Last edit by: MasterGeek

Referrals and self-referrals are an important part of maximizing rewards from Canadian-issued American Express cards. It is appropriate to discuss how the referral process works in this thread. However, please do not offer or request referrals here. Use only this thread and do read the Wikipost carefully before posting: Referral Offers (post only in this thread, no referral links, read Wiki post first).

This thread is a continuation of: Churning Amex in Canada (2017). All the listed offers below are still valid as of January 2018.

AMEX Business Gold Rewards - $250/year,FYF, 40K MR (by referral, else only 30K) after $5000 spending

(no longer FYF as of Jun 26, 2018)

Updated as of Jan 22, 2018

AMEX Gold Rewards - $150/year,FYF, 25K MR after $1500 spending + $50/$60 cashback from GCR. New as of Jan 15, 2017, on a referred signup: and an additional 5,000 Membership Rewards points for one approved Supplementary Card added to your account at time of online application. That’s a total of 30,000 Membership Rewards points.

AMEX SPG - $120/year, 25K SPG after $1500 spending + $30 GCR cashback

New card as of Sep 25 2017

AMEX Cobalt CREDIT card - $10/month ($120 annually)

Apply through GCR for $50 Rebate https://www.greatcanadianrebates.ca/...s/Amex-Cobalt/

This thread is a continuation of: Churning Amex in Canada (2017). All the listed offers below are still valid as of January 2018.

AMEX Business Gold Rewards - $250/year,

(no longer FYF as of Jun 26, 2018)

Updated as of Jan 22, 2018

AMEX Gold Rewards - $150/year,

- July 11, 2017, Amex Gold MR will no longer earn referral points.

- July 21, 2017, no other Amex MR card can refer to Gold MR

- Jan 22, 2018, as of Sep 14, 2017 the Amex Gold MR is no longer FYF. $150/yr applies on first statement. Only another Gold or Cobalt card can refer to Gold (and vice versa) for a 5,000 MR bonus. The Personal Gold cannot refer to Business Gold, Personal Platinum nor Business Platinum.

AMEX SPG - $120/year, 25K SPG after $1500 spending + $30 GCR cashback

New card as of Sep 25 2017

AMEX Cobalt CREDIT card - $10/month ($120 annually)

Apply through GCR for $50 Rebate https://www.greatcanadianrebates.ca/...s/Amex-Cobalt/

- Earn 2,500 Membership Tiered Rewards points for each month where you spend $500 (up to 30,000/year).

- Limited Time Offer: Apply by Jan 30, 2018 and you can earn a Welcome Bonus of 10,000 Membership Rewards® points after spending $3K in 3 months.

- See discussion thread for more details: 2017 American Express Cobalt (Canada)

American Express Canada application and reward strategies

#286

Join Date: Jan 2017

Programs: BAEC, Mileage Plus, Aeroplan, SPG

Posts: 62

You can apply and carry as many Amex CHARGE cards as you can qualify for, and the Amex Personal/Business Golds and Personal/Business Platinum cards are Membership Rewards CHARGE cards. People can carry all four if they are inclined to do so. There USED to be a limit of 2 MAXIMUM on the number of CREDIT cards that you can own, but it may have been increased to at least 3 now...the SPG cards are Amex CREDIT cards.

Great - thanks for the clarification.

#287

Join Date: Jan 2017

Programs: BAEC, Mileage Plus, Aeroplan, SPG

Posts: 62

One more question about people's experiences on this forum - as briefly mentioned, I applied for my first two SPG Amex cards a month ago - not sure why it took me so long - I remember applying last year but got declined and I had no clue why - I had thought that they underwriting standards might have been uber exclusive or maybe required 800+ credit scores (how naive of me).

Eventually - I reapplied for the 2 SPG cards and was initially declined for my first application again, but then called them and asked for a reassessment - turns out my name is such a common name, that they needed to do further fraud checks and both got approved within a week of each other.

Now for my question - I feel that the credit limits approved to me were pretty generous (14K/20K) - especially since they originally didn't even approve me - keeping in mind that I intend on applying for one of the charge cards in ~1-2 months from now, should I consider reducing the credit limits on the Amex's that i have currently? Does anyone have any experience where Amex declined them because of already too much credit available (not utilized) to them via their amex cards?

Basically i can proactively do this - or wait and see if i ever get that kind of a response, then I could call them up and ask them to reallocate the existing lines...

