morgan Stanley client. You can satisfy this requirement by opening an Access Investing account with a $5,000 investment. Access Investing is a Robo (automated) product: https://www.morganstanley.com/what-w...sting/my-goals

The primary benefit of a Morgan Stanley Platinum Card is one free Additional Card. Optionally, if you also open a CashPlus Platinum account, deposit $25,000 and meet activity requirements, you become eligible for an Engagement Bonus which offsets the Platinum Card's annual fee. Note: If you don't have a qualifying investment account, or if your only investment account is an Access Investing account, there is no longer an Engagement Bonus paid in the first year of having the CashPlus Platinum account.

Recommended step-by-step guide if goal is MS AmEx Platinum card with bonus and effectively no annual fee as of 8/1/21:

- Open MS Access Investing account (to establish the MS relationship) using online application with $5,000.

- Wait a few days.

- Open Platinum CashPlus account (requires existing MS relationship), must be opened by phone or through an advisor, cannot be done online.

- Fund Platinum CashPlus account with $25K.

- Wait a few days.

- Confirm CashPlus account's Account Fee Status page shows “Morgan Stanley Investment Relationship = Yes”.

- Apply for MS AmEx Platinum Card via the link that shows up in the CashPlus account once it's open.

- $5,000 monthly deposit or Social Security deposit in any amount and $25,000 Average Daily Cash Balance in the Bank Deposit Program to avoid Platinum CashPlus Monthly Account Fee.

- Meet minimum spending requirement on the AmEx Platinum card, as of 8/1/21: $6,000 within 6 months to receive sign-up bonus.

- Confirm $695 Annual Engagement Bonus posts to Platinum CashPlus account approximately 6 weeks after credit card approval. (As of 8/1/21, considerable discussion as to whether the FIRST Annual Engagement Bonus is paid within first few months of credit card account opening or at about 1 year after credit card account opening.)

- Enjoy the sign-up bonus and all other AmEx Plat perks, don’t eat or drink too much

.

. Notes:

All accounts can be opened the same day, best to wait a few days between account openings/applications to ensure each successive account is fully integrated into MS systems to avoid problems.

Few or no reports of MS AmEx Platinum credit card applications being declined for people with Access Investing and Platinum CashPlus accounts, seems once that MS relationship has been established, credit card approval is almost automatic.

The credit card will count toward Chase’s 5/24.

Premier CashPlus not eligible for $695 Annual Engagement Bonus for the MS AmEx Platinum Card.

MS launched Access Investing in December 2017, launched CashPlus in January 2020.

Morgan Stanley American Express Platinum Card

#46

Join Date: May 2021

Posts: 68

#47

Join Date: Feb 2020

Posts: 21

enough funds but "not meeting fee avoidance"?

