SPECULATION: new USA card priced between Centurion & Platinum?

#91

Join Date: Mar 2011

Programs: Delta Skymiles

Posts: 1,982

I think something possible would be something like

$999 Membership Fee

5x Airfare, Hotels

2x Gas & Groceries no limit

2x Restaurants

$250 Airline Credit

$250 Saks Credit

$250 Uber Credit

$250 Hotel Credit

Hilton Diamond

Marriott Platinum

Delta Silver (at most)

Or something to this effect. Sort of a “platinum card on steroids” would be my imagination as to what is viable. I think the card will either be just sub $1000 or perhaps $1250 or $1500. I doubt they go any higher with the AF than that. I’d also be surprised for there to be an initiation fee.

$999 Membership Fee

5x Airfare, Hotels

2x Gas & Groceries no limit

2x Restaurants

$250 Airline Credit

$250 Saks Credit

$250 Uber Credit

$250 Hotel Credit

Hilton Diamond

Marriott Platinum

Delta Silver (at most)

Or something to this effect. Sort of a “platinum card on steroids” would be my imagination as to what is viable. I think the card will either be just sub $1000 or perhaps $1250 or $1500. I doubt they go any higher with the AF than that. I’d also be surprised for there to be an initiation fee.

#92

FlyerTalk Evangelist

Join Date: Feb 2002

Location: San Francisco/Tel Aviv/YYZ

Programs: CO 1K-MM

Posts: 10,762

I think something possible would be something like

$999 Membership Fee

5x Airfare, Hotels

2x Gas & Groceries no limit

2x Restaurants

$250 Airline Credit

$250 Saks Credit

$250 Uber Credit

$250 Hotel Credit

Hilton Diamond

Marriott Platinum

Delta Silver (at most)

Or something to this effect. Sort of a “platinum card on steroids” would be my imagination as to what is viable. I think the card will either be just sub $1000 or perhaps $1250 or $1500. I doubt they go any higher with the AF than that. I’d also be surprised for there to be an initiation fee.

$999 Membership Fee

5x Airfare, Hotels

2x Gas & Groceries no limit

2x Restaurants

$250 Airline Credit

$250 Saks Credit

$250 Uber Credit

$250 Hotel Credit

Hilton Diamond

Marriott Platinum

Delta Silver (at most)

Or something to this effect. Sort of a “platinum card on steroids” would be my imagination as to what is viable. I think the card will either be just sub $1000 or perhaps $1250 or $1500. I doubt they go any higher with the AF than that. I’d also be surprised for there to be an initiation fee.

#93

Join Date: Oct 2016

Posts: 277

I think something possible would be something like

$999 Membership Fee

5x Airfare, Hotels

2x Gas & Groceries no limit

2x Restaurants

$250 Airline Credit

$250 Saks Credit

$250 Uber Credit

$250 Hotel Credit

Hilton Diamond

Marriott Platinum

Delta Silver (at most)

Or something to this effect. Sort of a “platinum card on steroids” would be my imagination as to what is viable. I think the card will either be just sub $1000 or perhaps $1250 or $1500. I doubt they go any higher with the AF than that. I’d also be surprised for there to be an initiation fee.

$999 Membership Fee

5x Airfare, Hotels

2x Gas & Groceries no limit

2x Restaurants

$250 Airline Credit

$250 Saks Credit

$250 Uber Credit

$250 Hotel Credit

Hilton Diamond

Marriott Platinum

Delta Silver (at most)

Or something to this effect. Sort of a “platinum card on steroids” would be my imagination as to what is viable. I think the card will either be just sub $1000 or perhaps $1250 or $1500. I doubt they go any higher with the AF than that. I’d also be surprised for there to be an initiation fee.

#94

Join Date: Jun 2004

Posts: 3,773

I think something possible would be something like

$999 Membership Fee

5x Airfare, Hotels

2x Gas & Groceries no limit

2x Restaurants

$250 Airline Credit

$250 Saks Credit

$250 Uber Credit

$250 Hotel Credit

Hilton Diamond

Marriott Platinum

Delta Silver (at most)

Or something to this effect. Sort of a “platinum card on steroids” would be my imagination as to what is viable. I think the card will either be just sub $1000 or perhaps $1250 or $1500. I doubt they go any higher with the AF than that. I’d also be surprised for there to be an initiation fee.

