Last edit by: Dr Jabadski

Note: If you don't have a qualifying investment account, or if your only investment account is an Access Investing account, there is no longer an Engagement Bonus in the first year of having the CashPlus Platinum account.

Recommended step-by-step guide if goal is MS AmEx Platinum card with bonus and effectively no annual fee as of 8/1/21:

- Open MS Access Investing account (to establish the MS relationship) using online application with $5,000.

- Wait a few days.

- Open Platinum CashPlus account (requires existing MS relationship), must be opened by phone or through an advisor, cannot be done online.

- Fund Platinum CashPlus account with $25K.

- Wait a few days.

- Confirm CashPlus account's Account Fee Status page shows “Morgan Stanley Investment Relationship = Yes”.

- Apply for MS AmEx Platinum Card via the link that shows up in the CashPlus account once it's open.

- $5,000 monthly deposit or Social Security deposit in any amount and $25,000 Average Daily Cash Balance in the Bank Deposit Program to avoid Platinum CashPlus Monthly Account Fee.

- Meet minimum spending requirement on the AmEx Platinum card, as of 8/1/21: $6,000 within 6 months to receive sign-up bonus.

- Confirm $695 Annual Engagement Bonus posts to Platinum CashPlus account approximately 6 weeks after credit card approval. (As of 8/1/21, considerable discussion as to whether the FIRST Annual Engagement Bonus is paid within first few months of credit card account opening or at about 1 year after credit card account opening.)

- $1,000+ yearly spending requirement on the AmEx Platinum card needed to avoid having to pay taxes on the Engagement Bonus. (This language was removed from the disclosure statement after the Engagement Bonus was increased to $695.)

- Enjoy the sign-up bonus and all other AmEx Plat perks, don’t eat or drink too much .

.

Notes:

All accounts can be opened the same day, best to wait a few days between account openings/applications to ensure each successive account is fully integrated into MS systems to avoid problems.

Few or no reports of MS AmEx Platinum credit card applications being declined for people with Access Investing and Platinum CashPlus accounts, seems once that MS relationship has been established, credit card approval is almost automatic.

The credit card will count toward Chase’s 5/24.

Premier CashPlus not eligible for $695 Annual Engagement Bonus for the MS AmEx Platinum Card.

MS launched Access Investing in December 2017, launched CashPlus in January 2020.

… I’m uncertain as to the requirements and procedures for a thread to have a Wiki(post). As with the New Platinum Card: To-Do List thread, might this thread qualify for a Wiki? Okay mia, you’re on. (Disclaimer: I have never applied for any of these MS accounts ... but I did stay at a Holiday Inn Express once  .)

.)

.)

.) - Open MS Access Investing account (to establish the MS relationship) using online application with $5,000.

- Wait a few days.

- Open Platinum CashPlus account (requires existing MS relationship), must be opened by phone or through an advisor, cannot be done online.

- Fund Platinum CashPlus account with $25K.

- Wait a few days.

- Confirm CashPlus account's Account Fee Status page shows “Morgan Stanley Investment Relationship = Yes”.

- Apply for MS AmEx Platinum Card via the link that shows up in the CashPlus account once it's open.

- $5,000 monthly deposit or Social Security deposit in any amount and $25,000 Average Daily Cash Balance in the Bank Deposit Program to avoid Platinum CashPlus Monthly Account Fee.

- Meet minimum spending requirement on the AmEx Platinum card, as of 8/1/21: $6,000 within 6 months to receive sign-up bonus.

- Confirm $695 Annual Engagement Bonus posts to Platinum CashPlus account approximately 6 weeks after credit card approval. (As of 8/1/21, considerable discussion as to whether the FIRST Annual Engagement Bonus is paid within first few months of credit card account opening or at about 1 year after credit card account opening.)

- Enjoy the sign-up bonus and all other AmEx Plat perks, don’t eat or drink too much

.

. Notes:

All accounts can be opened the same day, best to wait a few days between account openings/applications to ensure each successive account is fully integrated into MS systems to avoid problems.

Few or no reports of MS AmEx Platinum credit card applications being declined for people with Access Investing and Platinum CashPlus accounts, seems once that MS relationship has been established, credit card approval is almost automatic.

The credit card will count toward Chase’s 5/24.

Premier CashPlus not eligible for $695 Annual Engagement Bonus for the MS AmEx Platinum Card.

MS launched Access Investing in December 2017, launched CashPlus in January 2020.

Morgan Stanley American Express Platinum Card (2012 - 2021)

#751

Join Date: Dec 2018

Posts: 16

Sorry if this simple question has been answered already. I have an active vanilla plat which I got the sub on in the past year. Can I apply for the MS plat and get the 100k sub as well?