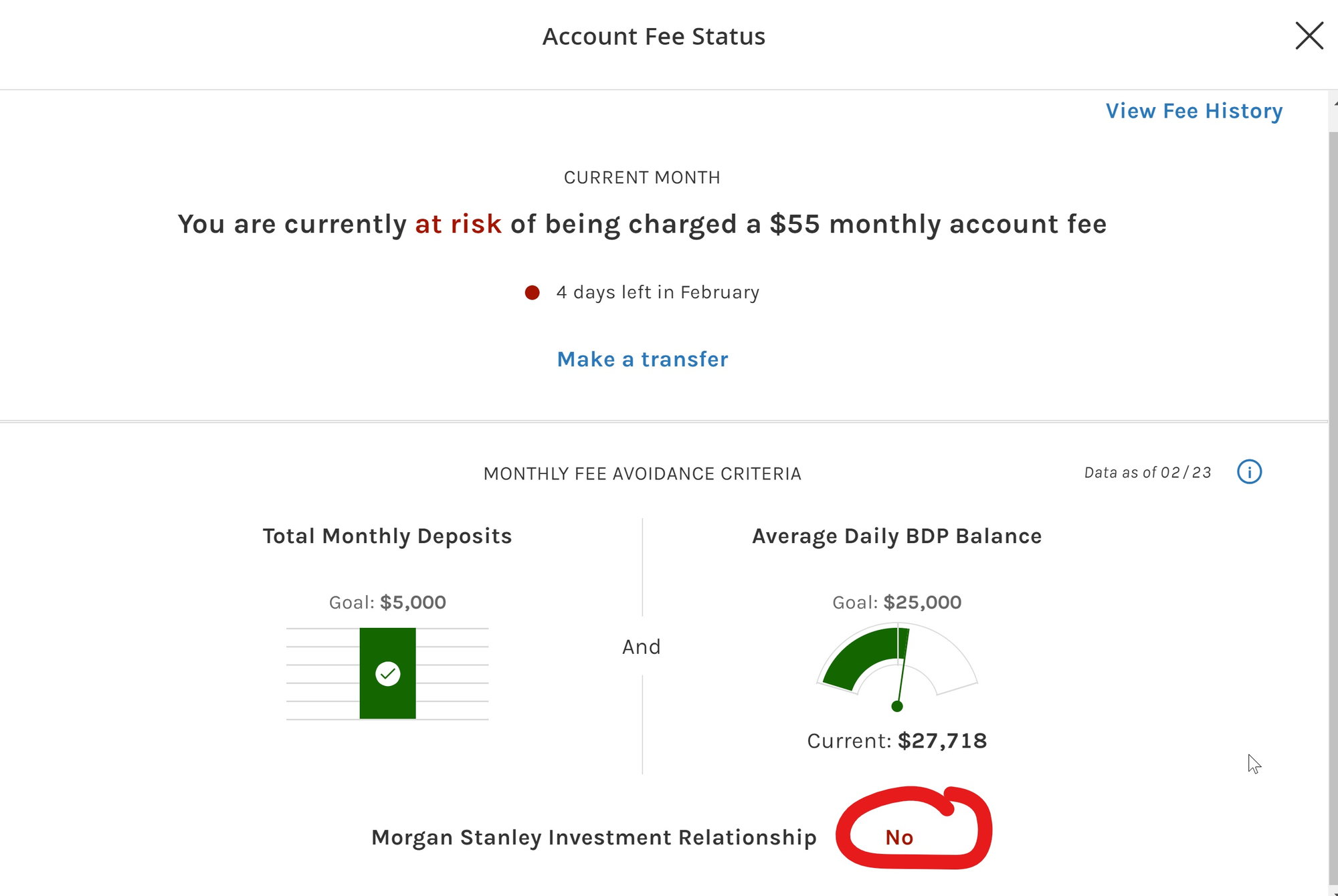

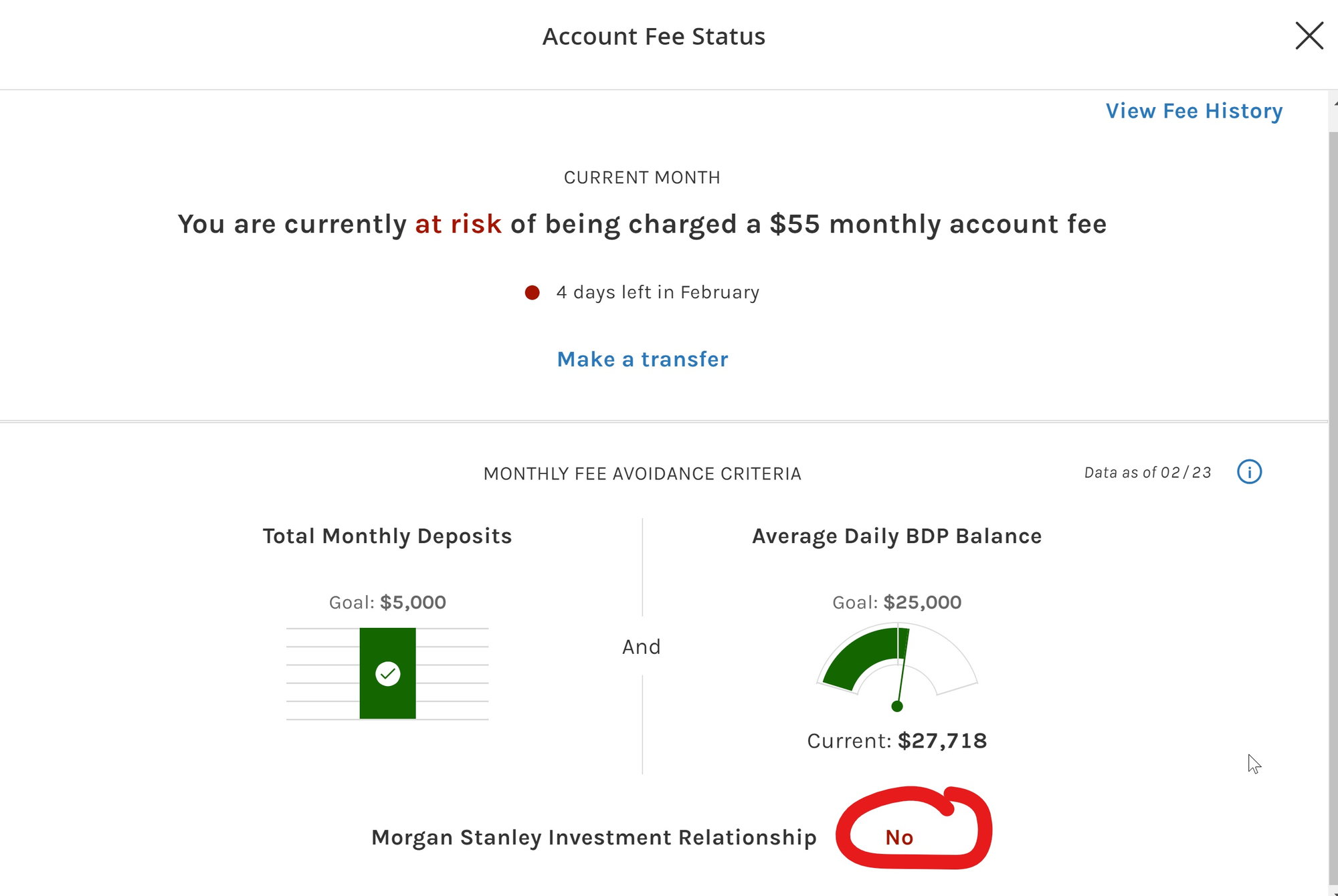

Yesterday I got this message:

However, my CashPlus account balance is $27k+ and I've transferred $5k into my CashPlus account this month. What could be the cause for this message? I've sent MS a message asking for clarification but a day later I haven't received a reply yet.

Just wondering if anyone here has had similar issue. One thing i can think of is that my Access Investing account is ~$4.7k(started with $5k, haven't touched it since December when I opened my account).

update:

so I just logged into my account again and saw a popup and clicked on it. It's showing the following. the "MS Investing Relationship" part doesn't seem to be right assume? I've also called them but the virtual advisor is not available till tomorrow.

Reminder: Your CashPlus account is not meeting fee avoidance

Your Morgan Stanley Account ending in **** is currently not meeting fee avoidance and may potentially be at risk of being charged the monthly fee. You may disregard this message if the fee avoidance criteria will be met by the end of the month.

Log into Morgan Stanley Online to view more information about your account.

Your Morgan Stanley Account ending in **** is currently not meeting fee avoidance and may potentially be at risk of being charged the monthly fee. You may disregard this message if the fee avoidance criteria will be met by the end of the month.

Log into Morgan Stanley Online to view more information about your account.

Just wondering if anyone here has had similar issue. One thing i can think of is that my Access Investing account is ~$4.7k(started with $5k, haven't touched it since December when I opened my account).