$999 Membership Fee

5x Airfare, Hotels

2x Gas & Groceries no limit

2x Restaurants

$250 Airline Credit

$250 Saks Credit

$250 Uber Credit

$250 Hotel Credit

Hilton Diamond

Marriott Platinum

Delta Silver (at most)

Or something to this effect. Sort of a “platinum card on steroids” would be my imagination as to what is viable. I think the card will either be just sub $1000 or perhaps $1250 or $1500. I doubt they go any higher with the AF than that. I’d also be surprised for there to be an initiation fee.

I'd rather drop the Saks credit (and possibly other credits) in favor of higher elite status with hotels and airlines. AmEx is unlikely to be able to offer Marriott Platinum, given that Cent's don't even get that, as was pointed out. But perhaps they could add status in more programs. Hyatt? And let's not forget to retain IHG Platinum which is useful. I also get good use out of Hertz Platinum, although a lower card would probably not offer it. I also don't want to lose Priority Pass.

Someone here or in another thread suggested that members get to pick and choose benefits, like Delta elites who can select from among a menu of options. I like that idea which would be a way for AmEx to keep the fee reasonable if every card holder did not sign up for every perk. I also wish the Uber credit were not restricted to month-by-month. I only take Uber a few times a year, but usually concentrated in a month or two with multiple rides exceeding the monthly credit. Then the unused credit for 9 or 10 months just expires (which I'm sure AmEx counts on).

#95

Suspended

Join Date: Jul 2001

Location: Watchlisted by the prejudiced, en route to purgatory

Programs: Just Say No to Fleecing and Blacklisting

Posts: 102,095

At least Delta Gold I should think.

I'd rather drop the Saks credit (and possibly other credits) in favor of higher elite status with hotels and airlines. AmEx is unlikely to be able to offer Marriott Platinum, given that Cent's don't even get that, as was pointed out. But perhaps they could add status in more programs. Hyatt? And let's not forget to retain IHG Platinum which is useful. I also get good use out of Hertz Platinum, although a lower card would probably not offer it. I also don't want to lose Priority Pass.

Someone here or in another thread suggested that members get to pick and choose benefits, like Delta elites who can select from among a menu of options. I like that idea which would be a way for AmEx to keep the fee reasonable if every card holder did not sign up for every perk. I also wish the Uber credit were not restricted to month-by-month. I only take Uber a few times a year, but usually concentrated in a month or two with multiple rides exceeding the monthly credit. Then the unused credit for 9 or 10 months just expires (which I'm sure AmEx counts on).

I'd rather drop the Saks credit (and possibly other credits) in favor of higher elite status with hotels and airlines. AmEx is unlikely to be able to offer Marriott Platinum, given that Cent's don't even get that, as was pointed out. But perhaps they could add status in more programs. Hyatt? And let's not forget to retain IHG Platinum which is useful. I also get good use out of Hertz Platinum, although a lower card would probably not offer it. I also don't want to lose Priority Pass.

Someone here or in another thread suggested that members get to pick and choose benefits, like Delta elites who can select from among a menu of options. I like that idea which would be a way for AmEx to keep the fee reasonable if every card holder did not sign up for every perk. I also wish the Uber credit were not restricted to month-by-month. I only take Uber a few times a year, but usually concentrated in a month or two with multiple rides exceeding the monthly credit. Then the unused credit for 9 or 10 months just expires (which I'm sure AmEx counts on).

#96

Join Date: May 2013

Location: DTW

Programs: AMEX, Ritz LT-Plat Prem, Hyatt Plat, SPG Plat, Hilton Diamond, Delta Plat, United Gold, Sixt Plat

Posts: 866

I think such a new card will be like a combination of Plat/Brilliant/Aspire with a touch of Green, with the credits structured to increase breakage.

$1650 AF (3x Plat, 1/3 Centurion... Makes geometric sense)

Same Uber credit as Platinum

6x on travel (amextravel and direct with airlines)

3x on transit/taxis/rideshare

2x on Hilton/Marriott direct

Bonus 1x on Delta

$100 quarterly airline fee credit

$50 quarterly Saks credit

$100 CLEAR credit

FHR benefit

Lounge access with guests (lower cards lose guest access)

$75 quarterly Starriott credit

Bonvoy Gold (Titanium after $25k)

$100 Ritz/St. Regis credit

Hilton Diamond

$125/6 months Hilton resort credit

$100 Waldorf/Conrad credit

Ability to redeem 10k MR for 1k Delta MQDs

Maybe "Platinum Preferred"?