Anyways.. just curious if anyone has any thoughts on this..

Eventually - I reapplied for the 2 SPG cards and was initially declined for my first application again, but then called them and asked for a reassessment - turns out my name is such a common name, that they needed to do further fraud checks and both got approved within a week of each other.

Now for my question - I feel that the credit limits approved to me were pretty generous (14K/20K) - especially since they originally didn't even approve me - keeping in mind that I intend on applying for one of the charge cards in ~1-2 months from now, should I consider reducing the credit limits on the Amex's that i have currently? Does anyone have any experience where Amex declined them because of already too much credit available (not utilized) to them via their amex cards?

Basically i can proactively do this - or wait and see if i ever get that kind of a response, then I could call them up and ask them to reallocate the existing lines...

Anyways.. just curious if anyone has any thoughts on this..

#288

Join Date: Dec 2011

Location: Canada

Programs: *void

Posts: 2,408

One more question about people's experiences on this forum - as briefly mentioned, I applied for my first two SPG Amex cards a month ago - not sure why it took me so long - I remember applying last year but got declined and I had no clue why - I had thought that they underwriting standards might have been uber exclusive or maybe required 800+ credit scores (how naive of me).

Eventually - I reapplied for the 2 SPG cards and was initially declined for my first application again, but then called them and asked for a reassessment - turns out my name is such a common name, that they needed to do further fraud checks and both got approved within a week of each other.

Now for my question - I feel that the credit limits approved to me were pretty generous (14K/20K) - especially since they originally didn't even approve me - keeping in mind that I intend on applying for one of the charge cards in ~1-2 months from now, should I consider reducing the credit limits on the Amex's that i have currently? Does anyone have any experience where Amex declined them because of already too much credit available (not utilized) to them via their amex cards?

Basically i can proactively do this - or wait and see if i ever get that kind of a response, then I could call them up and ask them to reallocate the existing lines...

Anyways.. just curious if anyone has any thoughts on this..

Eventually - I reapplied for the 2 SPG cards and was initially declined for my first application again, but then called them and asked for a reassessment - turns out my name is such a common name, that they needed to do further fraud checks and both got approved within a week of each other.

Now for my question - I feel that the credit limits approved to me were pretty generous (14K/20K) - especially since they originally didn't even approve me - keeping in mind that I intend on applying for one of the charge cards in ~1-2 months from now, should I consider reducing the credit limits on the Amex's that i have currently? Does anyone have any experience where Amex declined them because of already too much credit available (not utilized) to them via their amex cards?

Basically i can proactively do this - or wait and see if i ever get that kind of a response, then I could call them up and ask them to reallocate the existing lines...

Anyways.. just curious if anyone has any thoughts on this..

From our experience we've found Amex to be one of the easiest banks to get approval for our cards, w.r.t. applying for many cards within short timeframe of each other (1 month, 3 months, 6 months), as well as for approval for family members who have young credit histories, so it's definitely not a must to have pristine credit profiles/scores, certainly not 800+.

The limits that Amex gave you on your SPG CREDIT cards were very generous indeed. We've seen first-time Amex cardholders with a paltry $1000 initial limit, which then required some planned self-action to increase the limits with their online request tool, and without addition pulls at Transunion, to bump it up to now $9,000, in under a year.

The MR cards (Personal/Business Golds/Plats) are CHARGE cards, and they don't issue these to you with a published limit, you'd have to guess it to begin with. But Amex gives you the online "Spending Power" tool so that you can guess/test the limits with mock transactions, twice a day. We've often seen our initial MR card limits at a mere $3500 upon activation, but over time the spending power tool would show that the limit had increased to $5,000-$7,000 within a week or two, and then to $35,000 after about 6 months of good responsible card usage and balance payments.

Amex won't reallocate / consolidate the limits from the CREDIT cards (your SPG cards) with the MR CHARGE cards, but they will shift limits across their CREDIT cards. I've held up to 6 Amex cards concurrently and I don't believe they restricted my new applications because of the high combined limits. TD, MBNA, CIBC on the other hand, yes...but a quick phone conversation to lower existing card limits would resolve those stalled new applications whenever the total combined limit within that bank tallied up to be too high.

#289

Join Date: May 2018

Location: YYZ

Posts: 42

How are peoples experiences with AMEX doing hard credit pulls if you're an existing card member? Some DPs on reddit suggest majority of the time AMEX doesn't do hard pulls. Planning to apply for a few more cards, hoping to time it right.

