End of an Era! (Closed Centurion card account.)

#1

Original Poster

Join Date: Jan 2000

Posts: 3,026

End of an Era! (Closed Centurion card account.)

Well folks. After 40 years of having an American Express charge card in various colors my renewal came up yesterday for $10,000 (Primary and Supplement) for my Centurion.

We've had many years of great use of it but after 2020 and looking to 2021 travel plans there's no math to justify keeping it.

I had to talk to two Amex people to cancel it and while asking what they could do to keep me as a member but not offering anything or agreeing to my suggestions: Go back to the charter fee we were "guaranteed" or even go back to the $2500 it was time to give it up.

I still have my Hilton Amex but all primary spend will be my JP Morgan Reserve card.

It's been a pleasure learning and contribution to this group but it's peace out for now!

Cheers!

We've had many years of great use of it but after 2020 and looking to 2021 travel plans there's no math to justify keeping it.

I had to talk to two Amex people to cancel it and while asking what they could do to keep me as a member but not offering anything or agreeing to my suggestions: Go back to the charter fee we were "guaranteed" or even go back to the $2500 it was time to give it up.

I still have my Hilton Amex but all primary spend will be my JP Morgan Reserve card.

It's been a pleasure learning and contribution to this group but it's peace out for now!

Cheers!

#2

Join Date: Sep 2014

Posts: 777

Many are in same boat, and you may not be alone in those simply choosing to walk away.

Went through similar debate with AMEX few weeks ago when annual fee hit (gold card). AMEX won't reduce or waive annual fees for love nor money on charge cards. They might do something for credit cards, and indeed IIRC early on in covid-19 pandemic they were throwing a few bones to Amex credit card holders.

After being speaking both to a Tier I and II level CS reps general line is this; AMEX doesn't charge interest on balances because (naturally) their charge card holders aren't supposed to carry them month to month. That interest is one way credit cards make money. AMEX replaces (or makes) that revenue instead from annual membership fees. If they start reducing or waving those fees it would have an immediate affect on their bottom line.

Pointed out time and again that thanks to covid-19 many have had travel, business, entertainment and other things upended. AMEX countered that various rewards and offers should or do make up for annual fees in whole or part.....

Best anyone can hope for is some sort of retention offer, but even there AMEX isn't giving up much as it seems. It's all part of a well scripted scenario IMHO. CS rep pulls up account history and system generates "reward" based upon prior year or years spending habits. In other words retention award comes from doing something AMEX's computers believe card member will do anyway (spend levels), and offers a bit off the top as a gift. If card member doesn't rise to that occasion and leaves money on table, that isn't AMEX's fault.

Went through similar debate with AMEX few weeks ago when annual fee hit (gold card). AMEX won't reduce or waive annual fees for love nor money on charge cards. They might do something for credit cards, and indeed IIRC early on in covid-19 pandemic they were throwing a few bones to Amex credit card holders.

After being speaking both to a Tier I and II level CS reps general line is this; AMEX doesn't charge interest on balances because (naturally) their charge card holders aren't supposed to carry them month to month. That interest is one way credit cards make money. AMEX replaces (or makes) that revenue instead from annual membership fees. If they start reducing or waving those fees it would have an immediate affect on their bottom line.

Pointed out time and again that thanks to covid-19 many have had travel, business, entertainment and other things upended. AMEX countered that various rewards and offers should or do make up for annual fees in whole or part.....

Best anyone can hope for is some sort of retention offer, but even there AMEX isn't giving up much as it seems. It's all part of a well scripted scenario IMHO. CS rep pulls up account history and system generates "reward" based upon prior year or years spending habits. In other words retention award comes from doing something AMEX's computers believe card member will do anyway (spend levels), and offers a bit off the top as a gift. If card member doesn't rise to that occasion and leaves money on table, that isn't AMEX's fault.

#3

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

#4

FlyerTalk Evangelist

Join Date: Dec 2006

Location: Pacific Northwest

Programs: UA Gold 1MM, AS 75k, AA Plat, Bonvoyed Gold, Honors Dia, Hyatt Explorer, IHG Plat, ...

Posts: 16,843

After being speaking both to a Tier I and II level CS reps general line is this; AMEX doesn't charge interest on balances because (naturally) their charge card holders aren't supposed to carry them month to month. That interest is one way credit cards make money. AMEX replaces (or makes) that revenue instead from annual membership fees. If they start reducing or waving those fees it would have an immediate affect on their bottom line.