Doubtful that Brilliant or Aspire holders would move to this (the hotel benefits are a bit watered down). Might complement the DL Reserve (MQMs from Reserve, MQDs by MR). Definitely beats Plat+Reserve+Aspire+Brilliant, but you'd still want a restaurant card.

$1650 AF (3x Plat, 1/3 Centurion... Makes geometric sense)

Same Uber credit as Platinum

6x on travel (amextravel and direct with airlines)

3x on transit/taxis/rideshare

2x on Hilton/Marriott direct

Bonus 1x on Delta

$100 quarterly airline fee credit

$50 quarterly Saks credit

$100 CLEAR credit

FHR benefit

Lounge access with guests (lower cards lose guest access)

$75 quarterly Starriott credit

Bonvoy Gold (Titanium after $25k)

$100 Ritz/St. Regis credit

Hilton Diamond

$125/6 months Hilton resort credit

$100 Waldorf/Conrad credit

Ability to redeem 10k MR for 1k Delta MQDs

Maybe "Platinum Preferred"?

Doubtful that Brilliant or Aspire holders would move to this (the hotel benefits are a bit watered down). Might complement the DL Reserve (MQMs from Reserve, MQDs by MR). Definitely beats Plat+Reserve+Aspire+Brilliant, but you'd still want a restaurant card.

#98

Join Date: Nov 2013

Location: NYC

Programs: OZ Diamond *A Gold / Delta Gold

Posts: 775

#100

Join Date: Dec 2019

Posts: 452

I guarantee you those friends of yours are wealthy by any and all standards. Upper middle class doesn’t start at the top 1% or 0.5% of income earners. About $400k yearly income puts you in the top 1% of income earners in the United States.

I will give you thought that there is quite a gulf between top 1% and top 0.1%.

I will give you thought that there is quite a gulf between top 1% and top 0.1%.

wealth is accrued through saving / investing the riches.

#101

Join Date: Mar 2011

Programs: Delta Skymiles

Posts: 1,982

To me, these cards are going to have more to do with differentiated experiences.

Platinum - Travel Heavy Users

Gold - Rewards heavy users

Green - “buying into the system” users/aspirational users

Is there a card above Platinum that can help meet the needs of Travel & Rewards Heavy Users. If there is, it will be expensive.

Currently are users able to purchase a Platinum and Gold Charge Card (not as an AU but as a distinct card)? If so, no way this card is under $750 per year!

Realistically give the Gold Earnings, the Platinum Perks and one or at most two more “killer benefit” for either $950 or $1450 and I think you will fill the void for the truly niche market this would serve.

I wonder what type of monthly spend they would imagine is necessary for this type of card member to be successful on their end. 5k? 7.5k? 10k? What would that realistically look like in differentiation to a Platinum or Gold user?

Platinum - Travel Heavy Users

Gold - Rewards heavy users

Green - “buying into the system” users/aspirational users

Is there a card above Platinum that can help meet the needs of Travel & Rewards Heavy Users. If there is, it will be expensive.

Currently are users able to purchase a Platinum and Gold Charge Card (not as an AU but as a distinct card)? If so, no way this card is under $750 per year!

Realistically give the Gold Earnings, the Platinum Perks and one or at most two more “killer benefit” for either $950 or $1450 and I think you will fill the void for the truly niche market this would serve.

I wonder what type of monthly spend they would imagine is necessary for this type of card member to be successful on their end. 5k? 7.5k? 10k? What would that realistically look like in differentiation to a Platinum or Gold user?

#102

Join Date: Mar 2005

Location: CLT

Programs: AA EP, AA AC

Posts: 4,268

To me, these cards are going to have more to do with differentiated experiences.

Platinum - Travel Heavy Users

Gold - Rewards heavy users

Green - “buying into the system” users/aspirational users

Is there a card above Platinum that can help meet the needs of Travel & Rewards Heavy Users. If there is, it will be expensive.

Currently are users able to purchase a Platinum and Gold Charge Card (not as an AU but as a distinct card)? If so, no way this card is under $750 per year!

Realistically give the Gold Earnings, the Platinum Perks and one or at most two more “killer benefit” for either $950 or $1450 and I think you will fill the void for the truly niche market this would serve.

I wonder what type of monthly spend they would imagine is necessary for this type of card member to be successful on their end. 5k? 7.5k? 10k? What would that realistically look like in differentiation to a Platinum or Gold user?