#290

Join Date: Dec 2011

Location: Canada

Programs: *void

Posts: 2,408

Sure, the less hard pulls on your file, the better, as we used to think that with reduced enquiries it would improve your chances for approval for the next new card. But, with responsible usage/payments of your card accounts, your score will eventually recover. Meanwhile you'll find that just adding a bunch of multiple new tradelines to your burueau files can be more shocking to Equifax/Transunion algorithms than a new incremental pull, especially if you have a thin credit profile/history.

#291

Join Date: Jan 2017

Programs: BAEC, Mileage Plus, Aeroplan, SPG

Posts: 62

Wondering if anyone knows from experience- I got the SPG Amex right before the changes happened (I.e 20k points after 1k spend in 3 months).

one thought that occurred to me for which I can’t find the answer too- but do the Canadian SPG Amex cards not give you the 2 night/ 5 stay towards your elite status like the US Amex SPG cards do?

one thought that occurred to me for which I can’t find the answer too- but do the Canadian SPG Amex cards not give you the 2 night/ 5 stay towards your elite status like the US Amex SPG cards do?

#292

Join Date: Dec 2011

Location: YVR

Posts: 625

Wondering if anyone knows from experience- I got the SPG Amex right before the changes happened (I.e 20k points after 1k spend in 3 months).

one thought that occurred to me for which I can’t find the answer too- but do the Canadian SPG Amex cards not give you the 2 night/ 5 stay towards your elite status like the US Amex SPG cards do?

one thought that occurred to me for which I can’t find the answer too- but do the Canadian SPG Amex cards not give you the 2 night/ 5 stay towards your elite status like the US Amex SPG cards do?

#293

Join Date: Oct 2013

Location: Montreal

Posts: 586

I'm thinking about opening a supplementary card for my Amex personal Plat.

Does anyone know if Priority Pass membership is also given to the supplementary card and the terms if so (e.g., unlimited free visits, 1 guest, etc.)? Also, would the $200 travel credit be usable to book a flight for the supplementary cardholder instead of only the primary one?

Thanks.

Does anyone know if Priority Pass membership is also given to the supplementary card and the terms if so (e.g., unlimited free visits, 1 guest, etc.)? Also, would the $200 travel credit be usable to book a flight for the supplementary cardholder instead of only the primary one?

Thanks.

#294

Join Date: Dec 2011

Location: YVR

Posts: 625

I'm thinking about opening a supplementary card for my Amex personal Plat.

Does anyone know if Priority Pass membership is also given to the supplementary card and the terms if so (e.g., unlimited free visits, 1 guest, etc.)? Also, would the $200 travel credit be usable to book a flight for the supplementary cardholder instead of only the primary one?

Thanks.

Does anyone know if Priority Pass membership is also given to the supplementary card and the terms if so (e.g., unlimited free visits, 1 guest, etc.)? Also, would the $200 travel credit be usable to book a flight for the supplementary cardholder instead of only the primary one?

Thanks.