#5

Join Date: Sep 2014

Posts: 777

Don't know if allowed, but this link to Points Guy post explains things more clearly than I can...

https://thepointsguy.com/guide/ultim...ention-offers/

Waiving or reducing annual fee is basically straight up cash for all intents and purposes. It is money that comes out of AMEX's or any other CC's pockets and into yours.

Awarding points and or statement credits all require usually some activity on card holder's part. You only get "X" statement credits or points if you spend "Y" amount within a given period. AMEX like any other CC makes money upfront on those offers via merchant fees charged when purchase is made. There is a spread between what a CC makes in merchant fees and what they are offering as points or statement credits. You can be sure the house isn't losing money on those offers.

More to the point annual fee waiver or reduction once done is finished, you've got your money, and CC doesn't. With statement credits or bonus points usually there is a trigger, if account holder doesn't spend accordingly they lose out on offer. But CC still made money on merchant account fees. If you sign up for $25 statement credit for spending $125 at Levi's before 31 December, but only spend $120 AMEX won't give you that $25, but they made money on sums you did spend.

If so inclined you can read more here:

- American Express earns most of its money through discount revenue, primarily represented by earnings on transactions that take place with partner merchants.

- The company also generates revenue from cardholders through annual membership fees, interest on outstanding balances, conversion fees, and more.

- American Express has a "spend-centric" model aimed at growing the number of overall transactions on its cards through special offers and relatively low fees.