Platinum - Travel Heavy Users

Gold - Rewards heavy users

Green - “buying into the system” users/aspirational users

Is there a card above Platinum that can help meet the needs of Travel & Rewards Heavy Users. If there is, it will be expensive.

Currently are users able to purchase a Platinum and Gold Charge Card (not as an AU but as a distinct card)? If so, no way this card is under $750 per year!

Realistically give the Gold Earnings, the Platinum Perks and one or at most two more “killer benefit” for either $950 or $1450 and I think you will fill the void for the truly niche market this would serve.

I wonder what type of monthly spend they would imagine is necessary for this type of card member to be successful on their end. 5k? 7.5k? 10k? What would that realistically look like in differentiation to a Platinum or Gold user?

Safe Travels

#104

Join Date: May 2016

Location: In btw SJC & SFO

Programs: Marriott Titanium & LTP, Hilton Diamond (Aspire card), Hyatt Globalist, UA Gold (almost free agent)

Posts: 510

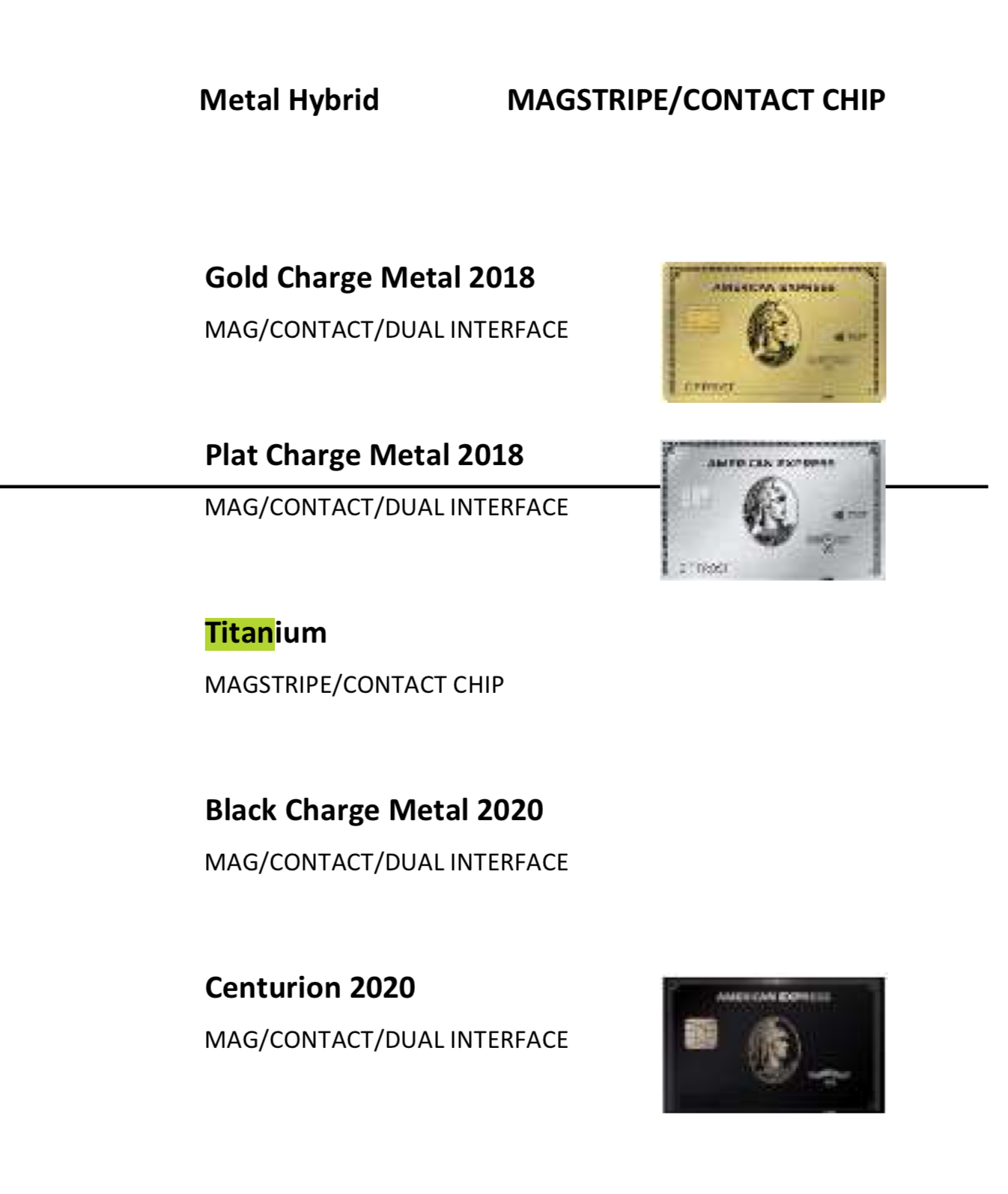

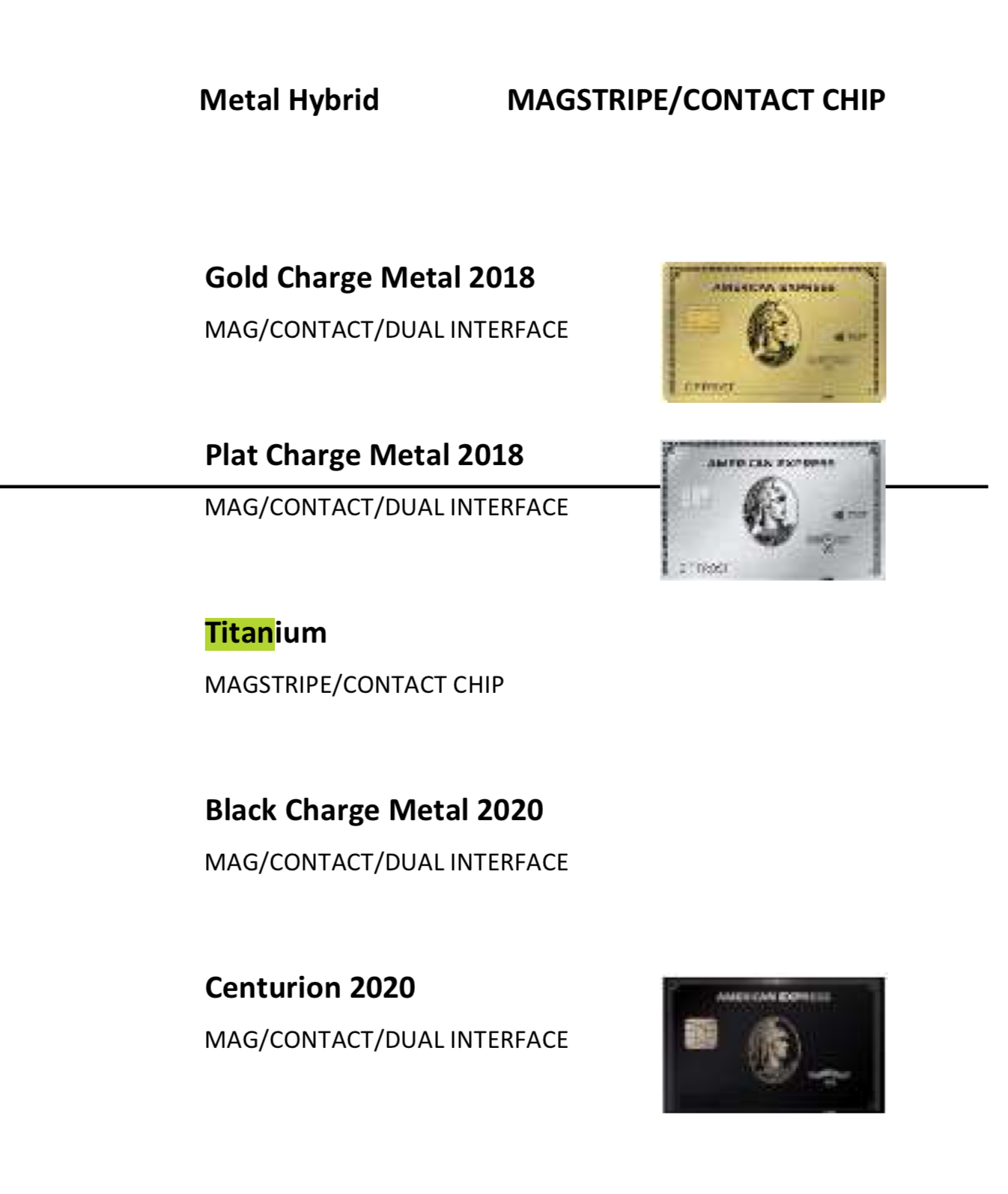

Looks like a reality and I do hope Coronavirus won't derail Amex's launch plan:

https://www.reddit.com/r/amex/commen..._titanium_and/

https://www.reddit.com/r/amex/commen..._titanium_and/

.

.