#295

Join Date: Jun 2016

Location: Prince Edward Island

Programs: Air Canada P25K, Hilton Honors Gold, Marriott Gold, MGM Gold

Posts: 1,582

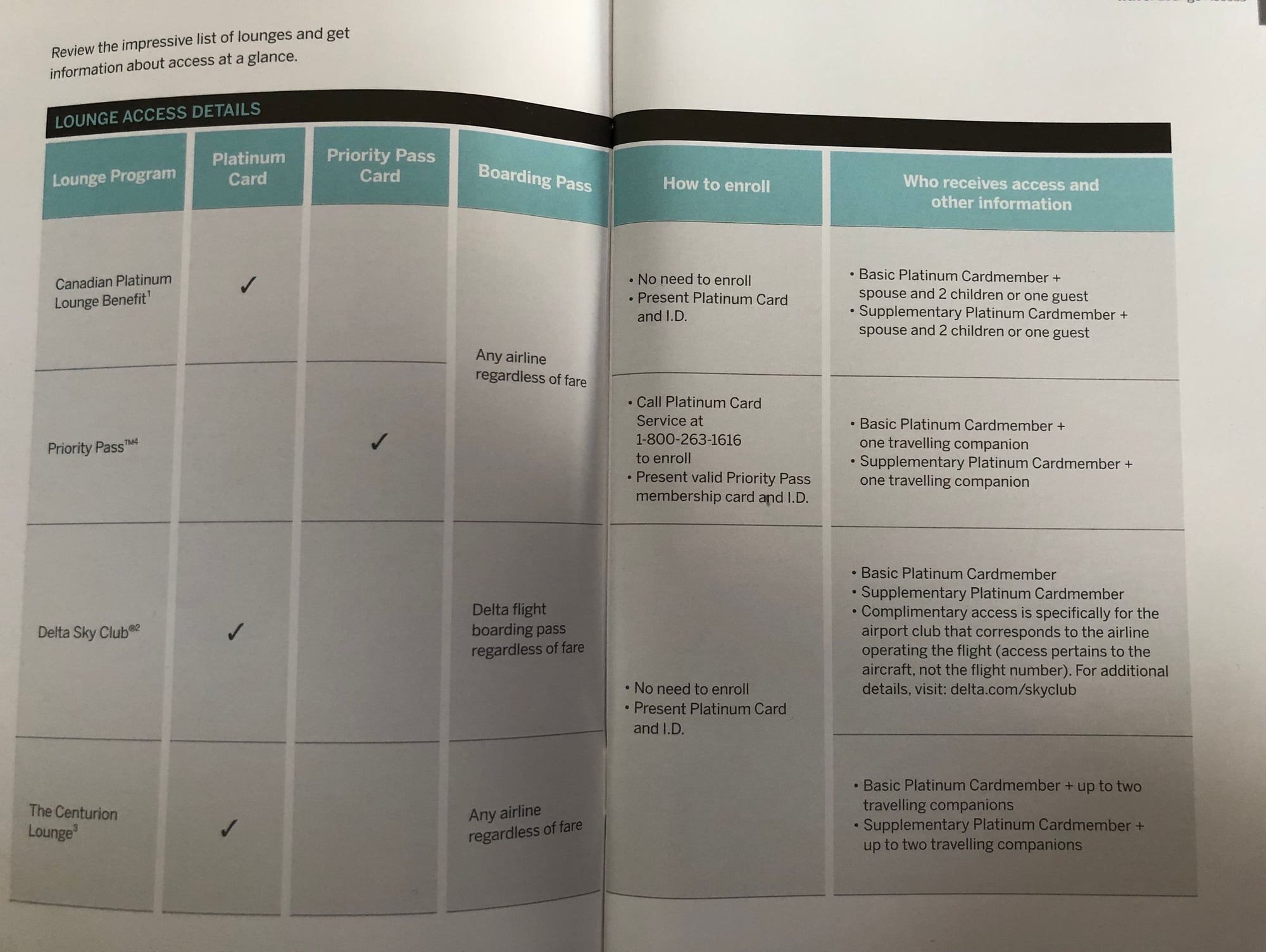

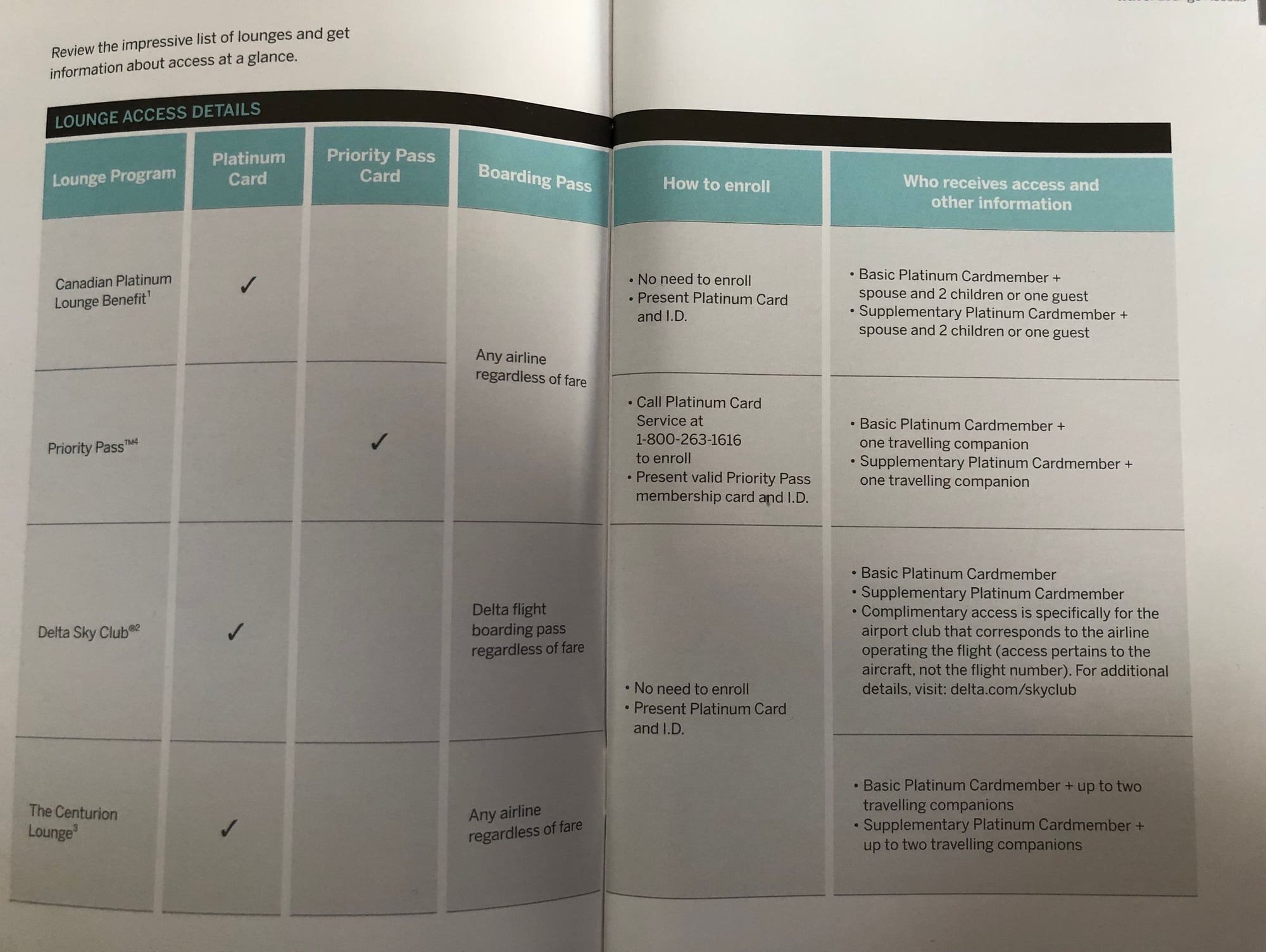

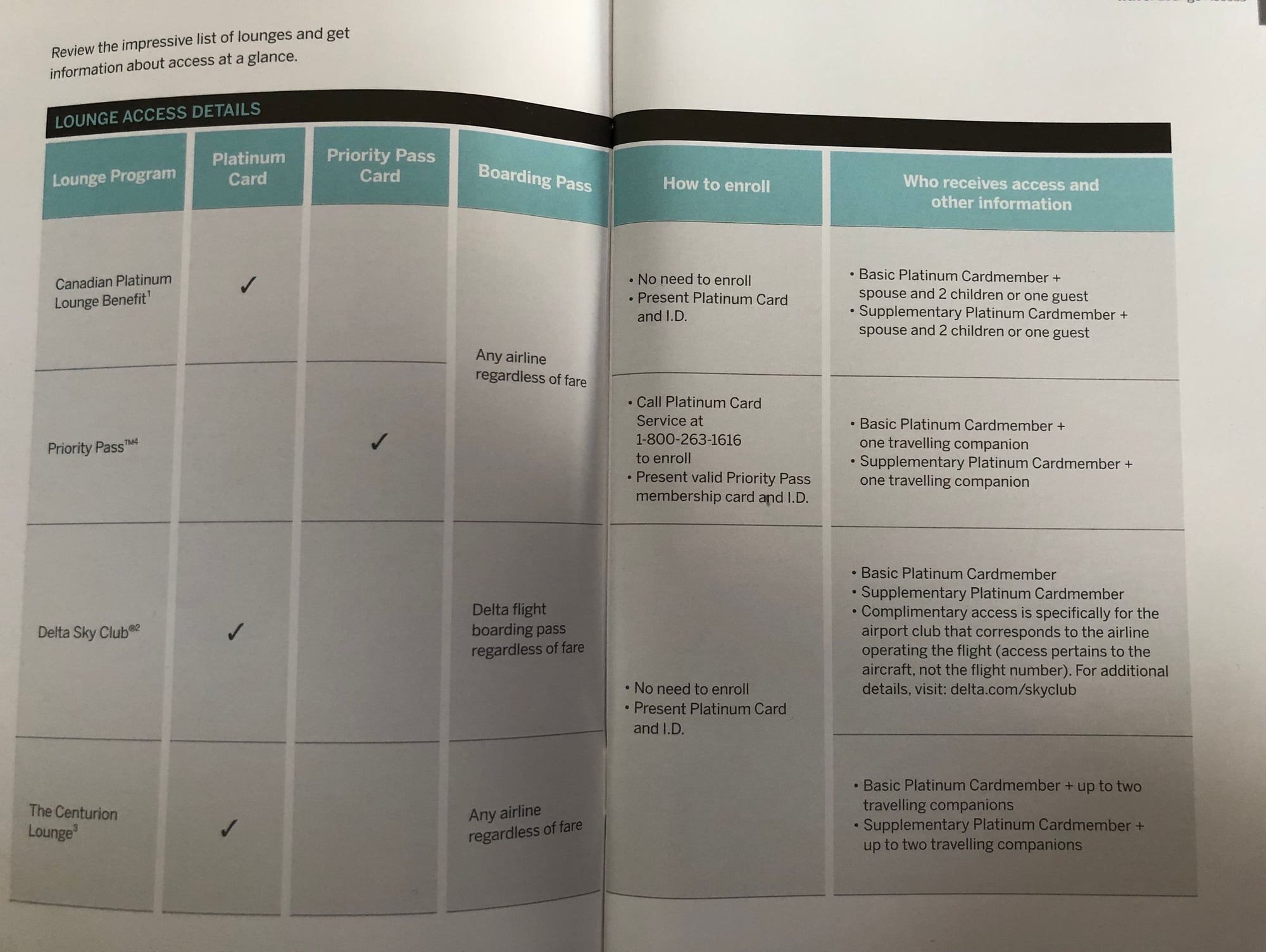

Are you sure about priority pass? I have the business platinum and it looks like supp. card holders can enroll in PP. The welcome page says " Business Platinum Basic and Platinum Supplementary Cardmember(s) (“Cardmember”) that are enrolled members of Priority PassTM (“PP membership”) have complimentary access to airport lounges participating in the Priority Pass program worldwide."

#296

Join Date: Oct 2002

Programs: United Premier 1K

Posts: 1,230

#297

Join Date: Dec 2011

Location: YVR

Posts: 625

Could you please provide a reference? I believe the OP was speaking of the Personal Platinum.

Last edited by prmetime; May 27, 2018 at 6:43 am Reason: further information

#298

Join Date: Oct 2002

Programs: United Premier 1K