#752

Join Date: Jul 2011

Posts: 15

See if this post is helpful: https://www.flyertalk.com/forum/33426794-post638.html

I wasn't necessarily convinced that he actually knew what he was talking about, as he supposedly asked another team - but take that for what it's worth.

A few follow up questions, if I may:

1) I believe it's been asked before, but didn't see a direct reply - there aren't any issues with the access investing account falling below $5k, after the initial investment and subsequent fees are taken out monthly, right?

2) If we set up the Cashplus account as a joint account (is this even possible if the access investing is single? Not sure if it will create a conflict when it comes time to link the accounts) - can we then both leverage that into two separate MS platinum cards for each of us? I'm assuming we'd only get 1 fee reimbursed though..

Thanks!

#753

Join Date: Aug 2021

Location: NYC

Posts: 9

So as a follow up here, we called in this morning and spoke to an advisor who actually told us that the MS Stock Connect plan does not fulfill the requirement of being an eligible investment relationship with MS in order to open up the CashPlus..

I wasn't necessarily convinced that he actually knew what he was talking about, as he supposedly asked another team - but take that for what it's worth.

I wasn't necessarily convinced that he actually knew what he was talking about, as he supposedly asked another team - but take that for what it's worth.

#754

Join Date: Jul 2011

Posts: 15

yes - as the vanilla / CS / MS versions should all be considered as separate products.

#755

Join Date: Dec 2018

Posts: 218

my wife got a vanilla platinum, then was denied the Schwab platinum. one person I spoke to said it was because the previous Platinum approval was within 90 days of the new application. the cryptic automated reason was "you were already approved for a card of this type so we cannot approve you for another." whether that means it will be available after the 90 days or is considered the "same" is something I will try to find out after the 90 days have passed.

#756

Join Date: Sep 2019

Posts: 38

For India, they would wire your money as $. It is up to the receiving bank in India to convert it at their exchange rate and deposit to the account. MS can only wire it as $ from here and not in Rupees.

#757

Join Date: Jul 2021

Posts: 88

All,

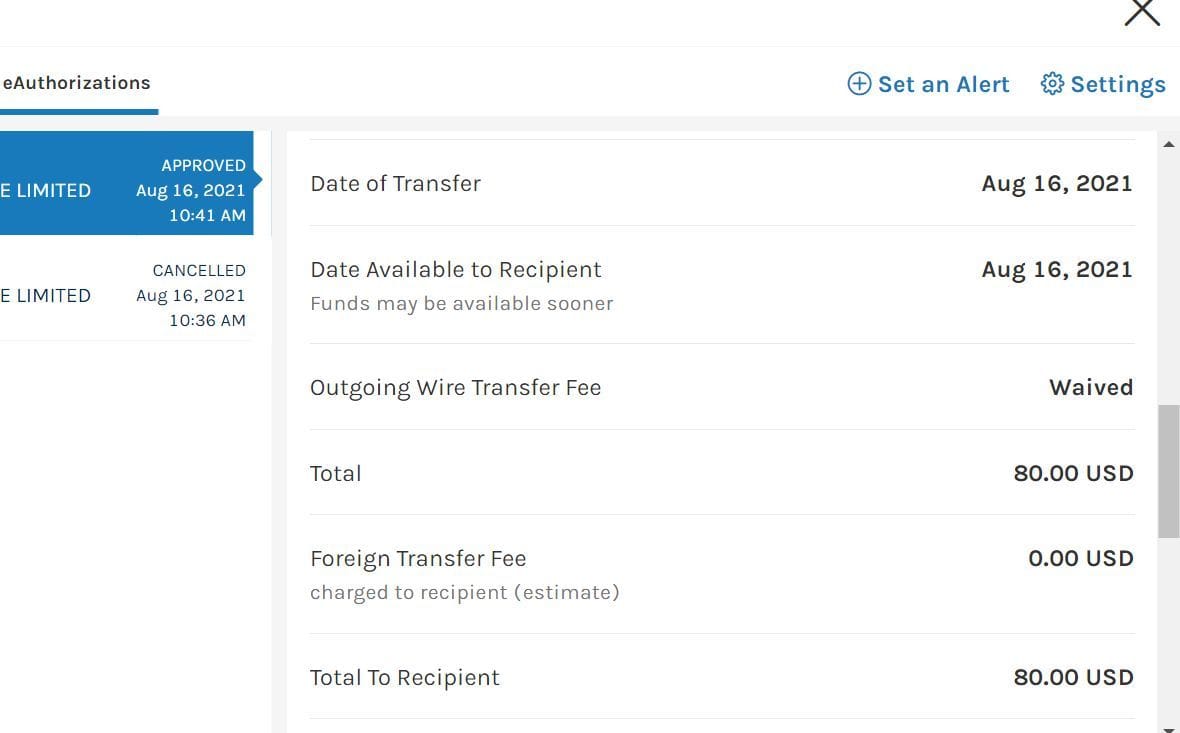

Performed a wire transfer/bank transfer using the Cash Plus account on Monday. It was very painless. It took 1 call and about 20 minutes.