#7

Join Date: Sep 2014

Posts: 777

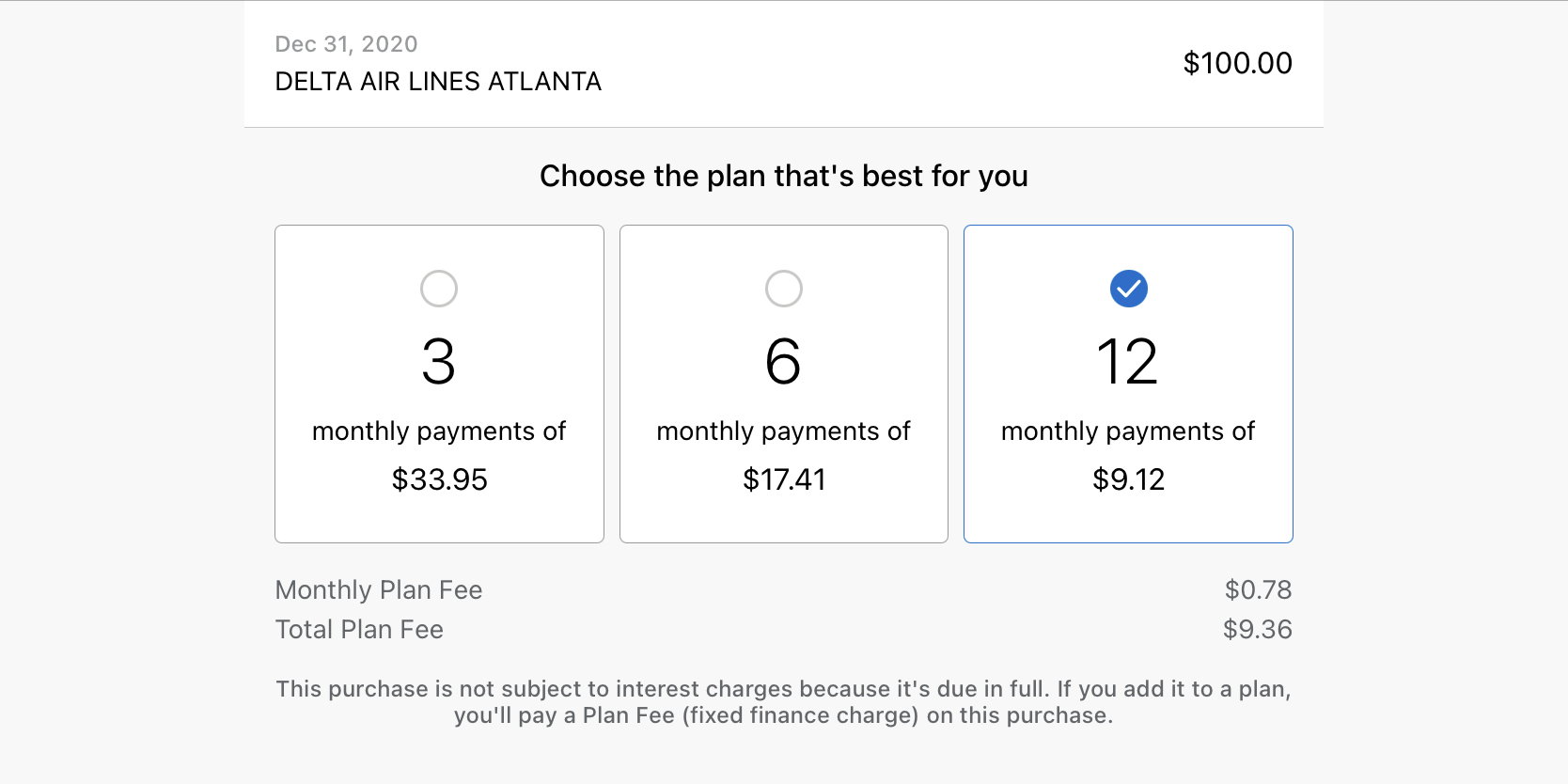

Like that Pay Over Time thing AMEX is promoting "Plan It" very heavily.

I was sat down when got first AMEX out of college; don't ever put anything on American Express you can't pay in full when bill arrives. Just don't do it!

American Express is a bank and guess bean counters sat around and realized they were leaving money on the table by not first offering revolving credit accounts. Now they've upped that game to include ways to turn their charge cards into sort of credit cards.

Haven't looked into "Plan It", but if it is anything like "Pay Over Time" you cannot get at that balance long as you have a balance for charge portion. Options are to pay off entire statement balance (including POT charges), pay monthly payment due (which includes small portion of POT charges), pay both current payment due and whatever other charges are on account,*and* then pay excess (which goes then to POT balance). This or simply not use card for charge purposes and pay down POT charges directly.

#8

Join Date: Sep 2014

Posts: 777

And I answered....

Depending upon form issued retention bonus requires action on card holder's part; usually they must spend "X" to get "Y". OTOH a fee reduction or waiver is cash money straight out requiring no further action from account holder.

Getting back on topic, if OP had been offered straight fee reduction/waiver of $10k. $5k or even $3k versus say any of the following:

Depending upon form issued retention bonus requires action on card holder's part; usually they must spend "X" to get "Y". OTOH a fee reduction or waiver is cash money straight out requiring no further action from account holder.

Getting back on topic, if OP had been offered straight fee reduction/waiver of $10k. $5k or even $3k versus say any of the following:

- 30,000 Membership Rewards points with no spend required

- 30,000 Membership Rewards points with no spend required PLUS 50,000 points after $40,000 spend in 90 days

- 5,000 Membership Rewards immediately, plus another 25,000 points after $10,000 spend in 90 days

- 30,000 Membership Rewards points or $300 statement credit after $2,000 spend in 90 days

- 20,000 Membership Rewards points or $200 statement credit after $3,000 spend in 90 days

- $100 statement credit or 10,000 Membership Rewards points for $3,000 spend in 90 days

- 5,000 Membership Rewards points immediately, plus 5,000 more points after $3,000 spend in 90 days

- 35,000 Membership Rewards after spending $5,000 within 3 months.

- $145 statement credit on top of $200 pandemic credit everyone gets at renewal.

#9

FlyerTalk Evangelist

Join Date: Jul 2008

Location: IAH

Programs: DL DM, Hyatt Ist-iest, Stariott Platinum, Hilton Diamond

Posts: 12,790

The MR money printer goes *brrrrrrrrrrrr* this year for many Green/Gold/Plat cardholders

I know I've received nothing short of 70k MR points in the past couple months across my Gold and Platinum cards for doing nothing but picking up the phone twice and agreeing to keep my cards open for another year.

I know I've received nothing short of 70k MR points in the past couple months across my Gold and Platinum cards for doing nothing but picking up the phone twice and agreeing to keep my cards open for another year.

#10

Join Date: Jun 2015

Location: DTW

Programs: Alaska, Delta, Southwest

Posts: 1,663

...

Went through similar debate with AMEX few weeks ago when annual fee hit (gold card). AMEX won't reduce or waive annual fees for love nor money on charge cards. They might do something for credit cards, and indeed IIRC early on in covid-19 pandemic they were throwing a few bones to Amex credit card holders.

...

Went through similar debate with AMEX few weeks ago when annual fee hit (gold card). AMEX won't reduce or waive annual fees for love nor money on charge cards. They might do something for credit cards, and indeed IIRC early on in covid-19 pandemic they were throwing a few bones to Amex credit card holders.

...

I've noticed that too, and it's offered on their credit cards too, not just their charge cards. They do occasionally have no-fee Plan It promos - I've used it twice to defer big purchases and invested the cash I would have spent instead. Under their usual fee structure, I agree it isn't worth it, but the no-fee promos seem to happen about twice a year.