Posts: 1,230

Edit: Dug up the package that came with the card to show confirmation in writing (there is similar language for the Hilton benefits, etc. The $200 travel credit is clear that it's only for the primary card holder)

Last edited by Toronto1970; May 27, 2018 at 4:40 pm

#299

Join Date: Dec 2011

Location: YVR

Posts: 625

I can only speak from personal experience. I have the personal platinum card and my husband has a supplemental card on the account. He was able to request and receive his own Priority Pass card.

Edit: Dug up the package that came with the card to show confirmation in writing (there is similar language for the Hilton benefits, etc. The $200 travel credit is clear that it's only for the primary card holder)

Edit: Dug up the package that came with the card to show confirmation in writing (there is similar language for the Hilton benefits, etc. The $200 travel credit is clear that it's only for the primary card holder)

#300

Join Date: Oct 2013

Location: Montreal

Posts: 586

I can only speak from personal experience. I have the personal platinum card and my husband has a supplemental card on the account. He was able to request and receive his own Priority Pass card.

Edit: Dug up the package that came with the card to show confirmation in writing (there is similar language for the Hilton benefits, etc. The $200 travel credit is clear that it's only for the primary card holder)

Edit: Dug up the package that came with the card to show confirmation in writing (there is similar language for the Hilton benefits, etc. The $200 travel credit is clear that it's only for the primary card holder)

As for the $200 travel credit, I was just curious as to whether the sole $200 credit allotted annually to the card is bookable for the supplementary cardholder. It irks me a little that I can't use it to book travel for others like I can with Aeroplan points as I personally don't see much value in booking through Amex travel services.