CSR was very knowledge and gathered the recipients bank information. He then sent me a eAuthorization which I approved and wire transfer was completed shortly after that.

There was no additional charge there was no FOREX exchange fees.

This is a very nice benefit of the cash plus account.

Performed a wire transfer/bank transfer using the Cash Plus account on Monday. It was very painless. It took 1 call and about 20 minutes.

CSR was very knowledge and gathered the recipients bank information. He then sent me a eAuthorization which I approved and wire transfer was completed shortly after that.

There was no additional charge there was no FOREX exchange fees.

This is a very nice benefit of the cash plus account.

#758

Join Date: Feb 2006

Posts: 1,061

All,

Performed a wire transfer/bank transfer using the Cash Plus account on Monday. It was very painless. It took 1 call and about 20 minutes.

CSR was very knowledge and gathered the recipients bank information. He then sent me a eAuthorization which I approved and wire transfer was completed shortly after that.

There was no additional charge there was no FOREX exchange fees.

This is a very nice benefit of the cash plus account.

Performed a wire transfer/bank transfer using the Cash Plus account on Monday. It was very painless. It took 1 call and about 20 minutes.

CSR was very knowledge and gathered the recipients bank information. He then sent me a eAuthorization which I approved and wire transfer was completed shortly after that.

There was no additional charge there was no FOREX exchange fees.

This is a very nice benefit of the cash plus account.

Thanks for sharing your experience. If you don't mind me asking, do you have enough assets with MS that you have a dedicated advisor, or did you just call the basic Cash Plus number and speak with a regular rep?

Also, the maximizer in me wants to know, if you've done these sort of transfers before, what dollar amount, including Forex fees, do you typically pay?

Part of me wants to find a reason to do a wire transfer so I can give the benefit a try......

#759

Join Date: Jul 2021

Posts: 88

Thanks for sharing your experience. If you don't mind me asking, do you have enough assets with MS that you have a dedicated advisor, or did you just call the basic Cash Plus number and speak with a regular rep?

Also, the maximizer in me wants to know, if you've done these sort of transfers before, what dollar amount, including Forex fees, do you typically pay?

Part of me wants to find a reason to do a wire transfer so I can give the benefit a try......

Also, the maximizer in me wants to know, if you've done these sort of transfers before, what dollar amount, including Forex fees, do you typically pay?

Part of me wants to find a reason to do a wire transfer so I can give the benefit a try......