update:

so I just logged into my account again and saw a popup and clicked on it. It's showing the following. the "MS Investing Relationship" part doesn't seem to be right assume? I've also called them but the virtual advisor is not available till tomorrow.

Last edited by xun911; Feb 24, 2022 at 7:36 pm

#48

Join Date: May 2021

Posts: 68

Yup, you need to call an advisor and ask them to link those accounts so that status pops up as "YES". It will take a business day to populate. My guess is that you've been in the grace period and haven't been getting charged the fee, but now that the grace period is over, you're finally being alerted to the fact that these accounts haven't been linked yet.

#49

Join Date: Dec 2018

Posts: 218

btw, started with $6,000 in the investment account and it's down $300 now, which is worse than what I would have done in an S&P500 mutual fund. so calculate the loss from the roboadvisor as a cost of keeping the account open.

#50

Join Date: Aug 2005

Location: DFW

Posts: 1,249

I am using it as a regular checking account, mainly for credit card bills. For the $5k requirement, I have MS set to pull the $5k from my savings account to meet the monthly requirement. I push or pull additional funds as needed to keep the CashPlus balance about where needed.

#51

Original Poster

Join Date: Feb 2010

Location: MSP

Posts: 497

We know why they did in the past:

In 2016 they launched Premier Cash Management - https://www.wealthmanagement.com/wir...-platinum-amex

Morgan Stanley, a Wall Street trading firm and brokerage lacking a single bank branch, is making a push to grab $50 billion in deposits held at rivals.