#11

Join Date: Aug 2012

Posts: 6,752

RE: disounted fee vs retension

People who prefer using MR points directly rather than transferring would probably find a discount on the fee, if only to be spared the upfront costs and/or spend requirement. Conversely, for those who prefer to transfer MR points and use the via FF redemptions, would likely overwhelming prefer a MR points retension.

Personally, I'd much rather have MR points than cash (the discount on fee) in this scenario.

People who prefer using MR points directly rather than transferring would probably find a discount on the fee, if only to be spared the upfront costs and/or spend requirement. Conversely, for those who prefer to transfer MR points and use the via FF redemptions, would likely overwhelming prefer a MR points retension.

Personally, I'd much rather have MR points than cash (the discount on fee) in this scenario.

#12

Join Date: Feb 2006

Posts: 1,063

This may be a dumb question, but I am curious, and some folks may actually know the answer.

The OP is clearly a desirable customer with a 40 year history, a Centurion holder, and I am sure he pays his bills on time.

I recently decided to upgrade by Green card to the Gold, rather than close the account, because the math made sense. Amex was happy to process the upgrade. Similarly, some customers choose to downgrade their credit and charge cards to products with lower or no annual fees to maintain their account history. I am sure Amex prefers downgrades to outright cancelations.

Does anyone know if it is possible to downgrade the Centurion card to a regular Platinum or even the lowly Green? Even Warren Buffet has a GREEN CARD....LOL

If I was the OP, I would be a little perturbed that they provide more of a retention offer, but he is also keeping his Aspire and is willing to maintain some relationship with them.

Last question: Assuming someone would successfully downgrade their Centurion, does anyone think Amex could see the account history and allow a user to upgrade again, or would you basically be dead to them and have to be re-invited?

It's possible the OP doesn't care, and, while it's nice to keep credit history for an old account, I am sure the OP has a long credit history anyway, with many other accounts. I doubt closing the Centurion is going to have much of am impact.

The OP is clearly a desirable customer with a 40 year history, a Centurion holder, and I am sure he pays his bills on time.

I recently decided to upgrade by Green card to the Gold, rather than close the account, because the math made sense. Amex was happy to process the upgrade. Similarly, some customers choose to downgrade their credit and charge cards to products with lower or no annual fees to maintain their account history. I am sure Amex prefers downgrades to outright cancelations.

Does anyone know if it is possible to downgrade the Centurion card to a regular Platinum or even the lowly Green? Even Warren Buffet has a GREEN CARD....LOL

If I was the OP, I would be a little perturbed that they provide more of a retention offer, but he is also keeping his Aspire and is willing to maintain some relationship with them.

Last question: Assuming someone would successfully downgrade their Centurion, does anyone think Amex could see the account history and allow a user to upgrade again, or would you basically be dead to them and have to be re-invited?

It's possible the OP doesn't care, and, while it's nice to keep credit history for an old account, I am sure the OP has a long credit history anyway, with many other accounts. I doubt closing the Centurion is going to have much of am impact.

#13

Moderator

Join Date: Jun 2003

Location: Miami, Mpls & London

Programs: AA & Marriott Perpetual Platinum; DL & HH Gold

Posts: 48,954

#14

Join Date: Aug 2012

Posts: 6,752

Just my take and speculation on why the OP may have simply cancled the card.

#15

Like some have said, if any card does not offer what you desire, just cancel it and move on. Never look back. The same with the card company. If the CC bank does not see any spending or with extensive card portfolio, then they know the cardholder is not serious with the request for retention offer. Then the CC bank wants to walk away too. CC banking relationship is a mutual relationship.

The JP Morgan Reserve is essentially a CSR card with some extended benefits (such as UAL etc). Centurion card is more for the name as to the benefits. Even with most of the cardholders of Centurion, they do not break even with all the fees.

I see OP finally came to his sense and wants to keep his Reserve card for the benefits. There are still plenty of people who want the Centurion cards. They made good fortunes from trading Bitcoin and Zoom stocks. Or some 25-year traders from NY banks. AmEx won't be crying for losing a Centurion card holder

The JP Morgan Reserve is essentially a CSR card with some extended benefits (such as UAL etc). Centurion card is more for the name as to the benefits. Even with most of the cardholders of Centurion, they do not break even with all the fees.

I see OP finally came to his sense and wants to keep his Reserve card for the benefits. There are still plenty of people who want the Centurion cards. They made good fortunes from trading Bitcoin and Zoom stocks. Or some 25-year traders from NY banks. AmEx won't be crying for losing a Centurion card holder