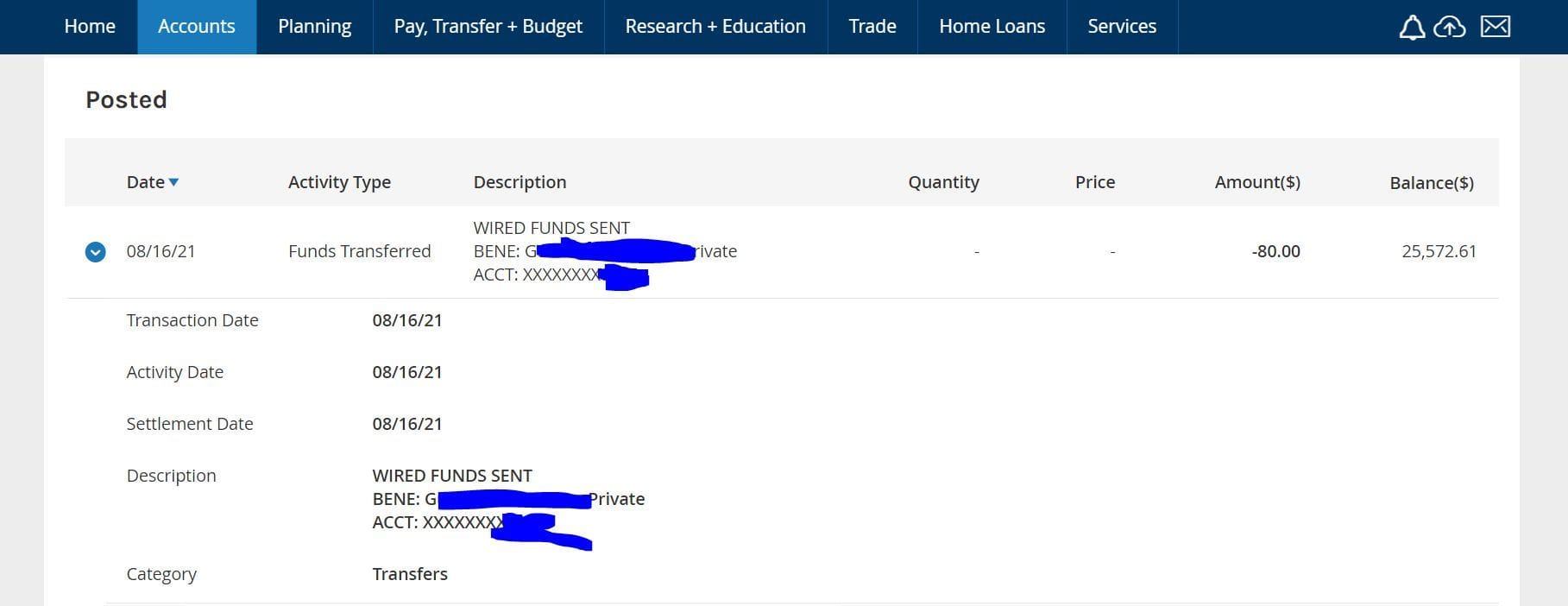

My transfer was only for $80 headed towards India to pay for some goods/services. Really an insignificant amount. Advisor did not care I was doing so little in the wire transfer. See screenshots below.

#760

Join Date: Jul 2005

Programs: Hilton Diamond, Starwood Platinum, AA, SW, Delta

Posts: 885

I was wondering since the MS Access invest in so many different investment vehicles won't it be a pain during tax time/

#761

Join Date: Mar 2013

Location: EWR

Programs: World of Hyatt, Marriott Bonvoy, Hilton Honors, UA Mileage Plus

Posts: 1,255

#762

Join Date: Sep 2019

Posts: 38

I only had $25,000 in Cash Management and $5000 in access investing. Other than that no other assets in MS. No dedicated advisor assigned to me. I just dialed the toll free general number for advisors. It is the first and only time I done such a transfer.

My transfer was only for $80 headed towards India to pay for some goods/services. Really an insignificant amount. Advisor did not care I was doing so little in the wire transfer. See screenshots below.

My transfer was only for $80 headed towards India to pay for some goods/services. Really an insignificant amount. Advisor did not care I was doing so little in the wire transfer. See screenshots below.

#763

Join Date: Jul 2021

Posts: 88

Do you mind sharing on how the USD conversion was? Did MS convert it or did the receiving bank convert it? I was told that for certain countries they could send only as $ (India was one of the countries I had asked)? If that was true, was the receiving bank transfer rate competitive. I know there won't be much of a difference while transferring $80, but as amount increases it can be a substantiative one. TIA

no mention of conversion for me. It just happened with no other input other than the amount I want converted. Very seamless

#764

Join Date: Apr 2002

Posts: 587

That’s good to know as I started investing in the market last summer. I also started trading options a few months ago so I was hoping my taxes wouldn’t get too complicated for 2021 with the addition of the mix of investments in the Access Investing account.

#765

Join Date: Oct 2018

Posts: 27

6/2/21 - Opened Morgan Stanley Access Investing Account using online application with $5k in investments

6/9/21 - Called to open Platinum CashPlus Account (unable to open account online), followed by an online ACH pull of $25k from an outside account to fund the account

6/9/21 - Opened Amex Morgan Stanley Platinum card, approved for card

6/11/21 - Met minimum spending requirement on the Amex

6/13/21 - Received the 60k bonus Amex membership rewards points for meeting MSR

6/14/21 - "Apply Now" link for Amex Morgan Stanley Platinum card disappeared from Account Summary page

Like a previous poster, have 2x $2,500 ACH pushes from Discover scheduled for each calendar month ... followed by a $5,000 ACH pull from the same Discover account.

I can only hope for a smooth posting of the Engagement Bonus in a couple months without any further calls. Fingers crossed.

6/9/21 - Called to open Platinum CashPlus Account (unable to open account online), followed by an online ACH pull of $25k from an outside account to fund the account

6/9/21 - Opened Amex Morgan Stanley Platinum card, approved for card

6/11/21 - Met minimum spending requirement on the Amex

6/13/21 - Received the 60k bonus Amex membership rewards points for meeting MSR

6/14/21 - "Apply Now" link for Amex Morgan Stanley Platinum card disappeared from Account Summary page

Like a previous poster, have 2x $2,500 ACH pushes from Discover scheduled for each calendar month ... followed by a $5,000 ACH pull from the same Discover account.

I can only hope for a smooth posting of the Engagement Bonus in a couple months without any further calls. Fingers crossed.

Scheduled Discover Bank pushes and pulls (as noted above - all initiated on the Discover end) have met the requirements for avoiding fees on the CashPlus account.