...

The new funds, along with $149 billion in deposits the firm had at the end of 2015, are needed to fuel loan growth to wealth-management clients and help Morgan Stanley achieve profitability goals disclosed in January.

...

The new funds, along with $149 billion in deposits the firm had at the end of 2015, are needed to fuel loan growth to wealth-management clients and help Morgan Stanley achieve profitability goals disclosed in January.

Morgan Stanley has been bumping up against capacity in funding loans to wealthy retail clients, and Halpern will be developing new deposit programs and products, said Eric Heaton, who runs the private banking group and will be Halpern’s boss.

If someone has a good argument why Morgan Stanley would still dish out $695 in incentives to clients paying a couple bucks a year in AUM fees now that they've had this sizable infusion of deposits, I'd be really curious to hear that argument.

#52

Join Date: Feb 2020

Posts: 21

Yup, you need to call an advisor and ask them to link those accounts so that status pops up as "YES". It will take a business day to populate. My guess is that you've been in the grace period and haven't been getting charged the fee, but now that the grace period is over, you're finally being alerted to the fact that these accounts haven't been linked yet.

However, I noticed something interesting, apparently I've received the Engagement Bonus couple of weeks already, and it's only been 2 months since I had opened accounts with them. I've been under impression that if the only investing account I have is Access Investing, there will be no EB for the for the first year? weird but I'm not complaining...

#53

Join Date: May 2021

Posts: 68

Just to touch on these assumptions, one important question to ask is: why would Morgan Stanley be compelled to keep paying you $695 for deposits?

We know why they did in the past:

In 2016 they launched Premier Cash Management - https://www.wealthmanagement.com/wir...-platinum-amex

Then at the end of 2018 they started to bump up against loan capacity due to insufficient deposits again, which led to the launch of CashPlus (and retirement of Premier Cash Management) in January of 2020. https://www.advisorhub.com/morgan-st...loan-capacity/

So what's changed? In late 2020 Morgan Stanley acquired E*Trade and more importantly they acquired E*Trade Bank. As of January of this year they have now fully merged E*Trade Bank into Morgan Stanley Private Bank, and with it picked up over $70bn in deposits. https://www.depositaccounts.com/bank...nk.html#health

If someone has a good argument why Morgan Stanley would still dish out $695 in incentives to clients paying a couple bucks a year in AUM fees now that they've had this sizable infusion of deposits, I'd be really curious to hear that argument.

We know why they did in the past:

In 2016 they launched Premier Cash Management - https://www.wealthmanagement.com/wir...-platinum-amex

Then at the end of 2018 they started to bump up against loan capacity due to insufficient deposits again, which led to the launch of CashPlus (and retirement of Premier Cash Management) in January of 2020. https://www.advisorhub.com/morgan-st...loan-capacity/

So what's changed? In late 2020 Morgan Stanley acquired E*Trade and more importantly they acquired E*Trade Bank. As of January of this year they have now fully merged E*Trade Bank into Morgan Stanley Private Bank, and with it picked up over $70bn in deposits. https://www.depositaccounts.com/bank...nk.html#health

If someone has a good argument why Morgan Stanley would still dish out $695 in incentives to clients paying a couple bucks a year in AUM fees now that they've had this sizable infusion of deposits, I'd be really curious to hear that argument.

Unrelated to that, I do think the MS Blue Cash Preferred is another reason to incentivize me to keep a relationship with Morgan Stanley. A lot of people who have moved through most Amex sign up bonuses keep the BCP as a keeper card. Being able to hold two BCPs (one vanilla and one MS version) means I can max out $12k of 6% groceries each calendar year—a $530 value after the $95 AFs on each card.

#54

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

#55

Join Date: May 2021

Posts: 68

Yes but since the MS version is a separate product, current BCP holders are still eligible for the SUB (no AF first year and $300ish)

Unless you’re getting NLLs, I’m not super incentivized to open a second BCP.

Unless you’re getting NLLs, I’m not super incentivized to open a second BCP.

#56

Join Date: Jun 1999

Location: NYC/LA

Programs: DL Plat, AA Plat Pro, Marriott Titanium, IHG Diamond Amb

Posts: 7,486

https://apply.americanexpress.com/am...ds/?page_url=1

That being said, I can’t recall if the old landing page did. But perhaps marginally noteworthy that it isn’t being actively marketed with the card. (Understand it’s still being marketed with the CashPlus materials.)

#57

Join Date: May 2021

Posts: 68

Just documenting my journey here. I decided to re-open my Platinum CashPlus account.

Originally opened: August 2021

MS Amex Plat opened: September 2021

Closed Platinum CashPlus: November 2021

Reopened account: February 2022

The MS representative I spoke with was able to reopen my old account (same account number, so I can keep my old debit card and paper checks). He was unsure if he would be able to, as he knew that (at least with the Active Assets accounts) there was usually a 3-month period where re-opening was possible, and I was just at the end of the 3-months (may have been beyond it, I am unsure of the exact date I closed).

At first I was told there would be no DocuSigns and things were as they were before. However, the same MS rep called me today and informed me there was a new DocuSign I had to complete, which were essentially just updated terms and services.

(I'm not saying this is new language in the DocuSign, but given my unique situation, thought it was interesting)

This makes it seem like I'll be paid my engagement bonus one year after the AMEX was opened, not one year after my Platinum CashPlus was opened. In fact, the only other language I could find regarding the timing of the Engagement Bonus being paid out was this:

I'm 100% expecting to not be paid the Engagement Bonus until February 2023, but being awarded it in line with my MS Plat 1-year anniversary (September 2022) would be great. This isn't something I would argue with a rep about, but the terms seem to imply I'd get it at the 1-year mark for my AMEX opening, as long as I have a CashPlus opened. I wonder if those terms were written, with the assumption that Amex Plats wouldn't be opened until the CashPlus was already setup and funded.

When I was setting the account back up, I did ask the rep when he thought I'd be paid out the engagement bonus, and his best guess was that I'd receive my 1st on February 2023 and the subsequent ones would be coordinated with my MS Plat AF (so September 2024 and beyond).

Originally opened: August 2021

MS Amex Plat opened: September 2021

Closed Platinum CashPlus: November 2021

Reopened account: February 2022

The MS representative I spoke with was able to reopen my old account (same account number, so I can keep my old debit card and paper checks). He was unsure if he would be able to, as he knew that (at least with the Active Assets accounts) there was usually a 3-month period where re-opening was possible, and I was just at the end of the 3-months (may have been beyond it, I am unsure of the exact date I closed).

At first I was told there would be no DocuSigns and things were as they were before. However, the same MS rep called me today and informed me there was a new DocuSign I had to complete, which were essentially just updated terms and services.

(I'm not saying this is new language in the DocuSign, but given my unique situation, thought it was interesting)

Notwithstanding any other provision of this Disclosure Statement, if you have not opened and maintained a qualified non-CashPlus Account or if your only qualified non-CashPlus Account is a Morgan Stanley Access Investing Account (“MSAI”), you will receive your first Annual Engagement Bonus during the Card Anniversary Month that is 12 months after you first open your American Express Platinum Card and subsequent Annual Engagement Bonuses will be paid annually thereafter.

The Annual Engagement Bonus will be paid in the month following the month you open your American Express Platinum Card (“the Card Anniversary Month”) with the exception of the first year you open your American Express Platinum Card.

When I was setting the account back up, I did ask the rep when he thought I'd be paid out the engagement bonus, and his best guess was that I'd receive my 1st on February 2023 and the subsequent ones would be coordinated with my MS Plat AF (so September 2024 and beyond).

Last edited by Road_Dog; Mar 7, 2022 at 9:18 am

#58

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

Here’s a hopeful data point for this account going forward:

Engagement bonus 1, $550 posted January 2021

Engagement bonus 2, $550 posted October 2021

The $1100 is not reflected on the 2021 consolidated 1099

Engagement bonus 1, $550 posted January 2021

Engagement bonus 2, $550 posted October 2021

The $1100 is not reflected on the 2021 consolidated 1099

#59

Join Date: May 2019

Posts: 11

Bonus 1 $550 posted January 2021

Bonus 2 $550 posted December 2021

And it DOES reflected on 2021 consolidated 1099.

Although reflected as $1081 (not $1100), and no one from MS can explain why.

#60

Join Date: Jun 2019

Programs: UA, AS, Marriott

Posts: 139

For my part, my first bonus of $695 posted this fall three months after account opening, reported in full on 1099. I paid zero in fees to MS